Original compilation: Babywhale, Foresight News

Original compilation: Babywhale, Foresight News

Important points:

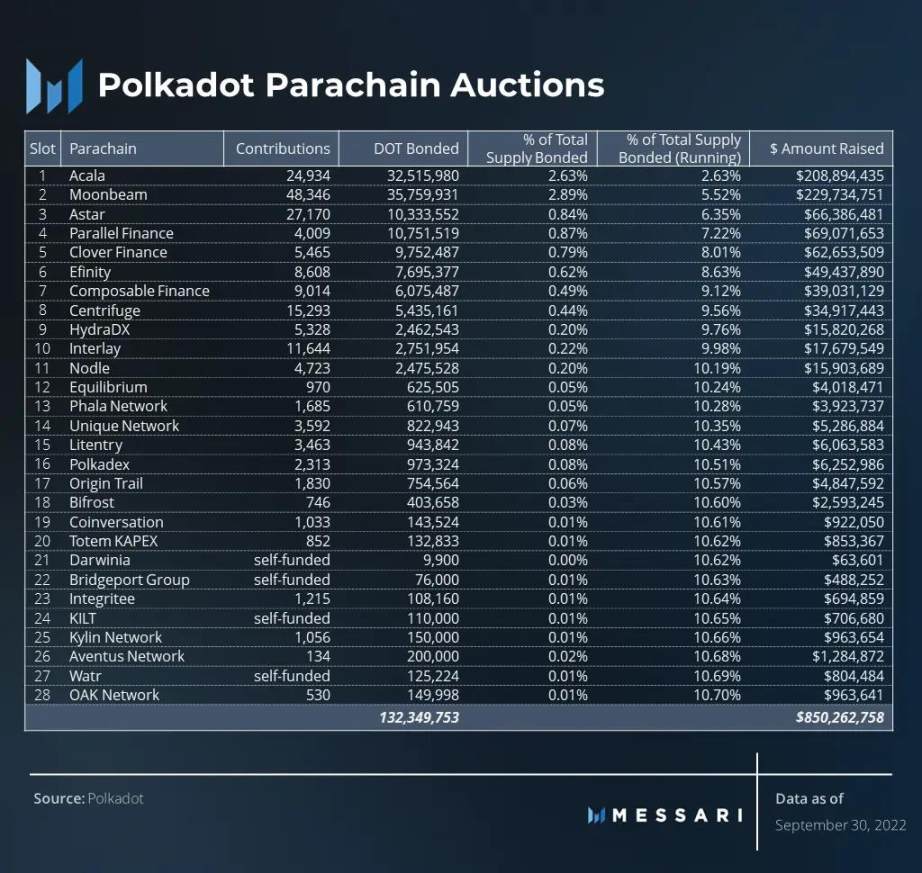

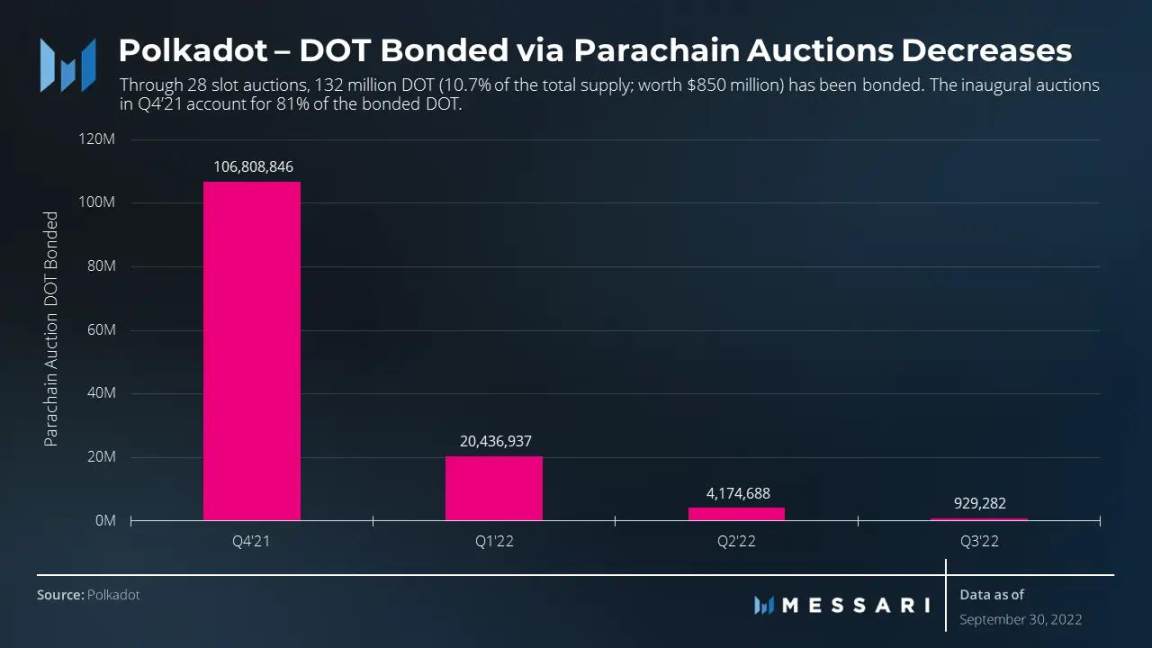

The Polkadot parachain auction produced eight winners in the third quarter. After 28 rounds of parachain auctions, Polkadot has locked 132 million DOTs, accounting for 10.7% of the total supply, worth about $850 million;

The adoption of the interchain messaging format (XCM) continues to increase, with Parity Technologies soon launching XCM V3;

In addition to XCM, Parity also released more information about Polkadot Governance V2. The V2 version will increase the number of proposals that can be voted on immediately and further decentralize the network;

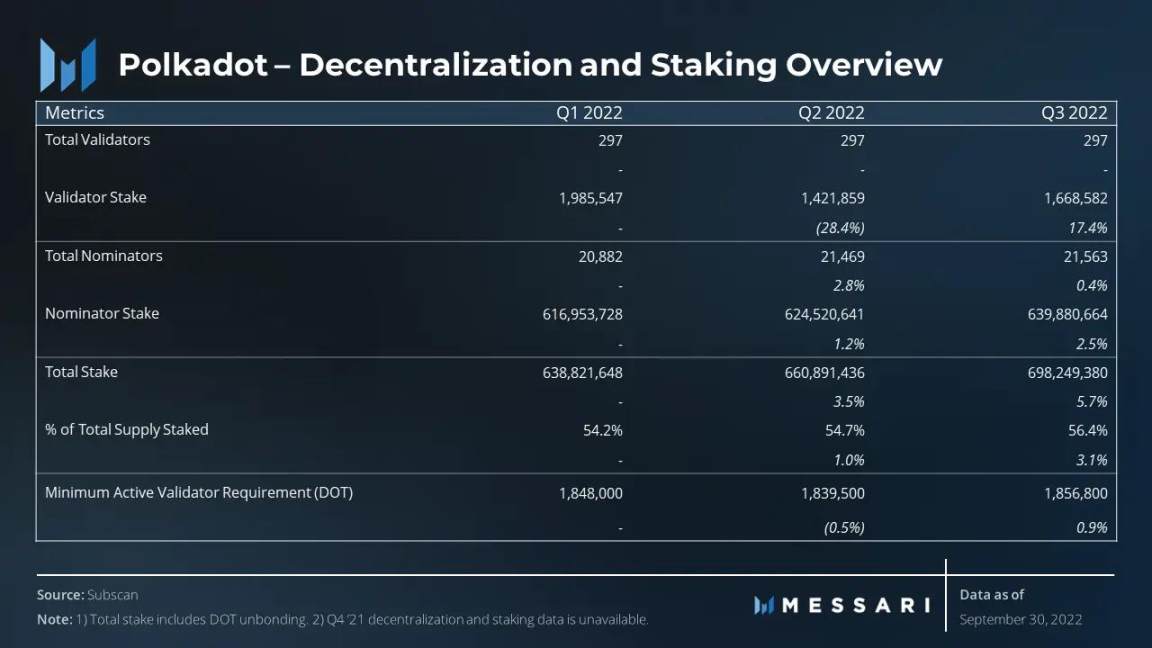

Metrics such as the number of validators, the number of nominators, and the percentage staked remain largely unchanged.

Polkadot Q3 performance analysis

financial analysis

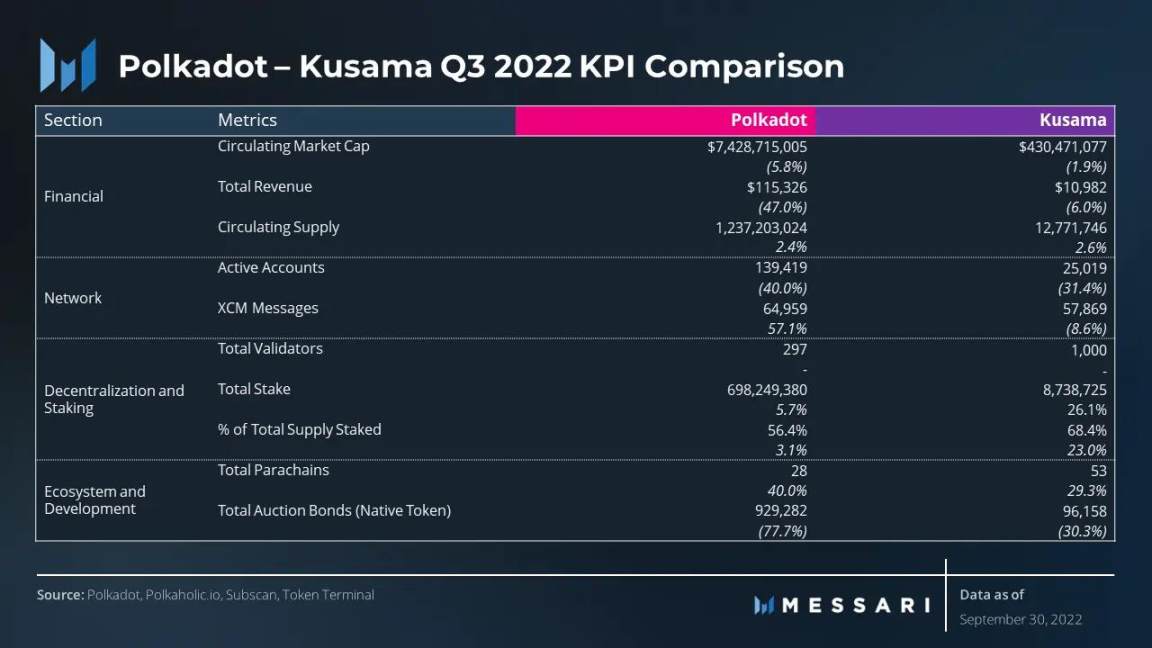

In the third quarter, the cryptocurrency market continued to be affected by the instability of the global macro environment, and the broader market rose 36% on the back of hawkish comments from the Federal Reserve, before returning to the level at the beginning of the quarter. The price of DOT rose by a maximum of 39% in this quarter, but not only gave up all the gains at the end of the quarter, but also fell by 6% from the beginning of the quarter.

Internal metrics such as DOT circulating supply and treasury stock continue to grow steadily as expected. DOT tokens are inflationary, with an annual inflation rate of approximately 10%. The treasury is funded mainly from block rewards and transaction fees. At the same time, metrics such as revenue and financial charges saw considerable volatility. Overall, Polkadot's financial performance in the third quarter of 2022 has largely stagnated.

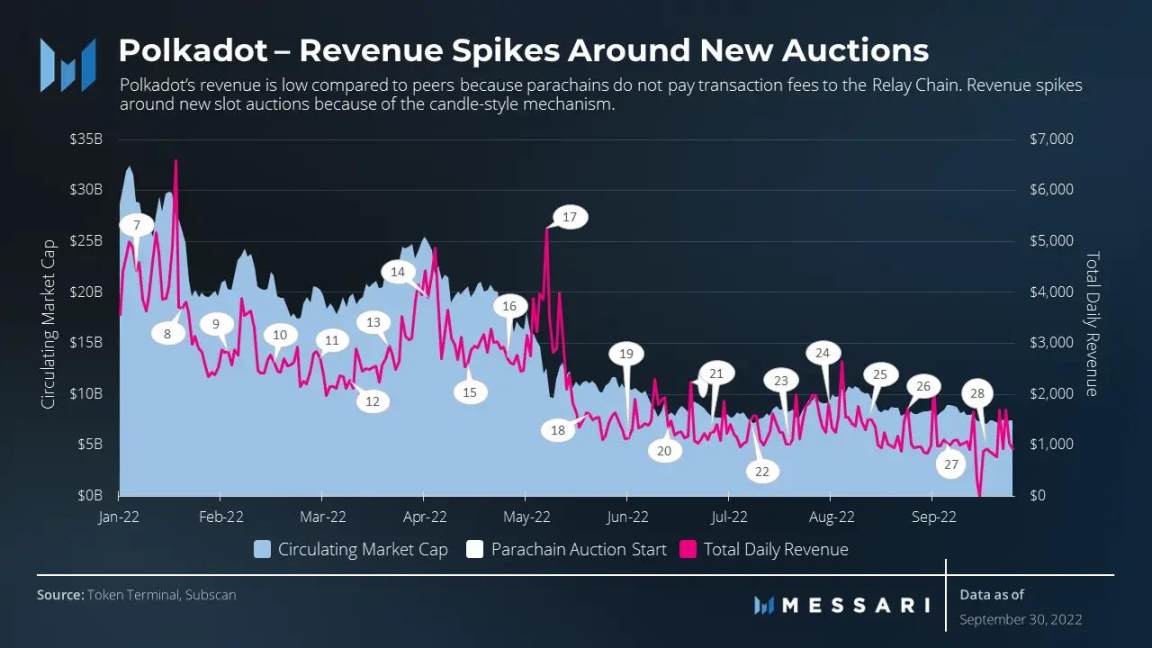

Although the relay chain is the core connection layer of Polkadot, the parachain is the component that really attracts end users, so most of the network activities take place on the parachain. However, parachain transactions are not affected by relay chain transaction fees. Instead, parachains have full autonomy over their fee structure. Most parachains require transaction fees denominated in native tokens, while also paying an additional fee to avoid spam.

The Relay Chain does support some functions used by end users (mainly token transfers, staking, validator elections, governance voting, and parachain slot auctions), and the fees are paid in DOT. This native relay chain activity generates Polkadot revenue. Because of the candle auction mechanic, revenue tends to spike when most auctions start.

In the third quarter, Polkadot's revenue was $115,000, and the current price-earnings ratio was 19,945 times. In comparison, Avalanche has $2.3 million in revenue and a traded P/E ratio of 665, while Cosmos Hub has $142,000 in revenue and a traded P/E ratio of 4,965. These base layer protocol metrics are pretty bad by traditional standards. Revenue-focused metrics coupled with high valuations also highlight the difficulty of evaluating base-layer protocols.

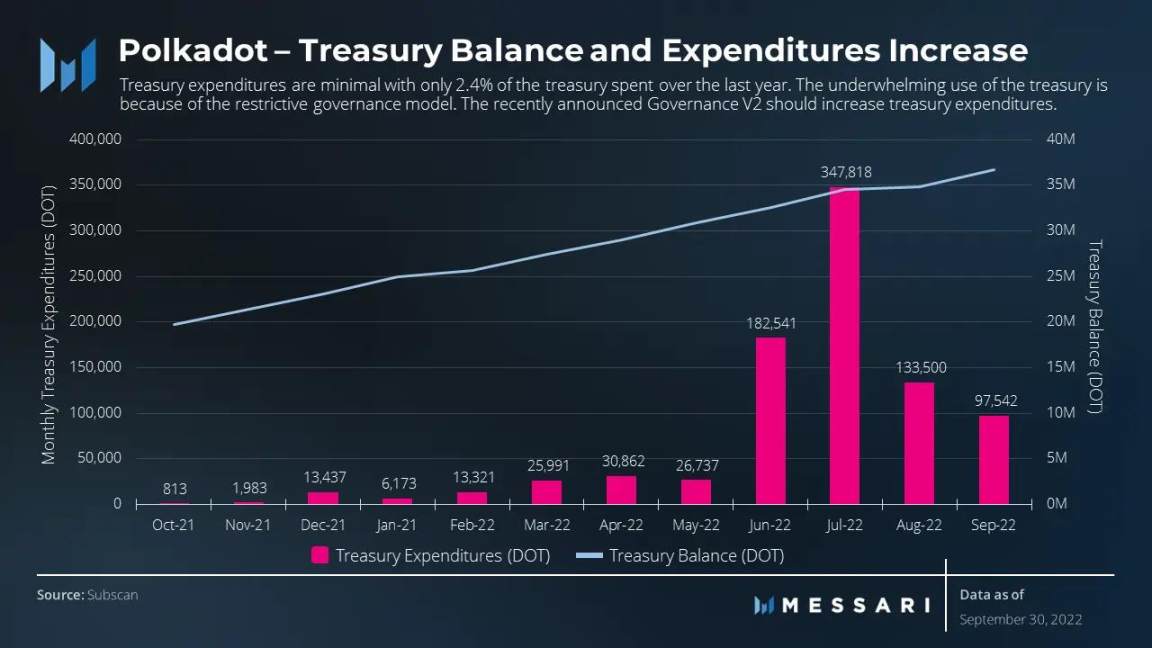

The Polkadot treasury is funded by block rewards, validator penalties, transaction fees, and more. In the future, parathreads will also generate new sources of funding by participating in the auction of each block. At the end of the third quarter, the Polkadot treasury had funds of 36.7 million DOTs, or about $236 million.

network overview

network overview

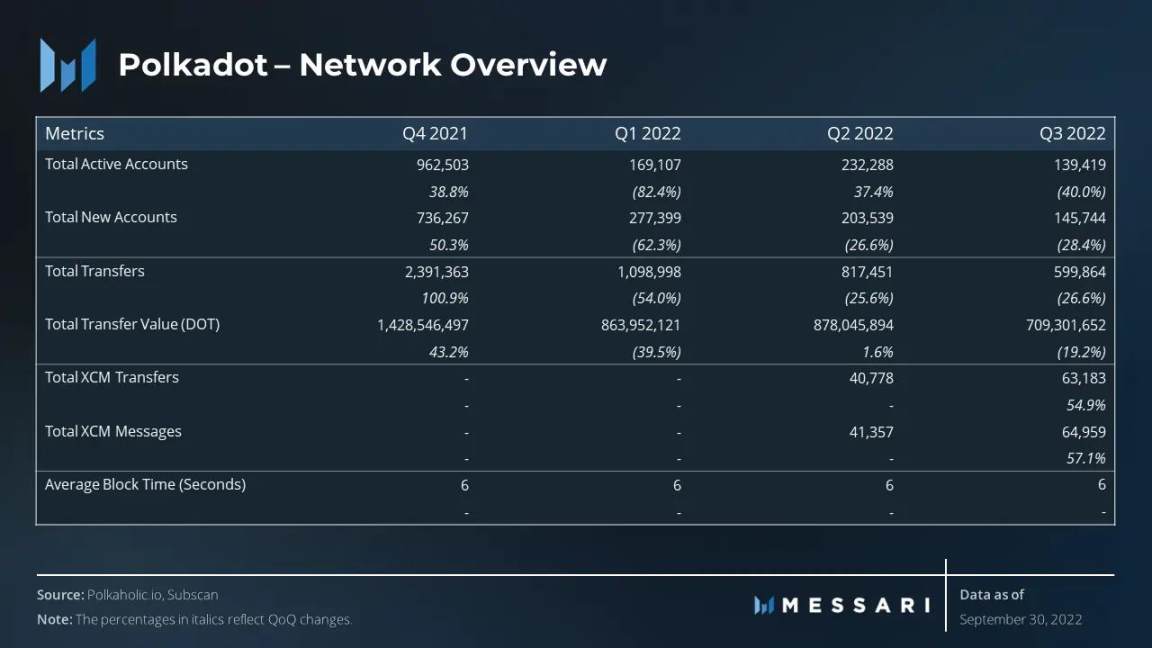

As mentioned in the revenue section, the Relay Chain supports account creation and token transfers for governance and slot auctions. In Q3, these two metrics saw a sizable decline for the third consecutive quarter, likely due to the bear market leading to reduced participation in parachain slot auctions and a reduction in the number of users themselves.

Although the relay chain supports functions such as account creation, token transfer, and parachain auction participation, its sole purpose is to relay information between parachains and coordinate validators. In order to remove these auxiliary functions, Polkadot is launching a new public welfare parachain.

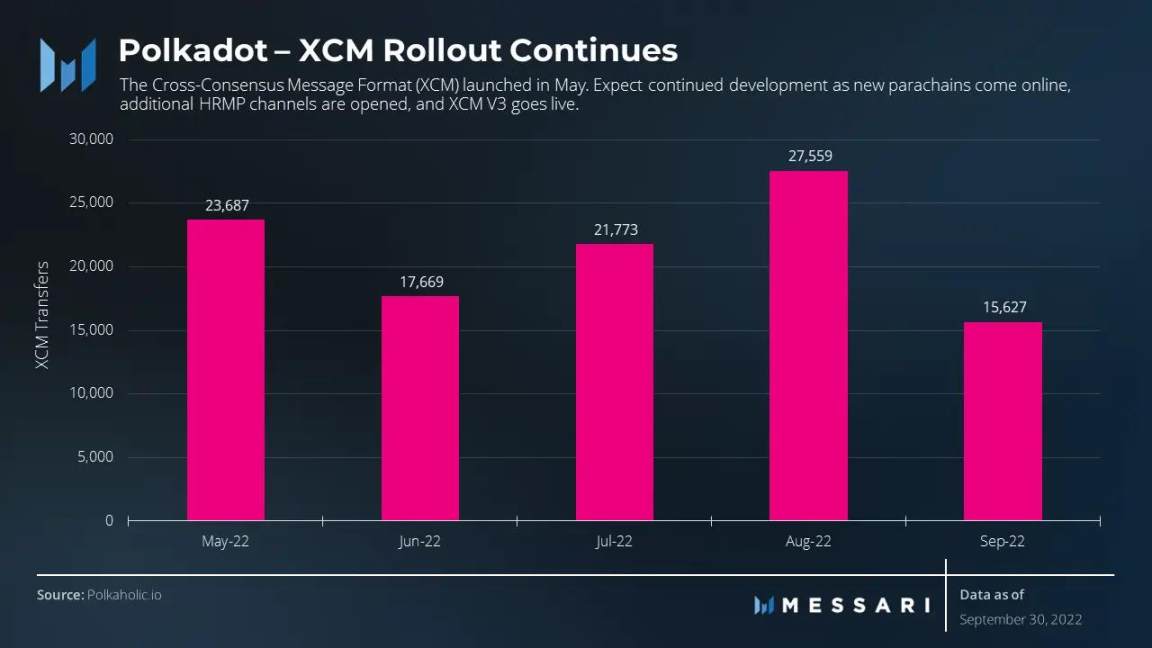

Most of the activities in the Polkadot ecosystem take place on parachains. Each parachain is a Layer 1 blockchain with its own community, economy, and governance model. Unfortunately, since the network is still in its infancy, aggregation of parachain user activity is difficult. Members of the Polkadot community are currently improving data sources to monitor overall activity. During this time, XCM can act as a proxy for the activity of the entire ecosystem.

The Interchain Messaging Format (XCM) is a communication language that allows parachains to exchange messages. XCM messages can be transmitted between parachains, between relay chains and parachains, and between other applications and base layer protocols outside the Polkadot ecosystem. XCM messages can be used for specific operations, such as asset transfers, etc. In the future, Polkadot expects to have more detailed data on specific parachain activity.

The expansion of XCM is critical to the continued development of the Polkadot ecosystem and opens the door for new application development. As a communication language, XCM allows parachains to exchange messages with other parachains, similar to Interchain Communication (IBC) on Cosmos. In early July, Polkadot founder Gavin Wood announced that he would launch the XCM V3 version.

Decentralization and Staking Overview

The third quarter is the quarter when Polkadot’s decentralization and staking levels continue to remain stable. Basic metrics such as number of validators, percentage of total supply, and minimum DOT required to run an active validator are stable. The consistency of metrics related to decentralization and staking indicates a well-functioning and healthy ecosystem.

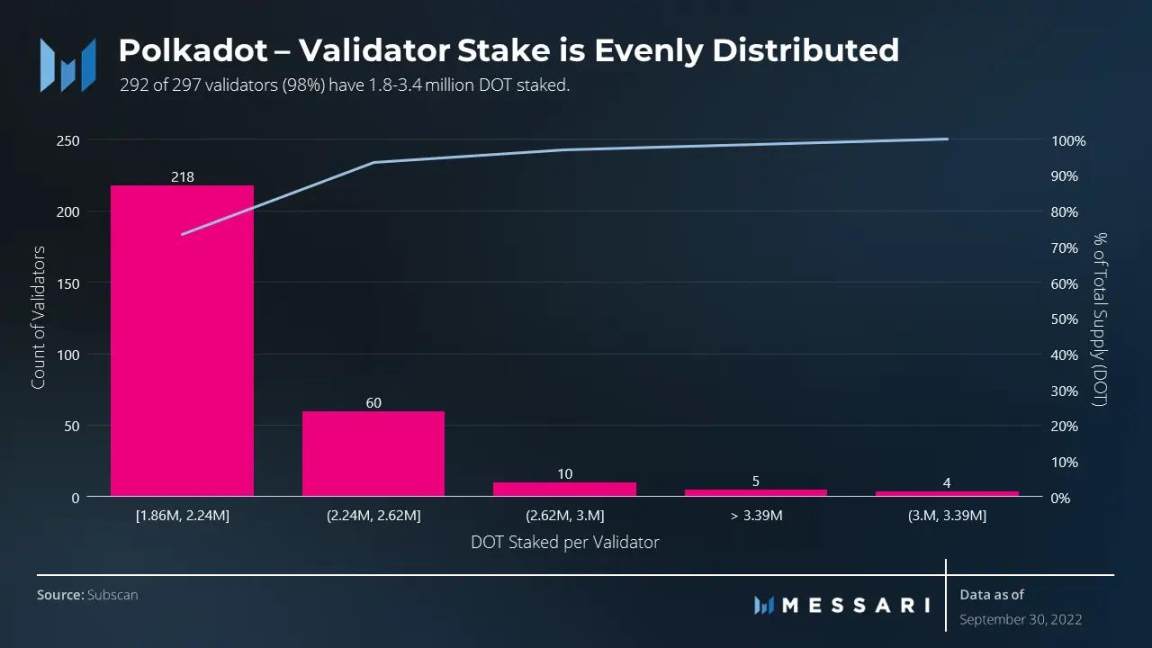

Polkadot's validator incentive scheme allows all validators to receive almost the same rewards. This incentive scheme allows nominators to increase their rewards by staking with validators with lower stakes. In Q3, 292 (98%) of a total of 297 validators staked between 18,000 and 3.4 million DOTs.

The relatively even distribution of validator pledges improves the decentralization of Polkadot. Although difficult to calculate, Polkadot could have very competitiveNakamoto Coefficient(a measure of the degree of decentralization). Eventually, Polkadot plans to expand the number of validators to 1,000 to support 100 parachains. However, Polkadot must first improve network storage and scalability to support additional validators.

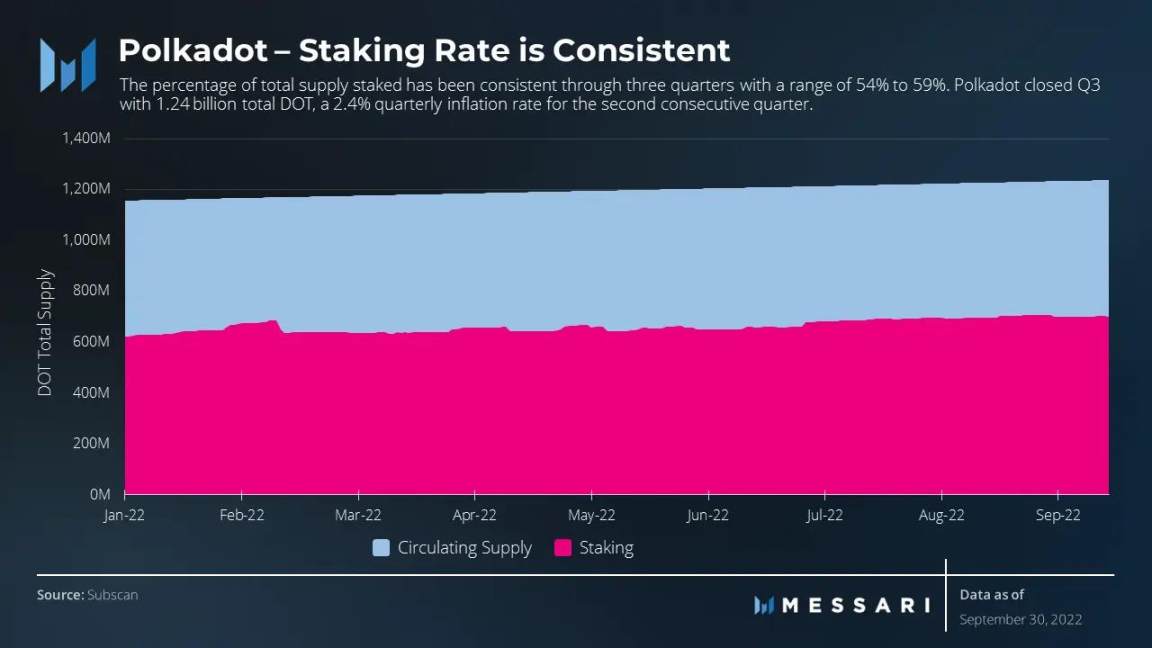

Polkadot networkIdeal pledge rate50%, and this number will vary with the number of parachains to secure the network while maintaining sufficient liquidity. Year-to-date, the percentage of total DOT staked is higher than ideal, ranging from 54% to 59%. When the system staking rate is higher than the ideal staking rate, nominator rewards will be reduced and additional rewards will be sent to the Ministry of Finance.

During the third quarter, Polkadot released two new pledge-related products:andandStaking Dashboard. Nomination pools allow users to create permissionless staking pools and enable any user with at least one DOT to stake. The staking dashboard provides a more user-friendly navigation and query experience. These new products resulted in a 3.1% month-on-month increase in the number of DOT staked, the largest increase this year.

Overview of Ecosystem and Developer Activities

The eight projects that successfully won the parachain auction in the third quarter are:

Darwinia: A trustless cross-chain bridge that combines zero-knowledge proof and optimistic provides a general cross-chain solution between heterogeneous chains without custody or token encapsulation;

Bridgeport Group: Web3, Metaverse and NFT ecological infrastructure projects;

Integritee: A blockchain project that achieves privacy protection through a trusted execution environment (TEE);

KILT: Blockchain-based identity protocol;

Kylin: Modular and configurable decentralized data infrastructure;

Aventus Network: An enterprise-level blockchain that provides development convenience and security;

Watr: Real asset tokenization project;

OAK Network: DeFi and automated payment platform.

The DOT bonded through the parachain slot auction is locked on the relay chain for about two years. Through 28 slot auctions, 132 million DOTs (10.7% of the total supply, worth about $850 million) have been locked on Polkadot. At the same time, DOT due to10% annual inflation rateThus there is no maximum supply.

The amount of DOT locked through auctions is steadily decreasing. Parachain auction participation peaked in Q4 2021, largely due to anticipation of the first auction.

The current lower threshold required to win parachain slots has resulted in projects being able to bid for slots through self-funding. When projects are self-funding, they are not crowdfunding DOTs from the community to issue native token rewards. As such, they retain a larger percentage of their native tokens, which can be sold through other channels, airdropped to the community, or added to treasuries. In the remaining 13 auctions scheduled to run until February 2023, more parachain teams may raise their own funds to participate in the auction without going through crowdlending.

Kusama is a "Polkata test field" with real economic value. For developers, Kusama is a testing ground for runtime upgrades, on-chain governance, and parachains.

Summarize

Summarize

Compared with the second quarter, which saw the collapse of Terra, the bankruptcy of Three Arrows Capital, the escalation of the war between Russia and Ukraine, and the Fed's aggressive rate hikes, the third quarter was relatively flat. The broader market gave up all its gains after a 36% rally as the Fed maintained a hawkish policy. Polkadot's valuation performance was relatively prominent in the third quarter, but the data on key performance indicators and network fundamentals were mixed.

Polkadot's financial and network activity largely mirrors native relay chain activity. Closely related KPIs such as active accounts, new accounts, revenue, and token transfers all saw double-digit percentage declines, likely driven by declining participation in parachain slot auctions and expectations of a bear market.

Most activities in the Polkadot ecosystem take place on parachains. Each Layer 1 parachain has its own community, economy, and governance model, making it difficult to aggregate data. Members of the Polkadot community are currently improving data sources to monitor overall activity. During this time, XCM messages act as a proxy for the activity of the entire ecosystem. Since its launch in May, over 100,000 XCM messages have been sent across various channels for different use cases. The imminent launch of XCM V3, the opening of more HRMP channels, and the addition of new parachains should accelerate XCM adoption.

Polkadot's decentralization and pledge data are basically consistent. Basic indicators such as the total number of validators, the total number of nominators, and the proportion of pledged volume remained flat or increased slightly, indicating that the ecosystem at the base layer is functioning healthily. Polkadot released two new staking-related products this quarter, the nomination pool and the staking dashboard. Now anyone can participate in Polkadot staking and greatly improve the staking user experience.

In the next few months, Polkadot will release a series of new products (recommended reading"The Polkadot Founder Personally Describes Polkadot's Latest Roadmap"Original link