Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

The energy industry is under intense pressure from environmentalists, the media and the public to shift fuel production to greener alternatives.

Energy companies are pouring money into developing technologies to achieve carbon neutrality, or better yet, reverse the damage done to the environment thus far.

Changing consumer behavior can be an important preventive measure, but technological innovation can also promote greener energy consumption. Blockchain technology and NFTs are at the forefront of innovative technologies that can be used to reduce carbon footprints.

first level title

Main points of this article:

Energy industry background

Energy Industry Challenges and Blockchain/NFT Solutions

Research on blockchain/NFT solutions put into use

first level title

Summarize

Energy industry background

According to the International Energy Agency (IEA), the total global energy supply (TES) is approximately 600 million megajoules. That's about 200 million megajoules more than total energy consumption. These energy surpluses are either traded country-to-country or held as reserves in case of shortages.

The emergence of the epidemic in 2019 reduced global energy consumption by 4.5%, mainly because the global travel industry was suspended to limit the spread of the virus. But this was short-lived, and energy consumption rebounded by another 5% in 2020 as travel in and out of some countries returned to normal.

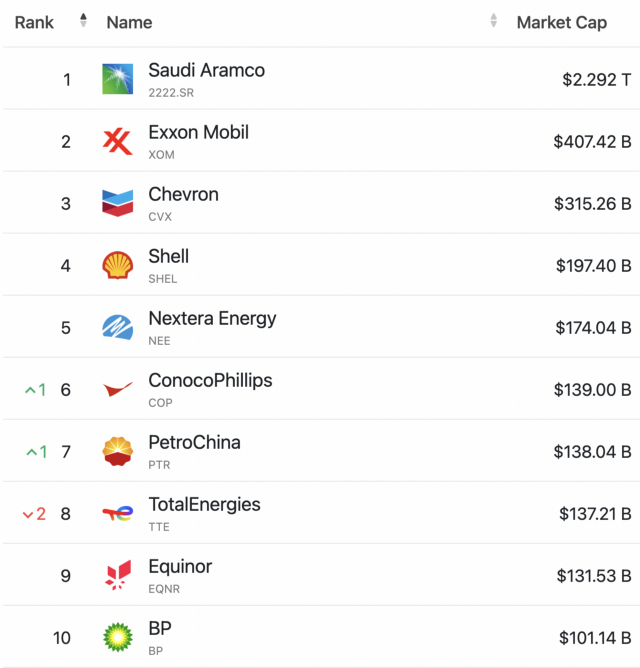

The world's top 10 energy companies (“MCs”) have a combined market capitalization of approximately $4 trillion. Among them, Saudi Aramco leads with a valuation of US$2.3 trillion, accounting for 58% of the total market value of the top 10 MCs.

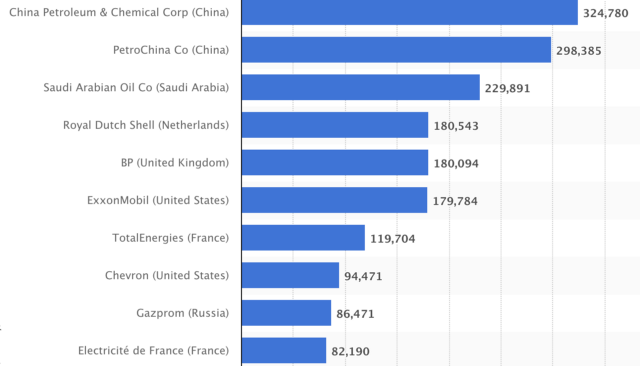

Although Saudi Aramco is the largest MC, its revenue from energy sales is only the third largest. Two Chinese companies lead in this regard, partly because of different domestic market conditions:

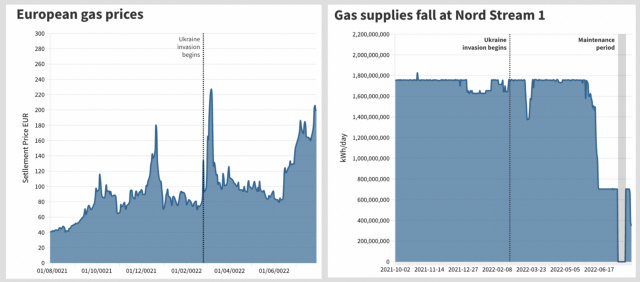

The Russian-Ukrainian war has raised concerns about fuel supplies, driving up energy prices. The United States has banned oil imports from Russia, leading to a rush for alternative, more expensive oil. At the same time, Europe is experiencing the "Nord Stream 1" gas spigot being cut off, causing energy prices in Europe to continue to rise:

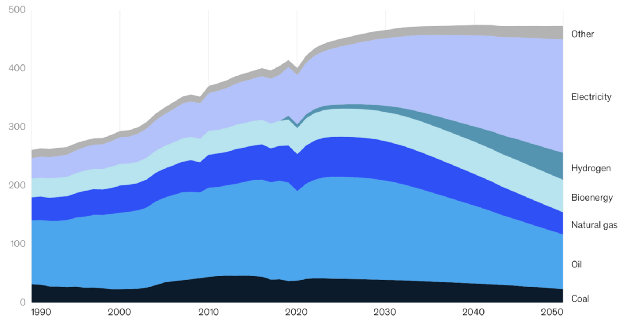

Electricity and hydrogen will account for about 50% of total fuel consumption by 2050, according to forecasts by global consultancy McKinsey. The figure below shows the consumption of different energy types:

(unit: MJ)

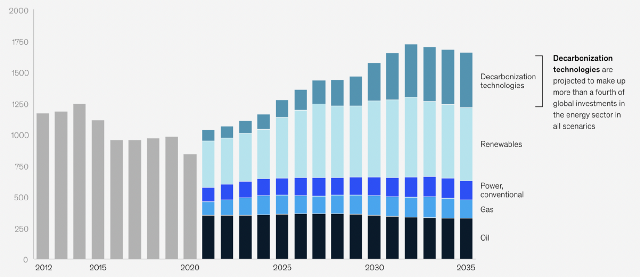

In addition, investment in technology in the energy sector will increase significantly in the coming years, with a quarter of investment expected to go to decarbonization technologies by 2035.

(Unit: US$ billion)

first level title

Industry Challenges and Blockchain/NFT Solutions

1. Carbon emissions

After a sharp drop in 2020, global carbon emissions will rebound strongly in 2021, almost returning to pre-pandemic levels. Addressing carbon emissions is a top priority for the energy industry. Carbon credits are a method governments use to control the amount of carbon dioxide they can emit into the atmosphere.

solution:

NFTs can be used to represent ownership of carbon credits and be traded as securities on the open market. This has the potential to promote better behavior on climate change. While carbon credits have already been implemented, NFT technology provides stronger ownership verification and thus enables a smoother transfer of carbon credits as separate assets in the secondary market. The use of NFTs for carbon credits has coined the term "ReFi" (regenerative finance).

2. Traceability of renewable energy

A Power Purchase Agreement(“PPA”)It is used in energy purchase agreements between renewable energy developers and consumers. However, verifying the flow of renewable energy can be expensive.

solution:

Blockchain and NFTs provide an easy way to track renewable energy. NFTizing energy can easily prove that energy is renewable. Currently, the solution for the energy industry is to require all listed companies to disclose energy information. If the information in the statements is inaccurate, these companies may be fined heavily. Therefore, reasonable investigation procedures need to be established to verify the accuracy of the disclosure. However, NFTized energy has an immutable, transparent record, can be quickly verified, and can reduce the compliance cost for checking energy.

3. Track plant and machinery

The energy industry uses many different types of plants and machinery in the process of converting materials or natural energy into storable and usable energy. Maintaining a registry of these devices can be expensive. Auditors need to verify the existence and valuation of these devices for financial reporting purposes, as their numbers are considerable.

solution:

Marking assets as NFTs on the blockchain helps to improve the efficiency and security of the verification process. Any asset in the real world can be tokenized as an NFT, which enables the real-time state of the asset to be recorded. Additionally, the energy industry can track which equipment needs repair or maintenance, reducing delays and the time it takes to report. This will have a knock-on effect of minimizing energy production downtime and maximizing production efficiency, as well as increasing final revenue. Once the industry starts to digitize, even portable machinery can be tracked, similar to existing blockchain solutions for supply chains.

4. Progress in decarbonization

A McKinsey report on energy investment highlights the expected increase in spending on new carbon-reducing technologies – which are moving from niche to mainstream. But where did the money to develop this technology come from? - Either increase revenue, reduce costs, or provide additional investment from shareholders or investors.

Income growth and getting invested can be a long process. However, cutting unnecessary or inefficient costs through innovation and the use of new technologies can be one of the most effective means of obtaining additional funds.

solution:

Using blockchain and NFTs can facilitate this by reducing compliance costs and increasing transparency, thereby reducing administrative/processing costs and facilitating the decarbonization process.

5. Energy transportation

Transporting, storing and tracking energy throughout the supply chain can be a challenge, especially for something as intangible as energy. Building the plant and equipment needed to build the infrastructure to track energy also costs a lot of money.

solution:

Tagging energy sources as NFTs on the blockchain increases the visibility of where the energy is located in the supply chain. Energy companies will be able to track energy upstream and downstream. Those responsible for decision-making can access real-time energy data and make informed decisions based on the data. If they anticipate delays in power delivery from power plants, they can adjust operations to keep power sustainable. Alternatively, they can buy excess electricity from other producers in time to prevent shortages.

6. Energy transition to electricity and hydrogen

By 2050, 50% of energy will be converted to electricity and hydrogen. Given the severe adverse environmental impacts of carbon emissions in this process, governments need to continuously analyze and monitor companies' progress against global targets.

solution:

Blockchain and NFT can digitize renewable energy through digitized energy certificates, thereby improving monitoring. The more the energy industry can be digitized using a secure decentralized database, the better the underlying data will be for governments to track performance. Incentives or penalties can then be adjusted based on real-time data to better change corporate behavior.

7. Carbon Capture Utilization and Storage (“CCUS”)

Increasing renewable energy production is one way of reducing your carbon footprint, but carbon capture is a way of reducing the amount of carbon dioxide emitted during energy production or extracting carbon dioxide that has already been released into the atmosphere.

solution:

Blockchain can support the use of verifiable, immutable data on carbon emissions in the atmosphere to track the progress of carbon capture. For example, IBM partnered with Mitsubishi to develop a CCUS blockchain solution that can track the capture and reuse of carbon dioxide. Mitsubishi is developing the physical infrastructure to capture CO2, while IBM is developing the digital platform to track CO2.

8. Complicated paperwork

The use of natural energy is actually very complicated. The amount of paperwork involved in oil and gas contracts is substantial, and delays at any stage of the process can have knock-on effects throughout the supply chain. It is common practice for many players in the energy ecosystem to maintain a surplus of energy within their storage facilities in case supply shortages occur.

solution:

Tokenizing energy using blockchain reduces verification time and increases data reliability.

9. Energy as a Service (“EaaS”)

Upfront infrastructure costs can be expensive. Building plants and machinery can take months or even years, during which time no income is generated.

solution:

EaaS is a form of distributed ledger technology (“DLT”). It eliminates the need for corporate users to manage energy production. It makes it easier for companies to focus on their core business and outsource energy production to specialized third-party suppliers.

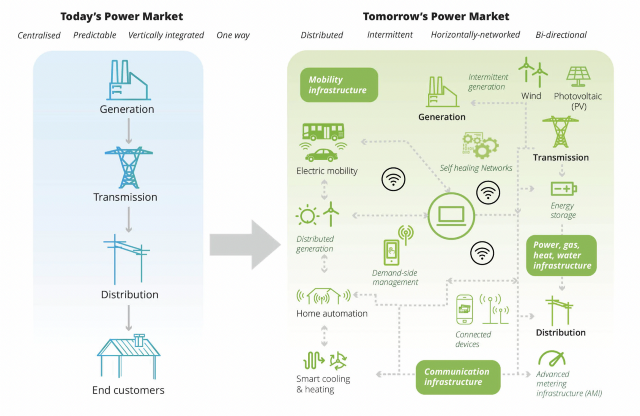

EaaS generated $65 billion in revenue in 2021 and is expected to double by 2029. It usually comes in the form of an online "subscription" and deployment of electronic devices that are owned by the service company. The graphic below (source: Deloitte) forecasts the future electricity market, powered by distributed ledger technology.

first level title

Real World Case Studies

1. FlexiDAO - Energy Attribute Certificate (“EAC”)

Energy attribute certificates are used to mark the flow of energy with unique characteristics or attributes and enable consumers to choose their preferred energy sources.

FlexiDAO has implemented NFT-based renewable energy certificates (real-time), with tradable and immutable attributes, which can be audited and used to report 24/7 carbon-free electricity achievements, and the project has been adopted by companies including Microsoft adopted.

2. Iberdrola Group

The Iberdrola Group has launched a blockchain-based pilot project to guarantee, in the form of real-time data, that the energy supplied and consumed is 100% renewable. This allows the group to easily trace the source of energy.

3. Energy Web Foundation

Energy Web has deployed a blockchain-based Energy Web Digital Operating System (EW-DOS) with a global community of more than 100 energy market participants. Participants who are able to produce their own energy can trade it with other participants.

Additionally, Energy Web's decentralized operating system allows energy companies to develop and deploy decentralized applications.

4、Power Ledger

Power Ledger has launched uGrid, a blockchain-based microgrid platform that can track and trade energy.

first level title

risk factors

Transitioning all energy companies, regulators, and other supply chain participants to a unified global blockchain will be a huge challenge. However, if the data is stored on a popular public blockchain, such as Ethereum, then each supply chain participant can build applications to extract the relevant information they need. However, there may be concerns about data sensitivity and data confidentiality, and under this premise, a private blockchain may be preferable.

Cryptocurrency mining based on the proof-of-work (PoW) consensus mechanism has long been criticized for its energy consumption, a misconception that needs to change before energy companies can adopt blockchain technology without risking their reputations. However, the tide is changing, and cryptocurrency "mining farms" can coexist with renewable energy generation and only turn on when energy is abundant, so mining through the integration of renewable energy will benefit the entire energy system. El Salvador is now building bitcoin mining facilities near the geothermal energy of the country's volcanic eruptions.

There are legal risks in using NFTs to make energy certificates, or tokenizing renewable energy certificates through the blockchain. Existing NFT trading platforms have relatively low entry barriers, while traditional centralized markets will have stricter KYC procedures, making it harder for bad actors to trade. Therefore, the energy industry may need to better develop secondary market infrastructure to ensure that verified participants can trade tokenized energy assets.

The trading of NFTs and the use of cryptocurrencies inevitably raises concerns about whether these transactions are being used for money laundering. In addition, fake transactions can also be a big problem - the authenticity of transactions is difficult to verify. This is prohibited in the heavily regulated stock market. Because it can give the impression that energy assets are actively traded when in reality it is false volume.

Summarize

Summarize

McKinsey’s decarbonization technology investment forecasts show that technology development in the energy sector is accelerating. Blockchain and NFT are very suitable for energy production, flow tracking, so unlike other industries, the energy industry may adopt blockchain technology earlier than expected.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.