Author | Qin Xiaofeng

Editor | Hao Fangzhou

Editor | Hao Fangzhou

Produced | Odaily

secondary title

1. Overall overview

On-chain data shows that investors withdrew a lot of ETH during 2022 as ETH exchange reserves dropped by more than 30% in 2022. It is reported that "exchange reserve (exchange reserve)" is a measure of the total amount of Ethereum currently stored in all centralized exchange wallets. The decline in the value of the indicator means that investors are currently moving their tokens, which indicates a sell-off. Supply is dwindling. Long-term exchange withdrawals may indicate that holders are currently accumulating, meaning they are bullish on the cryptocurrency.

According to Visa's official announcement, the payment giant Visa issued a document titled "Self-Custody Wallet for Automatic Payments", explaining the use of "Account Abstraction" (AA) to explore how to implement smart contracts to realize automated programmable payments. Since Ethereum does not yet support "Account Abstraction" (AA), Visa implemented its entrusted account solution on the Layer 2 blockchain StarkNet. StarkNet's account model is what is currently called "Account Abstraction" (AA). Accounts check that transactions come with the correct signature from a given address, while StarkNet's abstract account simply checks that a transaction comes from a given address. Using StarkNet's account model, Visa was able to implement a delegated account solution, enabling automated payments for self-hosted wallets.

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with support levels at $1,150 and $1,200, and resistance at $1,250.

1. Spot market

According to OKX market data, the price of ETH fell to $1,150 last week and closed at $1,209 during the week, up 2% from the previous month.

image description

(ETH daily chart, picture from OKX)

etherchain.orgThe daily chart shows that the price is currently consolidating around $1,200 and may continue to test $1,150 in the short term. The upper resistance is $1,250, and the lower support is $1,200 and $1,150.

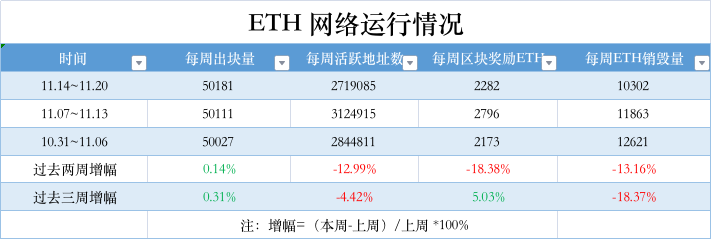

2. Network operation

OKlink data

OKlink data

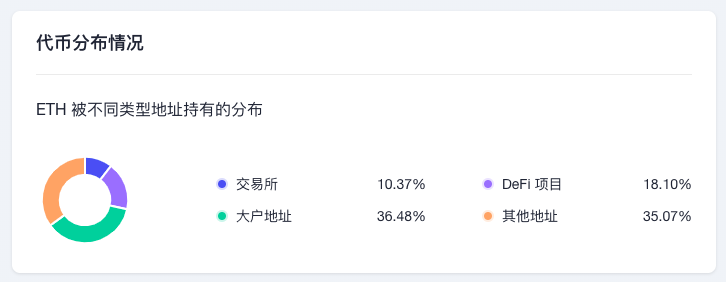

It shows that the total amount of pledged ETH in the entire network is currently 15,726,105 ETH, and the pledge rate is 13.15%, an increase of 53,793 compared with last week; from the perspective of the distribution of holding addresses, exchanges accounted for 10.37%, a decrease of 0.07% from the previous month; DeFi projects accounted for 18.1 %, an increase of 0.03% month-on-month; large addresses (the top 1000 addresses and excluding exchanges and DeFi projects) accounted for 36.48%, an increase of 0.02% month-on-month; other addresses accounted for 35.07%, an increase of 0.02% month-on-month.

1. Voice of the Community

V God predicts 3 major opportunities for cryptocurrencies in 2023: including the popularity of encrypted wallets, etc.

In an interview with David Hoffman, co-owner of Bankless, the founder of Ethereum, Vitalik Buterin, shared the outlook for the encryption industry in 2023, predicting three big opportunities that have not yet been realized in the encryption field, including the popularity of encrypted wallets, anti-inflation stablecoins and Ethereum Log in to the website supported by Fangfang. Also responding to comments about "the 'adoption wave' of decentralized applications is now over, with fewer opportunities for developers to come in and build new decentralized applications'".

First, Vitalik suggested that more development should be done on the cryptocurrency wallet infrastructure to make it easier to use on a daily basis and ensure that it can land billions of users.

Second, Vitalik stated that developing a hyperinflation-resistant and globally accessible stablecoin that can withstand all types of conditions, including on-chain and broader macroeconomics, would be a revolution for the industry.

In the end, V God said that any technological development that helps Ethereum take away login rights from Facebook, Google, Twitter, and other centralized monopolies will eventually allow Ethereum to gain more power in Internet-based applications. market dominance.

2. Project trends

(1) Intmax, the Ethereum Rollup expansion project, is launched on the test network v 1

Intmax, the Ethereum Rollup expansion project, announced the launch of testnet v1. The testnet is a command-line type, mainly for developers. Intmax plans to launch a general-purpose testnet in the first quarter of next year and launch the mainnet in the second quarter. According to reports, Intmax is a zkRollup for various network services and finance, featuring a sequencer that customizes privacy and decentralization for NFT. After the mainnet is launched, a decentralized sequencer can be realized, and block mining can be opened and rewarded.

(2) Loopring partners with crypto tax reporting company Koinly

Ethereum Layer 2 protocol Loopring announced a partnership with crypto tax reporting company Koinly, which will help global crypto investors and LRC holders pay taxes quickly. Users only need to connect the Loopring public wallet to Koinly, and they can calculate their own profit, loss, income, expenditure and other indicators according to the encryption tax requirements of more than 100 countries. (EIN Presswire)

(3) ProximityLabs launched a MetaMask-compatible solution NETH for NEAR

ProximityLabs, the research and development company of the NEAR ecosystem, has launched a MetaMask-compatible solution NETH for NEAR, making NEAR a non-EVM chain that provides MetaMask compatibility. NETH is a smart contract that enables users’ Ethereum accounts to sign transactions and remotely control paired NEAR accounts, and allows users to interact directly with NEARDApps using Ethereum wallets such as MetaMask.

Uniswap announced a partnership with the encrypted payment platform MoonPay, which will support users to purchase encrypted assets on the Uniswap platform in the form of credit card, debit card or bank transfer payment. Bank transfers are only available in the US, Brazil, SEPA, and most of the UK. Currently supported encrypted assets include DAI, ETH, MATIC, USDC, USDT, WBTC, and WETH (US users cannot purchase WETH or WBTC in this form for the time being). Users can purchase cryptocurrency and send it to wallet addresses on the Ethereum mainnet, Polygon, Optimism, and Arbitrum.

(5) Arbitrum has disabled the Arbitrum Rinkeby testnet

(6) Polygon launched the second Polygon zkEVM public test network, the first version will be deprecated on January 5

In addition, the first Polygon zkEVM public testnet launched by Polygon in October this year will be deprecated on January 5 next year.

Polygon launches the second Polygon zkEVM public testnet. The testnet optimizes the proof time from 10 minutes to 4 minutes by introducing a recursive upgrade. Polygon did not disclose a specific timeline for the mainnet launch, but said it was the "last step before the mainnet launch."

According to previous reports, on December 15, Polygon officially revealed that it has launched a comprehensive security audit of zkEVM. This audit will focus on the correctness and robustness of zkEVM, which is also the last key step that needs to be completed on the testnet before the mainnet goes live. It is reported that two security companies, Spearbit and Hexens, are responsible for the relevant audit work, involving 37 audit components inside Polygon zkEVM, to ensure that it is safe and reliable when it is launched on the Ethereum mainnet.

(7) The Optimism Goerli testnet will migrate to Bedrock on January 12

OP Labs announced that the Optimism Goerli testnet will migrate to Bedrock on January 12, 2023. Most users and applications will not be affected by this upgrade. Optimism is currently working with partners such as Alchemy, Ankr, Chainlink, Etherscan, Infura, Quicknode, and Tenderly to ensure a smooth upgrade, and on January 12th a migrated database will be shared so these partners and other node operators can launch their Upgraded nodes.

DeFiLlama According to previous reports, in May this year, Optimism announced the launch of the decentralized Rollup infrastructure Bedrock, which reuses Ethereum’s code, infrastructure, and design patterns as much as possible, and said that "EVM equivalent" is a thing of the past. Bedrock brought is "Ethereum Equivalent". Optimism said that Bedrock will be released as the infrastructure of Cannon, an interactive fault proof system, and its advantages include reduced transaction fees, increased maximum throughput, and increased node synchronization speed.

3. Borrowing

4. News

(1) Visa proposes to adopt StarkNet to realize automatic regular payment

Visa said that using the concept of account abstraction to provide automatic recurring payment functions for self-custodial wallets, StarkNet, an Ethereum Layer 2 scaling solution, can introduce other real-world applications beyond recurring payments into the blockchain.

(2) Twitter has supported searches to display the latest prices of Bitcoin and Ethereum

CO NEWS tweeted that Twitter has begun to display the latest prices of cryptocurrencies such as Bitcoin and Ethereum. This feature is currently only enabled for certain currencies. It is reported that when you search for Bitcoin or BTC, Ethereum or ETH in the Twitter search box, the corresponding price chart will appear, and the data comes from Robinhood.

(3) CME Group and CF Benchmarks launch reference rates and real-time indices for Aave, Curve, and Synthetix

The reference rate will be calculated and published once a day, while real-time index data will be published every second, and several crypto exchanges and trading platforms including Bitstamp, Coinbase, Gemini, itBit, Kraken and LMAX Digital will provide pricing for the new benchmark data.