first level title

annual event

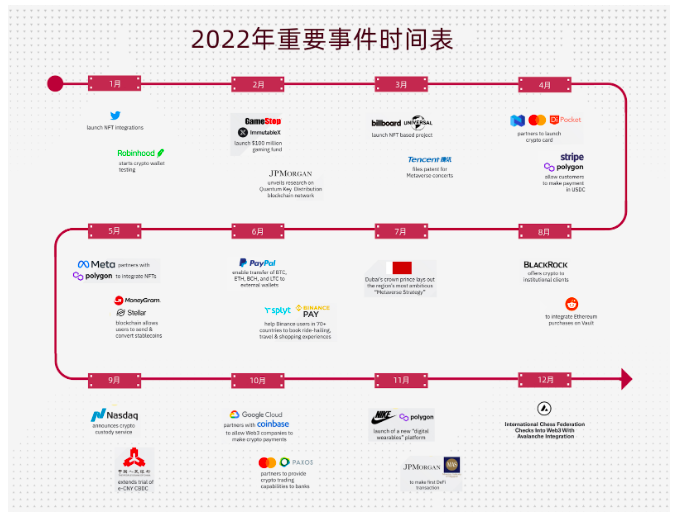

2022 is a challenging year for venture capital, with the market downturn not only affecting traditional asset classes such as stocks and bonds, but even cryptocurrencies.

● Despite the challenges, the continuous progress and iteration of the cryptocurrency ecosystem still makes us maintain a long-term optimism about its future.

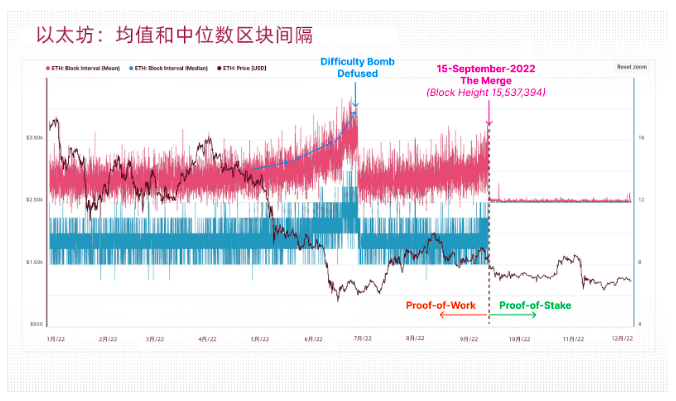

● One of the key events in the crypto industry in 2022 is the Ethereum merger in September, during which the Ethereum network switches from proof-of-work (PoW) to proof-of-stake (PoS), which is expected to reduce energy use by 99.9%.

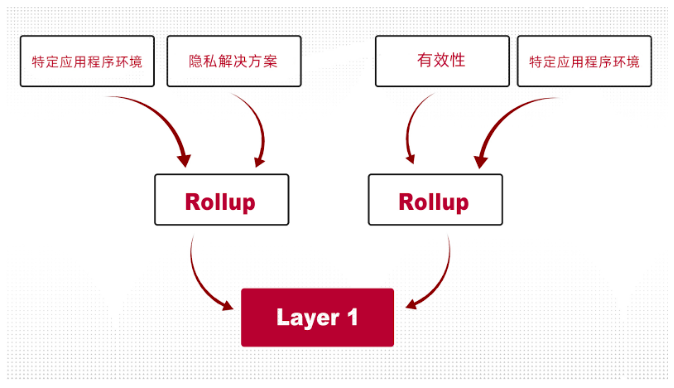

● Layer-2 solutions led by Optimistic Rollups currently dominate Rollups based on Ethereum. With the launch of Celestia next year, the competition in the Rollup field will become increasingly fierce. It remains to be seen who can maintain the long-term position in the industry.

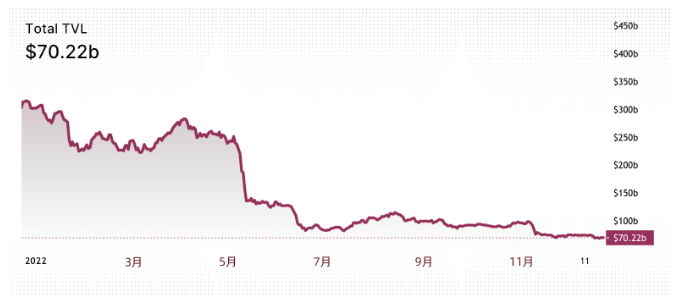

● The market share of DeFi will experience a sharp contraction in 2022, and the value of its related locked assets will drop by 76.4% from US$295.38 billion to US$70.22 billion. Relevant data show that the Terra ecological flash crash in May is the main cause of this result.

● Financing events increased by 19.4% year-on-year, and infrastructure, DeFi, and GameFi vertical industries accounted for the largest proportion of financing this year. However, compared with the signs of the previous year, the overall growth of industry financing events and funds has slowed down.

● Significant progress has been made in the regulation of cryptoassets in 2022, including the White House Act, the first cryptocurrency regulation, and Europe’s MiCA regulations, which aim to create a framework for regulating cryptoassets, showing that people in traditional industries are gradually becoming aware of blockchain The importance of technology.

● With the help of large institutions and many investors, Terra Ecology and its leader, Do Kwon, once became the first echelon blockchain project in the industry, but the instability of the stablecoin model caused it to fail within a few days in May 2022 fall apart.

first level title

summary

summary

Entering 2023, the cryptocurrency and web3 industries continue to develop at a high speed. The adoption of cryptocurrencies, the growth of Decentralized Finance (DeFi) platforms, trends in the Metaverse, GameFi, and the emergence of innovative blockchain technology have all seen significant progress in consolidating the industry over the past year.

One of the most notable trends in the industry is that more and more young people accept cryptocurrencies and regard them as mainstream assets held. From retail investors to large financial institutions, more and more people in traditional industries are beginning to see digital assets The value of cryptocurrency and its potential to transform the traditional financial system, this trend is also reflected in the increasing number of traditional merchants and businesses around the world adding cryptocurrencies as one of the payment methods.

In addition, the popularity of the DeFi and GameFi fields on various platforms has also exploded. According to the DefiLlama indicator, the total locked value (TVL) of DeFi has reached 295.38 billion US dollars. DappRadar shows that GameFi's independent Active wallets (UAW) reached 9.65 million, and the decentralized data of these platforms demonstrates greater transparency and accessibility in the field, and they may be becoming an alternative to traditional finance and popular games at a potential speed.

Another interesting area of development for 2022 is the rise of alternative Layer-1 and Layer-2 projects that aim to solve future scalability, speed, and fee issues that plagued the early days of the crypto industry, and are currently They are differentiating themselves by providing unique side features or using different consensus mechanisms, and trying to meet the needs of users in different scenarios.

The Web3 industry has experienced many challenges in 2022, such as local regulation, legal hurdles, on-chain security issues, and severe market volatility, which must be resolved before the industry can reach its full potential in the future.

In 2022, due to the Federal Reserve's interest rate increase and the sharp reduction in global liquidity, the entire encrypted economic environment will be severely depressed, which will also reduce its total market value by more than 2.2 trillion US dollars. The data shows that institutions in the centralized finance (CeFi) field The activity decreased by about 71.4%. Terra's death spiral, 3AC, FTX's successive bankruptcy, BlockFi, Genesis and other major institutions faced negative events such as liquidity depletion, financial difficulties or asset liquidation, which were one of the main causes.

In this industry report, we'll explore current trends, dig into the future of the Web3 industry, and properly forecast possible opportunities.

first level title

Global Encryption Asset Application

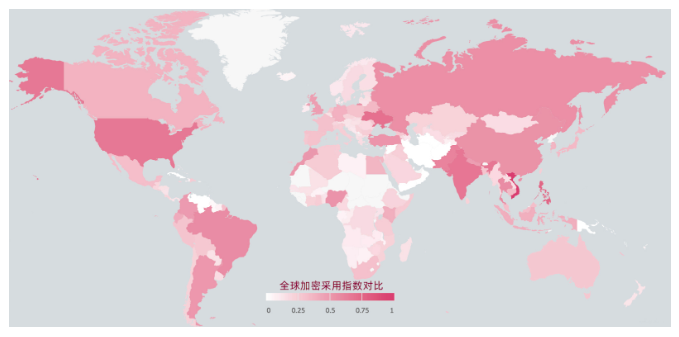

The Global Cryptocurrency Adoption Index shows that the current use of cryptocurrencies has increased in countries around the world, and all regions of the world have shown strong growth momentum in areas such as payment processing and value storage.

There are about 320 million encrypted users in the world, more than 40% of which are located in Asia, and the top three countries are the United States, Vietnam and Russia.

In 2022, the total number of encrypted users will increase by about 25 million+, which is a decrease from the 194 million new additions in 2021. Among them, the centralized exchanges (CEX) in the United States, South Korea and Russia have the highest number of visits, accounting for more than 22% of the total.

The United States has the largest share of the DeFi space and is almost six times as active as second-ranked Brazil.

Throughout South America and Africa, cryptocurrencies are commonly used for payments and asset preservation, with data showing that more than one-third of the population uses encrypted stablecoins every day.

image description

Source: Chainalysis 2022 Global Crypto Adoption Index

On the traditional corporate front, household names such as Disney, Starbucks, Adidas, and Nike are incorporating blockchain technology to enhance their supply chain management and payment capabilities. Major banks have also expressed increasing interest in the industry, such as Fidelity launching investor encryption services, BlackRock and Coinbase cross-industry cooperation to provide encryption services for institutional clients, and Goldman Sachs is also developing its encrypted data services.

first level title

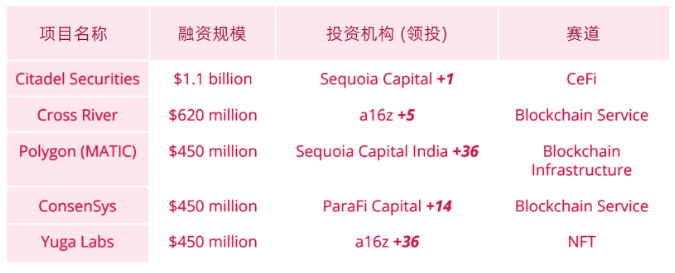

Review of Investment and Financing Events

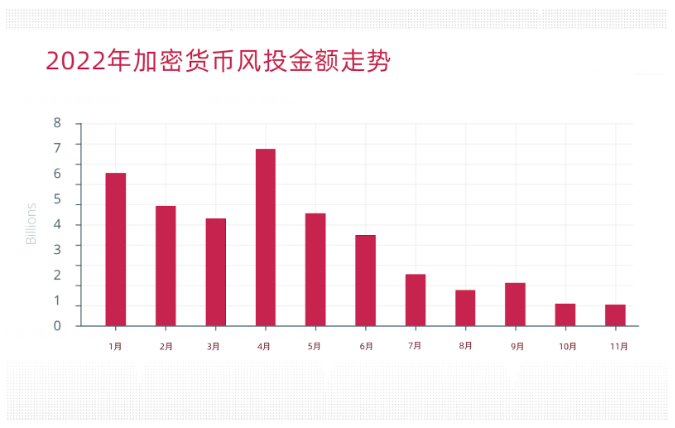

The cryptocurrency industry is facing many challenges this year, which is also very clearly reflected in the investment and financing sector. For example, several major market participants such as FTX, Celsius, Voyager and BlockFi have encountered setbacks, resulting in a decline in investor confidence and indirectly affecting The market value of the encryption field caused it to lose about 1.5 trillion US dollars.

Although Web3 venture capital funding has decreased since May 2022, the industry’s total capital investment for the year exceeded $36.1 billion, a 19.4% increase from 2021’s total of $30.3 billion. As far as the Web3 service category is concerned, although the investment situation throughout the year is relatively stable, it has won the favor of the most venture capital institutions, with a total of 592 rounds of transactions, followed by the DeFi and GameFi categories.

Looking at the number of venture capital transactions in 2022, as a group of the world's best and active venture capital companies such as A16z, Animoca Brands, Sequoia Capital and Pantera Capital, the number of investments shows that they are still continuing to raise chips in the encryption field. For example, large-scale encryption funds A16z and Redshirt Capital invested US$450 million and US$2.85 billion in that year, respectively. It is also mentioned that Citadel (Citadel Securities is a world-renowned market maker and high-frequency leader) has the highest financing amount in this year, with a total amount of 1.1 billion US dollars.

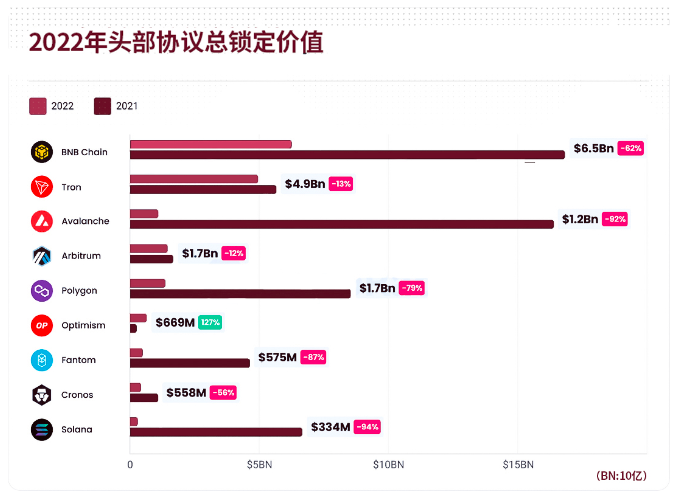

Layer 1

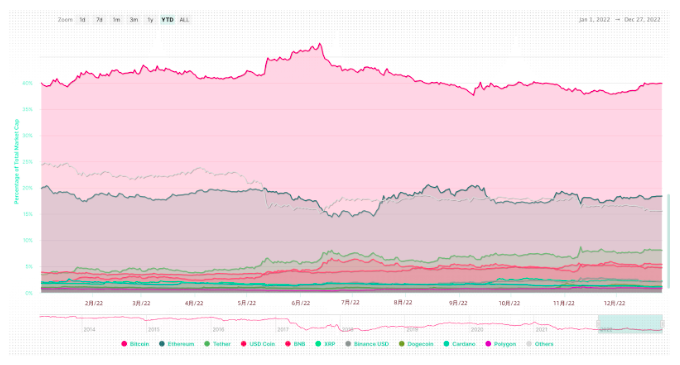

In 2022, various competing L1 underlying protocols will introduce new consensus algorithms, blockchain architectures, and execution environments. Among them, Bitcoin and Ethereum will continue to occupy a dominant position in industry transactions, with BTC accounting for 39.9% and ETH 39.9%. 18.3%, and together they account for 58.2% of the entire crypto market by market capitalization.

image description

Year-to-date (YTD) major cryptoassets as a percentage of total market capitalization

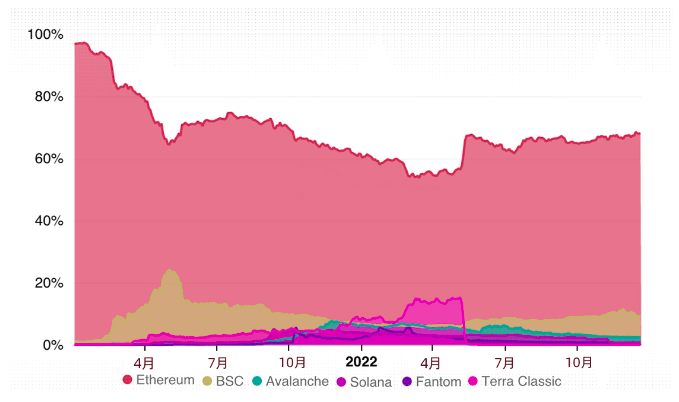

In 2022, the total value locked (TVL) of L1 will decline. For example, the market share of Ethereum will continue to decline from 96.91% in 2021 to 62.43% at the end of 2021, and will further decline to 59.01% in June 2022. .

In contrast, the TVL dominance of BNB Chain has increased significantly in the past year, from 0.78% at the beginning of 2021 to 7.02% at the end of 21, and reached an astonishing 10.02% at the end of 2022. This cycle shows a strong The stable market performance makes us pay attention to BNB Chain.

first level title

ethereum merger

ethereum merger

The merger and upgrade of Ethereum took place on September 15, 2022. Under the eyes of everyone, its "workload proof" has completed the transition to the "stake proof" mechanism.

This is one of the most impressive achievements since the inception of the industry in 2009. The graph below shows the average and median block intervals throughout the year, with a clear distinction between variable block times. See the network transformation process and potential performance improvements.

Since the merger event, the number of active validators has increased by a total of 13.3%, and there are now more than 484,000 validators in operation. This brings the total amount of staked ETH to a staggering 15.618 million, which is 12.89% of the total circulation of ETH.

With the transition to proof-of-stake, Ethereum’s monetary policy has significantly reduced the release time, in which the theoretical circulation has increased by about 0.5%. Considering Ethereum’s EIP 1559 destruction mechanism, it will offset about 0.1% per day, so compared to The pre-merger net inflation rate was around +3.9%, showing the dramatic change that post-launch has brought.

From the user's point of view, the merger of Ethereum has little impact on their experience and impact on using its network, and the gas fee that users are most concerned about has not changed significantly, but the merger event is still an important milestone in improving the scalability of the main network. After all, this can provide necessary preparations for continuous iterations in the future.

first level title

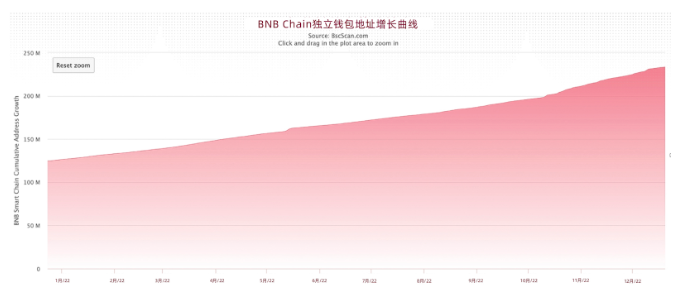

BNB Chain Growth

BNB Chain will continue to grow steadily in 2022, with TVL increasing from 7.02% at the end of 2021 to 9.24% at the end of 2022. Compared with competitors, the chain performs particularly well in terms of total transaction fees, which is second only to Ethereum. Industry second.

Through the innovation of new products, BNB Chain has maintained effective competitiveness. A key event in 2022 is the launch of the BNB Chain application side chain "BAS", which will allow developers to transfer data and assets from BNB Chain, thereby further easing network transactions. pressure to release limited resources.

Large-scale applications will be deployed on the BNB Chain, including GameFi, SocialFi, and Metaverse, who are expanding from a single chain to multiple chains, and expanding BSC's verification nodes from 21 to 41.

In addition, the network’s transaction volume also hit an all-time high, reaching 9.8 million in May 2022, with a peak of 2.2 million daily active users in October.

first level title

WAX and Solana

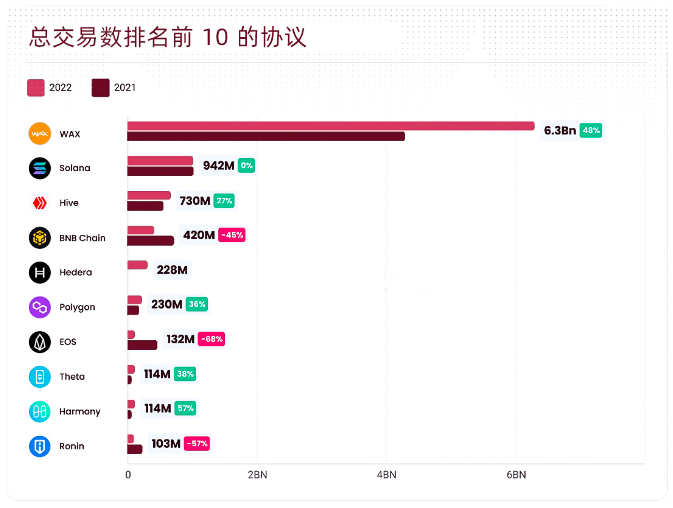

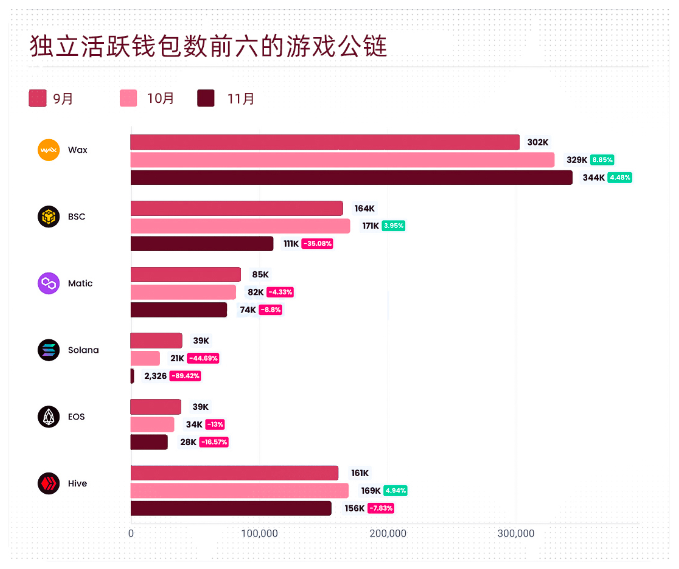

The top 10 L1 transaction volume in 2022 has changed to varying degrees compared with the previous year. Among them, the WAX protocol has the largest increase, and the number of transactions increased by 48.26% (6.32 billion), which is the highest in the total amount of transactions.

The Hive protocol has also seen significant growth, with the number of transactions increasing by 27.57% (730 million) that year. Both networks are underlying public chains dominated by the GameFi ecosystem.

Despite Solana's many challenges in 2022, its network will still rank second in the industry in terms of the number of transactions in 2022, although it will only increase by 0.06% (942 million) compared to the previous year.

One of the more prominent areas of Solana is the NFT ecosystem, which is one of the highlights of its public chain. With the development of Solana NFT in early 2022, the daily transaction volume of its platform Magic Eden even surpassed that of OpenSea.

On the other hand, the number of transactions on BNB Chain has dropped sharply, down 45.32% (420 million transactions) compared with the previous year. Although BNB Chain has the largest number of new addresses per day, it still cannot reverse the trend of declining transaction volume.

It is worth mentioning that the overall number of transactions in each category has increased significantly, an increase of 72.90% compared with the previous year, reaching 9.98 billion US dollars, which shows that the activity of all Layer-1 and related products will experience a significant increase in 2022. increase.

In 2022, the industry will introduce some new L1 protocols, including the famous Aptos, Celestia, and Sui. The highlights of these new public chains are:

● Cronos: Become the first EVM-compatible chain built on Cosmos, with strong interoperability and Proof of Authority (PoA).

Avalanche: It implements a novel leaderless consensus protocol, introduces the concept of subnets, and uses a unidirectional acyclic process (DAG) to organize transactions.

● Aptos: Introduced a new consensus algorithm (AptosBFT), parallel execution framework (Block-STM) and Move programming language.

● Sui: Similar to Aptos, it also adopts the split and dual consensus mechanism of simple transactions and complex transactions

● Celestia: It is the first modular blockchain network whose goal is to build a scalable data availability layer, enabling the next generation of scalable blockchain architectures.

Some early Web3 projects have started to launch on the Aptos and Sui chains, and we think it will be interesting to follow the development trend of the early protocols and follow the trend, if they establish a secondary connection with the early crypto ecosystem, it may be very important for the future more favorable development path.

Layer 2

first level title

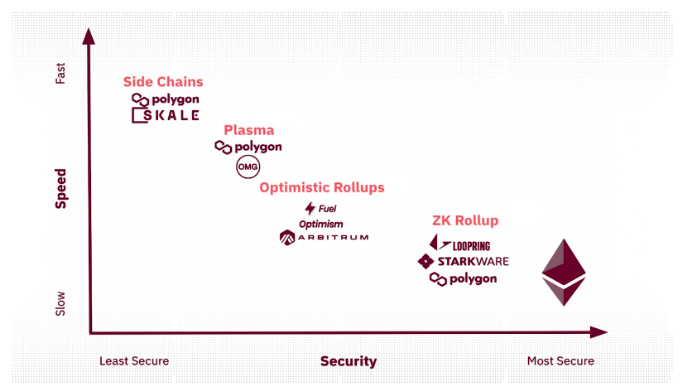

The challenge facing the growth of blockchain in recent years is that the existing L1 protocol has extremely limited scalability due to relatively low transaction efficiency. To solve this problem, many builders turned to the L2 extension layer. After a reliable consensus layer, complex data and operations can be transferred to the L2 faster to scale and improve the efficiency of the execution layer (the two main L2 solutions that have received attention in the past few months are Zero-Knowledge (ZK) and Optimistic Rollups).

Most transactions can be executed on L2, which provides more scalability and faster transaction speed and lower gas cost. When building Layer-2 expansion solutions, they must inherit the underlying security of the main chain , which is one of the conditions that distinguish them from sidechains, where the underlying security is always guaranteed by validators.

Zero-Knowledge Rollups

first level title

By doing most of the calculations off-chain, ZK-rollups reduce the amount of data that needs to be published to the blockchain, which in turn reduces the processing power required and the capacity used for transaction verification, so gas fees are lower, This makes transactions faster and cheaper. Additionally, since ZK-rollups only interact with smart contract-related data when necessary, they also help reduce the burden on their public chains.

Optimistic Rollups

first level title

Optimistic Rollups is another type of scaling solution that allows multiple off-chain transactions to be batched together before they are committed to the blockchain, an approach that helps users reduce fees by sharing the fixed costs of transaction formation, data aggregators Using a Merkle tree structure to calculate batches and improve transaction speed, but compared to Plasma and ZK-rollups, the throughput of Optimistic rollups is still at a low level.

When comparing various Layer-2 scaling solutions, it is important to consider their differences in speed and security. Optimistic rollups and Zero-knowledge rollups are generally considered more secure than sidechains and Plasma, but their speed may It is slower and has more limited execution capabilities, so it is important to carefully balance security and speed when choosing the most suitable solution for a specific scenario.

image description

Layer-2 solutions differ in security and speed

The Layer-2 scaling solution landscape has changed significantly in recent years with the introduction of the Ethereum Virtual Machine (EVM) Zero-knowledge Rollups (also known as zkEVM), as L1 platforms become more powerful and reliable, It is expected that a larger proportion of transaction behavior will be transferred to L2. In order to support this type of incremental transaction activity, it is particularly important to enhance the functions of DApps on L2 by using zkEVM and other measures. This is a relationship of performance interdependence , because with the improvement of L1 performance, L2 will play an increasingly important role.

If Ethereum continues to develop as a secure and reliable settlement layer, L2-generated income may increasingly be diverted from the Ethereum mainnet, which may result in lower staking returns for validators, potentially bringing introduce new security risks. Therefore, the potential impact of this trend needs to be carefully considered and steps taken to ensure the continued stability and security of the Ethereum network.

After examining the various characteristics of Layer-2 scaling solutions (including sidechains), Zero-knowledge Rollups seem to offer the best solution in terms of security, performance, usability, and some other important factors. It's important to note, however, that the most appropriate solution will depend on the specific needs and constraints of a particular scenario, which requires weighing a number of different factors.

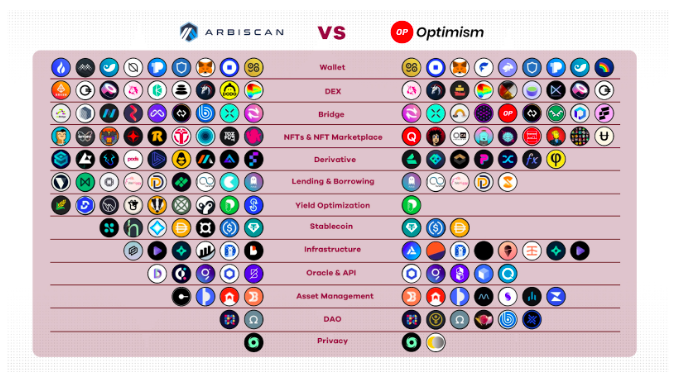

Optimism and Arbitrum are pioneers in this field (both use Optimistic Rollup technology), and their usage rate has increased significantly. A total of nearly 150 Dapps have been deployed on the chain, including Uniswap, Curve, Aave, etc. .

Comparison of dApps on Arbitrum and Optimism, two of the largest and most popular L2 solutions

Layer 3

first level title

We have discussed the benefits of Layer-2 scaling, especially in the context of Zk-Rollups and the potential of zkEVM to scale Ethereum, another scaling method that has been proposed is Layer-3 scaling, which refers to The idea of building protocols on top of protocols again to further extend blockchain capabilities.

The goal of Layer-3 extensions is to improve the performance and efficiency of the blockchain without sacrificing security and reliability. One of the main benefits of Layer-3 extensions is that it allows new features and functionality to be added to the blockchain, while No major changes are required to the underlying Layer-1(L1) or Layer-2(L2) protocols.

The L3 framework developed by StarkWare (StarNet parent company) presents a complex proposal in which layers are not only stacked on top of each other, but also assigned different purposes, as StarkWare points out three possible routes for Layer-3 expansion plan.

● L2 for extension, L3 for custom functionality - no attempt is made in this vision to provide further scalability, instead stack layers help the application to scale, then independent layers provide individual functionality customization (eg security, etc.).

● L2 for general-purpose extensions, L3 for custom extensions - customized standards can come in different forms: specialized applications that use schemes other than EVM for computation, with data compression optimized around the application-specific data format .

The key argument is that Layer-3 allows sub-ecosystems to exist within a single Rollup, enabling cross-domain operations within that ecosystem to take place at low cost without leveraging expensive Layer-1. A major advantage of L3 is that applications Designers can have better control over the technology stack.

image description

Layer-3 Design Possibilities

Layer 3 scaling is an active area in the blockchain community for research and development, and is expected to play an increasingly important role in the future as the demand for blockchain-based applications continues to grow through 2023.

DApp

first level title

More consumer and business adoption of blockchain, and more investor participation and support, have contributed to industry consolidation, a trend that shows the strength and maturity of the industry.

DeFi

first level title

DeFi (Decentralized Finance) is a class of blockchain-based applications that enable financial services such as lending, trading, and payment processing without traditional intermediaries.

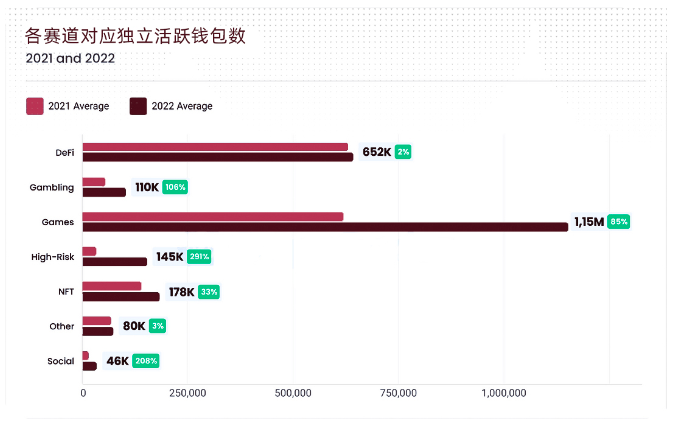

DeFi applications will reach an average of 652,970 dUAW in 2022, although this is only a 2% increase from 641,510 dUAW in 2021. But given events such as the Terra Luna debacle, cryptocurrency price crashes, and the hack of funds on blockchain bridges, it’s already an impressive feat for the DeFi space.

In 2022, the DeFi industry is facing many challenges, one of which is the sharp decline in the total locked value (TVL), (TVL reflects the value of funds invested in DeFi projects), which plummeted from the peak value of 295.38 billion US dollars in January to 12 70 billion US dollars last month, a total decrease of 76.4%.

Taking the TVL of the Layer-1 DeFi protocol as an example, Ethereum dropped to $32 billion, and BNB Chain dropped to $6.5 billion, down 74.56% and 62.5% respectively from the previous year. Layer-2 protocols, on the other hand, are doing better. Ethereum-based solutions Optimism and Arbitrum are growing strongly. These networks are becoming more and more popular with projects. Many projects integrate them and users test them on these networks. products, causing other public chains to be replaced by it in the leading position.

The TVL of the largest DeFi protocol Ethereum in 2022 fell by 74.56% to $32 billion. This decline may be due to market conditions and the combination of Layer-2 protocols being used more widely, but Ethereum still dominates DeFi 58% share of the total TVL of the market.

BNB Chain has the second largest TVL, about $6.5 billion. In terms of TVL scale, Ethereum and BSC are followed by Tron, Arbitrum, Polygon, Avalanche, Optimism, Fantom, Cronos and Solana.

The main reason for the decline in TVL in 2022 is the general decline in the value of cryptocurrencies, which affects the DeFi field. As the value of cryptocurrencies used in the DeFi system decreases, TVL also decreases. During this period, the entire cryptocurrency market experienced Significant loss of value was the root cause of the immediate impact.

Another important reason is the collapse of the Terra Luna platform, which caused a loss of about 50 billion US dollars. The Terra Luna platform was the second largest DeFi ecosystem at that time. Its flash crash had a major impact on the entire DeFi industry, and it also hit people. The confidence in DeFi has even affected the prices of other DeFi protocols.

At present, the DeFi protocol MakerDAO has the largest TVL, with a locked value of 6.04 billion US dollars, which is 8.68% higher than the TVL of other DeFi protocols, and 7.85% lower than last month. In terms of TVL and volume, it ranks first after MakerDAO DeFi protocols, in order, include Lido, Aave, Curve, Uniswap, Convex Finance, Pancakeswap, Justlend, Compound Finance, and Instadapp.

On the other hand, according to the Defillama indicator, the GMX and Alpaca Finance TVL indicators have increased by 9.98% and 33.99% respectively in the last month.

Despite the difficulties, the DeFi industry remains strong and continues to grow, with an increase in the number of financial applications built on smart contracts in 2022 that provide a variety of different services, such as providing basic financial services in areas where traditional banking services are not available. Banking services, and enabling transactions between traditional financial institutions and DeFi protocols.

Morgan) and DBS Bank (DBS) have launched pilot projects or transactions based on DeFi protocols. The track is expected to continue to grow and transform in the future, building on the progress made in 2022.

GameFi

first level title

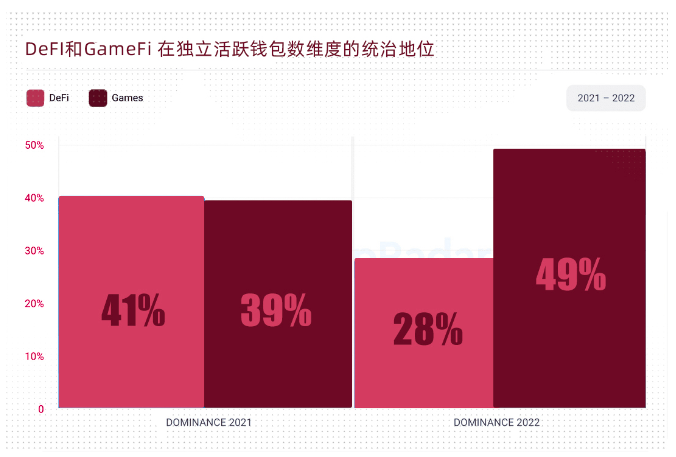

GameFi remains the most popular category of blockchain applications, with an average of 622,620 daily unique active wallets (dUAW) in the gaming segment in 2021, a figure that will grow by 85% in 2022 to an average of 1, 152,255, which accounts for 49% of the total number of Dapps in 2022, and the number of transactions also increased by 94.17%, reaching 7.44 billion.

According to DappRadar, Splinterlands is the most popular platform, growing 85% by 2022, reaching 217,914 unique active wallets per month. The second most popular game, Alien Worlds, saw a slight dip in activity in 2022 with a 3.67% share and now averages 178,118 unique active wallets per month.

One trend gaining traction in the GameFi space in 2022 is Move 2 Earn, a relatively new speculative marketplace that offers a range of products and services to reward users for being active, a popular project in this space is STEPN, cumulative monthly 2022 With over 2.23 million users and over 700,000 NFTs minted, other notable projects from Move 2 Earn include Step App, Genopets, and Walken.

We're also seeing gamification of different lifestyles, it's not just about making money, for example in the "earn while you play" model, where making money is an additional value option that enhances the experience in virtual and certain real life, the Some emerging projects in the category are Gameta and Metarun. Another spin-off type is "earn as you learn," where the program rewards users for self-studying on a specific topic.

With the increasingly weak performance of blockchain games in recent months, the performance of most projects generally declined slightly in the last quarter of 2022.

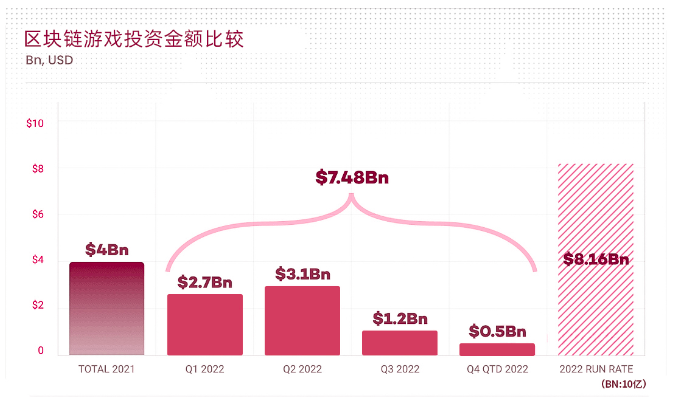

In recent months, the investment results of the blockchain game track have also been mixed. According to statistics in the third quarter of 2022, the track has experienced a year-on-year negative growth, and the total transaction amount has begun to decline. Continuing, while the number of deals increased 2.6 times year-over-year, the total deal value dropped by 19%.

With investments on a downward trend toward the end of 2022, several major platforms are starting to support blockchain games, such as the Epic Games Store, which hosts Blankos Block Party, and games owned by Gala Games.

Despite the turbulence and uncertainty in the digital asset market in 2022, the level of interest in the blockchain game industry shows that major investors are still optimistic about its potential, as companies that can use the blockchain game infrastructure to produce high-quality content Still continue to be sought after by the market and capital.

NFT

first level title

In 2022, due to the bear market and the overall economic downturn, the volume of NFT transactions has dropped sharply, which has raised concerns about the possible recession of NFT. However, we exclude the pulling effect of the overall bull market in 2021. The NFT market in 2022 still has made significant progress in many areas , which makes 2022 a year of NFT exploration and growth, as many new projects and applications emerge to test the transformative potential and practicality of NFT.

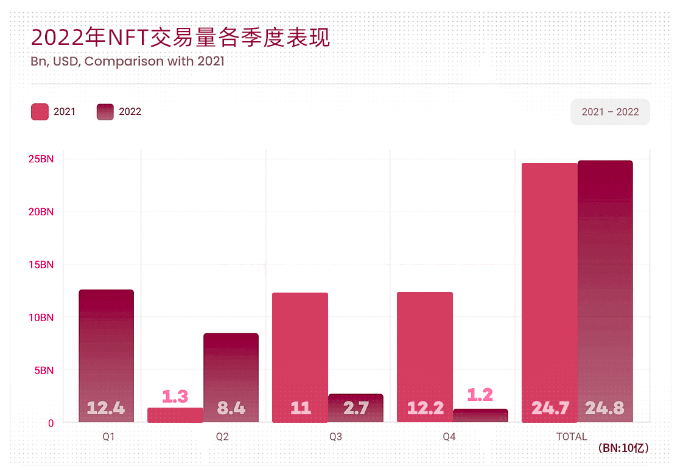

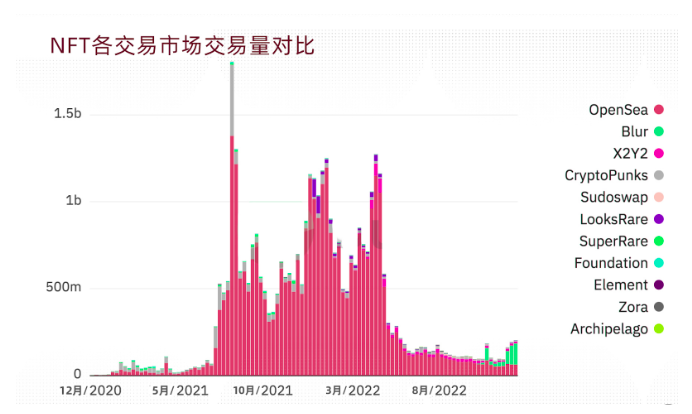

One of the notable trends is the volatility of NFT trading volume throughout the year. In the first quarter of 2022, the NFT market trading volume reached an all-time high of $12.46 billion. With the uncertainty of the collapse, the market declined in the second quarter of 2022, generating only $8.4 billion in volume. Further down to the second half of 2022, the trajectory is different from the same period in 2021, with a net profit of only $4.4 billion in the third and fourth quarters, compared to a full-year net profit of $23.2 billion in 2021, according to DappRadar .

From the analysis of transaction data on the chain, the NFT transaction volume is completely opposite to the performance of DeFi from the beginning of the year. Although the NFT transaction volume only increased by 0.41% year-on-year, the number of independent traders will increase by 876% in 2022, and the number of users will reach 10.6 million. NFT sales are also on the rise, up 10.6% to a peak of 68.35 million.

In the past few months, more and more NFT platform products have been launched. These platforms provide multiple functions and cater to different industry sectors, such as gaming, community building and decentralization, providing a variety of options for NFT buyers and sellers , among which OpenSea is still the most popular NFT market, with transaction volume accounting for 73% of the total NFT market.

Blur is a relatively new decentralized NFT marketplace that officially launched in October, aiming to attract professional traders with an introductory interface, zero transaction fees, and airdrop rewards. It quickly became popular among high-frequency traders, and these features enabled Blur to capture a significant market share in the final months of the year, even surpassing OpenSea in daily transaction volume in the fourth quarter, reaching 52,000 ether ( ETH) transactions (approximately $62.4 million), while OpenSea had a transaction volume of 13,000 ETH (approximately $15.6 million) in mid-December.

There are several factors that contribute to the stable transaction volume of NFT in 2022, especially the growing popularity of NFT in mainstream industries such as the art world and games will help to increase market interest, and the development of new technologies and platforms for NFT will also make it easier for people to acquire and trade these assets, which also contributed to the growth of the overall NFT market.

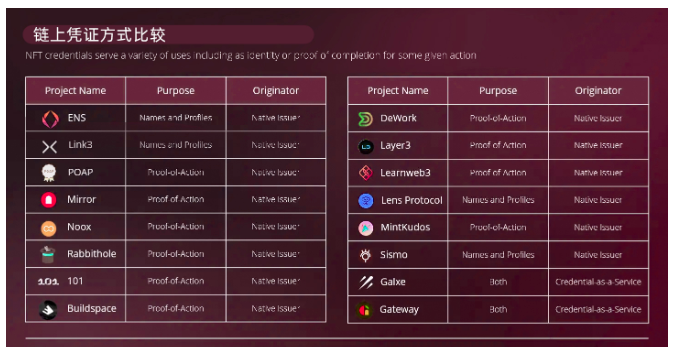

With the growth of the NFT sector, more and more users are interested in certificates on the chain. The certificates on the chain allow users to display their digital identities and interact with the protocol as anonymous individuals. These certificates are NFTs and can be used as soul binding Token (SBT) swaps or “sticks” to wallets, a new type of tokenized credential that symbolizes digital identity and affiliation, an idea first proposed by Ethereum founder Vitalik Buterin in early 2022.

On-chain credentials can be categorized by their purpose and originator. The purpose subcategory usually involves verifying identity or proving the completion of an operation. In this taxonomy, “Name and Profiles” includes information such as domain names and social media accounts, while “Proof -of-Action” focuses on user activities such as on-chain achievements, contributions, certifications or content.

The originator of the NFT is the source of the certificate, the application that provides the certificate is the native issuer, and the application that does not have its own NFT can choose to cooperate with a certificate-as-a-service provider (CaaS) such as Galxe or Gateway to develop and distribute the certificate , which simplifies the process of initiating credentials to third parties by providing the necessary APIs and infrastructure.

With the popularity of NFT and the emergence of more applications, many well-known brands, companies, and individuals have released their own NFT series and projects, and the results of these projects vary greatly from their influence.

Some well-known Web2 companies and game studios, including Square Enix, Ubisoft, and Zynga have already started using NFT and Web3 technology to enhance their products and services. Internationally renowned brands such as Gucci, Nike, and Adidas are incorporating NFTs into their marketing campaigns to connect more closely with customers, and Instagram, a social media platform with more than 500 million daily active users, has also become a major market for NFTs.

Looking back on the whole of 2022, NFT has experienced significant changes and growth. How the market will develop in the future is uncertain, but it is clear that NFT represents a dynamic and fast-growing market, full of cross-industry cooperation and emerging fields in the future. with great potential.

In 2021, the average number of dUAW for high-risk applications was 37,269, and this number has increased significantly in 2022, reaching an average of 145,825 dUAW, an increase of 291%. The increase in dUAW shows that blockchain users seem to care less Potential risks, we believe this may be due to the high benefits of such applications, or changes in the way users perceive and assess risks, because the potential benefits of these types of applications may exceed their potential risks.

SocialFi

first level title

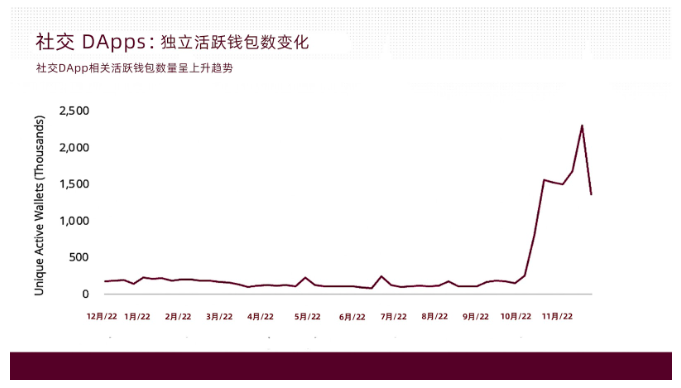

Looking back on 2022, another track that has gained attention is SocialFi (Social Dapp). Its products focus on enabling communication and interaction between users, such as social networking and messaging platforms. The average dUAW for social Dapps in 2021 is 15,054, and this figure will increase by 206% in 2022 to an average of 46,410 dUAW.

SocailFi meaningfully explores asset creation and ownership, open data and identity, and composable ecosystems as its core value features.

In the social space of Web3, we see innovative advantages that Web2 cannot, however, it remains to be seen whether any of these innovations will be widely adopted, because the path to mass adoption remains uncertain.

first level title

Hacking incident

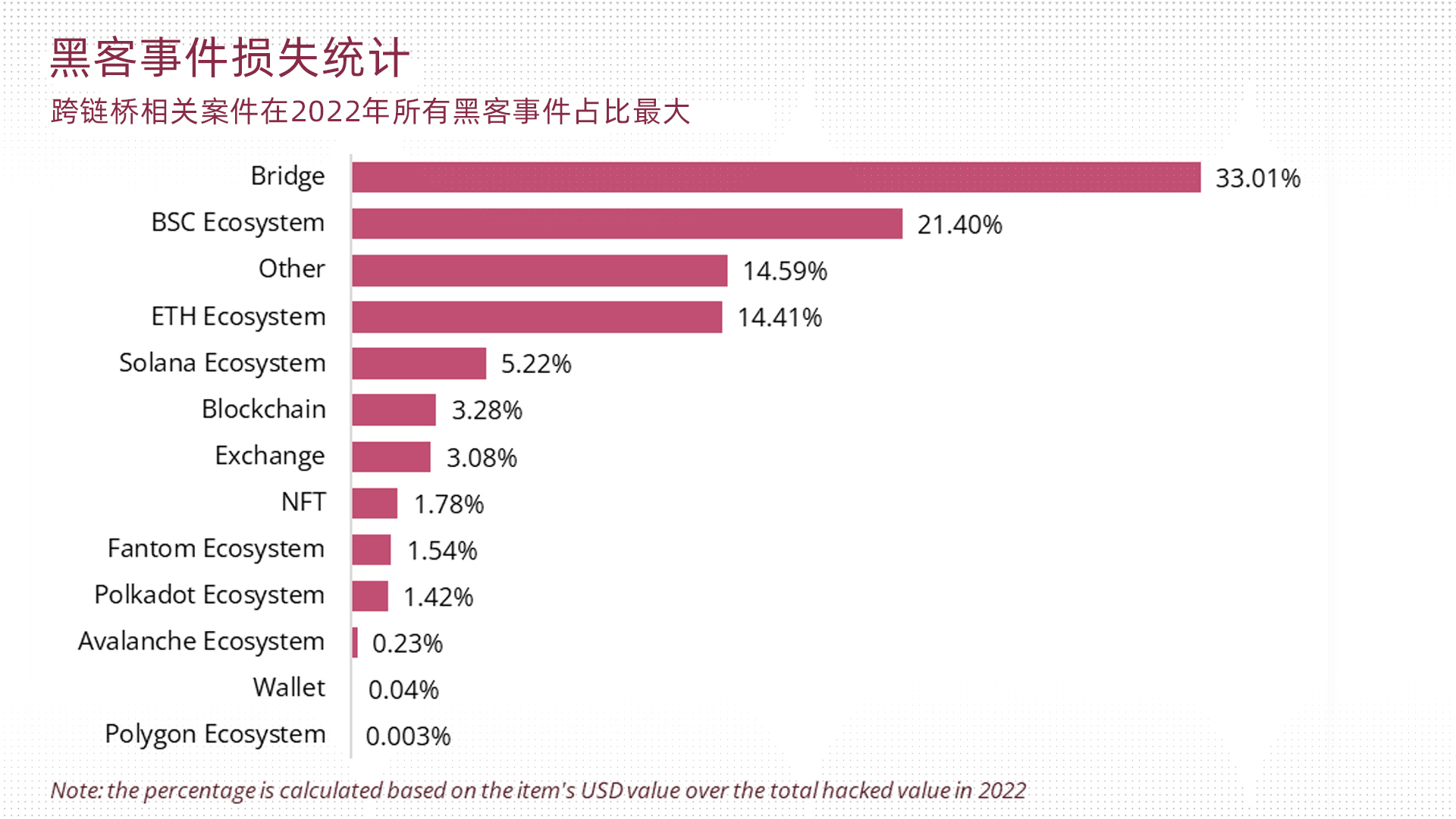

Due to the use of cryptography encryption and decentralized structure, blockchain is a highly secure technical framework. However, loopholes in smart contract code, malicious behavior or insufficient security measures can still lead to serious losses. A large number of Incidents of cryptocurrency attacks underscore the need to understand these potential threats and take protective measures.

In 2022, there have been many hacking and exploitation incidents in the cryptocurrency industry. As of this writing, the total loss caused by cryptocurrency hacking in 2022 is estimated to be about 3.7 billion US dollars. The Luna scandal, as this far exceeds the losses from all other scams combined in 2022.

All in all, scams and other illegal activities on the Internet are important issues that all users should be aware of. Although the number of these attacks may be small, the harm they can cause is enormous. Individuals and institutions need to be aware of these threats and Prevent problems before they happen.

first level title

Related legislation

In 2022, legislators around the world are enacting or have issued relevant laws and regulations to make cryptocurrency as an emerging category safer for investors and reduce the chances of bad behavior in Web 3.

The U.S. Securities and Exchange Commission (SEC) has released guidance on the use of blockchain technology in the securities industry, establishing regulatory requirements for companies utilizing blockchain to issue and trade securities. The guidelines are aimed at protecting investors and maintaining fairness and order in the market.

The European Union has introduced the Market in Cryptoassets (MiCA) regulation, which aims to create a consistent regulatory framework for cryptoassets across Europe. The regulations address multiple aspects such as licensing and registration requirements for crypto asset service providers, investor protection, and oversight of market participants.

The White House has introduced a bill that aims to create a comprehensive set of rules for the regulation of cryptocurrencies and other digital assets. The bill includes measures to prevent money laundering, fraud and other illegal activities, as well as guidelines for registering and monitoring cryptocurrency exchanges and other market participants.

first level title

Summarize

Looking back on 2022, this is a year of both achievements and challenges in the encryption industry. We have seen that Ethereum has successfully transitioned to the proof-of-stake mechanism through mergers, and other public chains have reached established milestones. However, the market also faces many risks, leading to a decline in overall trading volume and the bankruptcy of some well-known companies. But overall, 2022 is still a memorable year for the encryption industry.

Despite potential crises in the market or global economic conditions, the crypto industry continues to develop and progress. In 2022, global Web3 developers have been focusing on expanding the Layer-1 and Layer-2 ecology, and continue to explore potential application scenarios in the NFT field. Industry explorers who explore the compatibility of digital identities and traditional industries will continue to focus on their respective Subdivided fields.

Looking ahead to 2023, we expect the adoption of cryptocurrencies in traditional retail to continue to grow steadily, while also looking forward to the advent of new infrastructure to make blockchains more scalable and easy to use, such as modular blockchains and parallel Combining the execution engine with the innovation of the consensus mechanism, these breakthroughs will greatly improve the performance of the chain.

At present, we continue to pay attention to practical DeFi, such as irreplaceable on-chain pan-financial derivatives and lending agreements. We will evaluate its potential investment value in the future from the ease of use and demand of the product. If it is some mid-term product, we will After in-depth excavation from data such as historical liquidity and trading varieties, evaluate its investment possibility.

In the GameFi project, we pay more attention to early products with high interoperability and strong user retention, such as Web2 SLG games represented by Clash of Clans and King of Avalon. We believe that these games with strong social attributes and user stickiness Blockchain games can further boost the development of the Web3 industry. We have always had a positive view of the Web3 industry and are excited to see new ideas that will emerge in the areas of digital identity and social networking.

In conclusion 2022 reminds us that keeping assets safe is critical to the success of any business. We want to see companies and projects continue to prioritize investing in and improving their security measures, and educating users on how to make informed decisions. Together we can build a safer future for all.

Outlook and Suggestions

Looking ahead to 2023, we are committed to continuously providing high-quality research reports and insights to help customers and community members gain a deeper understanding of the Web3 ecosystem. No matter how the future changes, it is our duty to give back to our community and customers by sharing useful and interesting information.

The encryption market in 2023 is still full of uncertainties. We are now in the second decade of this industry. According to the development of other industries, it is expected that more traditional industry giants will participate. On the other hand, since the third quarter of 2022, countries are accelerating the regulation of the encryption industry. On the positive side, the digital encryption industry is also moving towards a healthy and legal market environment. At the same time, it is more likely to become a mainstream industry, because we expect In the near future, many traditional Web2 institutions will adopt and participate in large-scale.

Of course, opportunities always come with risks, and if the bearish market continues, more Ponzi schemes or hacks could happen in 2023. As a general investor, it is recommended to keep your encrypted assets properly. It may be a safer way to store your encrypted assets in a decentralized encrypted wallet with secondary verification function or a hardware cold wallet with biometric function. Crypto assets owned when market conditions improved remain safe and sound.

Compared with 2021, the proportion of institutional investment in the encryption industry in 2022 has decreased by more than 90%, which is also the lowest annual investment total since 2018. Today, VCs and ordinary investors are becoming more rational about every penny they spend on early-stage projects. They pay more attention to the practicality of the project in daily life, rather than unrealistic token economics or flashy ecosystem. Exquisite investment proposals will hardly attract the attention of venture capital institutions, and cookie-cutter projects are unlikely to survive in 2023. As a DeFi, SocialFi or GameFi type project, make sure you have a product ready to demo before talking to potential investors. As a Layer-1 or infrastructure project, it is best to have a complete and reasonable ecological closed loop. As an NFT or Dapp project, it is recommended to think clearly about what problems the project solves and so on.

text