流動性とPoSを効果的に組み合わせるにはどうすればよいでしょうか?ベラチェーン、テネット、マンガテを例に挙げます

PoS メカニズムはパブリックチェーンのセキュリティを保護する一方で、多額の資金を占有するため、資金の利用率が低くなります。 DeFi はしばしば批判され、流動性には忠誠心がなく、プロジェクトは死のスパイラルに陥る傾向があります。この 2 つをどのように組み合わせて、流動性がパブリック チェーンのセキュリティ保護に参加し、同時に利益を得られるようにするか? Berachain、Tenet、mangate などのプロジェクトがこの点に関して試みを行っており、PANews ではこの記事で簡単に説明します。

Berachain: 流動性の証明と 3 つのトークン モデル

Berachain は、Cosmos SDK を使用して構築された EVM 互換チェーンであり、独自の「流動性証明」コンセンサス メカニズムと 3 トークン モデルを採用しています。 Berachain は、より持続可能な方法でエコシステムを促進することを望んでおり、流動性プルーフのコンセンサスは、Berachain の流動性、資産活用、市場価値の同時成長を促進します。

Berachain の 3 つのトークンは、ネイティブ安定通貨 $HONEY、ガス トークン $BERA、ガバナンス トークン $BGT です。ガストークンをガバナンストークンから分離する理由は、ネットワークの頻繁なユーザーが時間の経過とともに投票権を失うことを避けるためです。

ユーザーはベラチェーンのコンセンサスシステムにさまざまな資産を預け、コンセンサスに参加する権利を取得し、取引手数料、プロトコル手数料、ブロック報酬$BERAを共有します。ユーザーが預けた資産は、新しく鋳造されたステーブルコイン $HONEY で AMM に流動性を提供するために使用されます。$HONEY 鋳造の担保は、ユーザーが預けた資産です。損失が AMM の一時的な損失によって引き起こされた場合、ユーザー 最終的に償還できる資産の数も減少する可能性があります。 $BERA はガス料金の支払いに使用されるだけでなく、ガバナンス トークン $BGT を取得するための誓約にも使用できます。これが $BGT を生成する唯一の方法でもあります。

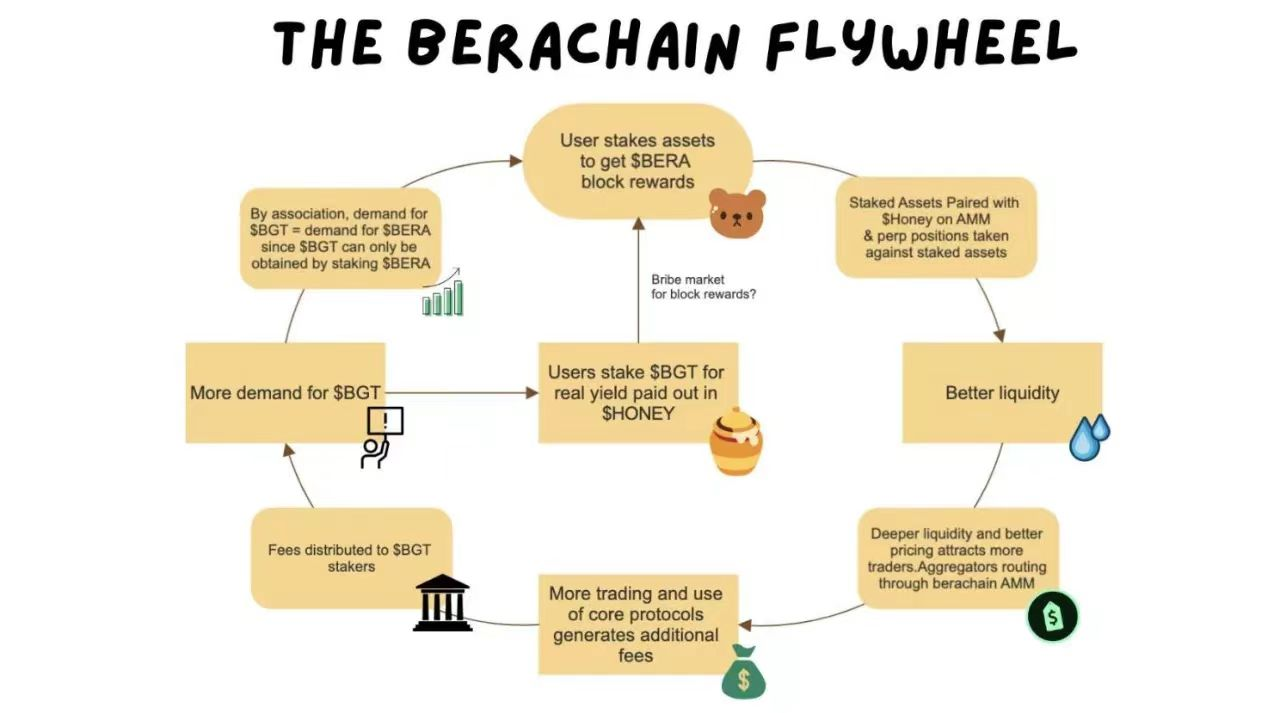

$BGTをステーキングすると、AMMの取引手数料などの契約収益の一部を得ることができます。すると、Berachainのフライホイールは以下のようになるかもしれません。

ユーザーは $BERA ブロック報酬を得るために資産を担保に入れ、担保に入れられた資産と $HONEY が AMM でトランザクション ペアを形成します。

担保される資産が多いほど、契約の流動性が向上し、取引量がより魅力的になります。

トランザクション量が増えるほど、生成されるプロトコル収益も増加し、$BGT の需要も高まります。

$BGT は $BERA をステーキングすることによってのみ生成できるため、$BGT の需要は $BERA の需要の増加につながります。

ユーザーは、$BERA を獲得するために、より多くの資産をステーキングするよう奨励されます。

現時点では、Berachain メイン ネットワークはまだ立ち上げられておらず、具体的なパフォーマンスはプロジェクトの立ち上げを待つ必要があります。同プロジェクトは今年4月、Polychain Capital、Hack VC、OKX Venturesなどから4億2000万ドルの評価額で投資を受けた。

理念: 多様なプルーフ・オブ・ステークと流動性ステーキング

Tenet は、Cosmos SDK 上に構築された EVM 互換チェーンでもあり、新しいプルーフ オブ ステーク フレームワークである Diversified Proof-of-Stake (DiPoS) が導入されており、従来の PoS モデルと比較してセキュリティが向上しています。

分散型アプリケーションでは、ガバナンス攻撃によるセキュリティ インシデントが時々発生します。これは、レイヤー 1 ブロックチェーンのネットワーク攻撃に相当します。多様化されたプルーフ・オブ・ステークにより、資産のバスケットを保持するユーザーが検証者としてネットワークのコンセンサスに参加できるようになり、多数の単一資産 (パブリック チェーン ネイティブ トークン) を保持するユーザーによってネットワークが制御されるリスクが排除されます。

Tenet のコンセンサスは、ETH、ATOM、BNB、MATIC、ADA、DOT など、ネイティブ トークン以外の資産がネットワーク セキュリティに参加することを承認できます。資産の種類が増加するにつれて、サイバー攻撃者は攻撃を完了し、これらの資産によってもたらされる共同セキュリティの恩恵を受けるために、これらの主流の暗号化資産のかなりのシェアを所有する必要があります。

ユーザーが独自のネットワーク セキュリティを維持しながら収入を得られるようにするために、Tenet は、Lido や RocketPool などの契約や、Binance や Coinbase などの機関によって鋳造された流動性担保デリバティブも受け入れています。同時に、Tenet は、ETH や ATOM などの資産による流動性ステーキングの完了を支援する独自の内部インフラストラクチャも提供します。 Tenet はネットワークのセキュリティをより重視しているため、Lido や他の契約のように 10% の管理手数料を請求することができません。これにより、独自のリキッド ステーキング サービスがより魅力的になります。

「このクロスチェーンプレッジ方式を通じて、テネットは多者間の互恵協力関係を構築したいと考えています。他のチェーンは、より多くのプレッジを通じてセキュリティを強化することができ、ユーザーはより多くの収入機会を得ることができます。テネット自体も、多様なプルーフの利点から恩恵を受けています。今後の安全性」機能強化。

現在、TENET はメインネットのベータ版を立ち上げており、ネイティブ トークン $TENET も最近 Bybit、Kucoin、その他の取引所に上場されました。 Tenet のシステムには、ネイティブのステーブルコインと DEX もあります。

Mangate Finance: 流動性の証明を備えた DEX アプリケーション チェーン

Polkadot エコシステムのクロスチェーン分散型取引所であるマンガテが、Kusama での第 68 回パラチェーン スロット オークションで落札されました。

マンガテ氏は、PoS が多数の資産をロックすることで、DeFi で利用できる資金が減り、約束された資金の効率が低下すると考えています。そこで、LPトークンを担保資産として利用して担保流動性を解除する流動性証明メカニズムを導入し、資本効率を向上させます。

マンガテも DEX アプリケーション チェーンの 1 つであり、従来の DEX と比較すると、トランザクションにガス手数料はかかりませんが、0.3% のトランザクション手数料が必要であること、コンセンサス レベルでの MEV を防止すること、流動性証明メカニズムと誓約 LP トークンは、流動性を提供することでブロック報酬とサービス料収入を同時に得ることができます。

今年6月のアップグレード後、マンガテは流動性証明でネイティブトークン$MGXの単一通貨プレッジを可能にし、$MGXの使用範囲を拡大し、ネットワークのセキュリティを強化しました。

まとめ

まとめ

上記のスキームでは、ベラチェーンは流動性がより持続可能であり、トークン モデルで流動性とトークン需要の間のフライホイールを形成できることを望んでいます; テネットはネットワーク セキュリティを強化するために他の PoS トークンを使用することを望んでいます; マンガテは LP トークンを質入れ資産として使用して、約束された流動性を解放します。

これらの改良された PoS ソリューションにより、資本効率が向上し、ブロック報酬を獲得しながら、DEX からの取引手数料報酬や他のブロックチェーンからのブロック報酬も獲得できるため、PoS 資産の利用が増加します。ただし、最近人気のある LSD と LSDFi は競合トラックでもあり、これにより、PoS 資産は、ネットワークのセキュリティを維持し、質権収入を獲得し、資産の流動性を維持しながら、DeFi 活動で追加の収入を得ることができます。

さらに、これらの改善により、より多くの種類の資産がブロックチェーンのコンセンサスに参加できるようになり、プロジェクトが成長すると、サポートされる資産の多様性により、実際により多くの価値のある資産が引き寄せられ、それによってネットワークのセキュリティが向上します。しかし、従来の PoS チェーンでデススパイラルが発生した場合、ネットワークを攻撃するには、パブリック チェーンのネイティブ トークンを保持する必要があります。 Tenet のようなスキームでは、主流通貨の大規模保有者もネットワークに対して攻撃を開始する可能性があり、これには利点と欠点の両方があります。