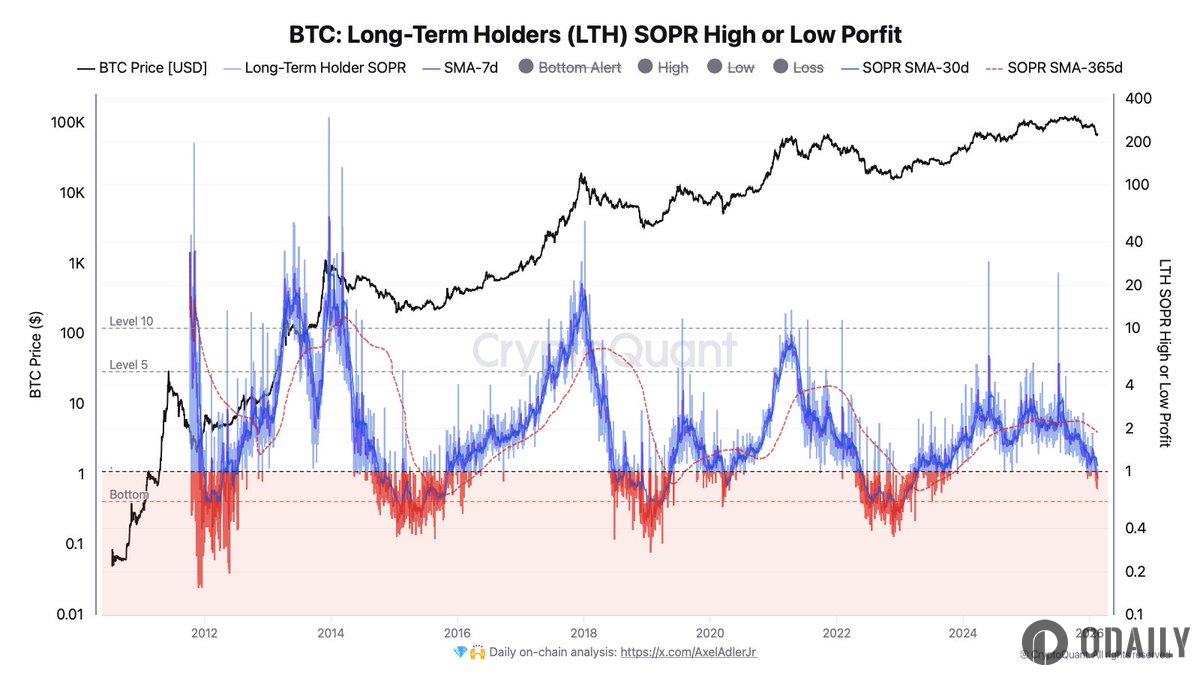

Analysis: Long-Term Holder SOPR Falls Below 1 for the First Time Since the End of the 2023 Bear Market

Odaily News, according to a post by crypto analyst Darkfost on the X platform, long-term holders (LTHs) are showing early signs of stress. As the market correction continues, LTHs are beginning to feel pressure based on the SOPR (Spent Output Profit Ratio) metric. Although the annual average SOPR for long-term holders is 1.87, the metric has now fallen below the threshold of 1 to 0.88, marking the first occurrence since the end of the 2023 bear market. This indicates that long-term holders are gradually starting to sell at a loss, reflecting rising market pressure.

However, this trend is not yet fully established. Looking at the monthly average, the SOPR remains at 1.09, suggesting that over a broader timeframe, most sales are still profitable. Therefore, the market has not yet entered a true long-term holder capitulation phase. These are merely early signs of weakening sentiment, which could subside if the market stabilizes, or intensify if selling pressure persists.