Original title: New Signs of Life in the Ethereum L2 NFT Ecosystem

Original author:Jack Gorman

Original compilation: Kate, Mars Finance

On-chain data shows new entrants and new use cases for NFTs

To the outside world, NFTs are dead.

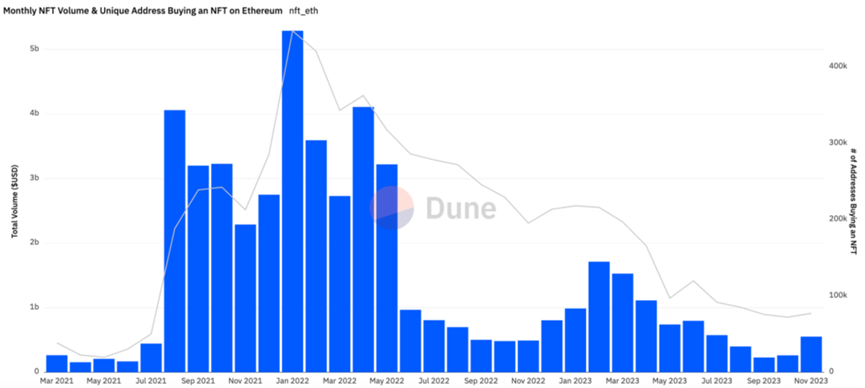

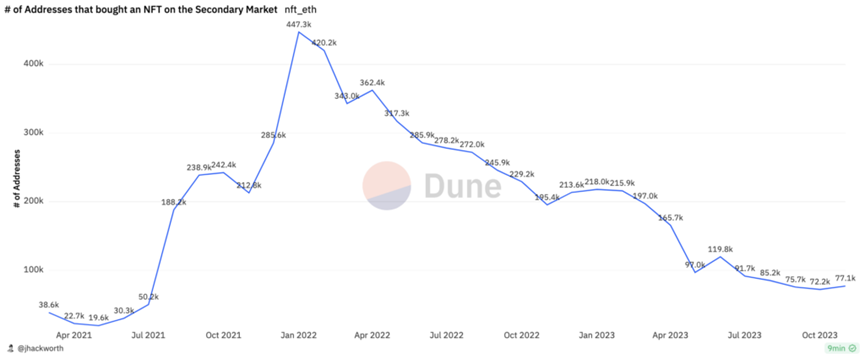

When you look at secondary market sales data - the most commonly cited metric - its irrefutable. From the peak of the NFT market in January 2022 to November 2023, Ethereums secondary transaction volume dropped by approximately 90%, and the number of different addresses purchasing NFTs on secondary platforms dropped by approximately 82%. September 2023 saw the lowest Ethereum NFT transaction volume and number of buyers since June 2021.

But the secondary market - which has been picking up in recent weeks - only paints part of the story. When you look elsewhere, you will find new signs of life in NFTs.

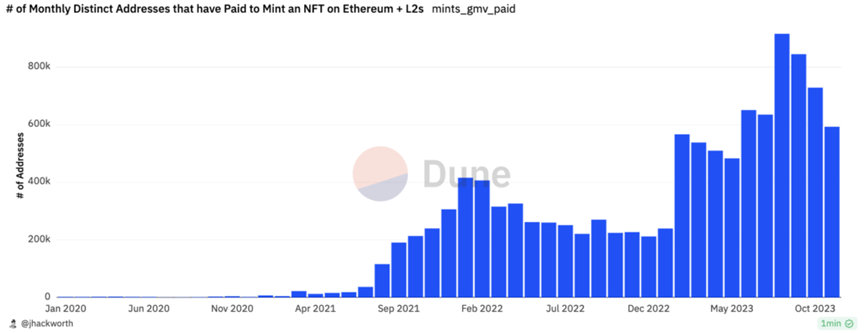

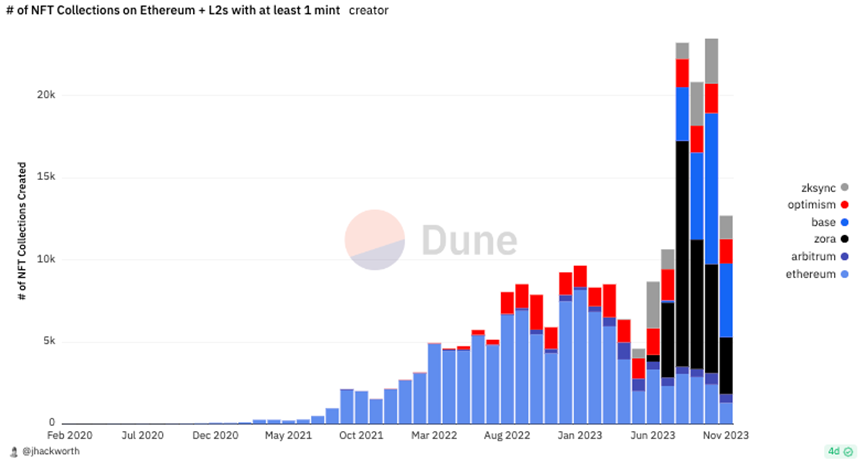

An encouraging indicator of NFT adoption is the growth in creation and collection of Ethereum, as well as second-layer chains such as Base, Zora, and Optimism. In terms of collections, the number of paid NFTs from different addresses continues to grow over time, indicating that there are new participants minting on the chain.

The growth in collection activity has been accompanied by an increase in new NFT contracts on chains such as Zora and Base, driven by a range of creation tools that make it easier to create NFTs.

While some spam and airdrops do exist in these data, the numbers are still encouraging.

One possible explanation for the growth in different addresses and new contracts is a simple Occams Razor point: as more projects, use cases, and art are created, more and more cryptocurrencies get involved in NFTs. By lowering the overall financial cost of NFTs, more non-cryptocurrencies will join the coming wave.

We may also be witnessing a shift in perceptions and use cases for NFTs. In the past, rarity, exclusivity, and super user transactions were the defining factors in the NFT market, making it more difficult for more users to join the cryptocurrency. Now, in addition to high-end collectibles, the proliferation of NFTs in various forms and use cases provides new opportunities to attract users and promote widespread adoption.

Barriers before NFT adoption

During the last bull market, NFTs emerged as a new asset class for Ethereum. In January 2022, NFT trading volume reached US$16 billion (US$5.2 billion after excluding wash trades). However, despite the high trading volume, only 447,260 different addresses actively purchased NFTs on the secondary market that month. This suggests that even at the peak of the market, NFT adoption was relatively small overall, dominated by a core group of active collectors and hoarders.

Why is adoption lower than many think? High costs, limited use cases, and whale-led speculative trading may turn people away from NFTs.

Looking at the table below, you can see how expensive it is to mint, trade, or create NFTs on the chain: The average deployment cost of an NFT contract in 2021 is $812, and the minting cost is $115.

High gas costs have become a barrier, limiting the ability of new entrants to use NFT, and also limiting the creation of artists and builders on the blockchain.

This has hindered early NFT adoption in favor of higher-priced assets, such as art or PFP, that have the potential to appreciate and justify on-chain costs.

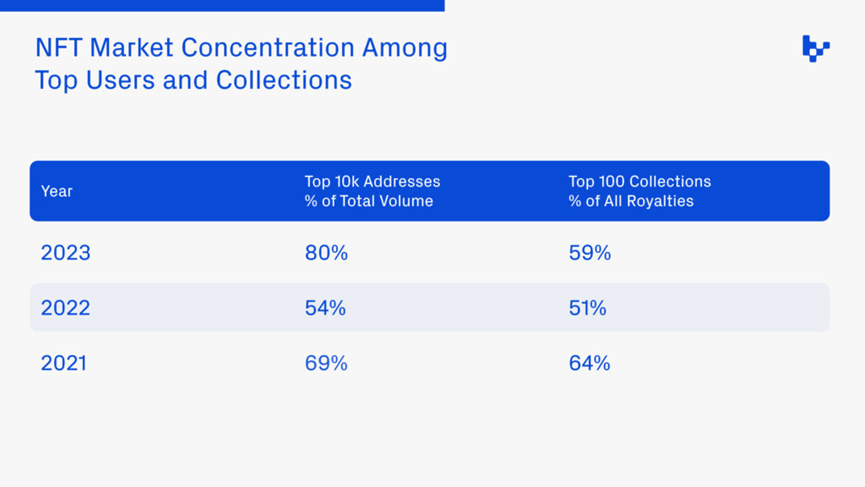

Further analysis shows that NFT market activity is concentrated among a small number of collectors and traders. In 2021, just 10,000 unique addresses (0.73% of all buyers) accounted for 69% of total transaction volume, and the top 100 collections accounted for 64% of all royalty items.

Of course, these barriers—high costs and limited use cases—are not unique to NFT adoption.

New technologies often follow similar adoption patterns, with early adopters often being wealthy individuals, niche groups, and speculators. In the early days of the internet, usage was limited due to the challenges of building and interacting on the web. As with NFTs, speculative investment poured into internet companies, driving valuations to unsustainable levels until the bubble burst. But the underlying potential of the Internet remains intact, transforming society as infrastructure improves and user experience enhances.

I believe the same transformation is beginning with NFTs. The focus is shifting from investments and luxury goods to a technology that brings a digital ownership revolution to the masses. As the saying goes, yesterdays luxuries are todays necessities.

I cant predict what will happen next in the NFT market. However, three on-chain trends show us the future development direction of NFTs:

1. Infrastructure and tooling have been improved, reducing minting costs and increasing potential use cases for NFTs (minting, collections and collections) embedded in applications

2. New models of community participation, not just holding NFT, provide opportunities to maintain community participation, such as on-chain management, governance and protocol rewards

3. In addition to PFP and art, new forms of NFT are gaining attention, including games, real-world assets and token-bound accounts

Minting costs are falling

As any technology advances, costs fall and new areas of demand are unlocked. We are now seeing this play out in NFTs, as second layers, improved tooling, and better infrastructure are reducing the overall cost of minting NFTs.

A recent cost of 1 million NFT transactions on Ethereum was $2.5 million, but only $629,200 on Base and $75,990 on Zora. At the same time, the amount of free minting is also rising: about 62% of Ethereum and L2-based NFTs can be minted for free.

Cheap NFTs are a feature, not a bug. Lowering cost barriers can lead to more collection, more experimentation, and more construction. More affordable NFTs will also enable new use cases where NFTs are the how rather than the why.

For example, Blackbird uses NFTs to track restaurant visits as part of a loyalty program that rewards diners for dining at their favorite restaurants. This application is implemented by Base, which allows minting NFTs with cents, and improves on tools like Privy to provide a better user experience.

Many users of Blackbird may not even realize that they are holding NFTs. Going forward, I hope more applications will leverage NFTs to interact with consumers in innovative ways.

empower communities

While previous bull markets were primarily focused on selling NFTs, we are now seeing a return of emphasis on the holder community.

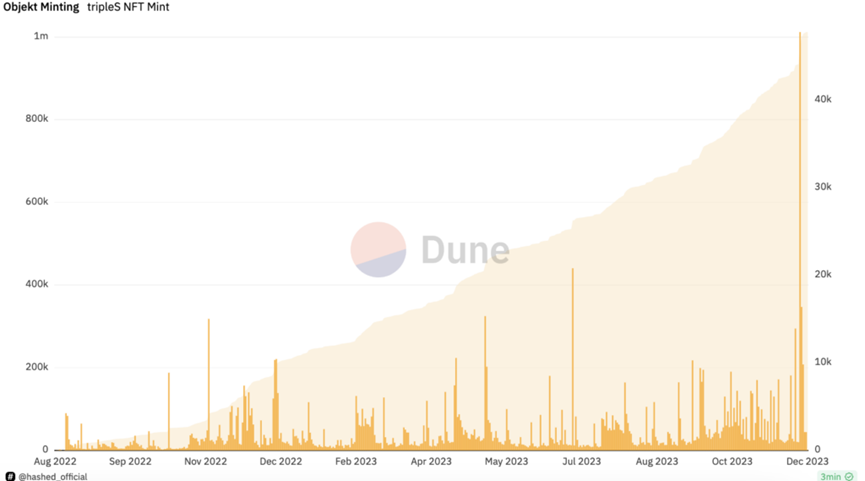

Companies like Botto and Basepaint are collaborating and voting to guide which themes or artwork should be chosen. Others offer new ideas for NFT governance. For example, K-pop group TripleS uses NFTs called Objekts as a way for fans to vote on the bands future (e.g., choosing a song title or selecting a sub-unit of the 24-member girl group to record their own song). The results so far have been positive, with over 1 million coins minted and 87,000 collectors, with millions of views on Spotify and YouTube.

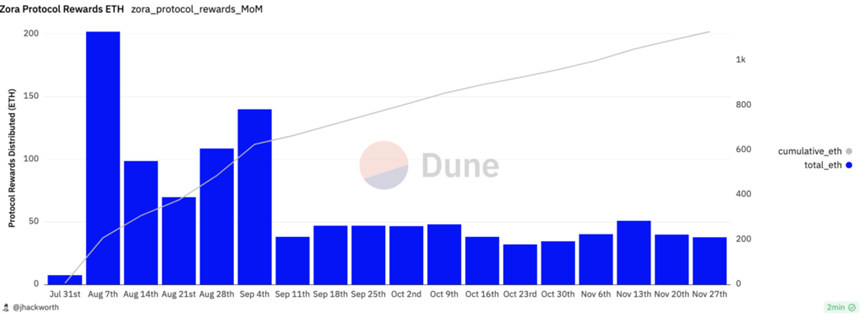

Initiatives such as Zora’s protocol rewards have demonstrated ways to incentivize users to create and participate on-chain. The project has seen early success, with over 1,130 ETH (approximately $2.5 million at the time of writing) distributed to thousands of collectors, creators, and builders across the network.

What makes these initiatives so exciting is that they allow community members to take a more active role in the community while growing their network.

NFTs are taking new forms

In the last market, the dominant type of collection was the PFP, a public display that showed you owned a rare or high-priced image. While some of the most well-known collections may always have value, NFTs may come in a variety of formats, such as gaming-related, musical, or even tokenized versions of real-world assets. Courtyard recently began tokenizing Pokémon cards, with over 9.7 billion card sales transactions in 2022, opening a more liquid market for the asset.

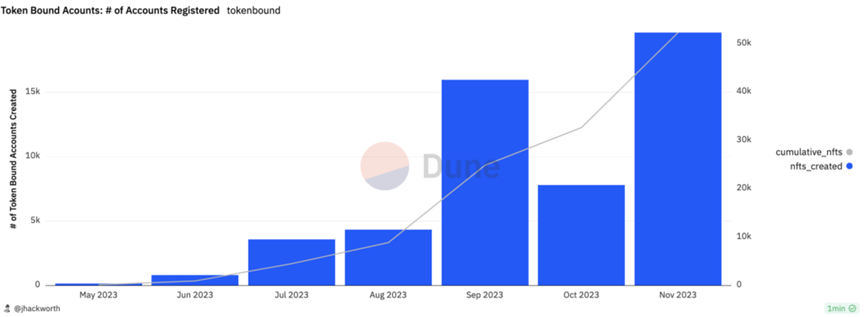

Even in addition to ERC-721 and ERC-1151, new standards have emerged, such as ERC-6551, which is a non-fungible token-bound account. Token-bound accounts convert NFTs into independent wallets capable of holding assets. While the total number of NFTs remains small at about 52,000, the number of token-bound accounts has been growing at a compound monthly growth rate of about 90% since June 4.

Token-bound accounts offer more than just NFT ownership, they can create profiles with embedded social graphs and inventory systems. This concept has already been applied to social media profiles by Lens, and expands to future possibilities, such as the account becoming an avatar in a video game, or a specific Bored Ape becoming a personality with its own fans.

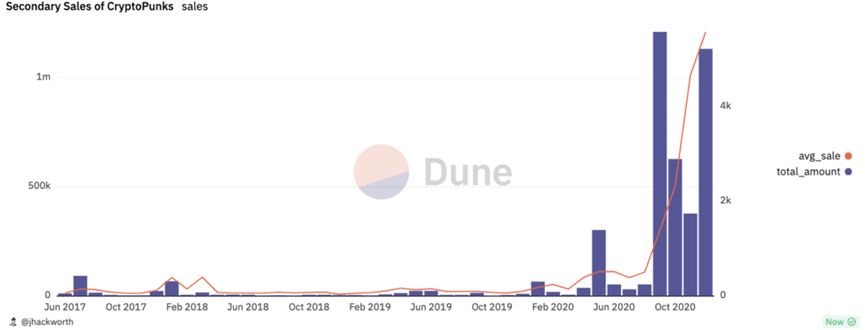

We are still in the early stages of NFTs as an asset class, and it is difficult to predict how everything will develop. After all, CryptoPunks started out free and saw little activity in the years after their June 2021 debut, until the price of punks exploded during the NFT craze. In 2017, few could have predicted that by 2021, some punks would be changing hands for $10 million to $20 million.

Im excited to see the continued development of NFTs. There is a lot of experimentation going on in this area, which is encouraging. As NFT use cases increase, NFT minting will become more common. Internet users may have hundreds or even thousands of NFTs in their wallets, used in various applications.

If you, like us at Variant, are excited to help grow existing NFTs, you can collect and mint this article as an NFT on Mirror.