전 PayPal 및 Meta 리더인 Marcus가 Lightning Network에 헌신한 이유는 무엇입니까?

원문 편집: Bai Ze Research Institute

원문 편집: Bai Ze Research Institute

거의 25년 동안, 거의 온라인 결제가 현실화될 기회를 가졌을 때, David Marcus는 그것을 실현하는 방법을 알아내려고 노력해 왔습니다.

90년대 중반에 그는 인터넷 액세스와 전화 서비스를 제공하는 통신 회사를 설립했습니다. 2000년에 그는 Echovox를 설립했고, 2008년에는 사용자가 휴대폰 청구서에서 온라인으로 직접 결제할 수 있는 모바일 플랫폼인 Zong으로 분사했습니다. 2011년 Zong이 PayPal에 인수되었을 때 Marcus는 PayPal에 합류하여 이듬해 사장이 되었습니다.

2008년 후반에 Satoshi Nakamoto는 Bitcoin 백서를 발표했고 Marcus는 곧 그것을 읽었지만 처음에는 "토끼 굴에 빠지지" 않았습니다. 그러다가 2012년 아르헨티나가 페이팔에게 화폐 인플레이션과 긴축을 이유로 해외로 돈을 보내는 모든 거래를 중단하라고 명령했을 때 P2P 전자화폐 시스템인 비트코인의 진정한 가치가 그에게 반향을 일으키기 시작했다.

"우리는 규제 대상이기 때문에 규정을 준수해야 합니다."라고 Marcus는 설명했습니다. "그날 비트코인 가격이 많이 올랐고, 와우, 아르헨티나 같은 곳에서 소비자들이 버는 돈을 옮기는 방법으로 비트코인을 많이 사고 있는 것 같았어요. 그래서 제 생각에는 비트코인은 돈에 대한 나의 관점과 일치하지 않는 특정 행동을 피할 수 있는 밸브가 될 수 있기 때문에 눈이 번쩍 뜨이는 순간이었습니다. 그래서 이것은 2013년에 저에게 전환점이며, 정말 제 믿음을 강화시켰습니다."

얼마 후인 2013년 5월, 그는 캘리포니아주 산호세에서 열린 비트코인 2013 컨퍼런스에 참석했는데 당시 비트코인 커뮤니티가 아직 작았음에도 불구하고 비트코인이 디지털 결제를 용이하게 할 수 있는 방법에 대한 돌파구에 관심을 보였습니다.

보조 제목

Libra는 한때 Lightning Network 채택에 가까웠습니다.

그러나 마커스는 제도화를 포기하고 이 개방형 인터넷 결제의 가능성을 받아들일 준비가 되어 있지 않습니다. 2014년 6월에 그는 Facebook 메신저 앱 개발을 담당하는 메시징 제품 부사장으로 Meta(구 Facebook)에 합류했습니다. Marcus는 2015년 메신저 P2P 결제를 출시하여 사용자가 자신의 은행 계좌에서 다른 사람에게 돈을 보낼 수 있게 했습니다.

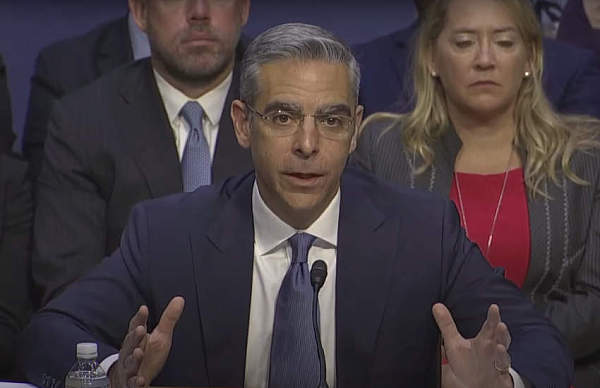

시간은 2019년 중반이 되었고 Marcus는 Facebook의 암호 화폐 프로젝트 Libra를 이끌기 시작했습니다. 이 프로젝트는 나중에 Diem으로 이름이 바뀌고 완전히 폐기되었습니다. 다른 중앙 집중식 디지털 통화 프로젝트와 비교할 때 Libra는 특히 가치 있는 것을 제공하지 않기 때문에 거의 모든 비트코인 지지자들로부터 "비판"을 받았습니다. Marcus는 또한 하원 금융 서비스 위원회와 상원 은행 위원회 앞에서 프로젝트를 변호해야 했으며 Meta의 과거 사용자 개인 정보 침해에 대한 질문에 답해야 했습니다.

그러나 Libra가 전통적인 금융 기관을 네트워크 노드로 사용하기 전에 Marcus는 실제로 Lightning Network 채택을 고려했습니다.

“저는 2018년 초에 Elizabeth Stark(Lightning 개발 회사인 Lightning Labs의 CEO)를 만났고 Lightning이 실제로 가야 할 길인지 알아내려고 했던 것을 기억합니다. Velocity, 정말 하고 싶어요." Marcus가 말했습니다. "그 당시 우리는 라이트닝 네트워크를 사용하고 WhatsApp 및 Messenger를 포함한 모든 메타 제품에 내장할 수 있는 세계적 수준의 지갑을 구축하고 사람들이 쉽게 가치를 전송할 수 있도록 할 수 있을 것이라고 생각했습니다."

그러나 궁극적으로 그는 제한된 노드와 유동성을 포함하여 아직 극복하지 못한 몇 가지 단점이 있기 때문에 프로토콜이 Meta의 비전을 실현하기에 충분히 강력하지 않다고 느꼈습니다.

Markus는 다음과 같이 지적했습니다. "오늘날에도 라이트닝 네트워크가 실제로 수십억 명의 소비자에게 도달하는 것은 어려울 것입니다. Layer-1에도 실제로 그렇게 하기에는 충분한 HTLC(Hash Time Lock Contracts)가 없습니다. 따라서 우리는 이 독점 기술을 구축해야 합니다. 그런 다음 최대한 분산화합니다.”

결국 거대 기업에서 "분산 결제"를 실현하려는 마커스의 꿈은 메타의 리브라 해체로 끝이 났지만, 그는 비트코인을 제외한 다른 블록체인 네트워크에서 글로벌 결제를 달성하려는 시도가 무익하다는 것을 깨달았습니다.

그는 “이 시점에서 진정한 개방형 인터넷 결제 프로토콜을 지원할 수 있는 유일한 블록체인과 기본 자산은 비트코인뿐이라는 흔들리지 않는 믿음을 확립했다”고 말했다.

(번역자 주: 마커스에 대한 이러한 견해는 트위터의 전 CEO인 잭 도시와 일치합니다. 도시는 결제 회사인 스퀘어를 이끌고 현재 약 2억 700만 달러 상당의 비트코인 8,027개를 보유하고 있습니다. 나중에 이름을 블록으로 변경하고 비트코인 제품을 완전히 개발했습니다. "Bitcoin을 보유하고 권한을 부여하는 것"이 Block의 목적이 되었습니다. "Bitcoin은 인터넷의 최고의 기본 통화입니다"는 Dorsey의 투쟁 목표입니다.)

보조 제목

비트코인과 라이트닝 네트워크가 더 나은 이유

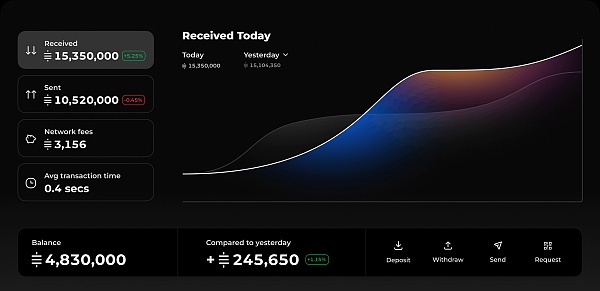

Lightspark는 기업이 고객에게 Lightning 지갑을 제공하는 데 도움이 되는 SDK와 최고 성능의 Lightning 네트워크 노드를 식별하고 트랜잭션을 노드로 라우팅하는 Lightspark Predict와 같이 Lightning 네트워크에 더 쉽게 액세스할 수 있도록 설계된 소프트웨어 및 개발 도구를 구축하는 데 중점을 둡니다. .

Lightspark는 Lightning Network 결제를 지원하는 중앙 집중식 플랫폼을 구축하는 대신 고객이 기존 Lightning Network에 액세스할 수 있도록 지원하는 도구를 구축하는 데 중점을 둡니다. 라이트닝 네트워크의 채택률은 여전히 페이팔과 같은 거대 결제 업체에 미치지 못하지만 마커스는 확장 가능성에 대해 낙관하고 있습니다.

"현재 라이트닝 네트워크에는 여전히 문제가 있지만 우리 팀과 나는 우리가 문제를 해결할 수 있다고 확신합니다."라고 그는 말했습니다. "Lightspark 서비스를 사용하여 라이트닝 네트워크를 통합하는 회사 고객의 경우 채널과 유동성, 설정할 최소 수수료 또는 최대 수수료에 대해 걱정할 필요조차 없습니다. 이러한 모든 복잡성은 다음을 통해 완전히 제거됩니다. 우리를."

사용자가 자신의 유동성, 채널 및 라우팅을 관리하지 못하도록 추상화하는 것이 어떤 의미에서 중앙 집중식의 신뢰할 수 있는 금융 중개자를 재현하는지 여부에 대한 질문에 Marcus는 비유를 사용하여 대답했습니다.

"인터넷 초창기에는 웹 사이트를 만들고 싶다면 자체 서버를 구축하고 라우터를 구입하여 직접 구성한 다음 모든 것을 유지 관리해야 했습니다."라고 그는 설명했습니다. "하지만 라이트닝과 비트코인이 더 나은 이유는 대량 시장 채택을 보다 쉽게 하려는 라이트스파크와 같은 회사가 있기 때문입니다. 어느 국가에 있든 인터넷에 연결되어 있는 한 네트워크에 있을 수 있습니다. .노드를 운영하고 비트코인 네트워크의 참여자가 되는 것이 비트코인이 놀라운 이유라고 생각합니다.”

그는 이제 자신의 의도가 새로운 솔루션을 출시하는 것이 아니라 일종의 라이트닝 네트워크 채택을 달성하는 것이라고 강조했습니다.

"우리는 모든 사람이 우리 서비스를 사용하는 것을 원하지 않습니다."라고 그는 계속했습니다. "광범위한 채택에는 실제로 나쁜 일입니다. 그렇죠? 우리는 모든 회사가 자체 사업을 운영해야 한다고 생각하므로 Lightning 공간에서 기업 고객을 수용할 것입니다."

중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.

위험 경고:

중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.