Original author: Huohuo

According to news on March 21, BlackRock announced that it will launch the first tokenized fund BUIDL on Ethereum. This move directly makes the RWA (Real World Asset, which refers to the tokenization of real world assets through blockchain technology) track popularity soaring. rise.

However, this is not the first time that BlackRock has stirred up the crypto market. As early as January, BlackRock took the lead in promoting the long-awaited Bitcoin Spot Trading Fund (ETF), which caused a sensation. Subsequently, the entire crypto market started a new round of craze. , the price of Bitcoin, which has been low for more than a year, began to break through the $40,000 mark.

It is expected that BlackRock will penetrate deeper into the encryption industry and become a decisive force in the future. As the worlds largest asset management institution, why is BlackRock interested in cryptocurrency? What impact will it have on the subsequent development of the encryption industry? Let’s take a closer look at this new Bitcoin whale in the crypto industry.

Who is BlackRock?

BlackRock, also known as BlackRock in English, was founded in 1988 and is currently the worlds largest asset management, risk mitigation and consulting company.

BlackRock currently has 89 offices in 38 countries around the world, with more than 16,000 employees and customers in more than 100 countries. At the same time, BlackRock holds stocks in 4,973 companies, including: Apple, Microsoft, Nvidia, Amazon, Facebook, Tesla, Exxon Mobil, etc.

BlackRocks top equity holdings, as of August 2023, source: startuptalky

In terms of revenue, in 2023, BlackRocks revenue totaled US$17.86 billion, of which the largest part (US$14.4 billion) came from investment consulting, management fees and securities lending. The largest regional contribution is the Americas, with revenue of US$11.9 billion in 2023. Overall, financial advisory and management fees make up the bulk of the companys revenue, with US companies accounting for the majority of the companys revenue.

Source: https://in.tradingview.com

According to relevant reports, BlackRocks assets under management reached US$10 trillion in the fourth quarter of 2023. It can be said that even without the launch of a Bitcoin spot ETF, BlackRock, as a towering tree in the global financial industry, is still firmly ranked first. Top spot. So why did BlackRock get into the crypto industry? Is it a normal expansion of one’s own development? Or is it because BlackRock sees the potential of Bitcoin and its ability to hedge traditional financial risks? Or does BlackRock think this is a good addition to their portfolio?

BlackRock’s Crypto Action

In fact, BlackRock has become interested in the encryption industry and blockchain technology as early as the past few years. However, there were many challenges at that time. First, the market volatility was relatively high, and secondly, there was a lack of reasonable supervision and market rules. It is fully established, and over the past decade, the SEC has been rejecting applications for spot Bitcoin ETFs due to concerns about market manipulation, so it has not made any significant moves.

However, on January 11, 2024, a number of institutions led by BlackRock launched the first batch of Bitcoin spot ETFs in the United States, called iShares Bitcoin Trust (IBIT), which directly reversed the application for spot Bitcoin ETFs in the past ten years. The embarrassing situation of being rejected has opened a new chapter in the development of encryption.

1) One of the biggest promoters of the approval of Bitcoin spot ETF

BlackRock is an organization with a large number of ETF approval records. According to foreign media reports, the company has 575/576 applications approved by the SEC. It can be said that the success rate is nearly 100%. Only one was rejected in October 2014. ETF is an actively managed ETF jointly submitted by BlackRock and Precidian Investments. The reason given by the SEC for rejection was the lack of transparency in earnings.

However, in the face of the SEC, which has rejected the Bitcoin spot ETF for ten years, BlackRock has made sufficient preparations in the application in order to improve the pass rate. On June 15, 2023, BlackRock submitted an application for a spot Bitcoin ETF. We also proposed solutions one by one to the issues that the SEC was concerned about. For example, in order to meet the SECs requirements for implementing effective monitoring measures to prevent market manipulation, BlackRock plans to enter into regulatory sharing agreements with relevant well-known platforms and list Coinbase as the custodian of the proposed ETF to ensure the safe management of Bitcoin.

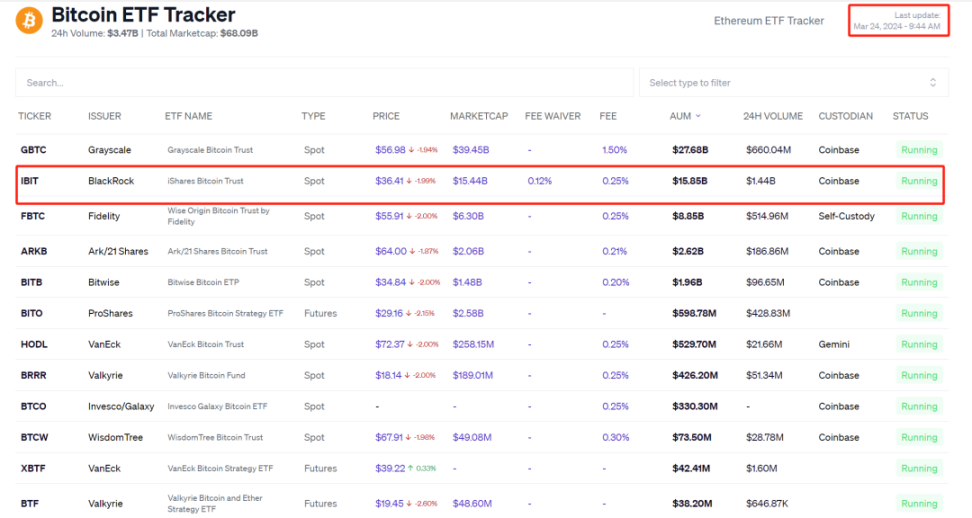

Due to BlackRocks participation and reputation, many investment/asset management institutions joined the application competition, and many financial companies such as Fidelity, Invesco, VanEck, Cathie Woods Ark Investment Management, WisdomTree, etc. followed suit, most of which List Coinbase as an ETF custody provider.

Unfortunately, on June 30, the SEC said that the documents submitted by BlackRock, Fidelity, and others lacked clarity and comprehensiveness in rejecting the application for a Bitcoin spot ETF. A few days later, BlackRock resubmitted its application. Generally speaking, the SECs decision time for Bitcoin spot ETF applications is a maximum of 240 days in total. Although there may be lengthy exchanges and discussions, the application has not been rejected outright like in the past, which brings hope that it may be approved in the future. , seen as a positive sign of progress.

And based on predictions at the time, and based on the publication time of each ETF’s application for rule changes in the Federal Register, Tokeninsight predicted that the eight institutional ETFs might be approved as follows:

Facts have proved that, in accordance with the earliest prediction time, in the early morning of January 11, the SEC announced its official approval of 11 spot Bitcoin ETFs, including BlackRock.

After the news was released, Bitcoin surged higher for a short period of time, rising to more than $49,000. After that, Bitcoin also started a spiral upward process. As of now, in less than three months, Bitcoin has topped $71,000.

In fact, as early as the beginning of BlackRocks application for a Bitcoin spot ETF, the market started a positive cheering mode with prices. Bitcoin exceeded US$30,000 and US$40,000 in October 2023, and reached US$45,000 after the application was approved.

Bitcoin’s trend over the past year

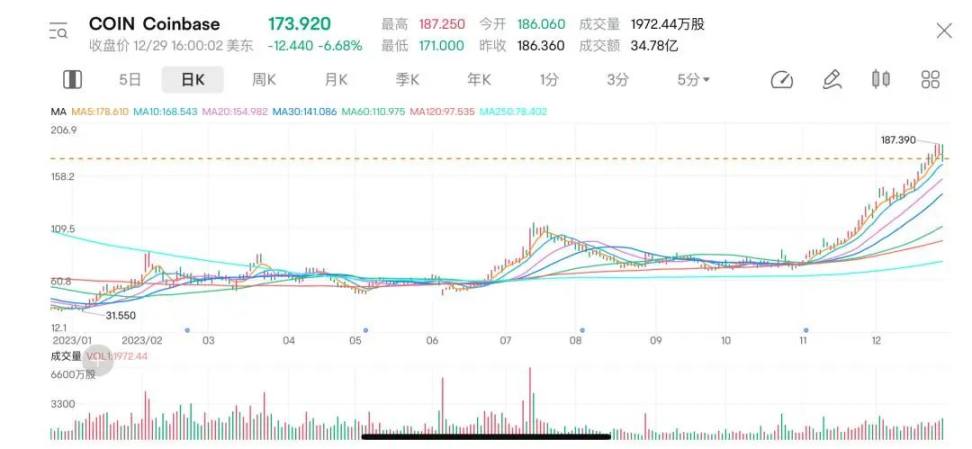

And because 5 of the Bitcoin spot ETF companies that applied for issuance chose CEX Coinbase as their custodian, the price of Coinbase also rose from US$70 in October 2023 to a maximum of US$187 in December.

Coinbase Token Price Trend in 2023

According to ChainCatcher news on March 24, since its debut on January 11, 2024, new spot Bitcoin ETFs (excluding GBTC) have significantly increased their Bitcoin holdings, and nine new spot Bitcoin ETFs (excluding Grayscale GBTC) currently holds 474363.55 BTC. Among them, BlackRock IBIT leads the way with 242,829.94 BTC holdings. This reserve makes IBIT a giant among its peers, accounting for 51.19% of the total holdings of these nine companies. When GBTC is considered along with these 9 BTC, the total rises to 824615.55 BTC, which is approximately 3.92% of the Bitcoin cap.

According to Cointelegraph’s March 25 news analysis, assuming there are no drastic changes in current capital flows, the number of Bitcoins in BlackRock’s spot Bitcoin ETF may exceed crypto asset management company Grayscale’s GBTC in the next three weeks.

Although market predictions suggest that the approval of Bitcoin spot ETFs may not have an obvious stimulating effect on the market in the short term, in the long term, its existence will significantly enhance the compliance and investability of digital assets, thereby improving market depth. and liquidity, will also help reduce market volatility and enhance investor confidence.

Overall, the reputation and influence of the worlds largest asset management company, as well as its expertise and experience in launching and managing ETFs, convinced the SEC and the market of the feasibility and value of Bitcoin ETFs. BlackRock gave crypto The world has had a huge impact. Next, we will take stock of the fact that it has already made many investments and preparations in the encryption field.

2) Major shareholders of the company with the largest Bitcoin holdings

Within BlackRock’s cryptocurrency portfolio, it holds a 5.53% stake in MicroStrategy. MicroStrategy, a business intelligence and software company, is currently the largest Bitcoin holder. BlackRock acquired shares of MicroStrategy through its various funds and ETFs, such as the iShares Core SP 500 ETF, iShares ESG Aware US Aggregate Bond ETF and iShares Russell 1000 Growth ETF.

MicroStrategy currently has approximately over 120,000 Bitcoins worth over $5 billion and has issued over $2 billion in debt to fund its Bitcoin purchases. According to a recent analysis by Forbes, BlackRocks stake in MicroStrategy is equivalent to owning more than 6,600 Bitcoins and is worth more than $300 million. This makes BlackRock one of the largest institutional holders of Bitcoin, although it does not directly own any Bitcoin. BlackRock’s stake in MicroStrategy also reflects its optimistic outlook and confidence in the company and Bitcoin.

3) US$384 million invested in Kuang Industrial Company, the leading Bitcoin company

BlackRock invested $384 million in Bitcoin companies in August 2023 as part of its strategy to explore the potential impact of digital currencies on the global economy.

BlackRock has invested in four Bitcoin industry companies, all of which are currently the largest and most mature Bitcoin block production companies, namely Marathon Digital Holdings, Riot Blockchain, Bitfarms and Hut 8 Mining.

BlackRock’s investment in Bitcoin industry companies is a bold and innovative move. On the one hand, it promotes the growth and development of the Bitcoin network and ecosystem, improves the security, stability and diversity of the network, and Supports the innovation and adoption of this technology; on the other hand, it also demonstrates its interest and participation in the cryptocurrency field, as well as its recognition and appreciation of the value and potential of the industry.

4) Work closely with crypto industry bodies

Issuers have been battling with the SEC over applications for spot Bitcoin ETFs, and BlackRock is actively promoting the matter while collaborating and consulting with other stakeholders and experts in the crypto industry, such as Coinbase, Fidelity and VanEck, to Address SEC concerns and requests.

In 2022, BlackRock reached a cooperation agreement with Coinbase to integrate its Aladdin operating platform with Coinbases leading cryptocurrency CEX to create a sound solution for IBIT ETF.

In addition to the Bitcoin ETF, BlackRock also has partnerships with some of the largest cryptocurrency players. It holds a minority stake in stablecoin company Circle Internet Financial and manages more than $25 billion in reserves in government money market funds, backing Circles USDC and more.

BlackRock also manages private Bitcoin trusts for professional clients. The trust has more than $250 million in assets, and most clients have since moved funds into new ETFs, according to people familiar with the matter.

BlackRock CEO: Bitcoin is awesome

BlackRocks acceptance of Bitcoin was gradual. During the epidemic, Rick Rieder, the companys chief investment officer for global fixed income, began allocating Bitcoin futures in his funds. Robbie Mitchnick, BlackRock’s head of digital assets, also helped convert Fink into a Bitcoin believer, according to people familiar with the matter.

Speaking of Fink, he was listed on the Forbes Global Billionaires List as early as 2022. Whether it is investment talent, leadership skills or social skills, the 72-year-old Larry Fink is known as the Godfather of Wall Street and Finance. The founder of Empire has played an important role in the development of BlackRock.

But Fink was not a believer in Bitcoin from the beginning. In 2017, Fink called Bitcoin a money laundering index and has repeatedly criticized cryptocurrency, calling it something that customers dont want to invest at all.

It was not until 2022 that Fink’s stance on digital assets began to change significantly. Bitcoins rebound after the 2022 cryptocurrency crash was a big factor in BlackRocks shift in perspective, according to people familiar with the matter.

During a conference call in April of that year, Fink said the company was researching the cryptocurrency space extensively and was observing growing customer interest. In the same month, BlackRock participated in Circle’s $400 million financing. Then in the summer, BlackRock quietly launched a spot Bitcoin product for U.S. institutional clients as their first private trust product. BlackRock seeded the fund with its own money and scaled it with outside investors.

Also that same year, BlackRock also formed a partnership with Coinbase to allow institutional clients who own Bitcoin on cryptocurrency exchanges to use their suite of software tools, Aladdin, to manage portfolios and perform risk analysis. So, Coinbase is currently the custodian of their spot Bitcoin ETF.

Now, it’s fair to say that Fink is one of Bitcoin’s biggest believers. His firm, BlackRock, has given Bitcoin legitimacy and manages the fastest-growing Bitcoin fund, alongside the heads of the digital asset industry. Participants formed partnerships and also opened the door for mainstream investors to buy and sell Bitcoin as easily as investing in stocks.

Now, BlackRock’s cryptocurrency ambitions are no longer limited to Bitcoin, as the asset manager is filing a pending application with the SEC to launch an ETF holding Ethereum, the second-largest cryptocurrency by market capitalization , which is also a native Token on the Ethereum blockchain, has a regulatory deadline of May, which is worth looking forward to.

summary

As BlackRocks slogan states, Invest in the New World, BlackRock believes that cryptocurrency and blockchain technology can transform the financial industry and create new opportunities for growth, efficiency, and inclusion.

Perhaps in recognition of the growing demand and adoption of cryptocurrencies among institutional investors, retail investors, governments and businesses, BlackRock’s interest in cryptocurrencies is no longer limited to jumping on the bandwagon or making a speculative gamble, but rather Its about treating it as a strategic long-term vision.

It is foreseeable that BlackRock will be indispensable in the future encryption field.