Original compilation:

Original compilation:Xiao Pang classmate @0xthefool

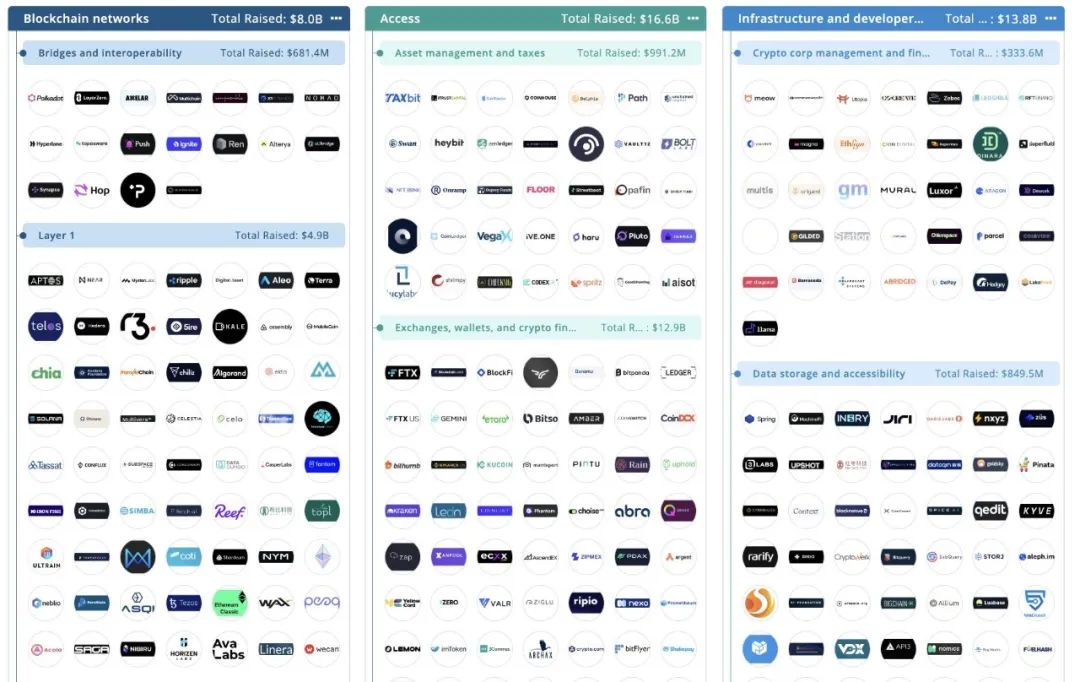

Pitchbook aggregated nearly 10,000 financing records in the encryption industry and made industry mapping for the market.

Including 5 sections of blockchain network, user interaction, infrastructure, Web3 and decentralized finance, 22 tracks and 1203 leading companies.

I sorted out all the key information to help you study each sector of the encryption industryfirst level title

Section 1 - Blockchain Network

Total $80 billion invested

The blockchain network stores and calculates data through distributed nodes to form a decentralized ledger to support the operation of transactions/smart contracts/DAPPs.

Growth drivers:

1) The scalability of the two pioneers BTC and ETH is far below industry needs

secondary title

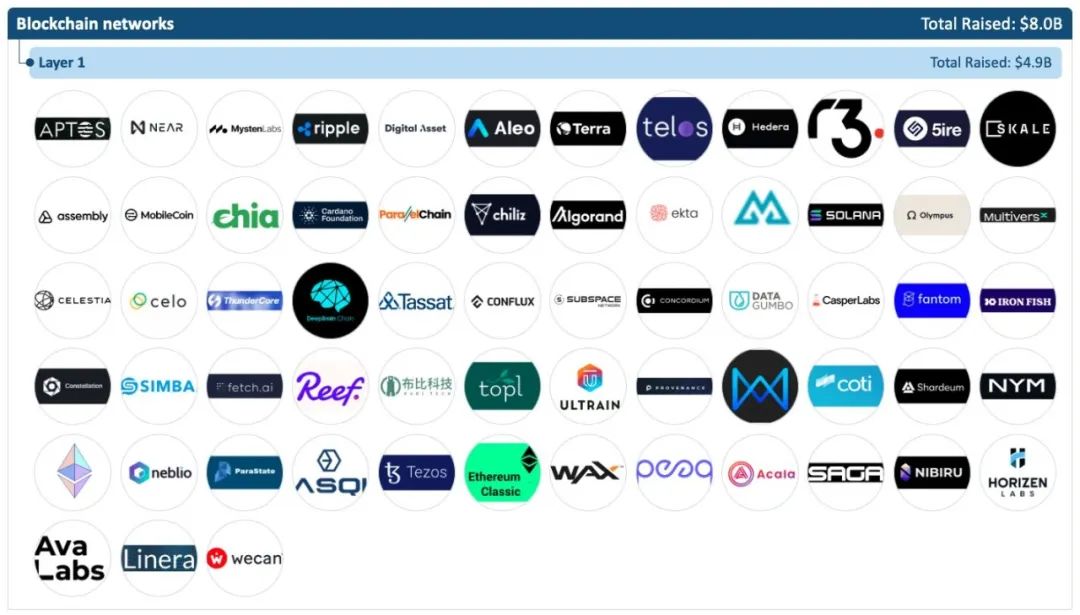

Track 1: Layer 1

In addition to the two chains of BTC and ETH, Layer 1 has a total of 63 leading projects such as APTOS and NEAR, with a total financing of 49 billion US dollars.

secondary title

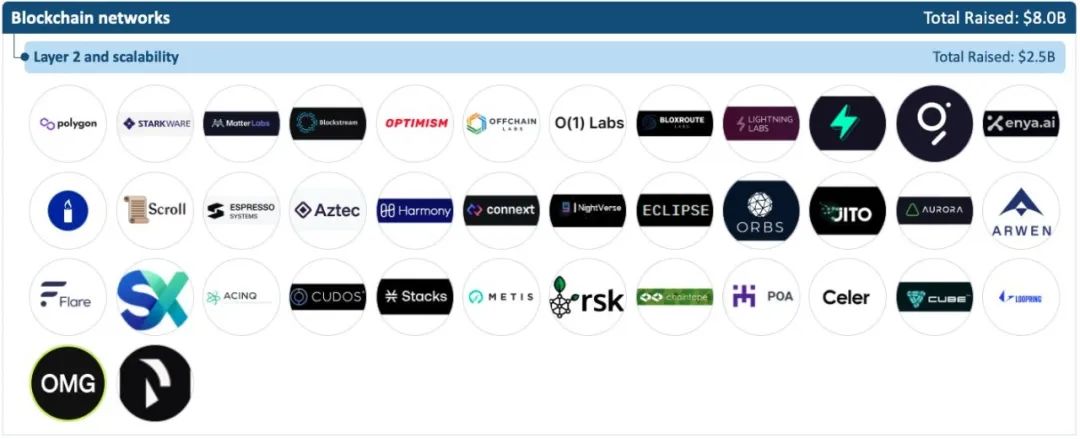

Track 2: Layer 2

secondary title

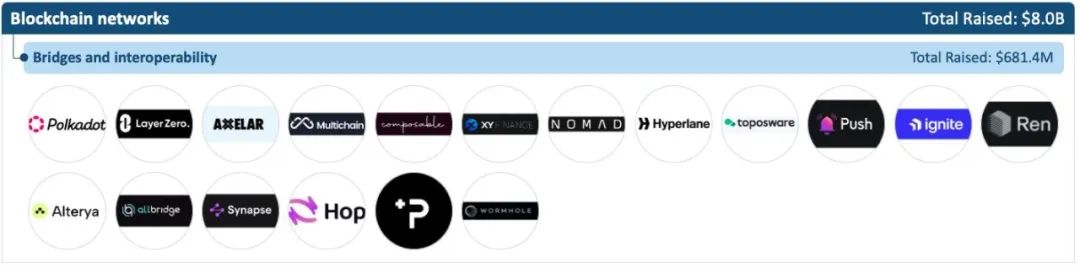

Track 3: Cross-chain

first level title

Section 2 - User Interaction

A total investment of US$166 billion

Most users cannot directly use the data on the blockchain, but need user interaction platforms/tools to complete crypto transactions, management and research.

Growth drivers:

1) In the bull market, a large number of individual and institutional exchanges with investment purposes poured in

secondary title

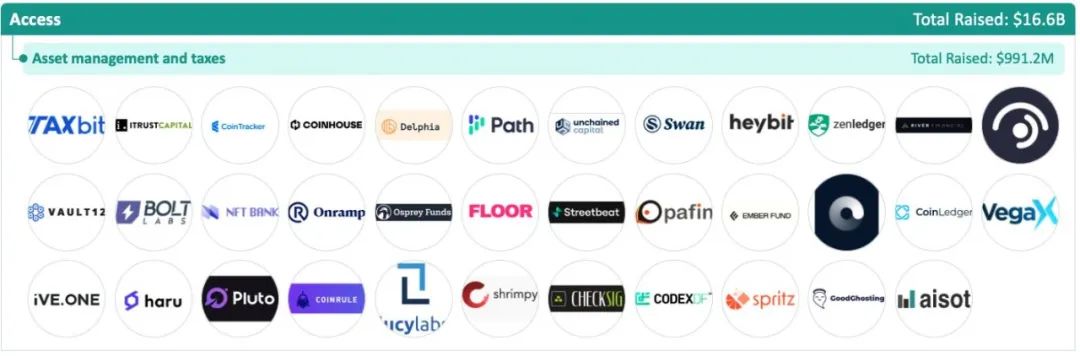

Track 1: Asset and Tax Management

secondary title

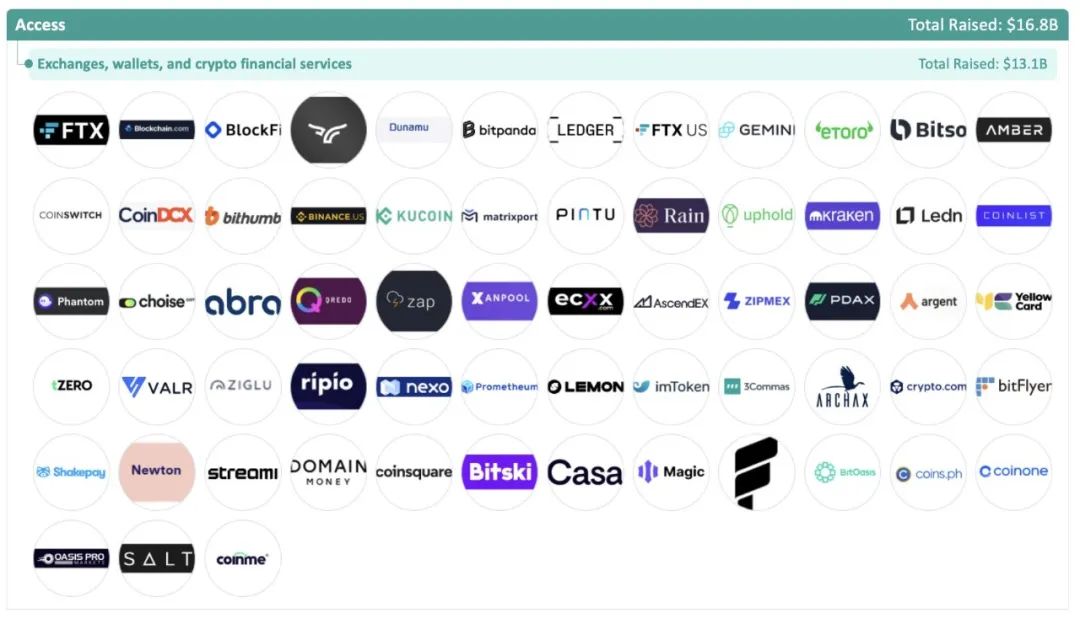

Track 2: Wallet and Exchange

secondary title

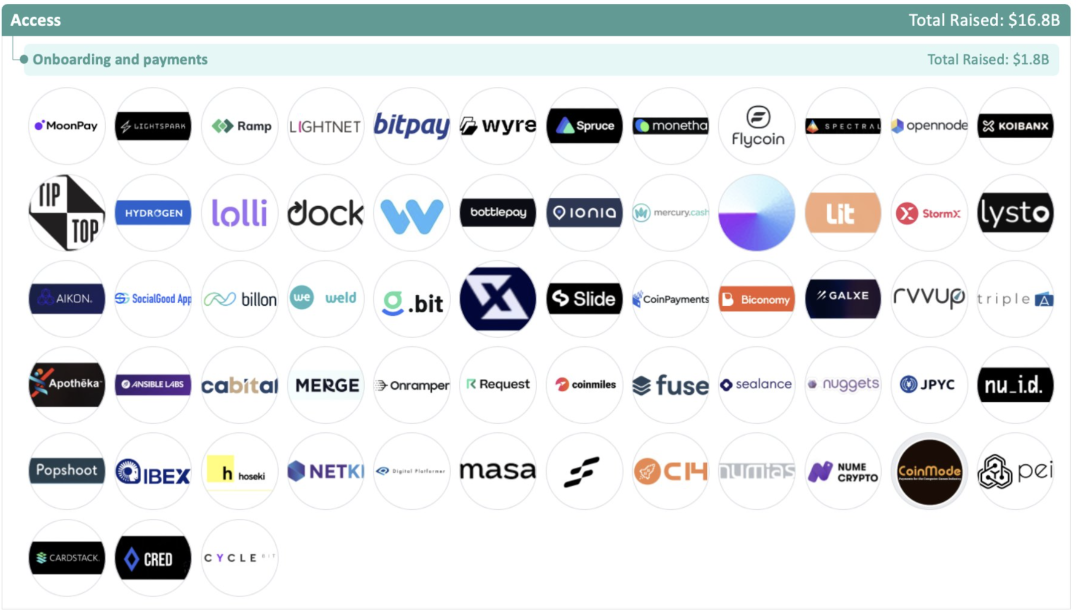

Track 3: Deposit and withdrawal and payment

secondary title

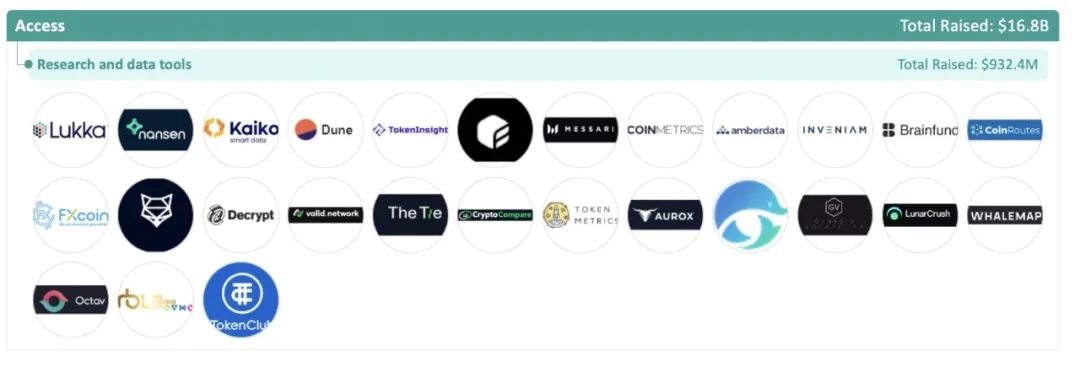

Track 4: Data and Research Tools

first level title

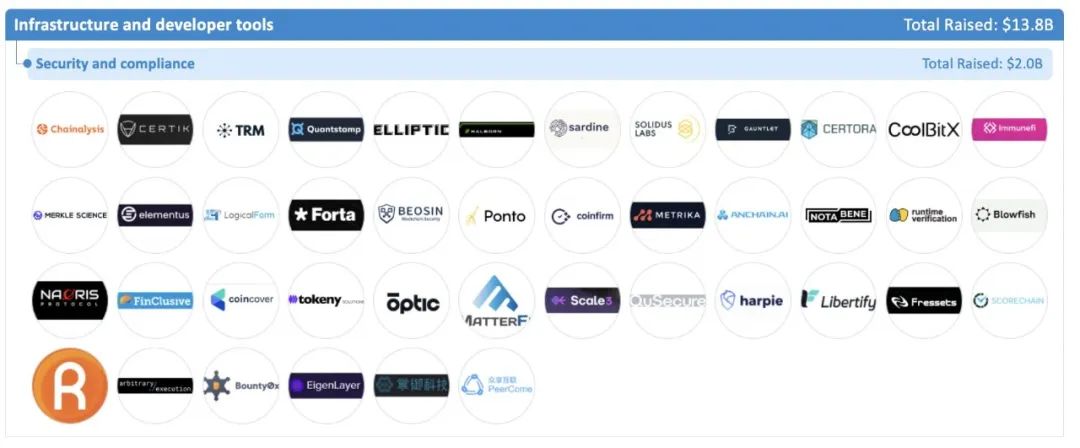

Section 3: Infrastructure and Development Tools

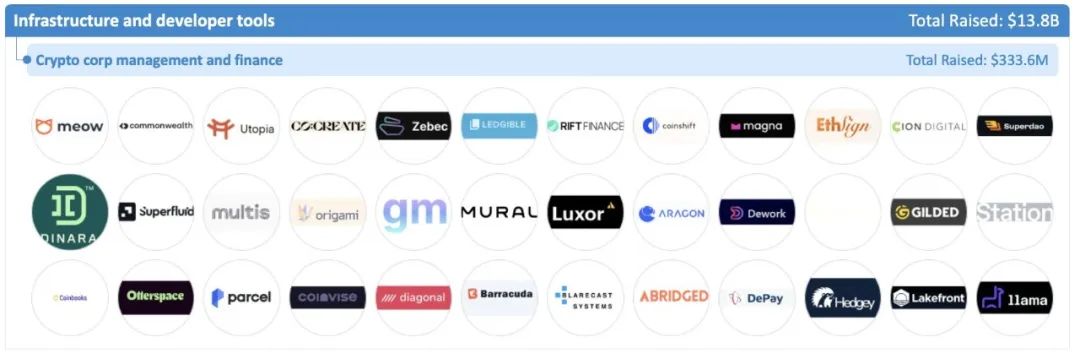

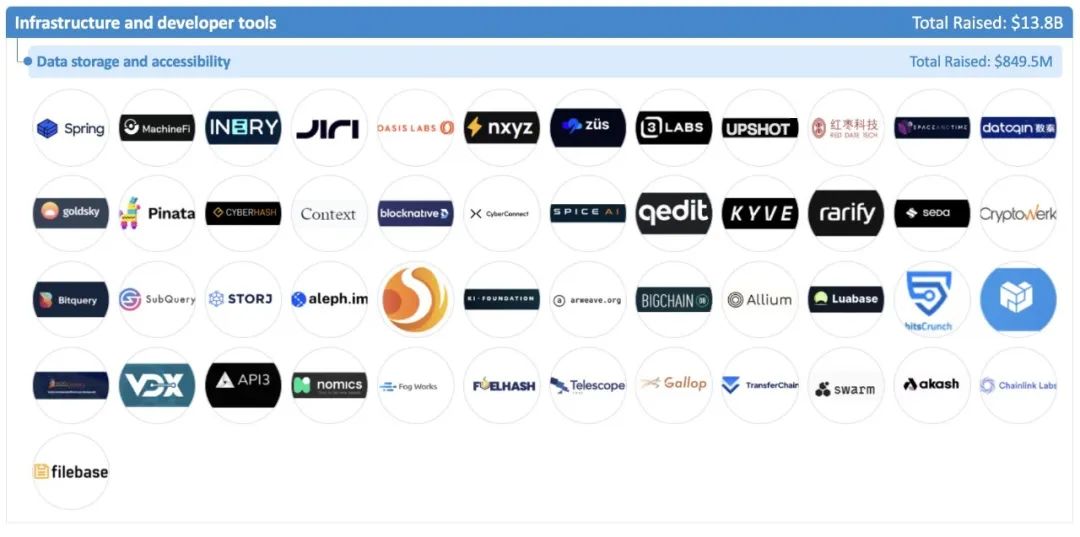

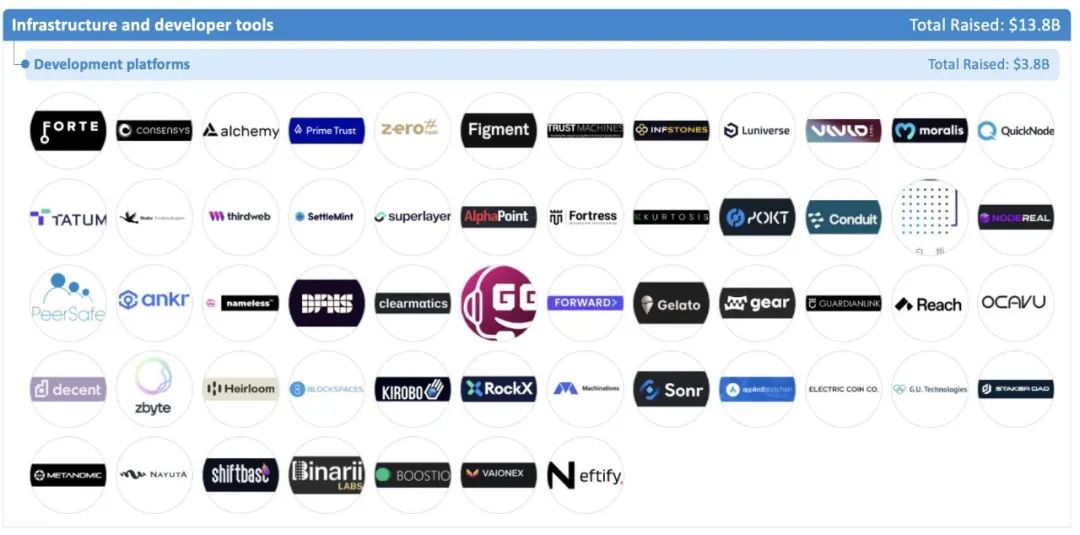

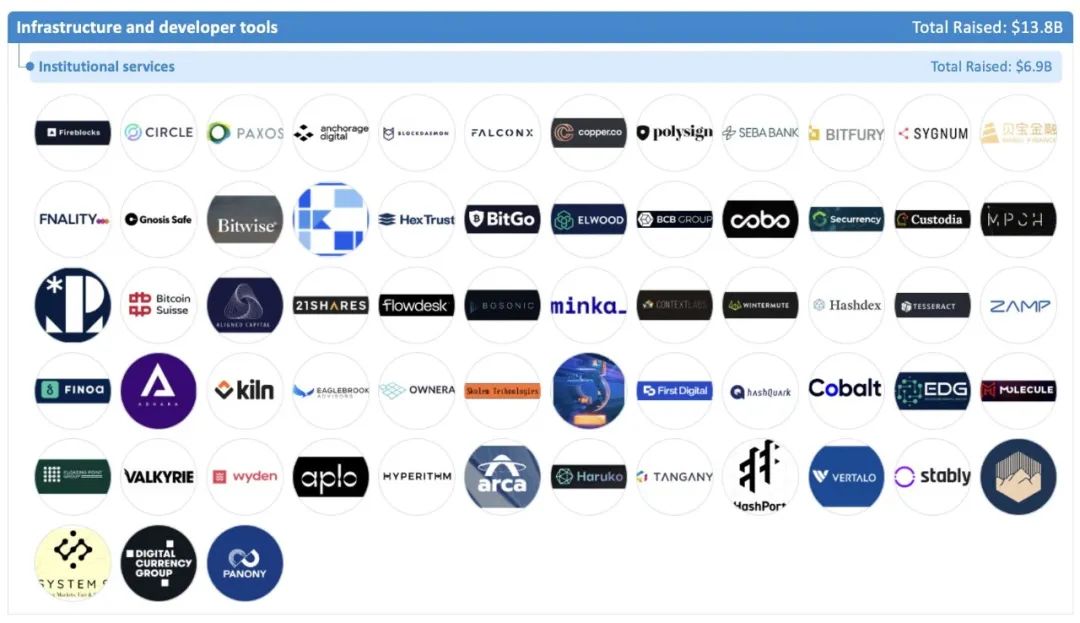

Infrastructure and development tool products have laid the foundation for further establishing a prosperous on-chain ecosystem, allowing more Builders and Developers to advance the industry. Companies in this sector raised a total of $13.8 billion.

Growth drivers:

1. Although encryption was initially more grassroots individual participation, more and more large institutions have also joined it

secondary title

Track 1: Encrypted enterprise team/financial management tool

secondary title

Track 2: Data Storage and Recall

secondary title

Track 3: Development Platform

secondary title

Track 4: Institutional Fund Management Tools

secondary title

Track Five: Security and Compliance

first level title

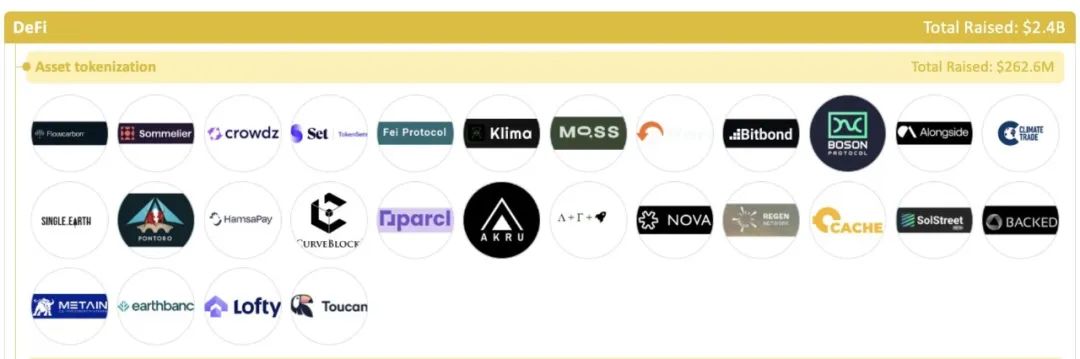

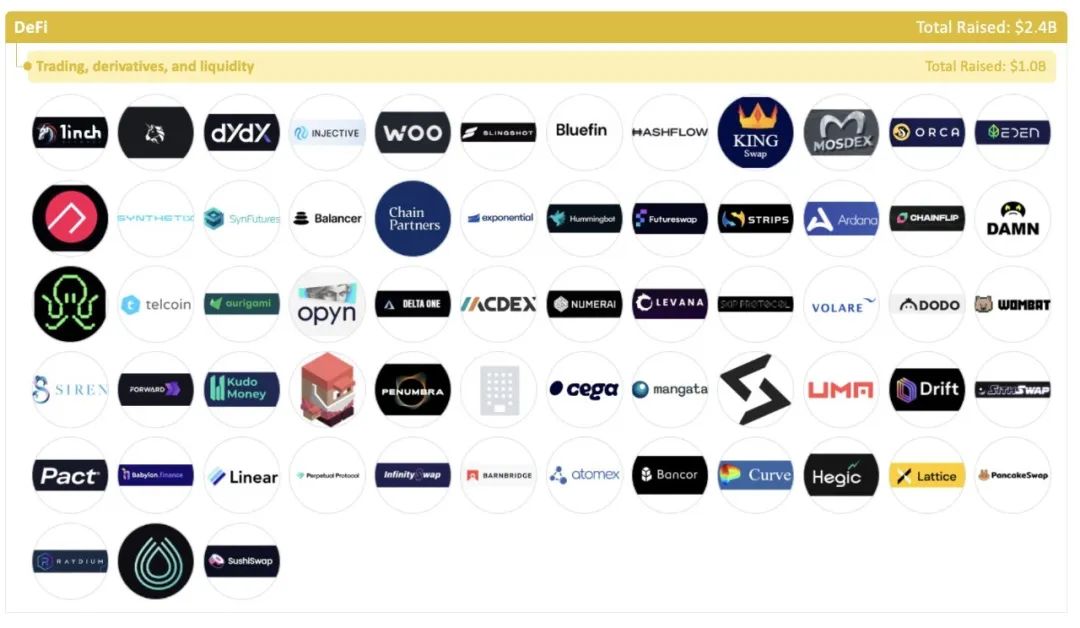

Section 4: Decentralized Finance

secondary title

Track 1: Asset Tokenization

secondary title

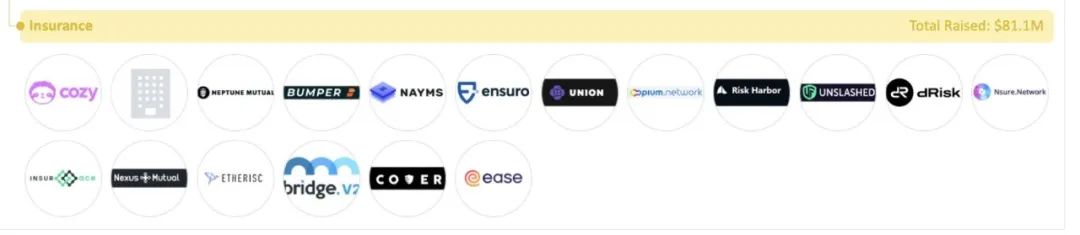

Track 2: Decentralized Insurance

secondary title

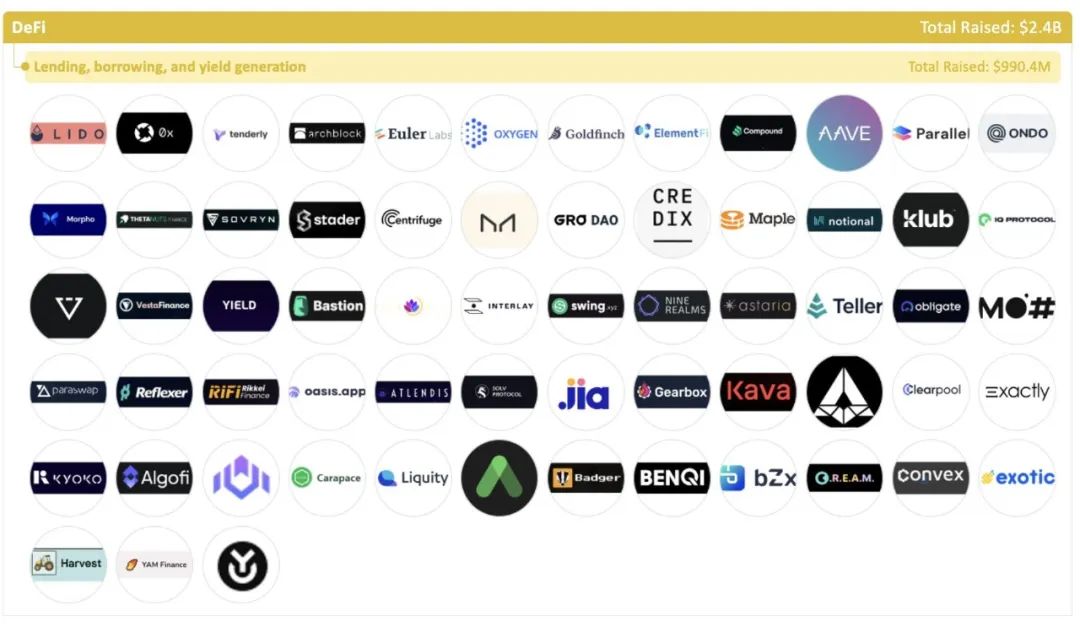

Track 3: Decentralized Lending and Yield Generator

secondary title

Track 4: Decentralized trading platform and derivatives

first level title

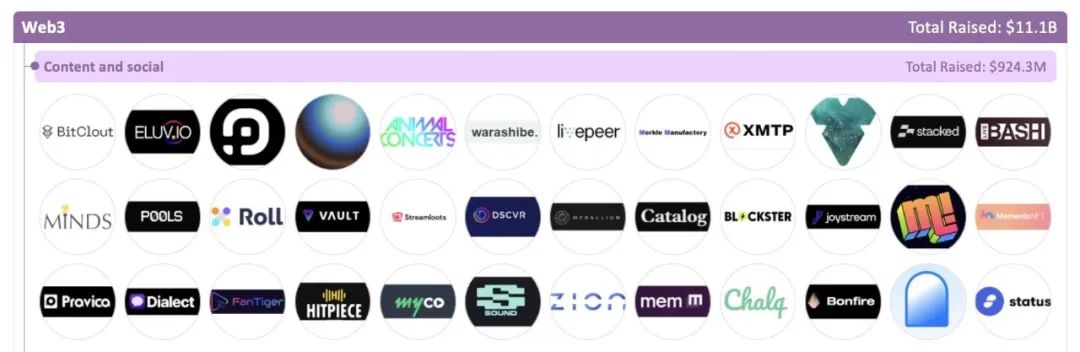

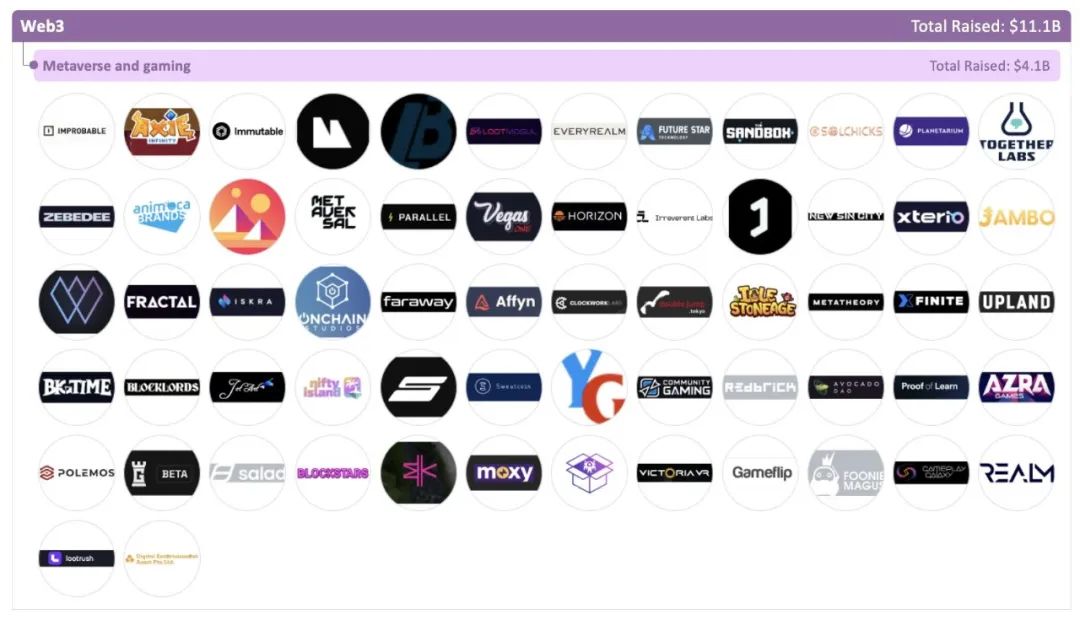

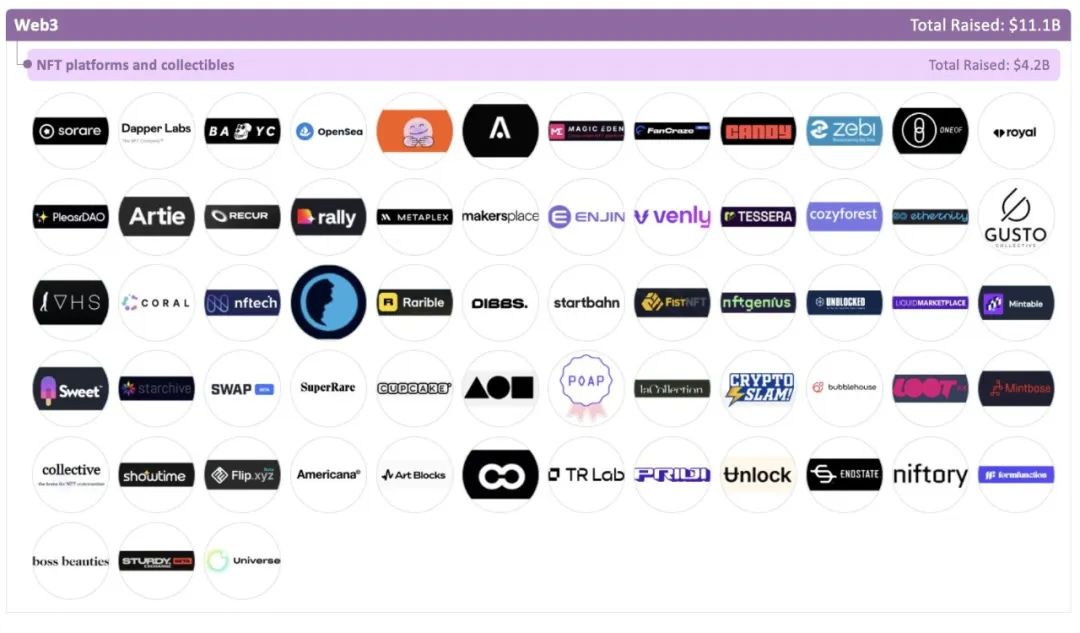

The fifth block: Web3

The development of blockchain allows us to give the ownership of the network platform to every user. Compared with the web2 platform represented by Internet giants, the web3 platform will open source code, allow users to own their own data, and build and make decisions together with the community. As the outlet of the last bull market, a total of US$11.1 billion was raised.

Growth drivers:

1. Declining trust in the Web2 platform

secondary title

Track 1: Content and Social

secondary title

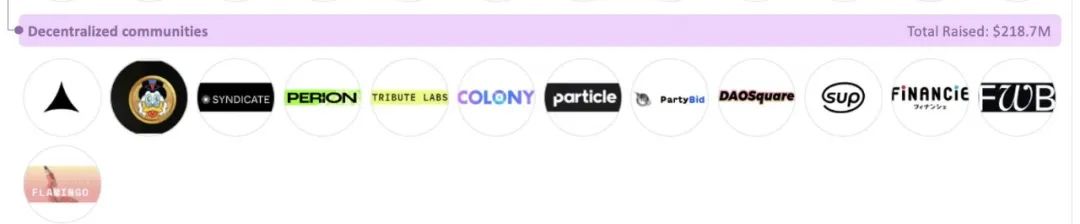

Track Two: DAO and DAO Tools

Decentralized autonomous organizations issue ownership of the organization to members through Token and NFT, and by holding tokens, members can manage, vote in DAO, and obtain rights and interests in other DAOs

secondary title

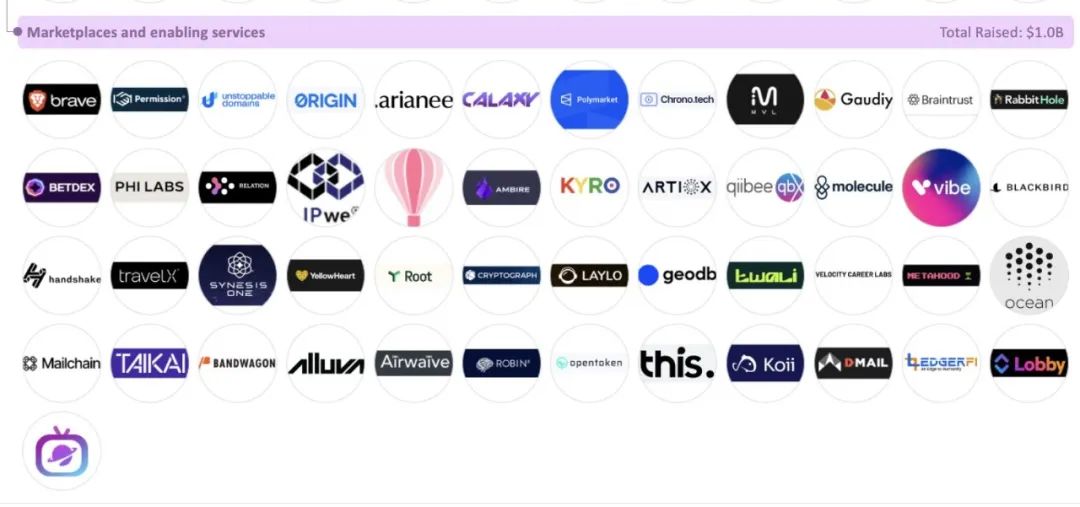

Track 3: Commercial and Consumer Platforms

secondary title

Track 4: Hardware Empowerment

secondary title

Track Five: Metaverse and Games

secondary title

Track 6: NFT and Collectibles Platform

Blockchain network:

Summarize:

Blockchain network:Layer 1, Layer 2,Cross-chain

User interaction:Asset tax management, wallet/exchange, deposit/withdrawal/payment, data analysis

infrastructure:Encryption organization management, data storage, development platform, fund management, security and compliance

Decentralized finance:Asset Tokenization, Decentralized Insurance, Decentralized Lending, Trading Platform

Web3:Social Content, DAO Tools, Market Platform, Hardware Empowerment, Metaverse, NFT

Because the content of PitchBook cannot be directly shared externally, the original link is not attached. The first author is the analyst Robert Le, and the content includes the translation and some adjustments of Xiao Pang.

In fact, there are more good cases that can be added to various industries. If there are more interested friends, I can make an in-depth analysis of various industries and top projects in the next issue.