คอลัมน์ความผันผวนของ SignalPlus (20240423): หุ้นสหรัฐฯ ดีดตัวขึ้น ราคาทองคำดิ่งลง

ความเชื่อมั่นด้านความเสี่ยงในตลาดหุ้นสหรัฐฯ ดีดตัวขึ้นเล็กน้อยเมื่อวานนี้ (22 เมษายน) โดยที่ SP 500 แพ้รวดหกเกมจบลง ตลาดได้พักหายใจก่อนดัชนี PCE ของวันศุกร์ สัปดาห์ผลประกอบการที่ยุ่งวุ่นวาย และการประชุม FOMC ที่กำลังจะมีขึ้น ในทางกลับกัน ข้อมูลเงินเฟ้อที่ย่ำแย่เมื่อเร็วๆ นี้ทำให้การคาดการณ์ของตลาดสำหรับ Federal Reserve เปลี่ยนไปใช้นโยบายผ่อนคลาย อัตราผลตอบแทนพันธบัตรสหรัฐฯ ยังคงผันผวนในระดับสูง และยังบังคับให้นักลงทุนทั่วโลกพิจารณาทบทวนวงจรการผ่อนคลายทางการเงินทั่วโลกที่คาดหวังไว้ เริ่มสงสัยในยุโรป ด้วยความมุ่งมั่นที่จะลดอัตราดอกเบี้ยของธนาคารกลาง ตลาดสกุลเงินจึงไม่สรุปความคาดหวังที่ธนาคารกลางยุโรปจะลดอัตราดอกเบี้ยสามครั้งในเดือนธันวาคมอีกต่อไป สำหรับเส้นทางการปรับลดอัตราดอกเบี้ยที่ก้าวร้าวมากขึ้นก่อนหน้านี้ อัตราเงินเฟ้อที่เกิดจากอัตราแลกเปลี่ยนทำให้ "เรามีเหตุผลที่จะต้องกังวลเกี่ยวกับการปรับลดอัตราดอกเบี้ยของ ECB"

ที่มา: TradingView, SP 500

ราคาทองคำพรีเมียมที่เกิดจากความขัดแย้งทางภูมิรัฐศาสตร์ค่อย ๆ ลดลงจากตลาด สปอตทองคำบันทึกการลดลงในวันเดียวครั้งใหญ่ที่สุดในรอบสองปี และยังคงลดลงอย่างต่อเนื่องในวันนี้

ที่มา: TradingView, XAUUSD

ในแง่ของสกุลเงินดิจิทัล ETF ยังคงการไหลเข้าในเชิงบวก โดยการไหลเข้าของ FBTC นั้นมากกว่า IBTC พี่ใหญ่เป็นเวลาสามวันติดต่อกัน และการไหลออกของ GBTC ก็ลดลงเช่นกัน นอกจากนี้ ตามที่บริษัทวิเคราะห์ข้อมูลใบหน้า Artemix ระบุว่า การไหลเข้าสุทธิของ Stablecoins ยังคงดำเนินต่อไปเป็นเวลา 15/16 สัปดาห์ในปี 2024 เมื่อสัปดาห์ที่แล้ว การไหลเข้าสุทธิของ Stablecoins สูงถึง 3.4 พันล้านดอลลาร์สหรัฐ ซึ่งเป็นระดับสูงสุดอันดับสามในปี 2024

ที่มา: Farside Investors; ทวิตเตอร์

ในวันที่ผ่านมา ราคาของ BTC ทะลุจาก 660 ล้านดอลลาร์เป็น 67,000 ดอลลาร์ จากนั้นกลับตัวกลับมาที่ประมาณ 66,000 ดอลลาร์

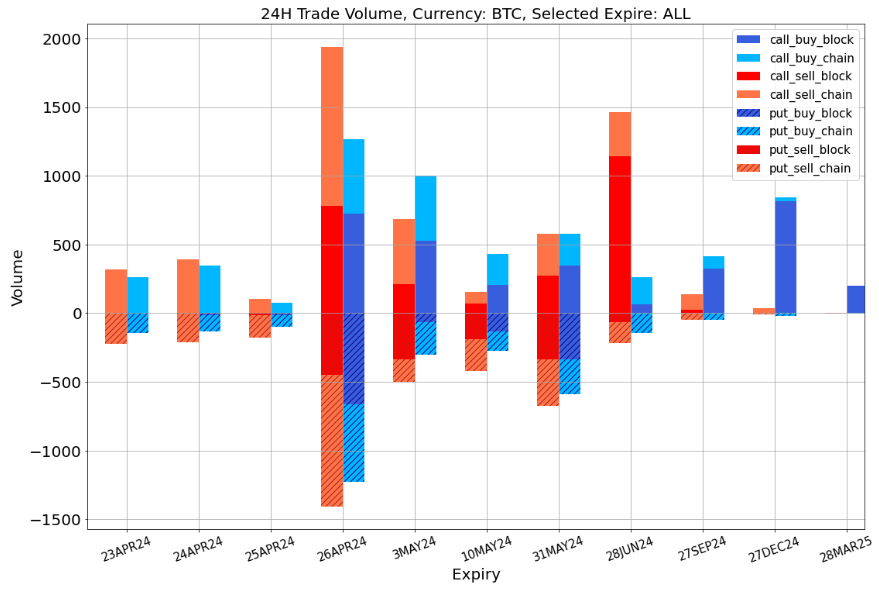

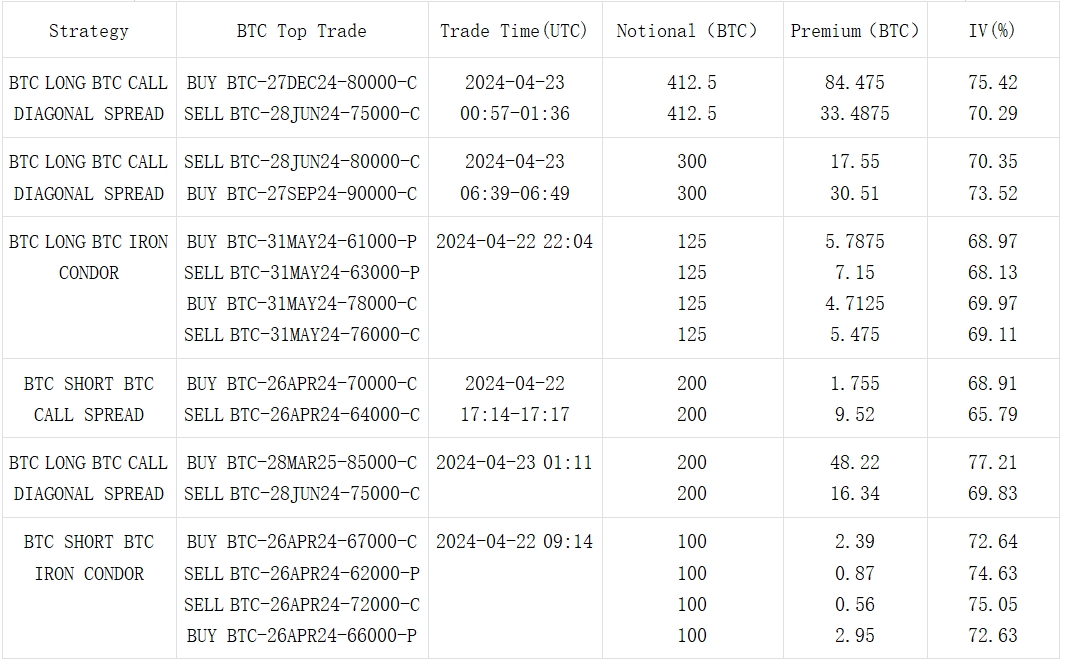

ในแง่ของตัวเลือก ความผันผวนโดยนัยได้รุนแรงขึ้นและลดลงอย่างเห็นได้ชัด ในบล็อก BTC มีธุรกรรม Iron Condor สองชุดในทิศทางตรงกันข้าม โดยซื้อ Vol เมื่อปลายเดือนเมษายนและขาย Vol เมื่อปลายเดือนพฤษภาคมเช่นกัน ตั้งข้อสังเกตว่าตัวเลือกการโทร BTC ณ สิ้นเดือนมิถุนายนคือ การขายจำนวนมากส่วนใหญ่ได้รับผลกระทบจากความแตกต่างของราคาสามเหลี่ยมระหว่างสองธุรกรรมบนแพลตฟอร์มจำนวนมาก ในขณะที่ขาย 28 มิถุนายน 75000 และ 80000 โทร ฉันซื้อ 27 DEC 80000-C และ 27 กันยายน 90000-C ตามลำดับ ซึ่งอาจรวมถึงเหตุการณ์ความไม่สงบที่เกิดจากการเลือกตั้งสหรัฐฯ

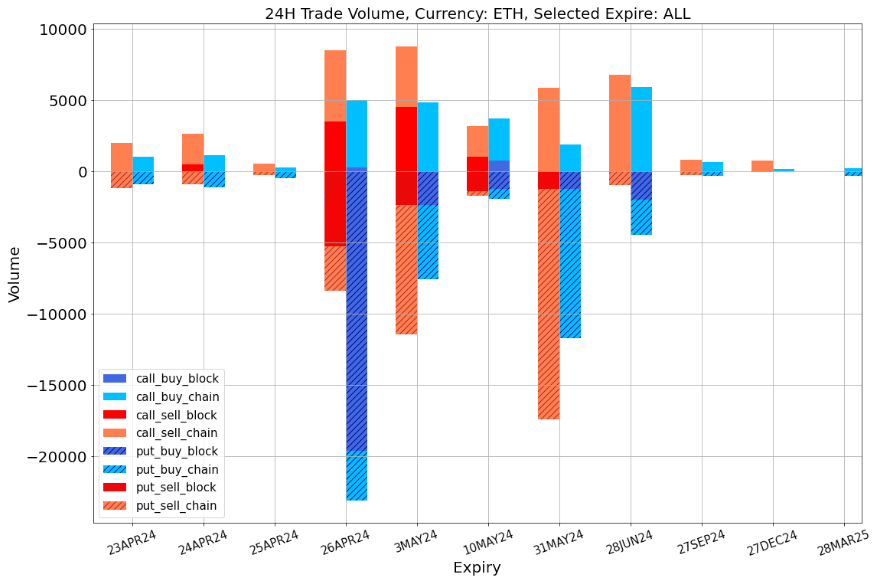

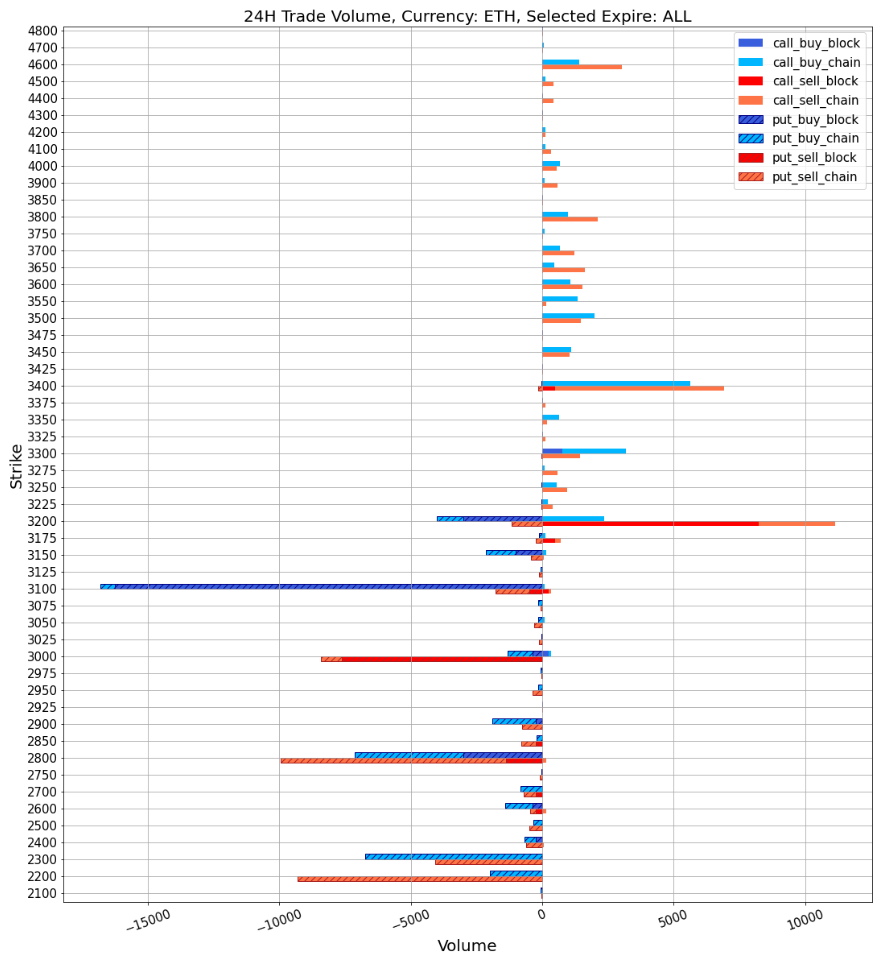

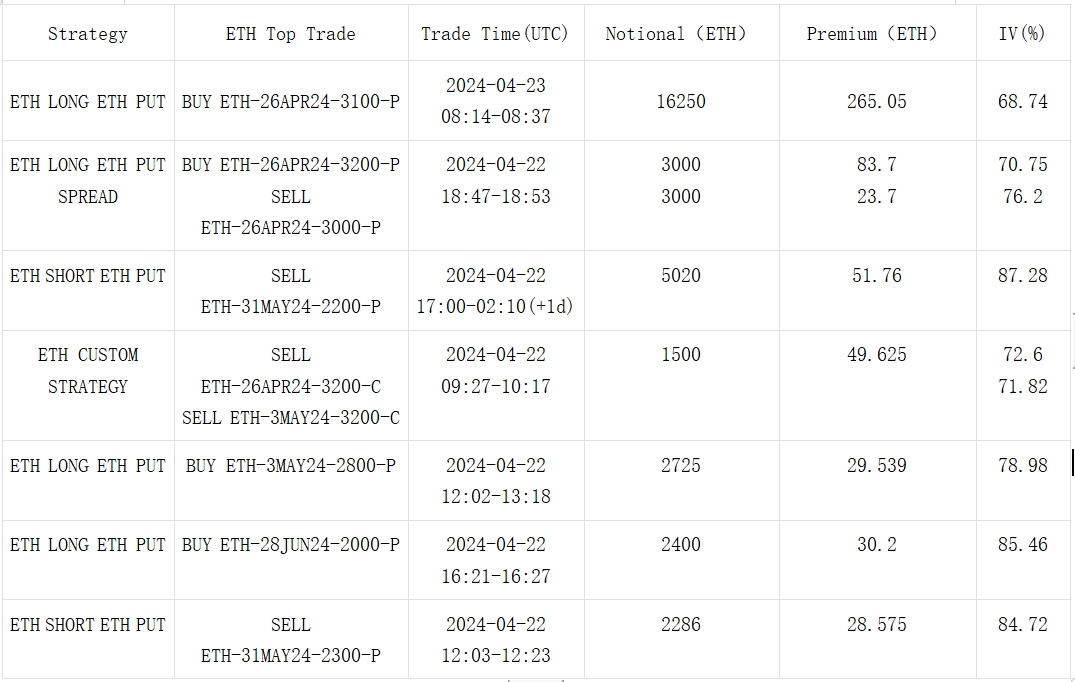

ธุรกรรมใน ETH ค่อนข้างกระจุกตัว นักลงทุนรายใหญ่ซื้อ 3100 Put จำนวนมากเมื่อปลายเดือนเมษายนเพื่อปกป้องการชำระหนี้รายเดือนที่กำลังจะเกิดขึ้น และวันที่ 31 เพื่อรับสิทธิ์ทองคำ

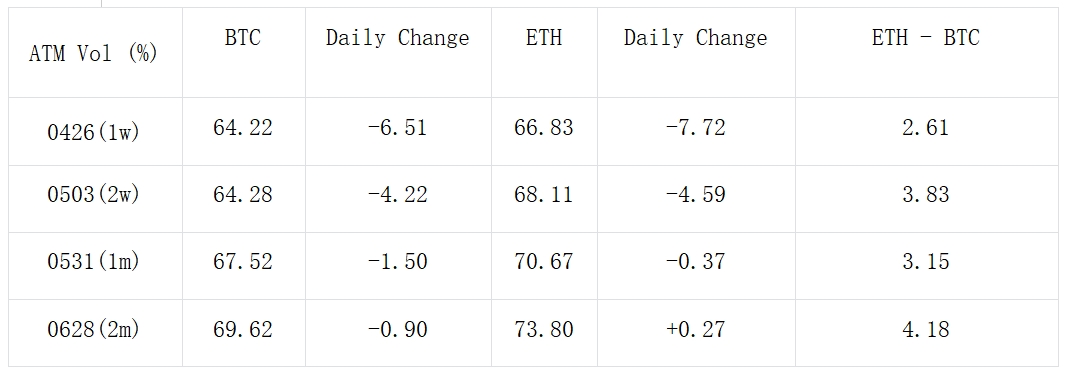

ที่มา: Deribit (ณ วันที่ 23 A PR 16:00 UTC+8)

ที่มา: SignalPlus

แหล่งข้อมูล: Deribit, การกระจายธุรกรรม ETH

แหล่งข้อมูล: Deribit, การกระจายธุรกรรม BTC, Call ณ สิ้นเดือนมิถุนายนมีการขายอย่างหนัก

ที่มา: Deribit Block Trade

ที่มา: Deribit Block Trade

คุณสามารถค้นหา SignalPlus ได้ใน Plugin Store ของ ChatGPT 4.0 เพื่อรับข้อมูลการเข้ารหัสแบบเรียลไทม์ หากคุณต้องการรับข้อมูลอัปเดตของเราทันที โปรดติดตามบัญชี Twitter ของเรา @SignalPlus_Web3 หรือเข้าร่วมกลุ่ม WeChat ของเรา (เพิ่มผู้ช่วย WeChat: xdengalin) กลุ่ม Telegram และชุมชน Discord เพื่อสื่อสารและโต้ตอบกับเพื่อน ๆ มากขึ้น

เว็บไซต์อย่างเป็นทางการของ SignalPlus: https://www.signalplus.com