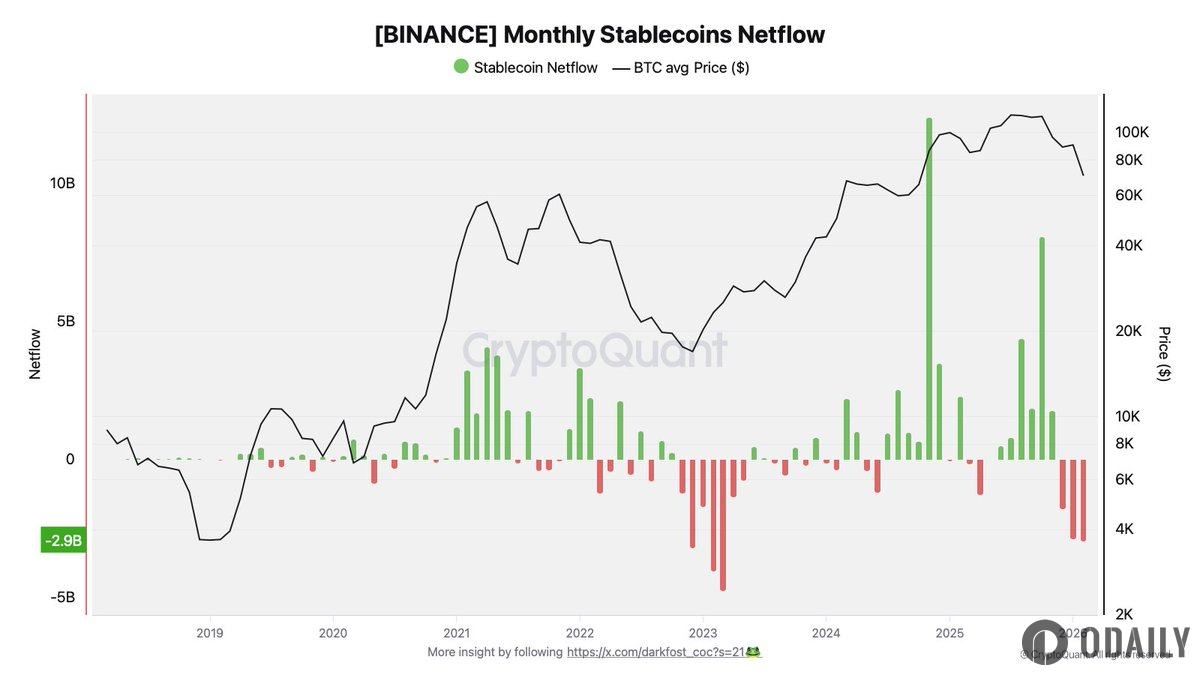

Viewpoint: Binance's Stablecoin Net Inflows Have Been Negative for Three Consecutive Months, Reserves Decreased by Approximately $90 Billion, Funds Continue to Flow Out of Exchange Ecosystem

Odaily News: Crypto KOL Darkfost posted on the X platform, stating that Binance's stablecoin net inflows have been in negative territory for three consecutive months, indicating a continued contraction of available liquidity in the crypto market. This phenomenon last occurred during the 2023 bear market. When major platforms like Binance, which concentrate a large amount of market liquidity, experience outflow dominance, it reflects investors' genuine de-risking position adjustments, meaning funds are gradually leaving the exchange ecosystem.

In December last year, Binance's monthly net outflow of stablecoins had already reached approximately $1.8 billion; this dynamic intensified significantly in January this year, with a net outflow of nearly $2.9 billion. February continued this trajectory, and although only half of the month has passed, nearly $3 billion in outflows have been recorded. Meanwhile, Binance's stablecoin reserves have declined substantially. Since November, reserves have dropped from about $50.9 billion to $41.8 billion, a contraction of nearly $9 billion during this period. This persistent decline in reserves points to weakening demand and more defensive position adjustments by investors. Against a backdrop of rising global uncertainty, a difficult-to-interpret macroeconomic environment, and escalating geopolitical tensions, these outflow signals indicate an increased willingness to reduce risk exposure. Market participants tend to adopt a wait-and-see approach, which mechanically adds pressure to liquidity and overall market dynamics.