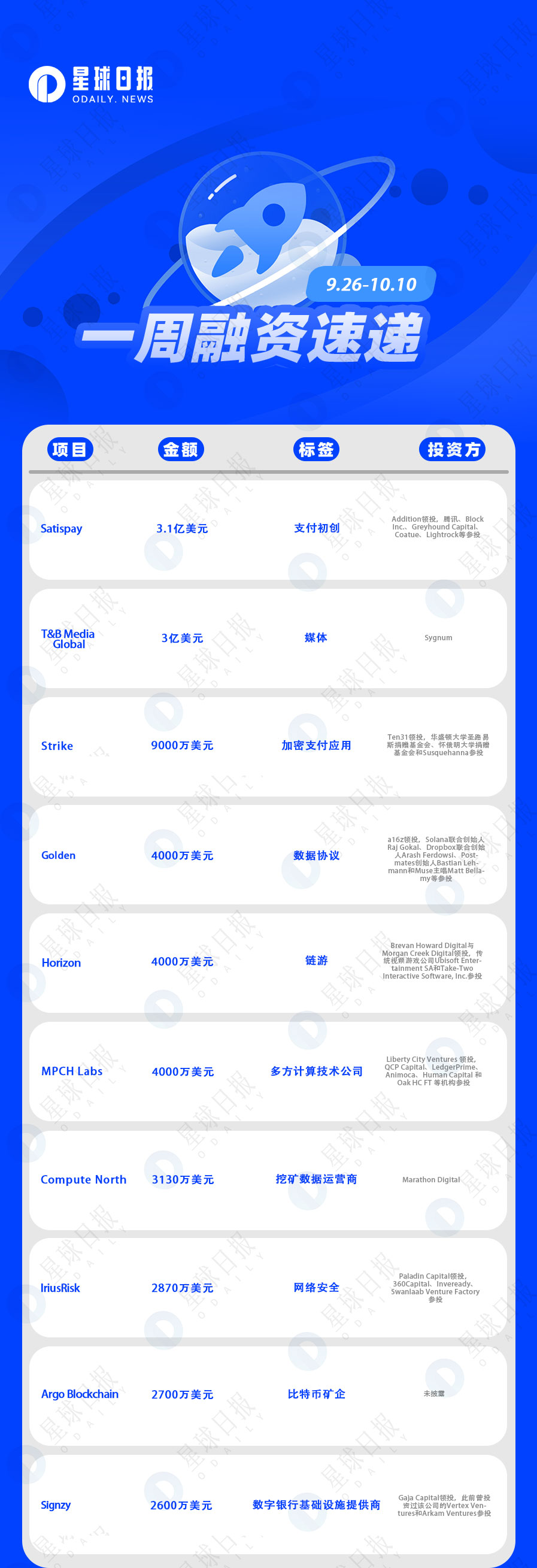

According to Odaily's incomplete statistics, a total of 66 blockchain financing events at home and abroad were announced in the two weeks from September 26 to October 10, and the total disclosed financing amount was about 1.3 billion US dollars.

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

Odaily news payment start-up company Satispay completed D round financing of 320 million euros (approximately 310 million U.S. dollars), with a valuation of 1 billion euros after the financing. This round of financing was led by Addition, with participation from Tencent, Block Inc., Greyhound Capital, Coatue, and Lightrock. Satispay said that the financing will be used to expand product portfolio and market expansion.

Founded in Italy, Satispay has expanded in France and Germany in recent years. Currently has 3 million consumers and 200,000 users, and its goal is to become the leading payment network in Europe. (TechCrunch)

*Thai media giant T&B Media Global completes US$300 million financing

On October 4, Sygnum, a Swiss-based digital asset bank, has helped Thai media giant T&B Media Global complete a US$300 million financing through an "equity-NFT" hybrid structure. T&B Media Global said the funding will be used to launch Translucia, its new internet metaverse platform. It is reported that the Translucia platform aims to provide a Launchpad for partners to utilize the blockchain infrastructure to build an interconnected metaverse. Sygnum will provide T&B Media Global with digital asset services, including building an "equity-NFT" hybrid structure, developing the Metaverse Token economic model, and Token custody services. (techinasia)

Bitcoin fast payment app Strike completes $90 million financing, led by Ten31

On September 27, Bitcoin fast payment application Strike completed a financing of US$90 million. This round of financing was led by Ten31, and Washington University St. Louis Endowment, University of Wyoming Endowment and Susquehanna participated in the investment. Strike is an encrypted payment application based on the Lightning Network. The company aims to challenge credit card giants Visa and Mastercard in everyday payments. (fortune)

Encrypted data protocol company Golden completes $40 million financing, led by a16z

On October 4th, Golden, an encryption company that uses Web3 tools to build data protocols, completed a $40 million Series B round of financing led by a16z, Solana co-founder Raj Gokal, Dropbox co-founder Arash Ferdowsi, and Postmates founder Bastian Lehmann And Muse lead singer Matt Bellamy and others participated in the vote. The company has raised a total of $60 million to date.

The new funds will be used to build a Web3 data platform, which is currently in the test network stage and is expected to be launched on the main network in the second quarter of 2023. Ali Yahya, a16z general partner, will also join the board, alongside current board member and a16z co-founder Marc Andreessen, the company said. (The Block)

Chain game company Horizon completes US$40 million in Series A financing

On October 4th, Horizon, a blockchain game company headquartered in Toronto, Canada, announced the completion of a US$40 million Series A financing, led by Brevan Howard Digital and Morgan Creek Digital, and traditional video game companies Ubisoft Entertainment SA and Take-Two Interactive Software, Inc. .Participated in the investment, the company has not yet disclosed the valuation of this round of financing, but according to PitchBook data, its valuation has reached 89.5 million US dollars after the last round of financing last year. (BNN Bloomberg)

On September 28, MPCH Labs, a multi-party computing technology company, announced the completion of a $40 million Series A round of financing led by Liberty City Ventures, with participation from QCP Capital, LedgerPrime, Animoca, Human Capital, and Oak HC FT.

The funding round will be used to develop Fraction, which will launch later this year. Fraction has created a toolkit for institutions to self-manage digital assets, wallets and workflows based on version. Multi-party computation (MPC) enables multiple parties to gather together for computation without revealing the private data they hold. (the block)

Miner Marathon Digital invests about $31.3 million in bankrupt Compute North

On October 6, Bitcoin mining company Marathon Digital has invested $10 million in convertible preferred stock and $21.3 million in unsecured senior promissory notes in various entities of the bankrupt Compute North, and has also paid about $50 million to Compute North The operating deposits are mainly deposits and prepayments related to supporting ongoing business.

Cybersecurity company IriusRisk completes $28.7 million Series B financing led by Paladin Capital

On October 5, IriusRisk, a cybersecurity start-up company, announced the completion of Series B financing of US$28.7 million. This round of financing was led by Paladin Capital, and 360Capital, Inveready, and Swanlaab Venture Factory participated in the investment.

The security platform developed by IriusRisk can help companies identify potential threats in software and system design and propose countermeasures, thereby improving product security. With the support of new funds, IriusRisk hopes to expand its business into the field of Web3 and blockchain. Its founder De Vries said that the next potential growth field of network security will be Web3 and blockchain technology, although this is a "still "in its infancy" industry, but it is expected that regulation and consumer demand for higher security will force more Web3 developers to build threat models into the product creation process (Sifted)

Mining firm Argo Blockchain raises $27M in share offering to ease liquidity pressure

On October 7, Bitcoin mining company Argo Blockchain raised $27 million by issuing 87 million shares to ease liquidity pressure. Argo’s profitability has been hit by a combination of rising energy prices and falling bitcoin prices, leading to a cash crunch, the company’s chief executive Peter Wall said. The company also raised $7 million through the sale of 3,400 Antminer S19s. (CoinDesk)

On September 26, digital banking infrastructure provider Signzy announced the completion of a new round of financing of 2.1 billion Indian rupees (approximately US$26 million), led by Gaja Capital, with participation from Vertex Ventures and Arkam Ventures, which had previously invested in the company.

It is reported that Signzy, headquartered in Bangalore, India, conducts biometric digital KYC (know your customer) solutions through blockchain smart contracts, and uses blockchain technology to digitize bank documents and business processes, such as identification and background checks , electronic banking policy issuance, etc.

At present, Signzy has reached cooperation with more than 240 financial institutions around the world, including the four major banks in India, MasterCard and Microsoft.

"xNFT" Blockchain Wallet Coral Completes $20M Funding Led by FTX Ventures and Jump Crypto

On September 27, “xNFT” blockchain wallet development company Coral announced the completion of $20 million in financing, led by FTX Ventures and Jump Crypto, and participated by Multicoin Capital, Anagram, K5 Global and a group of other strategic investors. Coral mainly builds Anchor blockchain development tools. They plan to use the funds to accelerate product development and launch Backpack, the first "executable NFT (xNFT)" flagship blockchain wallet product. xNFT will act as a native application in Backpack, similar to For WeChat Mini Programs, users can access on-chain applications, games or asset portals in their wallets. (venturebeat)

On September 27, Space and Time, a Web3 data platform, announced the completion of a $20 million strategic financing led by Microsoft M12 Fund, Blizzard Fund (Avalanche Ecological Fund), Polygon, Framework Ventures, HashKey, Foresight Ventures, SevenX Ventures, Stratos, Hash Global, CoinDCX and others participated in the investment. The financing funds will be used to build a decentralized data warehouse to support the conversion of data in all centralized servers into trustless data sources for smart contract calls.

Space and Time is a Web3-native decentralized data warehouse designed to connect on-chain and off-chain data and provide a wide range of enterprise-level use cases for smart contract applications. (cointelegraph)

On September 28, the hardware wallet company OneKey announced that it has completed a round of financing of approximately US$20 million, led by Dragonfly and Ribbit Capital, and participated by Framework Ventures, Sky9 Capital, Folius Ventures, Ethereal Ventures, Coinbase, and Santiago R Santos.

On October 1, Juno, an encrypted checking account provider, completed a US$18 million Series A financing, led by ParaFi Capital, and participated by Hashed, Jump Crypto, Uncorrelated Fund, Greycroft, and 6th Man Ventures.

Additionally, Juno is launching a tokenized loyalty program that will distribute its native ERC20 token, JCOIN, to verified users as rewards for certain activities on the platform. (The Block)

NFT project QQL completes $17 million in financing

On September 29th, QQL, a generative art NFT project, completed nearly 17 million US dollars in financing by means of coinage. The project was jointly launched by visual artist Tyler Hobbs and Dandelion Wist, co-founder of generative art platform Archipelago, allowing NFT collectors to pass the QQL algorithm As a co-creator of a work of art, the QQL algorithm is open to everyone, but only mint pass holders can turn their creations into official NFTs of the series. The final price of all 900 mint passes is 14 ETH, or about $18,732. The project has raised a total of 126,00 ETH, or about $16.86 million at current prices. (CoinDesk)

NFT-Based Loyalty System Developer Hang Completes $16M Funding Led by Paradigm

On September 30, Hang, an NFT-based loyalty system developer, announced the completion of a US$16 million Series A round of financing, led by Paradigm, with participation from Tiger Global, NBA superstar Durant’s 35 Ventures, Night Ventures, and Good Friends. Angel investors including Tiffany executive vice president Alexandre Arnault also participated in the round.

Hang's service is to help brand companies use NFT and blockchain technology to establish new loyalty and membership programs, and hopes to use this to reshape the relationship with loyal consumers. (Business Insider)

On September 28, Eclipse, a general-purpose Layer 2 infrastructure, announced that it had completed pre-seed and seed round financing of US$15 million at a valuation of more than US$100 million. The specific amount was not disclosed. Among them, the US$9 million seed round financing was jointly led by Tribe Capital and Tabiya, and Caballeros Capital, Infinity Ventures Crypto, Soma Capital, Struck Capital and CoinList participated in the investment. The other $6 million is the pre-seed round of financing, led by Polychain Capital, with participation from Tribe Capital, Tabiya, Galileo, Polygon Ventures, The House Fund and Accel.

Eclipse is a customizable multi-L1 compatible sharding platform that enables developers to deploy their own Solana-powered shards, using any chain for security or data storage. (coindesk)

DeFi rating project Exponential completed a $14 million seed round of financing, led by Paradigm

On October 3, Exponential, a DeFi rating project, announced the completion of a $14 million seed round of financing. This round of financing was led by Paradigm, with Haun Ventures, FTX Ventures, Solana Ventures, Polygon, Circle Ventures and more than 80 angel investors participating.

Exponential’s product is currently still in beta, and it will build a rating system focused on the DeFi market, using scores from A (best) to F (worst) to evaluate different pools, tokens, etc. Exponential will be rated based on a series of indicators, including the specific design of the protocol and chain, problems that have occurred in the past, dependencies with other projects, and so on.

In addition to the rating system, Exponential will also launch a custodial wallet. (wealth)

On September 28, based on the Avalanche decentralized insurance protocol, Re completed a $14 million seed round of financing, with participation from Tribe Capital, Defy, Exor, Stratos, Framework, Morgan Creek Digital, and SiriusPoint. (CoinDesk)

FinTech Company Numida Announces $12.3M Pre-Series A Funding Round Led by Serena Ventures

On October 2, Numida, a Uganda-based digital lending financial technology company, raised US$12.3 million through pre-Series A equity debt financing. Numida plans to expand its digital lending business abroad with this financing. This round of financing was led by American tennis star Serena Williams The venture capital firm Serena Ventures led the round, and other investors included Breega, 4Di Capital, Launch Africa, Soma Capital and Y Combinator.

Web3 firewall technology provider Blowfish completes $11.8 million financing

On September 30, Blowfish, a Web3 firewall technology provider, completed $11.8 million in financing, led by Paradigm, and participating investors included Dragonfly, Uniswap Capital, Hypersphere and Ravikant Capital.

It is reported that Blowfish will help wallets and other custodians protect their users by sending real-time warnings and making transaction content readable. Proceeds from this round of financing will be used to upgrade Blowfish’s fraud detection engine. (CoinDesk)

On October 6, Blackbird, a Web3 hotel platform, completed a $11 million seed round of financing, led by Union Square Ventures, Shine Capital, and Multicoin Capital, with participation from Variant, Circle Ventures, and IAC. Blackbird's minimum viable product could hit the market in the first half of 2023.

According to reports, Blackbird is a web3 platform specially built for the hotel industry, focusing on establishing a direct connection between restaurants and guests through loyalty and membership services. (The Block)

Tactic Closes $11M Funding Led by FTX Ventures

On September 27th, Tactic, which helps companies manage and simplify cryptocurrency finances, today announced the completion of $11 million in financing, led by FTX Ventures, Lux Capital, Exponent Founders Capital, Definition Capital, Coinbase Ventures and other institutions, as well as Founders Fund and Ramp, Dylan Field, Elad Gil, Sabrina Hahn and others participated in the investment.

Tactic is addressing the accounting of a business’ cryptocurrency holdings and on-chain activity by aggregating data from disparate sources, giving businesses a “complete financial view of their balances and activity.” (prnewswire)

Web3 community platform AQUA receives USD 10 million investment from investment company DIGITAL

On September 28th, Web3 community platform AQUA received USD 10 million investment from investment company DIGITAL, which is supported by billionaire Steve Cohen.

AQUA is reportedly built on Immutable X, a gaming-centric layer 2 blockchain, but plans to expand to other chains. (CoinDesk)

AIKON completes US$10 million Series A financing led by Morgan Creek Digital

On September 29, AIKON, a blockchain start-up company, announced the completion of a $10 million Series A round of financing led by Morgan Creek Digital, Blizzard Fund, Up2 Opportunity Fund, Hestia Investments, Yugen Partners, Mighty Capital, Alpha Edison and Think+ Ventures participated in the investment, and as part of the A-round investment, AIKON is integrating with the Avalanche ecosystem. As part of its Series A investment, AIKON is integrating with the Avalanche ecosystem.

It is reported that AIKON was established in 2017 and has since been committed to promoting the mainstream application of blockchain technology. Their flagship product, ORE ID, is a simple user login and blockchain identity management service.

BitQuery Completes $8.5 Million Seed Funding Round Led by Binance Labs

On September 28, the blockchain data company Bitquery has completed a seed round of financing of US$8.5 million. This round of financing was jointly led by Binance Labs and dao5, and Susquehanna, DHVC, INCE Capital, and angel investors from Google participated in the investment. Bitquery will use the funds raised to expand its data coverage to support more blockchains, drive new use cases, and build out its BIT protocol to facilitate real-time data delivery. Bitquery provides a suite of software products to parse, index and store blockchain data in a unified manner.

On September 27, Aspen Creek Digital Corp. (ACDC), a solar-powered Bitcoin mining company, completed a $8 million Series A financing led by Galaxy Digital and Polychain Capital. The financing will be used to build and operate a new 30 MW mining facility.

It is reported that ACDC was established in January 2022 and began operations at a 6 MW solar power generation facility in western Colorado in June this year.

Decentralized exchange Krypton completes $7 million seed round, led by Framework Ventures

On September 27, the decentralized exchange Krypton announced the completion of a US$7 million seed round of financing, led by Framework Ventures, with participation from Samsung NEXT, HashKey Capital, Finality Capital Partners, Foresight Ventures, GSR and MEXC. Krypton said that all codes of its platform will be open source and audited. They will use the funds to accelerate the construction of engineering and research teams and community development. It is expected to launch the exchange business in the first quarter of 2023. (decrypt)

On October 7, MynaSwap, a collectibles trading and storage platform, completed a $6 million seed round of financing at a valuation of $50 million. Avalanche ecological fund Blizzard Fund, Spartan Capital, Wave Financial, NFL stars Odell Beckham Jr. and Kyler Murray participated in the investment.

MynaSwap is a Web3 project by the team behind the Coolkicks sneaker chain. The Coolkicks brand is best known for its flagship store on Melrose Avenue in Los Angeles, which has attracted celebrities including NBA player Ja Morant, NFL quarterback Drew Brees and entrepreneur Gary Vee. (The Block)

NFT project Pokers announced the completion of $6 million in financing

On October 3, the NFT project Porkers announced the completion of $6 million in financing. Bandai Namco, Bandai Gashapon JP, a group of investors from Tencent Games and Web3 enthusiasts participated in the investment. Funds raised in this financing will be mainly used to enter the bonus and liquidity pool in the final stage of snapshot 5/5 (currently 3/5).

On September 27, Tokenscript, a subsidiary of Smart Token Labs, completed a US$6 million financing round led by Liang Xinjun, co-founder of Fosun International, with participation from HashGlobal, Bodl and Fenbushi Capital. Smart Token Labs raised funds through a Simple Agreement for Future Tokens (SAFT). It will use the funds to further develop TokenScript, a framework designed to improve token functionality.

Tokenscript is a product of the open source software company Smart Token Labs. The project provides open source middleware for connecting Web2 and Web3, and is currently integrating with platforms such as Shopify and Galaxy.

Digital Asset Management Firm Xalts Completes $6 Million Seed Round Led by Citi Ventures and Accel

On October 7, Xalts, a digital asset management company, completed a US$6 million seed round of financing. Citi Ventures and Accel, a subsidiary of Citigroup, jointly led the investment, and Polygon co-founder Sandeep Nailwal and others participated in the investment.

It is reported that Xalts is working with ecosystem participants to develop several products, including a structured product and repackaging platform, which will allow institutions to issue structured notes with embedded encryption options, aiming to encapsulate digital assets into suitable institutional investment investor's investment products. (The Block)

Fly to Earn drone platform Spexi raises $5.5 million in seed round

On October 5, Canadian drone startup Spexi Geospatial has received $5.5 million in seed funding to advance the world's first blockchain-powered Fly to Earn drone imagery platform.

According to the company, each of the pilot's missions will help create an ultra-high-resolution base layer image of Earth. Drone pilots who collect data for Spexigon will be rewarded in crypto tokens or dollars. (Dronedj)

Web3 infrastructure company Scale3 Labs completes $5.3 million in financing led by Redpoint Ventures

On October 7, Web3 infrastructure company Scale3 Labs announced the completion of a $5.3 million seed round of financing, led by Redpoint Ventures, with participation from Mysten Labs and Howard University. This round of financing will be used to expand the team size and ecosystem. Its founder Ola Muse stated that Scale3 Labs will not launch its native token.

It is reported that Scale3 Labs is an infrastructure company focused on providing services for blockchain node operators. It was founded by former Coinbase engineers Ola Muse and Karthik Kalyanaraman, who left Coinbase in August this year. Scale3 already supports the Sui network on its platform Autopilot, and plans to support Ethereum, Solana, and Aptos in the future. (The Block)

On September 26, card game developer Splinterlands announced the completion of a $5 million pre-sale round of financing, and all 500,000 Riftwatchers version card packs have been sold out. It is reported that Splinterlands is a card collection game based on the Hive chain and the BSC chain. It once used the game name "Steemmonsters", and then added NFT, land auction and other elements, and changed its name to Splintershards.

As previously reported, in July 2021, Splinterlands completed a $3.6 million token private placement round of financing, with participation from Animoca Brands, Yield Guild Games and others. (BSC News)

NFT video platform Glass completes $5 million in seed round financing led by TCG Crypto and 1kx

DeFi startup Arch completes $5 million seed round, co-led by DCG and Upload Ventures

DeFi startup Arch completes $5 million seed round, co-led by DCG and Upload Ventures

It is reported that this round of financing will be used to tokenize the broader decentralized financial index and develop the platform into a decentralized asset management protocol. Arch aims to enable ordinary investors to invest in DeFi and become the "BlackRock of Web3".

It is reported that this round of financing will be used to tokenize the broader decentralized financial index and develop the platform into a decentralized asset management protocol. Arch aims to enable ordinary investors to invest in DeFi and become the "BlackRock of Web3".

Security firm Cybera closes $5 million seed round led by Converge VC and New North Ventures

On September 30, Cybera, an encrypted cybercrime intelligence and reporting platform, announced the completion of a $5 million seed round of financing led by Converge VC and New North Ventures, Serpentine Ventures, Correlation Ventures, CV VC, Blu Ventures, K20 Fund and Dreamit Ventures, and David Frankel of Founder Collective participated in the vote.

It is reported that Cybera is committed to helping financial institutions and encryption companies prevent more fraud and money laundering activities before losses occur, and to help victims, the financial industry and law enforcement agencies use innovative technical solutions to quickly crack down on these criminals.

Web3 community yWhales completes $5 million seed round financing at a valuation of $80 million

On September 27, the Web3 community yWhales completed a $5 million seed round of financing at a valuation of $80 million. This round of financing was completed without external investors. yWhales is a Web3 community that uses the collective knowledge and experience of its community to help new startups and existing businesses take advantage of Web3 opportunities. Its purpose is to break down barriers to Web3 success and expand the reach of Web3 through education and ongoing collaboration. (prnewswire)

On September 30, Yas MicroInsurance, a Hong Kong-based insurance technology company, completed a PreA round of financing of US$4.5 million, with participation from Noria Capital, Zemu VC, JKL Capital, and 500 Global. This round of financing will expand its insurance products for the Web3 industry, including NFT investment, etc. Additionally, Yas MicroInsurance says its product speeds up the application and claims process through blockchain technology. (Tech in Asia)

Harpie Closes $4.5M Seed Round Led by Dragonfly Capital

On September 27, on-chain firewall provider Harpie completed a $4.5 million seed round of financing, led by Dragonfly Capital, with participation from Coinbase Ventures and OpenSea.

It is reported that Harpie aims to protect Ethereum wallet users and will establish a "trusted network" composed of applications that users want to send tokens. Any transaction outside this network will be identified as theft and blocked. (The Block)

On September 29, Minteo, a Latin American NFT trading platform, completed a $4.3 million seed round of financing. The company is betting on the digital asset industry in the region. Investors in the round included Fabric Ventures, Dune Ventures, CMT Digital, Impatient VC, Susquehanna Private Equity Investments, SevenX Ventures, FJ Labs, Big Brain Holdings, G20 Ventures, Alliance DAO, Zero Knowledge, and several angel investors. Additionally, OpenSea Ventures also participated in the financing. (techcrunch)

Digital asset company Lasso Labs completes $4.2 million seed round, led by Electric Capital

On October 6, Lasso Labs, a digital asset and NFT utility tracking startup, announced the completion of a $4.2 million seed round of financing, led by Electric Capital, with participation from Ethereal Ventures, Village Global, OpenSea and Page One Ventures.

It is reported that Lasso Lasb mainly provides tools for NFT owners to track their digital assets and the benefits of owning these assets. Its platform can obtain real-time data from on-chain and off-chain sources, determine digital assets and NFT utility instances, and communicate with Users share information, and users can also track NFT airdrops, minting windows, exclusive content, and more. At present, Lasso Lasb's services mainly support Ethereum, and will support blockchains such as Flow, Polygon and Solana in the future. (Axios)

On October 8, StemsDAO, a Web3 music start-up company, announced the completion of a $4 million seed round of financing, with participation from artists RAC and Boys Noize.

It is reported that StemsDAO is using the Web3 social graph protocol Lens Protocol to build a community of musicians. They can create tracks together and publish songs in the form of NFT. Each publisher can "full control and understand their IP and use it over time." IP".

On October 1, Fabric, a blockchain-based fan interaction platform based on geospatial networks, announced the completion of $4 million in financing, with participation from Sapir Venture Partners and others. Fabric uses technologies such as blockchain, real-time social, gamification, and augmented reality (AR) to improve the experience of sports live events. It also allows teams to use cutting-edge technology to attract fans and enhance the interactive experience of games. Users can also use AR assets to participate A range of recreational activities. (sportspromedia)

Decentralized music platform Stems completes $4 million in seed round financing led by Ideo CoLab

On October 4, the decentralized music platform Stems completed a $4 million seed round of financing led by Ideo CoLab, with participation from Collab+Currency, Village Global, Polygon Studios, Merit Circle, and Yield Guild Games.

Stems encourage more musical collaborations between artists and fans through NFTs and other Web3 tools. Artists can post music (or a combination of drums, bass, guitar, and other individual music tracks) to the Stems community, and users can then remix the audio into a new music NFT, with the original artist earning royalties when the NFT is sold. The company will launch the music platform on October 6th, at which time 7 NFTs will be released, each priced at 100 MATIC.

On October 9, NFT trading and pricing agreement Waterfall announced the completion of a $4 million seed round of financing led by Electric Capital and Pantera Capital. The new funds will primarily be used to expand the team, as well as build out the NFT trading and pricing protocol.

On September 28, the decentralized machine learning protocol ChainML completed a US$4 million seed round of financing, led by IOSG Ventures, and participated by HashKey, SNZ, Silicon Valley executives and angel investors. ChainML plans to use the financing funds to carry out the first iteration of the ChainML protocol to simplify the use of AI and machine learning models in smart contracts, DApps and wallets.

It is reported that ChainML aims to establish a tamper-proof and scalable protocol for machine learning and complex calculations in Web3, and provide decentralized solutions for machine learning and models. The ChainML protocol will help establish mechanisms that can ensure trust, achieve consensus, and meet the scalability needs of Web3. (The Block)

Payment startup NoFrixion completes €3.6 million seed round

On October 4, NoFrixion, a Dublin-based financial technology company, completed a seed round of financing of 3.6 million euros (about 3.56 million U.S. dollars) (about 3.535 million U.S. dollars), led by Delta Partners and Middlegame Ventures, and participated by Furthr VC. Will be used to develop its payments product and grow its team.

NoFrixion is a business payment startup co-founded by Bitcoin Core developers. NoFrixion recently launched the MoneyMoov API, which aims to connect traditional and digital infrastructures, allowing developers to integrate multiple payment options in one API, including cards, Open Banking (including Sepa and FasterPayments) and the Bitcoin Lightning Network.

Crypto Investment Tool Solvo Completes $3.5 Million Funding Led by Index Ventures

On September 29, Solvo, an encryption investment tool, completed a financing of US$3.5 million, led by Index Ventures, and participated by CoinFund and FJ Labs.

It is reported that Solvo aims to make it easy for users to invest in encrypted assets, and provides high annualized returns, multiple investment portfolios, and an efficient investment experience. The app is scheduled to go live in October. (The Block)

On September 26, Rotonda, Bithumb’s mobile wallet subsidiary, completed financing of 5 billion won (approximately US$3.5 million). Casper Labs, Willoughby Capital, HashKey Capital, Red Rock Capital and others participated in the investment. This round of financing will be used for overseas expansion.

Additionally, Rotonda said it plans to launch Burrito Wallet, a mobile wallet, by November.

France's "Metaverse Edition Shopify" METAV.RS completes 3 million euros in seed round financing

On October 3, France’s “Metaverse Shopify” and Web3 platform METAV.RS announced the completion of a seed round of financing of 3 million euros (about 2.96 million U.S. dollars), led by Studio, the investment arm of consulting firm Sia Partners, and Jsquare, a Singaporean Web3 fund. Ledger Co-founder David Balland, The Sandbox co-founder and CEO Sébastien Borget, serial entrepreneur Michael Amar, Partoo CEO Thibault Renouf, BCG managing director and partner Joel Hazan, Financière Arbevel CEO Sébastien Lalevée and Golden Bees CEO Jonathan Bordereau and investment fund 50 Partners also participated.

Web3 Payment Platform Suberra Completes $2.7 Million Financing, Spartan Capital Participates

On October 7, Suberra, a Web3 subscription and payment platform, announced the completion of US$2.7 million in financing, with participation from Spartan Capital, Delphi Digital, Hashed, Newman Capital, Defiance Capital, Arcane Group, and TsingTech Ventures. Funds from this round of financing will be used to launch its merchant platform and drive the next phase of Suberra's development, including accelerating growth, expanding operations and team size.

It is reported that Suberra is building its cryptocurrency payment platform, which can be used by enterprises to use its services such as automatic recurring payments and one-time cryptocurrency payments on a global scale in a fast and easy way. (The Block)

On October 8, the bond market agreement Bond Protocol announced the completion of a US$2.5 million seed round of financing, led by Chapter One Ventures and IDEO CoLab Ventures, with participation from Alchemy Ventures and Hypersphere.

P2E blockchain game Medieval Empires completes USD 2.1 million in seed round financing

On October 5, Play to Own blockchain game Medieval Empires announced the completion of a $2.1 million seed round of financing, with participation from angel investors including Evan Luthra, James Crypto Guru, Satoshi Stacker, Crypto King, and Davinci Jeremie. Medieval Empires is a multiplayer online strategy game. The background is set in the late 13th century. Players can build their own empires and use NFT to expand their territories in the game. According to Medieval Empires CEO Jan Berkefeld, they will follow up Private placement financing will be conducted. (itnewsonline)

Institutional DeFi platform dAMM announced the completion of a $2 million round of Token sales

On September 27, dAMM Finance, an institutional DeFi lending platform, announced the completion of a US$2 million private placement round of financing. Prismatic, WOO Network, LedgerPrime, Fischer8, Concave, Berachain and System 9, Inc participated in this round of financing. Launched in September this year, dAMM is an unsecured lending platform that adopts a "hybrid centralization-decentralization" model, applicable to any Token with an algorithmically determined interest rate. Market makers and investors can borrow dAMMs from tokens with liquidity pools on the platform, including stablecoins such as USDC, DAI, USDT, and LUSD, and tokens such as AAVE, ANGLE, MATIC, ETH, and LINK. (Decrypt)

On September 29, Seamm, a fashion metaverse application company, announced the completion of US$1.7 million in financing. The investor information has not yet been disclosed. The company aims to use its platform to help brands expand to the virtual world, and at the same time allow brands to create and sell exclusive digital collections. For users, Seamm will transfer real-life fashion to the metaverse and add personalized game characters and avatars. Consumers can also explore digital collections of different brands and artists, and make purchases in the in-app market. (fashion network)

On October 1, according to data from VentureCap Insights, Malaysian encryption trading platform MX Global Sdn Bhd (MX Global) announced the completion of a new round of financing of US$1.6 million, led by Binance and Hachiman Technology, the latter being the parent company of MX Global. MX Global is a regulated crypto trading platform that was approved by the Malaysian Securities Commission in July last year to allow users to trade digital assets such as bitcoin and ethereum. In March of this year, Binance made an undisclosed amount of strategic investment in MX Global and acquired a minority stake. Cuscapi Bhd, a digital business solutions provider, also participated in the investment. (vulcan post)

Metaverse project Union Avatars raises 1.2 million euros, led by Inverady Y FI Group

On October 5th, Metaverse startup Union Avatars announced the completion of a new round of financing of 1.2 million euros (about 1.18 million US dollars), led by Inverady Y FI Group, and some angel investors participated in the investment. Founded by Cai Felip and Jordi Conejero in 2020, Union Avatars aims to connect the real world with the metaverse digital world, and integrate virtual avatars who act as metaverse passports into the blockchain. The team plans to use the new funds to accelerate Product development, international expansion and talent development. (list123)

On September 29, Armalytix, a blockchain financial services anti-money laundering compliance company, announced the completion of a new round of financing of US$1 million, with participation from angel investors from HSBC, UBS, Bank of America and Goldman Sachs. Armalytix software helps companies in industries such as blockchain, financial services and accounting comply with anti-money laundering compliance requirements and avoid fines from regulators. It is reported that the team plans to use the funds to expand its business in the field of legal and financial assets. (uktech)

Web3 game platform InGame Sports completes more than $1 million in financing, led by Openner

On September 27th, Web3 game platform InGame Sports announced that it has completed a Pre-Seed round of financing of more than US$1 million. Openner led the investment, and Sports Rader and some angel investors participated in the investment.

InGame Sports will use the financing funds to launch infrastructure and additional products based on Web3 technology, and then integrate blockchain technology into its football mobile games, while expanding markets in multiple overseas countries/regions. (Innovation Village)

Magic Square completed a new round of financing, Huobi Ventures participated

On September 27, MagicSquare, a multi-chain encryption application store, announced that it has received a new round of strategic investment from Huobi Ventures. The specific amount has not yet been disclosed. Magic Square will use the funding to continue developing its platform, accelerate technology adoption and grow its user base.

As previously reported, MagicSquare completed a $3 million seed round of financing in July this year, led by Binance Labs, and announced the introduction of a new strategic investor, Gate Labs, in September.

Gate.io Labs Strategically Invests in Magic Square, a Multi-Chain Encryption App Store

On September 26, according to official news, the multi-chain encryption application store Magic Square announced that Gate.io Labs has become its strategic investor.

According to previous reports, MagicSquare completed a $3 million seed round of financing, co-led by Binance Labs and Republic, with strategic partners including KuCoin Labs, GSR, IQProtocol, Gravity Ventures, AlphaGrep and other angel investors.

On October 3, Metaverse game experience developer AlterVerse announced the completion of a round of private equity financing. Binance’s venture capital arm Binance Labs, Polygon Ventures, Ankr, Baselayer Capital, and EnjinStarter participated in the investment. The specific financing amount has not yet been disclosed.

It is reported that AlterVerse is one of the 14 projects shortlisted in Binance Labs’ fourth-season incubation plan. It previously released the pre-alpha version of the virtual world Sky City and plans to launch the alpha version before the end of the year. Currently, it has more than 75 partners, including skateboards. Car company Razor, digital sports fashion platform Fancurve, etc. (Blockchain Reporter)

NFT e-book company Book.io receives investment from book distribution giant Ingram Content Group

On October 1, Book.io, an NFT e-book company, announced the completion of a seed round of financing. The investor is Ingram Content Group, which is one of the world's leading book distributors and has extensive influence in the field of book publishing.

Cool Cats announces strategic investment from Animoca Brands

On October 5th, Cool Cats Group LLC, the parent company of Cool Cats, announced that it has received strategic investment from Animoca Brands and established a partnership to promote Cool Cats to become the world's largest NFT brand and a powerful media and content company, and through this partnership Expand Cool Cats related game products.