รายงานการพัฒนา LSD แบบหลายระบบนิเวศ: เส้นทางนี้ยิ่งใหญ่มาก และโครงการเพิ่งเริ่มต้น

ผู้เขียนต้นฉบับ:waynezhang.eth

ผู้เขียนต้นฉบับ:นิเวศวิทยา LSDFi/รายงานสงคราม LSFIเช่นเดียวกับเช่นเดียวกับผลกระทบของการอัพเกรดเซี่ยงไฮ้ต่อ LSD

BNB Chain

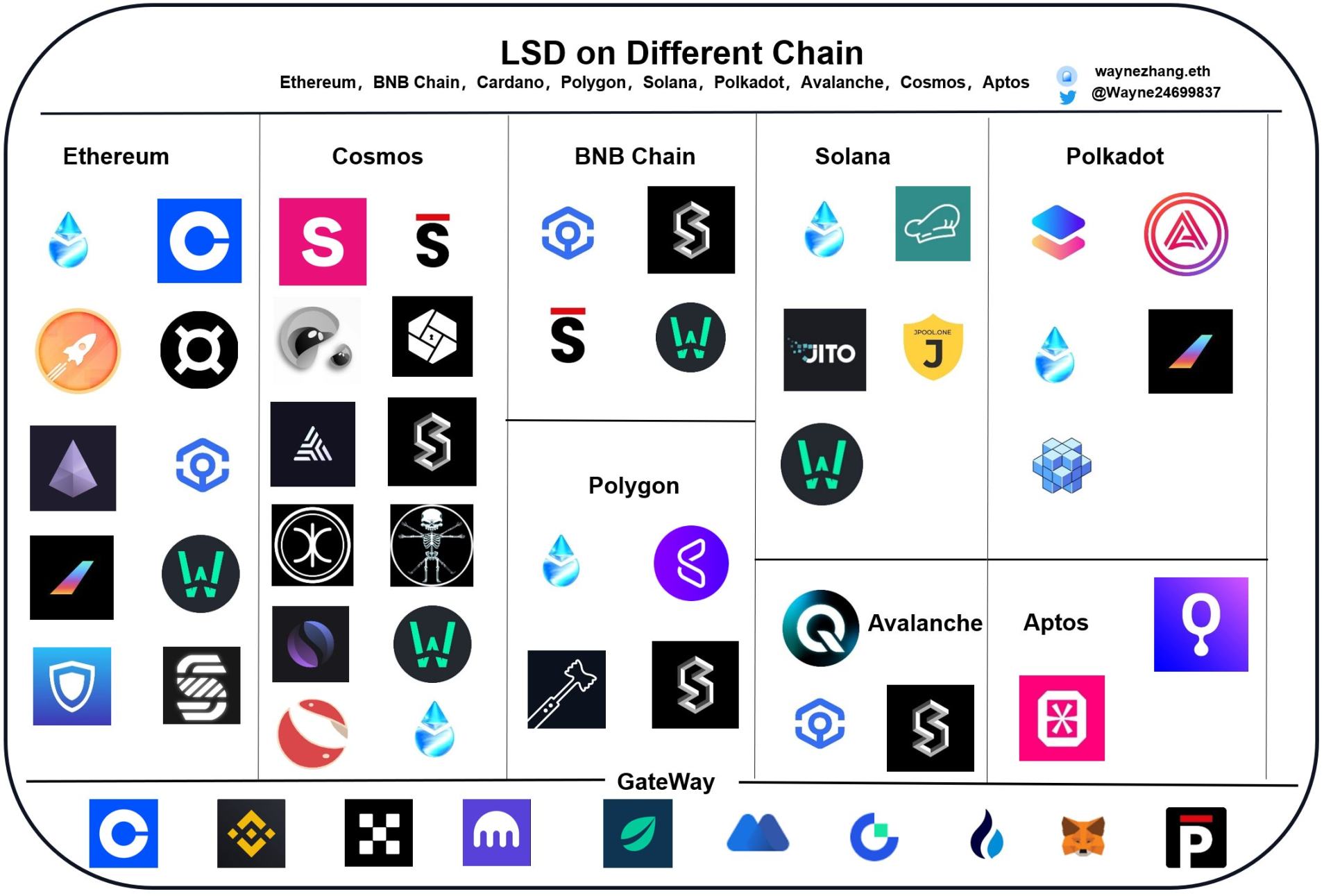

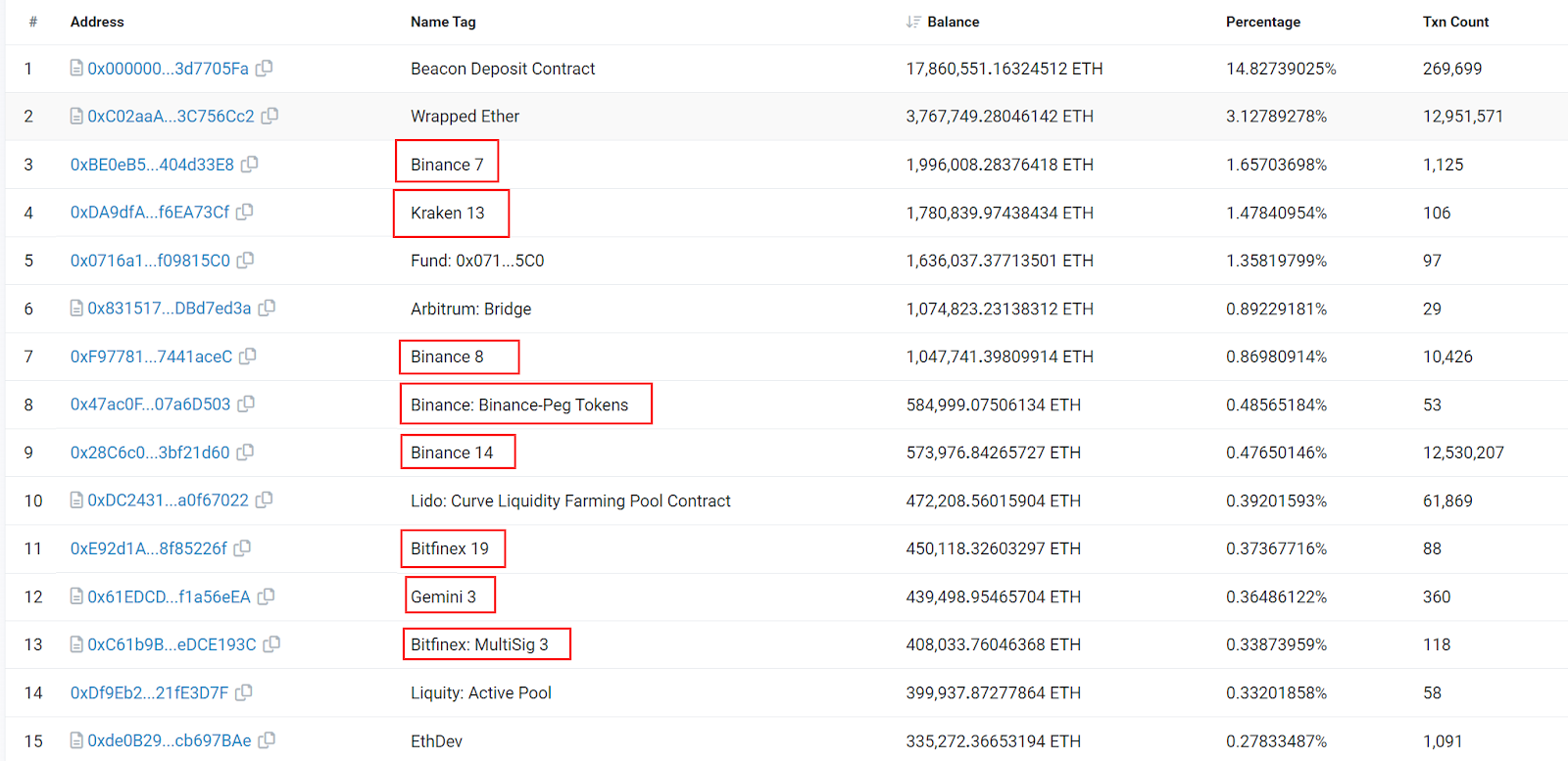

รายงาน แต่ทั้งโครงการที่เลือกและพื้นหลังของการคิดคือ Ethereum นี่เป็นเพราะปริมาณเงินทุนที่ Ethereum เข้ามาโดยสภาพคล่องเพียงอย่างเดียวนั้นเกินกว่า 14 พันล้านเหรียญสหรัฐ รายงานวันนี้จะสำรวจการพัฒนาและการเล่นเกมของ LSD ในระบบนิเวศห่วงโซ่สาธารณะอื่นๆ และสังเกตการพัฒนาของ LSD ในระบบนิเวศอื่นๆ จากด้านข้อมูล แนวโน้มการพัฒนา ผลกระทบของข้อมูลที่มีต่ออุตสาหกรรม LSD และการออกแบบผลิตภัณฑ์ LSD และความยุติธรรม . หารือ เชนสาธารณะที่ทำการสำรวจจะรวมถึง: BNB Chain, Cardano, Polygon, Solana, Polkadot, Avalanche, Cosmos, Aptos (ส่วนหนึ่งของเชนสาธารณะ 25 อันดับแรกที่จัดเรียงตาม Coingecko MC)

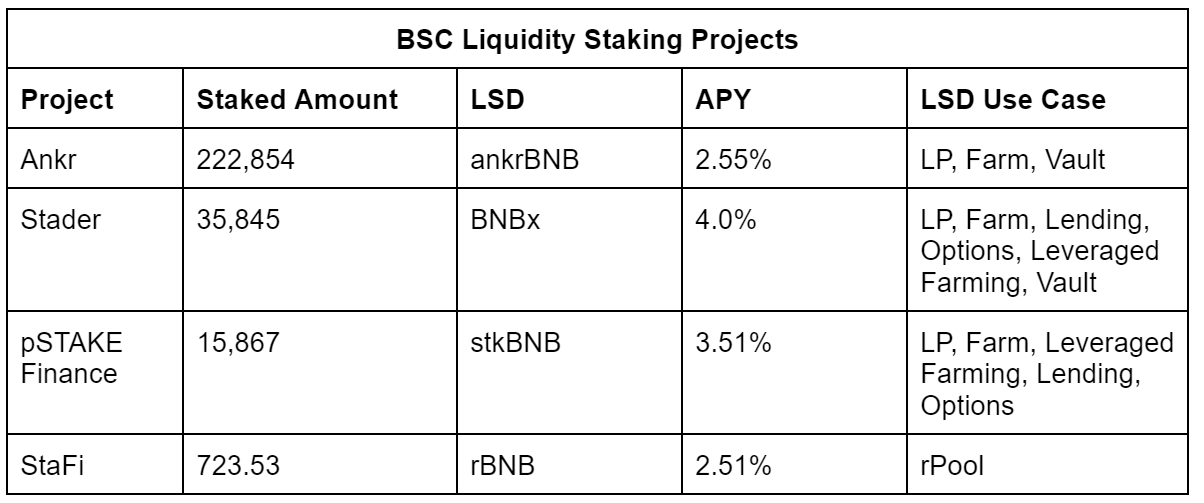

สถานะการเดิมพันปัจจุบันของ BNB นั้นคล้ายกับสถานะของ Ethereum โดยมีอัตราการเดิมพันอยู่ที่ 15.44% (Ethereum อยู่ที่ประมาณ 15.43%) และผลตอบแทนเฉลี่ยต่อปีของการเดิมพันในปัจจุบันอยู่ที่ประมาณ 2.84% ซึ่งค่อนข้างต่ำ ในหมู่พวกเขา Ankr ซึ่งเป็นแพลตฟอร์มรับจำนำแบบกระจายอำนาจที่ใหญ่ที่สุดของ BNB Chain คิดเป็นประมาณ 0.56% ของการหมุนเวียน

ฉันคิดว่าสาเหตุของการพัฒนาที่ช้าของ LSD ของ BNB Chain มีดังนี้:

1. ความสามารถในการทำกำไรของโปรโตคอล DeFi ดั้งเดิมของ BNB ดังที่เห็นได้จากข้อมูล DeFillama ในบรรดาคู่การซื้อขาย 337 คู่ที่เกี่ยวข้องกับ BNB เท่านั้น อัตราผลตอบแทนเฉลี่ยต่อปีคิดเป็น 80% ไม่ต้องพูดถึงโปรโตคอล DeFi ต่างๆ ในห่วงโซ่ ส่วนใหญ่สูงเกินกว่าอัตราผลตอบแทนของผู้รับจำนำ

2. ยูทิลิตี้ BNB

① BNB ยังเป็นโทเค็นแพลตฟอร์มของการแลกเปลี่ยน Binance การถือ BNB และวางไว้ในการแลกเปลี่ยนสามารถรับส่วนลดสำหรับค่าธรรมเนียมการจัดการและบริการอื่น ๆ

② ในขณะเดียวกัน Binance ก็มี Launchpad และบริการอื่น ๆ ของตัวเองโดยเฉพาะซึ่งดึงดูดผู้ใช้ให้ใส่ BNB ไว้ในกระเป๋าเงินหรือแลกเปลี่ยน ยกตัวอย่าง Launchpad ของ Space ID ล่าสุด จำนวนรวมของ BNB ที่ลงทุนไปถึง 8,677,923.94 ชิ้น และจำนวนผู้เข้าร่วมถึง 103. 598 คน จำนวนนี้เกือบ 39 เท่าของเงินเดิมพันทั้งหมดของ Ankrสำหรับผู้ถือธุรกรรม ไม่ว่าจะเป็นการรับส่วนลดค่าธรรมเนียมใน Binance หรือเข้าร่วมในผลิตภัณฑ์ DeFi ต่างๆ บน DEX รายได้และความมั่นคงจะสูงกว่า

Cosmos

ใน BNB Chain ศักยภาพของ LSD นั้นน้อยกว่าเชน ETH มาก

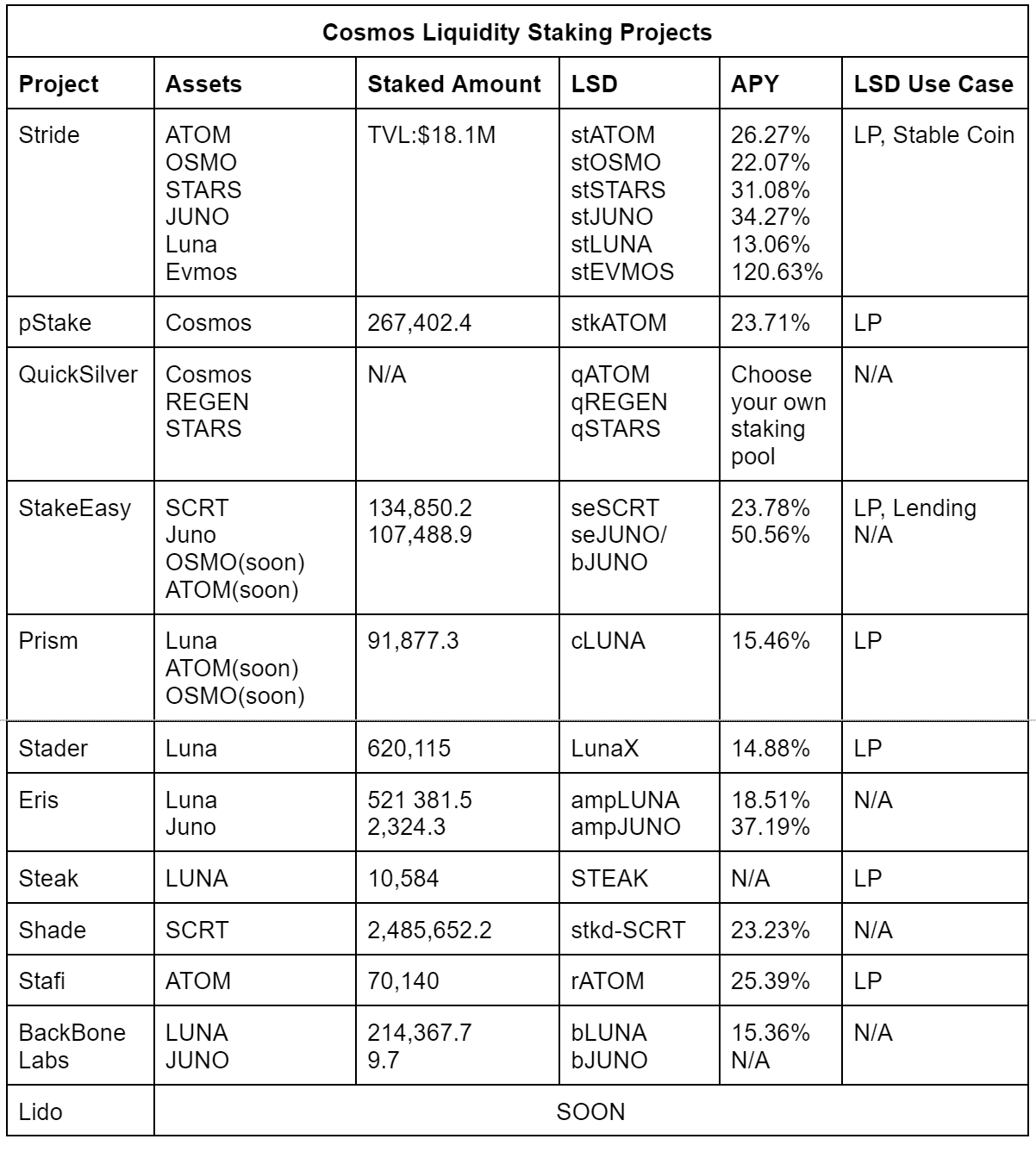

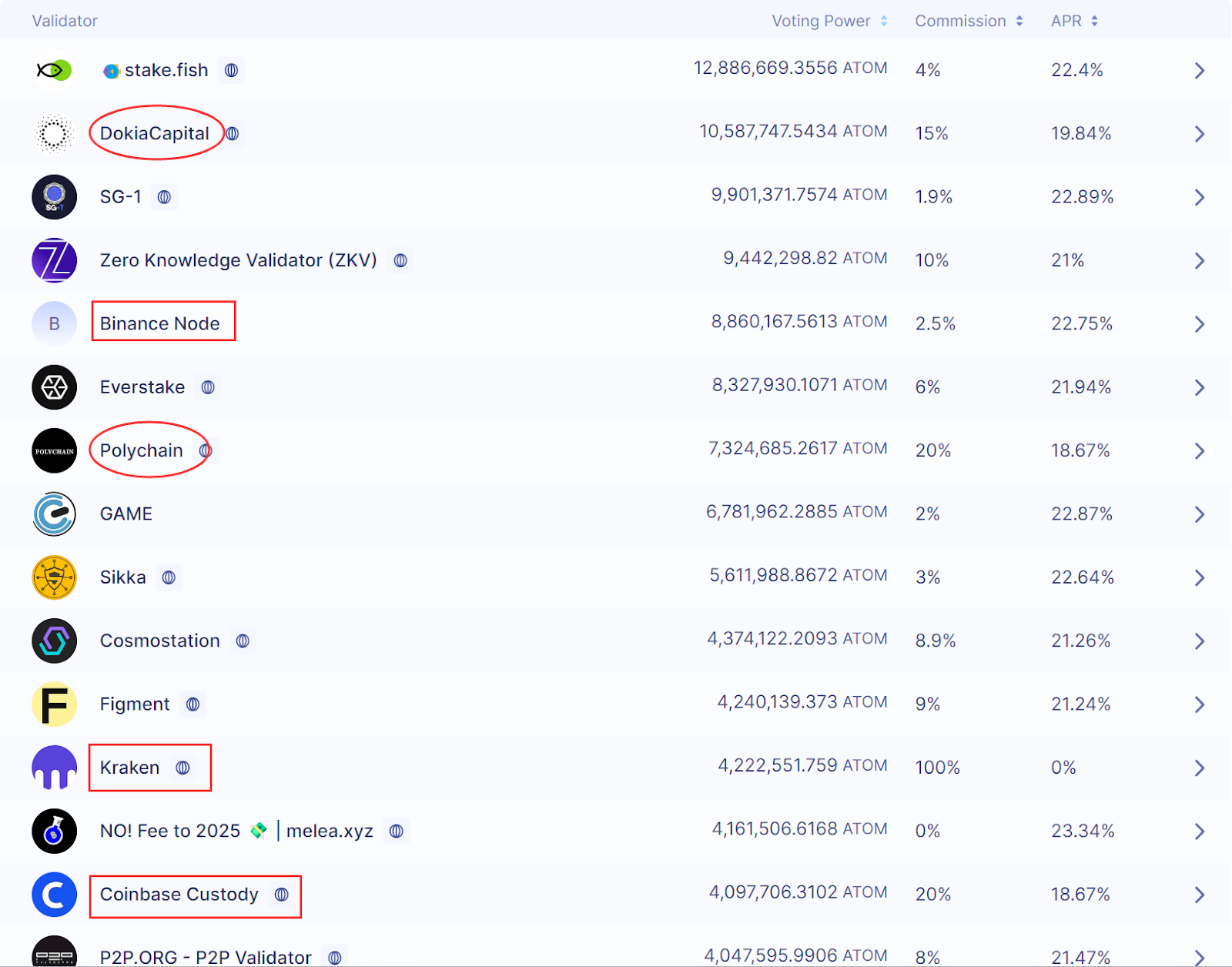

อัตราการรับจำนำของ Cosmos Hub อยู่ที่ประมาณ 61.96% และรายได้จากการรับจำนำโดยเฉลี่ยอยู่ที่ประมาณ 25.92% หลังจากการจำนำ คุณต้องรอ 21 วันนับจากเวลาที่สมัครจึงจะปล่อยคำจำนำได้ เมื่อเปรียบเทียบกับเครือข่าย ETH และ BNB สถานะการจำนำของ Cosmos นั้นเป็นเรื่องทางเทคนิคมาก เนื่องจาก ATOM ใช้เป็นโทเค็นของ Cosmos Hub เท่านั้น ห่วงโซ่แอปพลิเคชันใด ๆ ที่เปิดตัวในระบบนิเวศของ Cosmos จึงไม่จำเป็นต้องใช้โทเค็น ATOM เนื่องจากลอจิกค่าธรรมเนียมนั้นมาจาก AppChain แต่ละตัว (โทเค็นใดที่นักพัฒนาเลือกที่จะจ่ายค่าน้ำมัน) แต่ละ AppChain จึงมีเครือข่ายตัวตรวจสอบความถูกต้องของตัวเอง ดังนั้นเราจึงไม่สามารถใช้โปรโตคอลบนเชน ATOM เป็นพื้นฐานสำหรับสถิติได้ Stride, QuickSilver ฯลฯ มีเชนของตนเองสำหรับการสร้างโปรโตคอล ดังนั้น เราจะนับโปรโตคอล LSD บน Cosmos และเชน IBC ทางนิเวศวิทยาของมัน โดยมุ่งเน้นไปที่ ATOM , OSMO , STARS , JUNO , Luna , Evmos)

จากตารางด้านบน คุณจะเห็นประเด็นที่น่าสนใจสองประการ:

ตอนนี้ระบบนิเวศของ Cosmos แยกออกจากกัน ขนาดของ LSD มีขนาดเล็กมากและมีกรณีการใช้งาน LSD ไม่มากนัก ในฐานะผู้นำปัจจุบันของ Cosmos LSD Stride มี TVL ทั้งหมดเพียง 15 ล้านเหรียญสหรัฐ

Luna ปรากฏในรายการ LSD หลายรายการและมี LSD หลายประเภท

1. ทำไม LSD ถึงมีขนาดเล็ก?

① ระบบนิเวศของคอสมอสมีสายโซ่ L1 ที่คล้ายกันหลายสาย แต่ระบบนิเวศเหล่านี้ไม่สามารถออกจากคอสมอสได้ในขณะนี้ Cosmos ไม่ใช่เชนสาธารณะแบบครบวงจร แต่เป็นเชนที่มีฟังก์ชันพิเศษและ Appchain ผ่านโปรโตคอล IBC เช่น Kava และ Osmosis สำหรับเครือข่ายทั่วไป เช่น Canto, Juno และ Evmos ระบบนิเวศน์ยังอยู่ในช่วงเริ่มต้น

เมื่อวันที่ 22 มีนาคม LUNA ที่มีมูลค่ามากกว่า 30,000 ล้านเหรียญสหรัฐได้รับการจำนำในโปรโตคอลต่างๆ แซงหน้า ETH ที่มีมูลค่าจำนำที่ 28,000 ล้านเหรียญสหรัฐ กลายเป็นสินทรัพย์จำนำที่ใหญ่เป็นอันดับสองในสกุลเงินดิจิทัลกระแสหลัก ในเวลานั้น Lido ยังมีส่วนร่วมในการออกแบบ bLUNA ซึ่งเป็น LSD แต่เหตุการณ์ Luna-UST เกิดขึ้นในภายหลัง ในเวลานั้น Terra มีโครงสร้างพื้นฐานที่สมบูรณ์ และ LSD สามารถใช้เป็นหลักประกัน UST เงินกู้ ฯลฯ

② ต้นทุนค่าเสียโอกาส: โดยรวมแล้ว อัตราผลตอบแทนที่สูงนำมาซึ่งค่าเสียโอกาส ยกตัวอย่าง ATOM หากผู้ถือไม่จำนำ ATOM ค่าเสียโอกาสของเขาจะอยู่ที่ประมาณ 26% คุณสามารถตรวจสอบรายการสภาพคล่องของ Osmosis ได้ มีเพียง สาม ATOM LPs สูงกว่า 26% แน่นอนว่ายังมีวิธีอื่นๆ ที่ให้ผลตอบแทนสูง แต่ก็ไม่เสถียรและปลอดภัยเท่ากับการจำนำโดยตรง สิ่งนี้ยังสร้างวงจรอุบาทว์: อัตราการใช้ DeFi ต่ำ → ผลตอบแทนต่ำกว่าคำมั่นสัญญา → ผู้ใช้ลดการมีส่วนร่วมของ DeFi → อัตราการใช้ DeFi ต่ำ

④ ความเสี่ยงด้านสภาพคล่อง: หลังจาก ATOM ได้รับคำมั่นสัญญากับ LSD แล้ว จะใช้เวลา 21 วันในการปลดล็อกและมาถึงบัญชี (การก้าวย่างแสดงเวลา 21-24 วัน) ไม่เพียงแค่ LSD เท่านั้น แต่โหนดที่จำนำด้วยจะได้รับผลกระทบจากสิ่งนี้ด้วย

แต่แต่

Cosmos LSD ยังคงมีโอกาสที่ยอดเยี่ยมมาก

1. Cosmos 2.0: การรักษาความปลอดภัยระหว่างเชนจะส่งเสริม ATOM เป็นโทเค็นการรักษาความปลอดภัยสำหรับเชน IBC อื่น ๆ ด้วยความสามารถในการรวมที่เพิ่มขึ้นของบัญชีระหว่างเชน ATOM ในไม่ช้า Cosmos จะสนับสนุนฟังก์ชันสภาพคล่องซึ่งจะช่วยปรับปรุงสภาพคล่องของ ATOM มูลค่าของ ATOM จะเพิ่มขึ้นอีก ซึ่งจะส่งผลโดยตรงต่อความมั่งคั่งของ DeFi ในระบบนิเวศ

2. Osmosis และ DeFi ของ Kava กำลังทำงานอย่างหนักในการพัฒนา และพวกเขาจะสร้างโครงสร้างพื้นฐานด้านสินเชื่อและรายได้เพิ่มเติมสำหรับ LSD ตัวอย่างเช่น SiennaLend ยอมรับ seSCRT เป็นหลักประกัน โปรโตคอล LSD ใหม่ เช่น Quicksilver จะออกอากาศเพื่อดึงดูดความสนใจของผู้ถือมากขึ้น

3. Stride และ Quicksilver สามารถจัดเตรียมฟังก์ชันการกำกับดูแล เช่น การลงคะแนนเสียงผ่านตัวแทน ในอดีต การลงคะแนนจะกระทำโดยโหนดที่ได้รับมอบหมาย แต่ตอนนี้ สามารถมอบหมายโหนดดังกล่าวให้กับ LSD ได้โดยตรง จากนั้นให้ LSD นับผู้เดิมพันเพื่อเลือกการลงคะแนนเสียงผ่านตัวแทน

4. ผลประโยชน์ด้านสภาพคล่อง: ระยะเวลาปลดล็อคการจำนำ 21 วันสามารถรับประสิทธิภาพเงินทุนผ่าน LSD

5. ปัจจัยภายนอก: สงคราม LSD ที่เกิดจากการอัปเกรด Ethereum Shanghai จะส่งเสริมอิทธิพลโดยตรงของ LSD และส่งเสริมการพัฒนา Cosmos LSD โดยอ้อม

6. Cosmos พร้อมที่จะเปิดตัว Liquidity Staking Model (LSM)

หากคุณต้องการทราบข้อมูลเพิ่มเติมเกี่ยวกับความแตกต่างทางเทคนิคของข้อตกลงจำนำระบบนิเวศของ Cosmos โปรดไปที่ที่นี่。

หากคุณต้องการทราบประวัติของการพัฒนา Cosmos LSD โปรดไปที่ที่นี่

Polygon

ที่นี่

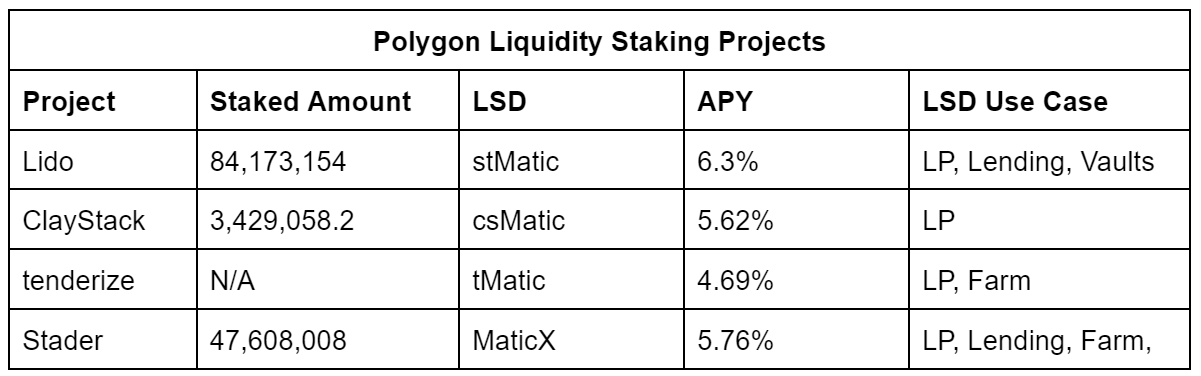

อัตราการจำนำรูปหลายเหลี่ยมคือ 39.92% และผลตอบแทนเฉลี่ยต่อปีคือ 8.82% Polygon POS เป็นไซด์เชนที่เข้ากันได้กับ EVM ซึ่ง Matic ทำหน้าที่เป็น Gas และให้คำมั่นสัญญากับโหนดเพื่อทำฉันทามติของ POS ให้เสร็จสมบูรณ์ 12% ของ Matic จะถูกใช้เป็นรางวัลเดิมพันประเด็นที่น่าสนใจมาก Lido บน Polygon กลายเป็น APY สูงสุด และฉันค้นหาใน DeFillama ซึ่งเป็นคู่การซื้อขาย MATIC ในบรรดาคู่การซื้อขายที่มี TVL สูงกว่า $10 ล้าน stMatic เกี่ยวข้องกับสี่ ซึ่งเป็นผลที่ตามมาโดยตรงจากผลกระทบนี้

Solana

อาจเป็นไปได้ว่าการครอบงำของ Polygon LSD ในปัจจุบันและอนาคตของ Lido

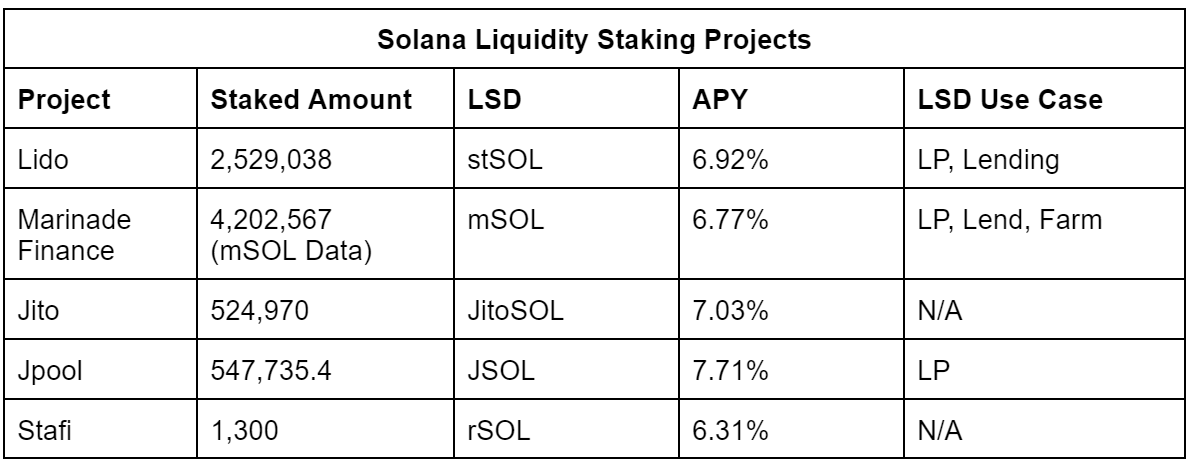

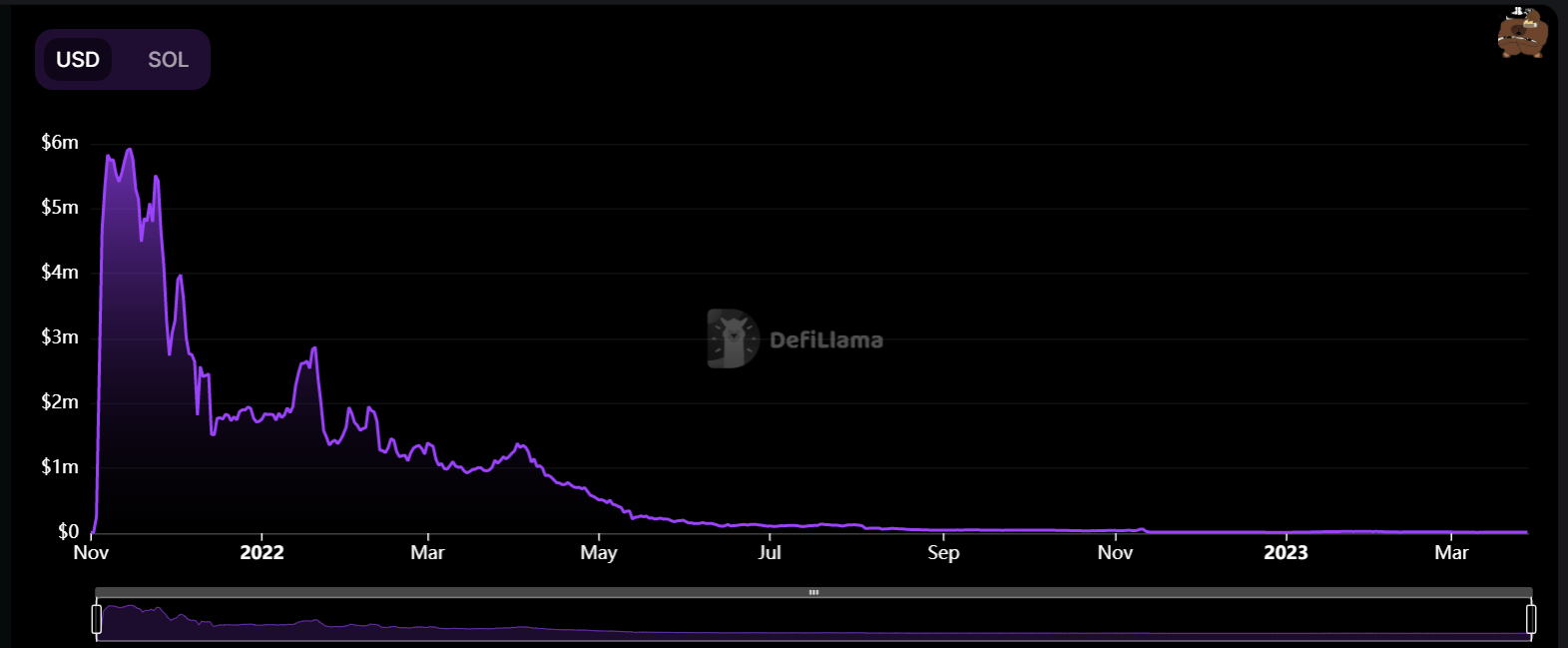

อัตราการจำนำเครือข่ายของ Solana คือ 70.75% และอัตราผลตอบแทนเฉลี่ยต่อปีจากการจำนำคือ 70.75% Solana มีผู้ตรวจสอบ 3165 ราย และผู้ตรวจสอบที่มีจำนวนผู้รับมอบสิทธิ์มากที่สุดคิดเป็นเพียง 2.86% ของจำนวนเงินจำนำทั้งหมดในระหว่างกระบวนการทางสถิติ TVL ของ aSOL, Eversol, Socean และโครงการ LSD อื่นๆ ได้ลดลงตั้งแต่วันที่ 22 พฤษภาคม และบัญชี Twitter นั้นถูกยกเลิกและไม่พบตอนจบน่าอาย

Cardano

ผู้เข้ามาใหม่นำโดย Stader อาจนำการพัฒนาใหม่มาสู่ Solana LSD

อัตราการเดิมพันปัจจุบันของ Cardano คือ 68.73% และผลตอบแทนเฉลี่ยต่อปีจากการเดิมพันคือ 3.26% ลดลง 7.1% นับตั้งแต่รายงานระบบนิเวศวิทยา Cardano ครั้งล่าสุดของฉัน (18 ธันวาคม: 74.05%) แต่ TVL กำลังจะทำลายสถิติ ADA จากระดับสูงสุดก่อนหน้านี้สถาปัตยกรรมทางเทคนิคพิเศษของ Cardano ทำให้ LSD พัฒนาในระบบนิเวศได้ยาก

ADA จะไม่ถูกล็อกเป็นระยะเวลาหนึ่งหรือจำเป็นต้องโอนไปยังกลุ่มการขุดในระหว่างระยะเวลาจำนำ หลังจากที่ผู้ใช้ให้คำมั่นสัญญากับ SPO แล้ว SPO จะไม่สามารถแตะต้องทรัพย์สินของคุณได้ และค่าธรรมเนียมจะถูกหักออกจากรางวัลทั้งหมดที่เกิดจากกลุ่มคำมั่นสัญญา ซึ่งหมายความว่าคำมั่นสัญญาของ Cardano ไม่เพียงแต่เป็นการไม่ดูแลเท่านั้น แต่ยังมีความยืดหยุ่นอีกด้วย และผู้ใช้ยังสามารถชำระเงินในขณะที่เดิมพันหรือใช้ในบริการ DeFi เช่น หลักประกัน iUSD

Avanlanche

อีกประเด็นหนึ่งคือ Cardano จะไม่ถูกยึด และทรัพย์สินของผู้ใช้จะไม่สูญหายเนื่องจากพฤติกรรมที่ไม่เหมาะสมของ SPO เมื่อการดำเนินการ SPO ผิดพลาด เครือข่ายจะยกเลิกรางวัลของยุคนี้ และการปฏิเสธรางวัลที่เกิดจากความผิดพลาดหลายครั้งจะทำให้ผู้ใช้ออกจากกลุ่มการขุดที่ไม่เหมาะสมนี้ อย่างไรก็ตาม อัตราเฉลี่ยต่อปีของผู้ดำเนินการ Cardano คือ 4.99% ซึ่งสูงกว่าผู้ใช้เดิมพันทั่วไปประมาณ 35% สิ่งนี้ดึงดูดผู้ใช้จำนวนมากให้ทำ SPO โดยตรง และเกณฑ์ต่ำ ปัจจุบันมีกลุ่มเดิมพัน 3,206 กลุ่ม

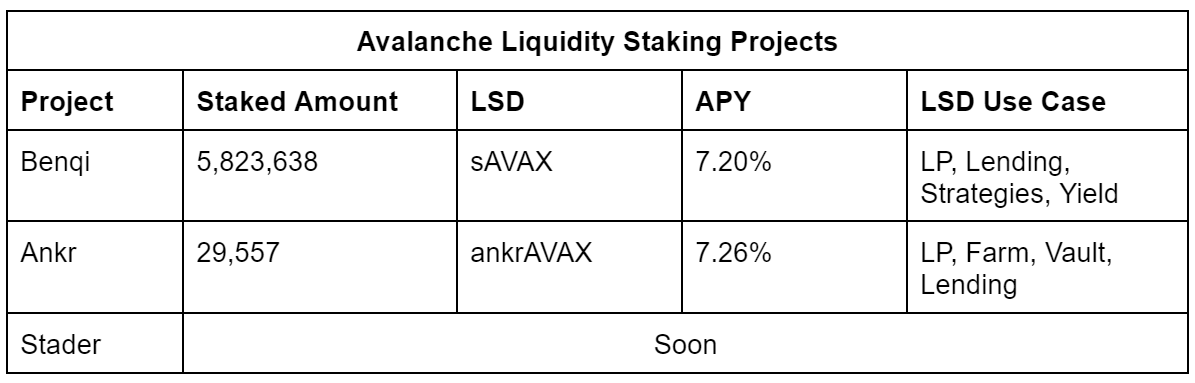

อัตราจำนำเครือข่ายของ Avanlance อยู่ที่ 62.05% และผลตอบแทนเฉลี่ยต่อปีอยู่ที่ 8.48% สถาปัตยกรรมทางเทคนิคของ Avanlanche คือเครือข่ายหลักแบ่งออกเป็น

C Chain (Contract Chain): แพลตฟอร์มสัญญาอัจฉริยะสำหรับแอปพลิเคชัน

P chain (platform chain): ใช้สำหรับการจำนำและการมอบหมาย AVAX โดยใช้เทคโนโลยี UTXO

X chain (ห่วงโซ่การทำธุรกรรม): เครือข่ายที่ใช้ในการโอนเงินโดยมีค่าธรรมเนียมการโอนคงที่

วิธีเริ่มต้นสำหรับผู้ใช้ที่ไม่ใช่ด้านเทคนิคในการเข้าร่วมการรักษาความปลอดภัยแบบลูกโซ่คือศูนย์จำนำบน Avalanche Wallet การเดิมพันผ่านสถานที่นี้เกี่ยวข้องกับการใช้โซ่ P และล็อค AVAX เท่านั้น หลังจากล็อคแล้ว จะใช้เวลา 21 วันในการแก้ไขคำสัญญา หลังจากมอบสิทธิ์ AVAX แล้ว รางวัลการยืนยันจะถูกสะสมไปยังที่อยู่ P-chain ที่คุณให้ไว้ ดังนั้นสิ่งที่โครงการ LSD ต้องทำคือใช้สินทรัพย์ทางเลือกในห่วงโซ่ C เพื่อออกสินทรัพย์ทางเลือกสังเคราะห์สำหรับตำแหน่งจำนำ ดังนั้นจึงมีปัญหาทางเทคนิคบางประการในเรื่องนี้ และจำเป็นต้องมีสัญญาการออกแบบ LSD เพื่อเชื่อมต่อ AVAX ของสาย P และ LSD ของสาย C ฉันพบโครงการ LSD เพียงสองโครงการเท่านั้น ซึ่ง sAVAX ของ Benqi เป็นผู้นำที่เด็ดขาด

Benqi ผู้นำ LSD ครอบครอง 1.7% ของ AVAX ที่หมุนเวียน และ sAVAX มีสภาพคล่องสูง ไม่ว่าจะเป็นการให้ยืม (การให้ยืมแบบหมุนเวียนช่วยเพิ่มผลตอบแทน) LP และผลิตภัณฑ์ DeFi อื่น ๆ ค่อนข้างมาก

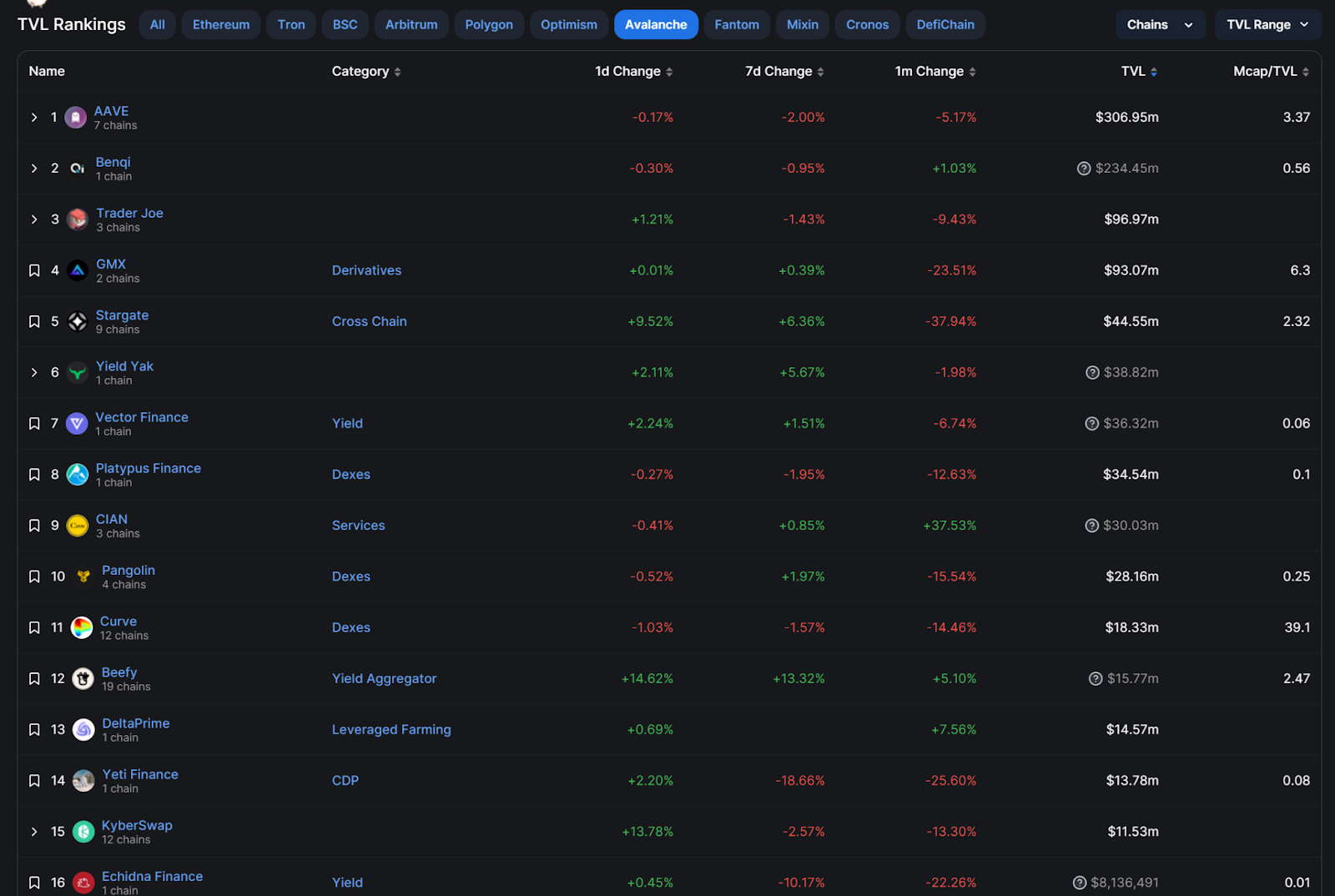

อย่างไรก็ตาม DeFi ของ Avanlanche กำลังพัฒนาดีขึ้น นอกจาก Wonderland ที่ราคา 635.75 ดอลลาร์แล้ว TVL ก็อยู่ใกล้ที่ 830.91 ดอลลาร์เช่นกัน พบผลิตภัณฑ์ DeFi ต่างๆ ได้ใน Avanlanche แนวการแข่งขัน DeFi ของ Avalance มีจุดเด่นที่ไม่เหมือนใคร: AAVE, Curve และ Beefy จาก 15 อันดับแรกของ DeFi เป็นผู้เข้าแข่งขัน โดยในจำนวนนี้ AAVE ครองส่วนแบ่งตลาดโดยตรงถึง 36.95% และ Bneqi ผู้ให้ยืมดั้งเดิมได้พัฒนามาตราส่วนธุรกิจที่หลากหลายและน้อยกว่า AAVE 80% ของทั้งหมด ขณะที่ GMX เชิงนิเวศวิทยาของตัวเอง Stargate เลือกการพัฒนาแบบหลายเชน และยังเฟื่องฟูในเชนอื่นๆ เช่น GMX ซึ่งกลายเป็นเจ้าแห่งอนุญาโตตุลาการโดยตรง คิดเป็น 32.96% และ TVL น้อยกว่า 100 M และการพัฒนาผิดพลาด ความแตกต่างของ TVL ระหว่าง GMX และ Stargate นั้นมากกว่าครึ่งแต่ทำไมมี LSD น้อยจัง? นอกเหนือจากเหตุผลทางเทคนิคแล้วภูมิทัศน์ของ DeFi อาจเป็นปัจจัยที่มีอิทธิพลเช่นกัน

หากคุณต้องการทราบกลไกการจำนำเฉพาะของ Avanlanche โปรดไปที่ที่นี่。

Polkadot

ที่นี่

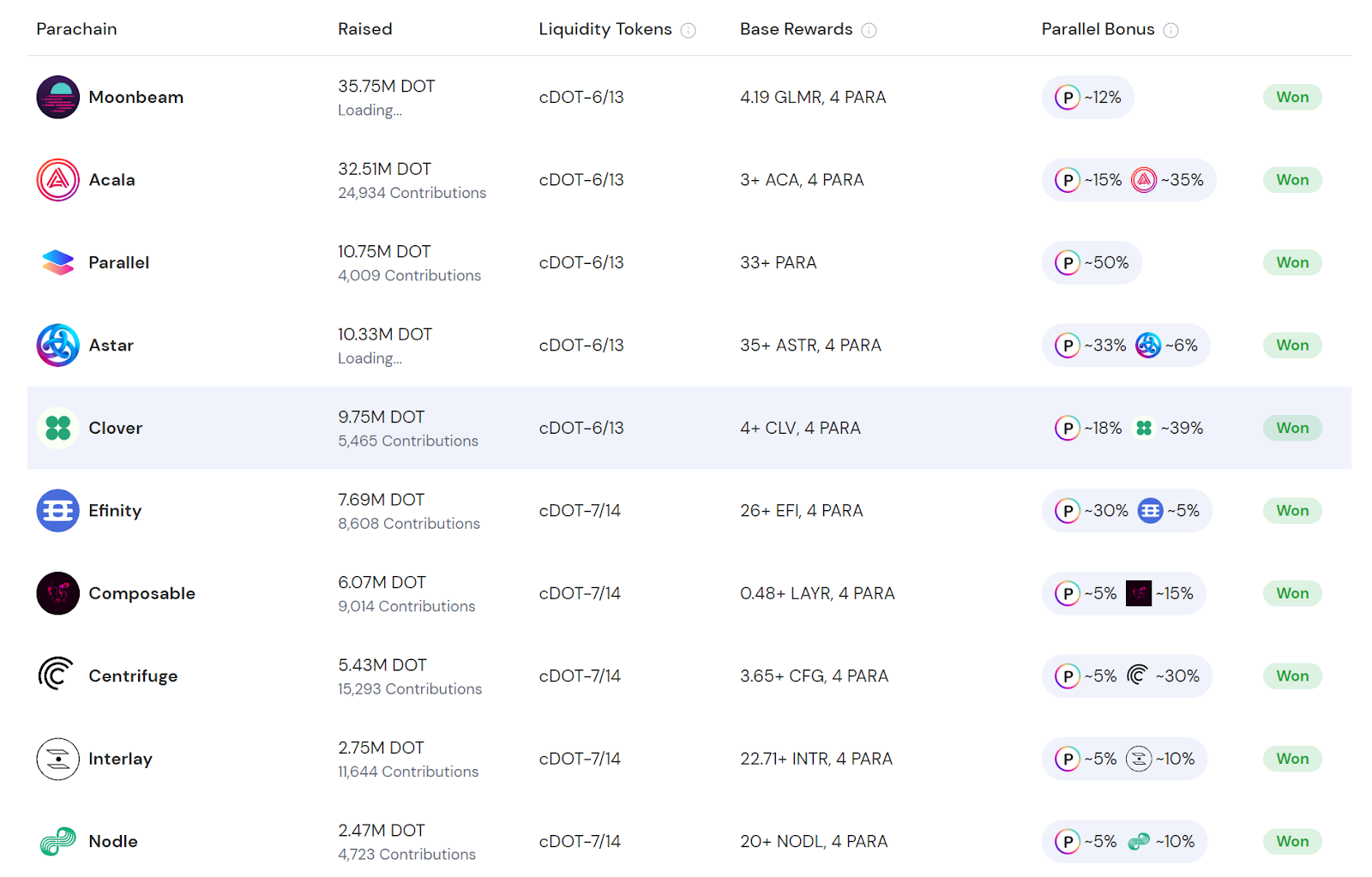

อัตราการจำนำของ Polkadot คือ 47.05% การจำนำผลตอบแทนต่อปีคือ 15.29% และการจำนำถูกล็อคเป็นเวลา 28 วัน กลไกฉันทามติของ Polkadot คือ NPOS (Nominated Proof of Stake) ซึ่งมีหน้าที่ 2 อย่าง ได้แก่ ผู้ตรวจสอบและผู้เสนอ ผู้ตรวจสอบจำเป็นต้องเรียกใช้โหนดการตรวจสอบ และผู้เสนอชื่อจะได้รับรายได้จากการเลือกผู้ตรวจสอบที่ยอดเยี่ยม และให้คำมั่นว่า DOT จะสนับสนุนงานของผู้ตรวจสอบในขณะที่ปกป้อง เครือข่าย หากผู้ตรวจสอบที่ได้รับการเสนอชื่อปฏิบัติตามกฎของเครือข่ายเพื่อรักษาความปลอดภัยของเครือข่าย ผู้ได้รับการเสนอชื่อสามารถแบ่งปันรางวัลการเดิมพันที่พวกเขาสร้างขึ้นได้ ในทางกลับกัน หากผู้ตรวจสอบประพฤติตัวไม่เหมาะสม ผู้ตรวจสอบจะถูกปรับและผู้ใช้จะเสียรางวัล DOTคุณสมบัติอีกอย่างของ PolkaDot คือกลไกการประมูลช่องใส่การ์ด: ช่วยให้บล็อกเชนเฉพาะหลายตัวสื่อสารกันในสภาพแวดล้อมที่ปลอดภัยและไว้ใจไม่ได้ จึงบรรลุความสามารถในการปรับขนาดบล็อกเชน พาราเชนเชื่อมต่อกับรีเลย์เชน ซึ่งต้องใช้สล็อตพาราเชน เข้าใจง่ายๆ คือ รีเลย์เชนคือซ็อกเก็ต ส่วนพาราเชนคือเครื่องใช้ไฟฟ้า รูซ็อกเก็ตที่มีจำกัดจำเป็นต้องผ่านการประมูล ดังนั้นโครงการจึงคิดค้น Crowdloan (PLO) ขึ้นมา อย่างไรก็ตาม โครงการที่ไม่ได้เข้าร่วมการประมูลก็สามารถใช้กลไก Parathread ได้เช่นกัน เมื่อเทียบกับ parachain ข้อแตกต่างคือต้องชำระเงินตามการใช้งานจริง และ parachain นั้นใช้งานได้ฟรีไม่จำกัด ภาพด้านล่างแสดงกรณีของ PLO เนื่องจากการมีอยู่ของ Crowdloan

ในแง่ของผลตอบแทน LSD ยังไม่น่าดึงดูดเพียงพอ และ DeFi จำนวนมากถูกสร้างขึ้นโดยใช้ PLO

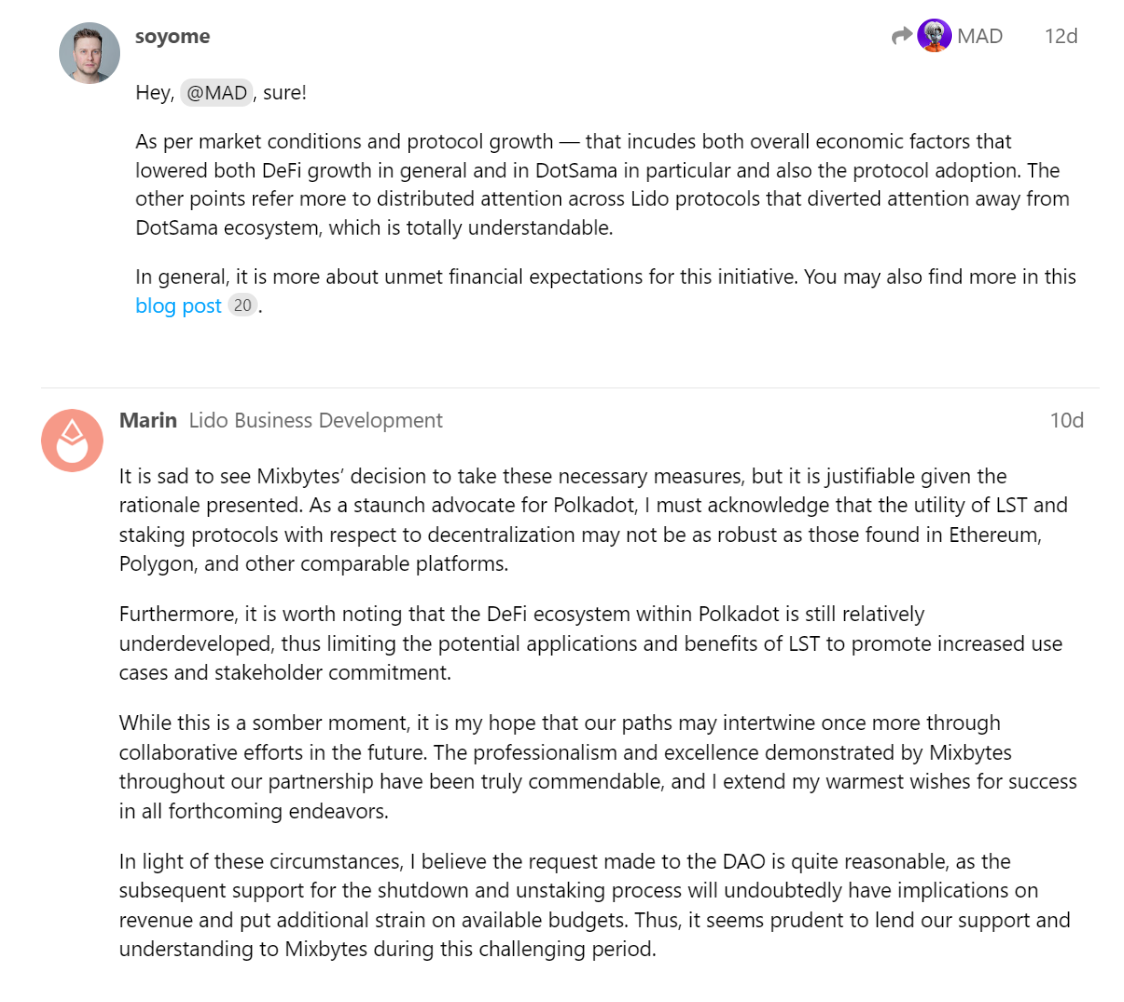

Lido ระงับเงินฝากจำนำ Polkadot และ KSM อย่างเป็นทางการในวันที่ 15 มีนาคม ฉันได้ตรวจสอบข้อเสนอในเวลานั้นและผู้ริเริ่มข้อเสนอ soyome (หัวหน้าของ MixBytes หุ้นส่วนของ Lido) และ Marin (BD ของ Lido) แสดงความคิดเห็นดังนี้:《State of Polkadot Q4 2022 》อาจหมายความว่าระบบนิเวศ DeFi ภายใน Polkadot ยังค่อนข้างด้อยพัฒนา ซึ่งจำกัดการใช้งานและประโยชน์ของ LSD และมีปัญหาด้านตลาดและการดำเนินงาน เนื่องจากระบบนิเวศของ PolakaDot นั้นค่อนข้างซับซ้อน ฉันจึงทำการวิจัยอย่างง่ายๆ เกี่ยวกับมันเท่านั้น และไม่ได้เจาะลึกถึงสาเหตุของการพัฒนาระบบนิเวศของมันมากเกินไป แต่เมื่อรวบรวมข้อมูล บทความมากมายเกี่ยวกับ Polakadot และ crowdlending ถูกตีพิมพ์ใน 21 และ 22 และเมื่อเร็ว ๆ นี้มีบทความใหม่น้อยมาก รายงานเผยแพร่โดย Messari

Aptos

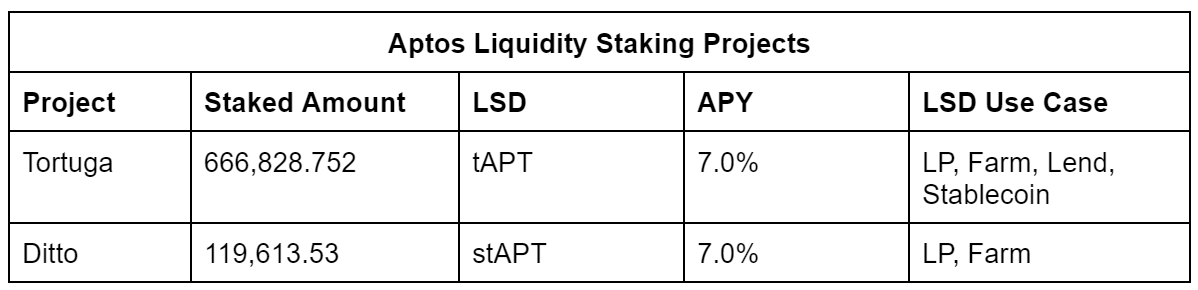

บางทีมันอาจจะให้คำตอบบางอย่างแก่เราตามข้อมูลจาก Aptos Explorer การจำนำโหนดของ Aptos คิดเป็น 82.5% ของอุปทาน $APT และรายได้เฉลี่ยต่อปีของผู้ขุดอยู่ที่ประมาณ 7% ในระหว่างการสืบสวน เราพบโครงการ LSD ที่เกี่ยวข้องกับ Aptos มากมาย แต่ส่วนใหญ่ของ หลังจากเดือนตุลาคม 2022 การอัปเดต Twitter ของพวกเขาจะหยุดลง และเว็บไซต์ของโครงการเหล่านี้จะไม่เปิดให้บริการในขณะนี้ และ TVL ปัจจุบันของ Aptos DeFi มีราคาเพียง 37 ล้านดอลลาร์ และข้อตกลงพื้นฐาน LSD ที่สอดคล้องกันก็ยิ่งน้อยลงไปอีก และจากกลุ่ม LP ของ Pancake และ Liquid Swap ค่า APY ของพูลสูงสุดสามารถสูงถึง 10% + (whUSDC-tAPT LP) และส่วนที่เหลือต่ำกว่า 2.78% แต่

ตามทฤษฎีแล้ว ทั้ง Aptos และ Sui อยู่ในระบบนิเวศของ Move โปรโตคอล LSD สามารถจัดการทั้ง APT และ SUI ได้ เมนเน็ตของ Sui จะเปิดตัวในไตรมาสที่ 2 จะส่งเสริมการพัฒนา DeFi ของระบบนิเวศของ Move และสร้างโครงสร้างพื้นฐานและกรณีการใช้งานเพิ่มเติมสำหรับ แอลเอสดี ? ? เป็นสิ่งที่รอคอย

สรุป

สรุป1. จากการวางแผนแบบหลายห่วงโซ่ของ Lido, Stader, Bifrost และ LSD อื่น ๆ จะเห็นได้ว่าการทำธุรกิจแบบหลายห่วงโซ่ของ LSD เป็นแนวโน้มที่หลีกเลี่ยงไม่ได้ เฉพาะจากมุมมองของการรับจำนำเท่านั้น ตราบใดที่กลไก POS ถูกใช้ , LSD สามารถสร้างได้ในทางทฤษฎี อย่างไรก็ตาม จากกรณีของโครงการข้างต้น

โครงการ LSD ส่วนใหญ่ควรเริ่มต้นด้วยห่วงโซ่หรือระบบนิเวศน์บางอย่างก่อนที่จะเริ่มทำเครือข่ายสาธารณะอื่นๆ

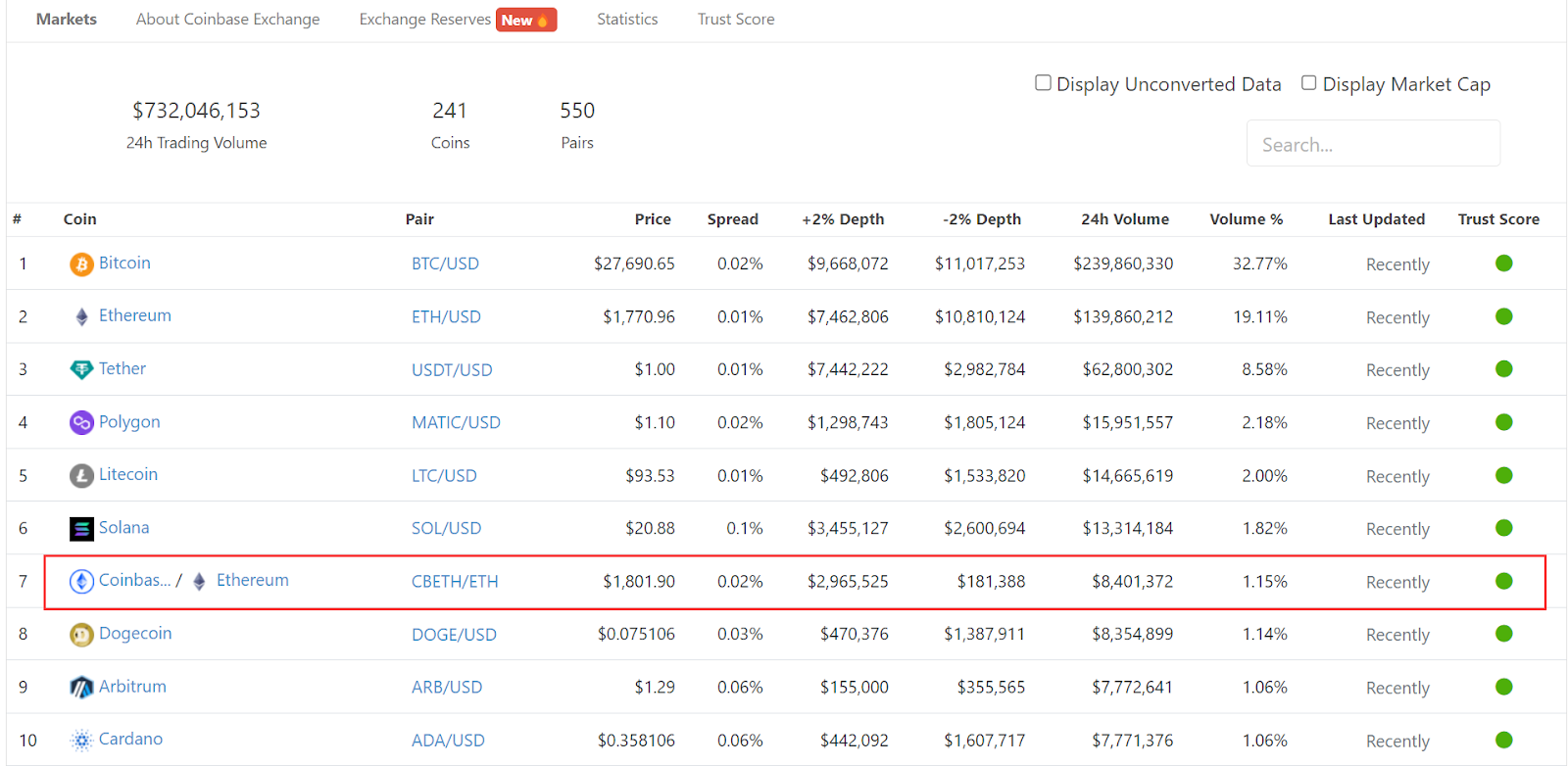

2. ปัญหาด้านการปฏิบัติงาน: ในกระบวนการจัดระเบียบข้อมูล ประสบการณ์ UI ของโครงการ LSD หลายโครงการแย่มาก นอกจากนี้ LSD ของหลายโครงการยังมี Use Case จำนวนมาก แต่ไม่ได้บอกผู้ใช้ถึงวิธีใช้งาน และ UX โดยรวม ประสบการณ์แย่มาก3. CEX เป็นปัจจัยที่ไม่ควรมองข้าม

ในฐานะพอร์ทัลทราฟฟิกที่ใหญ่ที่สุดของ Web3 ยังเป็นแหล่งรวบรวมโทเค็นต่างๆ อีกด้วย ยกตัวอย่าง Coinbase ปริมาณธุรกรรมที่ CBETH-ETH นำมาให้เพียงอย่างเดียวนั้นสูงถึง 8.4 ล้านดอลลาร์ นอกจากสภาพคล่องแล้วสิ่งนี้ยังส่งผลต่อโทเค็นอีกด้วย ความสนใจของนักเก็งกำไรในเส้นทาง LSD ความสนใจมากขึ้น4. การระงับโปรโตคอล LSD บางตัวหลังจากเปิดตัวเครือข่ายหลักของ Aptos ยังเตือนให้เราทราบด้วย โปรดใส่ใจกับโปรโตคอล LSD ในระบบนิเวศ L1s/L2s ใหม่ที่จะเปิดตัวในเร็วๆ นี้เลือกโครงการที่ยั่งยืน

ลงทุนสินทรัพย์ของคุณเอง5. FVM เพิ่งเปิดตัวไปเมื่อเร็วๆ นี้ และโซลูชัน LSD เช่น SFT, MFIL, STFIL และ HashMix ก็พร้อมที่จะออนไลน์แล้ว

LSD ได้กลายเป็นโปรโตคอล DeFi ที่จำเป็นสำหรับเครือข่ายสาธารณะ6. การรับส่วนแบ่งรางวัลผ่าน LSD หรือการเข้าถึง LSD Pool และผลิตภัณฑ์ LSD DeFi สามารถสร้างรายได้จริง สำหรับ DeFi ที่ครอบคลุม

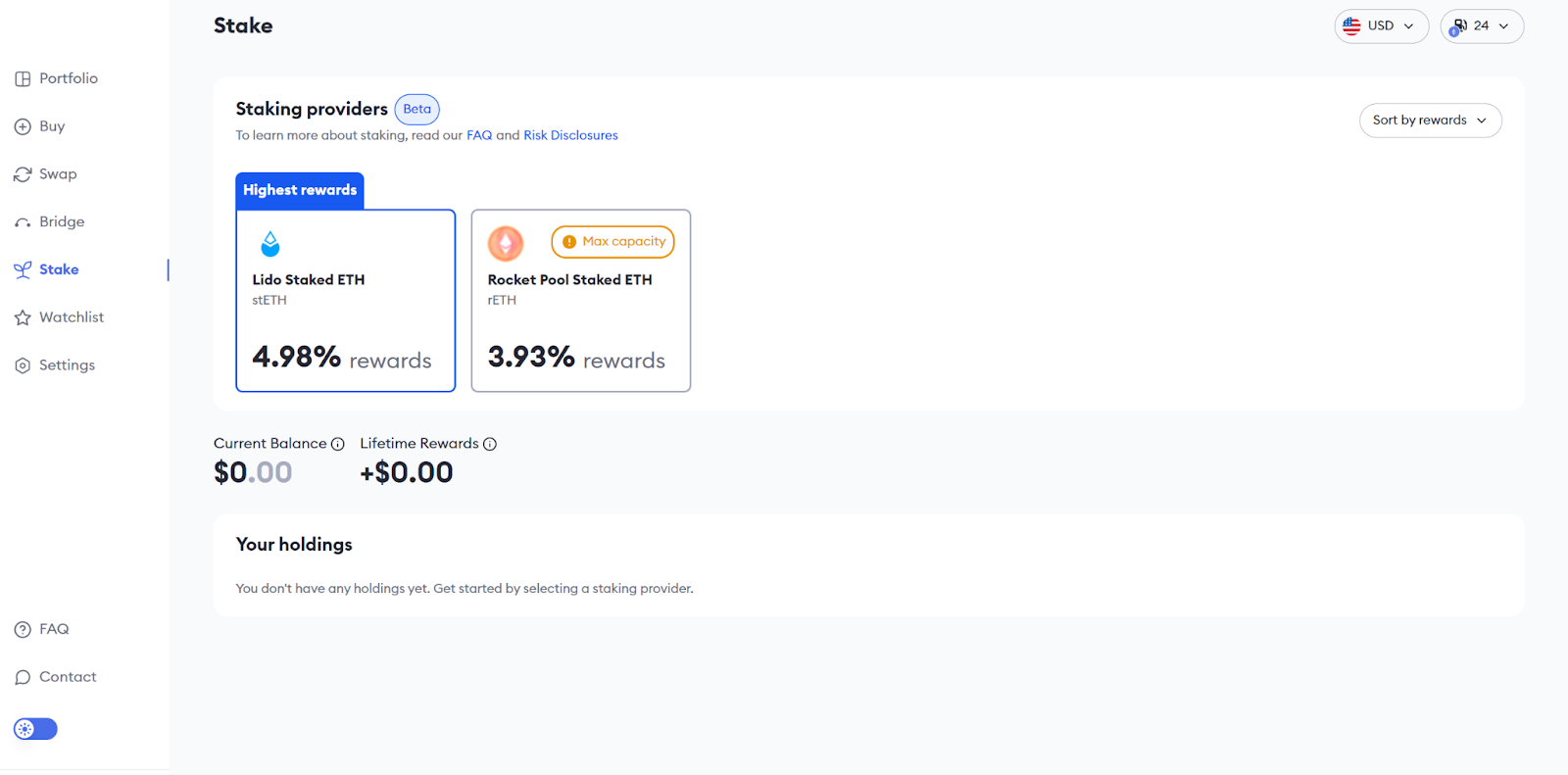

ธุรกิจ LSD อาจกลายเป็นจุดเติบโตของรายได้ใหม่สำหรับ DeFi แบบเก่า7. MetaMask ประกาศเปิดฟังก์ชั่นจำนำ Ethereum ในเดือนมกราคมซึ่งปัจจุบันเป็นรุ่นทดสอบเบต้า ใน Cosmos กระเป๋าเงิน Keplr เป็นทางเข้าสำหรับหลาย ๆ คนในการจำนำทรัพย์สิน Cardano ยังมีทางเข้ากระเป๋าเงินที่คล้ายกันสำหรับการจำนำ SPO BD ของโครงการ LSDFi อาจสามารถ

ใส่พันธมิตรด้านกระเป๋าเงิน

การอภิปราย (มุมมองส่วนตัวของพื้นที่)โดยไม่คำนึงถึงการวิเคราะห์ต่าง ๆ ที่ฉันได้ทำมาก่อน มันขึ้นอยู่กับประเด็นเดียว: ผู้ถือครองจะได้รับผลตอบแทนที่มั่นคงและสูงหรือไม่? แต่มองข้ามไปข้อหนึ่งคือความถูกต้องของการรับจำนำ การมีส่วนร่วมในการกำกับดูแลและการรักษาความปลอดภัยของเครือข่าย

วัตถุประสงค์หลักของ POS หรือกลไก POS ที่ปรับเปลี่ยนคือการรักษาความปลอดภัยของเครือข่าย แต่ในความเป็นจริง การกระจายแบบกระจายอำนาจของโหนดและการกระจายพื้นฐานของโทเค็นได้รับการพิจารณาในลิงค์ทางการเงินเริ่มต้นของเครือข่ายสาธารณะส่วนใหญ่และขั้นตอนการทดสอบเครือข่าย ประการที่สองคือการกำกับดูแล โซลูชั่น Cosmos' Stride และ Quicksilver การลงคะแนนเสียงแทนตัวแทนเป็นกรณีที่ดี ได้รับประโยชน์ และมีส่วนร่วมในการกำกับดูแล

LSD จำเป็นต้องรวมกันเพื่อรับรายได้หรือไม่? ฉันไม่สามารถตอบได้โดยตรง แต่มีสองกรณี:

① ในประเทศเล็กๆ ในแอฟริกาบางประเทศที่มีสิ่งอำนวยความสะดวกทางการเงินล้าหลัง สิ่งที่คุณควรกังวลคืออัตราเงินเฟ้อ แต่ถ้าคุณอยู่ใน Wall Street คุณจะคิดมากขึ้นเกี่ยวกับการสร้างเครื่องมือทางการเงินและผลิตภัณฑ์ทางการเงินที่สูงขึ้น② มีโทเค็นจำนวนมากที่มียูทิลิตี้เล็กน้อยในตลาดซึ่งสามารถคำนวณได้เกินขนาดประมาณ 100 พันล้าน เบื้องหลัง LSD เป็นสกุลเงินที่มีค่ามากเป็นอันดับสองในโลกเข้ารหัส ETH ซึ่งสามารถดำเนินการพัฒนาผลิตภัณฑ์ได้มากขึ้นในแง่ของความเป็นจริง คุ้มค่าและมั่นคง ทำไมถึงทิ้ง LSD ที่เป็นตลาดใหญ่ไป?

ตอนนี้ตลาดหมี ETH FDV มีมูลค่ามากกว่า 200 พันล้านดอลลาร์สหรัฐ แล้วจินตนาการของ LSD จะยิ่งใหญ่แค่ไหน?

③ LSD ของ chain อื่นๆ จำเป็นหรือไม่? ได้ LSD สามารถส่งเสริมการจำนำเครือข่ายระบบนิเวศ ปรับปรุงความปลอดภัยของเครือข่าย และในขณะเดียวกันก็จัดหาสภาพคล่องให้กับ DeFi และส่งเสริมการพัฒนาของ DeFi ภายในระบบนิเวศผู้มีอิทธิพลมากที่สุดในการต่อสู้ LSD อาจเป็นผู้ดำเนินการโหนดและ CEX

สินทรัพย์เนทีฟของเครือข่ายที่ไม่ใช่ POS สามารถใช้เป็น LSD ได้หรือไม่ ฉันไม่พบกรณีที่เหมาะสม แต่ฉันมีความคิด ไม่จำเป็นต้องรักษาความปลอดภัยของเครือข่าย อาจเป็นไปได้ที่จะออกแบบโดยใช้สิทธิ์การกำกับดูแล หลังจาก Token ถูกล็อค มันจะกลายเป็น xToken xToken แสดงถึงการไถ่ถอนสินทรัพย์ หลังจากช่วงเวลาหนึ่งและสามารถผูกพันกับการกำกับดูแล หากข้อตกลงนี้กำหนดการกระจายรายได้ผ่านการกำกับดูแล ก็สามารถพัฒนาผลิตภัณฑ์โดยใช้ xToken เพื่อกำหนดรายได้และอื่นๆ

อ้างถึง:

อ้างถึง:

สถานะการเดิมพัน: รางวัลการเดิมพัน

สถานะของแต่ละโครงการเบราว์เซอร์ blockchain: Defilillam, เว็บไซต์อย่างเป็นทางการของเครือข่ายสาธารณะ, Twitter, Google

ข้อมูลโครงการ: ข้อมูลเว็บไซต์อย่างเป็นทางการของแต่ละโครงการ Coingecko

เอกสารอ้างอิงอื่นๆ: KOLs Thread, บล็อกและบทความต่างๆ