On April 14th, in the warm atmosphere of the market recovery and the Hong Kong conference. The news of the listing of the crypto mining company BitDeer has spread throughout the crypto world.

“The completion of our business merger with Blue Safari is the beginning of a new era for BitDeer.” After the merger transaction was completed, Kong Linghui, CEO of BitDeer, said.

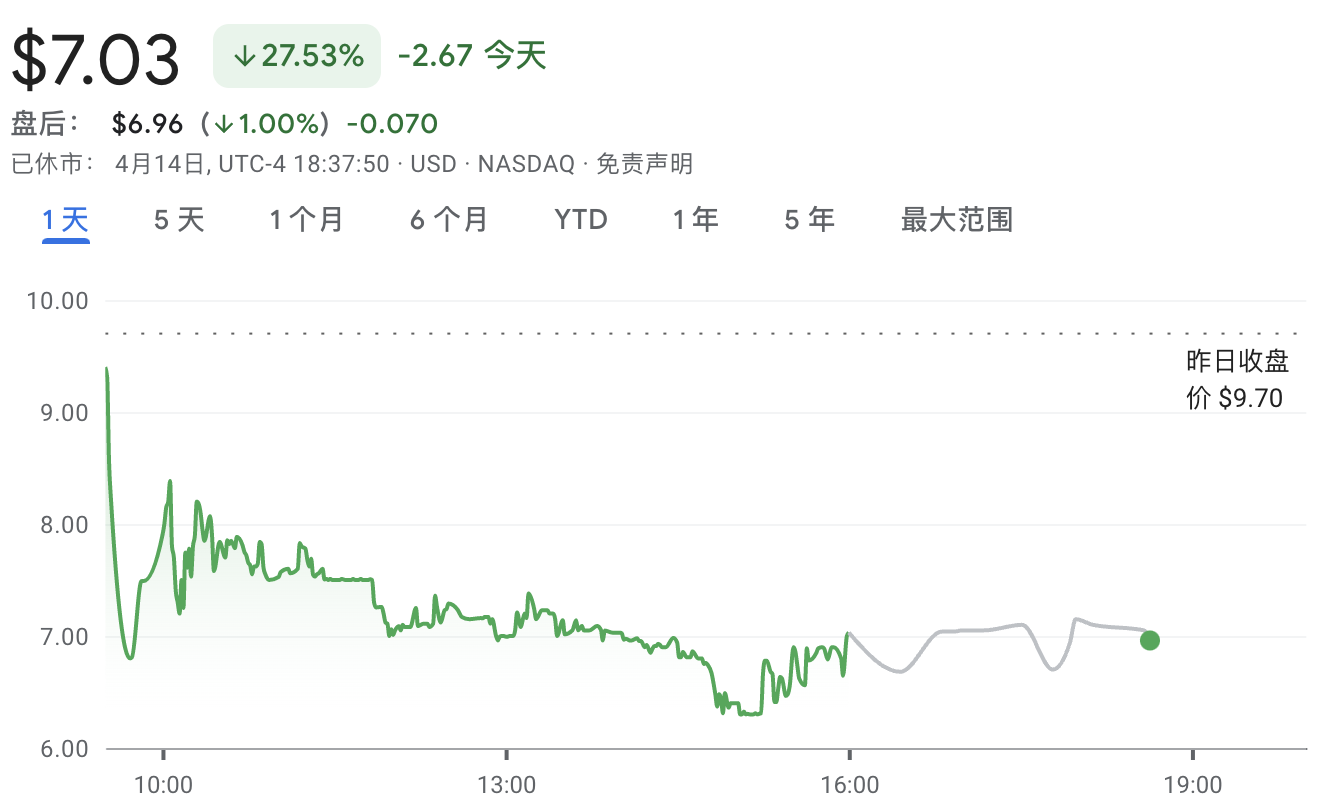

But after the listing, the stock price of Bit Deer has been falling all the way. According to market information, its stock price once fell to 6.3 US dollars, the highest intraday drop was about 30%. It broke on the first day of listing.

text

Why did this well-known and influential encryption company in the market get off to a bad start on the first day of its debut?

secondary title

The godfather of mining scored twice and was finally listed after five years

Bit Deer is a company owned by Wu Jihan. Speaking of mining tycoon Wu Jihan, I am afraid that no one in the encryption world knows it. And Bitmain, which he co-founded, was once facing a listing, but in the end it failed to do so.

In September 2018, Bitmain submitted a listing prospectus to the Hong Kong Stock Exchange. According to the prospectus, the company’s semi-annual revenue was US$2.845 billion and its net profit was US$743 million. As the absolute overlord of the mining industry, Bitmain once occupied about three-quarters of the global mining machine market at that time. Interestingly, because the production of mining machines requires self-designed chips, Bitmain once became the second largest chip design company in China, second only to HiSilicon.

When Bitmain planned to go public in Hong Kong in 2018, the company's valuation once reached 12-15 billion US dollars. Today, based on the closing price, the market value of Bit Deer is 658 million US dollars.

secondary title

Poor performance and successful listing, the capital market performance is sluggish

Documents disclosed by the SEC show that BitDeer is a cryptocurrency mining company headquartered in Singapore. The company operates six mining data centers around the world with a combined power capacity of 775 MW by the end of 2022. And its business is divided into three business lines: "self-operated mining", "computing power sharing" and "hosting". And all business lines are supported by the self-developed integrated intelligent software platform "Minerplus".

This acquisition adopts the SPAC model that has been widely used by technology companies in recent years. The so-called SPAC is Special Purpose Acquisition Company, special purpose acquisition company. A SPAC is a "blank check" shell company that first raises capital from the public and then acquires the target company. The advantage of SPAC is that it can bypass the traditional IPO process, shorten the time to market, reduce the cost of listing, and at the same time provide more flexibility and opportunities for the acquired company.

Blue Safari Group Acquisition Corp., which acquired Bit Deer this time, is such a "special purpose acquisition company". The company is backed by BSG First Euro Investment Corp. Prior to this, mining machine manufacturer CanaanCreative, mining company RiotBlockchain, Hut 8, and encrypted lending company BlockFi all adopted the SPAC method of listing.

After listing, BitDeer is expected to receive more financial support to further develop its business. As the "Godfather" of the mining industry, the "infighting" incident between Jihan Wu and Ketuan Zhan has been full of storms before, so this article will not repeat it here. However, after a series of complicated events, the final result is obvious - the split of the mining giant Bitmain.

After the split, Wu Jihan obtained part of Bitmain's business. And this part of the business was also reorganized by him, among which the long-established and prestigious BTC.com mining pool was sold. The rest, including the cloud platform, self-owned mines and other businesses, have gradually developed into the current BitDeer.

In the end, BitDeer failed to reap a satisfactory first-day increase.

secondary title

The mining industry structure has changed suddenly, and mining enterprises are struggling to survive

Although the current market has continued to recover, this is not a warm era for miners.

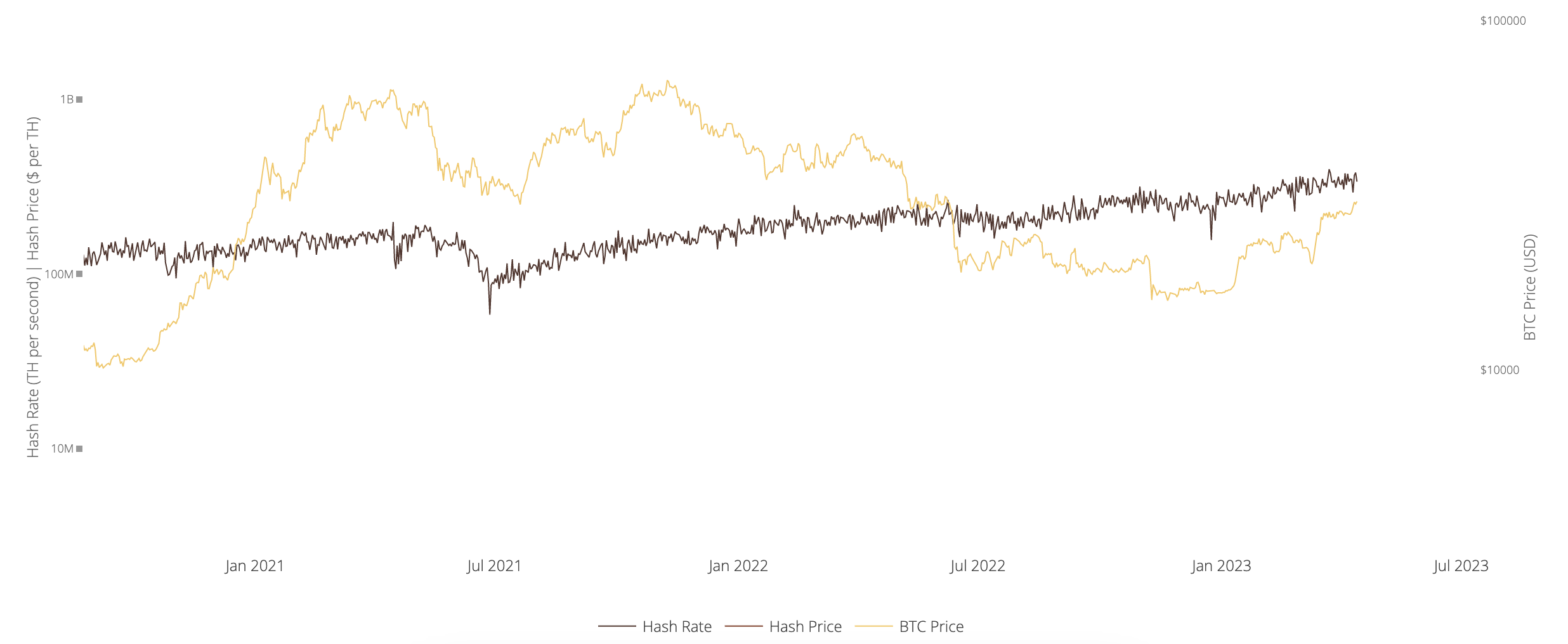

OKLink data shows that the current Bitcoin network computing power is about 342 EH/s, and the difficulty is about 48 T. When querying historical data, it is not difficult for us to find out. Since the end of the bull market in 2021, the price of Bitcoin has continued to bottom out, but the computing power has risen steadily. The cost of mining for miners has not been significantly reduced.

Throughout 2022, it will be a difficult year for crypto mining companies to survive.

However, BitDeer's main business, whether it is self-operated mining or institutional custody, cannot gain much significant advantage in this market context.

What's more, after the listing, the regulatory authorities' vague supervision of the encryption industry is a potential uncertain factor.

Just in the past 2022, many encrypted mining companies and listed mining companies have experienced crises of varying degrees. Even many mining companies went bankrupt.

In early September, the mining company Compute North became the "first mover" of this round of bankruptcies of mining companies. Subsequently, Argo, a mining company listed on the London Stock Exchange and Nasdaq, announced that its $27 million financing plan had failed, and its stock price plummeted by more than 50%. In December, mining company Bitfarms received a warning from Nasdaq to delist its shares. In the same month, Core Scientific, the “largest publicly traded mining company” that had once enjoyed great fame, was hit with a class action lawsuit and filed for Chapter 11 bankruptcy protection.

During a recent bull market, the mining landscape has changed.

The "old forces" such as home miners and mining pools are no longer new, and "industrialized" large-scale listed companies self-operated mining has become a "new trend". This asset-heavy business has also burdened large industrialized mining companies with high debts. In an unfavorable market environment, the leverage ratio of mining companies has put them in great danger. Jaime Leverton, CEO of Canadian mining company HUT 8, made a prediction for 2023 as early as last year-the first half of 2023 will be the peak of the crisis of survival of mining companies, and she is not sure whether it will ease in the second half of the year.