Bitcoin-Gold Correlation Hit All-Time High at 49.2%

image description

Summary:

Summary:

1. The global liquidity crisis in March 2020 accelerated the maturation process of Bitcoin as a quasi-currency - the correlation with gold reached a record high;

2. The hedging property of Bitcoin lies in its hedging effect on political and sovereign credit risks and credit currency risks. In the short term, due to liquidity risks, it still shows its risk properties;

3. Bitcoin, as a quasi-currency produced in the financial crisis, still maintains its sensitive response to monetary policy;

secondary title

1. The correlation between Bitcoin and gold has reached an all-time high

Bitcoin was born on October 31, 2008. As the first successful cryptocurrency in history, Bitcoin inscribed a mockery of the third-generation monetary policy in its first block, and has been placed high hopes by many people.

However, after Bitcoin "313" Black Friday followed the global stock market and other risky assets plummeted, ordinary investors generally felt disappointed and doubted the prospects of Bitcoin.

Has the property of Bitcoin as a quasi-currency changed after this plunge? PayPal's financial capital market research team reorganized the short-term performance and long-term correlation of assets from a more macro perspective and found that, contrary to public intuition, the special attributes of Bitcoin have been strengthened in this liquidity crisis, and the correlation with gold reached a record high.

In this global asset slump, Bitcoin’s performance in Q1 far outperformed other risky assets such as SPX. Therefore, we believe that the global liquidity crisis of March 2020 hastened the maturation of Bitcoin as a quasi-currency. With its short 10-year history, Bitcoin completed market deleveraging within 2 days and created the beginning of a new long-term bull market in an environment of 7x24 hours trading, no trading restrictions, and no third-party supervision. Its performance is actually worthy of tradition. Financial reflection.

image description

Chart 1 Correlation Analysis of Bitcoin, Gold and SP500

image description

Chart 2 The short-term performance of Bitcoin is subject to SP500, but the performance in 20Q1 is better than SP500

image description

Chart 3 Gold entered a 3-year long-term rising channel after the Fed’s QE action in 2008

secondary title

2. Hedging attributes PK risk attributes

During this liquidity crisis, there was a lot of controversy over the hedging properties of Bitcoin, and some conclusions soon emerged: Bitcoin is not a safe-haven asset. However, the demonstration process of these conclusions often lacks data support. Here, the PayPal Financial Capital Markets research team proposes the following dismantling analysis: Bitcoin's hedging properties are similar to another quasi-currency - gold.

However, in the face of this liquidity crisis, in addition to the U.S. dollar, various safe-haven assets including U.S. bonds and gold also showed signs of selling in the short term. The essential reason is that the sharp drop in crude oil and the market panic and plunge caused by COVID-19 quickly caused changes in the risk of commercial banks’ balance sheets, cut off the credit intermediary role of commercial banks in the short term, and caused money supply, especially the supply of US dollars, to appear. Rapid reduction.

image description

Figure 4 The Fed rapidly increased its balance sheet, but commercial banks were unable to act, reducing the money supply by $3 trillion

image description

Chart 5 In this liquidity crisis, U.S. bonds and gold also fell rapidly

In order to obtain sufficient liquidity or increase margins, institutions will give priority to the next-level liquidity and safe-haven assets in their hands, and sell Bitcoin in the process, which triggers the February Bitcoin because of A death spiral in the leverage of arbitrage accumulation.

image description

Chart 6 The correlation between Bitcoin and SPX and crude oil is gradually declining

We should also see the positive side of this incident. No other asset in the world has the ability to complete deleveraging within 2 days, and deleveraging will be an important impetus to the healthy development of the market in the long run effect.

secondary title

3. Bitcoin still maintains its sensitive response to monetary policy

Bitcoin was born in the 2008 financial crisis. It is a resistance to traditional finance and an effective hedge against the new monetary policy produced ten years ago. The relationship between Bitcoin and the global money supply is its most fundamental fundamental .

image description

secondary title

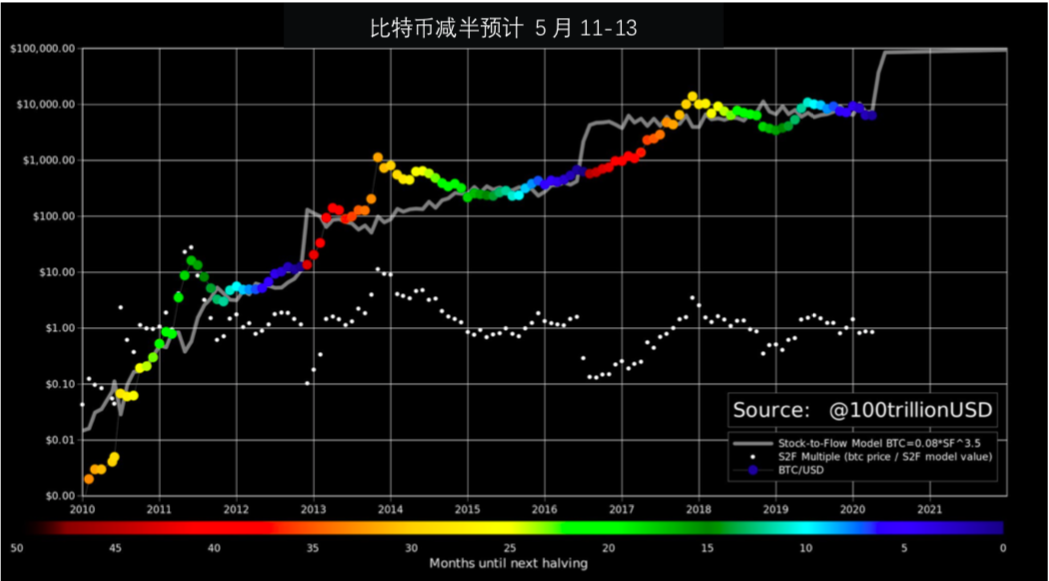

4. The 2020 "halving" will be a major test of the Bitcoin valuation model system

image description

Chart 8 Bitcoin halving and price chart

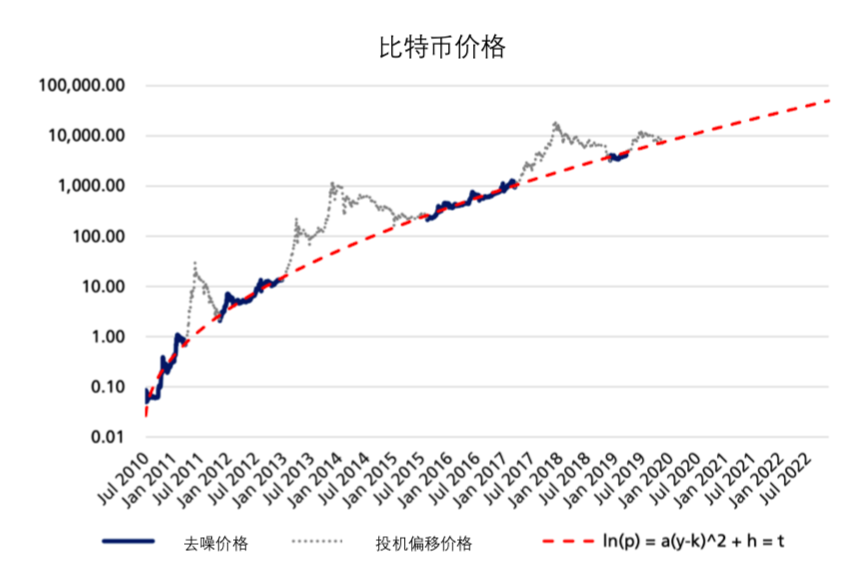

Bitcoin, as a quasi-currency without cash flow, is similar to gold. It is a consensus-type quasi-currency whose main value is reflected in the currency premium. Therefore, in the past, various consensus valuation models were applied to Bitcoin. Two of the more famous ones are:

Metcalfe's Law and Time Value and Bitcoin's Price Relationship

image description

Chart 9 The growth rate of long-term Bitcoin users has an impact on Bitcoin prices

As shown, the model believes that if there is no major change in the growth rate of the number of users, the price of Bitcoin may reach more than $50,000 in 2021.

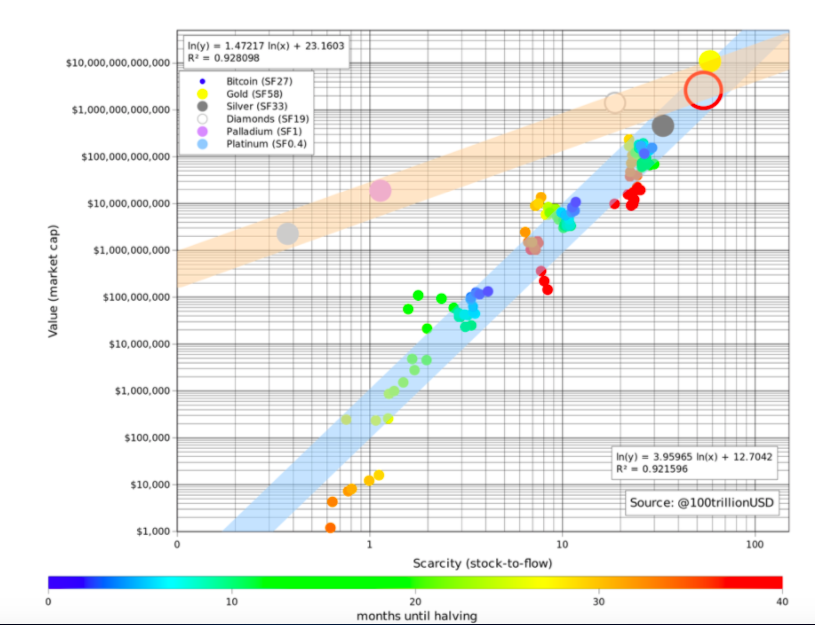

Scarcity S2F (Stock/Flow) Model

image description

Exhibit 10 Bitcoin S2F cross-asset and time-series model

The model believes that by 2020-2024, the reasonable valuation of Bitcoin's market value is between $1 trillion and $2 trillion, and the price of Bitcoin will reach between $55,000 and $110,000.

Both models have their model methodology and their logic is not absurd. Although there are imperfections, these two valuation stories are constructive.

The 2020 halving happens to be an important testing time for these two models, so let's wait and see.