Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

secondary title

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with a support level of $1,100 and a resistance level of $1,200.

Second, the secondary market

1. Overall overview

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with a support level of $1,100 and a resistance level of $1,200.

(ETH daily chart, picture from OKX)

Second, the secondary market

1. Spot market

etherchain.orgAccording to OKX market data, the price of ETH once fell to US$1,200 last week, and closed at US$1,177 during the week, a month-on-month decrease of 4.3%.

(ETH daily chart, picture from OKX)

OKlink dataThe daily chart shows that the price is currently consolidating between $1,100 and $1,200, and may continue to test $1,100 in the short term. The upper resistance levels are $1,180 (MA5) and $1,213 (MA10).

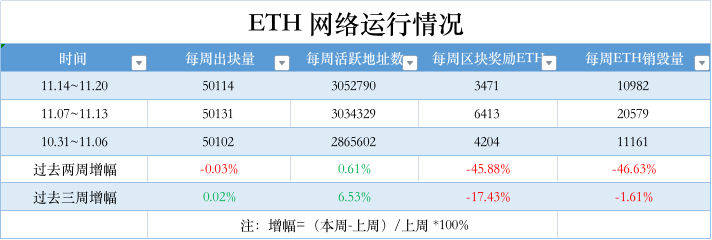

The data shows that in the past week, the Ethereum network generated 50,114 blocks, which was basically the same as last week; the number of active addresses per week was 3,052,790, a month-on-month increase of 0.6%; block reward income was 3,471 ETH, a month-on-month decrease of 45.8%; The weekly ETH burning volume reached 10,982, a decrease of 46.6% from the previous month.

OKlink dataOKlink data

3. Ecology and technology

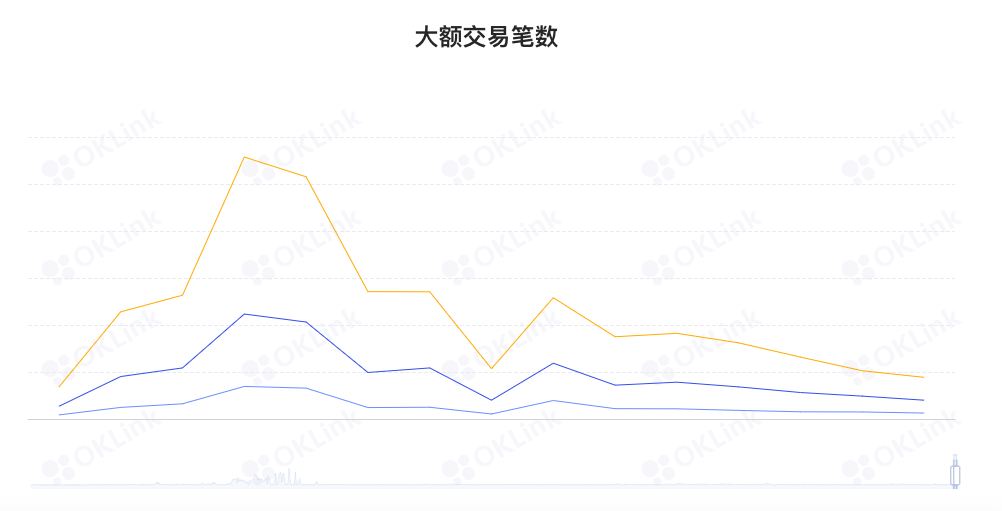

It shows that the number of on-chain transfers dropped sharply last week, with "above 1,000 ETH", "above 2,000 ETH" and "above 5,000 ETH" decreasing by 50.2%, 44.9%, and 42.7% month-on-month, respectively. The trading enthusiasm of giant whales has dropped significantly.

OKlink data

3. Ecology and technology

1. Voice of the Community

(1) Vitalik confirmed that he did not own the address that sold 3,000 ETH recently

Evan Van Ness, the founder of Ethereum News Weekly, tweeted that he had verified with Vitalik Buterin, the founder of Ethereum, that V God confirmed that he did not own the address that recently sold 3,000 ETH. According to previous news, SlowMist monitoring showed that V God related addresses recently sold 3,000 Ethereum through Uniswap.

(2) V God: Compared with hardware wallets, I prefer social recovery and multi-signature wallets

An encryption KOL posted: "Encryption Youtuber always says that if you don't have the private key, the cryptocurrency will not really belong to you, please buy a hardware wallet immediately. Okay, it sounds reasonable, but is there any actual data to prove it? How do you compare the percentage of crypto assets lost on centralized exchanges versus the percentage of crypto assets that people lose using self-custody?"

(3) V God: Singapore distinguishes the use of blockchain from cryptocurrency, which is strange

It is reported that Singapore is seeking to limit the participation of retail investors in cryptocurrency transactions in order to reduce the risk of market volatility to consumers. According to previous reports, Ravi Menon, managing director of the Monetary Authority of Singapore, delivered an opening speech at the Singapore Fintech Festival, saying that Singapore wants to be a center for digital assets, but does not want to be a center for speculating on cryptocurrencies. Coinbase CEO Brian Armstrong said Singapore's proposed rules to limit retail crypto trading are incompatible with its aspirations to become a hub for the so-called Web3 industry. (Bloomberg)

(1) Fuel, the Ethereum expansion solution, launched the Beta-2 test network, adding a cross-chain bridging function

(2) MetaMask and Laconic anti-phishing tool MobyMask light client

(3) ENS Equinox NFT jointly launched by ENS and Galaxisxyz

(4) The StarkNet token contract has been deployed to the Ethereum mainnet

Chainlink announces that its NFT floor price feed service will be launched on Ethereum

(6) Arbitrum One network adds validator nodes

The Arbitrum One network has added validator nodes. Currently validator nodes include ConsenSys, Ethereum Foundation, L2BEAT, Mycelium, Offchain Labs, P2P, Quicknode, Distributed Ledgers Research Center (DLRC) under the Institute for the Future (IFF), and Unit 410.

(7) MetaMask launches NFT price prediction function for Portfolio dApp

DeFiLlama (8) After Alameda went bankrupt, the acquired DeFi protocol Ren Protocol needed new financial support

4. News

After the collapse of Alameda, DeFi protocol Ren Protocol is in danger of not having enough funds to grow. Ren is an Ethereum-based DeFi protocol that can mint encapsulated encrypted assets to bridge to Ethereum and BNB chains. Ren has processed over $13 billion in cross-chain transaction volume since its inception. Alameda has acquired Ren since early 2021 and has provided $700,000 in quarterly funding for Ren's development.

The Ren team revealed that the current funds are only enough to develop until the end of the fourth quarter, and the remaining funds of the project are about 160,000 US dollars. Now, Ren hopes to secure funding from other sources. The team revealed Friday that it is exploring various opportunities with community members. These choices will likely be voted on by the RenDAO community. In addition to securing new funding, the Ren team hopes to launch the latest version of the protocol, Ren 2.0. (The Block)

The data shows that the value of collateral locked on the chain fell from $24.59 billion to $23.85 billion last week, a 3% drop for the week. Specifically, the number of ETH mortgages rose from 20.11 million to 20.85 million last week, an increase of 3.6%. From the perspective of individual projects, the top three lock-up values are: MakerDAO $6.42 billion; Lido $5.38 billion; Uniswap $3.45 billion.

(1) The address that has been dormant for more than 7 years wakes up and transfers 500 ETH

On-chain data shows that the addresses that participated in the Ethereum ICO as early as 2015 woke up. The entire balance of 500 ETH in this address has been transferred to williamsutanto.eth.