Original compilation: Babywhale, Foresight News

Original compilation: Babywhale, Foresight News

Main points:

After the FTX crash, Solana’s value was the most affected, with a 70% drop in market capitalization, but the network’s health remained stable.

FTX-agnostic integrations are in progress to strengthen the Solana DeFi ecosystem and address additional needs for support and service.

Solana's NFT landscape is still actively developing, and GameFi is close to reality.

Rumors of Solana development faltering after FTX and a mass exodus of core developers are false.

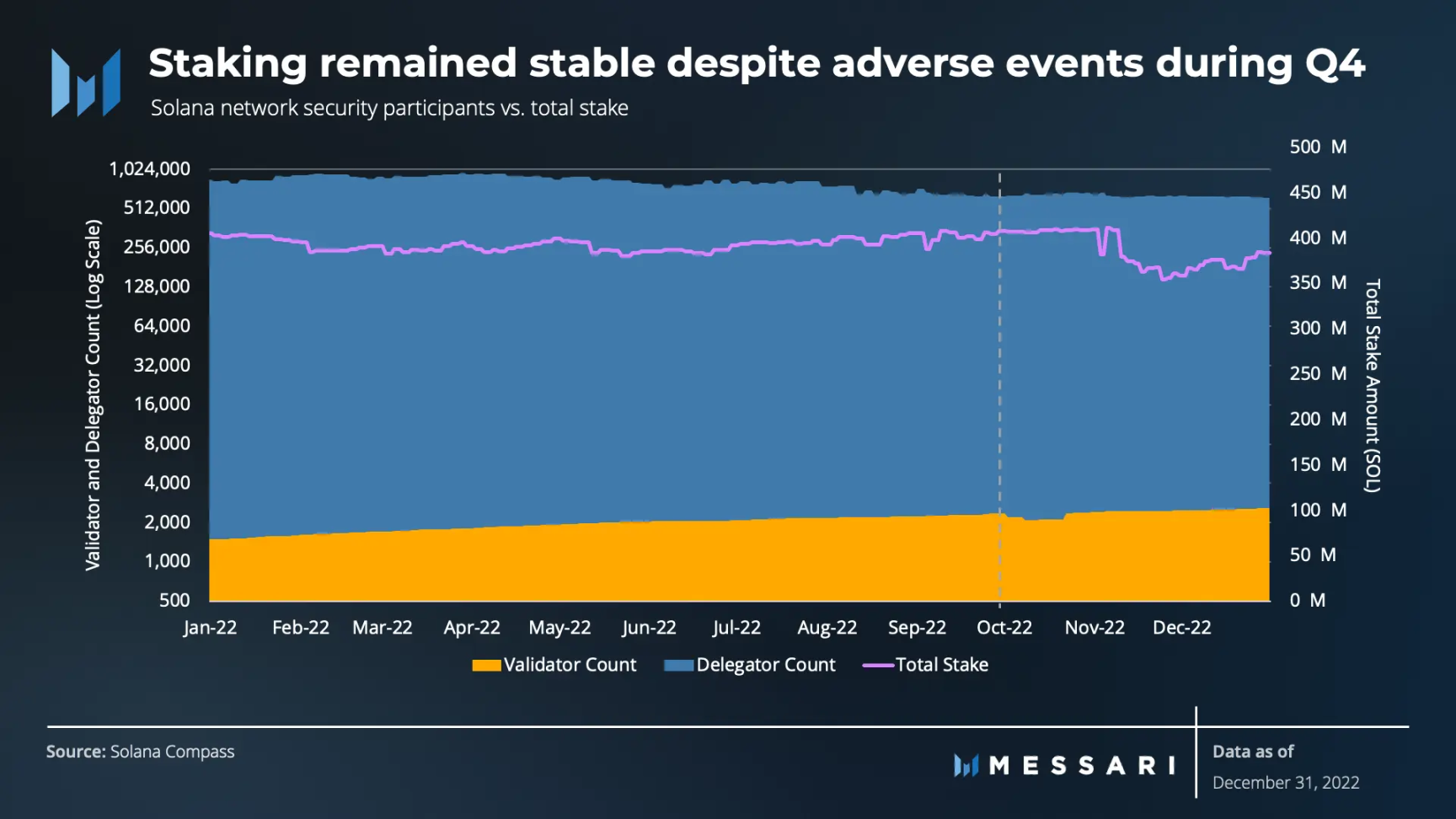

Staking and decentralization of the network remained stable and improved after the events of FTX and Hetzner.

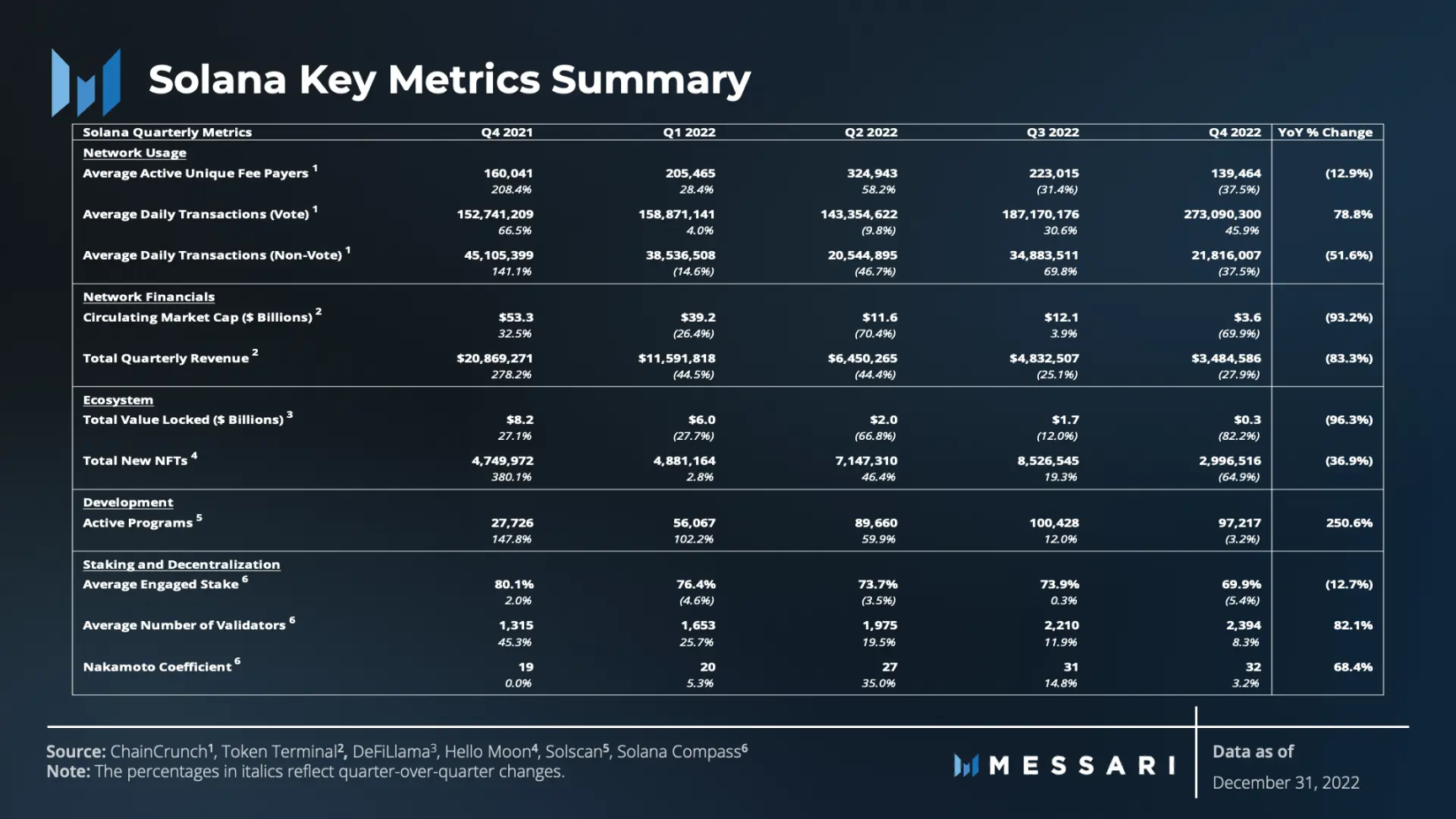

Key indicators

Key indicators

Season 4 Narrative

While Solana showed strength in the third quarter of 2022 and successfully navigated its challenges throughout 2022, the fourth quarter saw a rollercoaster decline. Q4 took a huge turn as FTX crashed and the sentiment that followed spread, but all is not lost.

Despite the shadow of FTX's bankruptcy, Solana's network and ecology still showed strong vitality in the fourth quarter. Solana's mission to increase usage remains unchanged, as evidenced by continued development, further integrations with partners like Instagram and Facebook, and ecosystem expansion into GameFi and DePIN (Decentralized Physical Infrastructure Network). The development of web capabilities continues as well, with countless other potential growth catalysts.

as of 2022Third Quarter Solana Reportperformance analysis

performance analysis

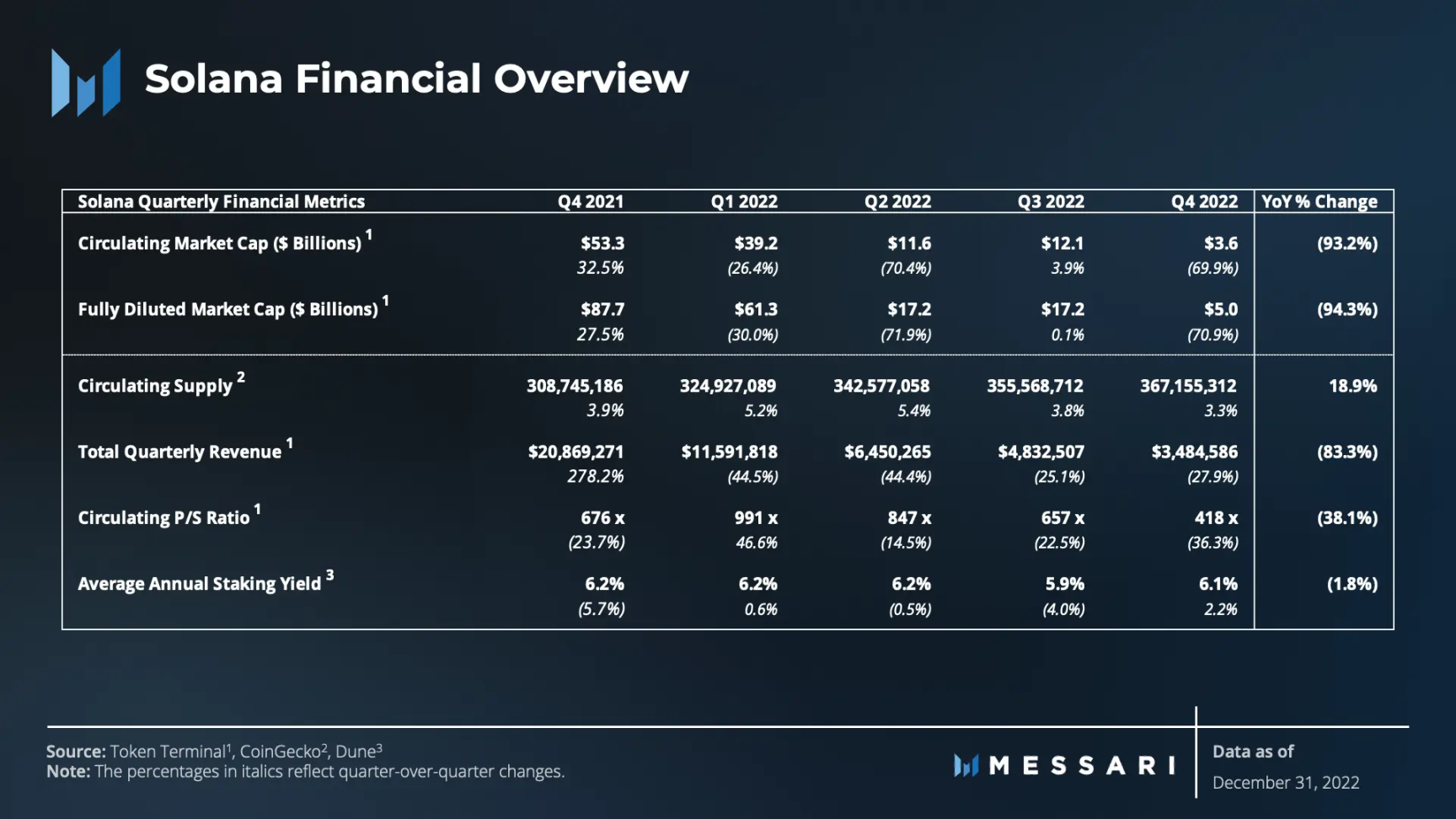

Overview of Financial and Network Conditions

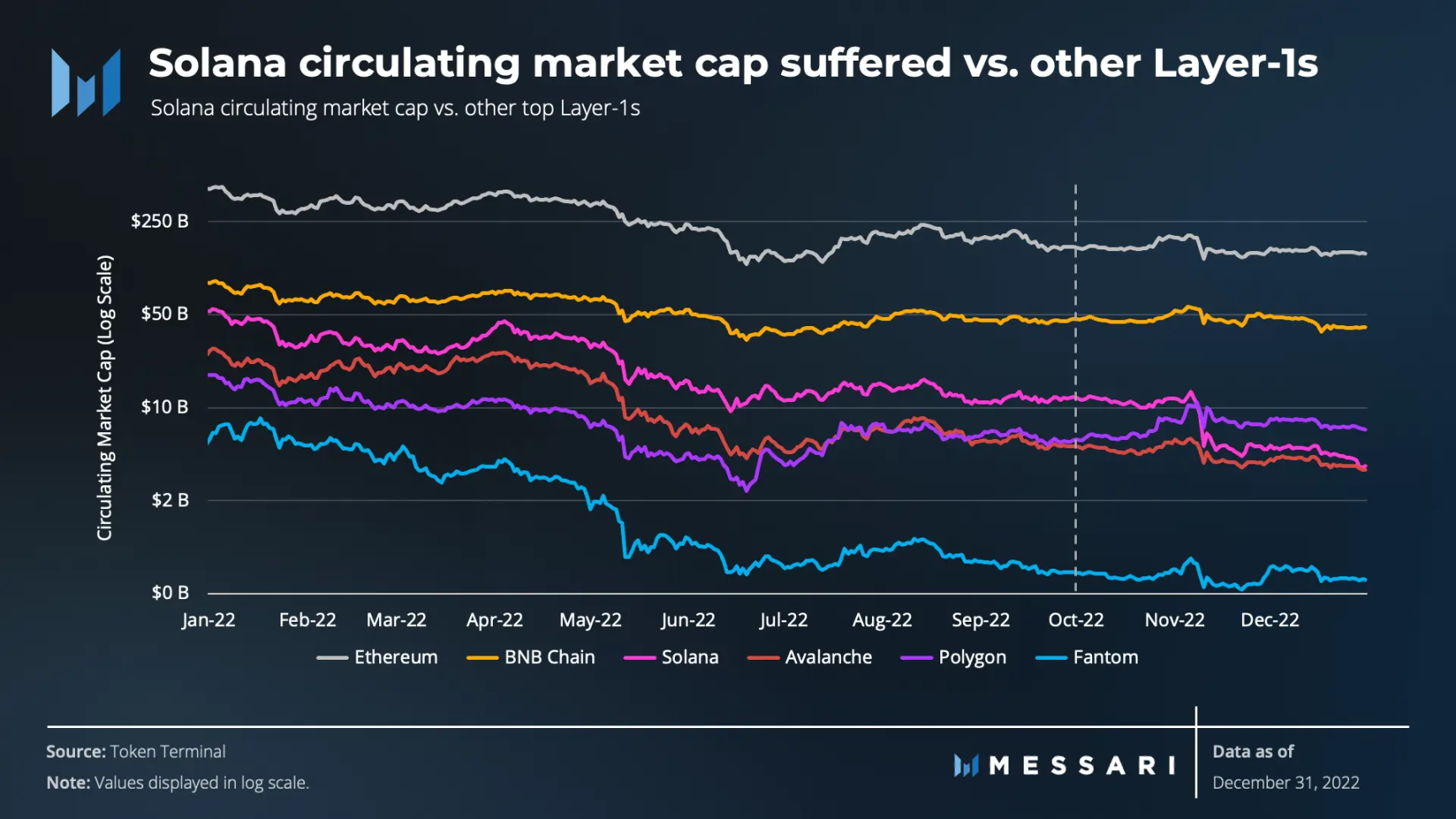

In Q4, the ongoing bear market combined with FTX's bankruptcy had a major negative impact. FTX is an important investor in Solana and an integral part of Solana DeFi, especially in the development of DEX Serum. As a result, Solana became one of the most affected networks, with its market cap dropping 70%, plummeting from $12.1 billion to $3.6 billion.

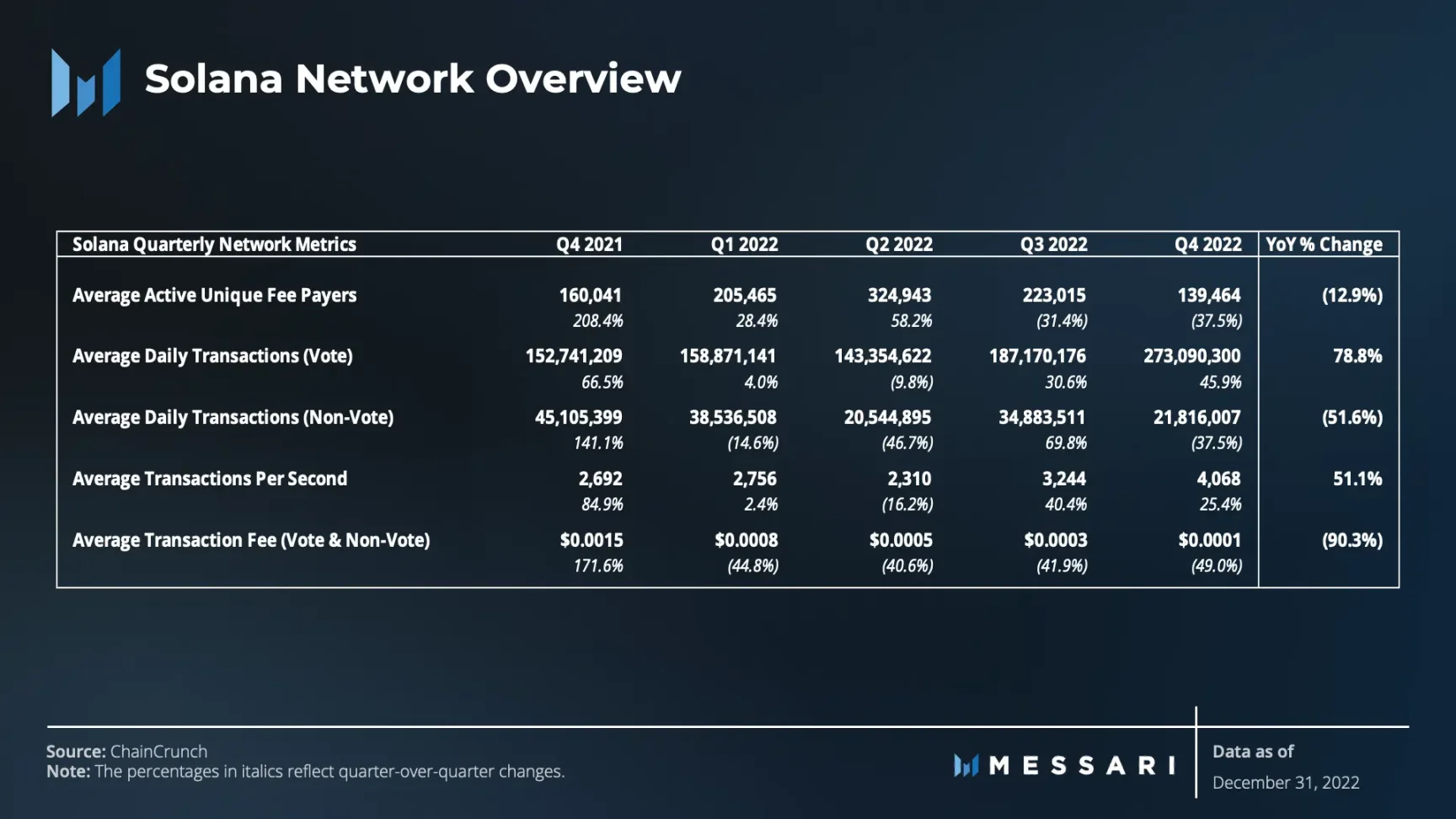

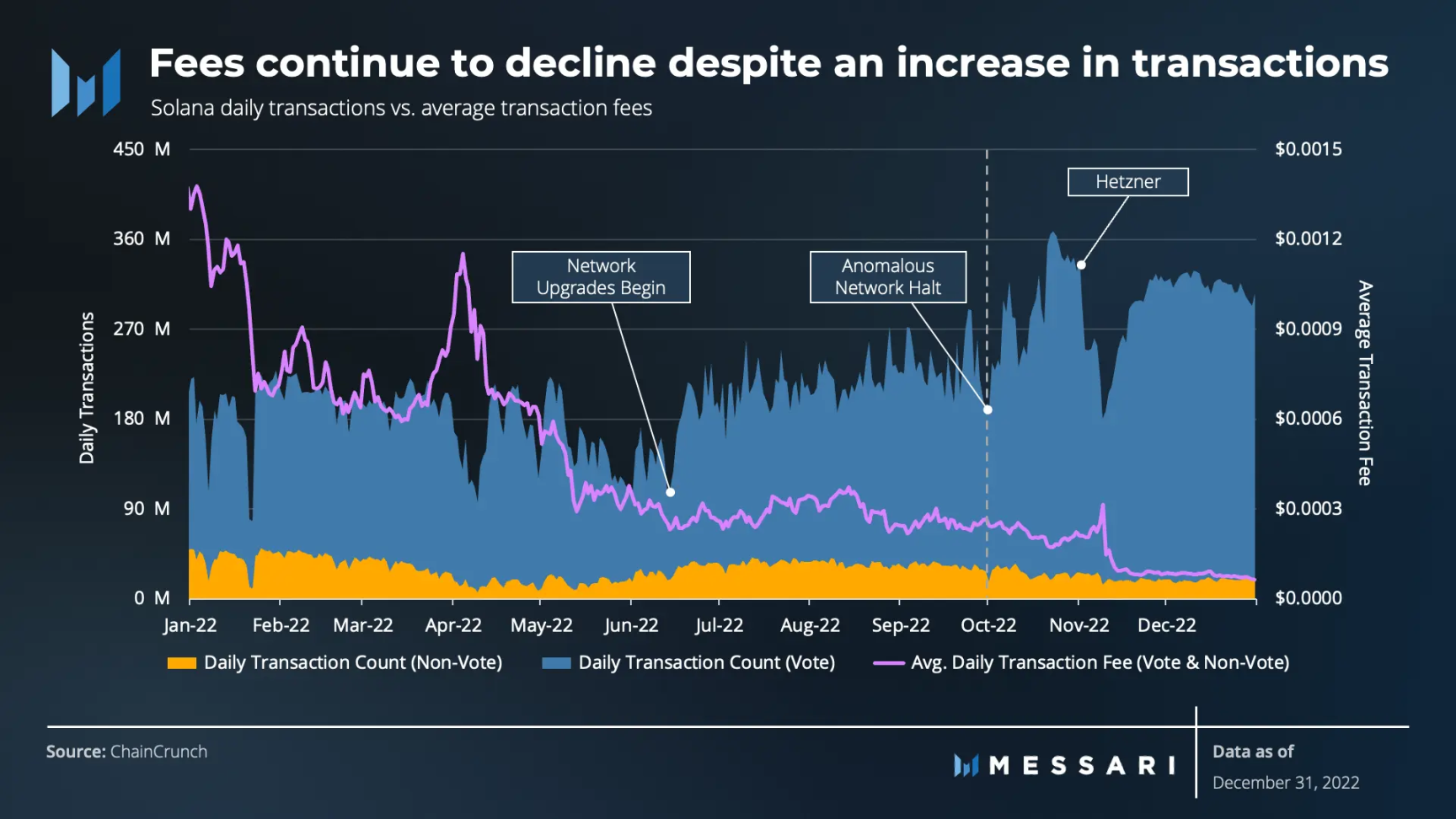

Despite market conditions putting downward pressure on user activity, average daily transactions and transactions per second (TPS) continued to increase due to improved network performance.

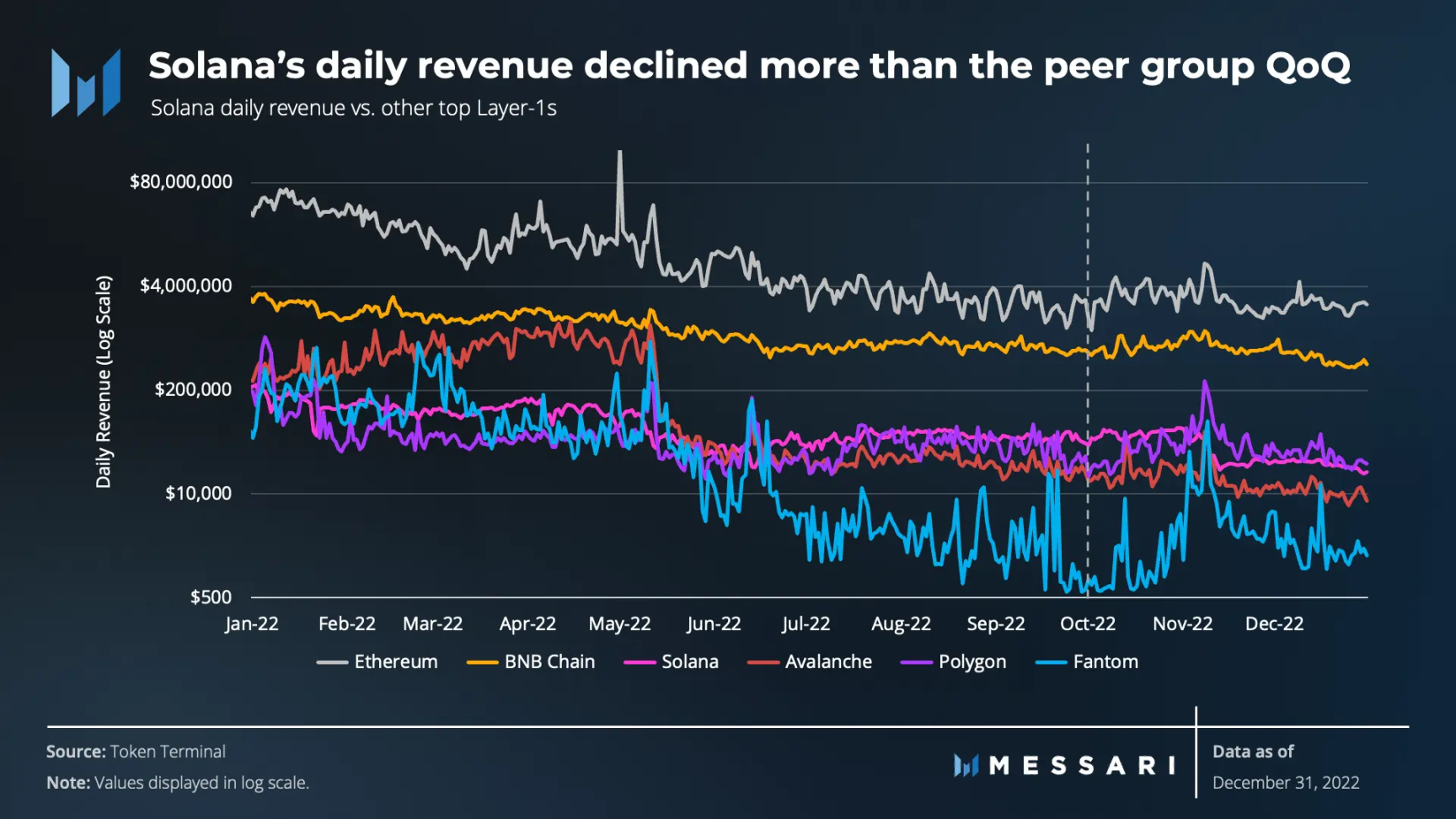

Despite an increase in total transaction volume, average transaction fees continued to decline (49%). Average transaction fees fell 90.3% year-over-year after declining for the fourth consecutive quarter. Revenue also continued to decline in the fourth quarter (27.9%). Likewise, total quarterly revenue fell 83.3% year-over-year. Nonetheless, the decline in revenue was less than transaction fees, suggesting that revenue was partially supported by growth in transaction activity.

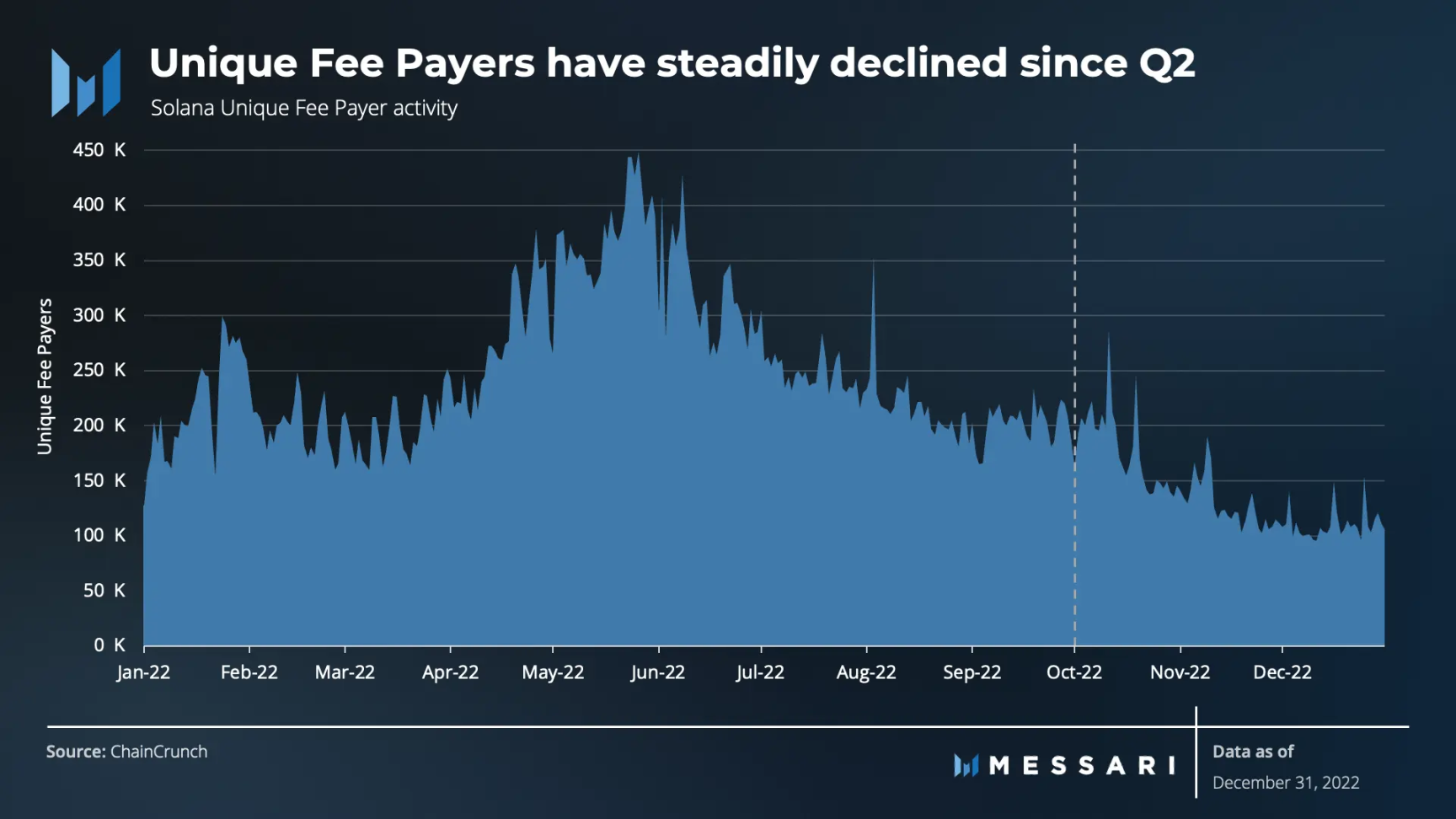

The Unique Fee Payers metric includes the number of unique accounts paying fees for at least one transaction per day. The average daily fee for independent fee payers has been steadily declining since the end of the second quarter. This user base stabilized at the base level at the end of the third quarter as it reached its long-term average. However, market sentiment following FTX pushed user activity down 37.5% in Q4 and ultimately 12.9% year-over-year.

The Independent Payer metric may not be the best way to measure user activity on Solana, as it does not account for transactions authorized by multiple users but paid by a single account. The unique signers metric may be a more accurate measure of absolute user activity.

Nonetheless, the trend for unique signers is closely related to unique fee payers for the quarter and year.

Transactions on Solana can be divided into consensus (voting) and non-consensus (non-voting). Non-voting transactions are similar to EVM transaction counts. They represent actual economic activity on the network.

During 2022, the transaction activity and performance of the network will fluctuate, sometimes for different reasons. During the first two quarters, network performance was impacted by spam caused by Gulfstream, Solana's mempool alternative for pending transactions. At the end of Q3 and beginning of Q4, the network stalled due to an unusual consensus error. at last,HetznerThe change in service sparked a wave of trading volatility in early November.

The "disruption" narrative is changing, though, as the aforementioned factors contributing to the underperformance have stabilized since the end of the second quarter. Network uptime since April 2022has been very long, more than 99% uptime each month. TPS, as a quarterly average, also hit an all-time high in Q4 due to several network upgrades. During the year and Q4, Solana continued to roll out upgrades related to QUIC, stake-weighted Quality of Service (QoS), and local fee marketplaces.

QUIC

Solana replaced its old data transfer protocol, the User Datagram Protocol (UDP), with QUIC. Although QUIC has some similarities to UDP, it allows finer control over data flow. QUIC enables validators to exercise more discretion in sending and receiving transaction data to and from slot leaders. In other words, validators can more easily filter out spam transaction data that has broken the chain in the past.

local fee market

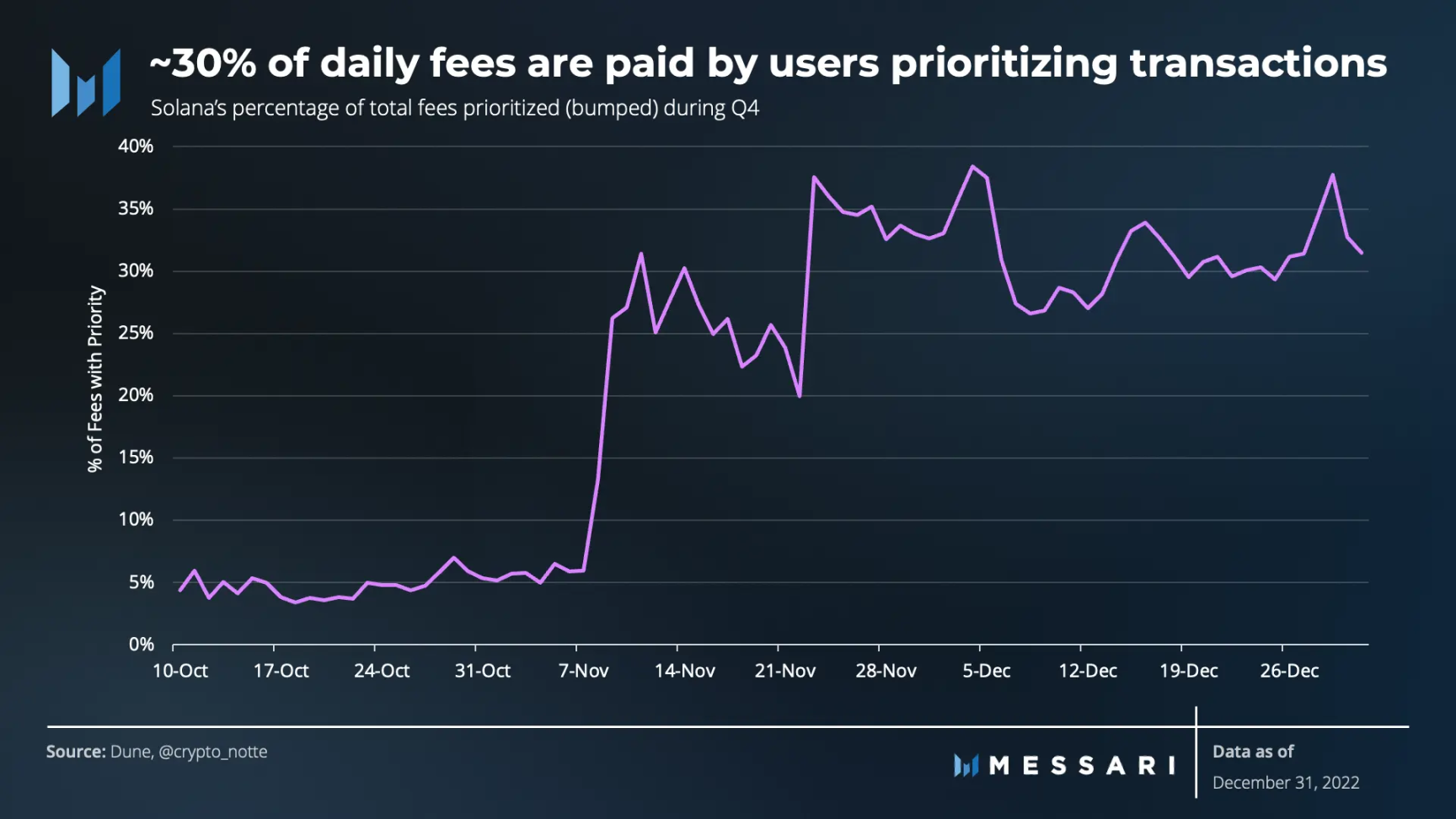

Solana accounts have a hard cap compute limit. Once reached, subsequent transactions cannot modify the state of that account during a given block. A local fee market allows users to send priority transaction fees to validators to modify the urgency of a particular account's state before it hits its computational limit in the current block.

The result is less spam on the web (since it's possible to bid more) and a more efficient market for block space.

On average, more than 30% of daily fees are paid by users who prioritize transactions. asmore wallets

Integrating local preferred transaction fees, this average could increase.

Additionally, Solana's local fee market can function during periods of high network activity. basic costkeep it steady, but in more active areas of the network, preferred transaction fees are skyrocketing.

Pledge-weighted Quality of Service (QoS)

Staking weighting ensures that validators always have the right to transmit transaction packets to the leader, rather than validators accepting and transmitting transactions indiscriminately. For example, a validator with a stake of 0.1% can always transmit 0.1% of transaction packets to the leader. The previous indiscriminate approach made it easy for validators to transmit packets smaller than their staked weight. As a result, the network will support smaller validators, allowing for increased centralization.

Collectively, these three upgrades bring performance stability to the network. Nonetheless, non-voting transactions (economic activity) fell 37.5% MoM and 33.3% YoY, most likely due to market sentiment.

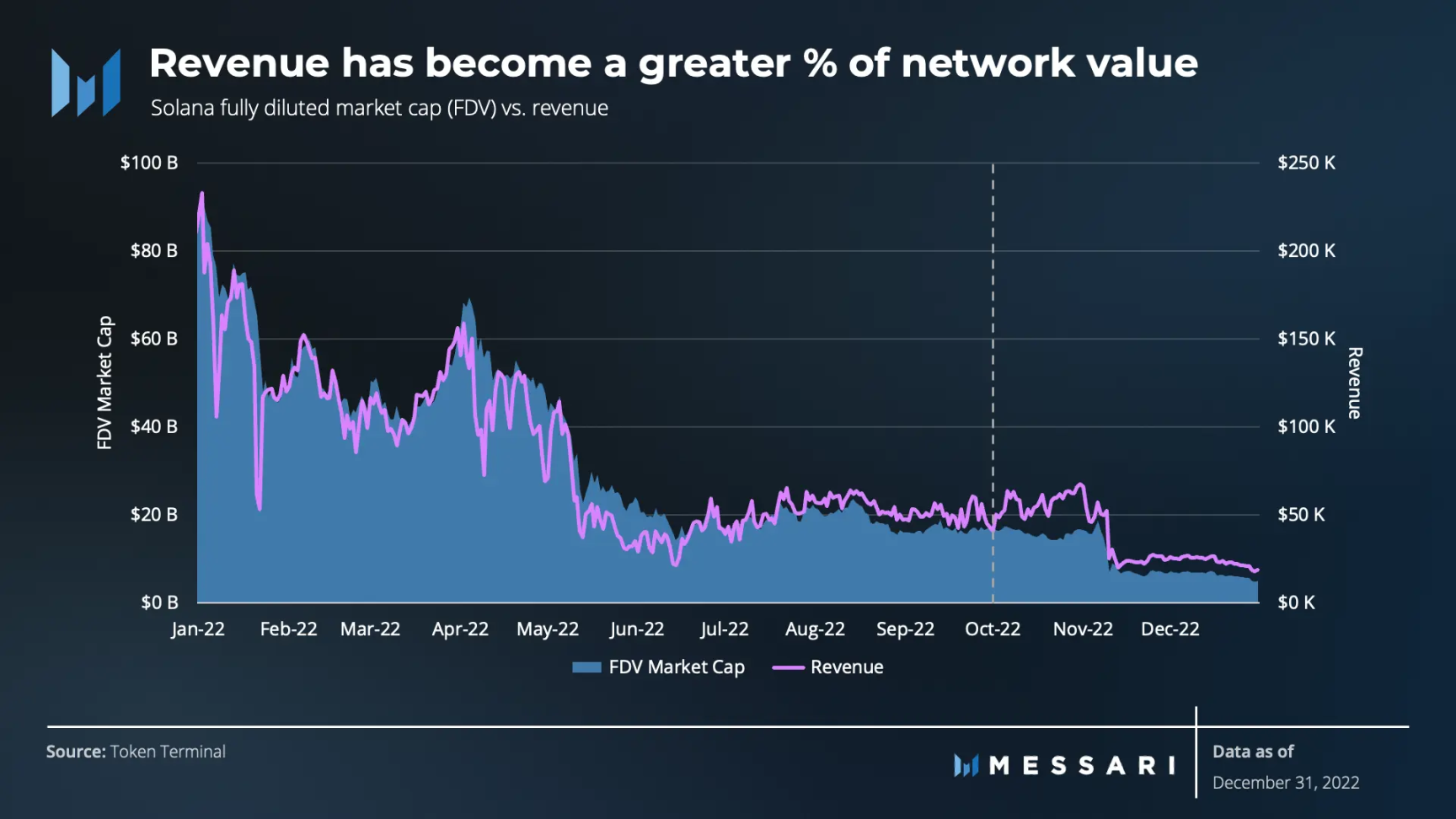

The existence of payers and the stability of daily transactions drive the revenue and value of the network. Ideally, more users and transactions (despite lower fees) increase revenue and represent a fundamental increase in value.

To this end, there is still a correlation between revenue and network value, given that fluctuations and trends in daily revenue are often accompanied by changes in network value.

As seen in 2021 and throughout the first and second quarters of 2022, degraded network performance has led to reduced transactional activity on the network and reduced ongoing revenue for the network. This puts downward pressure on the value of the network during that time. However, the network upgrade brings more stability. The 49% drop in transaction fees coupled with the 28% drop in revenue shows that fundamentals such as network stability, users, and transaction activity are becoming an important part of the value of the Solana network.

From a valuation perspective, the relationship between network value and revenue is also in line with the price-to-sales ratio. Since the first quarter, the price-to-sales ratio has fallen from 991 to 418, suggesting that the network is undervalued compared to historical levels.

However, it must be remembered that blockchain assets are an unprecedented asset class that may yet need to be appliedUnique Valuation Technique. Therefore, traditional financial metrics such as revenue and P/S ratios may not be the most appropriate when evaluating these metrics.

Overview of Ecology and Development

DeFi

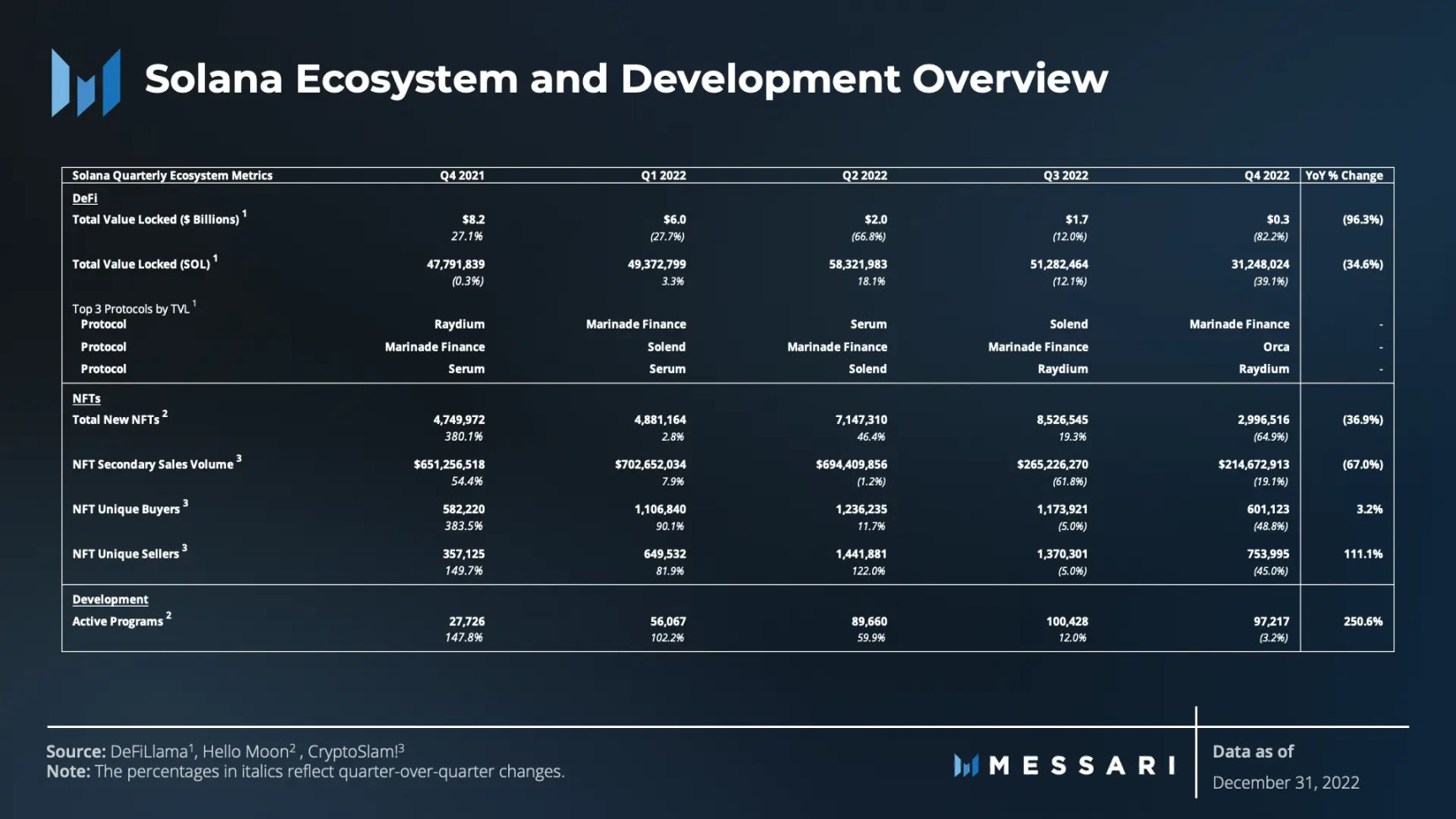

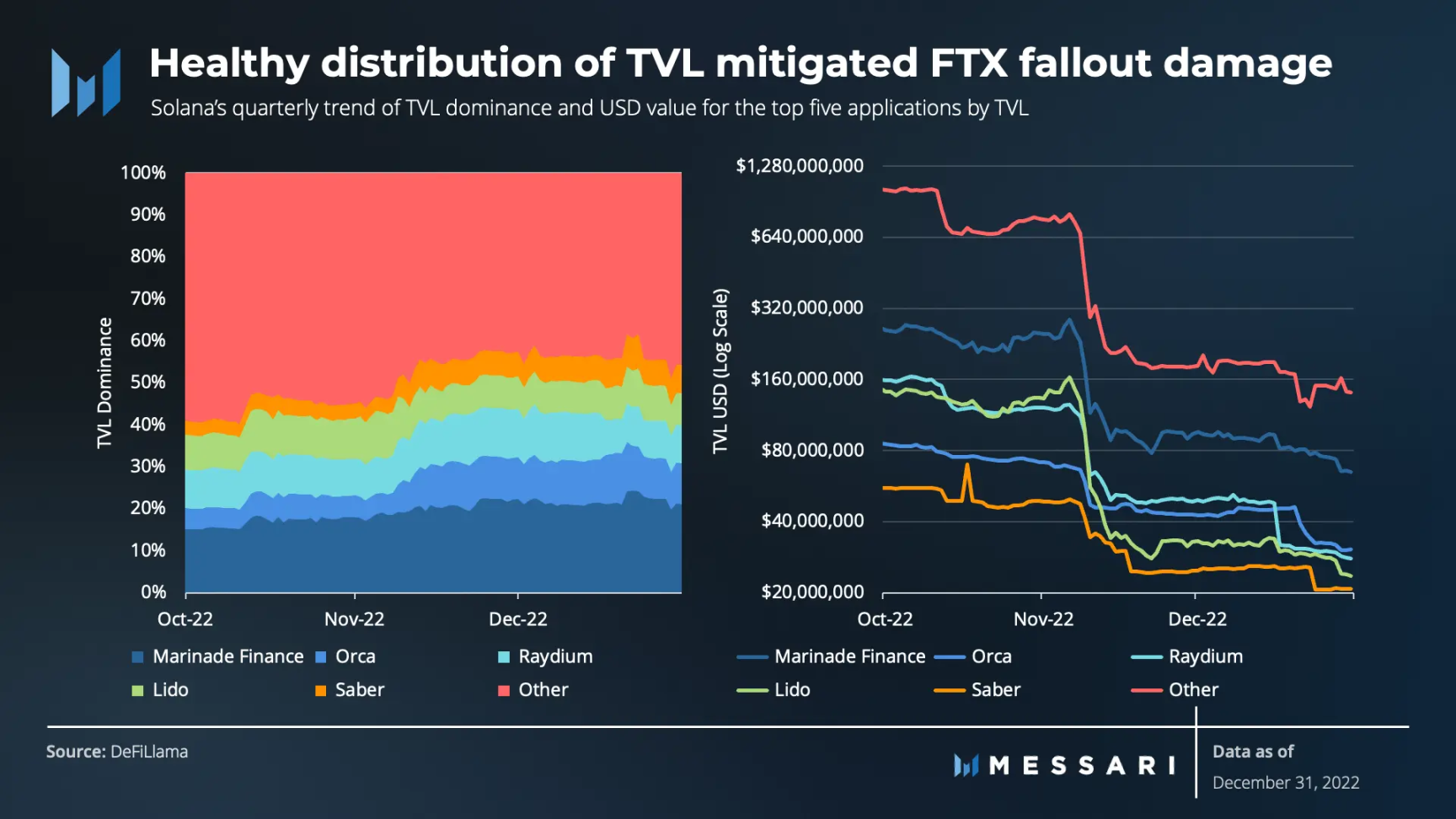

Solana DeFi hit by October Mango Markets breach and November FTX crashgreat influence. Since Alameda is no longer operating on-chain, the total value locked (TVL) has dropped significantly.

Mango Markets

On October 11, 2022, cryptocurrency trader Avraham Eisenberg executed a series of transactions that artificially inflated the price of MNGO tokens. The trader profited from the upswing by borrowing $116 million against unrealized profits and withdrawing the funds from Mango Markets. This exploit is a classic example of cross-market manipulation, in which the attackers ended up beingarrest。

FTX Bankruptcy

By the end of Q4, after the FTX/Alameda crash, Solana TVL was down 26% in SOL terms, while SOL itself was down 67% in USD value.

The community deployed a forked version of Serum because FTX/Alameda held upgrade keys to the original Serum contract. The fork quickly gained an order book depth of over $50 million on the SOL/USDC pair.

Sollet wrapper tokens “backed” by FTX dropped sharply in price and started trading at a steep discount to their expected collateral backing value.

The "Solend Whale" was liquidated, leaving the agreement with about $6.5 million in bad debts. The DAO passed a vote to use the Solend treasury to compensate users.

Nonetheless, there has always been a healthy distribution of TVL across applications on Solana, which may have mitigated further damage to the overall DeFi ecosystem. Currently, about 50% of TVL is locked in most long-tail DeFi protocols on the network.

Despite the difficult conditions, FTX-agnostic DeFi is still developing in the Solana ecosystem and positioned to support and service additional needs.

and

OpenBookandEllipsis Labsare two new DEXs gaining traction.

OpenBook is the community version of Serum V3, created in response to potential security issues with Serum upgrade keys.

Ellipsis Labs' Phoenix order book builds on Serum's centralized limit order book (CLOB) concept. It features efficiency-enhancing design decisions, such as removing the time-consuming process of entering DEX order books and setting optimal bid and ask prices from the DEX design.

Derivatives and Structured Products

andDrift、Zeta Markets、Mango Markets、Friktion、01 andCega. These teams are addressing key issues such as liquidity, new asset support, cross-margin, and user adoption.

Hxro NetworkThe core protocol also went live in Q4. Hxro is an on-chain derivatives infrastructure that supports and facilitates any derivatives application built on Solana.

Liquid Collateralized Derivatives (LSD)

Liquidity staking became more prevalent across the cryptocurrency space in Q4. On Solana,Jito LabsJitoSOL is gaining attention. Right now, Marinade and Lido are still far ahead in terms of market share, but that could change if JitoSOL's higher yields persist.

NFT

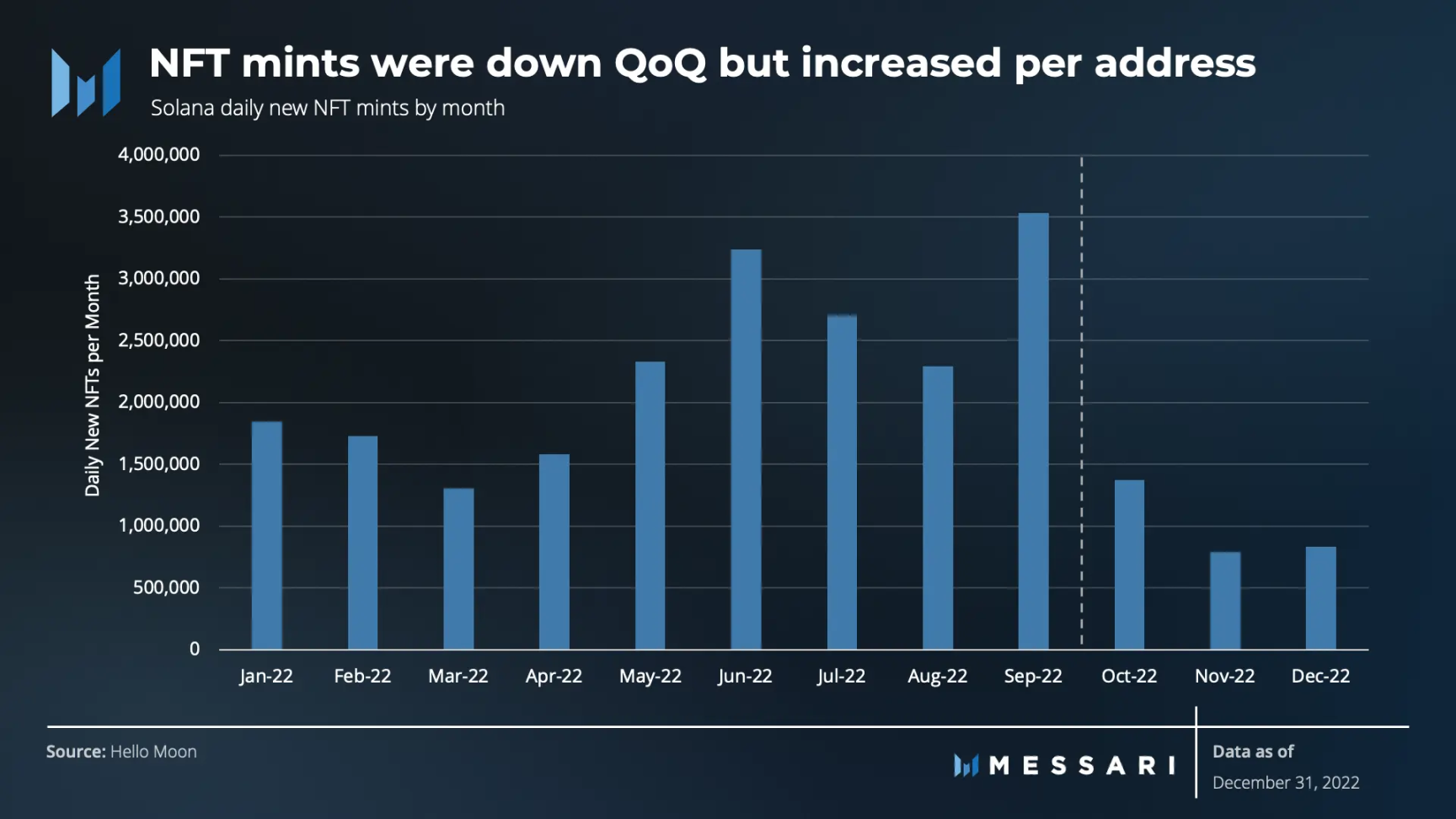

Solana's NFT ecosystem has also experienced a downturn, but not as dramatic as DeFi, like most other networks. The total number of new NFTs added daily fell for the first time month-on-month, with a drop of 65%. However, this decline came after a sharp surge in the third quarter. Despite the quarter-on-quarter decline in casting volume,Increased NFT minting volume per address on average, indicating that loyal users are emerging.

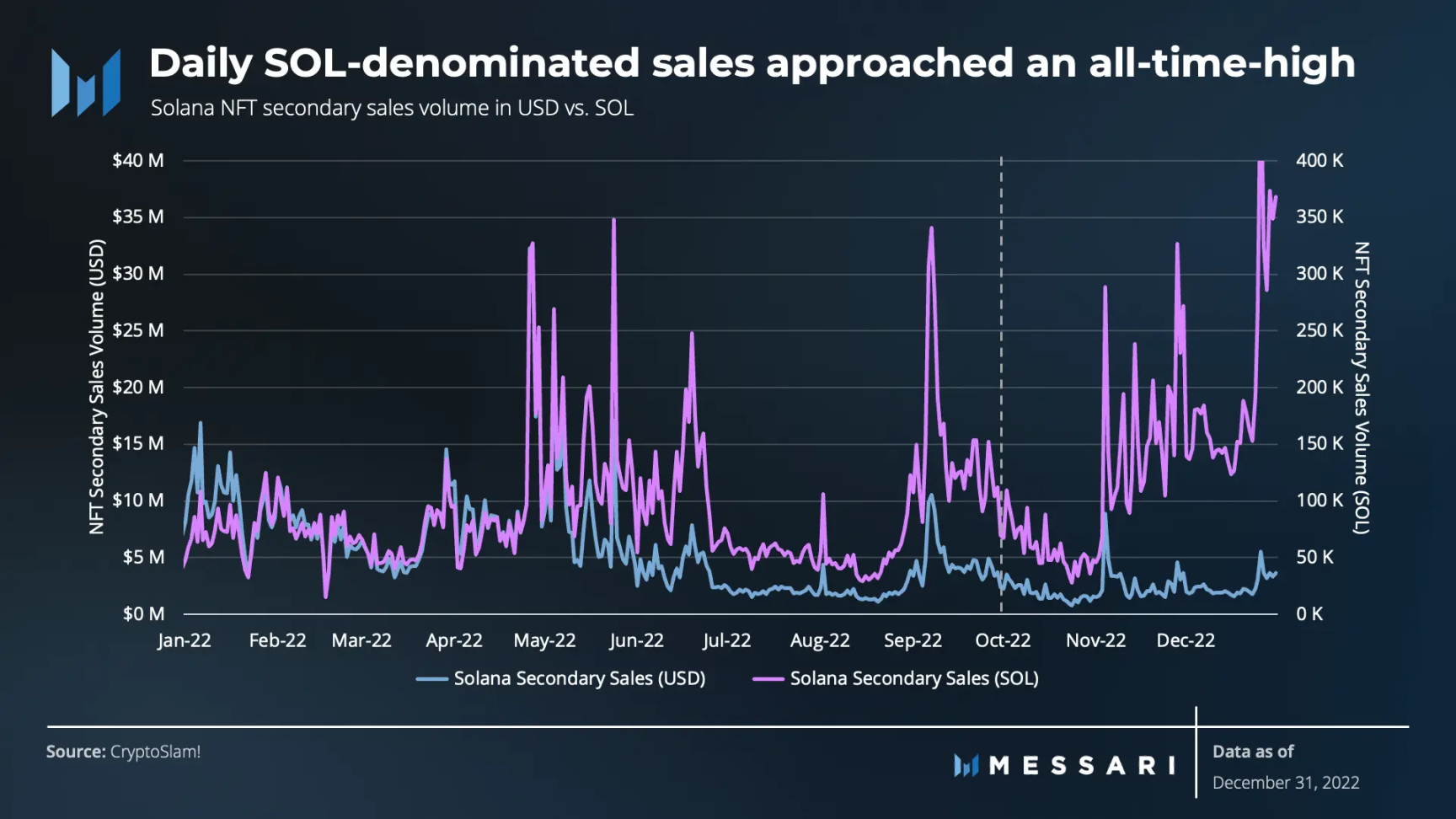

Although the number of new NFTs has declined in the wake of the FTX bankruptcy, NFT sales activity has remained relatively resilient. Daily volumes denominated in SOL hit a record high in December, as holders and traders scrambled to adjust strategies in response to the plunge in SOL prices.

Nonetheless, Solana's NFT landscape is still actively developing.

In addition to continuing to optimize Metaplex's digital asset standards, Metaplex advanced several key initiatives during the fourth quarter, including:

Development of methods that reduce the cost of minting NFTsplan;

solutionsolution;

Enhances its popular open source foundry solutions such asCandy Machine(V3);

so that creators cancollect royalties。

andMagic EdenandCardinalA form of royalty protection for creators at the protocol level was also announced. Some designs enable creators to ban marketplaces that do not enforce royalties. Time will tell which design wins out in the long run.

In addition to leading NFT platforms, Instagram and Facebook have integrated Solana NFT and their ownLaunched in the fourth quarter。

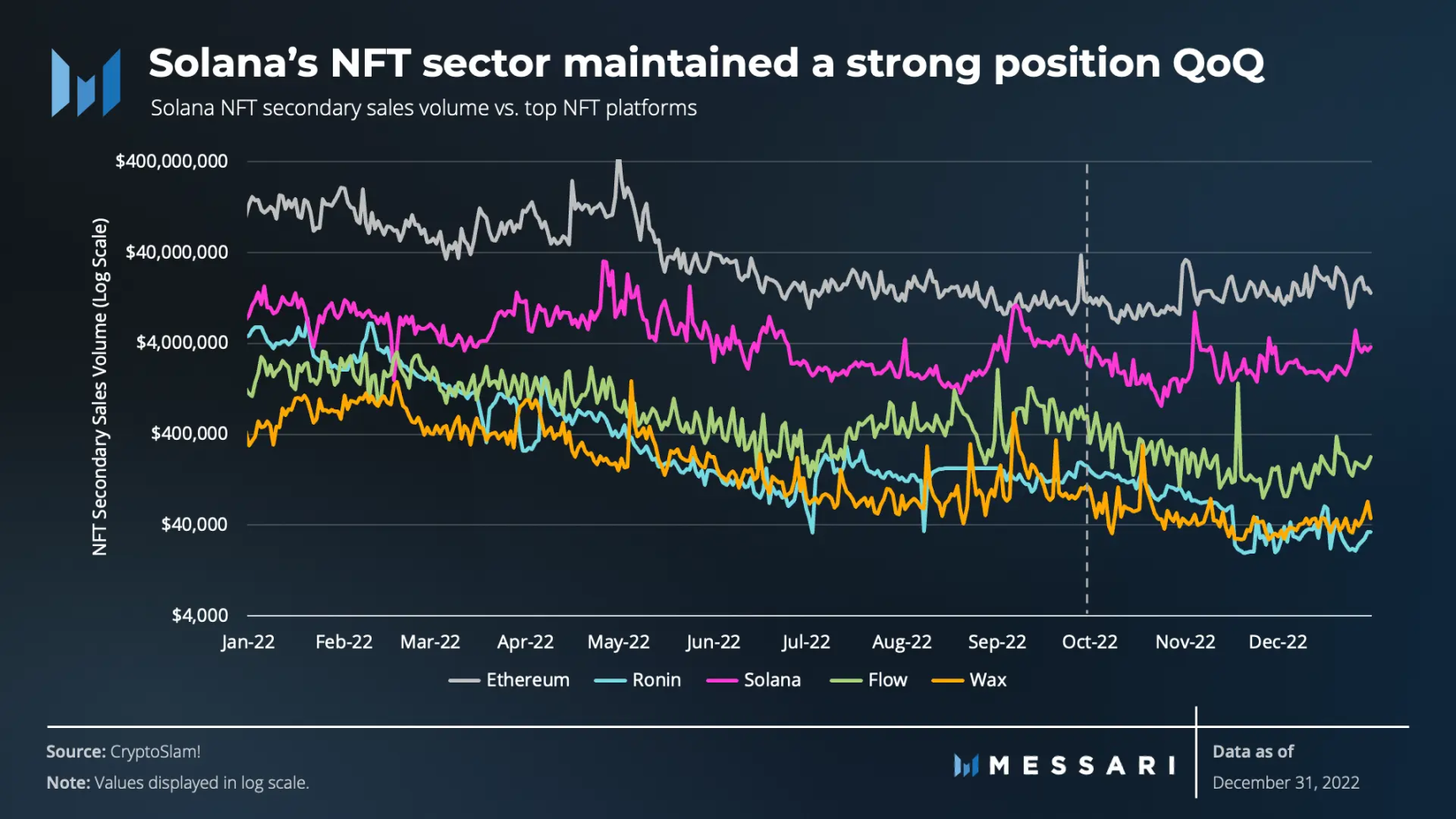

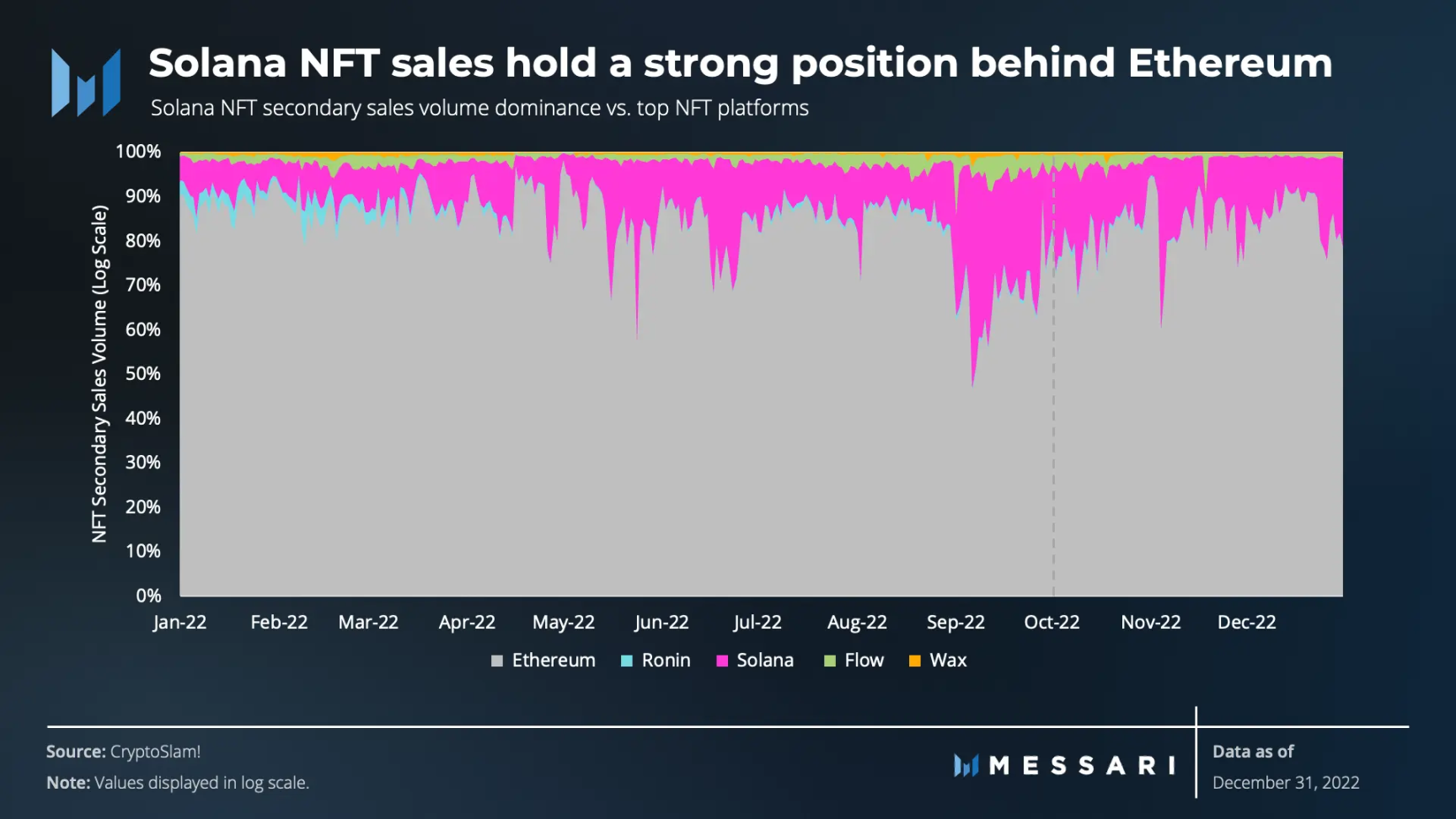

Solana's strategy and position in the NFT space remains strong, and it is the second largest network after Ethereum in terms of secondary market transaction volume.

GameFi

The crypto space is positioning itself to support the GameFi ecosystem, and Solana Ventures is leading the way. It promotes the ecological development of Solana games$150 million fundAttracted additional investment funds (notably Magic Eden'sMagic Ventures) and increased appeal to the game. This development puts GameFi on the cusp of catalyzing the development of the encryption field, and Solana is also fully developing its GameFi ecosystem.

More than 1,100 gamers attend Lisbon'sSolana Foundation Games Day. They tried dozens of completed (or near-complete) Solana eco-games. Currently (as of January 20th) there are 15 games live and this is expected to increase to 37 by March 2023.

Some highly anticipated games includeStar Atlas、ev.io、BR 1: Infinite、Auroryas well asLegends of ElumiaAuroryThe open alpha version of Elumia and the public beta version of Elumia will go live in the fourth quarter of 2022.

Frontier use cases

Orbis: enables Solana developers to use their SDK to integrate social experiences into their applications;

Aleph.im Network: Released Solana's first fully open-source decentralized indexer;

Hivemapper: A decentralized map network that has attracted attention after its launch;

Homebase: Put the real estate on the chain through Solana;

Helium: Official migration to Solana in Q1 2023.

Bonk: The first meme token on Solana.

The payments space is also emerging. In early November, sportswear company ASICS partnered with STEPN to launch and sell aUI Collectionrunning shoes. Running shoes are on sale during the end of Breakpoint and can only be purchased with USDC through Solana Pay. Within five days, the UI Collection sold out and generated over $600,000 in sales with instant settlement and no credit card fees.

Despite the problems facing the Solana ecosystem, there is hope for the future. As new applications revive usage and Solana's technology continues to evolve, the downward trend in value growth may thus reverse.

developer activity

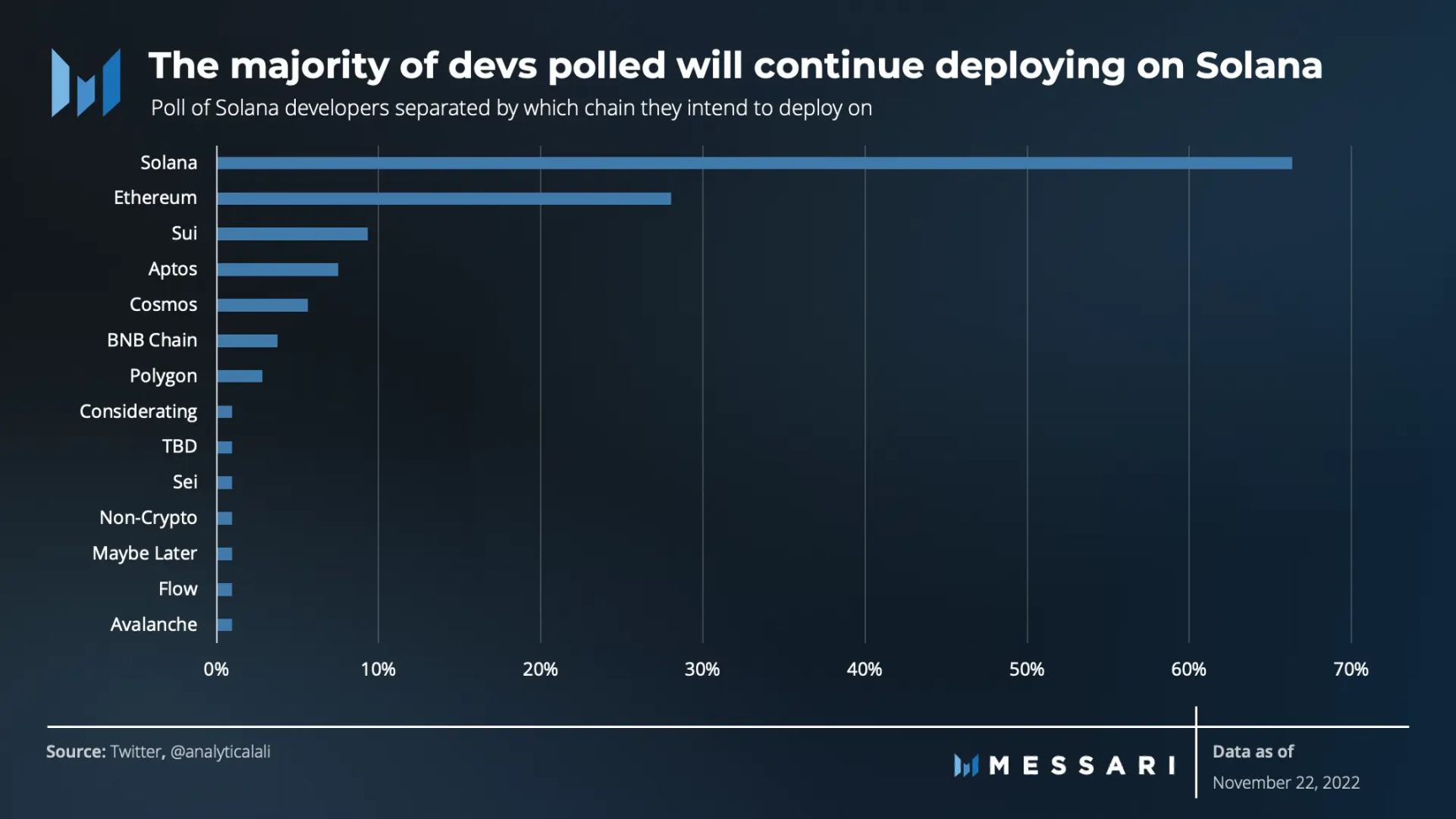

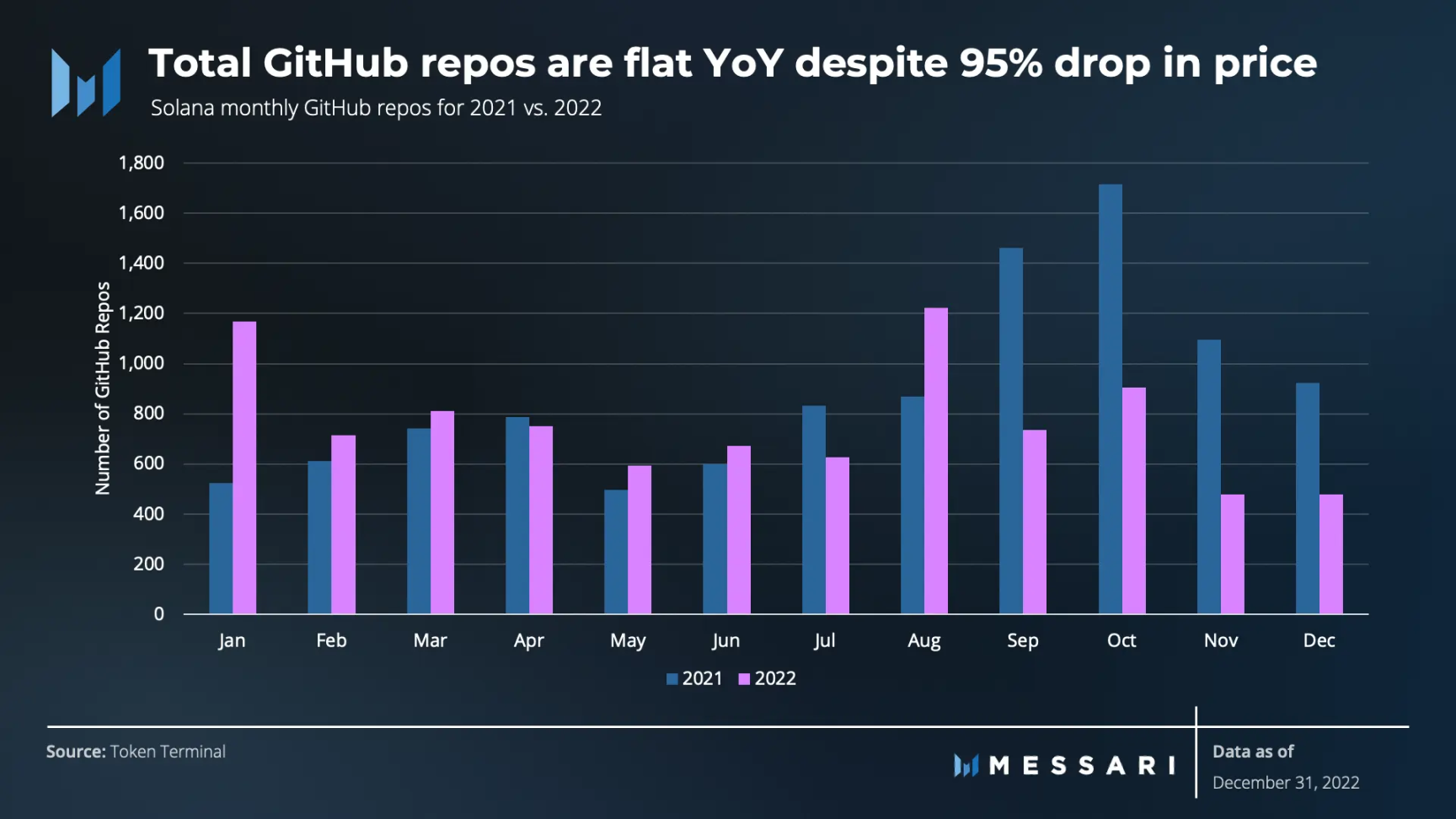

Following FTX's bankruptcy in Q4, Twitter was awash with rumors of Solana's faltering developmentrumor, a mass exodus of Solana core developers is underway. The rumors are false and mainly by Token Terminaldata problemlead to.

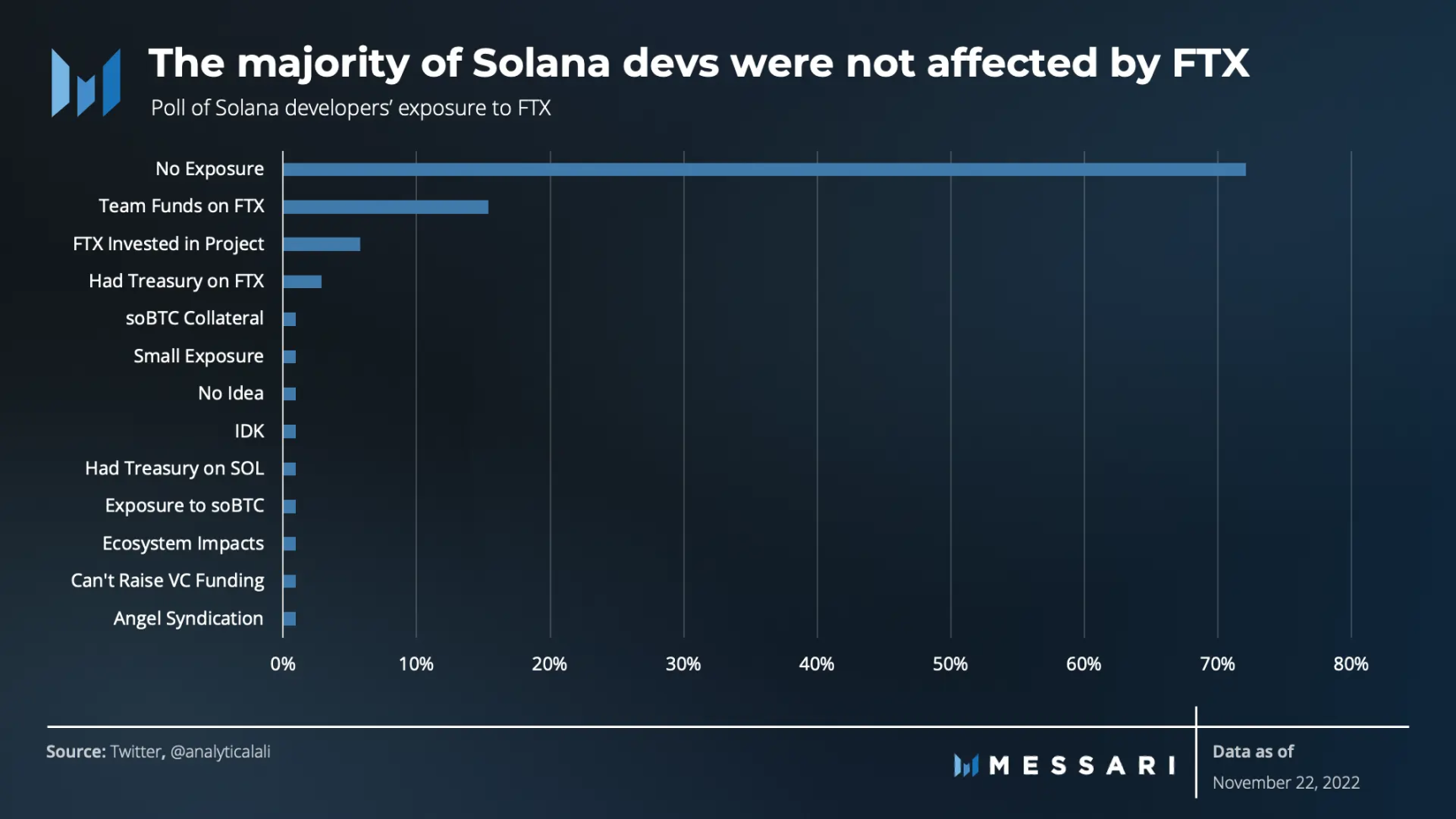

In addition, in the fourth quarter ainvestigationTo dispel rumors. While surveys like this are not rigorous enough for academic research, they do provide directional data for a better understanding of reality. There are two main takeaways:

1. A large number of developers choose to deploy applications on other chains, especially Ethereum, but most (66%) developers surveyed only insist on using Solana.

2. 72% of developers said their teams were not affected by FTX.

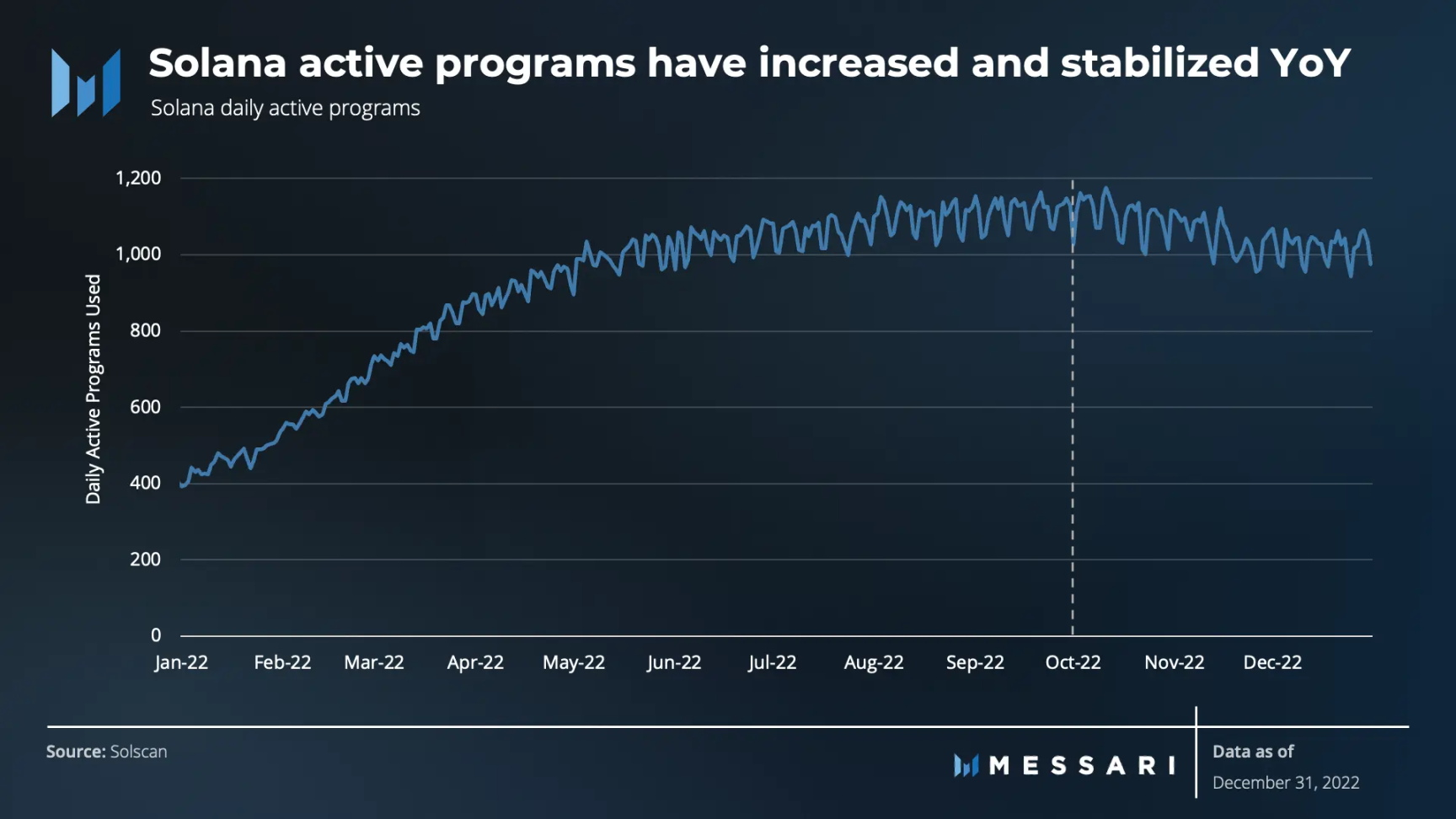

Active projects in a certain period is another indicator of ecological development. The number of active apps increased and stabilized as more apps were launched and the user base grew.

In previous reports, core developer engagement was also measured by a data source that tracked events in Solana Lab's GitHub repository.

However, current data sources on developer data are not perfect. Not all code or documentation commits are considered equal, which can lead to incomplete statistics of core developer activity.

While the data is incomplete, the evidence still shows that the number of GitHub developers is stable year-over-year despite a 95% drop in SOL prices over the same period.

Staking and Decentralization Overview

The narrative about the health of Solana's network infrastructure has also changed. There are fears that the guardians of cybersecurity will flee for one reason or another.

During the fourth quarter, the Twitter community speculated that Alameda Research, which controls 13% of the total SOL supply, would lead to significant selling pressure. However, the tokens are locked and protected by bankruptcy laws. In other words, these SOLs can only be unlocked after the liquidation process is complete, which can take a significant amount of time.

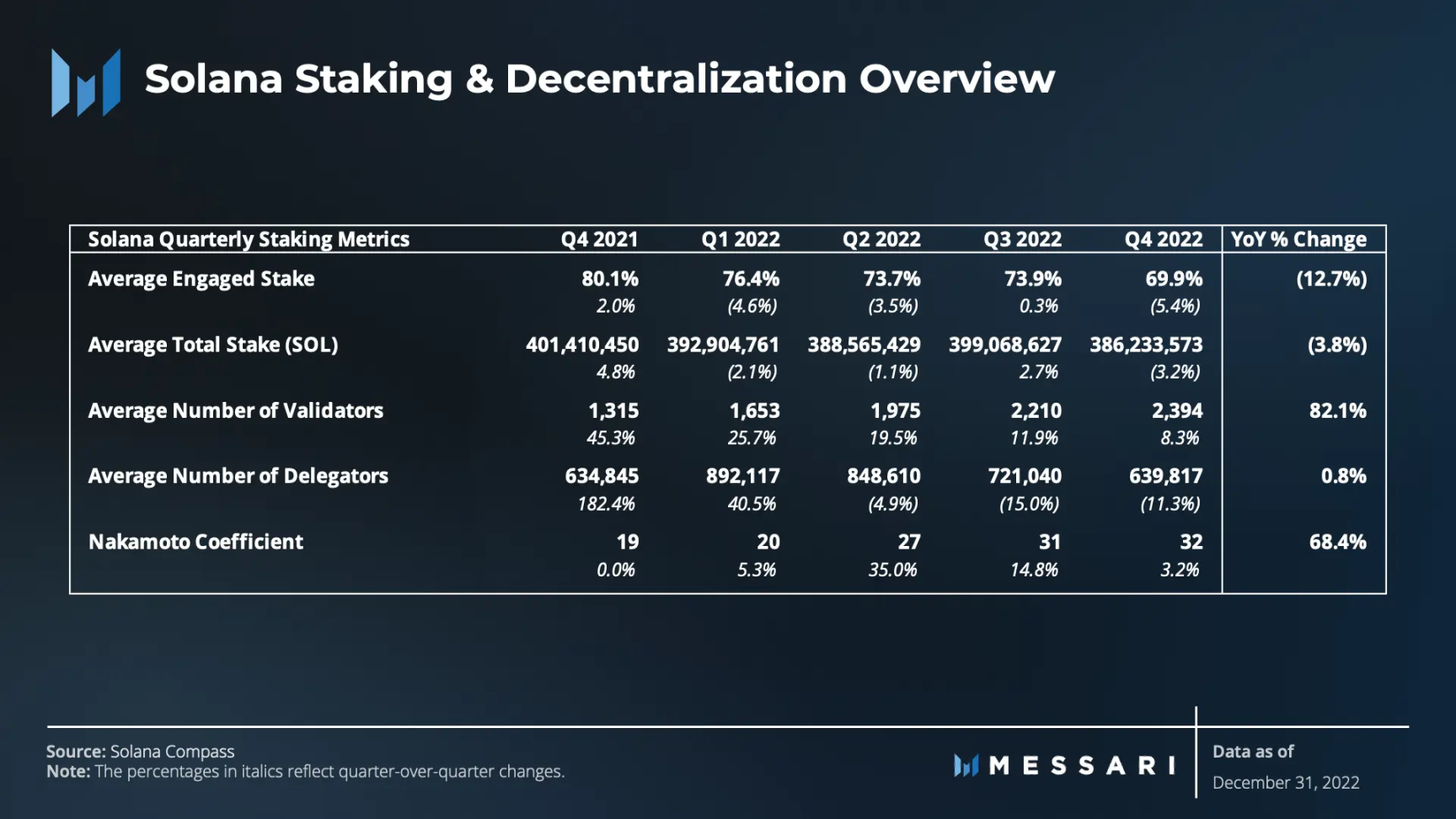

Despite events against Solana, the network's staking and decentralization have remained relatively stable. Solana’s average staking participation rate has remained around 75% over the last year.

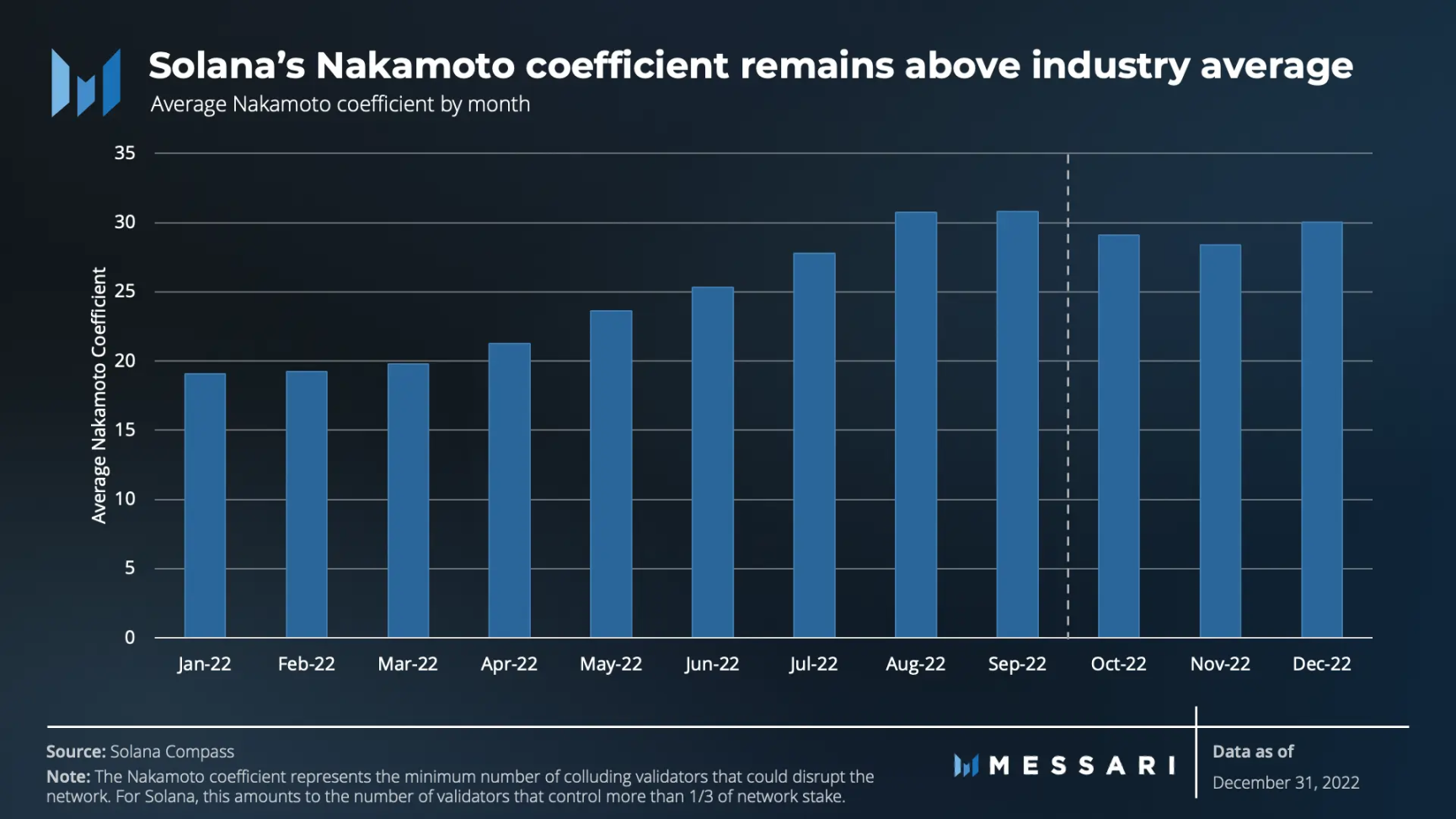

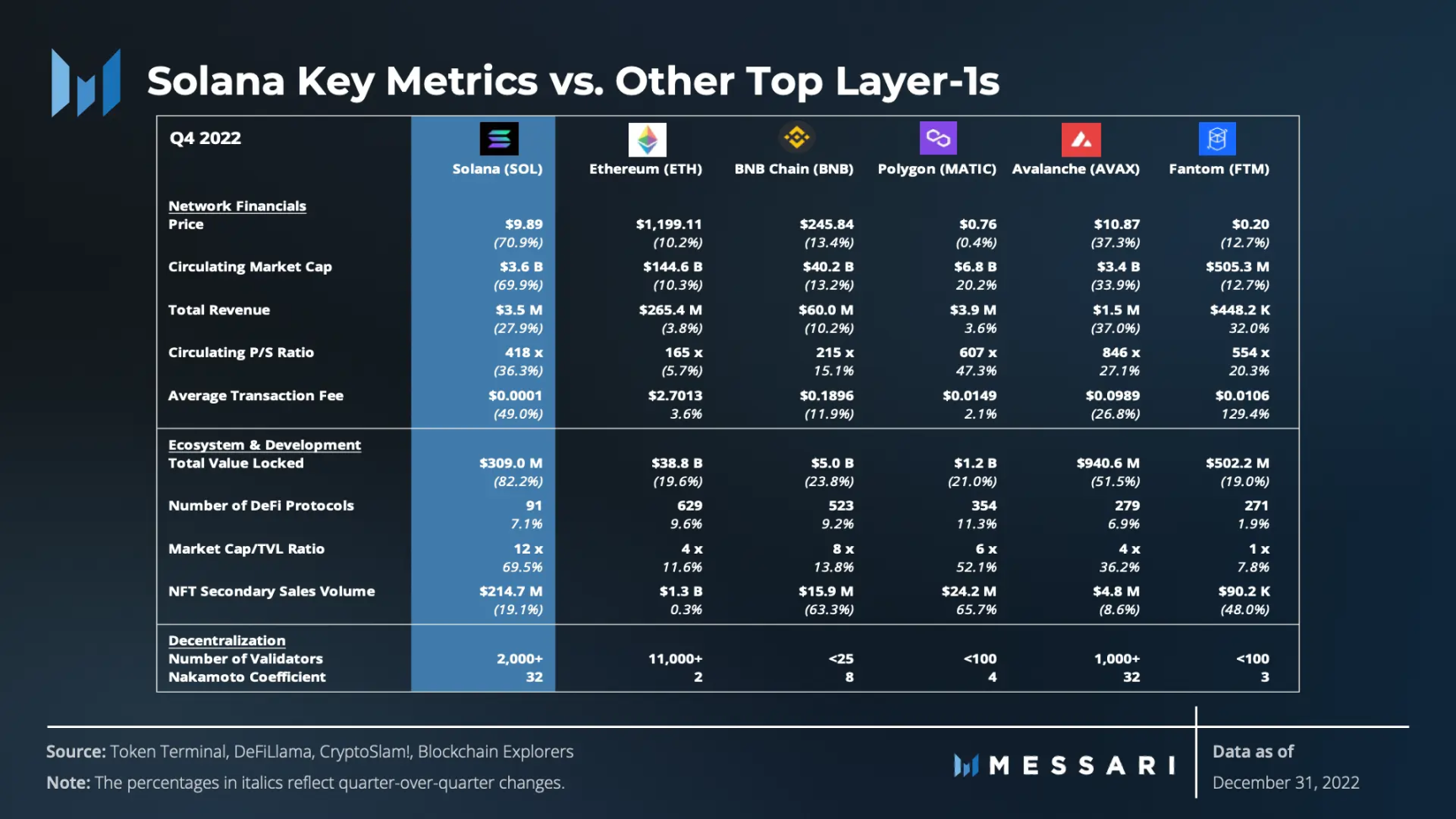

Solana's 32'sNakamoto coefficientCompared with other Layer 1 networks, it is still higher than the industry average.

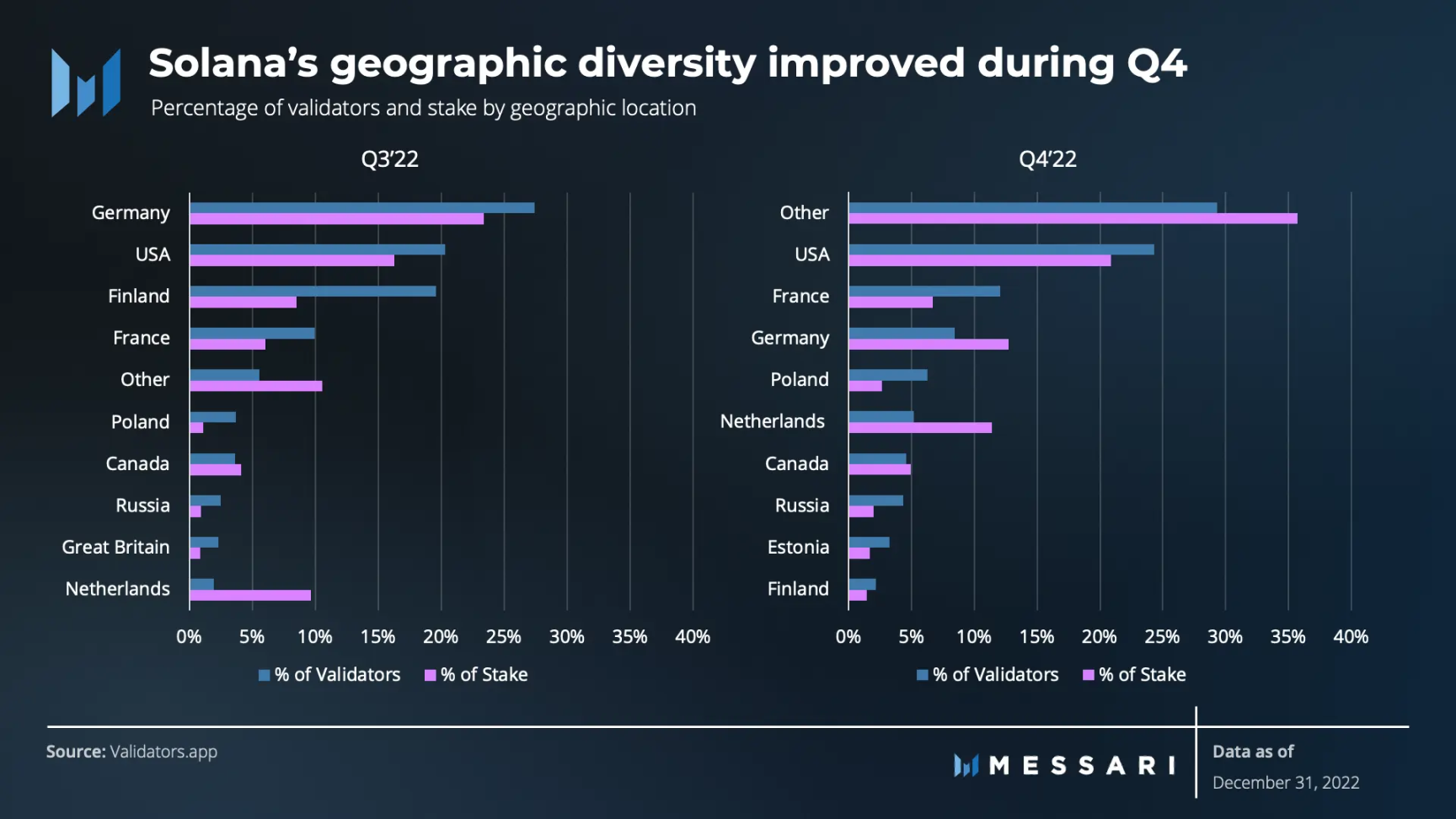

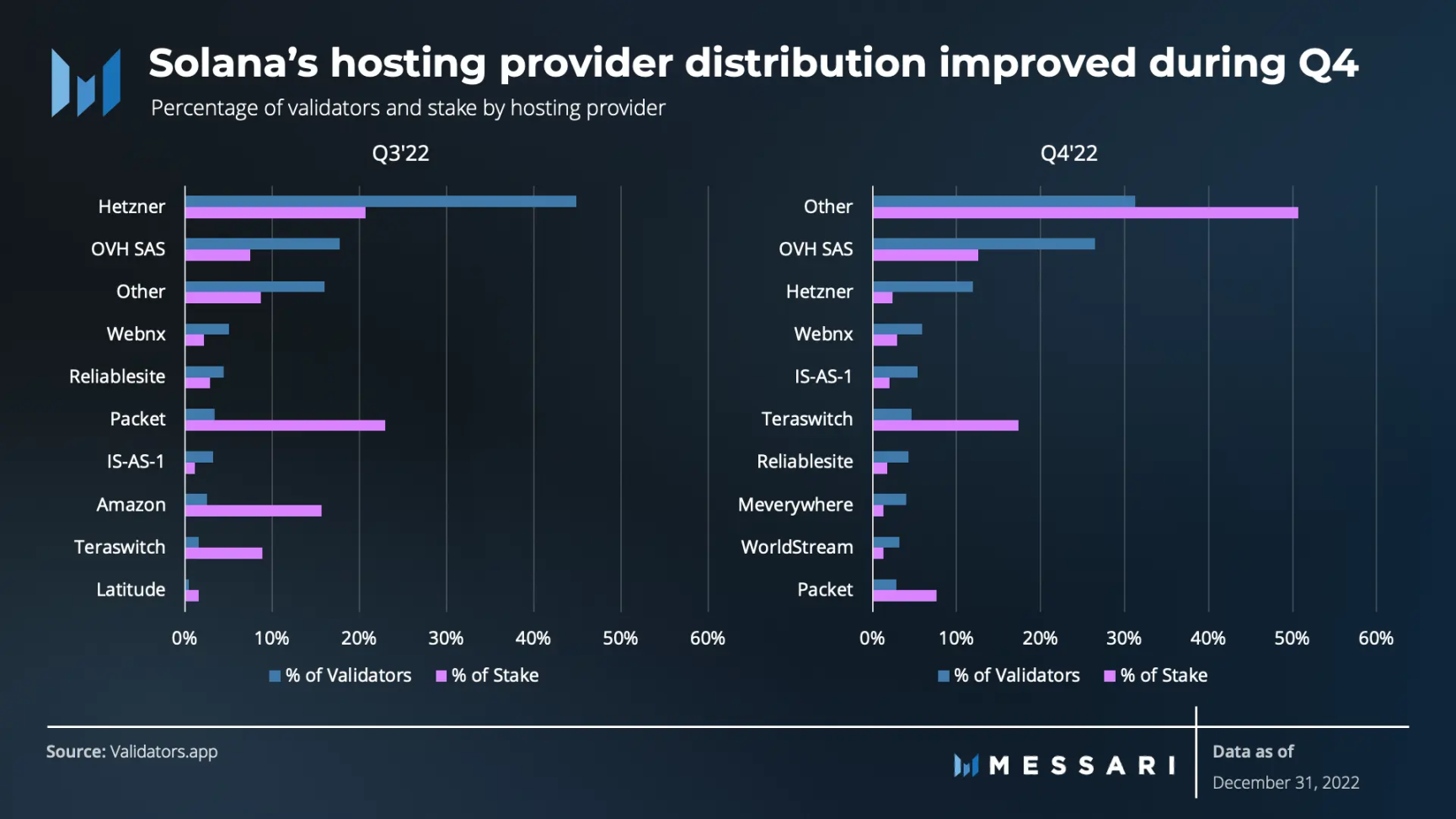

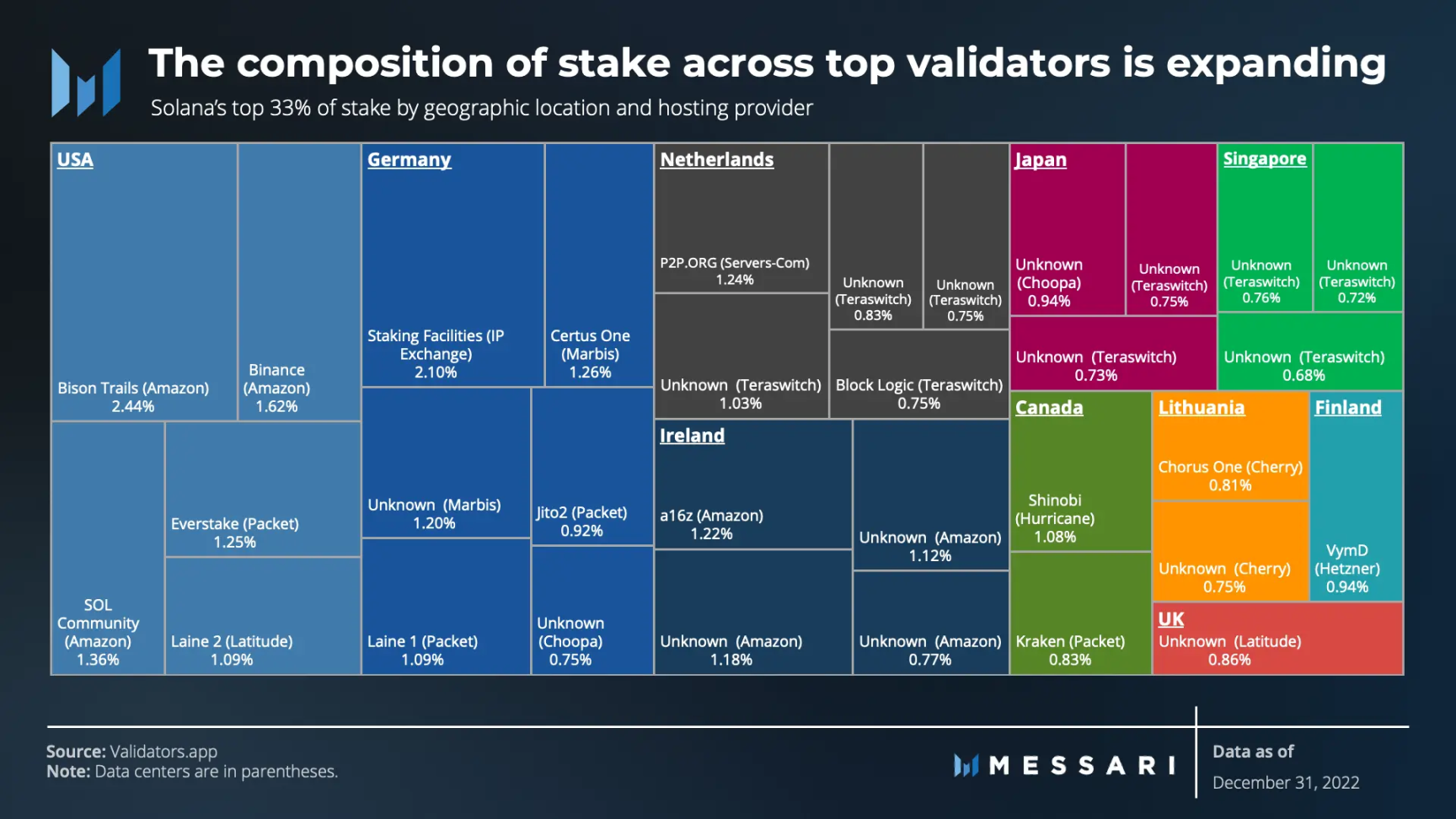

While high Nakamoto coefficients and growing validator sets are beneficial, they are not guarantees against centralization risks. Metrics such as geographic diversity, data center ownership, and entity control over validators also need to be considered to ensure a more comprehensive network health status.

Solana is designed to address the geographic concentration typical of Layer 1 networks. Too many validators in the same geographic location can compromise the health of the network due to geopolitical risks, regulations, and natural disasters.

As of December 31, 2022, validators and stakers are distributed across more than 35 geographic locations and more than 130 independent data centers around the world.

While globally distributed, ~25% of Solana validators and ~20% of staking volume are located in the US. "Other" locations account for approximately 30% of total validators and stake, including over 25 different countries.

Data center centralization is another issue. Private data centers such as AWS running validators may give their owners disproportionate power over the network. As of December 31, 2022, no single data center is hosting more than 33.3% of staked volume. The "other" category, which accounts for more than 30% of the total holdings, includes more than 125 separate data centers.

At the end of September 2022, a German web hosting companyHetznerHosts over 40% of the network's validators and over 20% of the stake. This relationship results in a network that is highly centralized in Germany and in one data center.

In early November 2022, Hetzner withdrew support for Solana-related activities, saying its policy prohibits the use of its servers for cryptocurrency-related activities. Fortunately, the move was not enough to disrupt the network. Still, the incident demonstrates the potential risks of a network that is too concentrated in a single geographic location and data center.

The situation is slightly different when evaluating the top 32 validators that make up the Nakamoto coefficient.

More than half of the validators control more than 33% of the network staking volume, mainly hosted by Amazon and Teraswitch. Additionally, one-third of these stakes are based in the United States. Assessing the makeup of these stakes among top validators is essential, even if there is not enough stake to collude. In this case, the network could be in jeopardy if these stakes were shifted to a more concentrated geographic region like the US, or to a handful of data centers like Amazon or Teraswitch.

competition analysis

competition analysis

Solana has experienced high growth since its inception until the third quarter of 2022, but its position as one of the top ten most valuable Layer 1 networks has since declined. Here, we compare Solana with the five chains with the highest TVL.

Following FTX's bankruptcy, Solana's valuation plummeted. Other chains were also affected, but not as much, especially Polygon.

Likewise, Solana's daily revenue is trending down, despite an increase in total daily transactions. Therefore, the decrease in revenue was attributed to the decrease in transaction fees. Other chains (except Polygon and Fantom) saw only small declines throughout the quarter.

During the quarter, Solana's price-to-sales ratio declined. Changes in P/S measure the revenue of the protocol and give an idea of the volume and cost of transactions processed by the protocol. Since Solana's value changes more significantly than its revenue, SOL's cost per unit of revenue becomes lower.

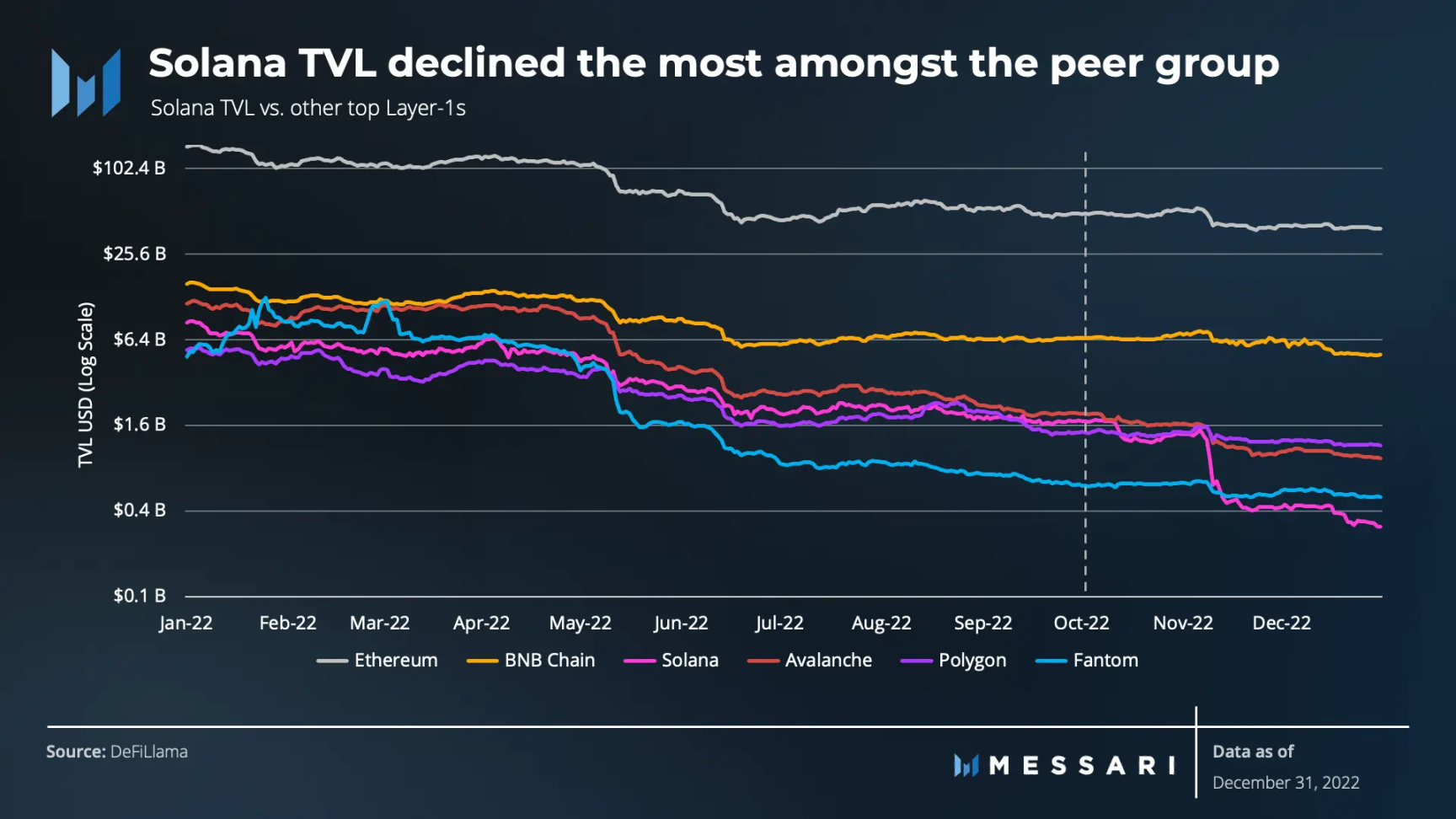

In the fourth quarter, DeFi suffered from Waterloo, and Solana’s TVL dropped the most. Declines in TVL are typically valued in USD, so a decline in the value of the native asset represents a change in TVL relative to the actual utilization of the native asset in DeFi. While TVL denominated in USD fell by a staggering 82%, locked volume denominated in SOL fell by a smaller amount (39%).

Several developments in the NFT space for Solana have allowed it to beThe total trading volume of NFT in the secondary marketMaintain a strong position relative to the top five L1s (including Solana).

Original link