Don't be silly, the exchange is the last big winner of DeFi

Produced | Odaily (ID: o-daily)

Produced | Odaily (ID: o-daily)

DeFi (decentralized finance), which has been "fried" for two years and has not caught fire, detonated the market in late June.

What ignited the DeFi pile of dry wood is undoubtedly the "loan mining" launched by the lending agreement Compound. In particular, the governance token COMP issued by Compound has created a considerable wealth effect, with a maximum increase of nearly 20 times.

"Loan mining" has also attracted other projects to imitate, motivating a large number of users to participate in pledge lending, and the locked value on the chain has also surged.

According to DefiPulse data, in less than a month from June 16 to the present, the total value of encrypted assets locked on the chain has more than doubled, and is currently reported at 2.15 billion US dollars.

The concept of DeFi is very popular, and centralized exchanges are not to be outdone, rushing to launch DeFi project tokens and contract products. More aggressive exchanges will launch multiple DeFi tokens a day, and they can't wait to fill up the progress bar directly.

For this type of exchange, we issue a soul torture: Are you really interested in DeFi projects? Is it rain and dew evenly, rubbing off the heat, or being single-minded and carefully reviewing?

In fact, this style of play has a low threshold, and it is difficult to become a differentiated advantage, and the traffic that can be captured is more limited.

"Gaowan" in the exchange began to think about the integration of "CeFi+DeFi", and wanted to use the exchange as a traffic entry to cut into the DeFi track. Some even planned and put it into action as early as two years ago.

"Centralized exchanges are the big players in future DeFi projects." A developer of a DeFi project gave a prediction.

secondary title

Conventional gameplay: launch DeFi tokens and contracts

After the DeFi concept became popular, how do exchanges "get hot"?

The most common ones are listing DeFi project tokens and DeFi-related contracts. For star/hot projects, the listing will create a "three-party win-win" situation for investors, projects, and exchanges.

1. Investors: meet transaction needs and avoid counterfeit currency troubles

Taking COMP as an example, within two weeks after its launch on June 16, its initial listing price of 0.08 ETH (approximately US$18.5) has been soaring all the way up to US$381.89, a maximum increase of nearly 20 times.

The huge wealth effect naturally attracted the attention of investors, but at that time COMP was only traded online on the decentralized exchange (hereinafter referred to as "DEX") Uniswap. But the vast majority of investors know little about DEX and will not use Uniswap. Therefore, investors who want to "buy, buy, buy" lack familiar investment channels.

"DeFi project tokens are generally preferred to be listed on Uniswap. However, Uniswap is only suitable for low-frequency transactions. Due to the poor depth, slippage usually occurs. From the perspective of user acceptance, users are more accustomed to centralized exchanges. If there is demand in the market Under such circumstances, it is inevitable for centralized exchanges to list DeFi tokens.” NestFans Forum 12 said.

The follow-up development is indeed the case. Centralized exchanges are keenly aware of the market's trading needs, and quickly launched Comp tokens and contracts.

For investors, the listing of DeFi tokens on centralized exchanges not only lowers the transaction threshold, meets transaction needs, but also prevents the problem of "counterfeit currency".

These days, in addition to fake official seals, there are also fake tokens everywhere.

Opium, a decentralized derivatives project, has issued a warning that the token named Opium (trade code: OPM ) appearing on Uniswap is fake, and the platform has not yet issued tokens. DeFi projects with similar problems include dYdX, Tornado.Cash, Curve Finance, 1inch.Exchange, and Balancer Labs.

Just imagine, you overcame "difficulties and obstacles" to log in to Uniswap, but ended up buying counterfeit coins, how do you feel?

However, when DeFi tokens are launched on centralized exchanges, with their resources, they can directly communicate with project parties and the community to help users avoid pitfalls. Therefore, it is not easy to have counterfeit currency problems, at least no similar problems have been exposed yet.

2. Exchange: a new channel to capture traffic

For the exchange, while meeting the trading needs of users, listing the currency also helps it capture traffic and benefits.

For popular projects, exchanges cannot be absent. Even if incremental users cannot be captured, it will help retain existing users.

CoinMarketCap data shows that Comp tokens are currently listed on more than 40 centralized exchanges such as Coinbase, Binance, and OKEx. Among them, Binance has also launched Comp contract transactions, allowing users to short positions. The current daily trading volume is 20 million US dollars; the derivatives exchange FTX has gone a step further. In addition to the COMP contract, the quarterly contract of the DeFi index and the perpetual Contracts and leveraged tokens allow users to short the entire DeFi field.

(Odaily Note: The DeFi Index benchmarks against 11 DeFi currencies, including COMP, KNC, LEND, MKR, KAVA, ZRX, LRC, REN, REP, BNT and SNX.)

For non-popular DeFi projects, if the exchange can issue its tokens, it usually has a certain first-mover advantage and even captures the entire project community.

Take Nest, an oracle project in DeFi, as an example. In May this year, trading platforms such as Hobbit, Matcha, and BiKi were launched. As the first launch platform, Hobbit promotes Nest; and sends people to the Nest community to answer questions and set up various user education groups.

"We used our own resources (media, community leader) to help Nest promote. We hope that through explanations, we can help users understand the value of the project, not just investors in the secondary market." Elsa, Vice President of Hobbit Business, explained explain.

Odaily interviewed many users in the Nest community, all said that because Hobbit was the first exchange and its follow-up actions, they finally chose to register, and Nest users preferred Hobbit for trading.

"Hobbit has captured the Nest community, and at present, Nest's transaction depth is also Hobbit with the best transaction depth, and miners' transactions are relatively active." Shi Er told Odaily.

3. Project & Community: Clear pricing, assured transactions, and expanded popularity

"Launching a DeFi project is a win-win choice between the project's community users and the exchange. The exchange has gained traffic and popularity, and community users need a place to trade." Godot, Marketing Director of MXC Matcha, explained.

For the early holders of DeFi projects, the realization of the above is a huge rigid demand.

Nest early holders told Odaily that before listing on the exchange, Nest had been trading off-exchange for more than a year.

However, over-the-counter transactions face a big problem: there is no middleman as a guarantee, which is prone to disputes, and the pricing of tokens is not transparent. "In many cases, everyone quotes a price by themselves, and they can only weigh it by themselves."

After Nest was listed on Hobbit and other exchanges, some early users and miners had a pricing market, making transactions more convenient. In addition, taking advantage of the resource advantages of the exchange, the Nest community has also introduced external blood to expand its popularity.

"Hobbit helped Nest build an overseas community, and the number of Telegram groups increased from more than 300 to more than 1,000. There were only two domestic groups before, but now there are four more." Elsa told Odaily, some users who originally belonged to Hobbit also joined Nest community to see how the project is progressing.

All in all, the initial exchange of DeFi projects has been deeply bound with the project itself, forming a community of interests.

Of course, although many exchanges have launched a lot of DeFi tokens, they have not carried out in-depth cooperation, and the effect is naturally greatly reduced. Do such "rain and dew" type exchanges really understand the DeFi projects they have launched?

4. Potential problems

After the COMP fire, many exchanges saw a wave of DeFi token listings.

Taking Biki as an example, a total of 9 DeFi tokens have been launched in the past 20 days, namely: COMP, WBTC, OKS, DMG, DEXT, DF, STONK and ASKO.

Behind the tide of listing on exchanges, there are many problems that cannot be ignored.

The first of these is liquidity (depth). Most DeFi projects are governed by the community, so there are no dedicated project parties and market makers. How to ensure the depth of listed projects has become the primary problem facing traders.

Hobbit's approach is to crowdfund liquidity, that is, the project community must have 5-10 large currency holders to make the market within a certain period of time (2-3 months), thereby exempting the DeFi token listing fee. Judging from the current practical effect, it is still good.

In addition, exchanges have launched a large number of DeFi tokens and lowered the threshold, and some junk projects may wear a DeFi coat and enter the exchange openly.

Although the DeFi market is hot, there are not many high-quality projects. Some project parties are just around the corner, trying to rush into the market again under the cloak of DeFi, and collect money to cut leeks. A common routine is to go to uniswap to build momentum first, and then move to centralized exchanges. Some counterfeit exchanges also tacitly knew this, silently fueling the flames, copying the DeFi projects on uniswap, and failing to fulfill their audit responsibilities. If things go on like this, the encryption market returns to the ICO era, and in the end there is only a feather in the ground.

Finally, judging from the current development status, the listing of DeFi tokens on many exchanges is “strong”, which may affect developers’ original plans.

Yang Mindao, the founder of dForce, told Odaily that although their token DF has been listed on many exchanges, their team has not actually been involved in it. "

"Strengthening" seems to have become an unspoken rule in the encryption market, and some exchanges even use "help you advertise" as an excuse.

However, once tokens are listed on the secondary market, the price will affect not only investors, but also the mentality of developers.

secondary title

Advanced gameplay: the integration of CeFi and DeFi

"The most fundamental thing for exchanges is to integrate DeFi projects at the functional and product levels, not just listing coins, which is beneficial to the overall development of exchanges and DeFi." Yang Mindao told Odaily.

It is true that although the effect of directly listing DeFi tokens on the exchange is obvious, the threshold for this kind of gameplay is low, easy to replicate, and difficult to differentiate advantages. Moreover, user stickiness is not high.

"Gaowan" in the exchange began to think about the integration of "CeFi+DeFi", and some even planned and put it into action as early as two years ago.

This kind of integration is mainly divided into two types: one is that the exchange serves as the entrance of DeFi traffic, and the other is that the exchange provides high-quality assets for DeFi.

1. The exchange serves as the entrance of DeFi traffic

The first type of "CeFi+DeFi" integration is to use exchanges as traffic entrances to enter the DeFi track, provide users with DeFi services, and lower the threshold for DeFi.

Odaily has experienced several mainstream mortgage lending products including MakerDAO, and found that the DeFi threshold mainly has the following points: First, lending products currently rely on web wallets such as MetaMask, and many users are stuck at the registration level; second, lending and follow-up The repayment involves multiple transfers, and the process is cumbersome; the third is that the product design is flawed and the user experience is not good.

"At present, DeFi has poor entry barriers, user traffic and product experience, while CeFi is criticized by customers for its transparency. We can use DeFi to collaborate to complete asset custody and settlement, while CeFi can be used in customer acquisition and compliance. and so on, so as to provide users with better services.” OKEx CEO JayHao said.

Specifically, the exchange’s own lending products can be connected to DeFi, and interest-earning products can also be connected to DeFi.

"Interest-earning products on exchanges still have counterparty risks. They either lend out on their own platforms, or take them out. Using DeFi to earn interest is equivalent to an extra choice." Mindao explained.

Take the current popular "loan mining" as an example. Ordinary retail investors have coins but have no access (the threshold is high), while exchanges have financing capabilities and can raise USDT, ETH, etc. to help users carry out "loan mining" and earn money from it. take profit.

Compared with directly entering the MakerDAO platform for deposit operations, the above mode is undoubtedly the most convenient for users, and it also provides a new traffic entry for Maker DSR.

Compared with directly entering the MakerDAO platform for deposit operations, the above mode is undoubtedly the most convenient for users, and it also provides a new traffic entry for Maker DSR.

In addition, Binance has also launched DeFi projects such as KAVA to participate in staking to obtain income (Staking). Recently, Hobbit has also made such an attempt: users can still get the weekly mining rewards of the Nest system while holding Nest on the exchange, which improves the user's DeFi participation experience.

2. Exchanges provide high-quality assets for DeFi

The DeFi field has been quite conservative before, especially lending projects that only accept decentralized project tokens as collateral.

But now, this trend is changing, the integration trend of DeFi and CeFi is strengthening, and some centralized tokens have also begun to become collateral.

"DeFi introduces real asset pledge, is it reliable? ""DeFi introduces real asset pledge, is it reliable? "analyzed its reliability.

At a time when the DeFi field is eager for high-quality assets, exchanges may become high-quality asset providers.

On the one hand, we have seen that stablecoins under exchanges have entered the DeFi market one after another.

For example, Coinbase’s USDC is basically recognized as collateral by all lending products; Binance’s stable currency BUSD has also entered Kyber and Aave, and Binance revealed that “the cooperation between BUSD, Compound and MakerDao is also in progress.”

On the other hand, the exchange platform currency is becoming a new high-quality asset alternative, entering the lending project as collateral.

On June 10, the Kava DeFi lending platform CDP was officially launched. After community voting, BNB became the first collateral asset to join the Kava DeFi platform. Moreover, Kava voted to allocate 3.848 million KAVA tokens from the Growth Fund to be distributed directly to minters, that is, BNB holders who participated in mortgaging BNB and lending USDX.

The combination of Kava and BNB also points out a way out for other exchanges: the platform currency enters the DeFi market and expands the boundaries of application scenarios.

In addition to Binance, OKEx has also taken action. Sources told Odaily that OKB may list Compound as collateral.

The demonstration effect of the two top exchanges may stir up a new wave of platform coins.

To further imagine, there will even be such a trend in the future: DeFi projects are listed on the exchange, and the exchange provides traffic and users for it, and the exchange platform currency (or the currency recommended by the exchange) is directly listed on the DeFi project...

secondary title

Heavy investment: investment, development exchange DeFi

Generally speaking, the first two methods are still "cooperative relationships" with light investment, while the last DeFi method is more of a test of the comprehensive strength of the exchange: capital, technology and talent pool.

On the one hand, exchanges can directly invest in DeFi projects and participate in project construction.

“Our investment department, including Binance Labs, Binance X and M&A investment teams, can provide financial support for innovative DeFi projects with development potential.” Binance told Odaily, “Many DeFi projects are still in very early stages. We will discuss with the project how to design more optimized transactions, liquidity models, token economy, etc., to help them better define the product’s market positioning and future development plans.”

On the other hand, leading exchanges are actively carrying out an "arms race" and developing their own public chains. A major development direction of the exchange public chain is DeFi. Among them, the decentralized exchange DEX is the top priority.

Why do centralized exchanges attach so much importance to the development of DEX? Judging from the data, Dex has great potential for development.

Data from Dune Analytics shows that in the first six months of this year, the Dex transaction volume on Ethereum reached nearly US$3 billion, compared with US$2.4 billion in the whole of last year.

"OKChain is now in the testnet stage. We also attract outstanding developers to the OKChain ecosystem to jointly build the DeFi ecosystem through activities such as hackathons, and based on OKEx's long-term accumulation in the digital asset industry, we will provide rich resource support and Technical support.” said Xu Kun, Chief Strategy Officer of OKEx.

"OKChain is now in the testnet stage. We also attract outstanding developers to the OKChain ecosystem to jointly build the DeFi ecosystem through activities such as hackathons, and based on OKEx's long-term accumulation in the digital asset industry, we will provide rich resource support and Technical support.” said Xu Kun, Chief Strategy Officer of OKEx.

Hobbit told Odaily that their exchange public chain HBTC Chain (HBTC Chain) has been positioned as a decentralized clearing custody chain from the very beginning. Among them, Open Dex will provide users with a complete DEX protocol on the chain to help users open their own decentralized exchanges. In addition, decentralized lending and derivatives transactions are also the focus of HBTC.

From the perspective of progress, HBTC is also in the testnet stage.

In contrast, Binance is at the forefront in the development of public chains.

As early as April last year, Binance Chain announced the official launch of the mainnet, and the DEX based on Binance Chain was also officially launched at the same time; the 2019 annual report shows that Binance DEX launched 121 trading pairs, and Binance DEX had 47,363,000 transactions. 332444 addresses.

In May of this year, Binance Chain released the Binance Smart Chain again, which supports EVM, is compatible with Ethereum, supports cross-chain interoperability, and is fully connected with Binance DEX. Currently, Binance Smart Chain is still in the testnet stage, and plans to launch the mainnet in Q3.

"One of the key goals of the smart chain is to fully integrate the assets on the Binance chain (> 6 billion US dollars) to establish a sustainable DeFi ecosystem. In order to make the development of DeFi projects more convenient and move towards implementation, we are stepping up the integration of mainstream tools Providers, including blockchain browsers, oracles, APIs, etc. In addition, we will also organize a Staking competition and Hackathon to promote communication with the community and get more community feedback.” Binance told Odaily.

Whether it is investing in DeFi projects, or entering the DeFi track through the original public chain, the essence is to empower and expand the ecological value of the exchange.

secondary title

Summary: DeFi is a strategic place for exchanges

It is a foregone conclusion that exchanges bet on the DeFi track.

For exchanges, DeFi can certainly bring traffic, but in addition to traffic, "high play" in the exchange thinks further and starts strategic layout in advance.

In this bustling DeFi wave, retail investors are destined to not be able to make waves, but the "CeFi representative team" exchange is most likely to have the last laugh.

appendix:

appendix:

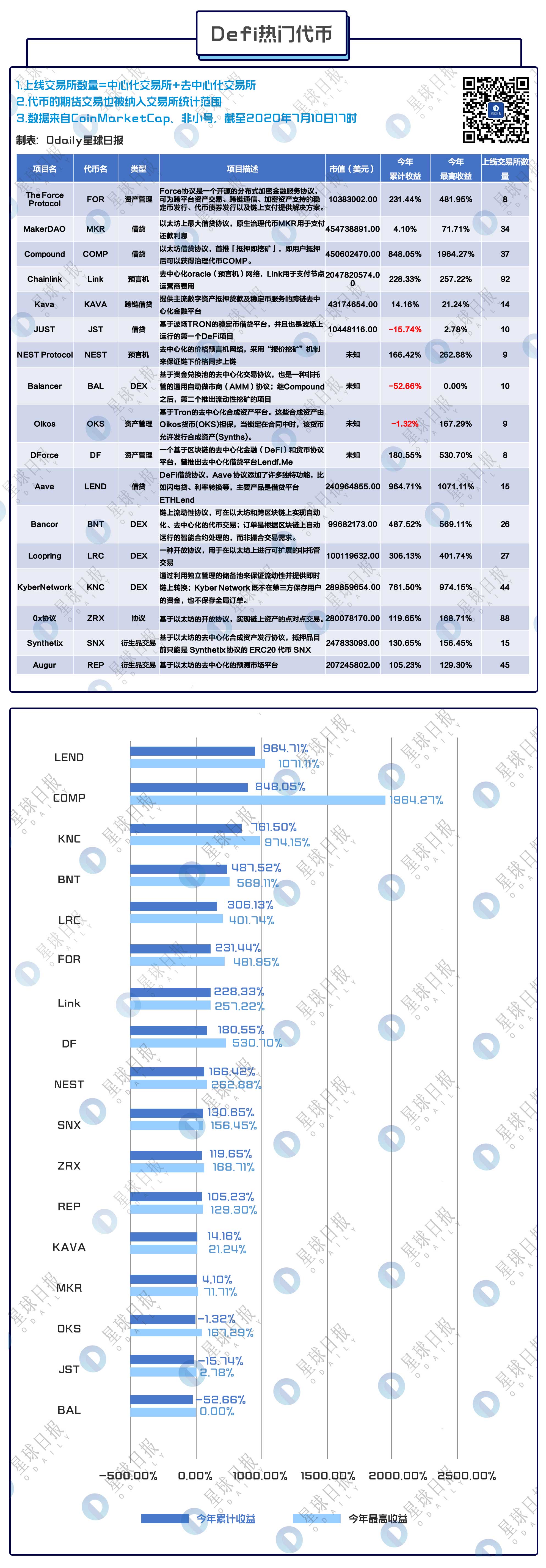

Summary of returns from popular DeFi tokens