ความเข้าใจเชิงลึกเกี่ยวกับอุตสาหกรรมแอร์ดรอป: “ข้อมูลปลอม” และพรรคหลู่เหมา

ชื่อเดิม: ติดตามข้อมูล (ปลอม): ทำความเข้าใจกับ กลุ่มการทำฟาร์มแบบแอร์ดรอป และอุตสาหกรรมโดยรอบ

ผู้เขียนต้นฉบับ: เคอร์มาน โคห์ลี

เรียบเรียงต้นฉบับ: Kaori, BlockBeats

สิ่งหนึ่งที่กวนใจฉันมากขึ้นเรื่อยๆ ในช่วงไม่กี่ปีที่ผ่านมาคือการที่อุตสาหกรรมพึ่งพา ข้อมูล เพิ่มมากขึ้น ฉันใส่สิ่งนั้นไว้ในเครื่องหมายคำพูดเพราะส่วนใหญ่เป็นของปลอม/ไม่เป็นความจริง เพื่อแสดงให้เห็นว่าเกิดอะไรขึ้นและทำงานอย่างไร ฉันคิดว่าจะเขียนบทความที่ยาวขึ้นเกี่ยวกับประเด็นทั้งหมด

เมื่อฉันเริ่มค้นคว้าบทความนี้ ฉันตระหนักได้ว่าเรื่องทั้งหมดนี้เป็นอย่างไรและมีนักลงทุนกี่คนที่ถูกหลอกโดยบทความนี้ ทั้งหมดนี้ถือเป็นเรื่องตลกใหญ่และแสดงให้เห็นว่าอุตสาหกรรมยังต้องไปไกลแค่ไหน

การประเมินค่าชั้นที่ 1

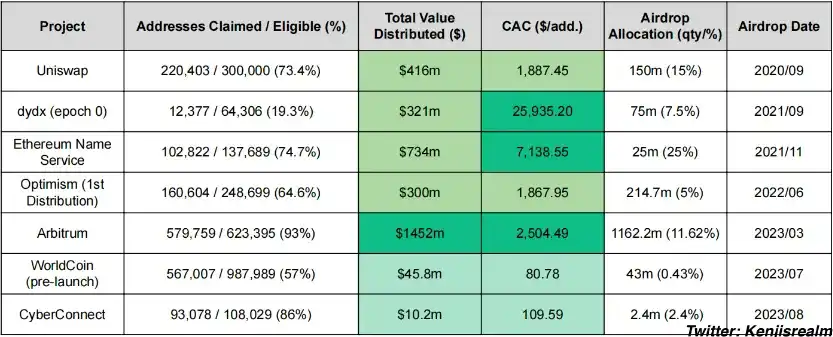

ปัญหาของเราเริ่มต้นจากโทเค็นที่ราคาสูงเกินไปและเกินจริงซึ่งนักลงทุนยินดีจ่ายเงินหลายพันล้านดอลลาร์เพื่อซื้อ สิ่งที่คุณต้องมีคือกระดาษขาวดีๆ สักเล่ม และคุณสามารถบิดเบือนหลักเศรษฐศาสตร์ของเรื่องทั้งหมดได้ การวิจัยของฉันเริ่มต้นด้วย Dune และฉันพบแดชบอร์ดนี้ที่คำนวณ CAC ของการส่งทางอากาศหลายครั้ง

นั่นเป็นการเริ่มต้นที่ดี แม้ว่าฉันอยากจะชี้ให้เห็นว่า CAC เหล่านี้ (จากมุมมองของโครงการ) ต่างก็เป็นตัวเลขที่กล่าวเกินจริง เนื่องจากเป็นเพียง: มูลค่าดอลลาร์ ($) / ที่อยู่ที่อ้างสิทธิ์ การคำนวณนี้ไม่ได้คำนึงถึงเปอร์เซ็นต์ของหยดลงอากาศที่ยังคงอยู่จริง เนื่องจากโดยทั่วไปแล้วที่อยู่จะมีเพียง 10%-20% เท่านั้นที่ถือ airdrops จึงปลอดภัยที่จะถือว่าหมายเลข CAC เหล่านี้สูงกว่าที่คุณเห็นด้านบนถึง 5 เท่าถึง 10 เท่า

อย่างที่สองคือเรามีระดับมูลค่าการแจกบินโดยนัย:

เลเยอร์ 1 / เลเยอร์ 2 / โปรโตคอลแบบไฮเปอร์ = ใช้เงินหลายพันดอลลาร์

แอปขนาดเล็กถึงขนาดกลาง = ใช้ไปหลายร้อยดอลลาร์

โชคดีที่ทั้งสองไม่ได้แยกจากกัน! หากคุณใช้แอปพลิเคชั่นที่ถูกต้องบนสายโซ่ด้านขวา คุณจะได้รับแอร์ดรอปสองครั้ง

ตามหลักการแล้ว คุณต้องการที่จะมุ่งความสนใจไปที่ห่วงโซ่ก่อนแล้วจึงโต้ตอบกับพวกมันให้มากที่สุด โอเค แต่คำถามคือจะเกิดอะไรขึ้นต่อไป?

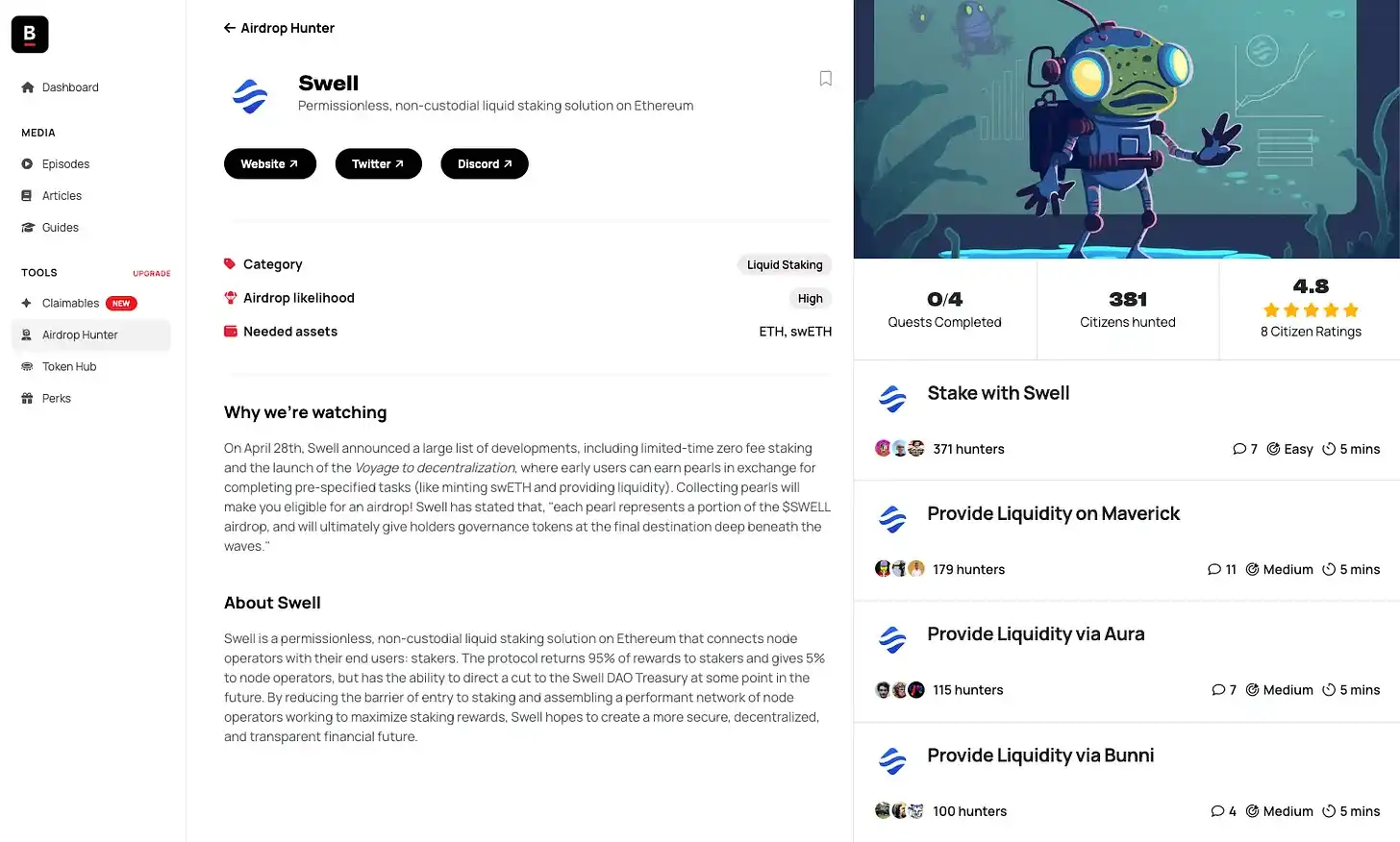

ค้นหาแอร์ดรอปที่เหมาะสม

โชคดีสำหรับนักล่าแอร์ดรอปของคุณ มีอุตสาหกรรมมากมายในการค้นหาแอร์ดรอปที่สร้างขึ้นเพื่อคุณโดยเฉพาะ โดยทั่วไปแล้ว ไซต์การค้นพบ Airdrop เหล่านี้ต้องการให้คุณดำเนินการ การกระทำ ที่เฉพาะเจาะจงมากและต้องการหลักฐานออนไลน์ว่าคุณได้ดำเนินการเหล่านั้นแล้ว ไม่ว่าจะเป็นคุณยายหรือบอทของคุณที่ดำเนินการ เพียงตรวจสอบให้แน่ใจว่าธุรกรรมนั้นมองเห็นได้บนเครือข่าย

แพลตฟอร์ม ภารกิจ ทั้งหมดเหล่านี้จริงๆ แล้วเป็นไซต์การค้นพบการลอยตัวของเครื่องบินซึ่งปลอมตัวเป็นเช่นนั้น หากไซต์เหล่านี้สามารถดึงดูดผู้ใช้คุณภาพสูงได้ ก็มักจะไม่เป็นปัญหา แต่ผู้ใช้ที่ดึงดูดโดยการใช้ไซต์เหล่านี้มักจะได้รับการจ้างงานสูงและแสดงถึงการคาดเดาระยะสั้นที่อุตสาหกรรมโดยรวมต้องทนทุกข์ทรมาน

ลองติดต่อเพื่อนที่เชื่อถือได้ของเราที่ dApp Radar เพื่อดูว่ากิจกรรม Airdrop ใดที่อาจเกิดขึ้นในเวลานี้

จากนี้ แผนเกมของฉันน่าจะเป็น:

· การใช้ zkSync เป็นเชนฐานของฉัน

· Layer Zero เชื่อมเงินทุนของฉัน

· Metamask เป็นกระเป๋าเงินโซ่ของฉัน

ทั้งหมดนี้อาจเป็นเพียงขั้นตอนการทำงานตามธรรมชาติของฉันและไม่จำเป็นต้องทำงานเพิ่มเติมใดๆ แต่คำถามคือ คุณต้องทำอะไรจึงจะรู้ว่าคุณอยู่อันดับไหนในบรรดาแอร์ดรอปที่เป็นไปได้เหล่านี้ ฉันประหลาดใจมากที่มีชุมชน เครื่องจำลองการทิ้งระเบิด ทั้งหมดเกิดขึ้น คนเหล่านี้มีอยู่เพื่อช่วยให้คุณเข้าใจจุดยืนของคุณเมื่อเทียบกับเกษตรกรผู้ปลูกเครื่องบินรายอื่น เพียงค้นหาคำว่า “airdrop” แล้วคุณจะพบแดชบอร์ดที่จำลองวิธีที่โปรเจ็กต์กระจาย airdrops โดยใช้เกณฑ์ airdrop ที่ผ่านมา

สิ่งที่น่าสนใจคือระดับของรายละเอียดที่ถูกดึงออกมา ดูคอลัมน์ทั้งหมดที่แมปโดยใช้ตารางนี้ คะแนนตามอำเภอใจ, เวลาการทำธุรกรรมล่าสุด, จำนวนธุรกรรม, สัญญาเฉพาะ, จำนวนเงินรวมของธุรกรรมในสกุลเงินดอลลาร์, วัน/สัปดาห์/เดือนที่ใช้งานเฉพาะ, อายุกระเป๋าเงิน และเวลาบล็อก

ทำไมต้องกังวลกับการคำนวณ airdrop ในเมื่อ “ชุมชน” ของคุณได้ทำเพื่อคุณแล้ว?

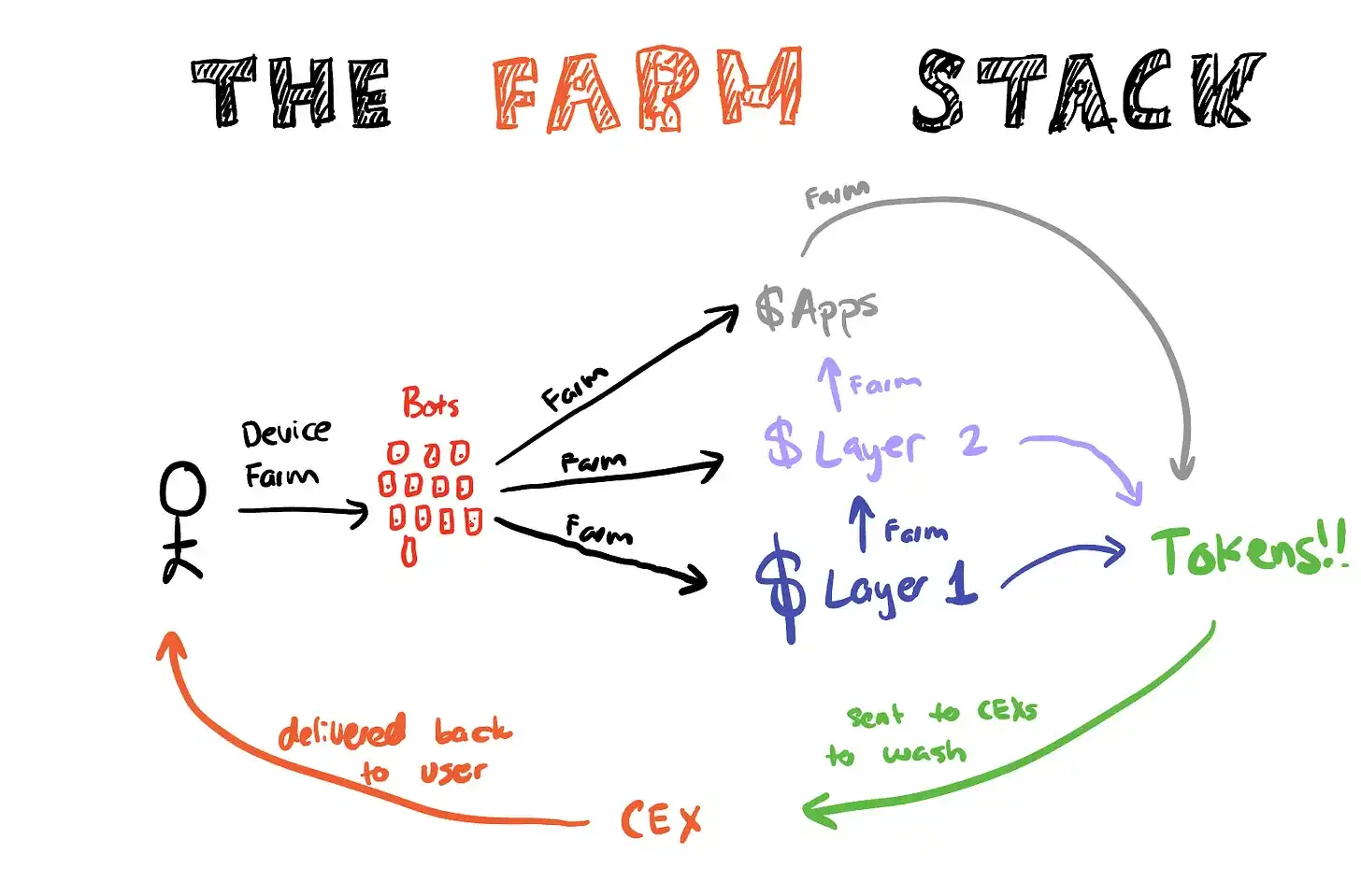

เกมระบบ

หากคุณประหลาดใจที่การวางแผนทั้งหมดนั้นดีเพียงใด ให้รอจนกว่าคุณจะเห็นส่วนถัดไป: หากคุณทราบการเรียงสับเปลี่ยนและการรวมกันของสิ่งต่าง ๆ ทั้งหมดที่เหมาะกับมาตรฐาน คุณสามารถเริ่มทำให้เป็นอัตโนมัติและสร้างระบบที่มีประสิทธิภาพโดยรอบได้ . ฉันใช้เวลาค้นคว้าและค้นพบเครื่องมือที่น่าทึ่งทั้งสองนี้ อาจลองดูเพื่อรายงานว่าเกม airdrop ทั้งหมดเสียหายเพียงใด

ประการแรกมาจากเพื่อนของเราที่ nftcopilot.com ที่สร้างแดชบอร์ดที่ยืดหยุ่นเพื่อให้คุณตั้งค่าฟาร์มของคุณโดยอัตโนมัติ

สิ่งที่น่าทึ่งคือความลึกและรายละเอียดที่พวกเขาใส่เข้าไปด้วย ในผลิตภัณฑ์ คุณสามารถสร้าง กลุ่ม และปรับแต่งพารามิเตอร์ต่อไปนี้ได้

1. จำนวนธุรกรรมที่ส่งผ่านสะพาน

2. เครือข่ายบริดจ์ (Ethereum, Polygon, Binance Smart Chain, Arbitrum, Avalanche, Optimism, Metis, Aptos)

3. การดำเนินการสุ่มที่กำหนดค่าจะรวมถึงความน่าจะเป็นของโอกาสที่กำหนดค่าไว้ ช่วงเวลาพักเครื่อง และจำนวนธุรกรรมสุ่มสูงสุดสำหรับแต่ละธุรกรรม

ขอให้ชัดเจนว่านี่ยังห่างไกลจากการเพิ่มมูลค่าและการทำลายมูลค่าให้กับระบบนิเวศทั้งหมด

สินค้าลอกเลียนแบบเพื่อยืนยันการประเมินราคาที่เป็นเท็จ

หากคุณซูมออก สิ่งที่เกิดขึ้นจริงๆ ก็คือค่าใช้จ่ายในการพิจารณาให้ Airdrops เหล่านี้มีค่าน้อยกว่าผลตอบแทนที่ได้รับจากความพยายาม เว็บไซต์อื่นที่ฉันพบช่วยทำให้ข้อตกลงชัดเจนขึ้นโดยให้รายละเอียดเกี่ยวกับราคาและ ROI ที่เป็นไปได้

ตอนนี้คุณสามารถใช้คณิตศาสตร์แบบง่ายของคุณเองเพื่อหาว่าคุณต้องการลงทุนเงินจำนวนเท่าใด และคาดว่าจะได้รับเงินจำนวนเท่าใด วุ้ย ฉันแก้ไขปัญหาเชิงปฏิบัติสำหรับทุกคนแล้ว ในระดับหนึ่ง อาจทำกำไรได้มากกว่าสำหรับบริษัทร่วมลงทุนที่จะเปิดตัว airdrops มากกว่าการลงทุนในโครงการจริง สภาพคล่องเร็วขึ้นและมีภาระทางจิตน้อยลง

ตราบใดที่ราคาของแอร์ดรอปต่ำกว่ารางวัลที่เป็นไปได้ แอร์ดรอปจะมีผลเหนือกว่า

ผลลัพธ์สุดท้าย

แล้วคุณคิดว่าอะไรคือผลที่ตามมาของภาคส่วนย่อยด้านการเกษตรที่ถูกสร้างขึ้นจากโครงการที่เกินจริงเหล่านี้? เป็นเพียงการต่อสู้เพื่อดูว่าใครเป็นผู้สร้างอุตสาหกรรมบอตเน็ตที่ใหญ่กว่าบนรากฐานของมัน หากตัวเลขออนไลน์สูงเกินจริง ผู้เข้าร่วมที่ไม่สงสัยซึ่งไม่รู้วิธีแยกวิเคราะห์ข้อมูลจะรายงานสิ่งที่พวกเขาเห็นและท้ายที่สุดก็หลอกลวงนักลงทุนรายย่อยให้เชื่อว่าโครงการที่พวกเขาลงทุนนั้นน่าดึงดูดใจในตลาดอย่างแท้จริง

ตรวจสอบทวีตด้านล่าง หากคุณเล่น Twitter คุณอาจสับสนและคิดว่า ว้าว สิ่งนี้เริ่มได้ผลจริงๆ ฉันควรซื้อใน ยิ่งมีคนเชื่อข้อมูลมากเท่าไร วงจรนี้ก็จะดำเนินต่อไปอีกเรื่อยๆ นี่คือตัวอย่างบางส่วนของการใช้ข้อมูลที่ไม่เหมาะสมที่ฉันพบบน Twitter

จากสิ่งที่ฉันได้แสดงให้คุณเห็นในบทความนี้ คุณคิดว่าตัวเลขใดๆ ในเมตริกแรงฉุดเหล่านี้เป็นจำนวนจริงหรือไม่ ไม่แน่นอน มันเป็นของปลอมทั้งหมด ข้อมูลเป็นของปลอม

คำตอบ

ไม่จำเป็นต้องได้รับอนุญาต

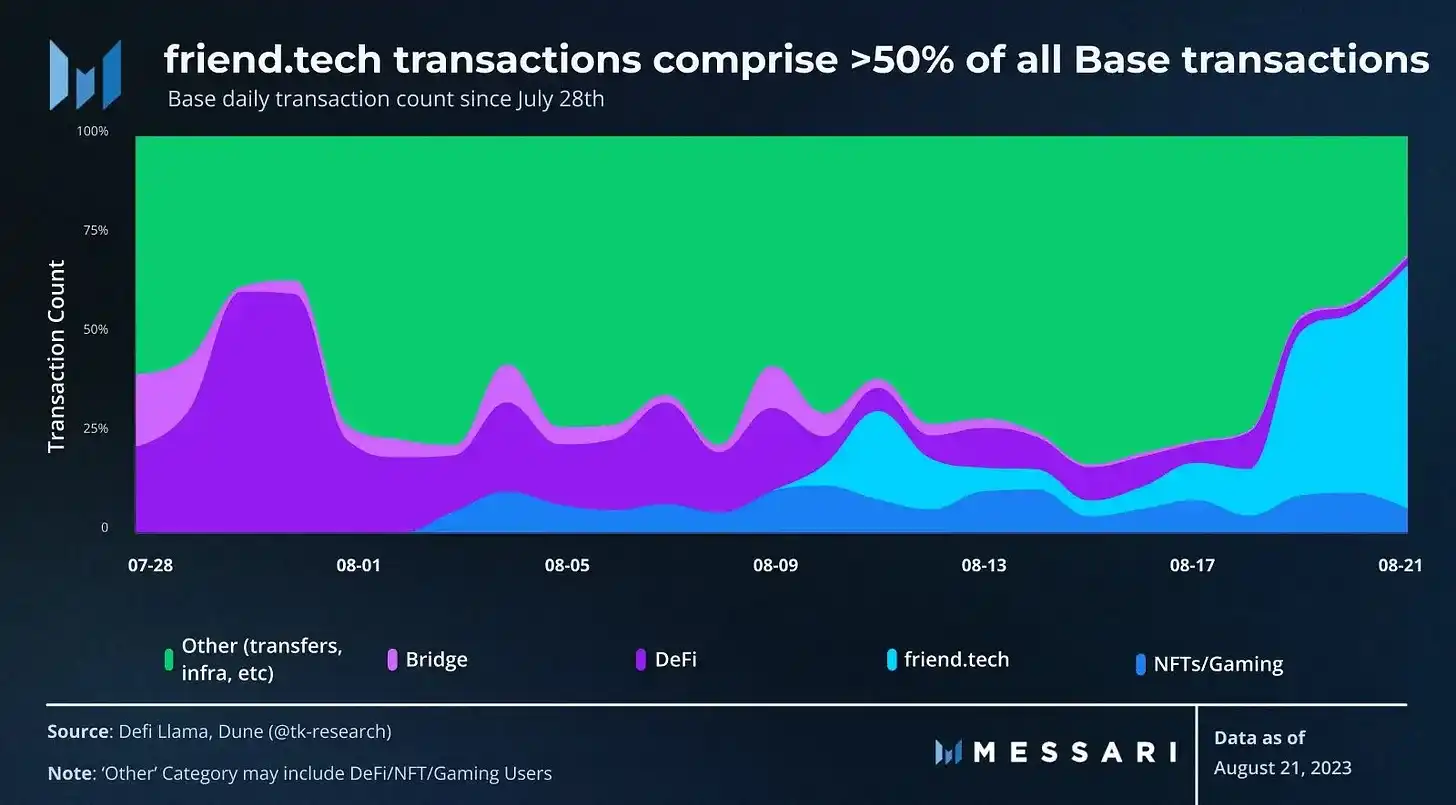

เราทุกคนกำลังหลอกตัวเองจนกว่าเราจะตรวจสอบตัวชี้วัดโดยพิจารณาจากใครเป็นผู้สร้างกิจกรรมนี้ การนับจำนวนฐานตามที่เป็นหมายความว่าคุณกำลังตั้งค่าแถบต่ำมากสำหรับการรวมข้อมูลระบุตัวตน (โดยพิจารณาว่าต้นทุนในการสร้างข้อมูลระบุตัวตนที่ไม่ได้รับอนุญาตนั้นเป็นศูนย์)

สิ่งที่ปัญหาข้างต้นมีเหมือนกันก็คือ ไม่มีการคำนึงถึงพฤติกรรมในอดีตหรือพฤติกรรมในบริบทที่กว้างขึ้น ดังนั้นคุณจะแก้ไขปัญหาข้างต้นได้อย่างไรหากคุณมีชั้นข้อมูลประจำตัวที่แข็งแกร่งกว่าในพื้นที่ crypto?