secondary title

1. Industry overview

The importance of stablecoins to the entire encryption market is self-evident, and it is also a barometer of bulls and bears to a large extent. In April-May 2022, the market value of stablecoins reached a peak of nearly 190 B, and then went down all the way. The current market value of stablecoins is 135 B. The market value of stablecoins reflects the flow of funds into and out of the market, in other words, the liquidity of the market, which is highly consistent with the bull-bear cycle of the entire market.

image description

Stablecoin market value (data source: DeFiLlama)

secondary title

2. Detailed explanation of OGV and OUSD

1. OGVIt is the governance and value accumulation token of the stable currency project Origin Dollar (OUSD) launched by the NFT trading platform Origin Protocol. OUSD initially launched on the Ethereum network in September 2020. Users can currentlyOrigin Dollar DAppUse USDT, USDC, DAI to mint or exchange OUSD (pegged 1:1 to USD) and earn yield in your wallet.

2.1 OUSD Value Capture

The OUSD smart contract will deploy the underlying stablecoins (USDT, USDC, DAI) to a set of diversified DEFI strategies (such as Compound, Aave, and Curve), and the generated income will automatically update each token holding through the rebase mechanism The balance in the recipient's wallet kept OUSD near $1. The protocol will adjust strategies to achieve high returns while diversifying risks. The rebase mechanism is triggered when a user interacts with the OUSD smart contract, and Chainlink Keepers ensures that rebase occurs at least once a day. The agreement will also obtain income by providing loans and market makers. In addition, a 0.25% exit fee will be charged when redeeming from the vault, which will be distributed to other OUSD holders, and users will receive a hybrid stablecoin in proportion to the three stablecoins currently in the vault.

2.2 OGV governance and value capture

Users pledge OGV to obtain veOGV with different proportional coefficients according to the quantity and unlocking time limit. veOGV can participate in the weekly DEFI strategy distribution weight voting, and the voting results are executed by Strategist multi-signature members on the chain. At the same time, 10% of all the value captured by OUSD will be distributed to stakers by repurchasing OGV in the market.

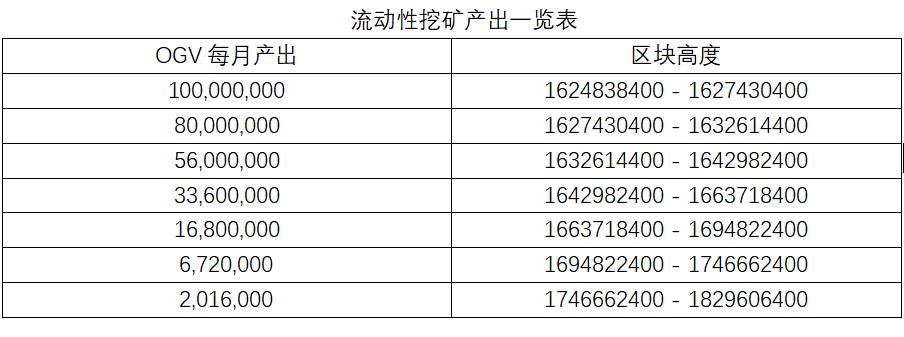

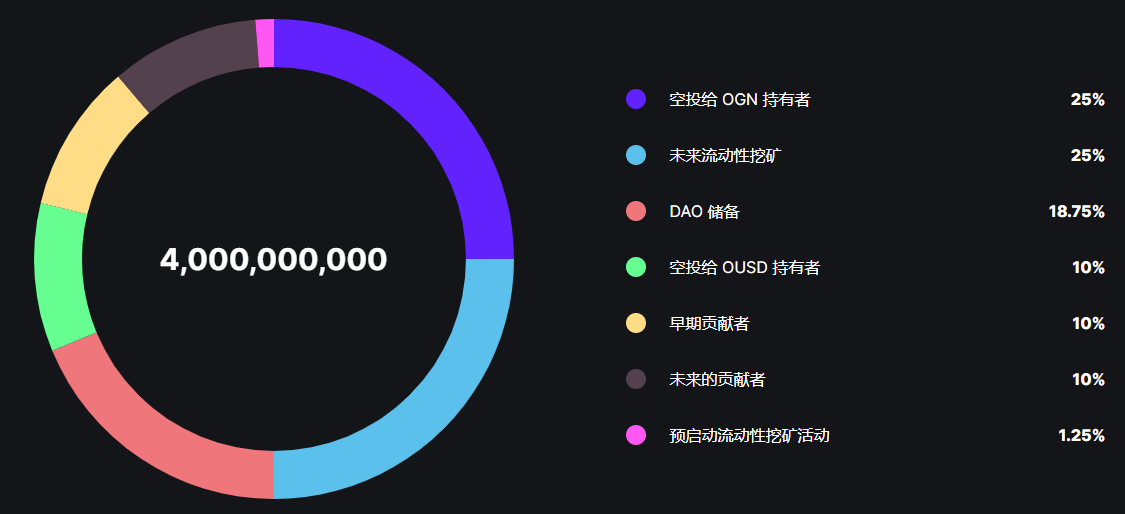

2.3 OGV Token Economics

image descriptionhttps://www.ousd.com/burn。

OGV allocation map

2.4 On-chain analysis of OUSD

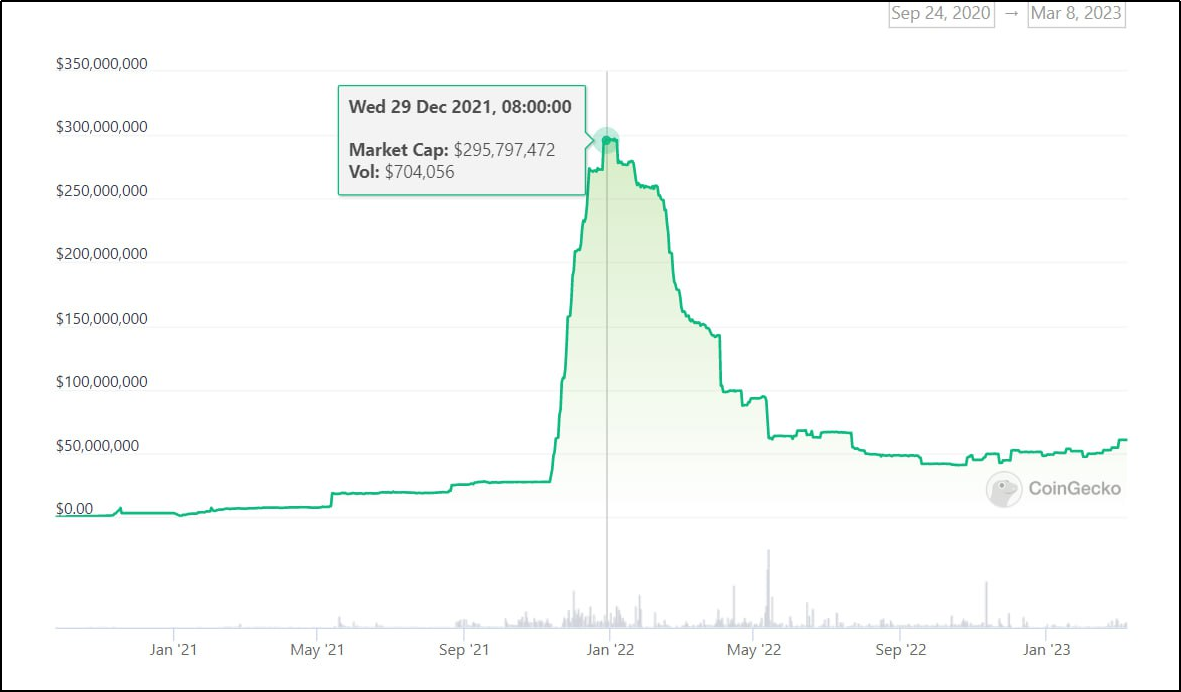

The value of OGV mainly depends on the application of OUSD, the following data comes from CoinGecko and Dune.

(1) Minting of OUSD

The overall trend is that the casting of OUSD is gradually increasing. The sudden increase in the middle part is that the project party launched a liquidity incentive activity at that time, and the casting volume was close to 300 million US dollars. It was also affected by the unanchor of UST and fell back to 40 million US dollars. The current OUSD casting volume It is 60.58 million US dollars.

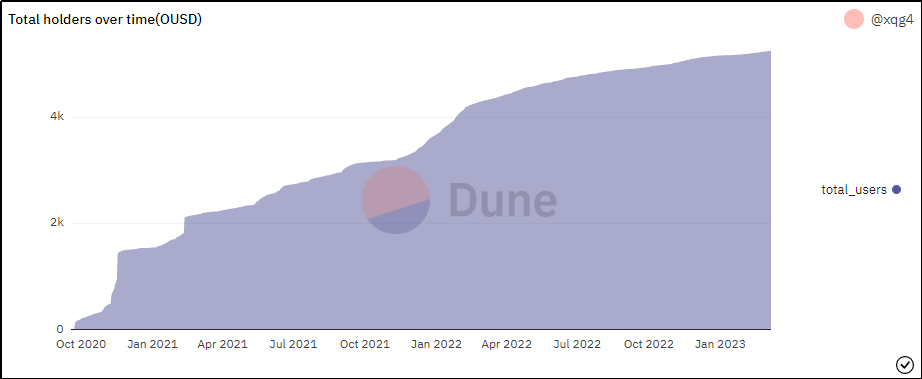

(2) Number of OUSD users

The current number of OUSD holding addresses is 2748, and the total number of users is 5252. The number of recent interactions on the chain is almost single digits per day. In comparison, TUSD currently has 47,000 currency-holding addresses and a total of 258,000 users. Recently, the number of interactions on the chain has exceeded 100 per day.

(3) Application of OUSD

secondary title

3. Competitive environment and horizontal comparison

3.1 Competitors

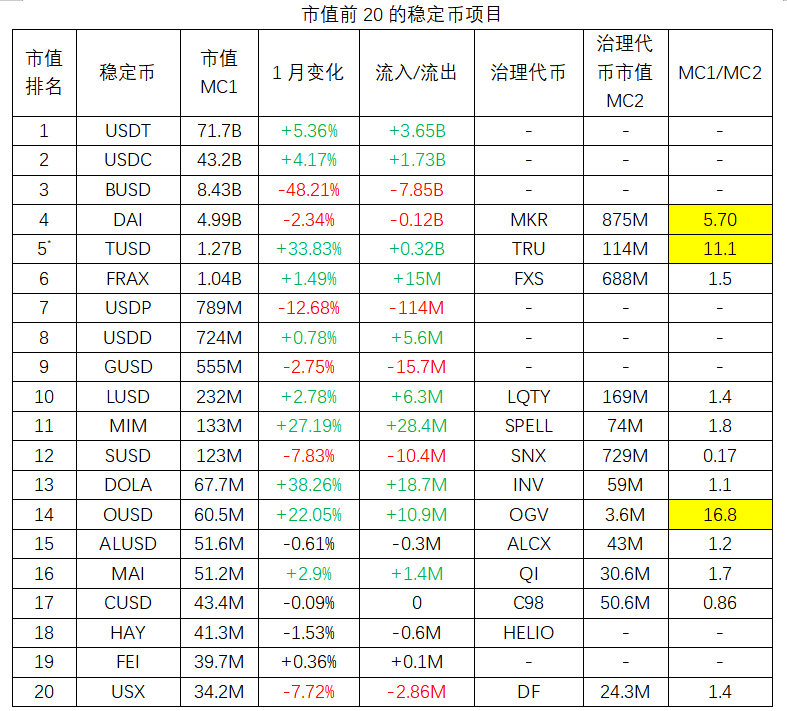

Considering that Binance chooses a stablecoin partner, it needs to meet two basic conditions: 1. The operation of the project is safe and stable; 2. A certain scale of use has been formed. Therefore, according to the DefiLlama data, excluding the unanchored stablecoins, we compiled a list of the current top stablecoin data in Table 2. It can be seen from the table that the BUSD outflow funds are mainly undertaken by USDT and USDC. At the same time, some stable currency projects have also achieved certain growth in absolute or relative value, such as TUSD, FRAX, USDD, LUSD, MIM, DOLA, OUSD. We choose stable currency projects with governance tokens to conduct in-depth research and try to find value coins from them.

Note: Strictly speaking, TRU is not the governance token of TUSD, both are only TrustToken products. The statistical date of the above data is March 8, 2023.

(1 )TUSD

TrueUSD (TUSD) is a 1: 1 dollar-anchored stablecoin launched by TrustToken, an American asset digitization platform. The U.S. dollar exists in the bank accounts of a number of trust companies that have signed custody agreements. are subject to audit.

According to on-chain data, from February 16 to February 24, Binance minted 180 million TUSD. TrustToken, which operates the dollar-pegged stablecoin TUSD, has been a partner of Binance since June 2019, a relationship that allows Binance to buy TUSD and convert it to fiat at zero fees.

From the above perspective, TUSD is indeed a very suitable partner for Binance, but it should be noted that strictly speaking, TUSD does not have a governance token, and the income of the stable currency is also owned by TrustToken. TRU does not capture value through TUSD, despite this, as a homologous TRU has risen by more than 240% since its peak of 0.042 on February 15th.

(2 )FRAX

FRAX was launched on the Ethereum mainnet in December 2020. It was previously a "partially algorithmic stablecoin", that is, partly backed by collateral, and partly supported by algorithms supplied by its governance token FXS. Historically, FRAX has not experienced serious unanchoring. At the end of February, the community voted and passed a governance proposal, setting the target collateralization rate (CR) of the FRAX stablecoin to 100%, removing the protocol’s algorithmic support for the stablecoin, and FRAX will become a fully collateralized stablecoin in the future. From the perspective of security and application scenarios, FRAX may also become a partner of Binance.

In addition, Frax Finance has developed a complete set of DeFi products, including FRAX, time-weighted average AMM Fraxswap, lending market Fraxlend, algorithmic market maker AMOs, encrypted native CPI stablecoin FPI, and cross-chain bridge Fraxferry. The Shanghai upgrade is approaching and Frax has launched the ETH liquid mortgage derivative fraxETH. There is no doubt that FXS is a high-quality currency, but its current market value is not low (CMC ranks 68), and compared with other projects, its growth potential is small.

(3 )LUSD

Liquity is a decentralized lending platform. The protocol will be launched on the Ethereum chain on April 5, 2021. Currently, it only supports Ethereum. Liquity has two native assets, one is the US dollar-pegged stablecoin LUSD, and the other is the governance token LQTY. On Liquity, users can deposit ETH and only pay a one-time fee to lend LUSD with no interest and no repayment time limit (minimum 110% mortgage rate is required). As of now, Liquity smart contracts have not caused a security incident.

Liquity itself has a high degree of decentralization, has not had any security issues, and continues to operate stably. The current LUSD stablecoin ecology is weak, and the usage scenarios are not rich enough, and the LQTY governance has just been launched. However, when LQTY was listed on Binance on February 28, its price doubled rapidly, which also largely indicates that Binance may cooperate with LUSD in the future, and correspondingly, LQTY will also have room for further rise.

(4 )MIM

abracadabra.money creates a decentralized stablecoin through staking innovation. These cryptocurrency-backed stablecoins aim to unlock liquidity in the decentralized finance (DeFi) space by minting liquid tokens based on the collateral of typically illiquid interest tokens (ibTKN). A stablecoin called Magic Internet Money (MIM) underpins the Abracadabra cryptocurrency ecosystem, while additional SPELL and sSPELL tokens help with governance and encourage market participation.

However, there are many controversies about MIM. Most stablecoins are backed by the same amount of fiat assets or other related assets, while MIM is only backed by a select group of digital assets, which brings certain risks to its stability. . During the crash of Terra, Abracadabra generated $12 million in bad debts, and MIM once dropped to $0.94. In addition, the project founder's former project wonderland promised a sustainable and profitable mechanism, but the project's native TIME token plummeted from more than $10,000 to $95.

Based on the above, it is less likely that Binance will choose MIM.

(5 )DOLA

Inverse Finance is a protocol that generates yields on stablecoins and continuously invests the yields in target tokens such as ETH. Inverse Finance creates a single capital-efficient lending pool based on the Anchor protocol combining synthetic credit and non-synthetic credit. In addition, Inverse Finance also issues the native synthetic/credit stablecoin DOLA on Anchor.

In the history of DOLA, there have been many unanchors of more than 2%. From this point of view, Binance is less likely to choose.

3.2 OUSD Competitive Advantages

(1) Safe and stable

OUSD is only as strong as the stablecoins that back it, and the protocol painstakingly evaluates each stablecoin through an in-depth stablecoin evaluation framework before adding it as a backing asset. The stablecoins currently supported by OUSD include USDT, USDC, and DAI, and new stablecoins may be added in the future. There is also the possibility of removing support if one and one of these stablecoins proves to be unreliable or puts OUSD holders' funds at risk. OUSD itself is like a stablecoin composed of a basket of mainstream stablecoins in the market. In theory, its security performance is more secure and stable than a single stablecoin.

In one case, during the USDT unanchor panic event last year, the project party used the governance process to publicly agree to temporarily withdraw from USDT. Projects also have the ability to act very quickly if there are liquidity issues among the supported stablecoins or if there are signs that they believe they are decoupling. The strategist role allows two multi-signature representatives to voluntarily exit a problematic stablecoin within a few minutes. It is important that strategists cannot withdraw funds or use strategies that have not been whitelisted to keep funds safe.

(2) Automatic interest generation

Compared with other stablecoins stored in the wallet, OUSD can automatically generate interest (current annualized rate of 4.53%), which releases the liquidity of stablecoins.

(3) OGV is cost-effective

Among the governance tokens of the stablecoin projects studied above, OGV has the lowest market value, only 4.8 million US dollars; at the same time, the ratio of the market value of stablecoins to the market value of governance tokens is the largest, as high as 16.8. Comprehensive comparison, OGV is the most cost-effective.

(4) Strong team strength

official websiteofficial websitesecondary title

4. Risk warning

1. Smart Contract Risks

Although smart contracts have been audited by multiple security companies, logical errors may still occur, resulting in the loss of investors' funds. At the beginning of the project, on November 7, 2020, $7 million was stolen by hackers due to a previously undetected reentrancy vulnerability. After the project proposed a compensation plan and completed multiple audits and security upgrades, it restarted in December of that year.

2. Third-party platform risks

Part of OUSD’s gains are built on top of other DeFi platforms, such as Aave, Compound, and Curve, which all have the added risk of adding additional smart contracts.

3. Stablecoin risks

secondary title

V. Conclusion

Overall, stablecoins will be a long-term narrative, and the exit of BUSD is bound to flow to other stablecoin projects. On the whole, OUSD has its own Defi attributes, and further reduces risks through a variety of safe and reliable stablecoins. The project team is strong. Although the current scale is less than 100 million US dollars and there are few application scenarios, it will have a lot of growth potential in the future. As the governance token of OUSD, OGV has the ability to capture value, which is seriously underestimated. Even at present, compared with other governance tokens, there is room for growth of 10 times. In addition, OGN, the big brother of OGV, has been launched on major exchanges. In the future, as the market discovers the value of OUSD, and if Binance can reach a cooperation with OUSD, then OGV will have great potential.

Investment is risky, the above report is for reference only, NFA, DYOR!