Không ai có thể dự đoán rằng thị trường được thúc đẩy bởi các tổ chức tài chính chính thống đăng ký Bitcoin ETF giao ngay cuối cùng sẽ được hưởng lợi nhiều nhất từ dự án fork Bitcoin - BCH (Bitcoin Cash).

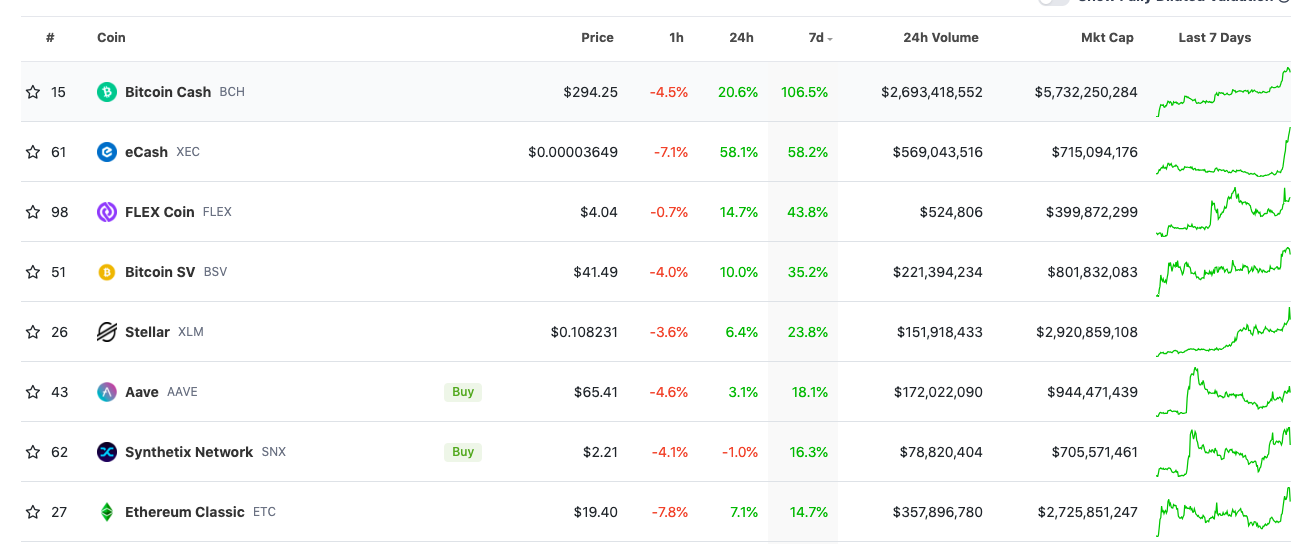

Dữ liệu CoingeckoNó cho thấy rằng trong tuần qua, BCH đã dẫn đầu các loại tiền điện tử khác với mức tăng 106,5%; trong hai tuần qua, BCH đã tăng từ 101 USD lên 325 USD, mức tăng tối đa 221% và hiện ở mức 294 USD.

Điều thú vị là, với sự gia tăng của BCH, một số dự án fork fork khác cũng đạt được mức tăng tốt: eCash (trước đây gọi là BCHA) có mức tăng hàng tuần là 58,2%, xếp thứ hai; ”) dẫn đầu một dự án fork BCH khác là Bitcoin SV. (BSV), xếp thứ 4 với mức tăng hàng tuần là 35,2%. Vì các mã thông báo này là cơ chế POW nên cộng đồng đã hét lên: Make Pow Great Again và một nhóm mã thông báo chuỗi công khai POW cũ như Litecoin (LTC), DASH và Ethereum Classic (ETC) thường tăng hơn 10% vào ngày hôm nay.

Ngoài việc tăng token, còn có những tin đồn và thảo luận sôi nổi trong cộng đồng BCH: Wu Jihan, cựu vương của BCH, sắp trở lại xây dựng và cộng đồng hét lên rằng mức áp lực tiếp theo của BCH là 1.000 USD ( mức giá cao nhất trong lịch sử là 1.650 USD). Mặc dù không có tin tức chính thức nào để xác minh những tin đồn trên thị trường, nhưng cái tên Wu Jihan vẫn có sức nặng trong lòng cộng đồng BCH — giống như V God đối với Ethereum.

Đối với những người mới bắt đầu đầu tư vào tiền điện tử sau khi DeFi bùng phát, Wu Jihan, người hiếm khi lên tiếng trong hai năm qua, dường như là một sự tồn tại xa lạ, nhưng trước năm 2021, anh ấy sẽ là một người nổi tiếng hàng đầu. Là một trong những người sáng lập Bitmain, nhà sản xuất máy khai thác lớn nhất thế giới và là “thợ mỏ” được giới truyền thông miêu tả, Wu Jihan là nhân vật “bố già” trong giới tiền tệ. Mỗi lời nói và hành động đều có tác động quan trọng đến toàn bộ thị trường , giống như CZ General, Nhà sáng lập Binance ngày nay.

BCH được Wu Jihan lăng xê trở thành đồng tiền fork hot nhất thị trường năm 2017. Tuy nhiên, với 2 hard fork, Wu Jihan đã tham gia sâu vào “Gongdou” của Bitmain và không có kỹ năng đuổi theo và thực sự đốt cháy nó. Trong vòng thị trường tăng giá tiếp theo, BCH sẽ dần dần rời khỏi vòng tròn chính thống.

tiêu đề phụ

(1) Wu Jihan fork Bitcoin và BCH ra đời

Năm 2017, xung đột gay gắt đã nổ ra trong cộng đồng Bitcoin: một phe dựa trên sơ đồ khối lớn được đại diện bởi Bitcoin ABC, chủ trương tăng giới hạn kích thước khối (1 MB lên 8 MB) để tăng tốc độ giao dịch của Bitcoin; phe kia phe dựa trên Bitcoin Core Thay mặt cho những người theo chủ nghĩa chính thống, ông chủ trương không thay đổi mã mạng Bitcoin mà sử dụng các công nghệ tiên tiến (chẳng hạn như Lightning Network) để giải quyết vấn đề về khả năng mở rộng.

Cuối cùng, với sự hỗ trợ của Bitmain, công ty có sức mạnh tính toán lớn, fork đầu tiên trong lịch sử Bitcoin đã xảy ra và Bitcoin Cash (BCH) ra đời. Vào thời kỳ đỉnh cao, vốn hóa thị trường của BCH từng lọt vào top 4 - vào tháng 12 năm 2017, tỷ giá hối đoái BCH/BTC đạt mức cao nhất mọi thời đại là 0,284 (hiện là 0,01) và chưa bao giờ đạt đến mức đó kể từ đó.

Sau BCH, hàng trăm dự án fork Bitcoin cũng ra đời trên thị trường, nhưng tất cả đều tồn tại trong thời gian ngắn và cuối cùng đã chết, và rất khó để đạt được kết quả như BCH. Wu Jihan, người đi đầu trong việc fork Bitcoin, cũng từng bị mang nhiều tiếng xấu khác nhau, nhưng điều này không cản trở sự hài lòng của anh ấy với “tác phẩm” mà mình đã tạo ra.

Bitcoin Cash đã trở thành một nhân tố quan trọng trong thị trường tiền kỹ thuật số. Nó không chỉ có những tính năng và lợi thế độc đáo mà còn có thể bổ sung và cùng tồn tại với các loại tiền kỹ thuật số khác. sự biến động đã mang lại nhiều cơ hội và thách thức hơn cho toàn bộ thị trường tiền kỹ thuật số.”

tiêu đề phụ

(2) Fork BCH, Wu Jihan so với CSW

Một năm sau khi BCH ra đời, CSW người Úc (Craig Wright, biệt danh Satoshi Ao Ben), người tự nhận là Satoshi Nakamoto, bắt đầu fork BCH, và Wu Jihan cũng trải qua nỗi đau do fork gây ra.

Vào tháng 11 năm 2018, BCH đã trải qua quá trình nâng cấp giới thiệu một tính năng mới gọi là Thứ tự giao dịch Canonical (CTOR). Tuy nhiên, việc nâng cấp này không nhận được sự đồng thuận của tất cả các thành viên, nhà hoạt động CSW đề xuất trực tiếp áp dụng khối siêu lớn 128 M và “khóa” client trong phiên bản 0.1 của Satoshi Nakamoto, nhóm Bitcoin ABC phản đối. Wu và CSW nhanh chóng gây ra một cuộc chiến mắng mỏ kéo dài, hai bên chửi thề nhau.

Cuối cùng, hai phiên bản không tương thích đã ra đời, BCHABC (được hỗ trợ bởi Jihan Wu và Roger Ver và cộng sự) và BCHSV (được hỗ trợ bởi CWS và cộng sự). Khi bắt đầu fork, cả hai bên đều tự nhận là BCH chính thống, đồng thời tìm kiếm sự hỗ trợ của cộng đồng và sự công nhận của thị trường; sau đó, sự cạnh tranh giữa hai bên ngày càng trở nên gay gắt hơn, bao gồm cạnh tranh sức mạnh tính toán khai thác, bỏ phiếu của cộng đồng và nhiều hình thức công khai khác nhau. tấn công và phòng thủ. Cuối cùng, Wu Jihan đã thắng, BCH ABC lại được đổi tên thành BCH, và BCHSV được thay thế bởi BSV.

tiêu đề phụ

(3) Đội ABC đâm sau lưng Wu Jihan, BCH lại fork

Xin chúc mừng! Sau khối mới này, sẽ không còn kẻ gây rối nào trong cộng đồng BCH nữa! Vào ngày 16 tháng 11 năm 2018, Wu Jihan đã tweet sau khi đánh bại CSW. Nhưng vào thời điểm đó, anh không ngờ rằng hai năm sau BCH lại trải qua một đợt fork.

Trọng tâm của fork là một bản nâng cấp được gọi là Kế hoạch tài trợ cơ sở hạ tầng (IFP), sẽ ủy quyền 8% cho mỗi phần thưởng khối (tiền bitcoin mà người khai thác kiếm được) cho BCH để cung cấp hỗ trợ cho các dự án phần mềm, chẳng hạn như Bitcoin ABC.

IFP buộc tất cả các thợ mỏ BCH quyên góp nhiều lợi nhuận hơn cho các nhà phát triển. Đây là điều mà các thợ mỏ không muốn thấy. Do đó, Freetrader, một nhà phát triển ban đầu của BCH, đã chọn phân nhánh trên cổng thông tin riêng của mình và đã giành được sự ủng hộ của nhiều thợ mỏ, cộng đồng và người dùng ủng hộ. Cuối cùng, BCH đã hard fork hai chuỗi một lần nữa: BCHN (Bitcoin Cash Node, không có hạn chế IFP) và BCHA (Bitcoin Cash ABC, có hạn chế IFP).

Khi đợt fork sắp diễn ra, một vòng cạnh tranh quyền đặt tên BCH mới lại bắt đầu. Tưởng chừng đội ABC, đội đã dẫn dắt sự phát triển của BCH trong 3 năm, sẽ giành chiến thắng nhưng cuối cùng BCHN, đội có lợi thế về dư luận và sự ủng hộ, đã chiến thắng và giành được quyền đặt tên cho BCH. công bố vào tháng 8 năm 2021 rằng họ sẽ đổi tên thành eCash (XEC).

tiêu đề phụ

(4) Bitmain Gongdou

Bắt đầu từ năm 2019, cuộc xung đột lâu dài giữa Jihan Wu và Ketuan Zhan, một người sáng lập khác của Bitmain, đã trở nên công khai.

Vào tháng 10 năm đó, Jihan Wu phát hành một lá thư nội bộ cho nhân viên, sa thải Ketuan Zhan khỏi mọi vị trí ở Bitmain; vào tháng 11, Jihan Wu đã tổ chức một “cuộc họp cổ đông đặc biệt” tại Bắc Kinh khiến Ketuan Zhan hoàn toàn mất quyền kiểm soát tuyệt đối. công ty.

Ketuan Zhan, người bị đuổi khỏi công ty, đã phải đâm đơn kiện, anh còn viết thư ngỏ nói rằng anh đã bị người cộng sự và người anh em thân tín nhất đâm sau lưng, những người đã cùng nhau đấu tranh. Sau đó, Ketuan Zhan đã khởi kiện ở nhiều nơi và vào tháng 1 năm 2020, Chính quyền Nhân dân quận Haidian đã hỗ trợ Ketuan Zhan, yêu cầu Cục Giám sát Thành phố đổi pháp nhân của Bitmain thành Ketuan Zhan. Ngày 8 tháng 5 năm đó, một cảnh kịch tính đã được dàn dựng. Ketuan Zhan đã nhận được giấy phép kinh doanh tại Trung tâm Dịch vụ Chính quyền quận Haidian nhưng bị một nhóm người không rõ danh tính giật đi khiến dư luận phản đối kịch liệt.

Sau đó, hai bên tiến hành đàm phán kéo dài vài tháng và cuối cùng đạt được thỏa thuận vào tháng 1 năm 2021. Ketuan Zhan đã mua gần một nửa cổ phần của Bitmain do Jihan Wu và một nhóm cổ đông sáng lập nắm giữ với giá 600 triệu USD. Jihan Wu chính thức từ chức khỏi Bitmain; Các trang trại khai thác ở Hoa Kỳ và Na Uy đã cùng nhau thoái vốn khỏi Bitmain và Jihan Wu giữ chức vụ chủ tịch của BitDeer.

Trong hai năm tiếp theo, tiếng nói bên ngoài của Wu Jihan bắt đầu giảm dần, sau nhiều lần chia tay và sự ra đi của Wu Jihan, BCH không còn để ý nhiều đến Bitmain nữa, và cuối cùng trở nên cô đơn. Đồng thời, trong quá trình Ethereum chuyển sang PoS theo lộ trình đã thiết lập, câu chuyện chính thống và hướng gió của ngành cũng đã thay đổi. Nhiều hệ sinh thái chuỗi công khai mới PoS đã trỗi dậy, DeFi đã khơi dậy một thị trường tăng trưởng mới và câu chuyện về tù binh và ngành khai thác mỏ từng giữ vai trò huyết mạch của ngành đang trên đà phát triển, dưới sự giám sát nặng nề, nó dần rời khỏi trung tâm của sân khấu. Các nhà phát triển BCH cũng đã cố gắng nắm bắt DeFi trong một thời gian, nhưng nó không gây được nhiều tiếng vang.

Tuy nhiên, đối với BCH ở thời điểm hiện tại, đó dường như là một bước ngoặt đối với Liu Anhua.

Một là quỹ ETF bitcoin giao ngay ngày càng trở nên hấp dẫn và được kỳ vọng sẽ kích nổ thị trường tăng trưởng, thứ hai là hệ sinh thái bitcoin có một câu chuyện mới với sự phổ biến của Ordinals và nhiều nhà phát triển cũ đã quay trở lại với nó; Ngoài ra, người đứng đầu EDX Markets gần đây, được hỗ trợ bởi các gã khổng lồ tài chính truyền thống, đã liệt kê bốn mã thông báo bao gồm BCH - cũng không được SEC liệt kê là chứng khoán, trong khi nhiều mã thông báo PoS thì có.

Đây có phải là sức hút của một chủ ngân hàng trong thời gian ngắn hay một sự hồi sinh câu chuyện hay thậm chí là sự trở lại giá trị trong ngành mã hóa? Còn quá sớm để nói.