24時間で6%急騰、ETH:これは売り圧力ですか?

本日、イーサリアムはエポック 194048 の最盛期に Shapella のアップグレードを完了しました。このアップグレードには、実行層のアップグレード (上海アップグレード)、コンセンサス層のアップグレード (Capella アップグレード)、およびエンジン API の変更が含まれます。最も重要なものの 1 つは ETH 出金機能のオープンであり、ユーザーは以前にビーコン チェーンのプレッジに参加していた ETH および関連収入を引き出すことができます。アップグレード完了後、Coinbase、Kraken、Ankr、BitGoなどがETHアンステーキング機能のオープンを発表しました。

アップグレード前、市場はETHの動向について楽観的ではなく、大きな売り圧力が価格の急落につながるのではないかと懸念していましたが、過去2週間のETHの低迷傾向も市場の予想を裏付けるものでした。しかし昨夜以降、ETH価格は1,870ドルから徐々に上昇し、今晩には一時2,000ドルに達し、過去24時間で6%を超え、市場の懸念は払拭されたようだ。

同様にtoken.unlocks (クリックしてジャンプ)同様にナンセン(クリックするとジャンプします)。

データによると、アップグレード完了後のステーキングされていない金額は 108,300 ETH であるのに対し、新しい誓約金額は 28,260 ETH、純引き出し金額は 80,120 (約 1 億 6,000 万米ドル) です。市場には大きな売り圧力があるようですが、ETHの価格は下落せずに上昇しており、これらのETHが市場に投げ込まれていないことを示しています。

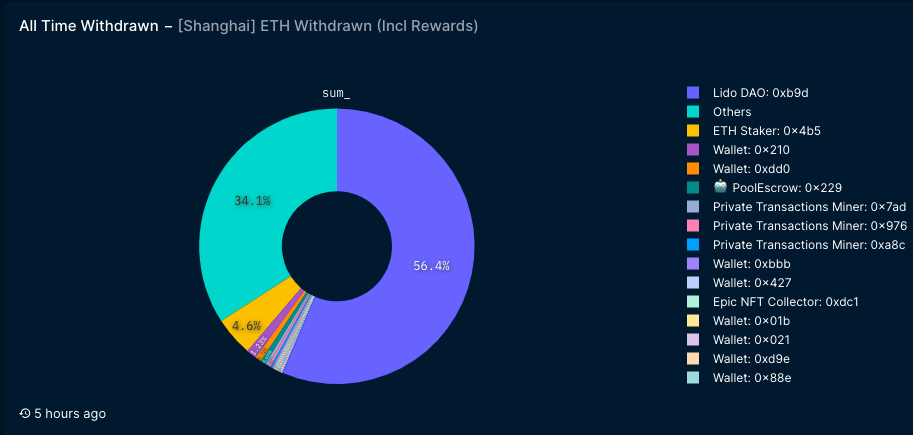

なぜ?なぜなら、コインを引き出したいというユーザーのニーズを満たすために、それらの半分近くがLidoによって事前に交換されるからです。データは、流動性ステーキングプロトコルである Lido が今日 54,477 個のトークンを引き出したことを示しており、これは総トークン引き出しの 50% 以上を占めています。以前、Lidoは、ユーザーの出金ニーズを満たすためにプロトコルバッファゾーンが確立されると述べた文書を発行しました。1,000 ETH未満の出金リクエストは1日以内に完了でき(標準的なイーサリアム出金には2~6日かかります)、1,000~5,000 ETHは出金リクエストに対応します。 2日以内に完了しますが、5000ETH以上の場合は4~10日、10ETH以上の場合は2週間程度かかります。平均ポジション価格の観点から見ると、Lido ユーザーが質入れした ETH の平均価格は 2,552 米ドルであり、市場価格よりもはるかに高いため、ETH を売却する可能性も低いです。

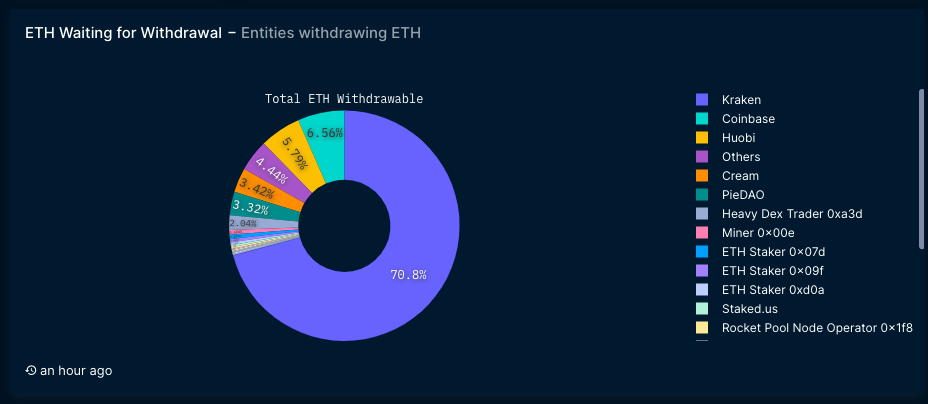

さらに、保留中の出金データから、バリデーターの大多数がETHの将来の傾向についてより楽観的であり、短期的な売却計画を持っていないことがわかります。データによると、現在、引き出し保留状態(ステータスは 0x01 タイプ)の検証者は 293,000 人(51% を占める)ですが、そのうち「全額」となっているのは 16,140 人(検証者総数の 2.8% に相当)のみであることがわかります。 「「撤退」は検証者のランクから撤退し、残りの検証者は部分的にのみお金を引き出し、誓約報酬を引き出します。合計 832,000 個の ETH トークン (約 16 億 5,000 万米ドル) が出金保留中であり、イーサリアムの出金制限ルールによれば、完全に出金するには 10 日かかると推定されています (1 日あたり最大 1,800 人のバリデータが出金)。

背後にいる組織の分析によると、コインの引き出しを待っているユーザーは販売する意思はなく、引き出しを「強制」されていると考えられます。ナンセン氏によると、ステーク解除を待っている企業の中では、Krakenが551,300ETHで1位、Coinbaseが51,000ETHで2位、Huobiが45,000ETHで3位となっている。 3 社の出金需要の合計は、保留中の出金全体の 80% 近くを占めます。

KrakenとCoinbaseの撤退は主にSECの圧力によるものです。今年2月、クラーケンはSECと和解に達し、ステーキングサービスを停止した。 Coinbaseはサービスの提供を継続すると繰り返し述べているが、クラーケン事件により、一部のユーザーはステーキングのためにCoinbaseからLidoなどの分散型プラットフォームに移行する可能性がある。情報筋によると、Huobi での多数の ETH 誓約出金は主に新旧株主の引き継ぎに関連しており、Li Lin は出金が開始された後に引き継ぎを行う必要があり、一部の ETH は出金されてから入金される可能性があります。

最後に、世界的な観点から見ると、現在担保されている ETH の総額は 17,456,038、合計担保率は 15.09%、担保されているすべての ETH の平均価格は 2134 ドルです。これは、現在のスポット価格では、平均含み損が7%というと、ユーザーにとって1億元を売るのは高くないかもしれない。暗号化市場が最も暗い時期を過ぎ、弱気市場から強気市場への過渡期にあるという事実と相まって、現時点での売却は最適な時期ではないようです。

また、アップグレード完了後、ETHプレッジへの参加に対する市場の熱意が高まるという現象も観察されました。データによると、過去 24 時間に、ネットワーク全体で 37,648 件の新しい誓約があり、そのうち 28,260 件がアップグレード完了後に実行され、75% を占めました。地上市場は ETH の将来の価格についてより楽観的です。そしてそれを長く持ち続けたいという強い意志があります。 OKXが発表した前回の調査レポートでは、回答者の83%が今後3か月以内にさらに多くのETHが担保されると予想しており、回答者の63%は2023年末までにETHが過去最高の5,000ドル以上に達すると予想していることが示されています。 。

現在、ETH が約束した ARP は 5% 近くで、すべての主流通貨の中で比較的高い値です。また、高いセキュリティと収益性により、スイスの金融銀行 InCore Bank のような伝統的な機関がイーサリアム エコシステムに参加し、ETH プレッジ サービスを提供し、より広範な金融市場に ETH を推進するようますます引き寄せられています。

最後に、ConsenSys がイーサリアム上海アップグレード記念 NFT シリーズ「イーサリアム、進化: 上海」の公開版の鋳造を開始したことを思い出していただきたいと思います。鋳造ウィンドウは 72 時間開かれます。どのユーザーもメタマスクを使用できますウォレットにNFTを無料で受け取ることができ、ガス料金のみを支払う必要があります。興味のあるユーザーは、公式 Web サイトにログオンして申請できます: https://shanghai-capella.consensys-nft.com/。