CEX儲備證明調查,哪家風險最高?

原創- Odaily

作者- 秦曉峰

最近,已經破產倒閉的FTX 有了不少最新動向,再加上Binance 頻頻遭遇「流動性危機」的質疑,進一步引發市場恐慌。多重因素疊加下,用戶對CEX 平台儲備證明(PoR)的關注度再次提高。

距離FTX 崩潰已經過去10 個月,曾經宣稱要提高行業透明度,定期發布PoR 報告的CEX,真的在踐行承諾嗎?

Odaily對Binance、OKX、Bitget、Kucoin、Bybit、HTX(Huobi 更名)、Gate 以及Crypto.com 等多家平台調查,發現一些有意思的情況。

一、Binance 等平台定期公佈PoR 報告

Binance、OKX、Bitget 以及Kucoin 四家平台,自去年11 月FTX 之後每月按時發布PoR 報告,並為用戶提供默克爾樹(Merkle Tree)進行開源驗證。其中,Binance 今年1 月升級系統——使用zk-SNARK 技術升級其儲備金證明系統,「斷更」了一期;Bitget 也因平台整體升級在2 月缺少一期報告。

其他幾家平台中,Bybit 兩月發布一次,累計更新五期PoR 報告。 HTX(Huobi 更名)宣稱每月初更新數據,但官網無法查看過往POR 報告,目前僅能看到9 月1 日的數據——後文統計時涉及的部分數據是從官方對外宣發的快訊中抓取,可能並不完整。

(Gate 報告)

Gate 目前只有由第三方審計機構出具的「儲備證明」,發佈時間分別是2020 年5 月以及2022 年10 月,此後再無相關數據呈現,也沒有提供驗證工具;Crypto.com 只是去年12 月發布的一份資產證明,承諾的默克爾樹資產證明也遲遲沒有上線。

二、Binance 總儲備遙遙領先,多家CEX BTC 儲備攀升

從各家統計的數據來看,Binance 資產總儲備遙遙領先,每個月位列第一,比其他幾家儲備之和還要多;OKX 僅次於Binance,始終排名第二;Bybit 從今年五月起超過HTX(Huobi 更名)位列第三。各家儲備變化情況如下方視頻所示:

(CEX 儲備金排行榜,點擊播放視頻)

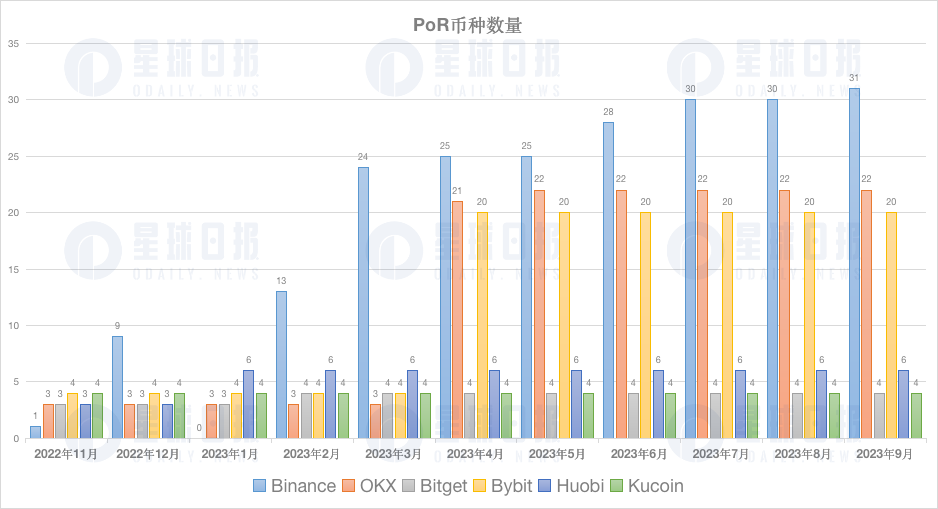

總體來說,各家資產儲備相較於首次公佈時都有明顯的增長。一個重要的原因是,儲備金公告涉及的幣種數量越來越多。以Binance 為例, 2022 年11 月報告中僅公佈BTC 儲備, 12 月報告增至9 種,此後不斷增加,最新的9 月報告中共計31 種代幣,也是所有CEX PoR 報告中最多的。

OKX 是公佈幣種數量排名第二的平台,從最早的3 種增加至今年4 月的21 種——目前是22 種;Bybit 僅次於Binance 以及OKX,從早期的4 種增至目前的20種。 Bitget 以及Kucoin 雷打不動,一直是四種——BTC、ETH 加上兩種穩定幣(USDT、USDC)。

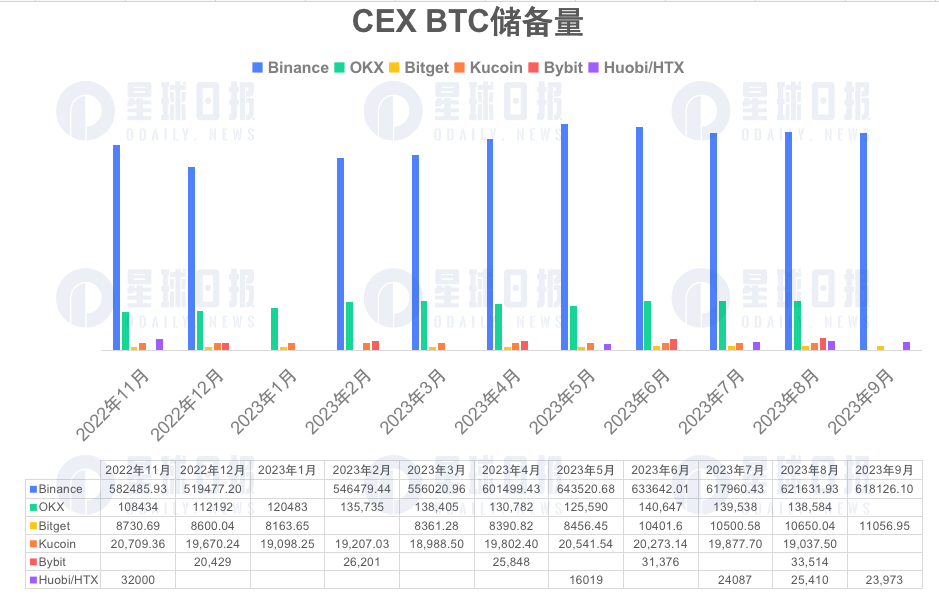

另外一個考量維度是BTC 儲備量。 Odaily統計數據顯示,Binance 上BTC 儲備量是最多的,目前約為61.8 萬個,其次是OKX(13.85 萬個)。各家BTC 儲備情況如下所示:

Binance、OKX、Bitget 以及Bybit 四家平台BTC 儲備量相較於10 個月前,都有著明顯增長,漲幅普遍在10% 以上,漲幅最多的是Bybit(64% ),其次是OKX(27.7% )以及Bitget(26.6% );HTX(Huobi 更名)跌幅最大,目前BTC 儲備量一度腰斬,目前回升至23973 。

最後一個指標是儲備金乾淨度,即非平台幣資產在總資產中的佔比。 Bitget 以及Kucoin PoR 報告並未涉及平台,進行剔除;另外四家中,Bybit 儲備金乾淨度最高, 4 月、 6 月以及8 月的報告中均超過95% ;Binance 緊隨其後,儲備金乾淨度一直維持在85% 以上,最高87.69% ;OKX 以及HTX(Huobi 更名)儲備金乾淨度都在50% ~ 60% 之間,換言之接近40% 儲備金都是交易所平台幣——HTX 平台幣統計時將HT 以及TRX 都包括在內。

三、各家具體儲備分析

Binance 總儲備從2022 年11 月首次公佈時的94.51 億美元,最高上漲至今年5 月的699.05 億美元;而後,由於6 月Binance 遭SEC 起訴引起恐慌,資金出逃明顯,當月最終錄得653.43 美元。

最近兩月,Binance 的總資產儲備持續下滑,但其BTC、ETH 儲備量相較於6 月並沒有明顯下降。一個可能的解釋是,加密市場行情整體下行,導致總資產儲備價值縮水。

(Binance 資產儲備變化,點擊播放視頻)

OKX 過去10 個多月,有幾個很明顯的變化:一是BTC 儲備量不斷攀升;二是穩定幣儲備量也不斷增長,從最初的30.6 億美元增長至54.3 億美元,漲幅超過70% 。不過,OKX 平台幣儲備價值始終在100 億美元以上,超過40% 。

Bitget 無論是BTC 儲備量還是總資產儲備,都不斷攀升,呈現向好態勢,這可能得益於其在今年升級打法——搶上各種新幣獲得較高的市場關注度。 Bybit 與Bitget 一樣,BTC 儲備量以及總資產儲備均穩步向上。

Kucoin 總體而言並沒有大的變化。另外根據Nansen 數據顯示,Kucoin 地址中平台幣KCS 佔比為12.7% ,其儲備資產乾淨度也超過了85% 。

關於各家CEX 的資產儲備情況,Odaily也將持續追踪。

推薦閱讀: