Sorting out the changes in ARK Invest's Crypto positions, how firm is Sister Mumu's bullishness?

This article comes from: Blockworks

Compilation: Odaily Azuma

The female stock goddess Cathie Wood, known as "Sister Wood", has always been one of the largest Crypto bulls on Wall Street.

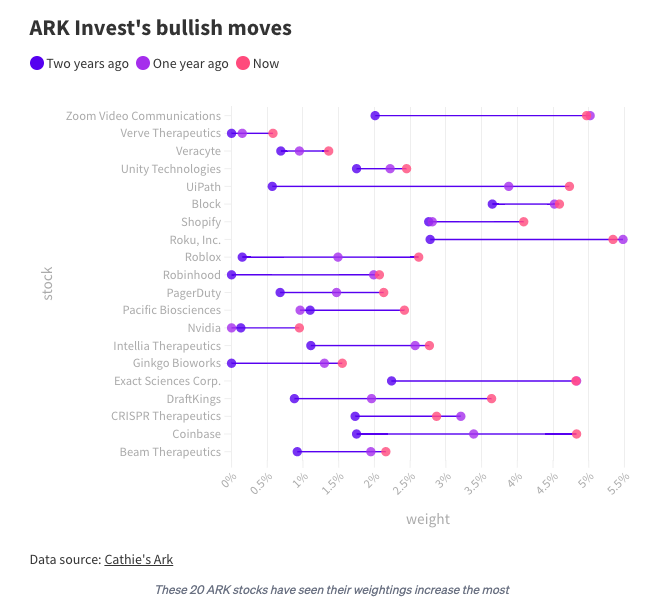

As of this week, ARK Invest, led by Cathie Wood, managed more than $11 billion in funds, of which a considerable portion of stock positions are related to Crypto. Especially since entering 2023, ARK Invest has increased its position in Coinbase (COIN ) several times. ) and other Crypto-related stocks. So, how bullish is ARK Invest on the Crypto market?

Overseas media Blockworks yesterday counted the changes in ARK Invest's Crypto-related stock positions in the past two years (May 2021 to present), trying to uncover the answer to this question through data.

secondary title

Coinbase, the favorite of "Sister Wood"

Exactly two years ago (roughly a month after Coinbase went public), ARK Invest held nearly 2.7 million COIN shares worth about $790 million, or 1.75% of the fund's total size.

However, Coinbase's stock price has fallen by more than 80% today. The price of COIN was about $300 two years ago, but the closing price of COIN on Thursday was only $49.22.

It is worth noting that,Cathie’s ArkThe data shows that the cost of ARK Invest's COIN to open a position is about 239.60 - 254.65 US dollars.

As of May 3, ARK Invest held nearly 10.8 million COIN shares, with a total value of about 556.6 million US dollars. Although the absolute value has declined, the value of these Coinbase stocks accounted for the proportion of the total size of the fund has risen to 4.83%. Currently, ARK Invest holds nearly 6% of the outstanding COIN shares, which is also the fund's fourth largest holding.

In short, ARK Invest's "holding ratio" of COIN has quadrupled in the past two years, which even exceeds the level at the peak of the last round of bull market - around November 2021, the price of COIN once rose to 330 USD, which also caused the value of ARK Invest’s COIN holdings to rise to 1.88 billion U.S. dollars (at that time, the position was increased to about 5.6 million shares), and the “holding ratio” also rose to 4.55% — but this is only the peak situation at the peak of the bull market. Data is not sustainable.

secondary title

Other Crypto related positions

In addition to Coinbase, ARK Invest holds shares in many other Crypto-related companies, even if the stock is in a long-term downturn.

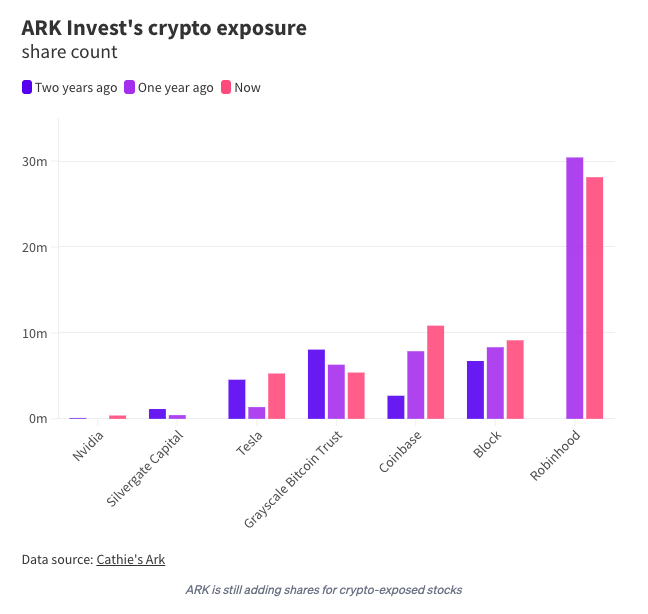

Robinhood (HOOD), a stock and cryptocurrency trading platform company, is ARK Invest's second favorite Crypto-related company. It currently holds about 28.1 million shares, worth $237.9 million, and its "holding ratio" is 2.07%.

Around November 2021, ARK Invest's "holding ratio" to HOOD was only 1.02%. Since then, although HOOD's stock price has fallen by about 75%, ARK Invest has more than doubled the number of shares it holds. There has been a reduction in positions in the past year-around October 2022, ARK Invest's "holding ratio" to HOOD was as high as 2.26%.

ARK Invest has also increased its "holding ratio" in Block, a bitcoin financial technology company founded by Jack Dorsey, which was 3.65% two years ago and has now risen to 4.59%. It's also ARK Invest's seventh-largest holding, with a total value of about $528 million.

As for chipmaker Nvidia, ARK Invest has increased its “holding” in the cryptocurrency, up from 0.13% two years ago, even though the company’s relevance to cryptocurrencies has fallen sharply following Ethereum’s successful move to PoS , which has now risen to 0.95%.

ARK Invest's largest holding is Tesla, with a stock value of $846 million, and its "holding weight" has barely changed in the past two years. But objectively speaking, the correlation between Tesla and Crypto is not that high, but the company holds about $280 million in Bitcoin on its balance sheet.

secondary title

How is the overall situation?

All told, ARK Invest's "holding" in Crypto-related stocks has risen 55 percentage points over the past two years, from just under 14% to 21%.

In May 2021, ARK Invest had roughly $44.4 billion in assets under management and roughly $6.1 billion in Crypto-related equity holdings (though Tesla accounted for almost half). The fund now has $11.3 billion in assets under management, including nearly $2.4 billion in crypto-related equity holdings.

In February of this year, "Sister Wood" emphasized her ultra-optimistic judgment on the Crypto industry in an interview with CNBC, and said that ARK Invest will continue to maintain its previous prediction that "Bitcoin will rise to $500,000", combined with the actual position From the perspective of changes, "Sister Wood" can be regarded as a unity of words and deeds.