In the past 24 hours, many new popular currencies and topics have emerged in the market, and it is very likely that they are the next opportunity to make wealth.

Written by: Bitget Research Institute

The sectors with strong wealth creation effects are: TON Ecosystem and Hong Kong Concept Sector. You can pay attention to whether the ERC 404 sector can be reborn in the future;

The most popular tokens and topics searched by users are: ZK, NGL, Base ecology (DEGEN, BRETT), RWA concept (ONDO, CFG);

Potential airdrop opportunities include: Espresso, Fuel Network;

Data statistics time: 4:00 on March 25, 2024 (UTC+ 0)

1. Market environment

From a macro perspective, at last weeks FOMC meeting, most Fed members believed that interest rates would be cut three times in 2024, which was a dovish signal. This week, we will focus on Friday’s core PCE data. If there are no new unfavorable policies or economic data, there will be no negative impact on the cryptocurrency market from a macro perspective. This market correction may be coming to an end.

Regarding BTC Spot ETF: From March 18 to March 22, BTC Spot ETF experienced continuous net outflows within 5 working days last week. The 5-day net outflows were: $154M, $326M. , $262M, $94M, $52M. It can be found that the net outflow has been decreasing day by day since March 19. If the net outflow continues to narrow or reverses to net inflow this week, BTC may drive the market to continue to rebound.

2. Wealth creation sector

1) Sector changes: TON ecology (TON, UP, FISH)

main reason:

Significant improvement in fundamental data: DefiLlama shows that the TVL of the TON ecosystem has exceeded US$80 million, which is four times the TVL value in early March.

The TON Foundation plans to launch the first-season public league on April 1 and provide $115 million in Toncoin community rewards to stimulate ecological construction and user activity.

Rising situation: TON token has increased by +160% in the past month, the IDO platform and Bitget Launchpad project TopUp (the token is UP) on the TON ecosystem has increased by +313% in the past month, and the TON ecological meme coin FISH has increased by +1321 in the past month. %.

Factors affecting the market outlook:

(1) TVL growth and infrastructure construction of the TON ecosystem: Even though TON’s TVL has exceeded US$80 million, it is still small compared to its market value of nearly US$19 billion. There is no outstanding native DeFi product in the TON ecosystem to attract funds, and the officially launched wallet also has many problems that have been criticized by the community. In the next stage of development, how much the TON Foundations $115 million community reward can have a stimulating effect and how much it can help improve ecological native projects will directly affect the development speed and development limit of the TON ecosystem. If the TON ecosystem can see continuous capital inflows, we can focus on meme coins, which have a relatively low market value and good liquidity, and look for opportunities for small capital participation to gain high returns.

(2) Verification of TONs value capture and profit model for Telegram: The markets high expectations for TON still focus on capturing the value of Telegrams platform. What kind of linkage can TON form with Telegram in the future? Can it make backed by 10 Transforming the concept of billion Internet users into a real and reliable profit model will be the key to whether TON can have a big breakthrough.

2) Sector changes: Hong Kong concept sector (CFX, ACH)

The main reason: The 2024 Hong Kong Web3 Carnival will be held on April 6. As the representative token of Hong Kong’s concept sector, CFX’s currency price has been relatively stable during the market correction and has taken the lead in rebounding. There is still some room for speculation before the start of the Hong Kong Web3 Conference. .

Rise: Conflux (CFX) has increased by +113% in the past month, and Alchemy Pay (ACH) has increased by +60% in the past month.

Factors affecting the market outlook:

The trend of Hong Kong concept sector tokens is closely related to the introduction of policies. Whenever Hong Kong introduces proposals or policies that are beneficial to the Web3 industry, it is likely to cause speculation in the sector. At the same time, it should be noted that the hype cycle of this sector is short, and there is a risk that the currency price may be exhausted and the currency price drops rapidly during the meeting.

3) The following sectors need to be focused on: ERC 404 (PANDORA)

main reason:

The once popular NFT Ghozali from India has started presale pre-sale and issuance of coins, and cooperated with Pandora to create Ghozali 404. After the fundraising started, it quickly reached the hard cap of 400 ETH, and the relevant tweet received up to 1.2 million views within 12 hours of being sent out. It shows that the Pandora project side has begun to cater to market hot spots and expand cooperation outwards.

The PANDORA token has fallen by 50% in the past month and has fallen by 65% from its historical high. It is a good opportunity for investors who are optimistic about the rebirth of this innovative sector.

Specific currency list: PANDORA

3. User hot searches

1) Popular Dapps

Polyhedra Network:

Polyhedra Network is a ZK full-stack project building next-generation infrastructure for Web3 interoperability, scalability, and privacy through zero-knowledge proof (ZKP) technology. This project is of epoch-making significance and will truly realize multi-chain interoperability based on ZK, especially its vision to build the worlds largest Bitcoin interoperability ecosystem. After the project was launched, the current market value in circulation is US$240 million, and CMC currently ranks 2,400 in market value. Investors can pay attention to the subsequent development of the project and wait patiently for the project to gradually develop and promote ecological construction and be discovered by the market.

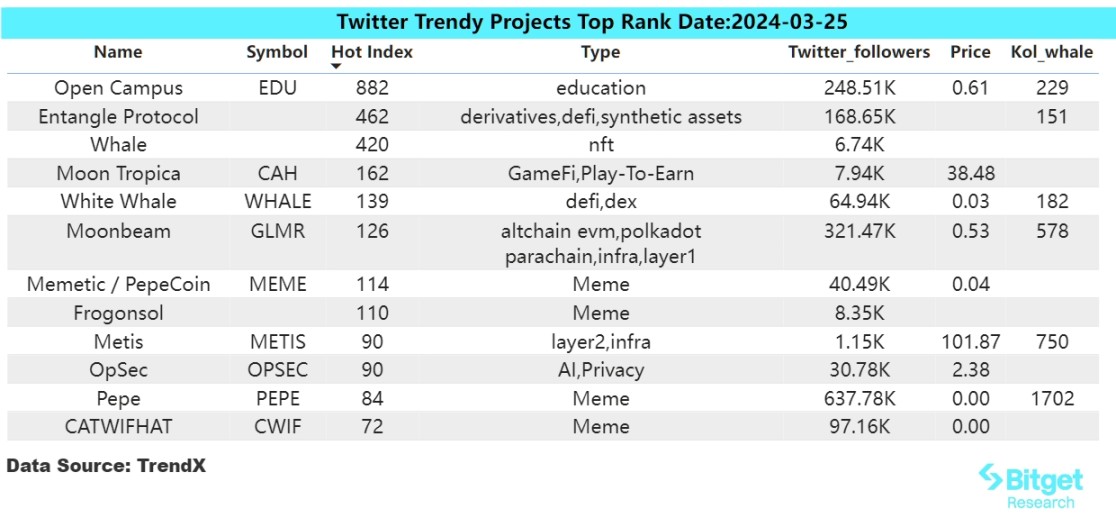

2)Twitter

Entangle Protocol:

Entangle Protocol is the first cross-chain protocol to use synthetic derivatives to synergize liquidity and assign value to liquidity in a universal Layer 1 and Layer 2 ecosystem. Simply put, the protocol allows users to interact seamlessly with liquidity pools across chains. With the development of the blockchain industry, there are more and more public chains and Layer 2, and it is very necessary to open up multi-chain liquidity. As an outstanding project in this field, Entangle’s value will be greatly magnified in the bull market. Investors are recommended Continue to pay attention to the projects token NGL, especially the development of the projects access to more high TVL ecology.

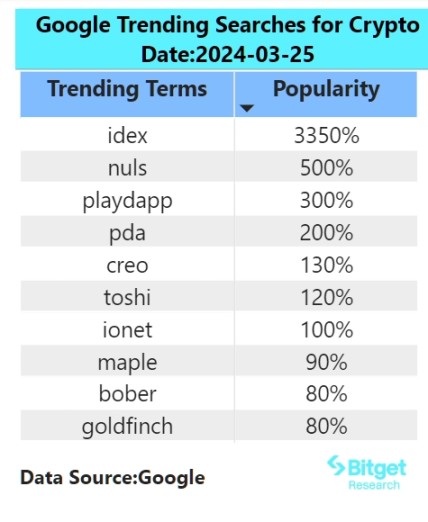

3) Google Search Region

From a global perspective:

(1) In the overall hot search ranking, the performance of the popular section RWA track is relatively outstanding:

The main reason: BlackRock recently submitted documents to the U.S. Securities and Exchange Commission and plans to cooperate with Securitize, a U.S. asset tokenization company, to launch the BlackRock USD Institutional Digital Liquidity Fund (BlackRock USD Institutional Digital Liquidity Fund). This marks BlackRock’s first The individual asset tokenization fund is about to be launched, which will continue to benefit the RWA project. The TVL of the RWA track will continue to increase in the future.

Specific projects: Affected by the above news, leading projects in the ecosystem will continue to benefit. You can focus on the following projects: ONDO, MPL, GFI and other leading RWA track projects. In the past 24 hours, ONDO increased by 28.8% and MPL increased by 28.8%. 8.2%, GFI increased by 26.9%, transactions were relatively active, and hot searches on the track continued unabated.

Judging from the hot searches in each region:

(1) Hot searches in Europe and CIS regions are mainly focused on MEME:

Following the MEME craze on the Solana chain, MEME on the Base chain has recently carried out market relays, and MEME assets with excellent price performance have continued to emerge. Also when such a MEME craze occurs on the Base chain, the beneficiaries are not only the Base public chain, investors who discovered excellent projects in the early stages, but also the largest DEX Aerodrome on the Base chain. Investors can pay attention to the market conditions of Base public chain projects from the above perspectives, including AERO, BRETT, DEGEN, etc.

(2) RWA frequently appears in hot searches in other countries and regions:

RWA is generally considered to be one of the ways for large-scale funds to enter the encryption industry. It also allows global users to enjoy real asset investment returns across countries, including real estate, energy, treasury bonds, etc. As BlackRock further expands its presence in the industry, bids within the industry have recently been subject to financial speculation, attracting high user attention. Investors can pay attention to leading projects in this field: ONDO, CFG, PENDLE, POLYX, etc.

4. Potential airdrop opportunities

Espresso

Espresso is a shared sequencer market project using ZK-Rollups. This project mainly solves the consensus and interoperability between various Layer 2. The core of Espressos strategy is to focus on privacy and decentralization, and the core members of the project are members of the Stanford University Applied Cryptography Research Group.

The project recently announced the completion of Series B financing of US$28 million, led by A16Z, with participation from Polychain, Coinbase Ventures, Sequioia, Sequioia, etc., with a luxurious financing lineup.

Specific participation methods: The project is currently in an early stage. Users can participate in early projects by participating in verification nodes, and may obtain early air investment qualifications. For specific implementation, please refer to the official documentation: https://docs.espressosys.com/sequencer/guides/running-a-sequencer-node

Fuel Network

Fuel Network is Ethereum’s modular execution layer. Fuel v1 was initially deployed in late 2020 as a scaling solution for Ethereum using the Optimistic Rollup model for payments. Fuel v1 uses a UTXO model, which allows for faster transaction processing because transactions are verified in parallel on the users hardware. Currently, Fuel has started the v2 high-speed modular execution layer plan to truly achieve capacity expansion.

On September 7, 2022, Fuel Labs announced the completion of US$80 million in financing, led by Blockchain Capital and Stratos Technologies, with participation from Alameda Research, CoinFund and others.

Specific participation methods: Download Fule Wallet on the Fuel Network official website, receive test tokens through the official Discord community, perform token swap in the Fuel test network, participate in the interactive Dapp, and maintain a certain level of address activity.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603807107

[Disclaimer] There are risks in the market, so investment needs to be cautious. This article does not constitute investment advice and users should consider whether any opinions, views or conclusions contained in this article are appropriate for their particular circumstances. Invest accordingly and do so at your own risk.