Original Source: Overseas Unicorns

Original Source: Overseas Unicorns

When the largest digital wallet in EuropeRevolutWhen it entered the United States and launched a cryptocurrency product, its core team in the United States found itself losing nearly $300,000 in one weekend due to fraud problems, and many of Revolut’s anti-fraud strategies that were effective in Europe suddenly became full of holes— —Just doing identity verification can no longer defend against scammers in the United States. A user who has completed KYC may be being controlled by fraudsters pretending to be financial advisors.

Soups is the head of Revolut's U.S. cryptocurrency product. He and his future co-founders Zahid and Aditya searched the market for anti-fraud software, only to find that they were too fragmented and fragmented, and largely built for e-commerce scenarios,Ultimately, they decided to start Sardine themselves to tackle fraud at high-risk merchants like Revolut.

Soups' past experience makes him the perfect portrait of a founder in this field:Standing at the intersection of Fintech and cryptocurrency, he was Coinbase's data science and risk director before working for Revolut, and has been a fraud fighter.This allowed Sardine to quickly sign star clients such as Brex, MoonPay, and FTX in the early days of its birth, making a golden start for its machine learning model and rule engine.

In September 2022, Sardine announced the completion of a US$51.5 million Series B round of financing, which was led by the company’s Series A lead investor, a16z’s growth fund. Other participants included Visa, Google Ventures, ConsenSys, and Cross River Top strategic partners such as Bank and Uniswap Labs.Pickup also participated in this round of financing of Sardine as an investor. This article is our investment Memo on Sardine in the second quarter of 2022. We desensitize it and share it, hoping to help improve the democratization of information in the investment industry.

In the crowded anti-fraud stack, Sardine has its unique competitive advantages: All In One (more comprehensive data sets and functions), cheap, and industry Know-how. But Sardine's goal is by no means just another anti-fraud software company, but to rely on this core capability to go to the payment business and become "Stripe for high-risk merchants." As we concluded at the end of our Persona article,KYC/AML is a "compliance cost". The anti-fraud that Sardine is doing goes a step further and becomes an "investment to reduce capital loss". Its own strategic value has changed from controlling costs to increasing revenue.The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

01 Summary

02 Theis

03 What is Sardine doing?

05 team

05 team

06 Finance & return

first level title

appendix

01. Summary

Sardine is an anti-fraud and payment company founded by former Coinbase and Revolut's Risk and Crypto team core managers, it isCreate Stripe for high-risk merchants (Crypto/NFT, cannabis, cross-border and subscription e-commerce, etc.), providing risk-free instant ACH bank transfer and card payment products, so that consumers no longer need to wait 3-5 days when depositing money, helping merchants increase conversion rates.

In September 2022, Sardine announced the completion of a US$51.5 million Series B round of financing, led by the company's Series A lead investor a16z's growth fund, XYZ, Nyca Partners, Sound Ventures, Activant Capital, Visa, Google Ventures, Eric Schmidt , Vikram Pandit, The General Partnership, NAventures, ING Ventures, ConsenSys, Cross River Digital Ventures, Alloy Labs and Uniswap Labs Ventures participated in the investment.

This Memo was originally written in May 2022, when Sardine's B round of financing was in progress. We think this is a company that has the potential to reap 10x+ returns at $500M and deserves a Series B participation.Discussed in this Memo:

1. Why does Sardine have a chance to become a legendary payments company?

2. Why there seems to be no anti-fraud companies worth tens of billions of dollars in the market?

first level title

02.Thesis

Revisiting our previous point of view in internal mapping: the current overall use cases of cryptocurrencies are still transactions and financial services, and the infrastructure related to money has the highest certainty. andSardine is a rare true FinTech company in this type of infrastructure (rather than an asset management or lending company that relies on balance sheets), and its business essence is SaaS, customers cut in from cryptocurrency companies, which is the equity asset under the intersection of the two sectors we are optimistic about.

secondary title

Market level:

As Crypto and financial services reach the next billion people, the anti-fraud and risk-free payment needs of FinTech and Crypto/NFT-related companies are exploding.There are currently 25,000 FinTech-related start-ups in the market (increased by 5 times in the past 4 years), anti-fraud capabilities are related to their survival in the bear market/capital market winter - they need to minimize millions to tens of millions of It is no longer an extensive pursuit of the number of users/transaction volume growth.

Anti-fraud products in the past were very fragmented and did not serve high-risk merchants represented by Crypto/NFT.secondary title

Sardine's level of competence:

Anti-fraud capabilities are a friend of time, and Sardine also got the best dataset.In the past, PayPal and Stripe used real money to pay for tuition fees, and each took what they needed from various fraudsters and wool parties, while Sardine started from behavioral data, and served MoonPay, FTX, and Brex with the largest business scale and the most complex scenarios Starting with our top customers, we obtained the most comprehensive and high-quality data sets, and completed the accumulation of anti-fraud capabilities using machine learning with high capital efficiency. In the future, our competitive advantages in data sets and models will continue to expand.

The anti-fraud capability is a technical asset at the "recommendation engine" level, allowing Sardine to end up doing payment and other second growth curves.Sardine's current business is only "connotation jokes", and it can find its own "Today's Headlines" and "Douyin" around this core competence extension scene. The real-time, risk-free ACH settlement that Sardine is currently trying is such a business, and there is still a lot of room for expansion of on-chain and off-chain payments in the future.

The ACH payment product that Sardine is trying will become one of the core infrastructures of the customer's business.secondary title

Team level:

Sardine has an absolute S-level team in the FinTech field.first level title

03. What is Sardine doing?

Sardine's team experienced a surge in trading volume at Coinbase, the launch of Revolut's Crypto product, and the expansion of the US market. At that time, Revolut US lost $300,000 due to fraud in a weekend. Neither Coinbase nor Revolut found an ideal anti-fraud provider. So the founding team left Revolut in 20 years to create a one-stop anti-fraud product that can solve the needs of fast-growing FinTech and Crypto companies.

In the past year, Sardine started from Fraud Prevention as a Service, providing one-stop anti-fraud services in the form of API for the most advanced and complex anti-fraud customers, and obtained the most comprehensive and high-quality data sets in the market for training Own anti-fraud machine learning models.

Sardine's long-term overall positioning is "Stripe for high-risk merchants"secondary title

3.1 Products

1. Fraud-as-a-Service

According to our previous Mapping, anti-fraud is a general concept that can be divided into two factions:

a) KYC and AML services around compliance, which is an input for customers to cooperate with regulatory authorities;

b) Anti-fraud services around asset loss, which is an investment for customers to increase their profits.

What Sardine does is a combination of both, providing customers with a single set of fraud detection APIs that can combine millions of data points to detect fraud,The life journey of service users includes registration, login, deposit, transfer and withdrawal, etc. Currently, there are mainly the following core use cases, and the charging model is the lowest monthly fee + usage (per API call or per user and transaction)

What are Sardine's core competencies?

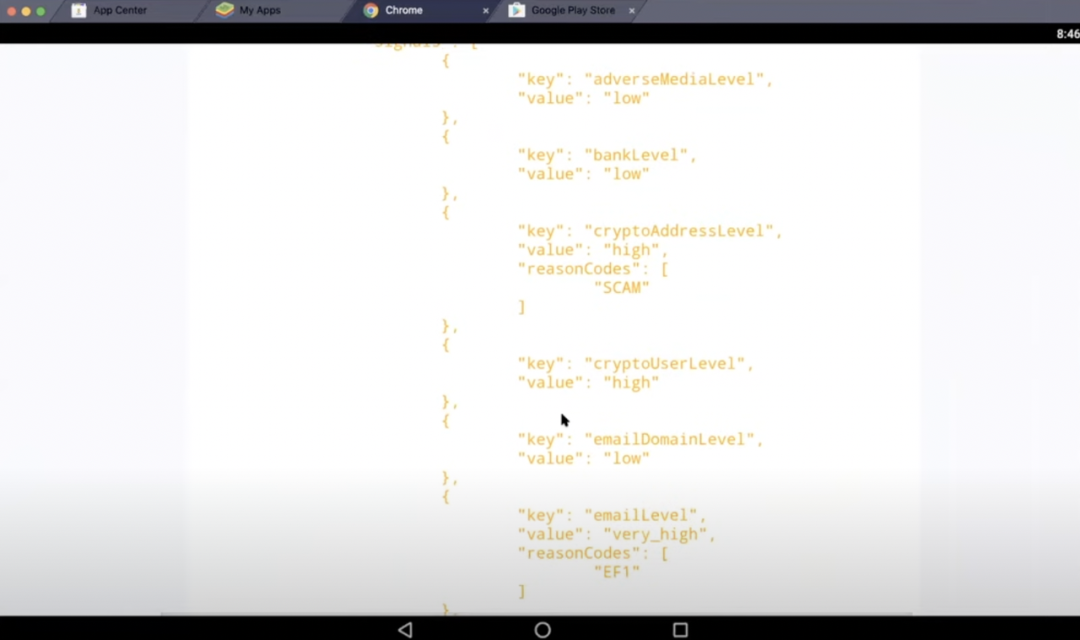

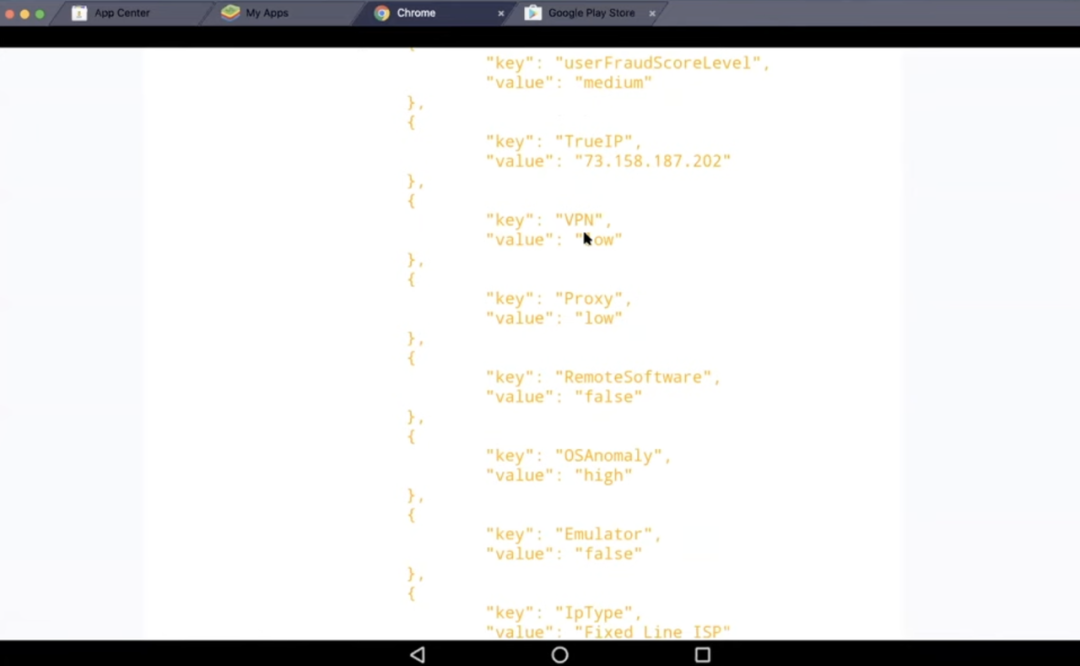

Device and behavioral data are Sardine's core technical capabilities. Its fraud detection service is "behavior-based" first. The founding team observed:

5-10% of FinTech and Crypto registrations come from mobile emulators, remote desktop control apps, or device farms, where fraudsters can buy clean devices andSardine's device intelligence technology can identify the real operating system and use the phone's sensor data to determine whether the device is an emulator

Normal users and fraudsters behave very differently: normal users never copy-paste their names or SSNs, while fraudsters type fast, but with a long dwell time per key, suggesting they are using keys with clunky springs Old devices with keyboards, or having hesitation when typing...

This type of behavioral data needs to be embedded in the customer's application to obtain it. Traditional KYC vendors often do not have the ability and motivation to obtain such data from customers. andSardine can monitor how customers type, click, scroll and move their mouse without compromising privacy and data security.This kind of behavioral data has a lot of noise, and Sardine can access top customers such as MoonPay and FTX, which ensures that its machine learning model is fully and leading in the training of this ability.

Account takeover fraud protection is a difficult problem that the founder of Sardine led the data science and risk control team at Coinbase to solve in depth. It is almost the best practice in the industry:

Sardine allows companies to detect the most sophisticated account takeovers, including credential stuffing attacks, SIM swapping (where fraudsters trick telecom operators into activating SIM cards on behalf of legitimate customers), email and SMS phishing, and more;

Sardine's multi-factor orchestration (MFA, a typical form of two-factor authentication 2FA, where users verify their identity by providing a verification code from Google Authenticator) allows companies to additionally authenticate users as frictionlessly as possible.

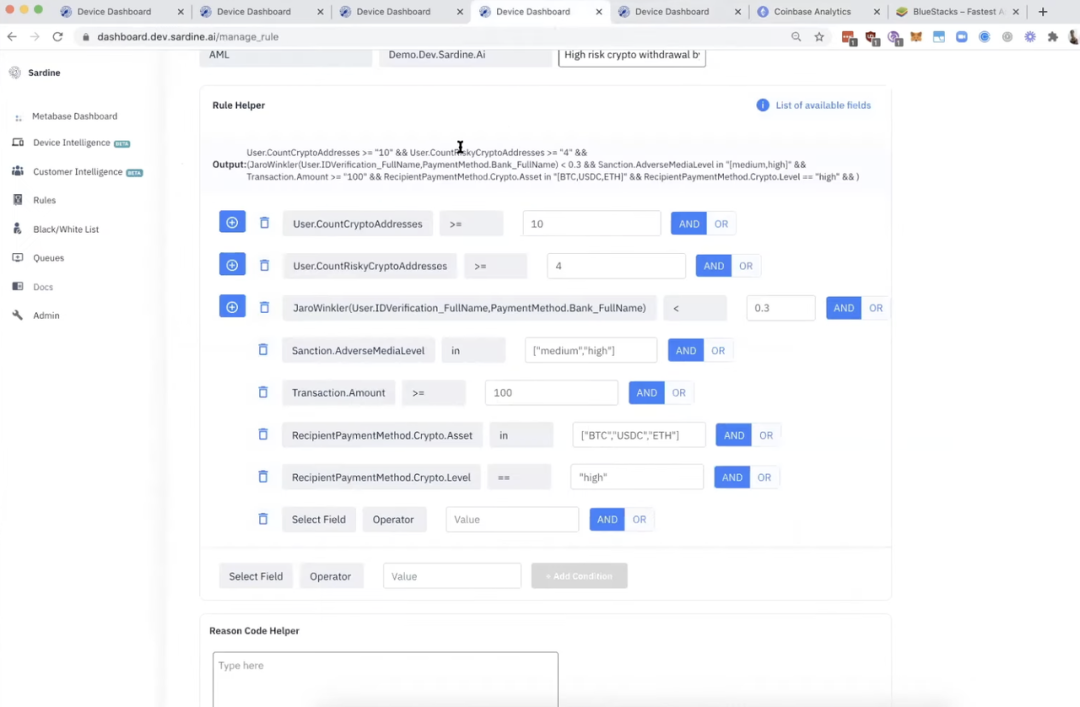

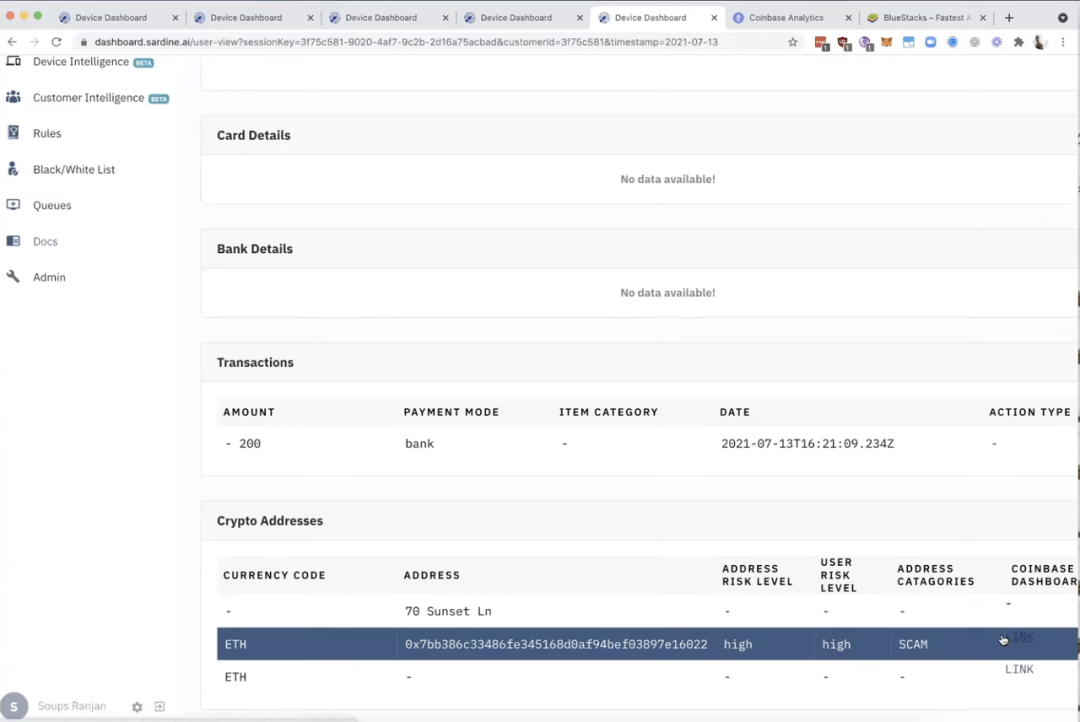

Ultimately, customers can use the Dashboard provided by Sardine to monitor various equipment, customer and transaction information in real time, and configure transaction monitoring rules without code—even Crypto related.

Why is Sardine's anti-fraud use case comprehensive and comprehensive?

Sardine's fraud detection platform combines millions of data points per user,Includes browser fingerprints, mobile device attributes, traffic data, sensor data, user behavior and user identities across credit bureaus, carriers, social networks, banks, card networks, email addresses, and on-chain addresses.

Sardine self-builds key behavioral data at the current stage, and other data points can be obtained through partners, and even directly provide white label services. Its partners include Au10tix, Blockset, Chainalysis, Checkout.com, EmailAge of LexisNexis, Prove, Sentilink, Very Good Security, etc., each of which has been dedicated to a certain data source for many years.

Its compliance, KYC and identity fraud, document verification and selfie recognition businesses are all white label products of its partners.For example, Sentilink solves credit card-related identity fraud, and Chainalysis addresses identity tags on wires. If customers do not have existing compliance or KYC-related suppliers, they can use Sardine's one-stop white label service instead of docking and integrating multiple suppliers by themselves. However, Sardine's income needs to be distributed to the partners behind it, which reduces the gross profit of this part of the income.

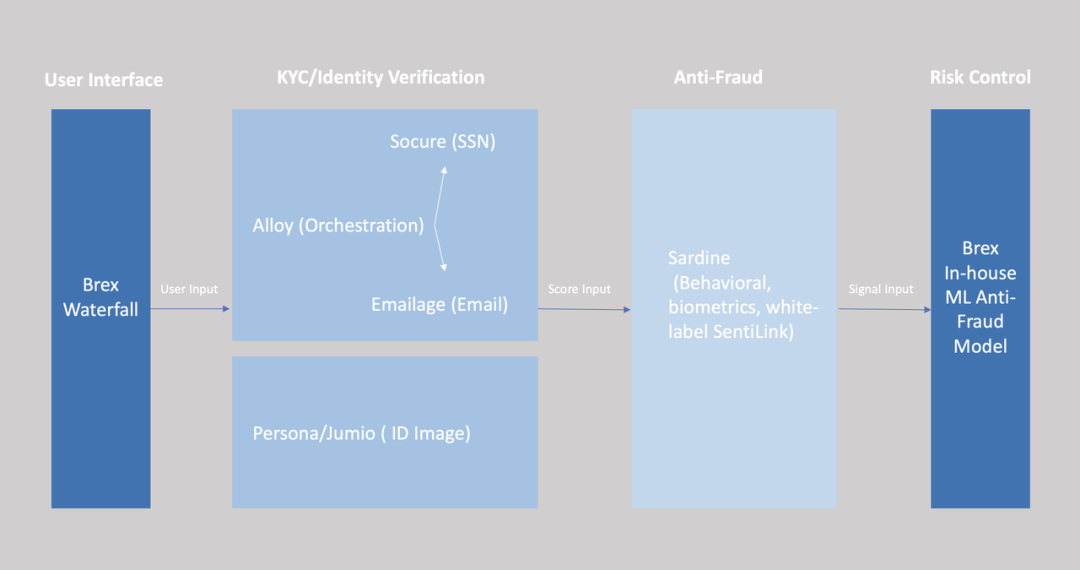

If the client already has a KYC&AML provider, the diagram below shows the relationship between Sardine and the partner:

Brex is an American innovative company's corporate credit card and fee control management software. In 2021, it canceled the recommendation review system and began to allow customers to fill in information and register by themselves;

Alloy is the KYC orchestration layer used by Brex, which helps it access multiple KYC providers in one stop, including Socure, which focuses on SSN, Emailage, which monitors mailbox registration dates and activities, and Persona, which identifies passport/ID photos;

The above-mentioned KYC suppliers are also expanding into the anti-fraud field, and will obtain the result of identity verification and give a risk score generated under their own black-box algorithm;

Brex will return the data spit out by KYC suppliers to Sardine in a unified manner. Sardine has already done data access and can quickly clean and process this part of the data. Sardine's anti-fraud model will comprehensively process the non-black box, transparent The processing results and risk signal are sent to Brex.

What is unique about Sardine?

Anti-fraud is a long and crowded track. Combined with customer interviews, Sardine currently gives me the feeling that it is similar to ClickUp (the task management track is also crowded). The core value proposition includes three points:All In One (more comprehensive data sets and functions), cheap, understand customers.

Sardine has positioned itself as a comprehensive anti-fraud fighter since Day One, rather than a single-point KYC or AML provider. Its All In One is reflected in three aspects:

From KYC, anti-fraud to AML products, customers can purchase from Sardine in one stop;

Comprehensive partners and data sources, Sardine chose to access the most comprehensive data sources in the market at an early stage, and was willing to get customer behavior data through burying points, rather than from SSN like Socure, Persona and other new generation KYC unicorns Wait for the data to start. Although Socure also claims to be providing anti-fraud solutions, its fraud monitoring and core data are still limited to SSN-related use cases;

at the same time,

at the same time,Brex and Southeast Asia's top-ranked exchange ZipMex (ZipMex was developing rapidly at the time, but then went bankrupt due to the debt problems of Sanjian Capital) both said that Sardine's services were 25-30% cheaper than their peers.Sardine is not only cheaper than BioCatch and other peers that also monitor behavioral data, but also its white-labeled SentiLink will be cheaper than purchasing SentiLink directly. We speculate that Sardine offers customers lower prices in two ways:

Pre-emptive detection of fraud through owned device and behavioral data, reducing the number of actual calls to partner APIs;

Both BioCatch and SentiLink have gradually focused on large financial institution customers, setting a relatively high minimum annual fee to naturally filter customers, and Sardine acts as a channel for SentiLink to serve Mid-Market's Crypto and FinTech customers, as a white Standard suppliers are still profitable.

finally,Sardine understands Crypto and FinTech customers better, while traditional anti-fraud providers are more accustomed to serving banks, e-commerce and retail companies.This is reflected in two ways:

Both Crypto and FinTech companies are looking to build their own in-house data science teams at the same time. Unlike various black-box anti-fraud suppliers (only one risk score is provided), Sardine’s data results to customers are completely transparent, including the value of each fraud detection item in addition to the risk score

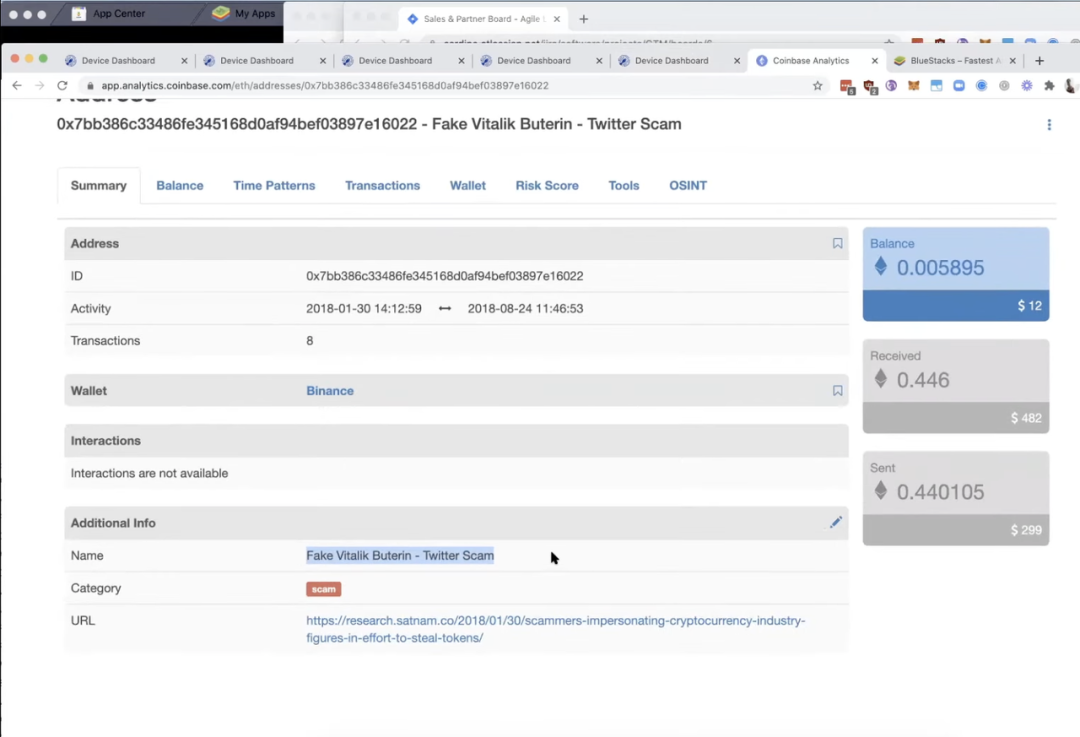

On-chain data products such as Sardine, Coinbase Analytics, and Chainalysis have been deeply integrated, which can identify the risk of user identity information on the chain and set monitoring rules for on-chain transactions

MoonPay's feedback on Sardine confirms its acceptance in this customer base:

Our biggest concern is the precision with which to reject trades - not wanting to draw too much and not too little. The rejection rate of the previous suppliers was too high. MoonPay will directly access these suppliers and collect its feedback to compare with its own online real situation. Finally, it is found that Sardine has better performance in catching fraudsters and releasing good transactions. . In the past, 25% of the tools would be rejected, but now it is 10-12%, which is reduced by half.

At the same time, anti-fraud is not the end of access. Suppliers need to continuously train their own models. Fraudsters will change the amount, originating country, etc. The previous suppliers did not continue to provide improvements.

Sardine's team really has industry experience in FinTech and Crypto, and integrated a lot of address-related information on the chain in fraud monitoring, proving that they really understand the opportunities here. Crypto's fraud is the most difficult, and it can do the kind of fraud that can reduce dimensionality and attack Netflix subscriptions.

Is this a foregone business?

yes. Anti-fraud has no network effect, but it has its own flywheel: better results bring better customers, and the data and labels of these customers will further improve the results.

At the same time, the stickiness of customers is very strong. Most customers need 3-6 months to switch between the created rules and the logic running online. The process requires a lot of engineering and data analysis resources. Although the competition is very fierce, the current practice of most customers is not to replace their existing suppliers, but to introduce a new supplier at the same time.

2. Risk-free instant ACH settlement

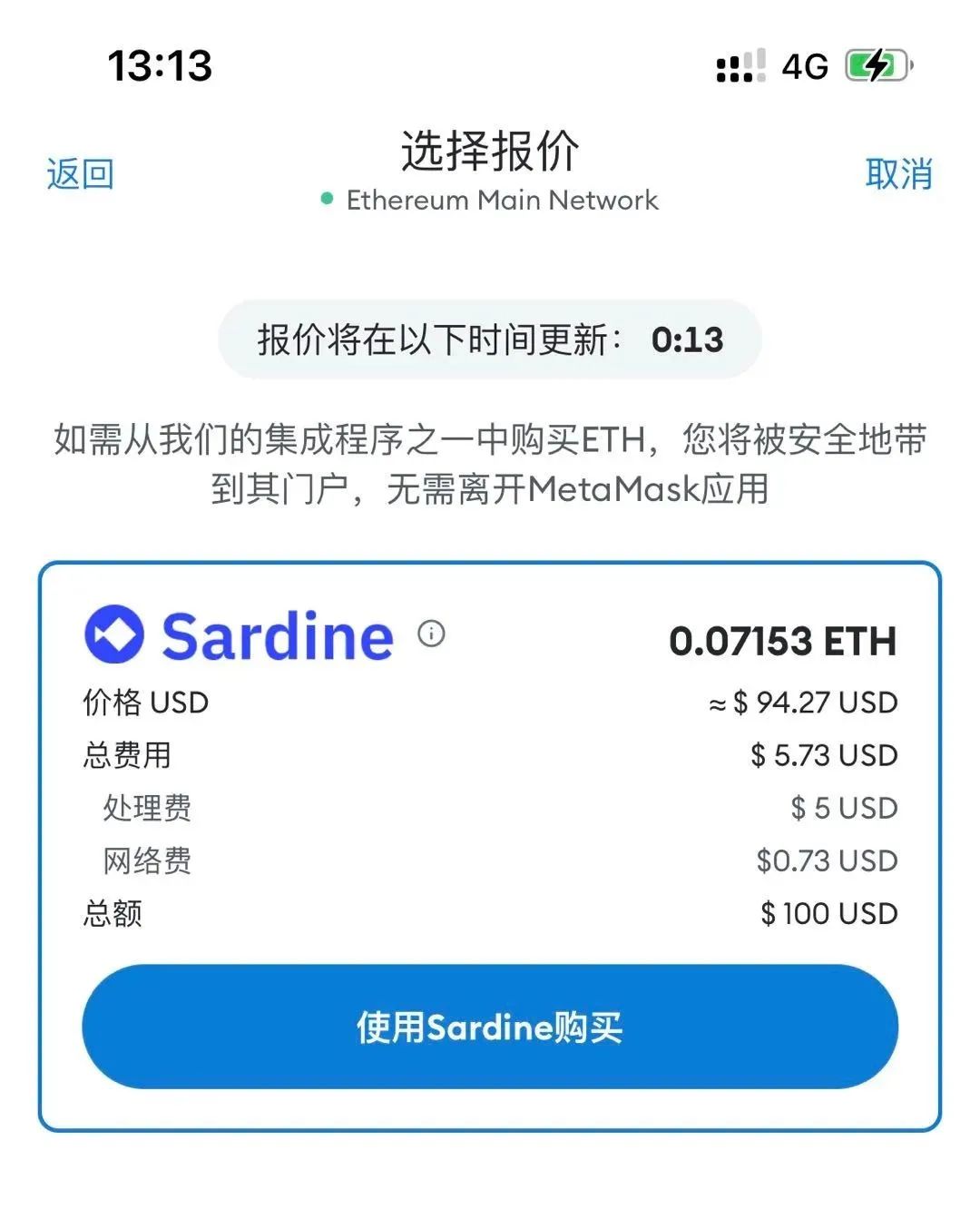

This is a new business officially announced by Sardine when it announced its A-round financing in February 2022. It will productize its own anti-fraud capabilities and provide customers with an ACH payment product that includes advances, risk control, supervision, and compliance.

Simple understanding of this business: the bank transfer version of MoonPay, users will pay a lower premium than using a card, and there is no need to wait for 3-5 days for transfers as before with bank transfers.

In the Model for investors in the B round, the Sardine team regards the deposit business as an upside for investors, and made a separate calculation, and did not mix this part of the income into the ARR income of the anti-fraud SaaS.

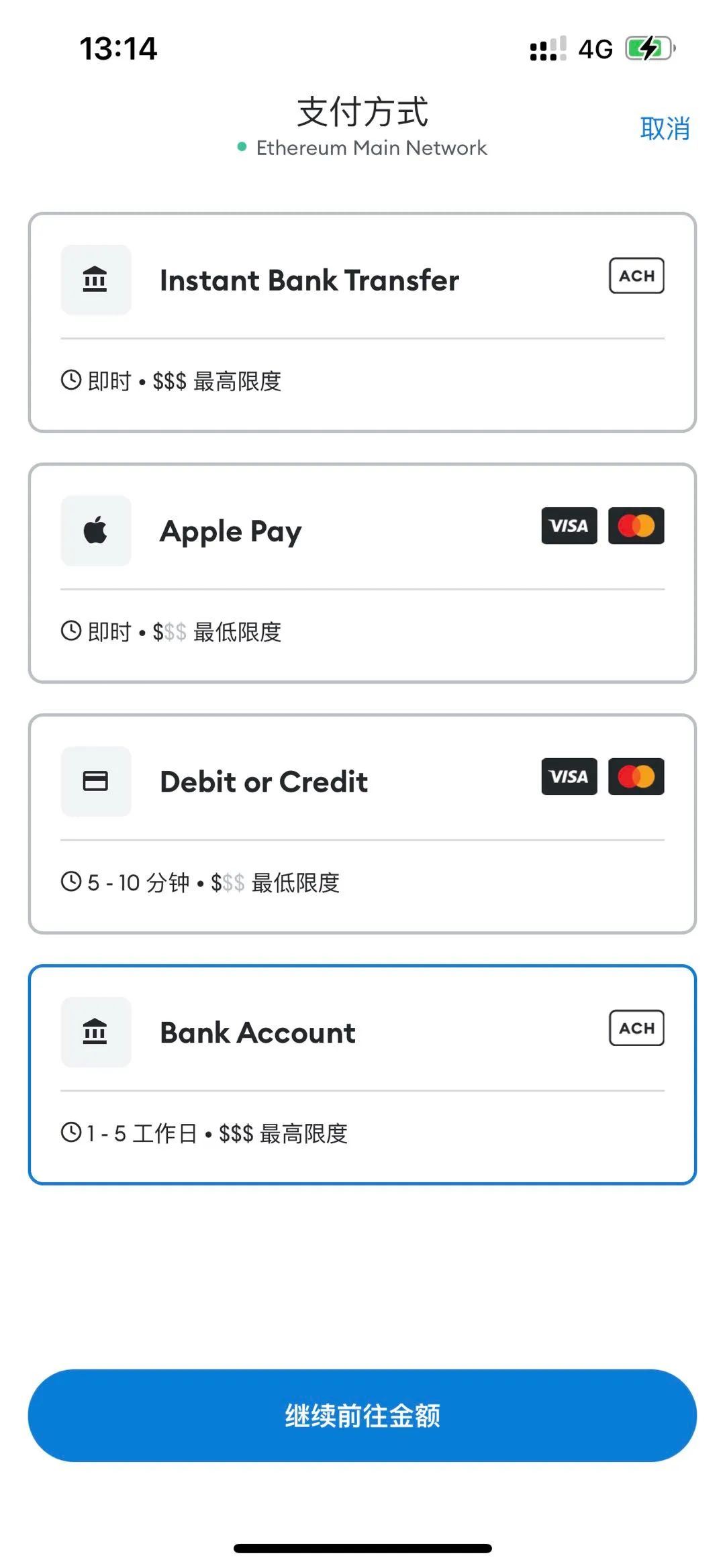

In October 2022, this function has been launched in scenarios such as Metamask wallet and Brave browser.

What is ACH? Why do I have to wait 3-5 days for my deposit?

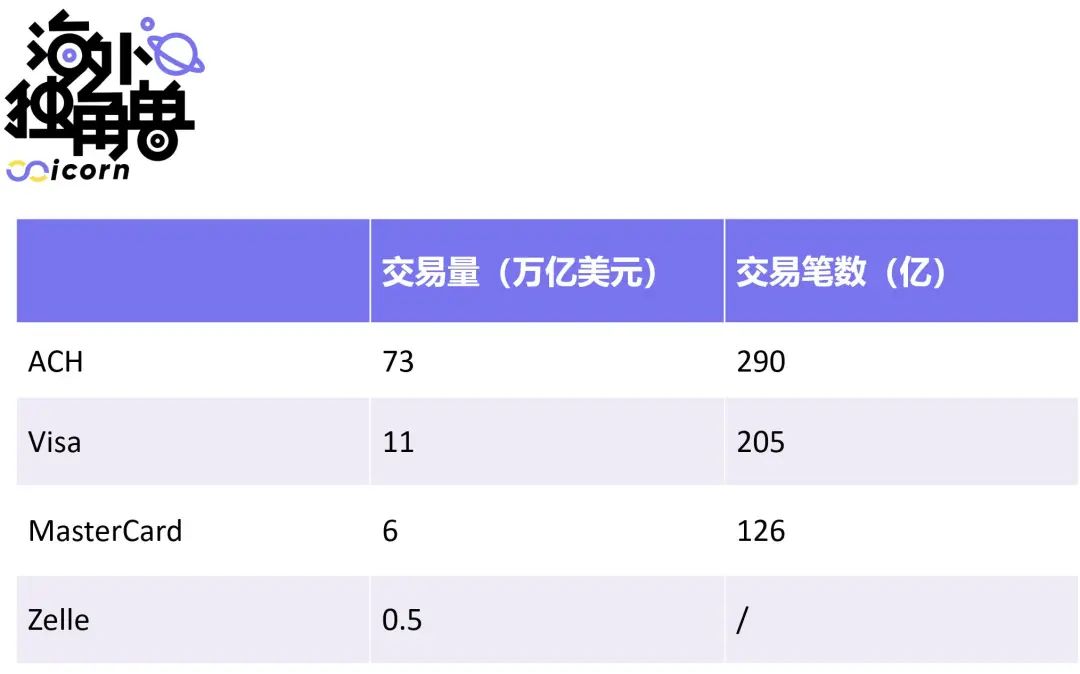

The full name of ACH is Automatic Clearing House, that is, automatic clearing house. A common understanding of ACH: it handles the check issuing and receiving related behaviors online, and is the largest payment system in the United States and even in the world.

The benefits of ACH are clear - extremely low processing fees, an order of magnitude lower than card networks:

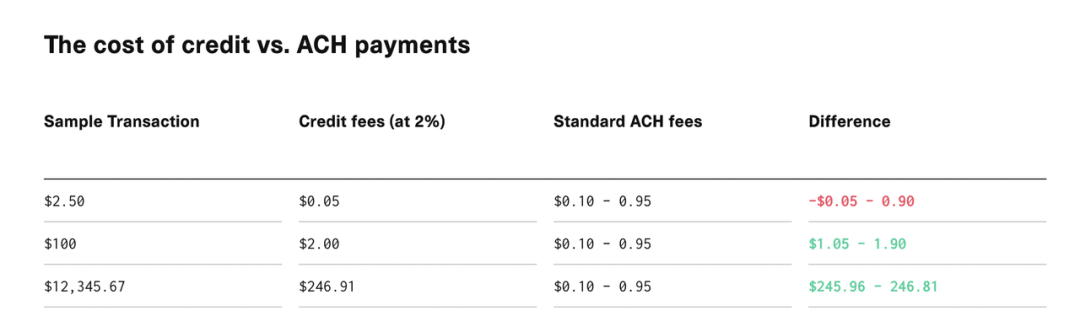

However, ACH’s approach behind the scenes is to package the bank’s transactions and send them to the counterparty bank four times a day. Limited by the overall mechanism design, cost and processing capacity, it usually takes 3-5 days to complete the actual settlement (this is the most ideal In this case, once the consumer fills in the wrong information of himself or the counterparty, he needs to go through the process again):

FinTech and Crypto exchanges can also choose to advance funds in advance, but they have to bear the risk of fraud:

The customer may have written a bad check (the professional term is called Non-Sufficient Fund)

Customer's bank account may have been compromised (online credit card payments require entry of CVV, billing address, card number, card expiration date, while ACH transfers only require account number and routing number)

……

More importantly, there may be frauds caused by other strange reasons in this transaction of the customer.And ACH's protection for consumers is that **when there is a problem with the payment itself, the ACH payment will be revoked.Consumers are not eligible when there is a problem with a product or service they purchased. The general ACH refund period is 90 days, and some banks can reach 120 days. This has led to the fact that anti-fraud products designed around e-commerce chargebacks in the past naturally do not match the ACH scenario.

Why do FinTech/Crypto exchanges need **RISK-FREE & INSTANT** ACH settlements?

"Risk-free" is related to capital loss, while "instant" is related to user growth.

We have already introduced the ACH fraud problem above, and we can imagine such a specific scenario:

The user uses Revolut to transfer money from their original bank, and there will be a lot of fraud here-the scammer can use the identity to bind a third-party bank account to deposit 10,000 US dollars to Revolut, and then use Revolut to go shopping or buy coins to spend For the money, the victim may realize that he has lost it one month later and complain to the card issuer. In the end, Revolut needs to compensate some or all of the money. (this is typical fraud risk)

Or there is no scammer at all, and the user writes a bad check - after transferring money to Chime, the money in the original bank account is spent, and Chime's frictionless transfer has already advanced the user, and he can simultaneously transfer Chime The balance is also spent, and then wait until the ACH transfer fails 5 days later, Chime needs to make up for the hole in the advance loss. (This is a typical Non-Sufficient Fund risk)

Due to the above reasons, many merchants no longer accept debit cards issued by Chime and Cash App. For example, users in certain regions cannot use Chime to pay for Uber.

There are also a large number of FinTech and Crypto products that do not advance funds, and they can’t even wait for the day of fund fraud. A large number of users who are unwilling to pay a 5-10% premium for credit card/debit card real-time currency purchases are given 3-5 days to successfully deposit. Scared off.

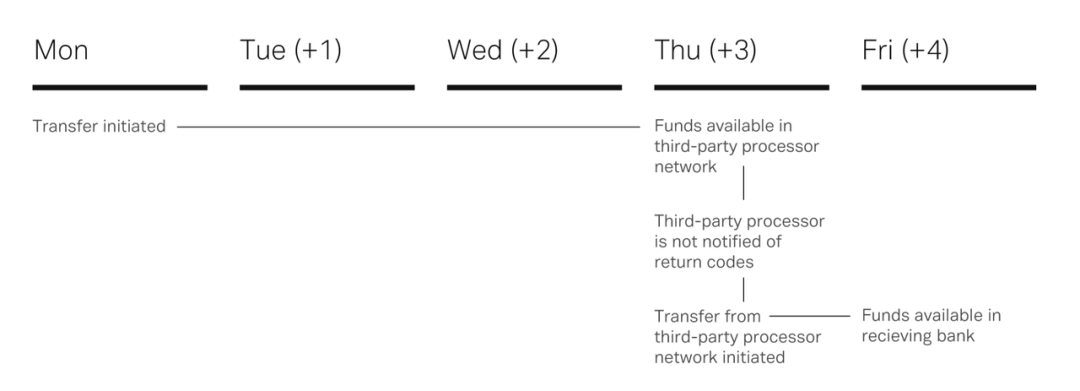

The following two images are from Binance and Coinbase:

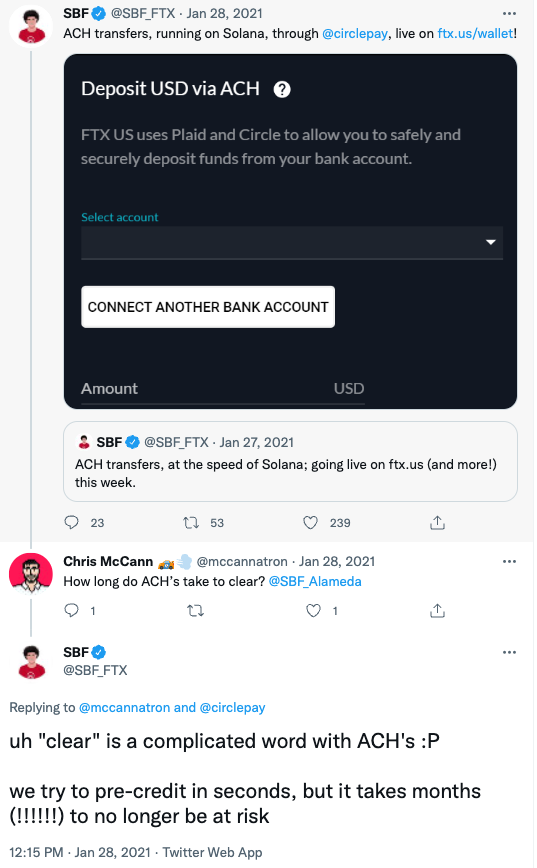

FTX's SBF (FTX has become a customer of Sardine and has a good opinion of it) also pointed out the current pain points and risks of ACH transfers:

The Sardine team described the situation as: "Fear of fraud hinders growth, creates poor user experience, reduces revenue and reduces customer trust". a16z refers to the current practice of exchanges as "a necessary trade-off to mitigate risks for a long time". They have to wait for 3-5 days until the settlement of user funds is completed before allowing them to trade. A large number of customers are in the process of this process (it is said The loss rate of deposits is as high as 70%, and the funnels of various exchanges will not be more efficient).

secondary title

3.2 Market Opportunities

Overall, due to the uncertainty of Crypto development, this is a difficult market to model. We can get a general feeling of the market that Sardine is in through some data.

Crypto and FinTech companies are facing the worst fraudulent losses in history, and the capital winter has come:

Scammers stole a record $14 billion in cryptocurrencies in 2021, an increase of more than 80%, according to Chainalysis. The IRS criminal investigation agency seized more than $3.5 billion worth of cryptocurrencies in 2021. At the same time, the number of scams itself increased by 60%, with 3,300 active addresses accepting scam funds.

According to Sift, the amount of payment fraud suffered by FinTech will surge by 70% in 2021, with cryptocurrency exchanges increasing by 140%. According to data from Aite-Novarica Group, the average fraud rate of financial technology companies represented by Neobank is about 0.3%, which is twice the 0.15% of credit cards and three times the average of 0.1% of debit cards in the past, which has led some merchants to stop accepting Chime , Cash App Card and other Neobank debit cards.

Coinbase described the risk of fraud in its annual report as follows:

We are exposed to transaction losses due to fraudulent returns, chargebacks, which may adversely affect our business, results of operations and financial condition. Some of our products and services are paid for by online transfers from bank accounts, which exposes us to the risk of chargebacks and insufficient funds in the account. In addition, some of our products and services use payment processors to capture credit and debit card payments, which exposes us to the risk of chargebacks and chargebacks. These claims may arise from fraud, misuse, delayed settlement, insufficient funds, etc.

Additionally, criminals are using increasingly sophisticated methods to commit crimes, such as counterfeiting and fraud. If we cannot recover the money from the user due to the user's bankruptcy or rejection, we will bear the loss of the return, refund amount.

In 2021, Coinbase's Transaction Expenses increased by 836% to $1.27 billion, of whichThe net increase in reverse transaction losses from the above exposures was $200 million.And the 200 million US dollars is only the loss caused by the customer's deposit to buy coins and the coins are withdrawn to the address on the chain, which is included in the expense item. The loss of funds caused by customer fiat currency-related deposit fraud is regarded as COGS, while Coinbase only reports Net Revenue, so we do not have specific data, but it will also be in the order of more than 100 million US dollars.

The 25,000 FinTech and Crypto companies around the world will definitely not do better than Coinbase. Sardine needs 1,000 customers and a single customer to contribute an average of 100,000 ARR to achieve an ARR of 100 million US dollars, and the market capacity is sufficient.

We also don't need to dwell on the anti-fraud SaaS market, because Sardine is aggressively attacking B2B payments and ACH transfers:

B2B is a $125 trillion annual market, and the companies innovating in this space are all around card networks (Brex, Ramp);

Real-time innovation in ACH is stalled by the cost of fraud in an $84 trillion annual market.

To capture $5 billion in a transaction volume of $100 trillion, a Take Rate of 2% means an ARR of $100 million.

Why haven't there been tens of billions of dollars in anti-fraud companies in the past?

The fact is that tens of billions or even hundreds of billions of dollars of companies have indeed emerged in this field, but we do not regard them as anti-fraud companies——Great payment companies like PayPal and Stripe are also anti-fraud companies.

Stripe is an e-commerce payment anti-fraud company in my opinion.Its early core payment processing capabilities were connected to Wells Fargo and First Data, and it actually only did two things:a) Acquire customers more efficiently with a simple API; b) Do a good job in anti-fraud.

Stripe's former early executives also believed that its core competence is anti-fraud (risk control):

Stripe in 2011 is that you can receive orders by filling in your name and email. After receiving $200, Stripe will verify your more information, such as social security codes, etc. Some very large companies charge billions of dollars on Stripe every year. USD, but their Stripe account id, which is the founder's name and their gmail address.

Stripe's risk control capability is a core competitive advantage. The payment itself is not much different. Shopify Pay is a White Label customer of Stripe, getting merchants on board as much as possible up front and then asking for more information as they scale. These are all information requested through Stripe's API, and Stripe Connect is based on this risk control capability.

And Stripe's risk control ability is bought with real money to buy tuition:

In fact, the acquiring bank usually settles with the merchant's bank by T+1, but since Stripe is the ISO agent of visa, they send the money out. If there is any fraud, Stripe will be blamed. As we all know, Shenzhen and Fujian The seller has been using Stripe since 2012, and has created Stripe's risk control system for almost ten years. 16 years later, Shopify + Facebook became popular, and some independent sellers started drop shopping site groups. The dispute rate is very high, and no matter how powerful the company is, it can’t handle it. If this happens to the domestic acquirer, the entire company will be dragged down. After all, there is no Stripe background. People just watch you prostitute and record it. Fraud each feature of the merchant, and then shape the merchant's model based on deep learning.

--Know almost

PayPal is also similar. It almost died of fraud in the early days. Later, CAPTCHA technology, anti-wool party and Igor algorithm were developed to identify abnormal merchants. According to LexisNexis 2015 statistics, PayPal's fraudulent losses accounted for 0.32% of revenue, while the average for other payment vendors was 1.32%. PayPal employs thousands of agents each year to manually sift through and label data to help improve its anti-fraud models, spending about $300 million a year on anti-fraud efforts.

secondary title

3.3 Customers

Sardine currently serves two types of clients:

FinTech(Neobank):Brex, the largest innovative credit card and fee control management company in the United States, Chipper Cash in Africa, etc.;

Crypto (exchange and deposit and withdrawal ramp):FTX, Bakkt, MoonPay and Transak, etc., the first two are the world's top exchanges, and the latter two are the market's leading credit card and debit card deposit ramps.

Sardine has not lost a client in May 2022, the only Churn is dharma.dharma is a DeFi wallet that closed its product after being acquired by OpenSea in January 2022. The team was confident they could keep acquiring 8 new customers per month for the next 12 months, and they exceeded their budget.

Sardine's current customers are very high-quality and have demonstrated very efficient sales capabilities. The company did not recruit the first salesperson until the ARR company of 2 million US dollars, and the first 50 sales leads were all in-bound. For customers such as Brex, an engineer from Coinbase within the team recommended Sardine and started using the product. The old colleague resources and industry reputation accumulated by the founding team in Coinbase and Revolut will be of great help to sales.It is very important for Sardine to win the two benchmark customers of Brex and MoonPay in the early stage. He also won FTX, which is conducive to winning Binance and other mid-to-long-tail customers.

Moreover, the geographical scope of Sardine's current customers is not limited to the United States. Companies such as Chipper Cash in Africa and exchanges in Southeast Asia are the top customers overseas.

secondary title

3.4 Competition

At present, the core competitors facing Sardine include two categories:

1. BioCatch and FingerprintJS based on biometric and behavioral data,The valuation has not yet reached 1 billion US dollars. They all want to be a purer single-link anti-fraud technology provider. The customers of BioCatch are mainly banks and other financial institutions, while FingerprintJS is more e-commerce and OTA. According to Brex Feedback, Sardine is significantly cheaper than these two competitors;

2. Comprehensive anti-fraud Sift, Insight Partner led multiple rounds of investment in a YC company. Its new economy customers are mainly e-commerce retail companies, and its solutions are more biased towards cards rather than ACH.

More indirect competition comes from larger competitors:

1. American credit giant EquifaxIn recent years, anti-fraud has been continuously increased, and Kount was acquired in February 2021; PayPal acquired Simility in 2018, and Mastercard acquired NuData and CipherTrace in 2017 and 2021 respectively.

Equifax acquired Kount, an AI-driven provider of fraud prevention and digital identity solutions that provides a personalized customer experience to more than 9,000 leading brands and payment providers, primarily e-commerce and retailers. Equifax acquires Kount to better leverage its large and differentiated data assets and expand its global footprint in digital identity and fraud prevention solutions;

NuData, acquired by Mastercard, is a behavioral biometrics company that can identify users based on their online interactions, helping customers in banking, e-commerce, consumer electronics, healthcare and other industries protect users from account takeover and digital identity fraud; CipherTrace It is a company that provides cryptocurrency AML compliance solutions. The purpose of Mastercard's acquisition of CipherTrace is to integrate CipherTrace's digital asset suite into its own network security solutions, thereby providing enterprises with greater transparency and helping them identify and understand risks. , and help manage its digital asset governance and compliance obligations;

At present, these suppliers are still independently acquiring customers in the market, but most of them do not target the FinTech and Crypto customer groups. The core customers served are still financial institutions, e-commerce and retailers, and they do not constitute direct competition with Sardine.

2.Stripe is also constantly improving its layout in the field of identity verification and anti-fraud,Stripe Radar and Stripe Identity have been released successively.

Stripe Identity uses identity documents and selfie verification, and can programmatically confirm the identity of users in 33 countries around the world to prevent fraud and simplify risk operations. Customers include Discord, Peerspace, Shippo, etc. The product's architecture has been developed by Stripe for its own use over the past decade;

Stripe Radar is Stripe's machine learning-based fraud prevention tool designed to protect companies from chargeback abuse and other fraudulent practices. In 2021, Stripe will acquire Bouncer, a company based on card authentication technology to reduce online transaction fraud, in order to further enhance the functionality of Radar;

Compared with competing products, the common advantage of Stripe Radar and Identity is that they can access billions of payment information in nearly 200 countries of Stripe. This quantitative advantage enables Radar and Identity to improve the accuracy of identity verification and fraud protection. Reduce blocking of legitimate customers and increase acceptance rates while safe. In addition, Stripe's product matrix is very rich. Radar and Identity can be seamlessly integrated with other functions of the Stripe platform to provide a single and consistent experience, which is also an advantage that many competing products do not have.

What Zipmex says about Sardine:first level title

04. What can Sardine be?

We don't want to just invest in an anti-fraud company, and Sardine doesn't want to be just an anti-fraud software provider. The deposit service it is trying is a good start. From the short term to the long term, the following are the ecological niches that Sardine may occupy in the market in the future:

Risk-free instant deposit on-ramp for Crypto and FinTech

Stripe for high-risk merchants such as Crypto/NFT, Neobank, cannabis trading platforms, cross-border and subscription-based e-commerce

An instant settlement platform for B2B transactions (Bill.com's core business is essentially subscription-based SaaS, and does not participate in B2B transactions themselves)

Real-time payment system for various account-to-account transactions

……

first level title

05. Team

Absolute S-level team, the biggest source of investment confidence, Soups has very good reviews on Coinbase and Revolut, and belongs to the founder of the best trader type. Zahid's performance at Uber was mediocre, but he proved his technical prowess at PayPal.

Founder & CEO Soups Ranjan:The former head of Coinbase's data science and risk team experienced Coinbase's rapid growth period from 2015 to 2019, and then joined Revolut as the head of financial crime risk (responsible for reducing payment fraud while ensuring user growth ) and Crypto Product Leader, launched the fully compliant Revolut Crypto US in the US market. Soups holds a Ph.D. in electrical and computer engineering from Rice U.

Co-founder Zahid Shaikh:Served as a senior product manager at PayPal and Uber for 10 years, experienced the spin-off of PayPal and the golden age of Uber, created the device intelligence patent FraudNet at PayPal, which helped the company reduce fraud by 40 million US dollars every year, and then joined Revolut to be responsible for launching the Crypto buying and selling function And manage a data team.

Co-founder Aditya Goel:After investing in PIMCO, he worked as a VP at Deutsche Börse, Europe's largest stock exchange (approximately US$30 billion in market value), responsible for product strategy and upstream and downstream investment. He joined Revolut in 2018 as the head of US products and operations. From zero to One established the US team and completed 1.2 million user acquisition.

Soups is also the co-founder of Risk Salon. Risk Salon is the most influential think tank in the field of risk control.

Some comments from clients about the team:

What Brex said about the Sardine team:The entire founding team is very smart, and Soups is a person with high morale, but the use cases of which direction to do in the future need to continue to think clearly.

What MoonPay said about the Sardine team:The team has insights in the FinTech and Crypto industries. Other players in the industry only think about card networks and traditional systems. Sardine's team feels completely different from other teams.

Deel COO (he and Sardine's Aditya are the earliest employees of Revolut US) commented on the Sardine team:first level title

06. Finance & returns

*For compliance reasons, we do not disclose Sardine's financial data here.

According to the standards of SaaS investors, if NNARR/S&M and NNARR/Burn are 1, it is Good, and if they can reach 2, they are Excellent.Sardine's performance is very good, NNARR/S&M 12.4 in 2021, NNARR/Burn 1.5, 2022 is expected to be 4.8 and 1.6 respectively.

From an Upside perspective, Sardine has a great opportunity to contribute more than 10 times the return:The anti-fraud business needs 1,000 customers and a single customer to contribute an average ARR of US$100,000 to achieve an ARR of US$100 million. The number of customers is a bit high, but there is plenty of room in terms of market capacity.If Crypto can enjoy the 20 and 21 year bull market again after going through the bear market in the next 2 years or so, the average single customer contribution ARR of Sardine’s business has a chance to reach 300,000 US dollars, and then 300-400 customers can complete it $100 million ARR goal.In addition, the ACH deposit business has room to achieve an ARR of 300-500 million US dollars in about 5 years, which means a transaction volume of 5-10 billion US dollars, which is 3-5 times the transaction volume of MoonPay in 21 years, because ACH is also very suitable for For large transactions, the completion of this transaction volume target can be expected.

From Downside's point of view, the most pessimistic situation would be that the entire Crypto market does not rise, so it will be difficult for Sardine to complete the growth of the number of users.The more likely reality is that Sardine's core use cases are focused on anti-fraud, and if it fails to expand to ACH settlement, it may be difficult for it to become a company with tens of billions of dollars. At this time, our possible exit path is acquisition-MasterCard's $640 million acquisition Kount, an anti-fraud provider, Ekata, an identity fraud provider, for $850 million, and Simility, which PayPal acquired for an estimated $500-1000 million. Given that Visa has become a strategic investor in Sardine, we also have the opportunity to recover the cost in the worst case of entering this round.

first level title

07. Conclusion

appendix

appendix

Sardine's CEO Soups gave a Keynote speech at Fintech DevCon. He shared the following Web3/digital bank fraud cases, which can help us understand the types of fraud Sardine is facing more intuitively:

Tech Support Scams:Victims are usually people whose social network accounts such as Facebook have been stolen. They will Google “Facebook account tech support” and then call a hotline number. There is nothing he can do and hangs up, and the victim then logs into the exchange to find himself buying some bitcoins and transferring them to a stranger;

Cryptocurrency Investment Advisor Scam:Scammers will pretend to be cryptocurrency investment advisors, and then convince customers to register with the exchange and give them access to the TeamViewer control screen. Victims use their own identities to complete KYC, while fake advisors have their account secrets;

NFT price-breaking scam:Fraudsters usually steal credit cards to buy NFT, then sell them immediately at or below the floor price, and then withdraw ETH;

Smart Contract Authorization Scam:The victim may have previously authorized the contract authority for unlimited withdrawal of a certain currency, and then purchased more of the currency with the card, and the contract automatically transferred the currency;

Zelle Scam:Scammers may ask victims to pay for something before they sell it and never ship it; Scammers may flesh out victims and engage in a fake refund process with them;

Money mule scam:Fraudsters will pretend to be mature people to steal the exchange account of the other party, and then use the stolen credit card to purchase cryptocurrency, and then withdraw cash;

Fake Pay Scams:Scammers hijacked a bank account, then created a new email domain and hundreds of fake employees to steal the funds on payday;

……

Soups also answered some of our concerns:

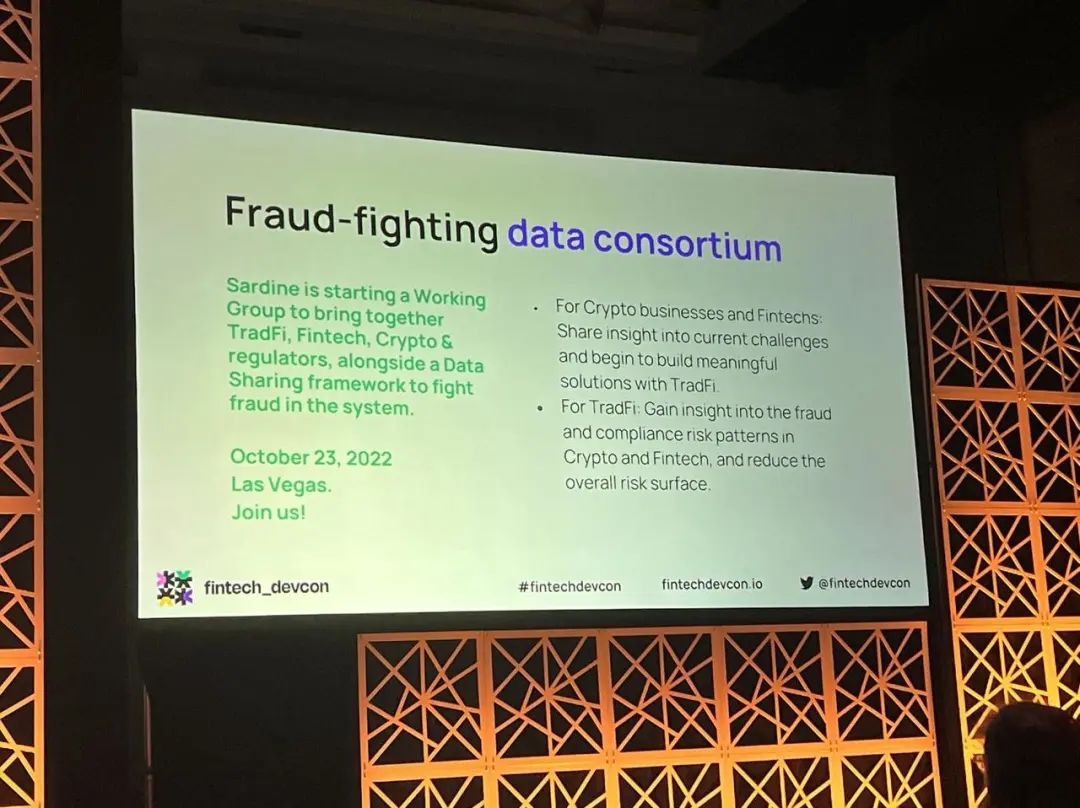

How does Sardine build fraud-related data barriers?

Soups believes that the solution is the Data Consortium that Sardine is building. It is expected to be announced at the Money 20/20 conference at the end of October. Sardine will take the lead in connecting traditional financial institutions (big banks) and new players such as exchanges and digital banks that are troubled by fraud. . Sardine specially recruited a person with strategic consortium experience in AWS and Ravi, the chief analysis officer of consortium Early Warnings behind Zelle, to join the team to do this project.

Browsers currently have more adequate privacy protection. Will the lack of fingerprint affect Sardine?

Soups said that Sardine is fully prepared for these privacy protection policy changes, and its solution does not rely on fingerprinting, because these expert fraudsters know how to deal with their own fingerprinting.

How is Sardine's data delivered? How to measure the error rate? When will the model be updated?

Original link