サイバーガバナンスの茶番劇:1人が独自の提案を可決したが、当局者はその実施を拒否したと述べた

オリジナル - 毎日

著者 - ルーピー・ルー

8月1日、BinanceはサイバーコネクトのトークンCYBERが8月15日にBinance Launchpoolに上場されると発表した。 CYBERは発売以来、誰も想像していなかった形で市場の注目を集めてきました。

CYBERはまず韓国のCEXで最高値36ドルを付けたが、これは他の主流取引プラットフォームに比べて120%のプレミアムだ。その後、「ウーロン指」ガバナンス提案が 12 時間という驚異的な速さで可決され、超循環する多数のトークンのロックが解除されました。かつては大手マーケットメーカーDWFが登場しました。 Odailyでは、今週末に起こった不条理なドラマを以下でご紹介します。

プレミアムは最大120%で、発行部数が少ないため規制命令をめぐる議論が起きている。

Binanceが発表したCYBERトークンエコノミクスによると、CYBERの総供給量は1億で、そのうち9%がコミュニティの報酬に、34%が生態系の開発に、25.12%が個人投資家に、15%がチームに割り当てられている。およびコンサルタント、10.88 % が地域の財務省に寄付されます。 CoinList Public SaleとBinance Launchpoolはそれぞれトークンの3%を割り当てます。

その初期流通量は総供給量に比べて非常に少なく、わずか 11,038,000 CYBER で、総トークン供給量の 11.04% を占めます。

Launchpool の開始当初、このトークンの発売は市場からあまり注目を集めませんでした。しかし、オンラインになってから約1週間後、Upbit での CYBER の立ち上げにより、プロジェクトは即座に「エキサイティング」なものになりました。

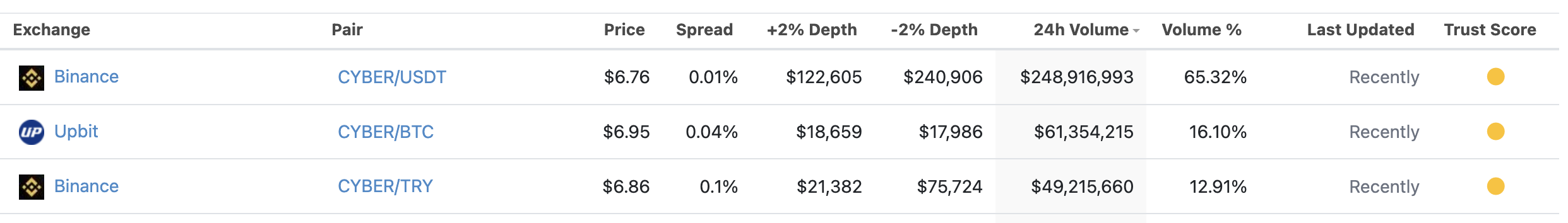

8月22日、アップビットはCYBER取引を開始した。 Coingecko のデータによると、Upbit の CYBER/BTC 取引ペアは現在、CYBER の市場シェアの 10 分の 1 以上を占め、取引量では CYBER 取引ペアとしては 2 番目に大きいです。昨日、このデータはかつて20%を突破しました。

サイバーの価格も韓国投資家の活発な取引熱を受けて高騰を続けている。最盛期のCYBERの価値は現在の約4倍だった。

ただし、この価格は韓国市場でのみ存在します。 「キムチプレミアム」が再び市場に韓国の衝撃をもたらした。

Upbit では、CYBER はかつて約36ドル高い位置の。 Binance では、CYBER の最高価格はわずか 16.2 ドルです。 Upbit のプレミアムレートは約120% 。

Upbit の CYBER/BTC 取引ペア

サイバーコネクトの公式説明によると、韓国の主要取引プラットフォームはイーサリアム上でのCYBER入出金のみをサポートしているとのこと。価格の不一致は、イーサリアム上の CYBER 流動性の欠如によって引き起こされます。

ただし、興味深い統計は、提案の発表時点のものです。 CYBER の流通トークンには、約 564 万の CYBER-ETH、240 万の CYBER-OP、および 300 万の CYBER-BSC が含まれます。

にもかかわらずイーサリアムの独立したネットワークが流通量の半分以上を占める。しかし、この保険料の高さは人々を困惑させるものですが、CYBERの保険料がこれほど高い理由は他にあるのでしょうか?

Upbit の保有高がその理由として考えられるかもしれません。 0xScopeの監視によると、オンチェーンデータは、Upbitのウォレットアドレスが360万以上のCYBERを保持していることを示しています。この量循環供給量の33%を占めます。

CYBER トークンの最大保有者である Upbit は、Binance よりも多くのトークンを保有しています。

一方で、これは韓国のトレーダーのCYBERに対する熱意を反映しています。一方、CYBERも隠れていますポジションの集中, コントロール可能なリスク。

別のあからさまな動きもこの懸念をさらに強めている。 8月31日、有名な暗号通貨マーケットメーカーであるDWF Labsは、もう1つの韓国市場リーダーであるCEX Bithumbに40,000 CYBERを預け入れました。これは、当時の市場価格に基づいて約360,000米ドルに相当します。過去最高値の 36 ドルでは 144 万ドルを超えます。

偶然にも、DWF が市場に参入してから 24 時間以内に CYBER は急速に上昇し、48 時間以内に史上最高値に達しました。

流通率100%を超えるトークンのロック解除:元々はウーロンフィンガー

昨日の早朝、サイバーコネクトからのガバナンス提案により、始まったばかりのカーニバルはすぐに終結した。

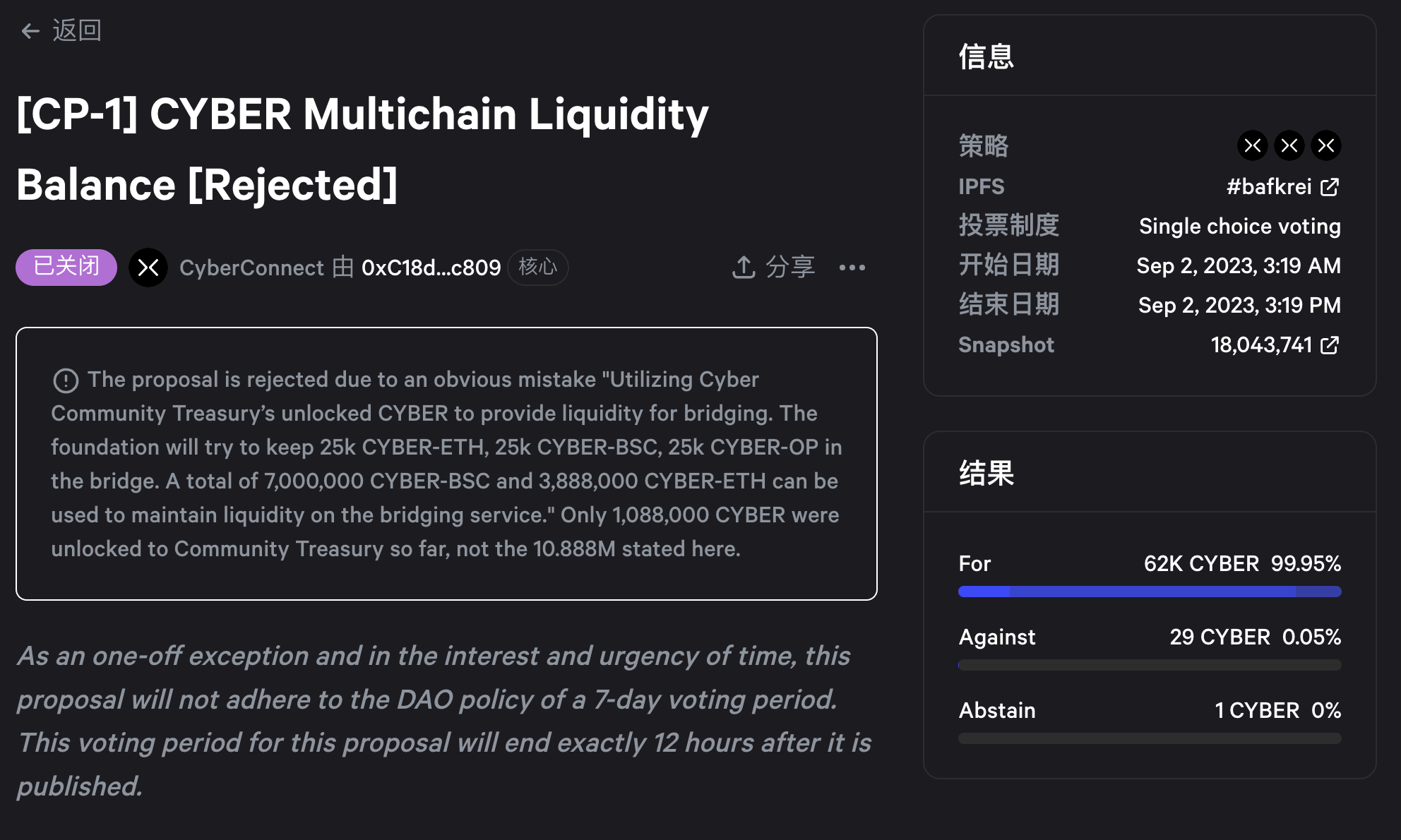

サイバーコネクト、緊急提案「CP-1」を発行。サイバーコネクトは、複数のチェーンに CYBER クロスチェーン ブリッジが存在しないため、異なるチェーン間の CYBER が低下すると考えています。マルチチェーンの流動性の欠如,これにより、CEX のプレミアムが高額になりました。

この問題を解決するために、トークンのロック解除を通じて流動性のバランスをとり、イーサリアム、オプティミズム、BNBチェーンネットワーク間のCYBERの流動性バランスの問題を解決します。

これは 3 つのステップで実装されます。

LayerZero の ProxyOFT を利用した CYBER-ETH、CYBER-BSC、CYBER-OP ブリッジを導入します。

Cyber DAO Vault は CYBER のロックを解除し、そのようなブリッジに流動性を提供するために使用されます。ボールトでロックが解除された CYBER は、ブリッジ サービスの流動性を維持するために使用されます。ブリッジサービスの提供はCYBERの総供給量には影響しません。

合計7,000,000 CYBER-BSCと3,888,000 CYBER-ETHがロック解除されます。

チェーンの流動性は、トークンの燃焼と鋳造によってバランスが保たれます。たとえば、保管庫内の CYBER-ETH がなくなると、新しい CYBER-ETH が鋳造され、同量の CYBER-BSC または CYBER-OP が燃焼されます。

この提案が出たとたん、CYBERは急落した。

Coingecko データは、CYBER の合計を示しています。流通供給量はわずか約1100万枚、このロック解除により、一度に1,088万コインのロックを解除する、流通供給量全体にほぼ等しいため、CYBER投資家は大騒ぎになった。

提案が発表されてから1時間以内に、CYBERはアップビットで67%、バイナンスで26%急落した。

急落後、反転が起きた。ロックを解除するための天文学的な量のトークン、ただのウーロンだったことが判明。

オデイリーがサイバーコネクトに確認を求めたところ、関係者らは次のように述べた。CYBER 保管庫内のロック解除されたコインの数は 108 万コインのみであるはずですが、スナップショットに記載されている 1,088 万コインは誤った数です。、オンチェーン投票は可決されましたが、データエラーのため、実行されません。

その後、サイバーコネクトは提案書に記載されたCYBERロック解除回数に誤りがあったとの公式声明を発表した。この提案は無効であると宣言されました。同時に、前述の流動性の欠如に対処するための新しい提案を開始することが発表されました。

「集中型」コミュニティ投票の茶番劇

CYBERは発表の中で、「この提案は速やかに正式に撤回されたにもかかわらず、市場での噂は止まらず、パニック、不確実性、CYBERに対する疑念を引き起こした」と指摘した。

同時に、彼らはコミュニティにとって最大の懸念事項にも対応し、「CYBERトークンの市場操作は根拠のない噂である」と「コミュニティに保証」した。

しかし、この提案はコミュニティの不満をさらに煽ることになりました。市場操作の噂は根拠がないと約束しているにもかかわらず、仮想通貨プロジェクトにとって、この提案は確実にサイバーのセキュリティをさらに強化します。「一元化された」印象。

暗号化プロジェクトの場合、「分散化」が各プロジェクトを表します。しかし、サイバーコネクトでは、とんでもない光景が見られました。

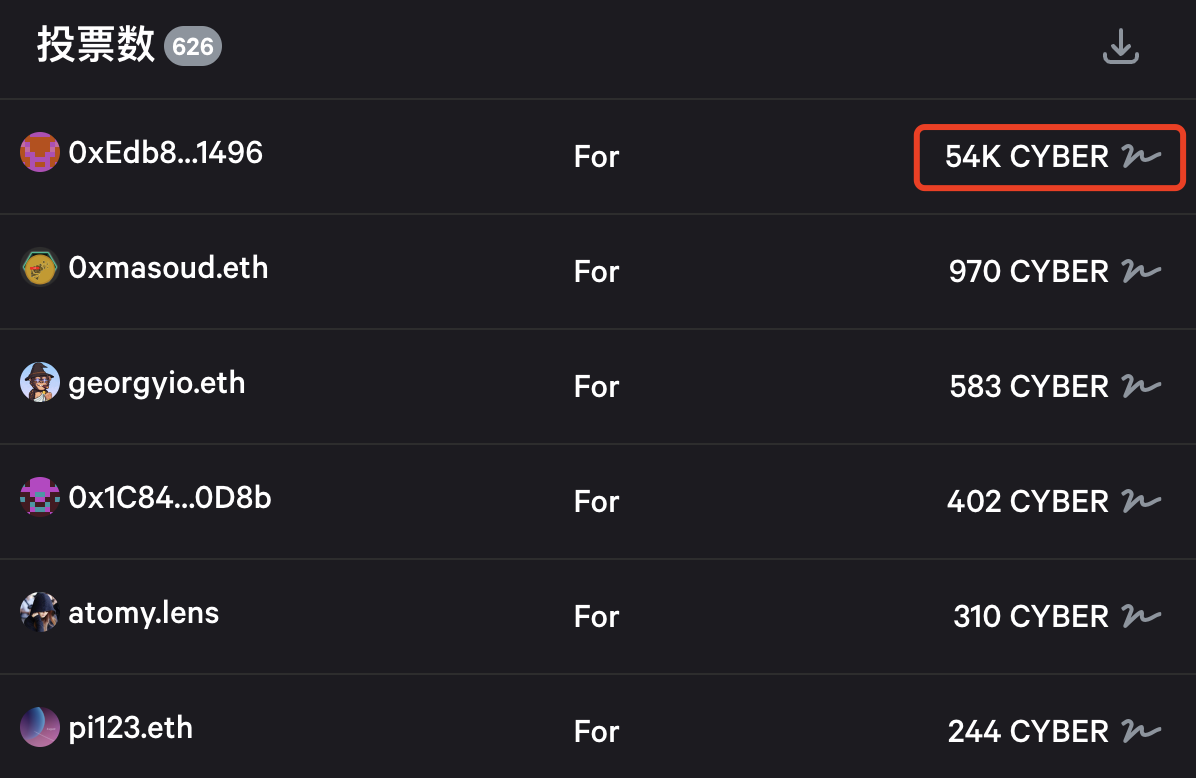

「cybergov.eth」(サイバーガバナンス)という名前のユーザーが有効期間を開始したのは、12時間さんの投票です。のみユーザー投じられた総投票数を占めた87% 投票。

この提案はユーザーの圧倒的な支持を得てすぐに可決された後、提案書の作成ミスにより再び正式に禁止されました。実行を拒否します。

確かに、このようなばかばかしい投票は最終的には失敗しました。では、もしガバナンス提案が成功すれば、それは「自作自演、自作自演」の茶番になってしまうのではないだろうか?

現在のオンチェーンの世界では、大多数のプロジェクトでは、依然として「集中型」ガバナンスが一般的な選択です。

次は何ですか?

オンチェーンアナリストの Ember は、8 月 29 日 (CYBER の現在価格は 7 ドル) から始まり、Upbit ウォレット アドレスが保有する CYBER ポジションの数が 9 月 2 日正午 (CYBER の現在価格は 13 ドル) まで増加し続けたことを監視しています。ウォレットアドレスのCYBER保有数は過去最高となる約394万7千個に達した。この期間は、CYBER の価格が上昇した時期と一致しました。

現在、プレッシャーはバイナンスにかかっています。アップビットのサイバーから 360 万枚のコインが流出し、そのほとんどがバイナンスに流入しています。価格操作の脚本を疑わざるを得ませんが、別のCEXでも同じことが繰り返されるのでしょうか?