LDキャピタルトラックウィークリーレポート(2023/11/20)

ローン

Aave

Aaveプロトコルの親会社であるAave Companiesは、Avaraへのブランド変更と暗号通貨ウォレットファミリーの戦略的買収を発表し、その創設者スタニ・クレチョフ氏は、Avaraは暗号通貨ウォレットファミリーの買収を通じてユーザーがWeb3エコシステムに参入できるよう支援する計画であると述べた。 。この社名変更はブランド変更であり、Aave の既存のビジネスにはほとんど影響しません。

Aaveコミュニティは、「11月4日のセキュリティインシデントを不足イベントとして特徴付ける」コミュニティ温度チェック投票を開始し、不足分を補うためにロックされたAAVE誓約トークンをオークションにかけることができるセキュリティモジュールをアクティブ化しました。投票は11月20日に締め切られたが、可決されなかった。

Compound

Compound コミュニティは 4 か月の成長計画を開始し、7,770 COMP を割り当て、そのうち 2,760 COMP は成長計画の事業開発業務をサポートする計画に基づいて BD ファンドに割り当てられ、残りの 5,010 COMP は成長基金。本日(13日)投票が締め切られ、可決される予定です。

Compound コミュニティによって先週開始された提案 191 は、定足数に達しないため実装されません。この提案では、複合成長イニシアチブに 4 か月にわたって 7770 COMP (約 40 万ドル相当) を割り当てることが提案されています。

Compound の創設者によって設立された RWA 企業である SuperState は、Distributed Global と CoinFund が主導する金額非公開のシリーズ A ラウンドで 1,400 万ドルの資金調達を完了しました。

MakerDAO

Scroll チームは、貸出プロトコル SparkLend を Scroll ネットワークに導入することを提案する提案書を MakerDAO ガバナンス フォーラムに公開しました。

LSD

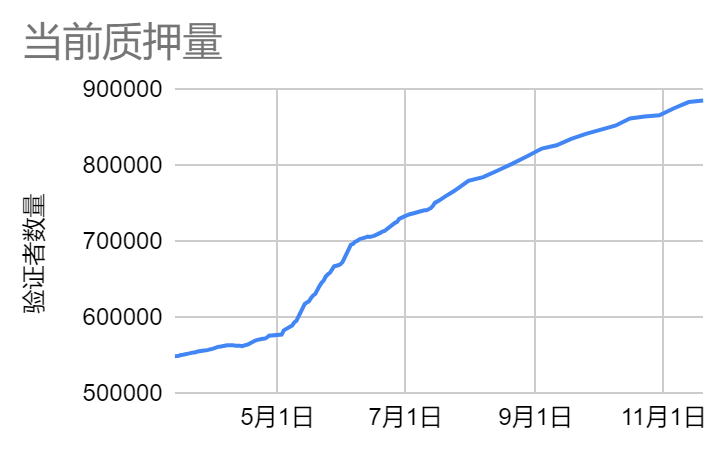

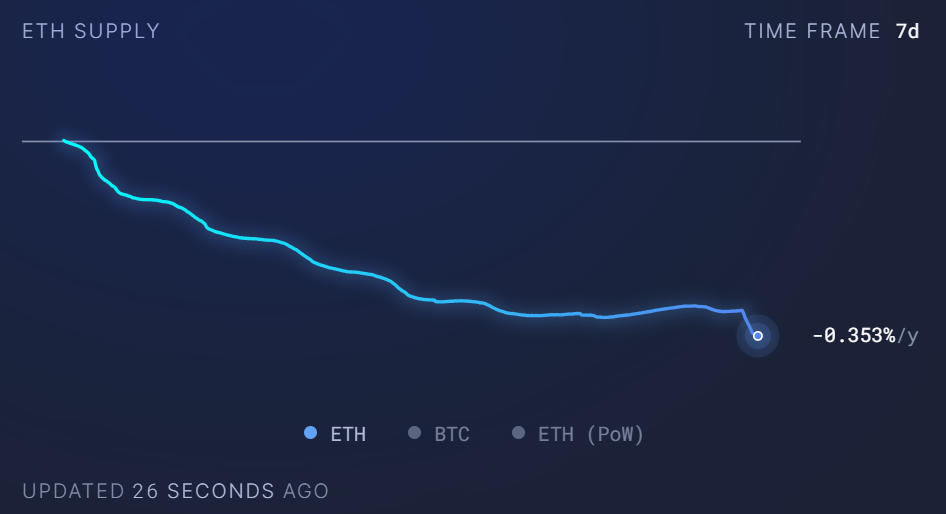

先週、2,853万ETHがビーコンチェーンにロックされ、これはプレッジ率23.72%に相当し、前月比0.3%減で、そのうちアクティブな検証ノード数は885,600で、前月比0.3%増加しました。 0.43%。今週のETHステーキングリターンは3.6%、ETHの年率インフレは-0.353%で、Uniswap、Maestro、BananaGunがガスを燃やすトップ3のDefiとなっています。

今週のETHプレッジは前月比0.3%下落した

出典: LDキャピタル

今週のETHステーキング利回りは3.6%です

出典: LDキャピタル

ETHの年換算インフレ率は-0.35%に低下

出典: 超音波、LD Capital

3大LSDプロトコルのうち、価格パフォーマンスではLDOが週間で9%上昇、RPLが7.9%下落、FXSが10.8%上昇したが、ETHプレッジ量の観点からはLidoが週間で0.47%上昇した。週間では、ロケットプールは1.62%上昇し、フラックスは0.80%上昇した。先週、ETH価格は1.7%下落し、ETH価格の大幅な変動により一部のプレッジ者がプレッジを解除して売却する事態となり、ETHプレッジ率はまれに見るわずかな低下を示しました。先週、Brevan Howard Digital が 500,000 LDO を取引所に移管し、Dragonfly Capotal が 150 万 LDO を取引所に移管しました。Rocket Pool の現在の預金プール残高は 18,000 ETH、RPL プレッジ率は 50.94%、実効プレッジ率は 93.78% です。 ; SSV ネットワーク上で担保された ETH の数が 39,000 に達しました。

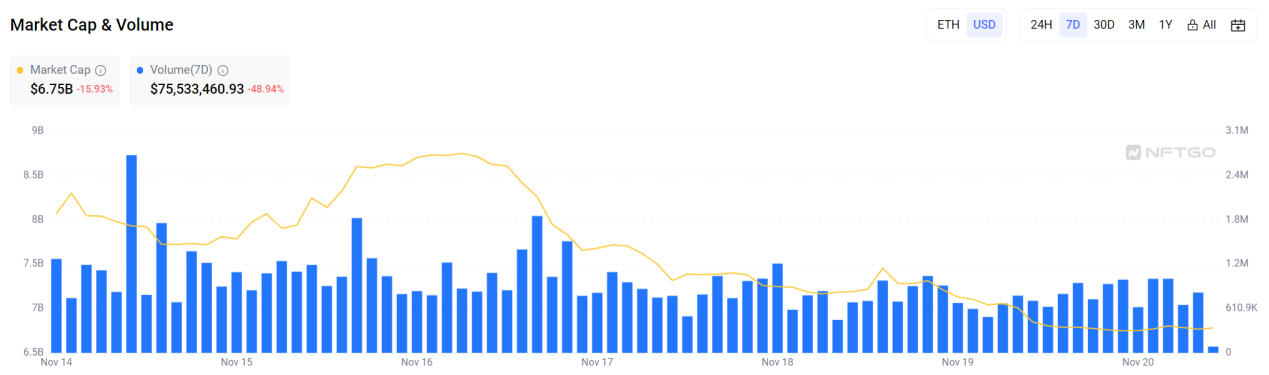

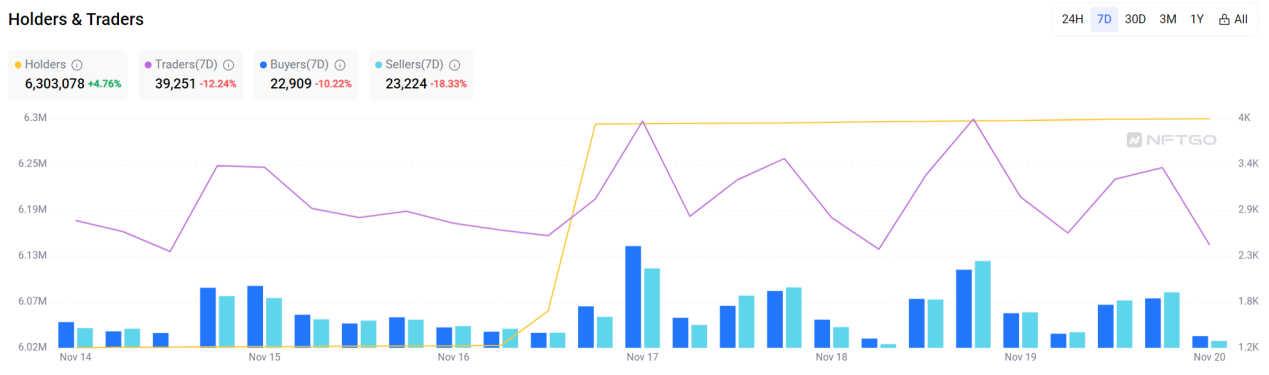

NFTFi

先週のNFT市場の総取引高は7,553万米ドルで、前月比48.94%減、市場総額は67億5,000万米ドルで、前月比15.93%減、NFT保有者数は630万人、 NFTトレーダー数は前月比4.76%増、39,000名で前月比12.4%減となった。

出典: NFTGo、LD Capital

出典: NFTGo、LD Capital

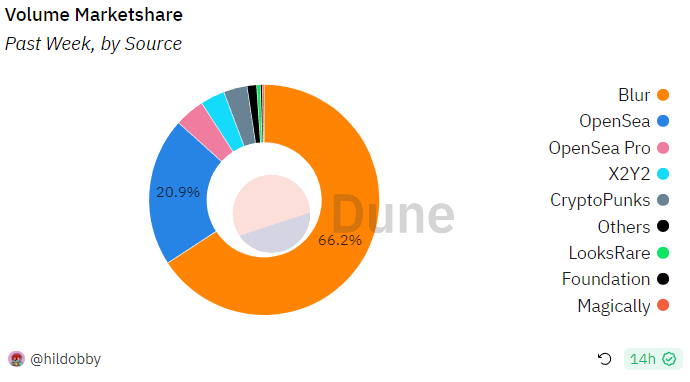

NFT取引プラットフォームのうち、ブラーの先週の取引高は5,491万米ドルで、前月比35%減、市場シェアは66.2%に増加、TV L1億600万米ドルは1億600万米ドルで、前月比11%減、ブラーは 11 月 20 日に第 2 四半期を終了する可能性があり、11 月 27 日には、流通供給量の 6.88% に相当する 3,750 万個の Look がロック解除されます。

出典: デューン、LD キャピタル

NFT融資市場では、BendDAOの現在のTVLは9,965万米ドルで、前月比3.3%減で、うち18,100ETH預金、利用率12.72%、預金金利7.09%、借入金利4.06となっています。 %(借り手に支払われる)、BEND 質権金利は 4.54%。Jpegd TV L2 は 477 万米ドルで前月比 4.6% 減少、Curve の pETH/WETH LP 利回りは 24.29% でした。 。 BENDトークンは過去1週間で38%上昇し、プロトコル融資事業の成長を大幅に上回っており、プロトコル住宅ローンに対する現在のBENDトークン補助金は実際の借入金利を超えており、NFT保有者に裁定の余地を残している。

イーサリアム L2

TVL

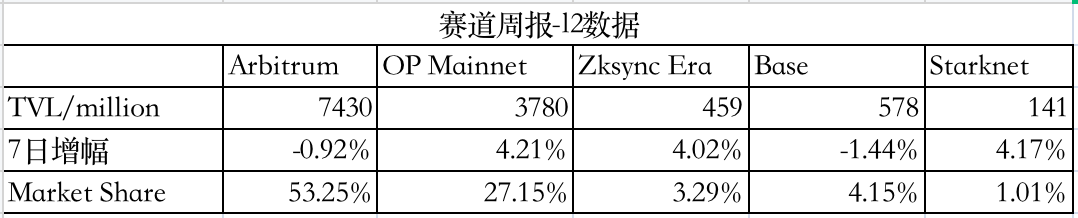

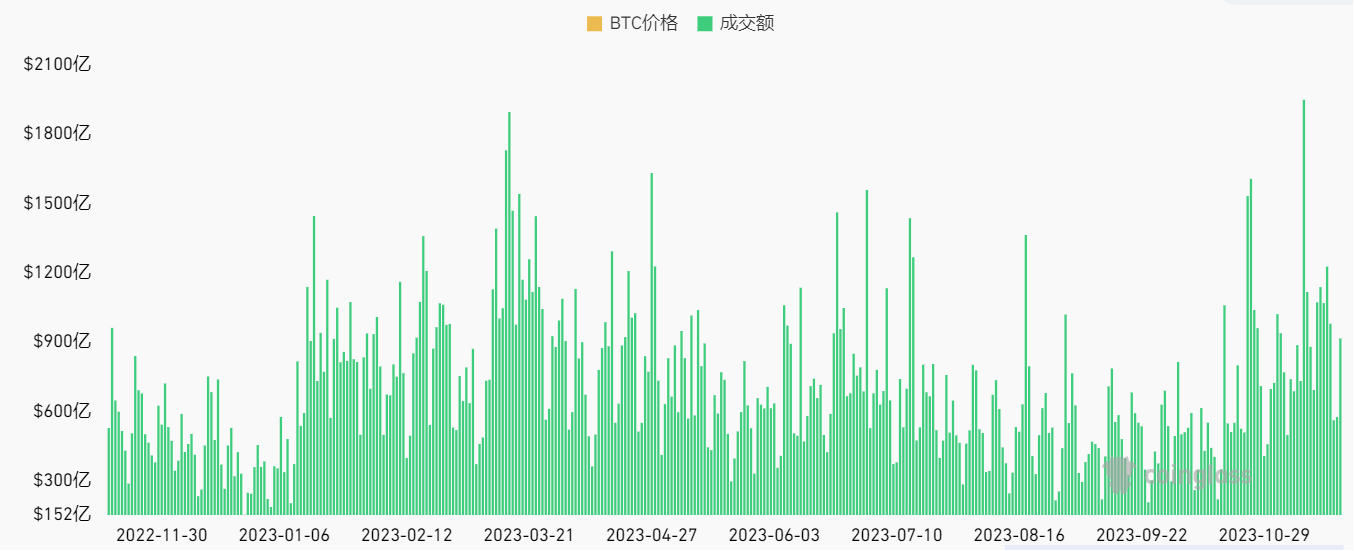

レイヤ 2 TVL の総額は 139 億 5,000 万米ドルで、TVL 全体は過去 7 日間で 1.86% 増加しました。

出典: L2 ビート、LD Captial

Optimism

1. OP スタックの最初の失敗は、Canyon ハード フォークが 11 月 15 日に Super Chain テスト ネットワークで正常にアクティブ化されたことを証明します。

2. ラティスはまた、OP Stack のコア開発者として Super Chain に参加し、主にオンチェーン ゲームやその他のアプリケーションの L2 に使用される Redstone Holesky テスト ネットワークをリリースしました。

Arbitrum

Arbitrum Sepolia テストネットは現在オンラインになっていますが、Arbitrum Goerli は今日から 2 か月以内に廃止され、その後は Arbitrum Goerli にアクセスするには個人ノードを実行する必要があります。

オンチェーンアクティビティ

出典: アルテミス

AI

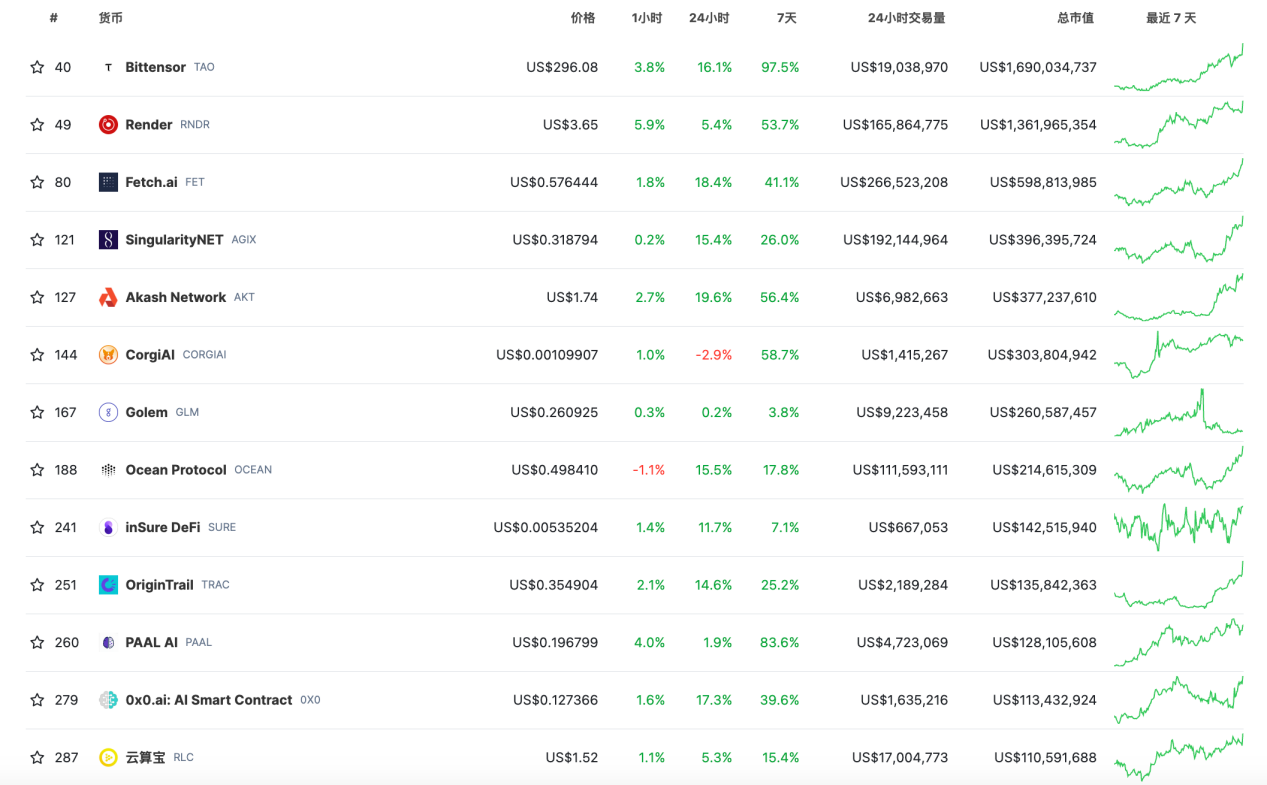

AI セクターの多くのプロジェクトのトークン価格は、OPENAI 関連のイベントとセクターのローテーションにより、先週大幅に上昇しました。7 日間の上昇率は、TAO-97.5%、RNDR-53.6%、FET-41.1%、AKT-でした。 56.4%と他のプロジェクトも違う伸びの度合い。

出典: コインゲッコ

OpenAI

1. OpenAI の創設者である Sam Altman 氏と Greg Brockman 氏が Microsoft に入社します。 Microsoftは、アルトマン氏とブロックマン氏が新しいMicrosoft人工知能チームを率いることになり、アルトマン氏のチームに必要なリソースを迅速に提供すると述べた。以前、OpenAIの創設者サム・アルトマン氏はOpenAIのCEOおよび取締役会の職から外され、OpenAIの共同創設者であるグレッグ・ブロックマン氏もサム氏の解任を受けて辞任することを選択した。

2. Twitchの共同創設者エメット・シアー氏がOpenAIのCEOに就任したことを認めた

RNDR

1. RNP-007 が最初のコミュニティ投票を通過: この提案は、AI クラウド プラットフォーム FEDML と Render の間のコラボレーションを促進し、AI コミュニティのニーズを Render のコンピューティング ネットワークに導入し、FEDML の研究者とデータ サイエンティスト コミュニティがアクセスできるようになります。 GPU ネットワークへのレンダリング ディストリビューション アクセス。

DEX

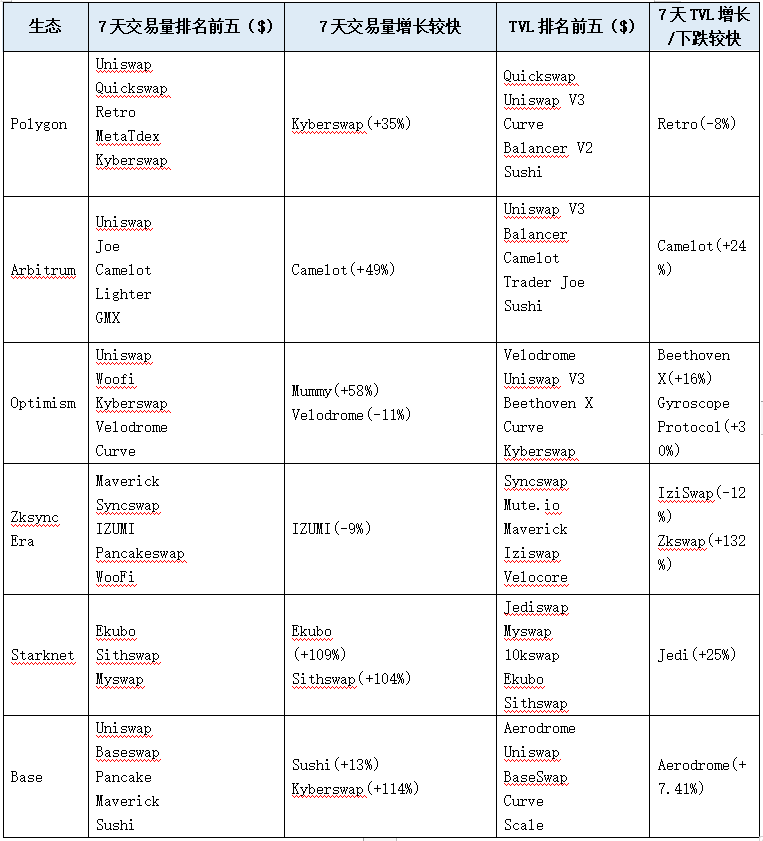

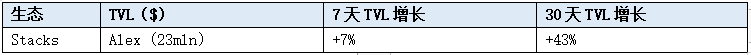

Dex combined TVL 12.79 billion,前週から6億減少。デックスの24時間取引高は25億1000万、7日間取引高は270億で、先週と比べて20億増加した。

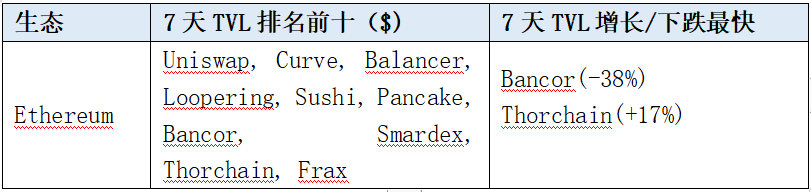

Ethereum

RUNE TVL はイーサリアムのトップ 10 にランクインしました。 RUNE 独自の裁定メカニズムにより、裁定業者は BTC-RUNE と ETH-RUNE に多額の取引手数料をもたらし、APY と TVL の両方が増加しました。RUNE はインセンティブ メカニズムを使用して、1 回の取引につき 3 米ドルの RUNE が確保されるようにしています。ネットワーク上の 1 米ドルの非 RUNE 資産はロックされているため、TVL の成長レバレッジによって RUNE の需要が増幅され、購入圧力が高まります。 thorchain の好循環が維持できるかどうかを判断するには、BTC の価格とセーバーの合計貯蓄価値が増加し続けるかどうかに注意してください。

ETH L2/sidechain

BTC L2/Sidechain

Alt L1

Cosmos

今週の IBC ボリュームからの純流入数トップ 10 プロジェクトは、Osmosis、Cosmos Hub、Axelar、Kjira、Celestia、Neutron、Terra、Stride、Akash です。

AIトークンは、OpenAIの共同創設者で(現)元CEOが先週金曜日に同社の取締役会によって劇的に解任されたというニュースに関連して、週末に大幅な上昇を見せた。

このニュースにより、暗号トークンのワールドコイン(WLD)は、OpenAIの取締役会による驚きの動きの前に最後に見られた価格レベルまで急騰しました。 AKASHとIBCに関連するFETも今週の上昇を主導し、過去24時間で50%以上急騰し1.66ドルとなったアカッシュ・ネットワーク(AKT)が主導した。

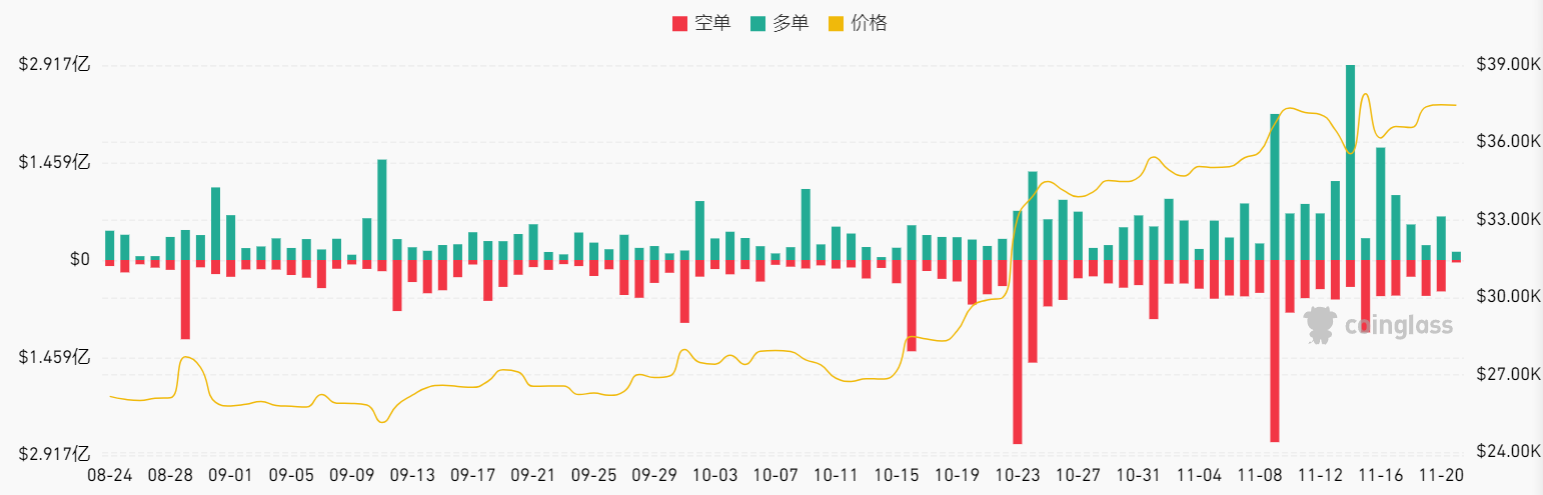

デリバティブ

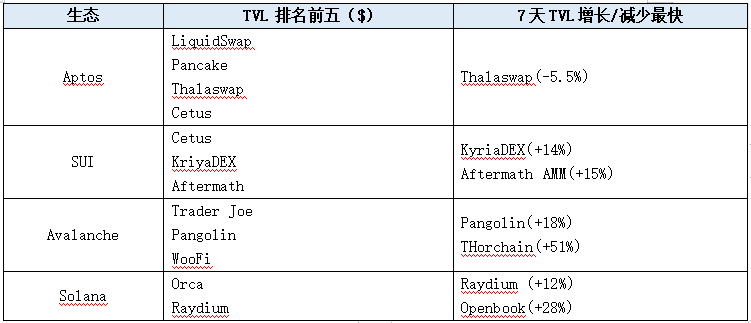

先週BTCは35,500から38,000の間の広い範囲を維持した。契約建玉は330億ドル付近で不安定なままだった。

過去 1 週間、同契約は依然として高い取引高を維持していましたが、前週に比べて減少しました。アルトコインは大幅に反落し、契約取引センチメントは低下した。 BRC 20などのオンチェーンイベントに注目が集まっています。

清算データから、10 月下旬以降、清算額が大幅に増加していることがわかります。その主な理由は、BTC が 32,000 の圧力レベルを突破して新たな上昇トレンドを形成し、トレーディング資金が市場に流入し、BTC の変動により契約の清算が発生したためです。

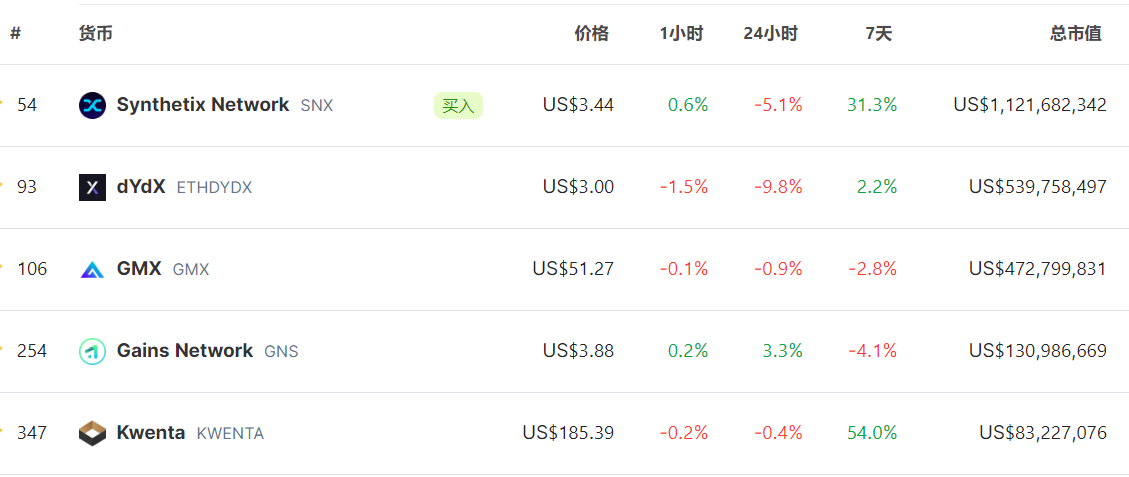

デリバティブ DEX に関しては、DYDX が依然として取引高のリーダーです。しかし、12月初旬に大規模リリースのニュースが伝えられると、ファンドが利益確定をしたり、ヘッジの必要から早めに撤退したりして通貨価格が下落した。そして、SNX とその Perp フロントエンド Kwenta は資金調達の注目を集め、今週利益を記録しました。

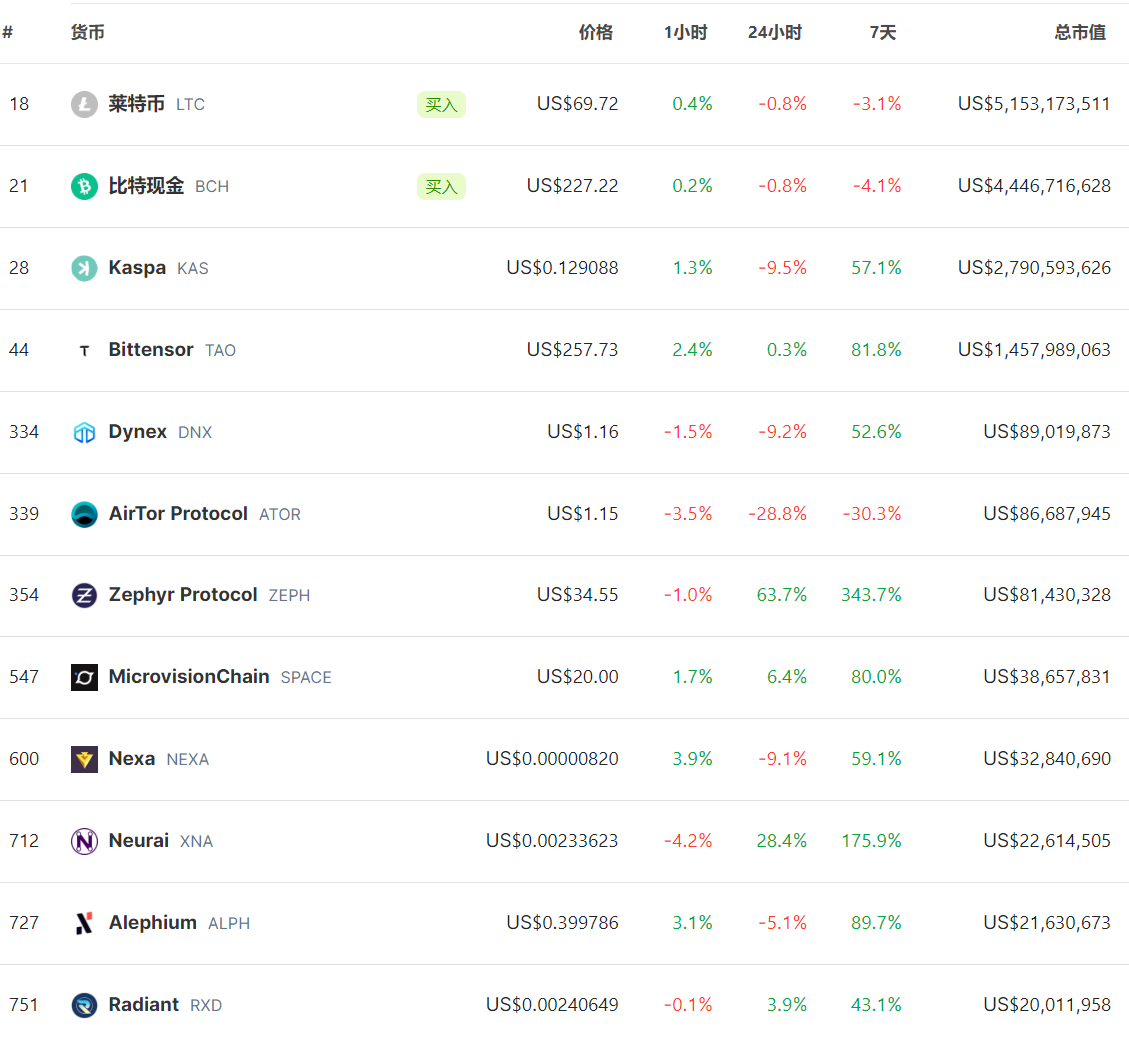

POW

LTCやBCHなどの古いPOWトークンはファンドの注目を集めておらず、ショック段階にあります。 KASが力強い躍進を続ける中、新しいPOWコンセプト通貨はファンドの注目を集め、過去1週間で素晴らしい利益を達成しました。

最下層が POW で高速であることを主張することに加えて、現在の POW トークンは一般に、スマート コントラクト プラットフォーム、プライバシー ネットワークとプライバシー トークン、AI コンピューティング パワー プラットフォーム、AI アルゴリズム プラットフォーム、モノのインターネットなどの他の概念やサービスを重ね合わせています。 。 待って。 TAOはAIアルゴリズムプラットフォームに属し、DNXとCLOREはAIコンピューティングパワープラットフォームに属し、ATORはプライバシーネットワークに属し、ZEPHはプライバシー安定通貨に属し、XNAはモノのインターネットに属します。

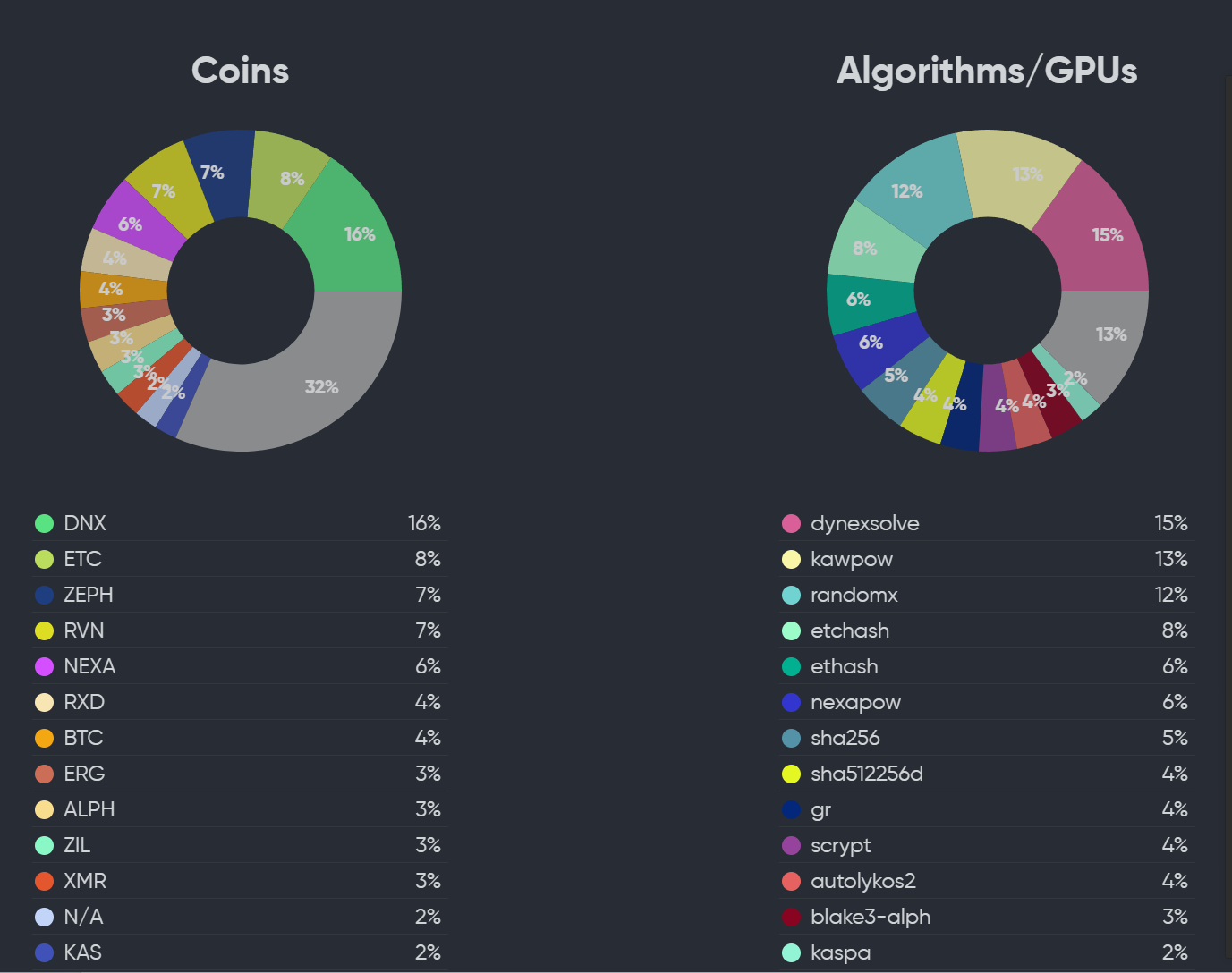

F2Pool の 24 時間生産高から判断すると、KAS の生産収益は現在 BTC に次ぐ第 2 位です。 DNX の生産高も回復し、7 位に位置しています。

GPU コンピューティング能力の観点からは、DNX が依然として 1 位にランクされています。 ZEPH のコンピューティング能力は、DNX と ZEPH に次いで 2 番目に急速に成長しました。 ZEPHはPOWをベースとしたプライバシーステーブルコインとして海外コミュニティからも注目を集めており、近年の成長を促進しています。

GameFi

11 月 7 日から 13 日まで、Gamefi セクターで最も値上がりした上位 3 つのターゲットは MEME、ILV、IMX です。 (注: Gamefi プロジェクトが多すぎるため、一部のプロジェクトのみが含まれています。)

Illuvium

· 11 月 28 日に Epic Games ストアで入手可能になります。

Stepn

· StepnとGas Heroは、StepnのGenesisおよびOGシューズの所有者にGas HeroのNFTエアドロップを発行すると共同発表しました。そのうち、ジェネシス シューズ (箱を含む) の所有者は 1 BCV + 1 ヒーローを受け取ることができ、OG シューズ (箱を含む) の所有者は 1 ヒーローを受け取ることができます。 Gas Hero は 11 月 24 日から 12 月 8 日までコミュニティ テストを受け、ゲーム トークンとして GMT を使用する予定です。

the Sandbox

・サンドボックスは、AaveエコロジーNFTゲームAavegotchiと協力して新作ゲーム「Ripples of the Gotchiverse」をリリースし、P2E報酬として50,000 SANDと5,000 GHSTを提供します。

· グッチがサンドボックスに入り、グッチ コスモス ランド エクスペリエンスを開始します。

· サンドボックスの親会社である Animoca Brands は、サウジ NEOM 投資基金から 5,000 万米ドルの投資を受け、そのうち 2,500 万米ドルは転換社債の発行を通じて行われます。