Matrixport: Bitcoin breaks out to new highs, signaling a bullish bias.

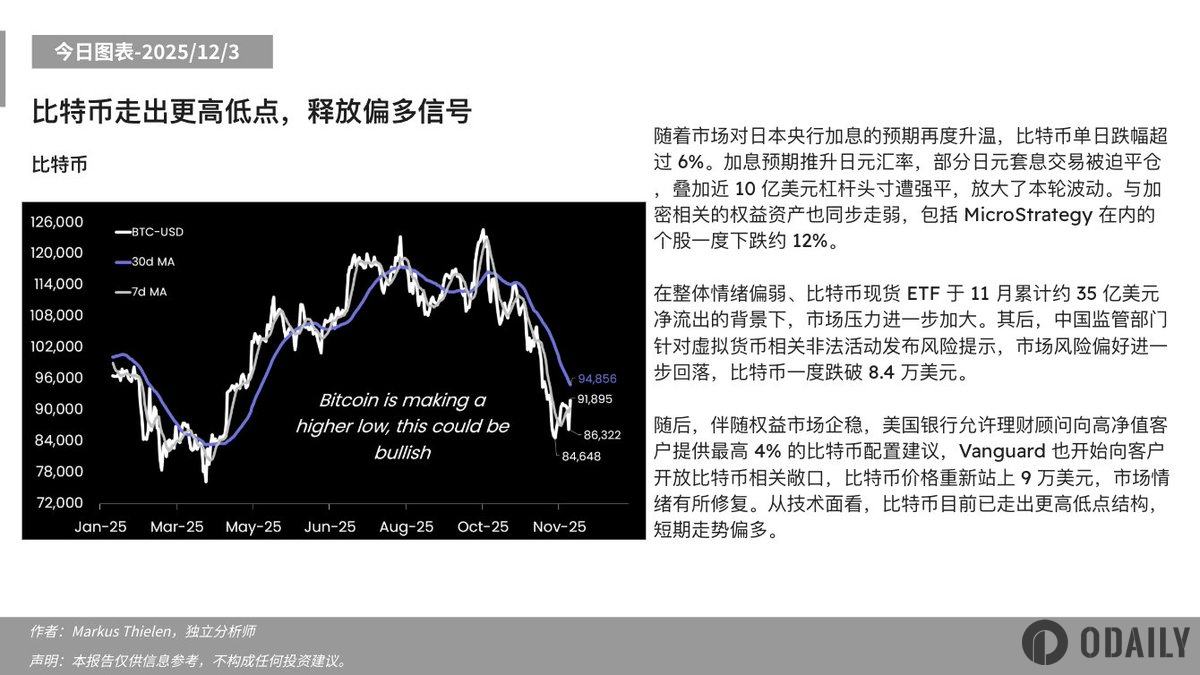

According to a chart released today by Matrixport, as market expectations for a Bank of Japan interest rate hike intensified, Bitcoin fell by more than 6% in a single day. The expectation of a rate hike pushed up the yen's exchange rate, forcing the liquidation of some yen carry trades. This, coupled with the forced liquidation of nearly $1 billion in leveraged positions, amplified the volatility. Crypto-related equity assets also weakened, with individual stocks, including MicroStrategy, falling by approximately 12% at one point.

Amidst weak overall sentiment and a net outflow of approximately $3.5 billion from Bitcoin spot ETFs in November, market pressure intensified. Subsequently, Chinese regulators issued risk warnings regarding illegal activities related to virtual currencies, further dampening market risk appetite, and Bitcoin briefly fell below $84,000.

Subsequently, as the equity market stabilized, Bank of America allowed financial advisors to offer high-net-worth clients advice on Bitcoin allocations of up to 4%, and Vanguard also began opening up Bitcoin exposure to its clients. Bitcoin prices rebounded to above $90,000, and market sentiment improved somewhat. From a technical perspective, Bitcoin has now formed a higher low structure, indicating a bullish short-term trend.