深入解讀EigenLayer白皮書:共識層的擴容,LSD重要發展方向

白皮書白皮書。

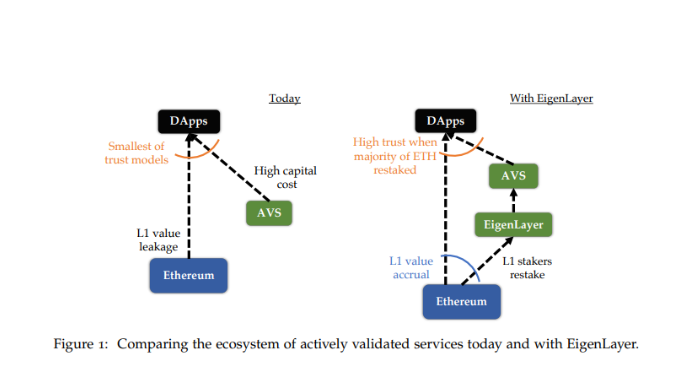

Eigenlayer 是建立在以太坊上的再質押(Re-staking)協議,以太坊節點可以通過EigenLayer 將質押的ETH 進行二次質押來獲得額外收益,同時也可將以太坊共識層效用向外傳遞到各類中間件、數據可用性層、側鍊等協議,讓它們以更低的成本享受到以太坊級別的安全性。

一級標題

一級標題

一級標題

1. 碎片化的可信網絡

目前,數以千計的去中心化應用(DApps)構建在以太坊之上,整個生態也在不斷發展壯大。一個可信的去中心化底層網絡價值基礎源於:開發者不需要任何聲譽或信任,就可以讓其開發出來的DApp 被任何信任該底層區塊鏈並驗證的人採用。 Rollup 是以太坊性能擴展的重要方向:不使用EVM 執行交易,最終還是回到以太坊進行結算。雖然不同的Layer 2 採用不同的安全驗證方式,但是人們信任基於以太坊的Layer 2 。

然而,任何不在EVM 之上部署或證明的模塊,都無法利用以太坊可信底層的安全性,比如基於新共識協議的側鏈、數據可用層(DA)、新的虛擬機、預言機和可信執行環境等等,一般來說,它們需要搭建自己獨立的AVS(主動驗證系統),為自己的系統安全負責。目前的AVS 生態存在一些缺點:

正文

一級標題

正文

正文

再質押

正文

正文

正文

正文

正文

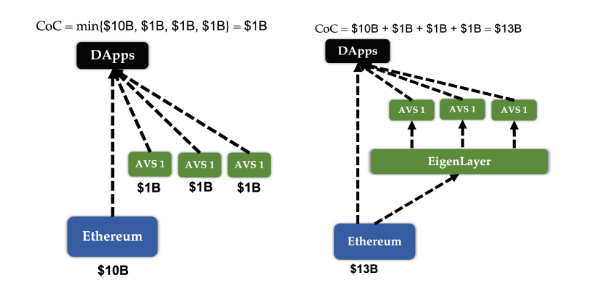

EigenLayer 上的AVS 可以租用以太坊驗證者的安全服務,有以下好處:

在EigenLayer 的安全模式增加了破壞的成本(130 億美元)

二級標題

二級標題

二級標題

2.1 支持多種質押模式EigenLayer 提供多種質押方式類似於Lido 的流動性質押(Liquid Staking)以及超流動性質押(Superfluid Staking),其中超流動性質押可以允許LP 對的質押,具體而言:

直接質押,將質押在以太坊上的ETH 直接質押到EigenLayer 上

LSD 質押,已經質押在Lido 或Rocket Pool 的資產再次質押到EigenLayer 上

LSD LP 質押二級標題

二級標題

二級標題

2.2 委託人一級標題

信任模式一級標題

二級標題

3.1 罰沒機制設計

二級標題

3.2 不使用同質化權證

二級標題

二級標題

二級標題

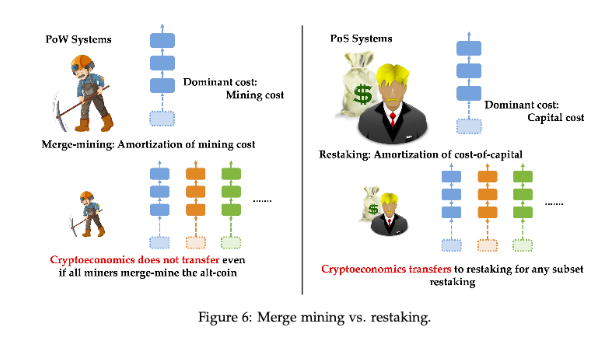

3.3 與合併挖礦的異同

二級標題

二級標題

3.4 風險管理

二級標題

3.4 風險管理

EigenLayer 中存在兩類風險:

許多運營商可能串通同時攻擊一組AVS;

AVS 可能存在非預期的罰沒漏洞(slashing vulnerabilities),如誠實節點可能被罰沒。

3.4.1 運營商串通在現實中,只有一部分運營商選擇加入給定的AVS,其中一些運營商可能串通從一組AVS 中竊取資金,然後會出現複雜的攻擊。

一種解決方案是限制任何特定AVS 的破壞收益。

這個解決方案取決於那些AVS 的設計者。例如,

橋可以限制罰沒週期內的價值流動,預言機可以限制該週期內交易的總價值,等等。

另一個解決方案是EigenLayer 可以主動增加AVS 的破壞成本。

EigenLayer 創建一個開源的儀表板,構建在EigenLayer 上的AVS 可以監控參與其驗證任務的一組運營商是否也在許多其他AVS 中再質押。 AVS 可以在其合約中製定規範,僅激勵參與少量AVS 的EigenLayer 運營商。

3.4.2 意外罰沒

在AVS 及其相關基礎設施和合約經過實際測試之前,許多罰沒風險需要控制以避免產生更大的疊加風險。一種風險是AVS 創建時的意外罰沒漏洞(例如,代碼bug),這種漏洞一旦觸發會導致誠實運營商損失資金。我們在這裡提出兩條解決方案:

二級標題二級標題

正文

正文

二級標題

正文

正文

正文

我們注意到,當使用EigenLayer 再抵押的所有ETH 都用於保護一個AVS 時,這個AVS 可以獲得最大的安全性。然而,這有兩個障礙:

AVS 給運營商的預期收入是否能高過運營成本;

一級標題

一級標題

二級標題

4.1 實現新的應用場景

二級標題

二級標題

二級標題

4.2 利用質押者的異質性,大幅擴展區塊空間

風險偏好更高的節點可以選擇風險更大,收益流動性更差但是收益率更高的協議提供驗證

二級標題

4.3 打破民主和靈活性間的平衡

二級標題

4.4 推進以太坊質押者的去中心化進程

二級標題

4.5 支持多代幣的節點群

二級標題

二級標題

二級標題

4.6 商業模式

協議使用EigenLayer 可以採用的商業模式包括:

使用協議原生代幣支付:協議在EigenLayer 上面部署一個AVS 作為協議,用戶需要支付協議代幣獲得服務,收入一部分支付給協議代幣持有者,另一部分支付給EigenLayer 中的ETH 再質押者。

一級標題

5. 關於EigenLayer 更多內容

Medium 專欄,及時獲取更多項目的深度解讀和一手調研。隨著白皮書的發布,EigenLayer 也計劃於明日上午9 點(PT)組織