카피캣 시즌이 다가오고 있나요? 상위 10개 촉매제 이벤트 살펴보기

원저자: DeFi Warhol

원본 편집: Deep Chao TechFlow

저는 7년 동안 암호화폐 분야에서 일해 왔으며 현재 우리는 제가 본 것 중 가장 낙관적인 시장 상황 중 하나에 있습니다. 다음 달에 알트코인 가격이 급등할 수 있는 10가지 요인은 다음과 같습니다.

1. FTX 보상금 160억 달러

최근 FTX는 총 160억 달러를 분배했으며 그 중 120억 달러는 현금이었습니다. 이 자금을 받은 이들 중 다수가 시장에 재투자해 새로운 매수 물결을 촉발할 것으로 예상된다.

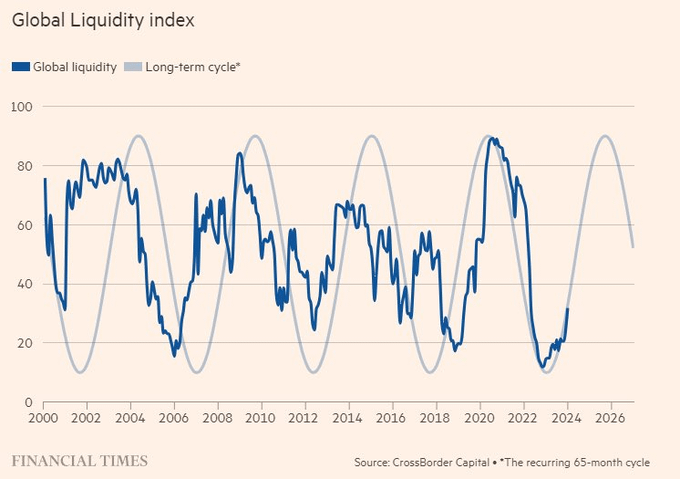

2. 글로벌 유동성 지수

암호화폐 시장과 글로벌 유동성 사이의 상관관계는 매우 분명합니다. 지수가 현재 수준에 도달할 때마다 시장은 대개 강력한 랠리를 따릅니다.

3. 이더리움 ETF

현재 이더리움 ETF의 개발은 느리지만, 곧 따라잡을 것이라고 굳게 믿습니다. 시간 문제 일뿐입니다.

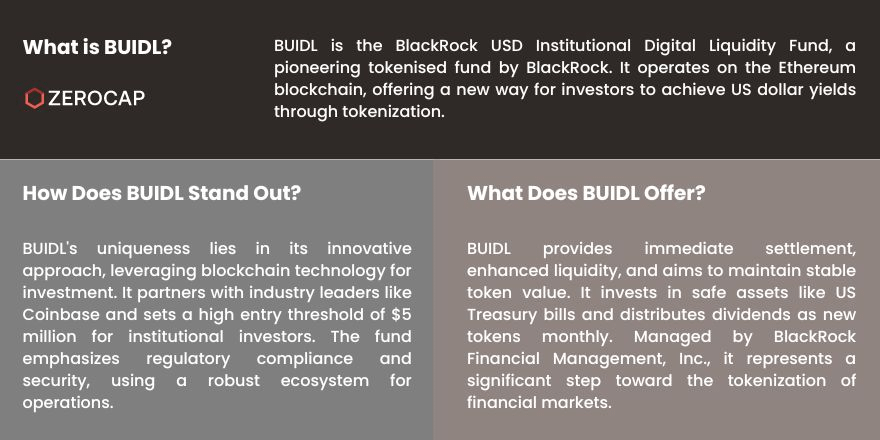

4. BlackRock의 BUILD 펀드

ETF 외에도 세계 최대 자산운용사 블랙록(BlackRock)은 블록체인 기술에 대해 매우 낙관적이다. BUILD Fund는 이를 다시 한번 증명했으며 이는 시작에 불과합니다.

5. Goldman Sachs는 토큰화를 수용합니다.

BlackRock만이 조치를 취하고 있다고 생각하시나요? 다시 생각해 보세요. 주요 기관들은 이미 이러한 흐름에 동참했습니다.

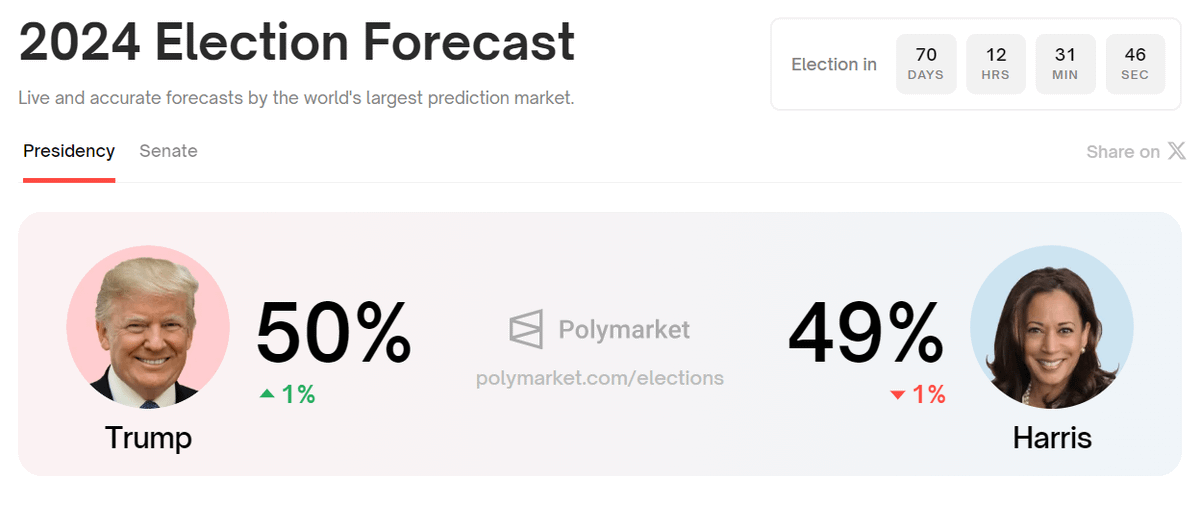

6. 미국 선거

트럼프 대통령은 그의 행정부가 업계를 지원함에 따라 암호화폐에 긍정적인 영향을 미쳤습니다. 현재는 경주에서 약간 앞서 있기 때문에 지켜볼 만하다.

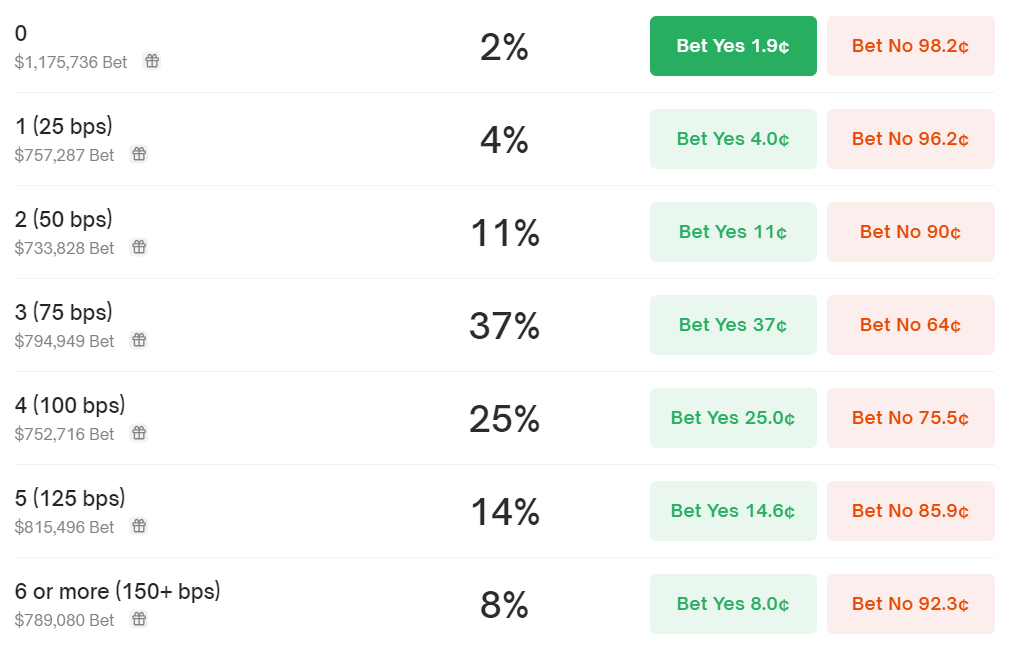

7. 금리 인하

시장에서는 올해 3차례 금리 인하가 예상되는데, 9월 금리가 25bp 인하될 확률은 무려 90%에 이른다.

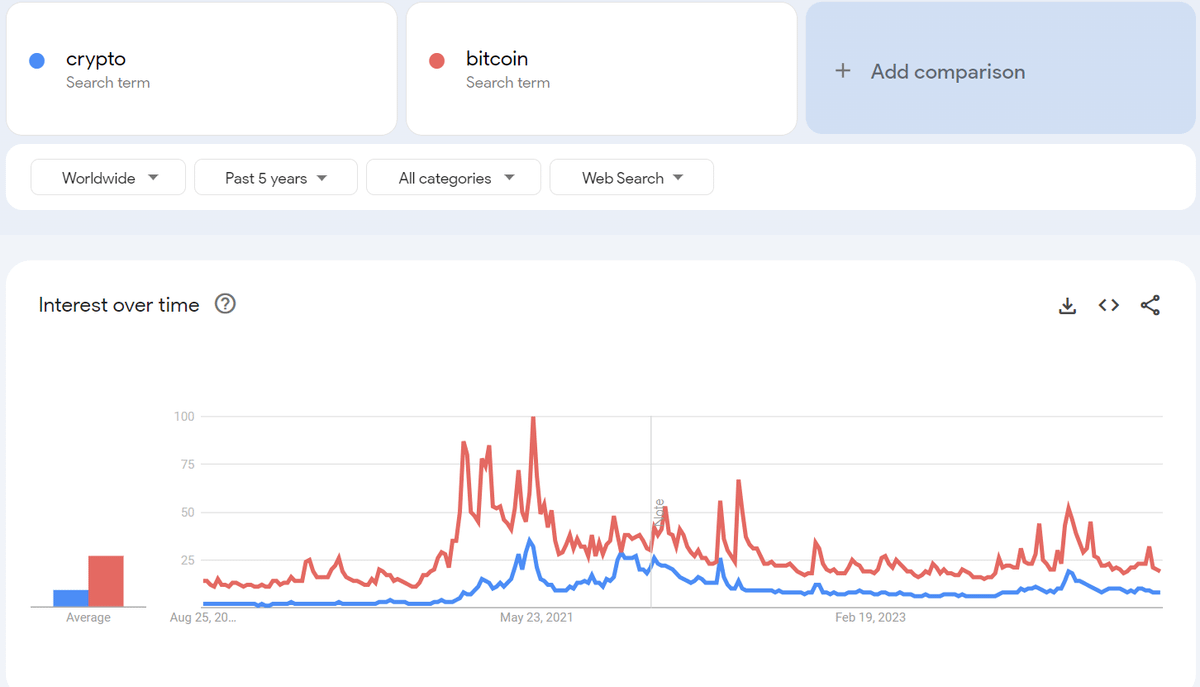

8. 일반 투자자들은 여전히 방관하고 있다

'암호화폐' 및 '비트코인'에 대한 Google 검색량은 하락장 수준에 머물고 있습니다. 게다가 Coinbase 앱의 순위는 416위에 불과합니다.

9. 미국 달러 지수

DXY는 지난 몇 달 동안 계속 감소했으며 현재는 주요 지원 수준에 있습니다. 이 지원 수준이 위반되면 암호화폐에 매우 긍정적인 영향을 미칠 수 있습니다.

10. 하락 요인이 사라지고 있다

MtGox 사건, 독일의 비트코인 매도, 점프 트레이딩, 경기 침체 우려, 전쟁 등 시장 매도의 주요 원인이 줄어들고 이러한 요인도 약화되는 것으로 보입니다.