The Broad Future of Synthetic Assets|Roast Boy Creators Alliance

secondary title

How do you define "synthetic assets"?

I define synthetic assets as: alchemy, the transformation of one asset type into another.

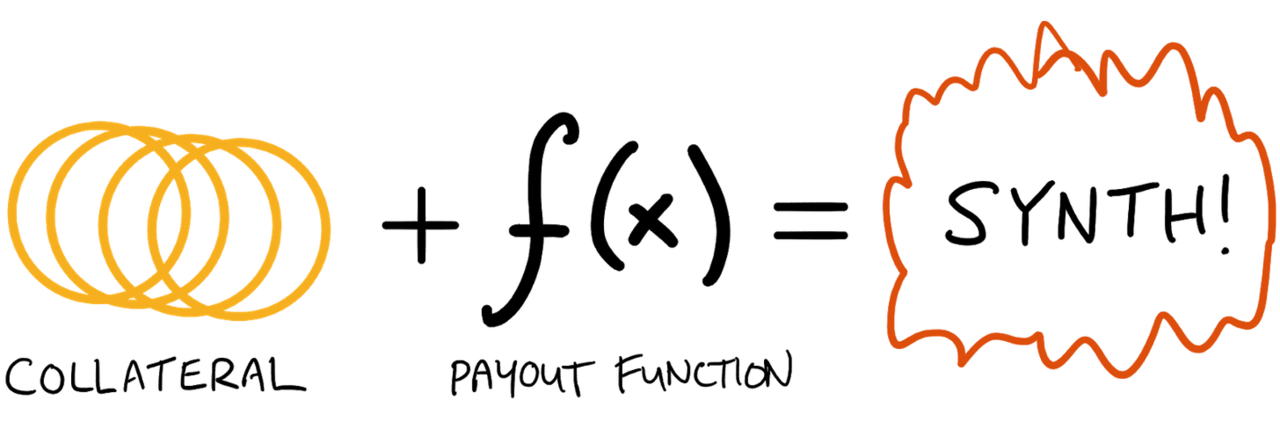

Specifically, this alchemical process looks like: Collateral combines payment functions to produce a synthetic asset

This article is supported by Roast Boy Creators Alliance

Taking Maker's DAI as an example, the specific process is shown in the figure below:

Generalizing this principle, it can be speculated that if you choose any collateral and any arbitrary payment function, you can create synthetic assets of anything.

In other words: any collateral + any payout function = any composite asset

Some examples of synthetic assets

How to make synthetic assets of gold? so easy

Collateral (USDC) + Payment Function (USDC * 1oz Gold) = Synthetic Assets ($GLD)

If you want to track the Token of Bankless Twitter followers? can 👇

Collateral (USDC) + Payment Function (USDC * Number of Unbanked Twitter Followers) = Synthetic Assets ($BNKLES)

Then there is the synthetic NFT index tracking token 👇

Collateral (ETH) + Payout Function (ETH * NFT Index Value) = Synthetic Assets ($NFTINDEX)

This is the real power of synthetic assets on Ethereum to create financial assets for anything.

How to achieve

The key trick in this alchemical process resides in what I call the "payment function" above, the payment function defines the synthetic asset, which means that the user's ability to create any possible synthetic asset is limited only by the throughput of this payment function .

This is where the UMA protocol shines, UMA enables developers to define almost any payment functionality they want.

Because UMA contracts are written "pricelessly," meaning no on-chain price data is required. UMA is designed to require on-chain price data only in the event of a "dispute", which is very rare. (In the 10 months since UMA was launched, there have only been 6 disputes, which means that only 6 on-chain requests are needed to protect the TVL of 200 million US dollars).

In other words, UMA allows users to define almost any arbitrary payment function and build almost any type of synthetic asset without pushing any data to the chain.

Synthetic asset development

I divide synthetic assets into four categories

1) Stablecoins or stablecoin-related composites

Maker's DAI is a synthetic asset pegged to $1. All fiat-backed stablecoins also fall into this category, including the recent wave of algorithmic stablecoins (ESD, FEI, RAI, etc.). These types of synthetic stablecoins have obvious utility, something that many cryptocurrency folks care about, and are in high demand today.

A similar product is a zero-coupon bond, also known as a yield dollar. According to the above format, it is probably like this 👇:

Collateral (ERC20 Assets) + Payment Function (USD/ERC20 Assets) = Consolidated USD

Creating synthetic dollars can choose any collateral type and allow users to borrow against that collateral.

This is an efficient way to enable lending on ERC20 assets: for example, recently the team at BadgerDAO was using the UMA synthesizer to build CLAWS, a synthetic asset backed by Badger vaults that Badger stakeholders can borrow from their holdings , these products can be backed by LP tokens or indeed any ERC20 token.

2) Encryption related

It can help users trade and hedge.

For example, call options on altcoins. UMA has been used to create call options on $UMA, $BAL, $UNI, and $xSUSHI, resulting in an infinite number of applications, and I expect demand for these option types to grow significantly as the volatility market for altcoins develops growing.

Another is BTCDOM, launched by Domination.finance, where users can take a position on the relative strength of Bitcoin compared to other markets. Another thing to consider is Degenerative.finance's uGas (YAM Finance's brand), which can hedge the gas fee cost of the Ethereum network.

Another example is ethVIX, through the use of UMA, it is possible to buy tokens that track the volatility of Ethereum.

I also put synthetic cryptocurrencies in this bucket, like the synthetic version of Bitcoin on Ethereum. Many existing methods (e.g. renBTC, WBTC) rely on locking actual bitcoins, but it is entirely possible to create fully synthetic BTC or other cryptocurrencies.

For example, the YouMyChicFila team created Mario.cash, a fully synthetic version of Bitcoin Cash on Ethereum.

3) Synthesis of specific objects

People using cryptocurrencies don't really care about trading gold on the blockchain these days because less than 10% of the currency traded per day is simply too stable for today's. Exceptions include the Yam Finance team’s uSTONKS, a token that tracks the top 10 stocks on Reddit’s WallStreetBets.

text

4) Comprehensive

Even more interesting, synthetic assets will enable builders to invent new technologies that do not exist in traditional finance.

Consider what YouTube has done for content creators. Before YouTube, making a movie or TV show was very expensive. You have to be a Hollywood studio. YouTube lowered the cost for users to distribute their own videos, which created a long tail of video content that never existed before.

No one could have predicted that unboxing videos or Twitch, or a lot of content on Douyin would take the short video space by storm. Under no circumstances would a Hollywood studio come up with a show that would attract millions of eyes on a channel as open as YouTube. This entertainment is "emergency", that is, no single top-down entity can create it.

My point is that the same thing will happen with DeFi and synthetic assets. UMA and other DeFi protocols make it less than $1k to build financial assets. By contrast, it costs Wall Street banks millions of dollars to launch new financial products.

This sets the stage for "user-generated financial products," a field where builders will invent new things we can't predict today.

I have considered this idea before, and share it for everyone to exchange:

Tokens to track important crypto metrics such as the total value locked in DeFi or the total market cap of all NFTs

A token that incentivizes collective action, especially between governments and citizens

Tokens Incentivizing Covid Vaccines