부 기능: CZ의 경험과 부모로부터 물려받은 유산이 그의 바이낸스 제국을 만들었습니다.

원래 제목: 바이낸스 CZ 만들기: 암호화폐의 가장 강력한 설립자를 형성한 힘에 대한 독점적인 시각

원문 편집: Guo Qianwen, Lin Qi, Gu Yu

CZ는 두바이에 있는 자신의 집 책장 앞에 앉아 있습니다. 영상 속 그는 상냥하고 온화하며 겸손하기까지 하다. 바이낸스를 세계에서 가장 크고 가장 영향력 있는 암호화폐 거래소로 만든 야심찬 사람인 그의 경쟁자들이 가장 잘 알고 있는 것과 정반대입니다.

그는 다른 얼굴로 다른 사람들을 대하는 데 익숙합니다. "미국인들이 저를 대하면 저를 아시아인이라고 생각합니다. 대부분의 미국인보다 약간 더 아시아인이지만 그들이 아는 다른 아시아인보다 조금 덜 아시아인입니다. 그들이 거래하는 데 익숙한 미국인보다 조금 덜 미국인입니다. 나는 그 사이에 있습니다.

최근 CZ의 강인한 면모가 그를 집중 조명하고 있다. CZ와 바이낸스는 적들을 전략적으로 압도하고 느슨한 규정을 가지고 플레이하여 큰 성공을 거두었습니다. 국가가 가장 유리한 규정을 제공할 수 있을 때마다 설립자는 이곳에 진을 치고 미국을 포함한 여러 국가의 관리들은 바이낸스가 기만적이라고 비난했습니다. 국제 제재 및 자금 세탁 규칙 위반.

바이낸스는 운영 방식이 바뀌었고 규정 준수가 이제 목표라고 주장하며 CZ는 개혁된 회사를 대변할 때 항상 부드럽고 겸손한 면모를 보여 왔습니다. 그러나 바이낸스의 전환은 CZ가 실제로 누구이며 어떻게 비즈니스를 구축했는지에 대한 질문을 제기했습니다. CZ의 배경과 바이낸스 운영에 대한 공개 기록이 부족하여 더욱 가슴 아픈 질문이 되었습니다.

CZ의 배경을 면밀히 살펴보면 바이낸스 설립자가 몇 년 동안 치열한 비즈니스 라이벌 사이에서 어떻게 갈등을 겪으면서 친근하고 일상적인 사람이라는 이미지를 유지했는지 알 수 있습니다. 지인들과의 인터뷰와 중국어 매체의 광범위한 논평을 바탕으로 한 그의 과거에 대한 잡지의 상세한 조사는 CZ의 정체성을 형성한 두 개의 세계, 즉 그가 자란 캐나다와 "바다거북이로 돌아온 중국"을 밝혀냈습니다. " 금세기 전반, 그는 상하이의 떠오르는 바람을 틈타 단숨에 글로벌 비즈니스의 최전선에 섰다.

CZ는 두 곳 모두에서 교훈을 얻었고, 중국 기술 분야의 초기 광란 동안 널리 퍼진 치열한 비즈니스 전술 중 많은 부분을 마스터하는 동시에 캐나다인의 캐주얼하고 위협적이지 않은 특성(전술에서 주의를 산만하게 하는 행동)을 유지했습니다.

첫 번째 레벨 제목

학자 아버지가 가족을 이끌고 해외로 이주

Keremeos Court 건물은 상쾌한 주변 환경을 제외하고는 눈에 띄지 않는 깔끔한 일련의 가족 타운하우스입니다. 톡 쏘는 삼나무와 양치류의 광대한 열대우림으로 둘러싸인 이 주택은 태평양과 접해 있는 밴쿠버의 서쪽 가장자리에 위치한 브리티시 컬럼비아 대학교의 2,000에이커 캠퍼스의 일부입니다.

이미지 설명

1989년경 아버지가 찍은 밴쿠버 라드너 시계탑 앞의 CZ. 사진 제공: CZ

이곳의 환경은 CZ의 어린 시절 시골과는 완전히 다릅니다. 강소성에서는 학교와 교실이 부족하고 수수한 돌 책상으로 가득 차 있습니다. 자원이 부족한 시골 지역에서는 흔히 볼 수 있으며 겨울에는 학습이 더욱 어렵습니다. 그의 아버지처럼 CZ는 중국의 빈곤과 박탈을 이해했고 학계가 피난처가 될 수 있음을 깨달았습니다. 10살 때 가족은 시골을 떠나 중국 과학 기술 대학교가 있는 중국의 작은 도시인 허페이로 이사했습니다.

이 지식의 오아시스에서 CZ는 때때로 그에게 체스를 두게 한 상급생들 사이의 토론을 앉아서 들었습니다. "CZ는 이렇게 회상합니다. '그 사람들은 저에게 체스와 바둑을 두는 방법을 가르쳐 주었습니다. 그들은 캠퍼스에서 다양한 이야기를 했습니다. 심지어 정치에 대해서도요. 제 생각에는 당신보다 7~10살 많은 사람들과 함께 있으면 네 또래 아이들과는 조금 다른 것들에 대해."

CZ 가족이 브리티시 컬럼비아에 왔을 때 그들은 세계에서 가장 오래된 문명 중 하나에서 세계에서 가장 젊은 문명 중 하나로 이주했습니다. 1870년대에 설립된 밴쿠버는 원주민 커뮤니티 외에는 거의 방문하지 않았습니다. 이 도시는 빠르게 중국에서 캐나다로 상품과 사람의 흐름을 연결하는 관문이 되었으며 수십 년 동안 반중국 인종주의의 거점이었습니다. 이러한 편견의 징후에는 캐나다의 철도와 밴쿠버 시의 대부분을 건설했음에도 불구하고 중국인 남성이 아내를 캐나다로 데려오는 것을 단념시키는 악명 높은 "인두세"가 포함됩니다. UBC 역사학자이자 중국 이민학자인 헨리 유(Henry Yu)는 "[밴쿠버]에는 항상 중국인이 있었지만 그들은 해리포터처럼 계단 아래에서 살았다. 그들은 집주인이 아니라 하인이었다"고 말했다.

그러나 1980년대에 이르러 관료들의 태도는 완전히 바뀌었다. 천연 자원 기반 경제를 활성화하고 다각화하려는 캐나다는 한때 경멸했던 태평양 전역의 이민자들을 유치하기 시작했습니다. 이 계획에는 CZ의 아버지와 같은 학자들을 끌어들이기 위해 C$400,000를 투자하는 사람들을 위한 비자가 포함되어 있습니다. 오타와는 야망 있는 중국인들에게 "세계 경제에서 성공하고 싶다면 캐나다가 사업의 문을 열어주고 있다"는 신호를 보낼 계획이다.

반아시아인 정서는 여전히 밴쿠버에 존재하며 아시아인은 커뮤니티의 일부 지역에서 매우 인기가 없을 수 있지만 CZ는 인종차별을 자주 접하지 않습니다. 그가 다녔던 고등학교는 모든 민족의 학생들로 구성되어 있었고, 그들 대부분은 대학과 관련이 있었습니다. 그래도 CZ는 몇 가지 중요한 면에서 급우들과 다릅니다. 그는 수십 명의 다른 아시아계 학생들에도 불구하고 중국 본토에서 온 두 명의 학생 중 한 명이었다고 회상했습니다. 대부분은 부유한 홍콩과 대만 출신이며 CZ와 달리 대학원생과 캠퍼스 직원을 위해 마련된 소박한 주택에 거주하지 않습니다.

CZ는 자신의 가족과 다른 학생들 사이의 막대한 부의 격차와 중국어를 사용하는 부유한 이민자 집단 사이에 존재했던 격차를 회상합니다. 그는 "홍콩의 아이들은 브랜드, 패션 브랜드, 스포츠카 등을 더 좋아한다"며 "대만인들은 모두 부자지만...더 겸손한 태도를 갖고 있어 그들과 더 잘 지낸다"고 말했다. 대만 가정은 겸손의 가치에 대해 많은 것을 배우지 못합니다.”

오늘날 Binance와 BNBToken이 누리는 높은 평가는 CZ가 수십억 달러의 가치가 있음을 의미하지만 적어도 공개적으로는 여전히 "겸손한 가치"를 유지합니다. 운전하지 않는 람보르기니를 구입하고 암호화폐 회의론자들에게 "빈곤을 즐기라"고 말하는 암호화 커뮤니티의 더 불쾌한 사람들과 비교할 때 CZ는 그의 화려한 면모를 보여준 적이 없습니다.

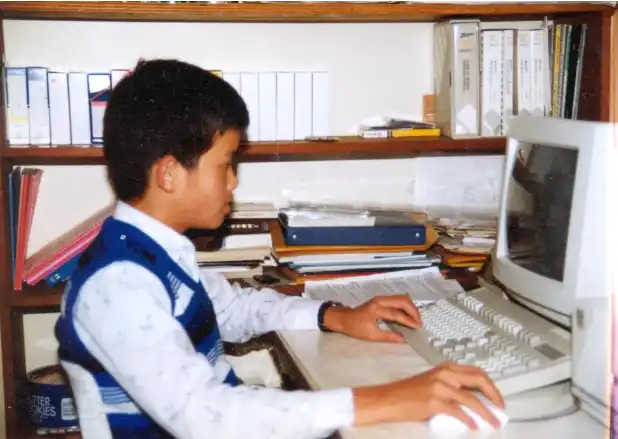

이미지 설명

1990년경 밴쿠버에서 첫 컴퓨터를 사용하는 CZ, 사진 제공: CZ

고등학교 때 그의 부유한 친구들 중 일부는 일을 시작했는데, 대부분은 참신한 일이었거나 그들의 부모가 그들이 일의 혹독함을 이해하기를 원했기 때문이었습니다. CZ는 생계를 위해 일하는 유일한 학생 중 한 명입니다. 여기에는 Chevron에서의 여름 야간 근무와 McDonald's에서의 2년 근무가 포함됩니다. 암호화폐 거물로 그의 말년에 누군가가 패스트 푸드 체인에서 일하는 CZ의 경험을 놀렸습니다. 그러나 겸손하게 시작한 일부 부자와 달리 CZ는 맥도날드 옷을 입은 자신의 이미지를 리트윗하기까지 하면서 자신의 노동자 계급 과거와 결코 거리를 두지 않았습니다.

전반적으로 CZ는 그의 고등학교 시절을 목가적이라고 묘사하기까지 하는 유쾌한 것으로 묘사합니다. 그는 배구 팀의 주장으로 4년을 보냈고 캐나다 전국 수학 대회에 참가했습니다. 체육선생님에게서 '챔피언'이라는 별명을 얻었다. CZ의 고등학교 친구 Ted Lin은 학교의 많은 사람들이 "창펑" 발음을 발음할 수 없다는 사실 때문에 이름이 지어졌다고 말했습니다. CZ는 암호 세계에 들어간 후에야 현재 이름인 CZ를 채택했습니다. 그는 이전에 "CP"라는 이름을 사용하려고 시도했지만 온라인상의 친구들이 불법 시장에서 "아동 포르노"의 약자라는 말을 듣고 중단했다고 말했습니다.

밴쿠버(그가 은퇴하고 싶다고 말한 곳)와 캐나다에 대한 그의 애정에도 불구하고 그의 행동 중 일부는 그의 공언한 애정을 속였습니다. 그는 몇 년 동안 도시에 발을 들여놓지 않았으며 거기에 활동적인 가족이나 박애주의적 연결이 없다고 인정했습니다. 그럼에도 불구하고 CZ는 여권 정보뿐만 아니라 그의 성격 때문에 자신이 캐나다인이라고 주장합니다. "나는 캐나다인처럼 생각합니다. 우리는 친절하고 공격적이지 않고 지나치게 경쟁적이지 않고 일반적으로 도움이 되는 사람들입니다."라고 그는 말했습니다.

그는 캐나다에서 많은 혜택을 받았기 때문에 (그가 자란 곳인) 캐나다에 대해 따뜻하게 이야기합니다.

인생을 바꾸는 베스트셀러 금융 서적

4월 초 현재 CZ는 순자산 290억 달러로 블룸버그의 억만장자 목록에서 46위에 올랐습니다(CZ는 "부정확하고 모든 변동성을 감안할 때 추정하기 어려운 수치"라고 말했습니다). 지난 가을, 많은 언론 매체는 FTX에서 그의 라이벌 Sam Bankman-Fried를 무너뜨린 대담한 암호화폐 거래에 초점을 맞췄으며, 최근에는 CZ의 규칙 플레이 충돌에 대한 바이낸스와 규제 기관 사이의 균열에 대한 보도가 많이 있습니다. 많은 비순응적인 기술 기업가들이 대학에서 그들의 대담하고 도전적인 자질을 보여주지만(소셜 네트워크에서 Zuckerberg가 묘사한 것을 생각해 보십시오) CZ의 경우에는 그렇지 않은 것 같습니다.

이미지 설명

몬트리올 McGill University에 있는 CZ의 첫 거주지

McGill University에서 학업을 마칠 때 CZ는 1999년에 Jeremy Cooperstock 교수와 함께 인공 지능에 관한 학술 논문을 공동 집필하면서 나중에 그의 경력에서 보여줄 탁월함을 공개적으로 보여주었습니다. 널리 알려지게 되었습니다. 몬트리올의 한 카페에 앉아 있는 Jeremy Cooperstock은 CZ를 잘 기억한다고 말했습니다. 부분적으로는 자신이 그의 대학원 세미나에서 유일한 학부생이었기 때문입니다. 그는 "그에게 돈을 잘 주지는 못하겠지만 좋은 경험을 해줄 것"이라고 말했습니다. 그의 기억 속에서 CZ는 매우 똑똑한 성격의 사람이었지만, 오랜 세월이 지난 후 그는 그의 전 제자가 억만장자가 된 것을 알고 놀란다.

이 기간 동안 CZ는 자신의 인생을 바꾼 무언가를 읽었다고 말합니다. 학술 논문이나 Atlas Shrugged와 같은 장황한 논문이 아니라 전형적인 중산층, 평범한 사람을 대상으로 한 영화입니다. 책: "부자 아빠, 가난한 아빠" ". 1997년에 출간된 이 베스트셀러 개인 금융 책은 적은 돈으로 평생을 열심히 일한 아버지와 기업가 또는 투자자로서 부자가 된 두 아버지의 이야기를 우화로 풀어냅니다. 그 책은 CZ가 아버지의 조언을 의심하게 만들었습니다. 그때까지 그는 박사 학위를 마치고 민간 부문에서 일하고 있었고 직업적 존경을 받았지만 향후 20년 동안 물질적 부는 거의 없었습니다.

"아버지는 항상 열심히 일하고 좋은 직장을 얻으라고 가르치셨고, 부모님도 그런 사고방식을 공유하셨습니다. 그들은 사업을 좋아하지 않았습니다. 부자 아빠 가난한 아빠를 읽고 난 후 생각하기 시작했습니다. 내가 CEO가 되어야 하는 것이 아니라 의미 있는 무언가를 만드는 것입니다.”

CZ의 생각이 부의 창출로 바뀌었을 때 그는 Zuckerberg 및 다른 재능 있는 억만장자들과 같은 선택을 했습니다. 바로 대학을 중퇴하는 것입니다. 2000년 여름 인턴십 기간 동안 도쿄 증권 거래소의 정규직이 되었고 McGill University로 돌아가지 않기로 결정했습니다. (많은 언론에서 CZ가 McGill 졸업생이라고 보도하지만 이는 정확하지 않습니다.)

첫 번째 레벨 제목

상하이에서 사회 규칙을 공부하는 "귀국자"

중국의 번영하는 남동부 해안에 있는 상하이는 당시 중국 경제의 원동력이 된 "기관차"였습니다. CZ가 상하이로 이전한 2005년에 이 도시는 홍콩과 싱가포르에 이어 세계에서 세 번째로 분주한 컨테이너 운송 항구가 되었으며 14년 연속 11%의 GDP 성장률을 기록했습니다. 중국은 부상하고 있으며 상하이는 그 중심에 있습니다.

결정적으로 상하이에서의 CZ의 초창기는 국내 기술 회사와 업계 리더가 부상하는 중국 기술의 황금기와 일치했습니다. Robin Li, Jack Ma 및 Ma Huateng은 밀레니엄 전환기에 회사를 시작했으며 폭발적인 투자와 개발을 경험하고 있습니다.

CZ는 "나는 그것이 확립된 곳이 아니라 개발되고 있는 곳으로 가라고 배웠다"고 말했다.

그는 상하이로 돌아온 유일한 젊은 캐나다인이 아닙니다. 1990년대 캐나다의 극심한 경기침체는 2000년대 중반 역이민 급증에 박차를 가했다. CZ와 같은 귀국자는 해외로 이민을 갔다가 중국으로 돌아온 사람을 가리키는 중국어 말장난인 "하이귀"로 알려져 있습니다. 한 연구에서는 2017년 현재 거의 50만 명의 귀환자가 캐나다와 전 세계에서 중국에 도착했다고 추정했습니다.

CZ와 그와 같은 다른 사람들에게 타이밍이 더 좋을 수는 없습니다. 영어를 구사하고 중국어와 문화에 능통한 서양 교육을 받은 귀환자들은 중국에서 따뜻한 환영을 받으며 현지 동료들보다 더 높은 급여를 받는다고 Miu Chung Yan은 말했습니다.

그러나 CZ는 자신을 받아들이고 싶어하는 도시에 와서 현지 언어를 구사하지만 중국의 빠르고 격렬하며 자유 분방한 비즈니스 환경에서 모호한 규칙과 규정을 다루기가 어렵다는 점을 인정합니다. "저는 비즈니스 문화를 이해하지 못했고 처음부터 배워야 했습니다."라고 그는 회상합니다. 규칙 기반 기업과 평등주의적 아이디어가 만연했던 뉴욕, 도쿄, 밴쿠버에서 CZ에게 관계, 특히 관계의 핵심은 다음과 같습니다. 지지자가 될 공무원은 낯설어 보인다. 알코올은 이러한 비즈니스 관계를 구축하는 데 있어 중국 문화에서 특별한 위치를 차지합니다. 강한 중국 술인 Baijiu는 비즈니스 협상에서 친선과 존경의 표시로 자주 사용됩니다.

CZ는 "나는 그것에 대해 읽었고 그것에 대한 소문을 들었다"고 말했다. "하지만 실제로 사업을 시작하면 관리들과 만찬에서 그들은 바이주를 마시고... 그들은 관계에 대해 이야기하고, 때때로 처리해야 할 다른 것들이 있고 그것들은 모두 나에게 낯설기 때문에 그 접근 방식이 정말 마음에 들지 않았습니다.”

그럼에도 불구하고 CZ는 상하이에서 빠르게 돈을 벌었습니다. 2005년에 그는 다른 4명의 주재원과 함께 고주파 거래 시스템을 제공하는 SaaS(Software-as-a-Service) 회사인 Fusion Systems를 공동 설립했으며 Goldman Sachs 및 Credit Suisse와 같은 세계 최대 은행과 제휴했습니다. . 그 시간 동안 그는 규칙을 빨리 배웠습니다. 그는 중국에서 규칙이 "의도적으로 모호"하여 관리들에게 엄청난 해석 및 선택적 집행 권한을 부여한다고 말했습니다. 신예 기업가는 자신의 수학과 코딩 기술을 활용했지만 회사에서의 그의 역할은 귀국자 지위를 사용하여 동양과 서양 사이의 중개인 역할을 하면서 "판매원처럼 생각하는" 방법을 그에게 가르쳤습니다. 주니어 파트너이자 "중국 환경에서... 중국인처럼 보이는" 유일한 사람으로서 CZ는 "회사 서비스를 어떻게 마케팅해야 할까요? 다음 계약을 어떻게 따내야 할까요?"라고 생각했습니다.

그리고CZ에대한전설이있듯이2013년심야포커게임이그의인생행로를바쳤습니다. 를암호화폐에소개합니다.CZ는전력을다합니다.달러를투자했습니다.개웹사이트로시작한암호화폐스타트업Blockchain.info에기술책임자로합류했습니다. CTO로고용되었습니다.

OKCoin은 CZ가 공개 전투에 참여하는 것을 두려워하지 않는 대담한 공개 암호화폐 인물로 자신을 연마한 전장입니다. 처음에 CZ는 Reddit과 같은 플랫폼에서 대중과 상호 작용했는데, 이는 CTO들 사이에서 일반적이지 않은 것으로 OKCoin 및 암호 화폐에 대한 비판을 정중하지만 단호하게 반박했습니다. 그러나 2015년 CZ는 회사의 방향에 대해 OKCoin CEO Mingxing Xu와 분쟁을 겪은 후 회사를 떠나는 대신 동일한 플랫폼에서 이전 진술을 철회하고 이전 고용주를 비난했습니다.

1,600단어의 Reddit 스레드에서 CZ는 Star Xu의 지시에 따라 회사가 봇을 사용하여 거래량, 가짜 준비금 증서 및 불투명한 재무 정보를 늘리는 방법을 자세히 설명했습니다. 이에 대해 Star Xu는 CZ가 학업 자격 증명 및 기타 사기 행위를 위조했다고 비난했습니다. 이 불화는 결국 사그라들었지만 CZ가 논쟁에서 강하게 파업하려는 의지를 보여 주면서 동시에 신생 암호화폐 산업에 대한 중국의 규제를 더욱 엄격하게 만들었습니다.

CZ의 다음 회사인 Bijie Technology와의 논쟁과 경계 밀기는 한 단계 더 나아갔습니다. Bijie Technology는 거래 플랫폼 및 거래 플랫폼용 소프트웨어를 제공하는 또 다른 SaaS 회사입니다. 그 후 2년 동안 Bijie의 기술은 30개의 중국 거래소의 초석이 되었고 나중에 Binance의 강자가 되었습니다.

그러나 CZ의 기술로 구동되는 대부분의 거래 플랫폼이 "우편 통화 카드"(중국 제국 및 혁명 시대의 우표) 거래를 포함하면서 곧 문제가 발생하여 튤립 열풍을 일으켰습니다. 카드 마니아가 확산되면서 온라인 장터와 의심스러운 우표 판매자가 생겨났다. 소위 "스탬프 교사"와 "자산 고문"은 순진한 투자자를 QQ 및 WeChat과 같은 메시징 플랫폼의 투자 대화방으로 유인하여 투자자에게 디지털 거래 플랫폼을 통해 우표 및 수집품의 지분을 구매하도록 조언합니다. 그러나 대부분은 고의적인 조작 및 매도 사기입니다. 2016년 중국 국영 신문인 증권시보(Securities Times)의 조사에 따르면 일반 투자자, 특히 중국 노인들은 수억 위안을 잃었고 일부는 연금 전체를 잃었습니다.

CZ는 우표 사기와 직접적인 관련이 없지만 그의 기술은 틀림없이 사기가 번창하는 데 도움이 되었습니다. 더욱이 만연하는 광란은 당국에 비상을 걸었습니다. 중국 관리들은 불규칙하고 위험한 행동에 보상하는 디지털 플랫폼의 억제되지 않은 성장을 제한하는 새로운 규정을 신속하게 제정했으며 디지털 금융 혁신에 대해 더욱 회의적입니다. 2017년 1월, 국가는 우표 및 수집품 거래 플랫폼을 시정하거나 폐쇄하라고 명령했으며, 그해 8월까지 이러한 거래 플랫폼의 운영이 중단되었습니다. Bijie의 고객 대부분은 폐업했습니다.

한편, CZ의 야망은 다른 곳을 찾기 시작했습니다. 2017년에는 암호화폐 가격의 급격한 상승으로 수백만 명의 신규 투자자가 이 공간으로 유입되었습니다. CZ는 업계 선두주자인 샌프란시스코에 기반을 둔 Coinbase가 현금을 인출하는 것을 봅니다. 그는 기회를 보았고 그해 7월 상하이에서 자신의 거래 플랫폼인 바이낸스를 시작했습니다.

바이낸스는 단 1년 만에 고품질 거래 플랫폼, 글로벌 고객 기반 및 거의 규제되지 않은 규제 정책 덕분에 코인베이스를 능가하여 세계 최대의 거래 플랫폼이 되었습니다. 얼마 지나지 않아 이 회사는 기술적인 위업인 자체 블록체인을 출시한 최초의 거래 플랫폼이 되었습니다. 고객은 거래에 대한 토큰 보상을 받을 수 있으며 바이낸스는 출처를 알 수 없는 자산을 포함하여 수백 개의 디지털 자산을 거래할 수 있는 기능을 추가했습니다. 이러한 전술은 Binance가 Coinbase 및 기타 경쟁사로부터 고객을 훔치는 데 도움이 되었으며, 회사의 낮은 거래 수수료와 고객 심사 시 질문을 거의 또는 전혀 하지 않는 정책을 가지고 있습니다.

지금까지 CZ는 아시아의 더 빠르고 공격적인 비즈니스 규칙에 분명히 적응하여 북미 기업과의 경쟁을 상대적으로 유치하게 만들었습니다. The King of Cryptocurrency에서 한 아시아계 미국인 기업가는 바이낸스의 갑작스러운 부상에 놀라움을 금치 못하는 언론을 조롱합니다: "여기서 일어나는 일은 서구 시장에서 떠오르는 기업들의 오만함과 편애입니다. 아시아는 코인베이스의 DNA에 없습니다. 저는 그들이 다리를 못 댔어."

첫 번째 레벨 제목

추방으로 인해 CZ의 힘이 증가했습니다.

어떤 면에서 중국을 떠나는 것은 바이낸스와 창립자 CZ의 장기적인 이익에 부합합니다. 수년 동안 CZ와 그의 회사는 바이낸스가 베이징과 동맹을 맺었다고 묘사하는 미국 경쟁자들에게 휘둘려 왔습니다. 이러한 동맹은 특히 미국과 중국 간의 긴장 상황에서 CZ와 미국 규제 당국의 관계를 더욱 어렵게 만들 것입니다. 수년 동안 회사는 중국 출신과 중국에서의 사업 활동을 의도적으로 은폐했다는 비난을 받았지만 Binance는 부인했습니다.

그러나 공식 규제 밖에서 운영하는 것을 선호하는 회사와 설립자들에게는 어떤 국가도 그들을 오랫동안 수용할 수 없습니다. 바이낸스의 일본 체류 기간은 짧습니다. 2018년 사기꾼들은 가짜 Google 광고를 사용하여 고객이 바이낸스 로그인 정보를 입력하고 계정을 비우도록 속였습니다. 바이낸스는 손실에 대해 직접적인 책임이 없었지만, 이 스캔들로 인해 일본 규제 당국은 바이낸스를 거래소로 등록하도록 요구했고 이는 CZ에게 적합하지 않은 선택이었습니다. 그래서 CZ는 자신의 암호화폐 제국을 몰타로 이전하기로 결정했습니다. 그곳에서 당시 총리였던 Joseph Muscat은 암호화폐와 관련된 모든 것을 기꺼이 환영하고 다른 질문을 하지 않았습니다.

몰타에서의 기간도 짧았습니다. Binance는 더 이상 새로운 본사 위치를 찾지 않고 대신 본사 없이 운영할 것이라고 발표했습니다. 한동안 Binance는 너무 분산되어 CZ가 모든 의도와 목적을 위해 네트워크에서 분리된 것처럼 보였습니다. 2021년 바이낸스의 반대자는 미국에서 바이낸스를 토큰 상장 폐지로 고소했습니다. 원고는 CZ를 찾기 위해 사설 탐정을 고용했습니다. 조사 결과에 대한 그의 보고서에서 사설 수사관은 그의 팀이 CZ를 추적하기 위해 "극단적인" 노력을 기울였지만 성공하지 못했고 바이낸스가 CZ의 과거와 행방을 은폐하기 위해 다른 사람을 고용하여 그가 "거의 감지할 수 없게" 했다고 의심했습니다. 최근 Fortune은 보고서의 진술이 정확함을 확인한 사설 탐정에게 손을 내밀었습니다. (소송은 결국 기각되었다.) 2022년까지 CZ는 암호화폐 거래에 대한 제한이 거의 없는 두바이에 나타나지 않을 것이다.

마이그레이션에 대한 바이낸스의 접근 방식은 탈중앙화에 집착하는 암호화폐 신봉자들 사이에서 찬사를 받았습니다. 당연히 이것은 바이낸스를 무법 해외 카지노로 간주한 다른 국가의 규제 당국을 화나게 했습니다. 이유 없이는 아닙니다. 지난 3년 동안 바이낸스는 윤리적으로 의심스럽거나 잠재적으로 명백한 범죄 행위에 노출되었습니다. 여기에는 이란의 국제 금융 제재에도 불구하고 이란 사용자가 바이낸스의 거래 플랫폼에서 거래할 수 있도록 허용한 느슨한 "KYC" 정책과 계획을 제안한 바이낸스 경영진에 따르면 2018년 미국에 자회사를 등록하려는 실패한 계획이 포함됩니다. 회사의 나머지 부분에서 미국 규제 당국의 주의를 분산시키는 "규제 싱크홀" 역할을 하기 위한 것입니다.

바이낸스는 의심스러운 전술에 가담한 것을 인정했지만 이를 해고했다고 말했습니다. 지난 2월 이 회사는 미국 법무부 및 기타 규제 기관과의 전면적인 합의에 거의 도달했으며 과거의 위법 행위를 해결하고 앞으로 나아갈 길을 제시했다고 말했습니다. 이는 CFTC가 최근 바이낸스를 상대로 한 소송에서 합의의 실행 가능성에 대한 의문이 제기됐음에도 불구하고 그렇습니다.

동시에 기업들은 페이지를 넘기고 싶다고 말했지만 특히 거래 플랫폼 FTX의 붕괴 이후 규제 당국의 암호화폐에 대한 광범위한 불신으로 인해 이러한 열망이 복잡해졌습니다.

지난 11월 FTX 스캔들을 폭로한 것은 CZ의 트윗이었지만, 그는 FTX 회사 초기에 그가 알고 투자한 회사인 SBF가 저지른 사기에 누구보다 놀랐다고 말했습니다.

CZ와 SBF는 2020년부터 2022년 초까지 암호화폐 붐이 일어나는 동안 업계에서 가장 영향력 있는 인물 중 두 명이며, 그들의 여정에는 몇 가지 주목할만한 유사점이 있습니다. 가장 분명한 사실은 CZ의 아버지가 대학 세계의 비주류 인물임에도 불구하고 둘 다 학자의 자녀라는 것입니다. 그에 반해 SBF는 스탠퍼드대 법대 교수 2명의 아들로, 캠퍼스에 멋진 집을 소유하고 학계에서 최고의 삶을 살고 있다.

오늘날 두 사람은 매우 다른 상황에 처해 있습니다. SBF는 종신형을 선고받을 수 있는 일련의 사기 혐의에 대한 재판을 기다리며 여전히 부모님 집에서 살고 있습니다. 한편 CZ는 이미 바이낸스 공동 창업자 허 이(He Yi)와 함께 두 아이의 아버지가 되었습니다.

CZ가 경쟁사의 특권과 자격에 분노하는 것을 상상하기 쉽습니다. SBF는 2022년 여름에 CZ가 미국 땅에 발을 디디면 체포될 것이라고 제안하는 것을 포함하여 트위터에서 그를 여러 번 조롱했습니다. (바이낸스는 CZ가 아버지의 장례식 참석을 포함하여 최근 몇 년 동안 캐나다를 여러 번 방문했지만 그곳에서 매우 절제된 생활 방식을 유지했다고 말합니다.) 그러나 CZ는 한때 경쟁자에 대한 개인적인 복수심은 없다고 주장합니다.

CZ는 "그는 똑똑하고 재능이 있지만 매우 공격적인 어린 아이처럼 보였습니다."라고 포춘에 말했습니다. 그는 주로 고객으로 SBF를 3~5번 만났다고 말했습니다. 거래 플랫폼.

4월 중순 현재 바이낸스는 암호화폐 시장 붕괴(FTX 붕괴 이후)와 규제 당국이 점점 더 공격적으로 회사를 뒤쫓는 조합을 이겨낸 것으로 보입니다. 재정은 블랙박스로 남아 있지만 블록체인 데이터에 따르면 바이낸스는 최근 몇 달 동안 경쟁사로부터 시장 점유율을 얻었으며 비트코인 및 기타 암호화 통화로 인해 거래량과 수익도 증가할 수 있습니다.

한편 CZ는 그와 그의 회사가 분산되어 있으며 어떤 국가도 소유하지 않는다고 계속 주장합니다. 이러한 관점에서 그는 중국, 캐나다 및 기타 국가의 영향을 초월했으며 진정한 무국적자가되었습니다.

첫 번째 레벨 제목

아버지의 유산

그의 트위터 피드에서 볼 수 있듯이 CZ의 영어는 완벽하지 않습니다. 예를 들어 그는 작년에 "MLB 심판"을 "야구 심판"이라고 불렀습니다. 그러나 그의 겸손함과 사려 깊음은 매우 캐나다적인 느낌이 듭니다. 30분간의 인터뷰가 진행되는 동안 그의 태도는 포스트잇을 들고 두바이를 떠돌아다니는 억만장자라는 새로운 정체성에도 불구하고 30년 전 밴쿠버 맥도날드에서 먹었던 감자튀김을 여전히 가지고 있음을 암시합니다.

그럼에도 불구하고 무엇이 그를 움직이게 하는지 정확히 파악하기는 어렵습니다. Crypto는 여전히 최첨단 산업이며 Coinbase와 같은 기존 기관을 포함한 모든 주요 업체는 이점을 얻거나 생존하기 위해 "교활한"전술을 사용하려고 합니다. 바이낸스가 최근 "순조롭게 진행"하겠다는 약속에도 불구하고 대부분의 경쟁사보다 법에서 더 멀리 떨어져 있을 수 있습니다.

그러나 CZ는 밴쿠버에서 자라면서 규칙을 어기는 법을 배웠느냐는 질문에 "나는 항상 상당히 친밀하고 규칙을 준수하는 시민이었습니다... 나는 항상 보수적인 성격을 가지고 있었습니다. 다르게 생각할 수도 있습니다."라고 그는 말했지만 암호 화폐의 문화는 그의 견해를 바꾸었습니다. 우리는 단지 내가 더 유리한 곳을 찾고 싶을 뿐입니다."

이 주장은 어떤 면에서는 설득력이 있지만 바이낸스의 이기심에 맞춰진 것처럼 느껴지기도 합니다. CZ는 자신과 바이낸스에 가장 적합한 규칙을 찾거나 규칙이 없는 경우를 분명히 찾을 수 있었습니다. 이것은 다른 시대의 규칙에 따라 연기한 그의 아버지와 극명한 대조를 이룬다.

캐나다 온타리오에 있는 GeoTech의 지구물리학자인 Jean Legault는 업계 리더의 추천으로 CZ의 아버지 Shengkai Zhao와 6년 동안 함께 일한 사람을 고용했습니다. Legault는 Shengkai를 비범한 기술적 사고를 가진 뛰어난 지구물리학자로 기억했습니다. Shengkai는 GeoTech가 소프트웨어를 사용하여 엔지니어에게 귀중한 도구인 지구물리학 데이터의 3D 반전을 생성할 수 있도록 하는 원본 코드를 작성했습니다. 회사는 오늘날까지도 그의 사용 설명서를 사용합니다. Legault는 "나중에 다른 지구물리학자들도 같은 작업을 하도록 요청받았지만 그들은 아주 좋은 사람인 Shengkai를 복제할 수 없었습니다."라고 덧붙였습니다.

Legault에 따르면 Shengkai는 일하기 위해 살았고 학계나 비즈니스에서 정상에 도달할 수 있었지만 너무 겸손했습니다. Shengkai는 결코 자신의 지식이나 업적을 자랑하지 않습니다. CZ는 이에 동의하며 그의 아버지가 문화 혁명 기간 동안 서투른 영어로 경력을 쌓기 시작했고 사업에 뛰어든 적도 없다고 Fortune에 말했습니다.

CZ는 아침부터 밤까지 아버지가 연구실이나 데스크탑에서 복잡한 수학 방정식을 연구하는 것을 지켜보던 것을 회상합니다. 그러나 그럼에도 불구하고 이민자로서의 역사적 힘과 변화는 Shengkai가 학계의 변두리에서만 일할 수 있음을 의미하며 다른 시간이나 장소에서 태어났다면 그가 얻었을 명성을 결코 향유할 수 없습니다.

그러나 그의 아들 CZ는 이민의 영향을 받았는데, 바이낸스 제국의 성공은 CZ가 이전에는 결코 실현할 수 없었던 아버지의 운명을 완수한 것일 수 있습니다.

Shengkai는 작년에 백혈병으로 사망했습니다. 그를 생각하면 CZ의 어조는 어린 시절을 생각하는 듯 조금 안타까웠다. "아버지는 하루 종일 연구실과 컴퓨터에서 시간을 보내셨고, 제 배구 경기에는 한 번도 오지 않았습니다. 저는 주장이었고 일주일에 두 경기를 했지만 부모님은 경기를 한 번도 본 적이 없었습니다."

원본 링크