Nayms is an insurance technology company. The traditional insurance industry is opaque, slow and inefficient. The new project Nayms introduces blockchain technology to make the insurance industry transparent and efficient, and at the same time raises risk pricing and insurance business management to a new level. s level.

Nayms is also the only company that has obtained both an encrypted asset license and a commercial insurance license, and is the first project in the world to carry out a fully regulated insurance business on the chain.

Nayms perfectly combines the characteristics of centralized supervision and accountability with the characteristics of decentralized finance (DeFi). Nayms' insurance business is fully regulated in Bermuda, the world's third largest insurance jurisdiction, with oversight provided by the Bermuda Monetary Authority, a leading technology-forward regulator.

Next, veDAO will lead you to understand the unique design and operation mechanism of Nayms in detail.

Segregated Account Company (SAC)

Nayms is registered in Bermuda as a Segregated Account Company (SAC) with statutory authority to issue segregated accounts, each of which is owned by all investors in that account. Segregated accounts are defined in the relevant "legislation" as separate and distinct pools of assets and liabilities managed by the same institution.

Every insurer with capital in the Nayms market is actually a separate account, and each separate account has its own unique business plan. Technical matters, licenses to operate, etc. for separate accounts are handled by Nayms' SAC.

sponsor

Each separate account is set up at the request of a third party, called a sponsor. Sponsors can create crypto-native insurance businesses based on their expertise and understanding of crypto insurance. The promoter needs to fill in various materials and a detailed business plan according to Nayms' requirements before submitting an application for creating an insurance business to Nayms. Completed applications are reviewed by Nayms for comprehensiveness, reasonableness, and alignment with internal benchmarks, with the final decision to approve or reject the application.

If the sponsor's application is approved, Nayms' SAC will open a separate account in the name of the sponsor who is responsible for implementing the insurance business plan and ensuring that the account is adequately capitalized and deployed prudently. The promoters should assist Nayms in managing the accounts, including conducting business, maintaining adequate capital levels, preparing financial statements and documents for regulatory requirements, and facilitating audits, among others. Sponsors are paid through a pre-agreed method with Nayms.

capital

An insurance company must have sufficient capital before starting underwriting business because capital is the ultimate reserve for claims. The capital raising of Nayms independent accounts is carried out through token swap, that is, each independent account obtains capital by selling the ERC-20 tokens of the account, and the ERC-20 tokens to be sold (also issued) The price is set by the promoter, and the price multiplied by the number of ERC-20 tokens to be sold should be the required capital level for the segregated account. The type of capital in the segregated account and the required amount is applied for by the promoter and approved by Nayms, and the type of capital can be wrapped bitcoin, ethereum or stablecoins, etc. The provision of funds by the funder is equivalent to signing an agreement with Nayms to obtain financial benefits and other rights and interests according to the terms and conditions of the agreement. The process of obtaining capital for independent accounts and the management of capital are all on the smart contract, which is an open and transparent record, and anyone can verify it through a block browser.

Schematic diagram of the capital provider's capital injection into the segregated account

Each independent account has its corresponding ERC-20 token, which is equivalent to LPtoken, and its holder is the account owner and entitled to return on investment. Sponsors are responsible for determining when their accounts are in surplus (defined as assets exceeding insurance liabilities) and presenting this to the SAC Board of Directors in due course. If both parties agree that a surplus distribution should take place, the control smart contract is instructed to execute the operation. The smart contract distributes the cryptocurrency-denominated surplus proportionally to the account owners - the account's ERC-20 token holders. Surplus amounts accumulate from one distribution to the next until the user chooses to withdraw funds.

Account ERC-20 tokens can only be traded in Nayms' internal market and cannot be traded in the external market (because of registration and transfer). In its internal market, account ERC-20 tokens are divided into a primary market and a secondary market. The tokens sold when raising funds for an independent account for the first time are the primary market, and the account ERC-20 tokens after the account has been up and running Currency trading is the secondary market. Capital providers invest and trade based on their consideration of the sponsor's business plan and reputation. Secondary transactions can be priced at par, at a discount, or at a premium, depending on the performance of the segregated account. Under Bermuda law, the details of the latest token holder are recorded in the account owner’s company register each time a transaction is made. The online version of the registration is dynamically updated in near real time.

When a segregated account is to be wound up, either because it has reached its pre-agreed maturity date, or at the promoter's discretion or at the direction of Nayms, the account has ceased to operate, after all present and future liabilities have been satisfied and all Once the investments are also liquidated, a "reverse" token swap occurs. Nayms’ smart contract is required to buy back all the ERC-20 tokens of a segregated account from a capital provider in exchange for all available funds in that account. When the liquidation is initiated, the following operations will happen automatically. After the liquidation, the register of the account owner (ERC-20 token holder) will be cleared and the account will be closed.

Underwriting and Claims

Once the segregated account is fully capitalized, you can start selling insurance. Insurance contracts can be set up by an underwriting specialist, either the sponsor himself or one of his representatives, who have access to Nayms' online underwriting software or "Policy Builder". Policy Builder is used to generate a schedule or statement page for each insurance contract, including participant identities: designated insured, underwriter, broker, and claim administrator, etc., and underwriting details: risk level, total insurance limit, total premium and payment cycle, as well as commission fees, etc. Policy Builder also allows users to upload documents in PDF. The schedule and documents together form the complete insurance contract.

Any underwriter with a separate account underwriting authority must adhere to the account's underwriting guidelines, which are developed by Nayms based on the sponsor's input in its application. Any portion of an underwritten insurance contract that exceeds the underwriting guidelines must be submitted by the underwriter to Nayms for approval. Before issuing a final insurance contract on Policy Builder, Nayms reviews policies in an order based on the underwriter's authorization level.

governance

governance

As an insurance licensee, Nayms maintains control of the segregated accounts. Delegating certain rights and responsibilities for account management and other administration to the promoter or its representatives by signing a legal agreement. This license (and sublicenses) is captured in the terms and conditions of the Master Services Agreement (MSA). A sponsor's MSA includes a binding authorization agreement, which in turn contains underwriting guidelines. Brokers must join Nayms' platform to receive commissions, and brokers must sign a Terms of Business Agreement (TOBA). At the same time, brokers must be licensed to conduct business in Bermuda to enter the market.

Nayms supervises the segregated accounts in strict accordance with the SAC functional requirements, of which it is particularly important that all segregated accounts must maintain sufficient capital to comply with Bermuda's Solvency Capital Requirements (BSCR) framework, and Nayms will regularly review the solvency ratios of all accounts , and a dedicated robot is responsible for implementing monitoring and reminders.

Token

Although Nayms is a centralized company, supervised by its board of directors and the Bermuda Monetary Authority, it has integrated DeFi capabilities into its platform through the NAYM token, which combines cutting-edge scientific and technological innovation with compliance. NAYM tokens are different from account ERC-20 tokens: account ERC-20 tokens can only be traded internally, while NAYM tokens can be listed and traded on external exchanges. NAYM is the utility token of the Nayms platform. Holders can share in the positive performance of the market through staking and participate in the governance of the Nayms Discretionary Fund (NDF).

Nayms charges a commission on insurance business in the marketplace. For example, policy purchases and account ERC 20 token transactions charge a certain percentage of fees, and commissions include various cryptocurrencies (such as wBTC, ETH, DAI, etc.). The commission is deposited into the account of the smart contract, called the commission pool, from which it is regularly distributed to the following three aspects:

1/4 is sent to the Nayms staking contract and subsequently converted to DAI. Rewarded to users who are staking NAYM.

Send 1/4 to the Nayms Discretionary Fund (NDF) to increase its reserves.

1/2 is sent to Nayms SAC Limited (“Nayms SAC”) as income. Nayms SAC also earns entry fees and user licensing fees.

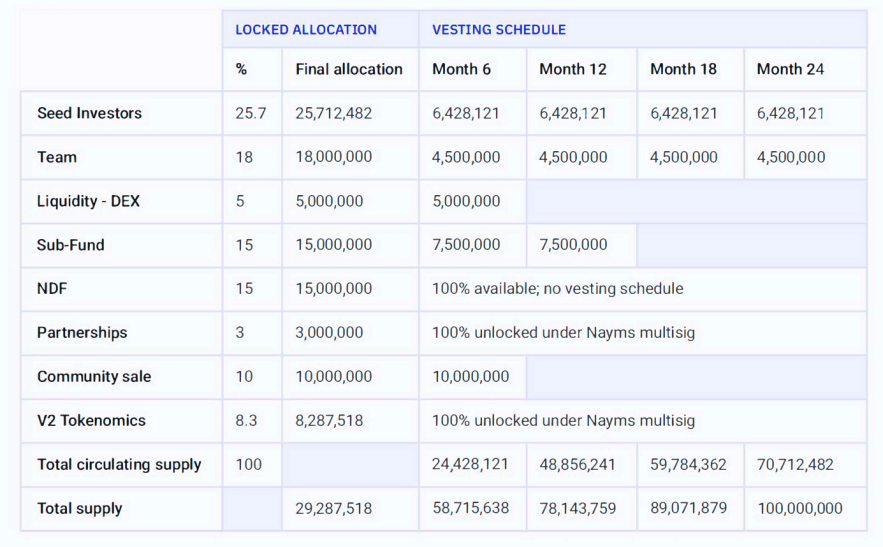

Nayms plans to issue 100 million NAYM tokens. Tokens will be distributed to various parties in the future.

Like many other tokens, the circulating supply of NAYM will grow over time.

The schematic diagram of the circulation of NAYM tokens in the Nayms ecosystem is as follows:

financing information

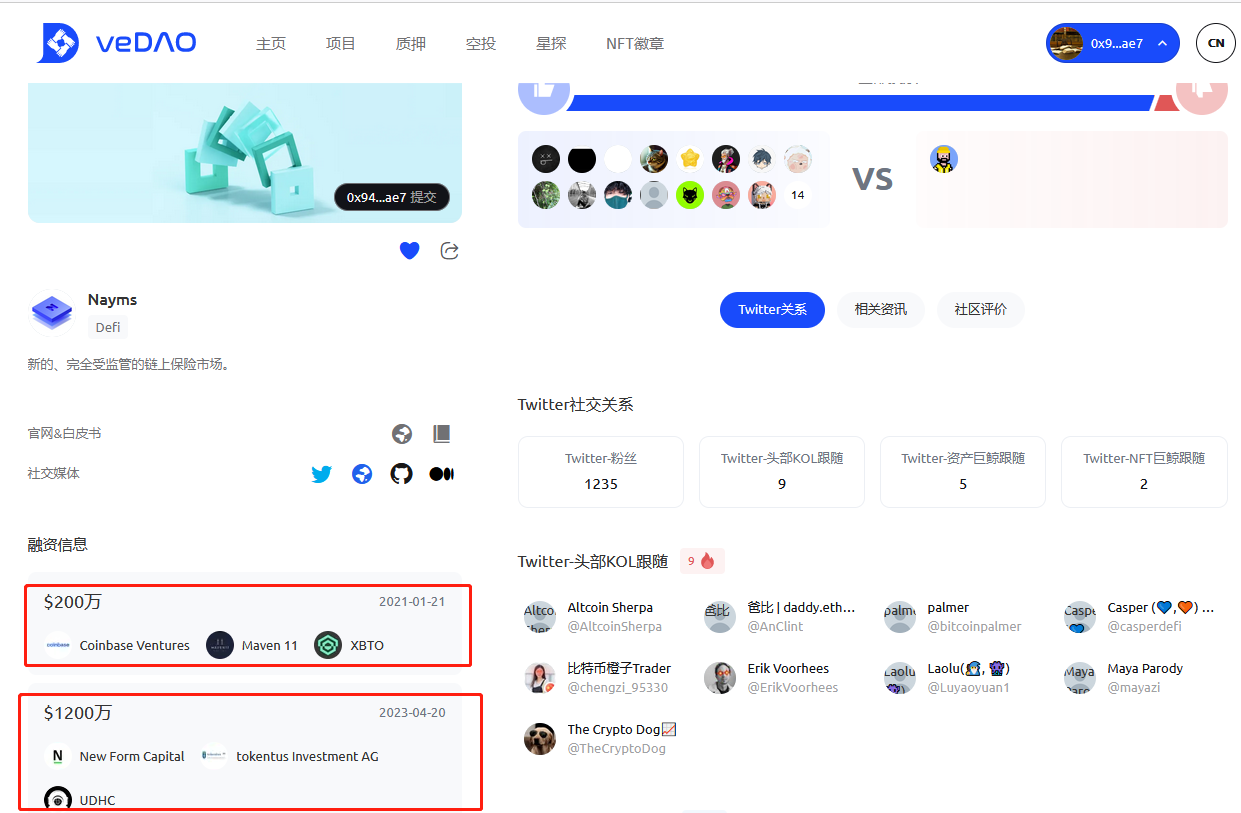

On April 20, 2023, Nayms announced that it had completed a $12 million private placement financing at a valuation of $80 million, led by UDHC and participated by New Form, Tokentus, and Keyrock. Combined with a £1.5 million ($2 million) seed round in early 2021 (investors include XBTO, Coinbase Ventures, Maven 11 and Insurtech Gateway), Nayms' total private funding round comes to $14 million. The APP of the Nayms insurance project has not yet been launched, and there is no information about the public offering of NAYM tokens.

team

Nayms was established in 2020 and is based in the UK. The Nayms team includes professionals in blockchain technology, insurance, capital markets, regulation, legal and corporate management, including 4 leadership members, 18 team members and 7 advisors. Nayms will use the new funds to expand its global team and accelerate the development of its crypto-native insurance marketplace.

Related Links:

Official website: https://nayms.com/

White Paper: https://nayms.com/resources/

github: https://github.com/nayms

Twitter: https://twitter.com/nayms

About veDAO

veDAO is an investment and financing community dedicated to discovering early potential projects. By gathering public wisdom and professional opinions, community participants, investors, and project parties are provided with a fair, transparent, and democratic project evaluation and investment and financing process, so that all participants can share the project development dividend.

Website: https://app.vedao.com/