This article comes fromThe Blocksecondary title

Odaily Translator | Nian Yin Si Tang

Summary:

Summary:

- Ripple led a $72 million Series B round in digital asset market maker Keyrock. Six Fintech Ventures and Middlegame Ventures also participated in the funding round, which closed in September.

- The company plans to use the funds to strengthen its market-making business and expand its options and over-the-counter business.

Crypto payments firm Ripple led a $72 million Series B round in digital asset market maker Keyrock. Ripple has also been a major client of the company for the past three years.

Venture capital firms Six Fintech Ventures and Middlegame Ventures also participated in the round, which closed in mid-September. Keyrock CEO Kevin de Patoul declined to disclose the valuation, but told The Block that this is a significant boost to the company’s valuation — the company last raised a €4.3 million Series A round in October 2020.

Market makers such as Keyock provide bid and buy prices for assets to platforms such as exchanges. Typically, they earn income by charging a selling price above the buying price, pocketing the difference, or spread, between the two.

The firm also provides market-making advice to clients for a flat monthly fee. This means providing liquidity to markets where trading volumes have not yet reached sufficient levels to generate revenue for market makers.

“One of our big visions is to provide liquidity to the markets that need it the most,” de Patoul explained, “where the ability to generate revenue through spreads is very limited, so we have a fee structure (to provide liquidity) .”

In addition to focusing on options and expanding its over-the-counter trading business, the company hopes to use the funds to further expand its market-making-as-a-service business.Like its competitors, Keyrock invests in companies and funds. The company recently invested inLeadBlock Partners' new $150 million fund

. LeadBlock is a European crypto venture fund founded by former Goldman Sachs employees.

Notably, Keyrock's financing comes at a time when its competitors are under pressure. Both GSR and Wintermute have recently been brought under intense scrutiny for possible FTX exposure, despite ultimately saying those exposures are manageable. Right now, the collapse of Alameda Research, a trading institution closely related to FTX, has dried up liquidity in the cryptocurrency market. There is a so-called "Alameda Gap" in the industry.Keyrock itself was not immune to the FTX debacle. For example, Liquid, which was acquired by FTX, is a client of the company. On Nov. 20, five days after the Japanese exchange halted withdrawalspause

transactions on its platform.

“We have very aggressive counterparty risk management and we were able to get funds out of Liquid before withdrawals were suspended... so neither our nor our clients’ funds were affected.”

Overall, de Patoul took a positive view of heightened market concerns, stating that since FTX’s debacle, the company has not experienced any downtime.

Meanwhile, the company is busy pushing ahead with expansion plans. With the funding, the Brussels-based company plans to expand to Switzerland and Singapore next year, and has already opened an office in London.

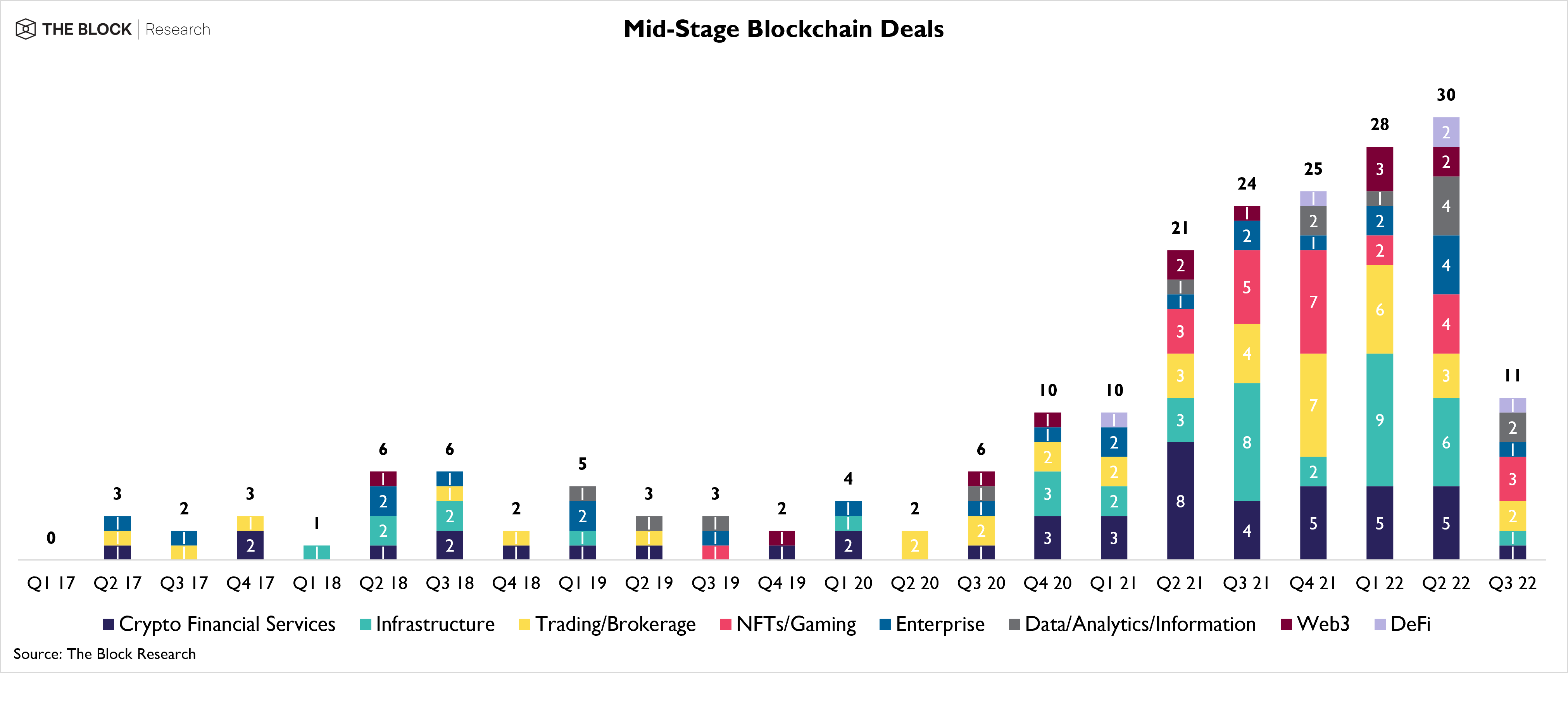

In all of these jurisdictions, Keyrock is seeking regulatory clearance and the company is currently in the process of obtaining a license in the UK.Mid-term deals like Keyrock's financing are increasingly rare in the current market. Data from The Block Research showed that mid-term deals fell from 30 in the second quarter to 11 last quarter, 。