日活為8?Solana與Starknet輿論戰下的數據真相

- 核心觀點:文章指出,儘管Starknet曾因空投後用戶流失而備受嘲諷,但其通過All in BTCFi戰略實現了數據層面的顯著復甦,鏈上活躍度、TVL及資金流入等關鍵指標均證明其已培養出具有真實需求的優質用戶群。

- 關鍵要素:

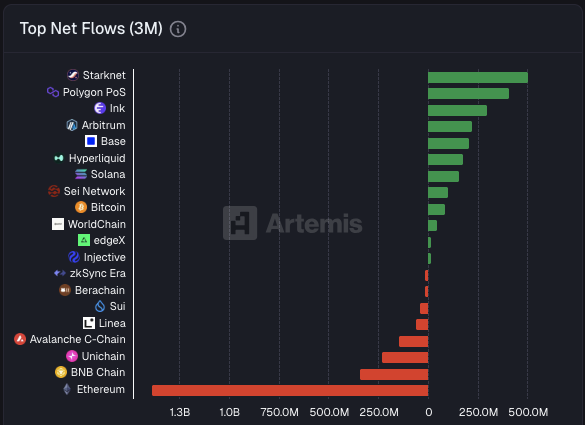

- 數據顯著回升:Starknet的TVL已超3億美元,日活地址保持在2000-4000,日交易筆數超24萬,且3個月資金淨流入達5.042億美元,位居區塊鏈榜首。

- 戰略轉型成功:Starknet擺脫以太坊L2標籤,全力投入BTCFi生態,其質押的比特幣價值已超2.14億美元,佔其總TVL約70%。

- 用戶質量提升:當前留存用戶的交易頻率高,為網路貢獻了大部分手續費收入,表明用戶從「擼毛人」轉向了有真實交易需求的群體。

- 生態逐步完善:圍繞BTCFi,Starknet已構建了從錢包、跨鏈橋、質押到借貸與收益協議的完整生態,玩法已跑通。

- 技術淵源深厚:創辦人早期研究利用零知識證明改進比特幣,其核心技術STARK密碼學為此戰略提供了歷史和技術支撐。

Original | Odaily (@OdailyChina)

Author | Golem (@web3_golem)

On the evening of January 14th, the official Solana account unexpectedly posted a mocking tweet targeting Starknet, claiming it had "only 8 daily active users and 10 daily transactions, yet supports a $1 billion circulating market cap and a $15 billion maximum valuation," and bluntly stated Starknet should go to zero.

One hour after the post, the official Starknet account quickly responded with a picture of an ugly chimpanzee, retorting, "Who told Solana this little brother these numbers?" StarkWare CEO even resorted to personal attacks, commenting under Eli Ben-Sasson's mocking post, saying, "Solana has 8 marketing interns (all bald), posting 10 tweets a day." Solana co-founder Toly also posted, saying, "This post is doing great, promoting the responsible marketer."

As tensions escalated between the two sides, some figures in the crypto space began urging for peace. He Yi posted, saying, "Take a deep breath and relax, we're all friends, let's prioritize harmony." However, she simultaneously captioned it with "peanuts, melon seeds, mineral water," indicating a spectator stance. The official Near account posted, suggesting Solana and Starknet should become friends again.

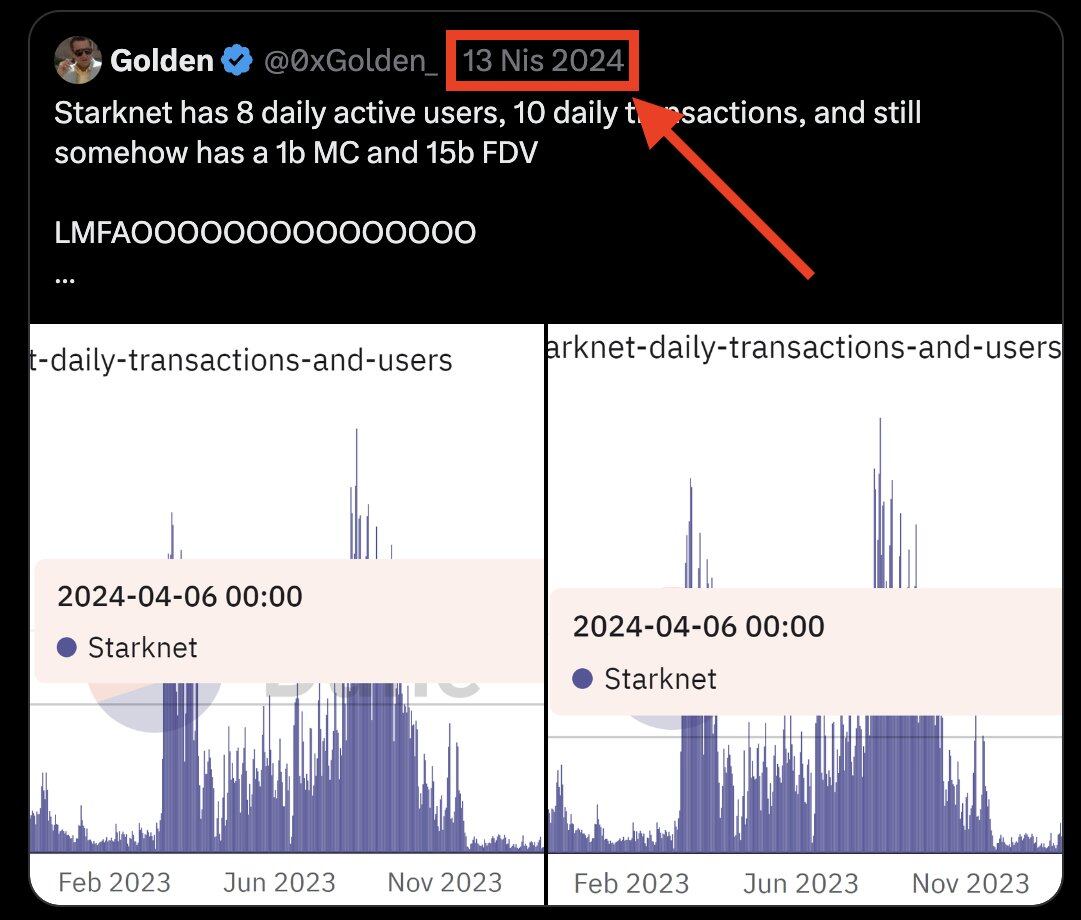

However, some viewpoints suggest this was a deliberately planned traffic exposure event by the official accounts, warming up for potential future collaboration. Simultaneously, netizens uncovered that Solana's post was not original; a user had posted an identical tweet as early as April 2024.

Solana's mocking tweet about Starknet was copied and pasted from a user's tweet in 2024.

Regardless of the real reason behind the Solana admin's "sudden outburst" mocking Starknet, from a data perspective, Starknet is no longer the "ghost town on-chain" it once was.

A Sudden Clap of Thunder in the Silence

In 2024, the L2 market was fiercely competitive with strong winner-takes-all effects. Arbitrum and OP Mainnet had already captured a large share of common use cases. Therefore, after the Starknet airdrop concluded, user attrition was significant, making it a legitimate target for criticism and mockery.

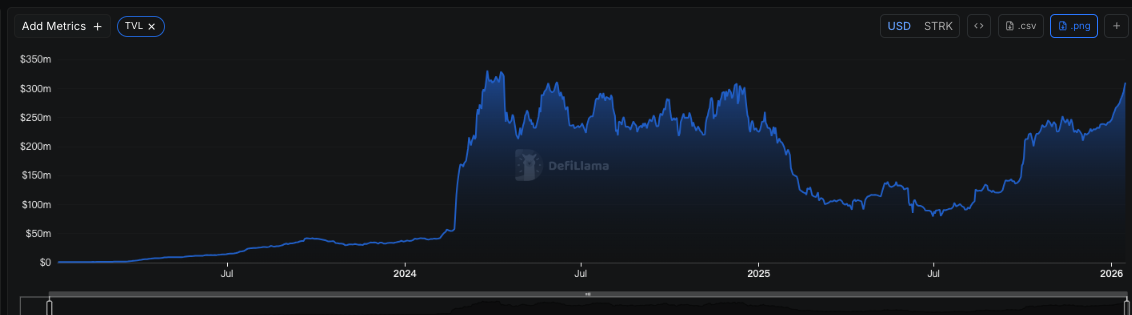

But after more than a year of perseverance and hard work, Starknet can now hold its own against most L1s. According to DeFiLlama data, Starknet's TVL began recovering in September 2025 and has now exceeded $300 million, returning to 2024 levels. In blockchain rankings, it sits at 22nd place, surpassing a host of L1s and L2s like Monad, Scroll, Linea, and Sei.

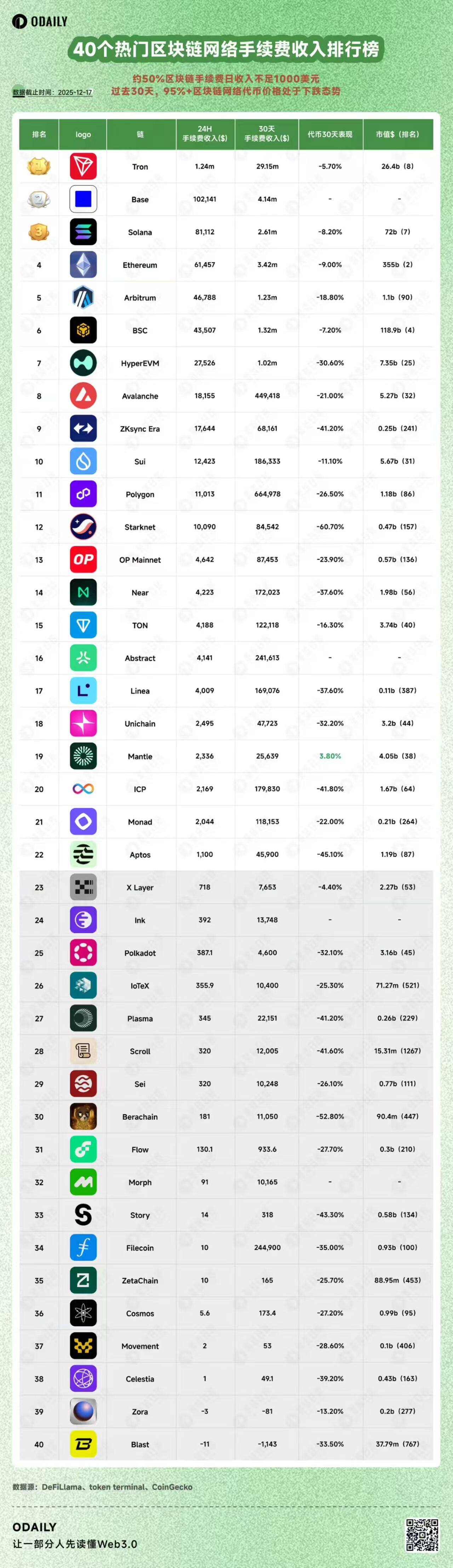

Simultaneously, its stablecoin market cap, fee revenue, and ecosystem DEX trading volume also began recovering after September 2025. Starknet's daily fee revenue over the past four months has remained in the $5,000-$10,000 range. While this pales in comparison to its daily fee revenue in 2023-2024 (averaging over $150,000 per day), it still ranks among the top performers among numerous blockchains.

Odaily conducted a ranking of fee revenue for 40 mainstream blockchains in mid-December, with Starknet breaking into the top 15, surpassing blockchains like Monad and TON in daily fee revenue.

In terms of on-chain activity, Starknet has finally cultivated a group of genuine loyal users (rather than pure airdrop farmers). According to the Dune dashboard created by the Starknet Foundation, Starknet currently maintains a daily active user count of 2,000-4,000 (unique addresses), with daily transactions exceeding 240,000.

Compared to Starknet's peak daily active users of over 100,000 (in 2023), its current daily active users are indeed still negligible. However, in terms of transaction count, the transaction frequency of these addresses (less than 2% of the peak) has reached about one-third of the peak level (over 600,000 daily transactions in 2023). This data proves that the users remaining on Starknet are high-quality users with genuine transaction needs, contributing the majority of the network's fee revenue.

Don't simply view Starknet as a gathering place for "niche enthusiasts" in the blockchain space. In fact, Starknet has attracted external capital favor and enjoys relatively high retention. According to Artemis data, Starknet's 3-month net capital inflow reached $504.2 million, ranking first among blockchains. The second-place Polygon trailed by $100 million, far ahead of blockchains like Solana and BSC.

Shedding the Ethereum L2 Label, All in on BTCFi

The reason for Starknet's comeback is actually quite simple: it doesn't compete with blockchains like Solana, BSC, and Base in the Meme or hot narrative frenzy. Instead, it goes all-in on BTCFi.

Today's Starknet is shedding its Ethereum L2 label. Its official account has even added a note (BTCFi arc) after the Starknet name. In March 2025, Starknet's parent company, StarkWare, announced the establishment of a "strategic Bitcoin reserve." The outside world initially thought this was just hype and didn't expect Starknet to be serious. By the end of September 2025, after over six months of development, Starknet announced the launch of BTC Staking with 100 million STRK incentives. Users staking BTC on Starknet could receive staking rewards and STRK incentives.

As of now, BTCFi has been live on Starknet for over three months, and the launch of this product is highly correlated with the recovery of Starknet's on-chain data.

According to Dune data, the value of Bitcoin currently staked on Starknet exceeds $214 million, accounting for about 70% of Starknet's total TVL ($300 million). Approximately 50% of the deposited assets on the platform are native BTC, with the remainder being various wrapped versions of BTC, primarily SolvBTC and WBTC.

The Bitcoin ecosystem on Starknet has also gradually matured, encompassing everything from wallets to cross-chain bridges and staking, to lending and yield protocols, with proven use cases.

Starknet BTCFi Ecosystem Landscape

Users can stake Bitcoin on platforms like Endur and Voyager and delegate it to validators. In return, stakers receive STRK tokens (the current APY for Endur, denominated in STRK, is approximately 2.09%). Subsequently, the obtained LST tokens can be deposited into lending protocols like Vesu to generate additional yield. For institutional investors, Re7 Capital can also create customized yield solutions.

As for why Starknet dares to go all-in on BTCFi, it might be related to the founder's personal experience. As early as 2013, before Starknet was born, Eli Ben-Sasson was already researching the use of zero-knowledge proofs to improve Bitcoin. This research eventually became one of Starknet's core technologies (STARK cryptography). Therefore, fully embracing BTCFi today is, in a way, a return to its original vision.

Although the blockchain world doesn't always reward idealists and those who work diligently in silence, freed from the "hostage" situation of airdrops, Starknet's steps have become lighter and more steady.