Glassnode: ตลาด Bitcoin กำลังผ่านวงจรความผันผวนต่ำอย่างที่ไม่เคยเกิดขึ้นมาก่อน

สรุป

การรวบรวมข้อความต้นฉบับ: Deep Tide TechFlow

สรุป

ราคา Bitcoin ขึ้นชื่อในเรื่องความผันผวน แต่ตลาดกำลังเผชิญกับการบีบอัดความผันผวนที่รุนแรง

ตลาดฟิวเจอร์สค่อนข้างทรงตัว โดยทั้งการซื้อขาย bitcoin และ ethereum อยู่ในระดับต่ำสุดตลอดกาล โดยมีการซื้อขายแบบสปอตและการเก็งกำไรอยู่ที่ 5.3% ซึ่งสูงกว่าอัตราปลอดความเสี่ยงเล็กน้อย

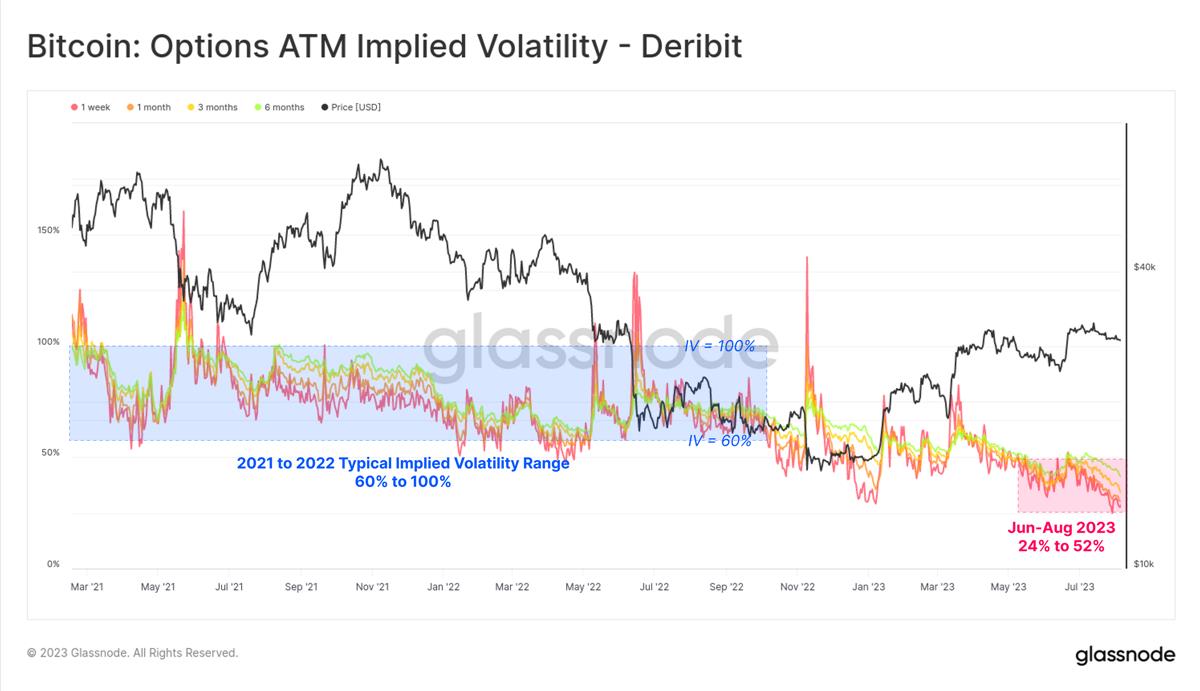

ความผันผวนโดยนัยในตลาดออปชั่นกำลังเผชิญกับการบีบอัดความผันผวนอย่างมีนัยสำคัญ โดยค่าพรีเมียมจากความผันผวนนั้นต่ำกว่าครึ่งหนึ่งของเกณฑ์มาตรฐานในปี 2564-2565

ชื่อระดับแรก

ช่วงเวลาแห่งความสงบ

ตลาด Bitcoin กำลังผ่านช่วงเวลาที่เงียบสงบ โดยมีตัวชี้วัดความผันผวนหลายตัวตกลงสู่ระดับต่ำสุดตลอดกาล ในบทความนี้ เราจะมาดูสิ่งที่น่าทึ่งเกี่ยวกับช่วงเวลาอันเงียบสงบนี้จากมุมมองทางประวัติศาสตร์ และจากนั้นจะพิจารณาราคาของตลาดอนุพันธ์อย่างไร

อันดับแรก เราทราบว่าราคาสปอตของ Bitcoin สูงกว่าค่าเฉลี่ยเคลื่อนที่ระยะยาวที่สังเกตกันอย่างกว้างขวางของอุตสาหกรรม (111 วัน, 200 วัน, 365 วัน และ 200 สัปดาห์) ค่าเฉลี่ยเหล่านี้มีตั้งแต่ต่ำสุดที่ $23,300 (200 DMA) ไปจนถึงระดับสูงที่ $28,500 (111 DMA) แผนภูมิยังเน้นช่วงเวลาที่คล้ายกันในสองรอบที่ผ่านมาซึ่งมีแนวโน้มที่จะสอดคล้องกับแนวโน้มขาขึ้นมหภาค

เราสามารถสังเกตสถานการณ์ที่คล้ายกันมากโดยใช้ราคาที่รับรู้บนเชน ซึ่งจำลองฐานต้นทุนของสามกลุ่ม:

🟠 ทั้งตลาด (ราคาจริง)

🔴 ผู้ถือระยะสั้น (เหรียญที่ถือไว้ไม่เกิน 155 วัน)

🔵 ผู้ถือระยะยาว (เหรียญที่ถือนานกว่า 155 วัน)

ราคาสปอตอยู่เหนือทั้งสามโมเดลอีกครั้ง และแสดงการจัดตำแหน่งที่แข็งแกร่งกับเครื่องมือวิเคราะห์ทางเทคนิคแบบคลาสสิกที่กล่าวถึงข้างต้น

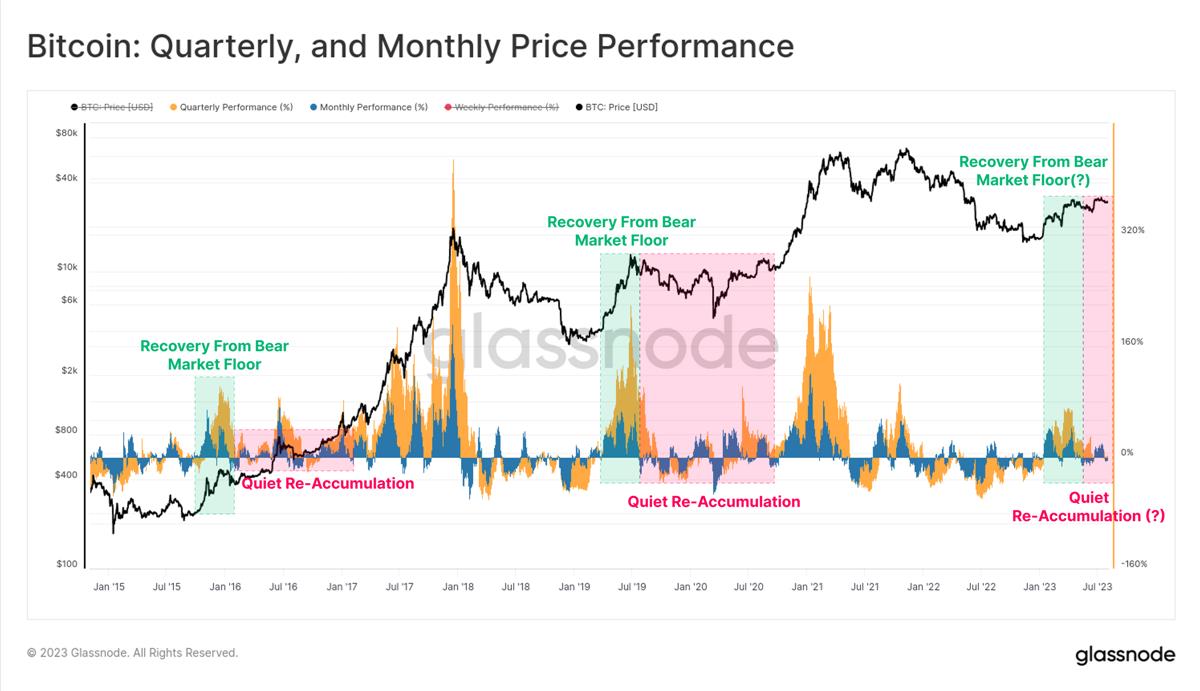

842 วันผ่านไปแล้วนับตั้งแต่ราคาตลาดกระทิงสูงสุดในเดือนเมษายน 2021 การฟื้นตัวในปี 2023 นั้นดีกว่าจริง ๆ เมื่อเทียบกับประวัติศาสตร์ โดยลดลง -54% จากระดับสูงสุดตลอดกาล เทียบกับการลดลง -64% ในอดีต

นอกจากนี้เรายังทราบด้วยว่าทั้งรอบปี 2015-16 และ 2019-20 ประสบกับความเบื่อหน่ายด้านข้างเป็นเวลา 6 เดือน ก่อนที่ตลาดจะเร่งตัวขึ้นเหนือระดับ retracement -54% บางทีนี่อาจเป็นสัญญาณบ่งบอกถึงความเบื่อหน่ายที่รออยู่ข้างหน้า

หลังจากที่เริ่มต้นอย่างร้อนแรงจนถึงต้นปี 2023 ประสิทธิภาพราคาทั้งรายไตรมาสและรายเดือนก็เย็นลง อีกครั้งที่เราเห็นความคล้ายคลึงกันมากมายกับรอบก่อนหน้านี้ กล่าวคือ การดีดตัวจากด้านล่างมีโมเมนตัมเริ่มต้นที่แข็งแกร่ง แต่จากนั้นก็เข้าสู่ช่วงของการแข็งตัวของแรงกระแทกอย่างต่อเนื่อง

ชื่อระดับแรก

ความผิดพลาดจากความผันผวน

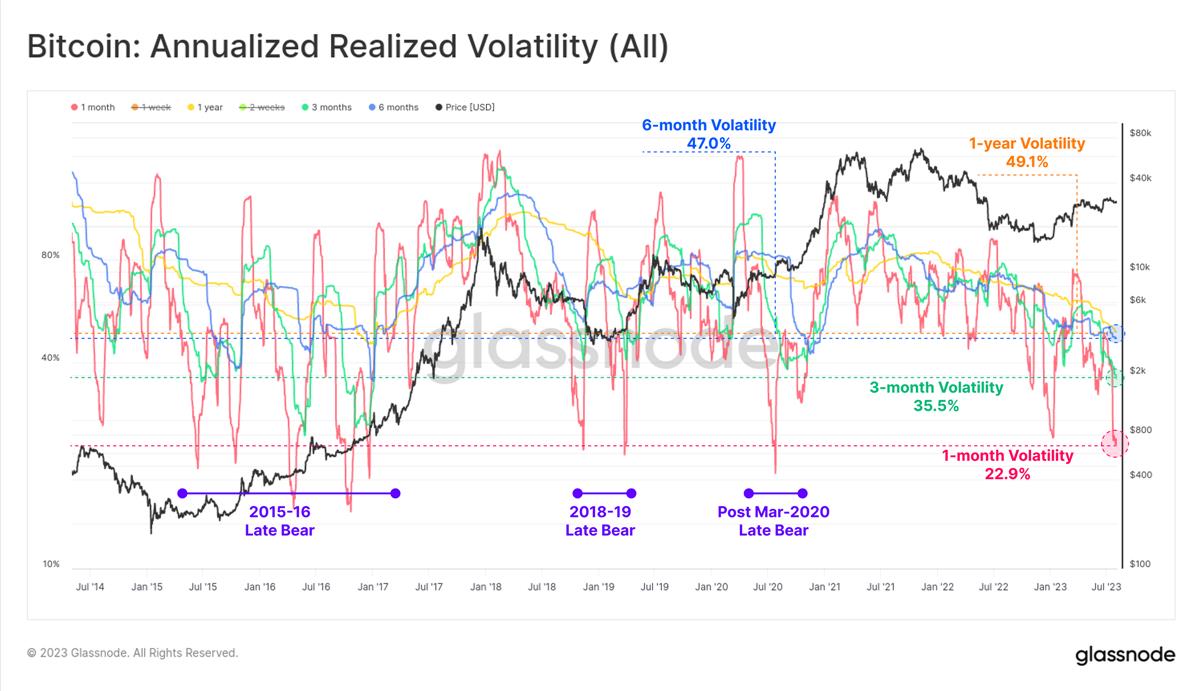

ความผันผวนที่เกิดขึ้นจริงของ Bitcoin ลดลงอย่างรวดเร็วในช่วงสังเกตการณ์ 1 เดือนถึง 1 ปีในปี 2023 ซึ่งแตะระดับต่ำสุดในรอบหลายปี ระดับความผันผวนใน 1 ปีตอนนี้อยู่ที่ระดับที่ไม่เคยพบเห็นตั้งแต่เดือนธันวาคม 2559 นี่คือช่วงที่สี่ของการบีบอัดความผันผวนขั้นสุด:

ตลาดหมีในช่วงปลายปี 2558 เข้าสู่ช่วงสะสมใหม่ในปี 2559

ตลาดหมีในช่วงปลายปี 2018 มีการขายออก 50% ในเดือนพฤศจิกายน อย่างไรก็ตาม ตามมาด้วยการฟื้นตัวขึ้นในเดือนเมษายน 2019 โดยเพิ่มขึ้นจาก 4,000 ดอลลาร์เป็น 14,000 ดอลลาร์ในสามเดือน

หลังจากเดือนมีนาคม 2020 ตลาดก็แข็งแกร่งขึ้นเมื่อโลกปรับตัวต่อการแพร่ระบาดของไวรัสโคโรนาสายพันธุ์ใหม่ (โควิด-19)

การพังทลายของตลาดในช่วงปลายปี 2022 เมื่อตลาดกำลังแยกแยะความล้มเหลวของ FTX และสถานการณ์ตลาดในปัจจุบันของเรา

ช่วงราคาระหว่างราคาสูงสุดและต่ำสุดภายใน 7 วันเพียง 3.6% มีเพียง 4.8% ของเซสชันเท่านั้นที่เคยพบกับช่วงการซื้อขายรายสัปดาห์ที่น้อยลง

ช่วงราคา 30 วันนั้นสุดขั้วมากขึ้นราคาได้เคลื่อนไหวภายในช่วง 9.8% ในช่วงเดือนที่ผ่านมา และมีเพียง 2.8% ของเดือนเท่านั้นที่น้อยกว่าช่วงนั้น การรวมตัวและการบีบอัดราคาในระดับนี้เป็นเหตุการณ์ที่หายากมากสำหรับ Bitcoin

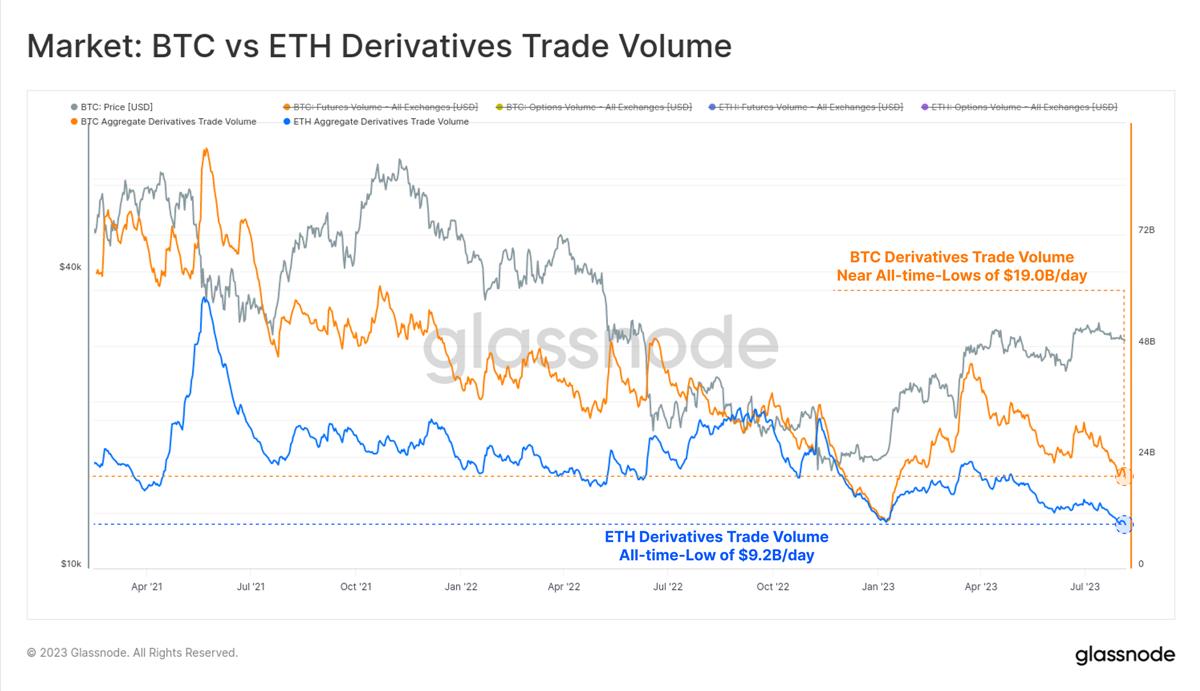

ช่วงเวลาแห่งความสงบนี้ยังปรากฏให้เห็นในตลาดอนุพันธ์ของ Bitcoin และ Ethereum สำหรับทั้งสินทรัพย์ ฟิวเจอร์ส และออปชันมีการซื้อขายใกล้หรือต่ำเป็นประวัติการณ์

ปริมาณการซื้อขายอนุพันธ์ของ Bitcoin ปัจจุบันอยู่ที่ 19 พันล้านดอลลาร์ ในขณะที่ตลาด Ethereum ซื้อขายเพียง 9.2 พันล้านดอลลาร์ต่อวัน ซึ่งต่ำที่สุดในเดือนมกราคม 2023

ตลาดยังคงรักษาจุดยืนที่ค่อนข้างไม่ชอบความเสี่ยง โดย Bitcoin ค่อยๆ เพิ่มความโดดเด่นในตลาดฟิวเจอร์ส ในช่วงปี 2564-2565 ปริมาณการซื้อขายและดอกเบี้ยแบบเปิดของตลาดซื้อขายล่วงหน้า Ethereum จะเพิ่มขึ้นอย่างต่อเนื่องเมื่อเทียบกับ Bitcoin และแตะจุดสูงสุดที่ 60 BTC : 40 ETH ในช่วงครึ่งหลังของปี 2565

Bitcoin ครองตำแหน่งเหนือกว่าอีกครั้งในปีนี้ โดยเสนอว่าสภาพคล่องที่ลดลงและความเสี่ยงที่ลดลงยังคงเป็นแรงผลักดันให้เงินสูงขึ้นตามเส้นความเสี่ยง

ในช่วงเดือนที่ผ่านมา ความสนใจแบบเปิดของ Bitcoin ในตลาดฟิวเจอร์สก็ค่อนข้างคงที่ที่ 12.1 พันล้านดอลลาร์ ซึ่งคล้ายกับระดับที่เห็นในช่วงครึ่งหลังของปี 2022 เมื่อ Bitcoin ราคาถูกกว่าในปัจจุบันประมาณ 30% และการแลกเปลี่ยน FTX ยังคงเปิดใช้งานอยู่ นอกจากนี้ยังคล้ายกับการชุมนุมในเดือนมกราคมปี 2021 เมื่อราคา Bitcoin สูงกว่าที่เป็นอยู่ในปัจจุบันถึง 30% ตลาดมีการเติบโตน้อยลง และการเก็งกำไรแบบมีเลเวอเรจเพิ่งจะเริ่มต้นขึ้น

จากมุมมองเชิงเปรียบเทียบ ตลาดออปชั่นได้เห็นการครอบงำและการเติบโตเพิ่มขึ้นอย่างเห็นได้ชัด โดยมีดอกเบี้ยแบบเปิดมากกว่าสองเท่าในช่วง 12 เดือนที่ผ่านมา ตลาดออปชันขณะนี้เป็นคู่แข่งกับตลาดฟิวเจอร์สในแง่ของความสนใจแบบเปิด

ในทางกลับกัน ความสนใจแบบเปิดในตลาดฟิวเจอร์สนั้นลดลงอย่างต่อเนื่องนับตั้งแต่สิ้นปี 2022 (เมื่อ FTX ล้มเหลว) โดยเพิ่มขึ้นเพียงเล็กน้อยในปี 2023

ด้วยปริมาณที่น้อยและกิจกรรมที่ขาดความดแจ่มใสในตลาดฟิวเจอร์ส เป้าหมายต่อไปคือการระบุว่าโอกาสใดที่ทำให้เทรดเดอร์มีความเคลื่อนไหวในตลาดอนุพันธ์ของสินทรัพย์ดิจิทัล

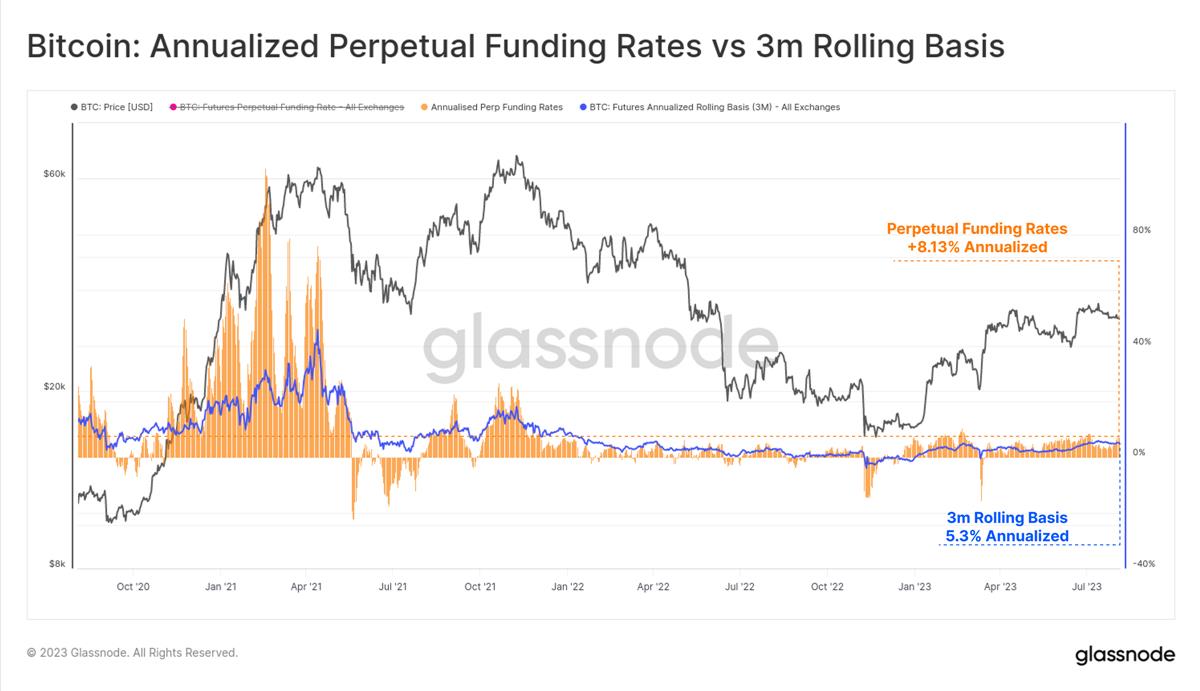

ในตลาดฟิวเจอร์ส โครงสร้างคำศัพท์แสดงให้เห็นว่าอัตราผลตอบแทนต่อปีในช่วง 5.8% ถึง 6.6% สามารถได้รับผ่านกลยุทธ์การเก็งกำไรแบบสปอต อย่างไรก็ตาม อัตรานี้สูงกว่าอัตราผลตอบแทนของพันธบัตรรัฐบาลสหรัฐฯ หรือกองทุนตลาดเงินระยะสั้นเพียงเล็กน้อยเท่านั้น

ตลาดสัญญาถาวรเป็นสถานที่ซื้อขายสินทรัพย์ดิจิทัลที่มีสภาพคล่องมากที่สุด โดยที่เทรดเดอร์และผู้ดูแลสภาพคล่องสามารถล็อคอัตราพรีเมี่ยมของเงินทุนเพื่อเก็งกำไรฟิวเจอร์สและราคาสปอตได้ การเก็งกำไรแบบสปอตรูปแบบนี้มีความผันผวนและไดนามิกมากขึ้น แต่เมื่อพิจารณาถึงความเสี่ยงที่เพิ่มเข้ามา อัตราผลตอบแทนต่อปีในปัจจุบันที่ 8.13% จึงน่าดึงดูดยิ่งขึ้น

เป็นที่น่าสังเกตว่าตั้งแต่ปลายปี 2022 อัตราการระดมทุนยังคงเติบโตในเชิงบวกอย่างต่อเนื่อง ซึ่งบ่งชี้ถึงการเปลี่ยนแปลงที่สำคัญในความเชื่อมั่นของตลาด

ในตลาดออปชัน เราจะเห็นความรุนแรงของการบีบอัดความผันผวน โดยความผันผวนโดยนัยตกลงสู่ระดับต่ำสุดตลอดกาลจนถึงการหมดอายุสัญญาทั้งหมด

ตลาด Bitcoin มีความผันผวนมาก โดยมีความผันผวนโดยนัยในการซื้อขายออปชั่นระหว่าง 60% ถึงมากกว่า 100% ในช่วงส่วนใหญ่ของปี 2021-22 อย่างไรก็ตาม ในปัจจุบัน ค่าพรีเมียมจากความผันผวนของราคาออปชันมีน้อยมากในอดีต โดยมีค่า IV อยู่ระหว่าง 24% ถึง 52% ซึ่งน้อยกว่าครึ่งหนึ่งของค่าพื้นฐานระยะยาว

โครงสร้างคำศัพท์ IV (ความผันผวนโดยนัย) แสดงให้เห็นว่าค่าพรีเมียมจากความผันผวนกำลังหดตัวในช่วงสองสัปดาห์ที่ผ่านมา ความผันผวนโดยนัยสำหรับสัญญาเดือนธันวาคมลดลงจาก 46% เหลือ 39% ในช่วงสองสัปดาห์ที่ผ่านมาเพียงอย่างเดียว ออปชั่นที่จะหมดอายุจนถึงเดือนมิถุนายน 2024 มีพรีเมี่ยมความผันผวนเพียง 50% ซึ่งถือว่าค่อนข้างต่ำในอดีต

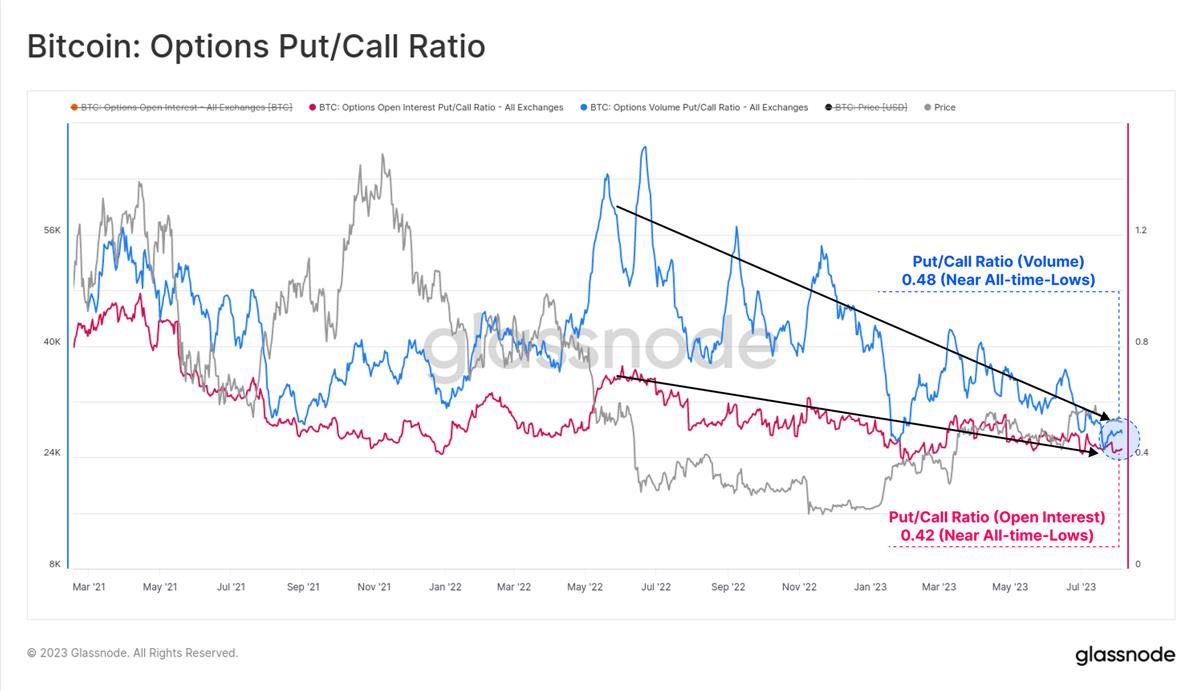

สำหรับตัวชี้วัดทั้งปริมาณและดอกเบี้ยแบบเปิด อัตราการวาง/การโทรอยู่ที่หรือใกล้ระดับต่ำสุดเป็นประวัติการณ์ โดยมีการซื้อขายในช่วงระหว่าง 0.42 ถึง 0.48 นี่แสดงให้เห็นว่ามีความเชื่อมั่นสุทธิในตลาด โดยความต้องการตัวเลือกการโทรยังคงครอบงำอยู่

ชื่อระดับแรก

สรุปและสรุป

มีพาดหัวข่าวไม่กี่ฉบับที่ประกาศว่า Bitcoin เป็นสินทรัพย์ที่มีความมั่นคงด้านราคาและไม่ผันผวน ซึ่งทำให้ช่วงการซื้อขายรายเดือนต่ำกว่า 10% มีความโดดเด่น ในปัจจุบัน ความผันผวนของตลาดถือว่าต่ำที่สุดเท่าที่เคยมีมา ทำให้เกิดคำถามว่าความผันผวนที่เพิ่มสูงขึ้นนั้นจะเกิดขึ้นในอนาคตหรือไม่

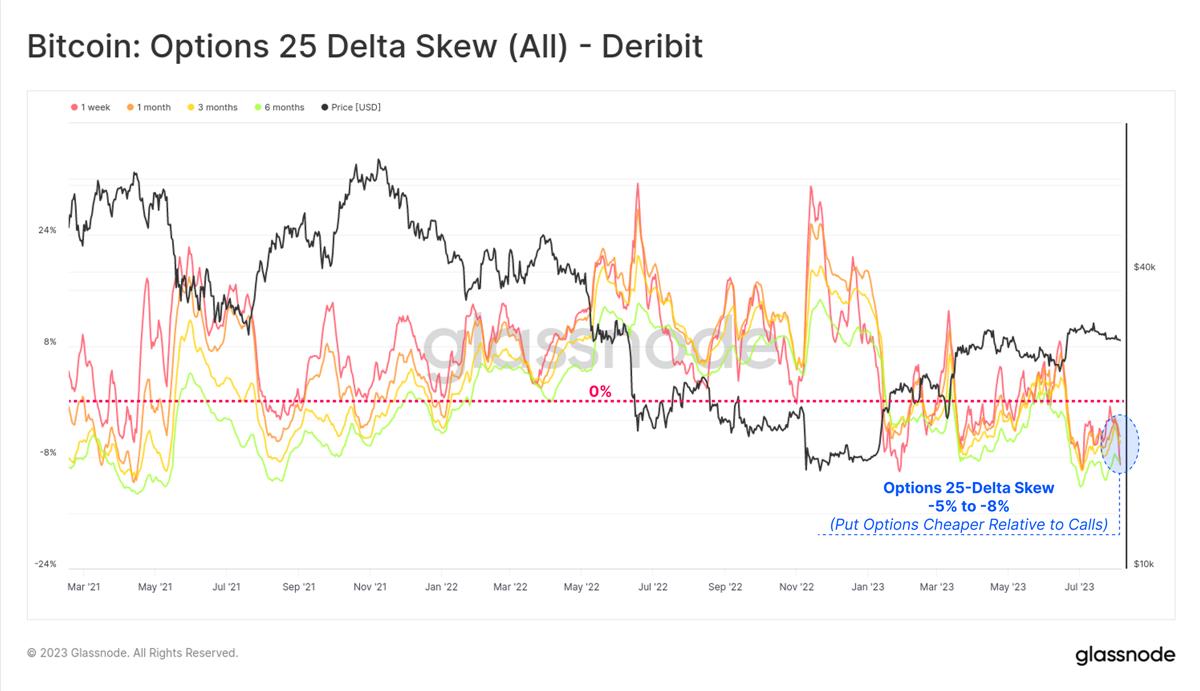

อัตราผลตอบแทนเงินสดในอนาคตอยู่ระหว่าง 5.3% ถึง 8.1% ซึ่งสูงกว่าอัตราปลอดความเสี่ยงของกระทรวงการคลังสหรัฐฯ ระยะสั้นเล็กน้อย ค่าพรีเมียมจากความผันผวนโดยนัยในตลาดออปชันนั้นอยู่ในระดับต่ำสุดตลอดกาล และความต้องการออปชันแบบพุตโดยเฉพาะนั้นบางที่สุด

เมื่อพิจารณาถึงความผันผวนของ Bitcoin เรากำลังนำเข้าสู่ยุคใหม่ของเสถียรภาพราคา Bitcoin หรือความผันผวนกำหนดราคาผิดไปหรือเปล่า?