At 14:42 on September 15, 2022, the OKLink multi-chain browser detected the birth of the first PoS block of Ethereum Merge. Since then, the consensus mechanism of Ethereum has officially changed from PoW to PoS. Merge is another milestone moment since the birth of Ethereum, which not only attracted global attention, but also allowed some scientists to smell the opportunity of "risk-free arbitrage".

An article "How to make $200,000 overnight" exploded in the Web3 community. A team of scientists claimed to have profited nearly 10,000 ETHW (about 200,000 dollars) in this arbitrage operation. As the event fermented, the Okey Cloud chain chain guard team took the lead in conducting a comprehensive method analysis and data statistics on this arbitrage behavior.

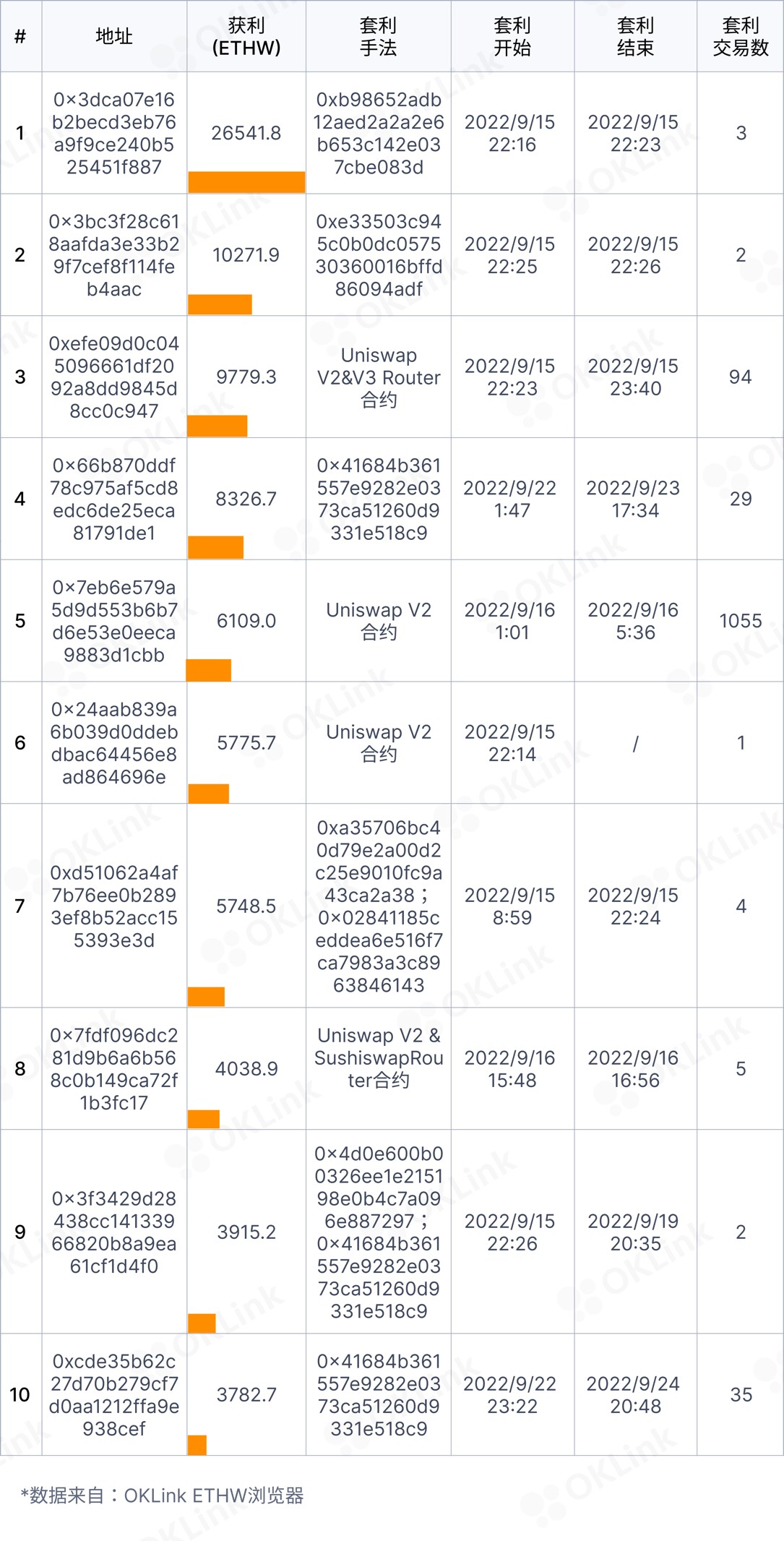

According to the statistics of Okeyyun chain guards, the arbitrageurs have gained more than 217,129 ETHW (currently worth 2.67 million US dollars) in total. However, with the in-depth analysis of the data, we found that the above-mentioned team of scientists controlled0xefeThe address at the beginning only ranked third in the profit list of this fork arbitrage, and the profit of the first-ranked address was nearly three times that of it.

secondary title

1. Why can "Happy Beans" turn into "Golden Beans"?

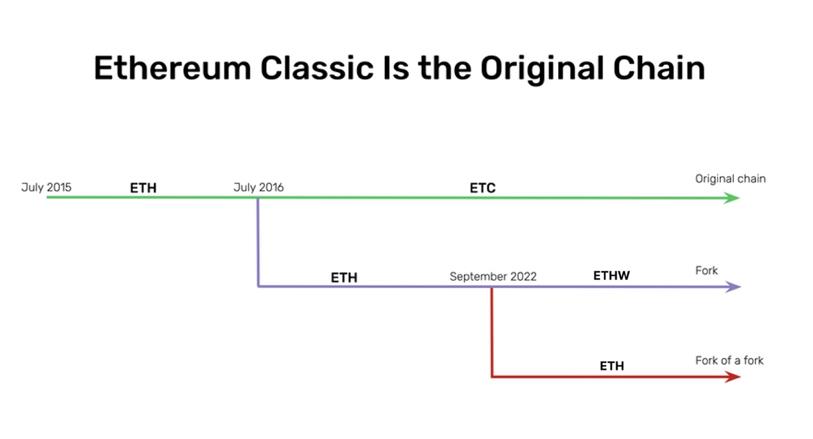

Before understanding this arbitrage event, you need to know what is the EthereumPoW chain (hereinafter referred to as: ETHW). ETHW is a blockchain network where some miners who do not want to give up the huge profits of PoW continue to use the original consensus mechanism to produce blocks during the merger of Ethereum.

Whereas a blockchain fork requires duplication of all existing functionality, wallet balances, assets, and smart contracts. This means that all assets running on Ethereum will exist in equal amounts on the ETHW mainnet after the fork. However, due to the low recognition of the value of forked chain networks such as ETHW and ETF by the community and project parties, many forked chain assets have been reduced to "Happy Beans".

Centralized stablecoin project parties (such as USDT, USDC, etc.) stated that they would not recognize stablecoin (shadow) assets on Ethereum fork chains other than the ETH main chain (POS), because the value of stablecoins in the real world is endorsed The dollar amount of will not "fork". Therefore, the centralized exchange will not provide the recharge address of the ETHW chain USDT/USDC.

At this point, the arbitrage point has quietly appeared~

Although the value of assets such as USDT/USDC on the ETHW chain is 0, there are still a few valuable assets on the ETHW chain, such as ETH(W). So how can you get ETHW for free on the ETHW chain? Arbitrageurs are eyeing the ETH or WETH that they forgot to withdraw from the liquidity pool (LP). Arbitrageurs "buy" valuable ETH(W) by charging USDT/USDC or other valueless tokens into LPs containing ETH(W), and finally transfer ETHW to the exchange to withdraw from the market.

secondary title

Second, who is making a fortune silently?

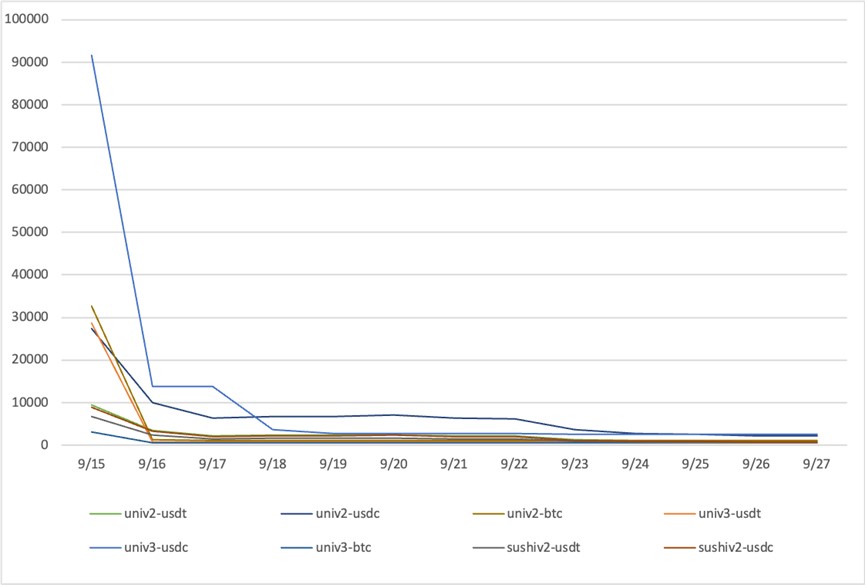

We selected 8 liquidity pools with better depth: USDT-WETH, USDC-WETH, and WBTC-WETH in the two major DEXs of UniswapV2&V3 and Sushiswap, to calculate the amount of profit.

The author's address (0xefe) of 0.2 million earned 9,779.3 ETHW in this statistics, ranking only third. The profit of 0x3dc, which ranks first, is 2.7 times that of 0xefe: 26,541.8 ETHW, which can be described as "making a fortune in silence"!

Note: No.4 and No.10 addresses use the same arbitrage contract;

secondary title

3. Analysis of two arbitrage methods

The ETHW fork arbitrage method is mainly divided into two categories:

1) Interact with the Router address of DEX (build DEX front-end), and use shadow assets to withdraw ETH(W) from LP

2) Construct an arbitrage contract, with one or more addresses providing initial funds (valueless shadow assets, such as UDSC), and the contract executes multiple arbitrage of multiple liquidity pools. During the process, the contract collects WETH in LP, and DEX The Router contract converts WETH into ETH into the arbitrage contract address, and finally transfers it from the arbitrage contract to the profit-making address ETH(W)

Both arbitrage methods can be divided into two steps in operation: prepare shadow assets → charge into the pool to arbitrage ETHW

Below, we select two addresses from the top 10 profitable addresses as representatives of the two types of arbitrage methods for analysis:

No.1: 0x3dca

a. Prepare shadow assets

and0x041and0xb00Authorized arbitrage contract 0xb98 to withdraw USDC

Borrow stETH and USDC in advance for 0xb98 to call

b. Charge into the pool and get ETHW

Address at 22:16 on September 150xf6aIn transaction (0xd6a) created in0xb98arbitrage contracts of

A total of 9290 stETH prepared in the previous stage were transferred to the arbitrage contract 0xb98, and then transferred from 0xb98 to Curve's stETH/ETH liquidity pool, in exchange for 8980 ETH to the arbitrage contract 0xb98;

and0x041and0xb00Provide a total of 13,235 USDC to the arbitrage contract 0xb98, and then provide a total of 20,000 USDC borrowed by 0x236 and 0xf6b.

A total of 33,235 USDC will be split into three parts by 0xb98:

After exchanging 5017 USDC for USDT, exchanged 2815 WETH to the USDT/WETH liquidity pool of Uniswap V3 to the arbitrage contract 0xb98

After exchanging 3345 USDC for 160WBTC, 1784 WETH were withdrawn from the WBTC/WETH liquidity pool to the arbitrage contract 0xb98

Put the remaining 25,087 USDC into the USDC/WETH liquidity pool in exchange for 12,255 WETH to the arbitrage contract 0xb98

Convert 16,855.8 WETH to ETH (W) into 0xb98

Finally, transfer the ETH (W) profit of 0xb98 to the ordinary address of 0x3dca

Image from: OKLink ETHW BrowserTransaction 0xd6ab transaction details page

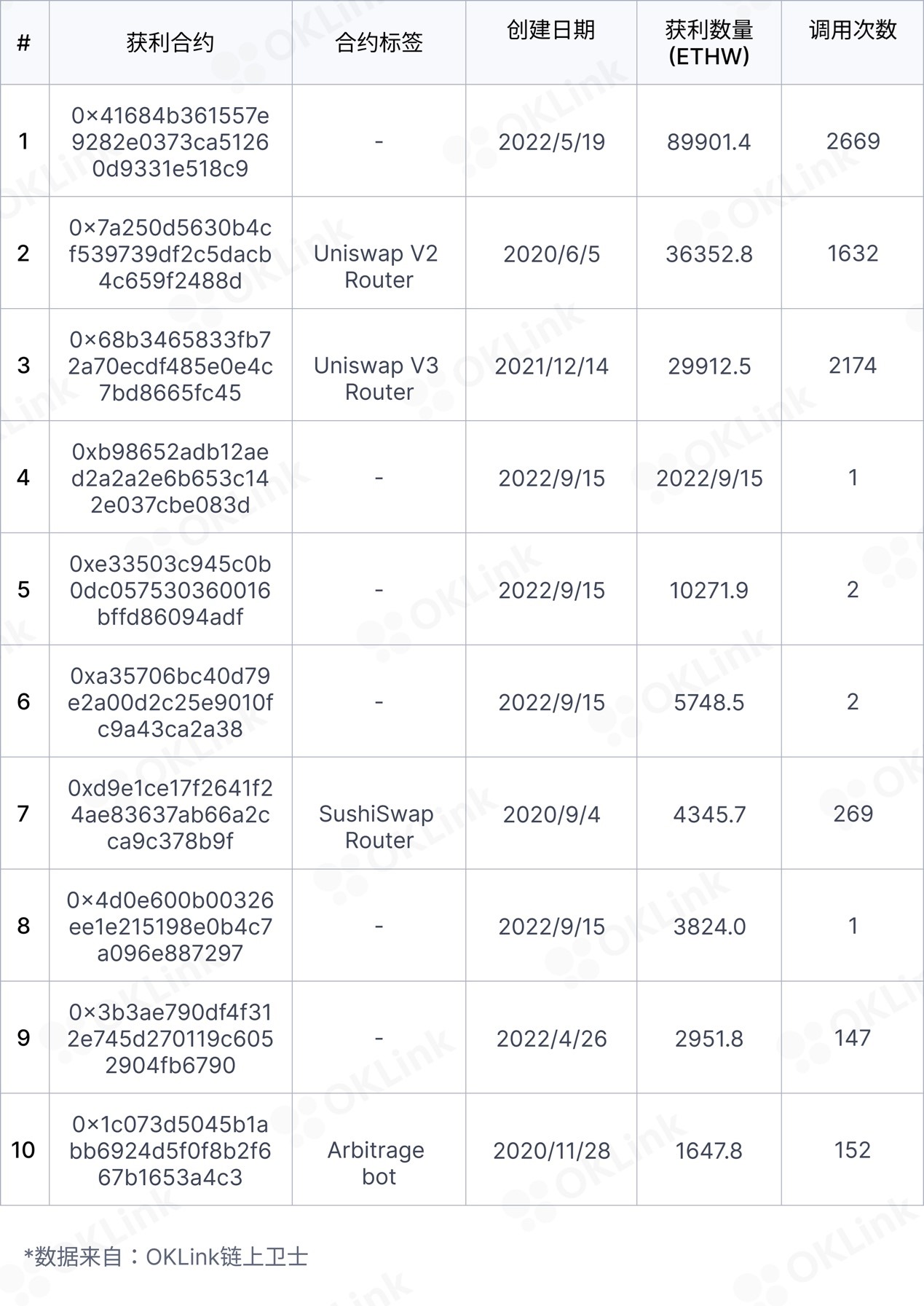

Arbitrage Contract Ranking Top 10

* The arbitrage contracts in this statistical range provided arbitrageurs with a total of 217,129.7 ETHW. Due to the limited number of liquidity pools in this statistics, the actual profit amount of arbitrageurs will be more than this value.

From the above statistics we can conclude:

1) Calling the Router contract for arbitrage is the choice of most people

2) Some contracts created in Merge have fewer calls, which are obviously arbitrage contracts customized by individual arbitrageurs this time

3) Some arbitrage contracts created earlier can still complete arbitrage in the fork, which shows that such arbitrage methods have already appeared and can be reused

No.3:0xefe

The operation of 0xefe, the author’s address of 0.2 million, is also divided into pre-preparation and post-fork arbitrage operations.

First of all, starting from September 14th, the shadow assets in the early stage of arbitrage are all controlled by0xab9The address of (200528.eth) was extracted from three centralized exchanges including OKX and sent to 0xefe, which were 7.58 BTC, 2,099,990 USDC, and 42,996 USDT respectively.

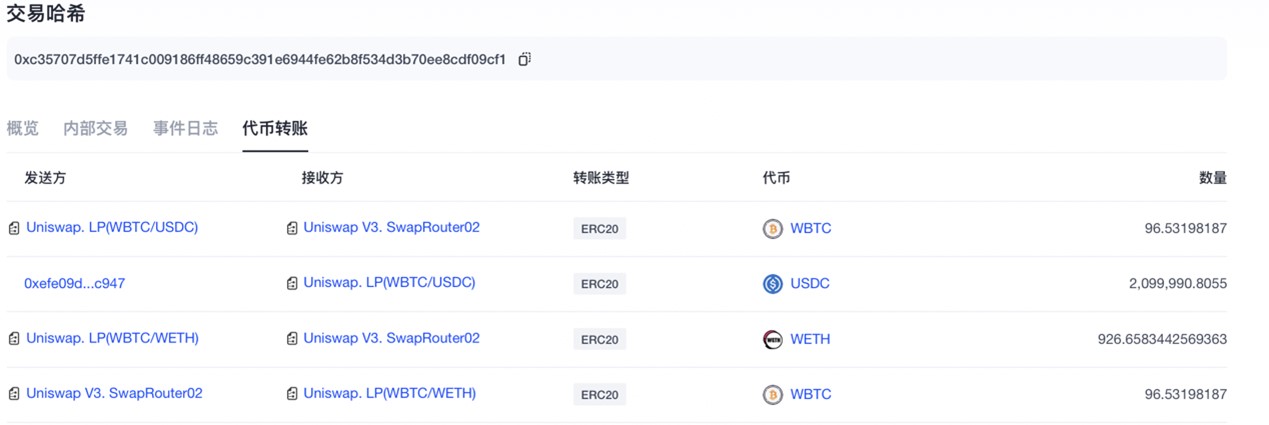

Among the total 90 arbitrage actions at the 0xefe address, we selected the one with the most profit (926ETHW) for operation analysis (hash:0xc35707d5ffe1741c009186ff48659c391e6944fe62b8f534d3b70ee8cdf09cf1

secondary title

4. The arbitrage window period is about 9 days

secondary title

5. How to identify such arbitrage risks?

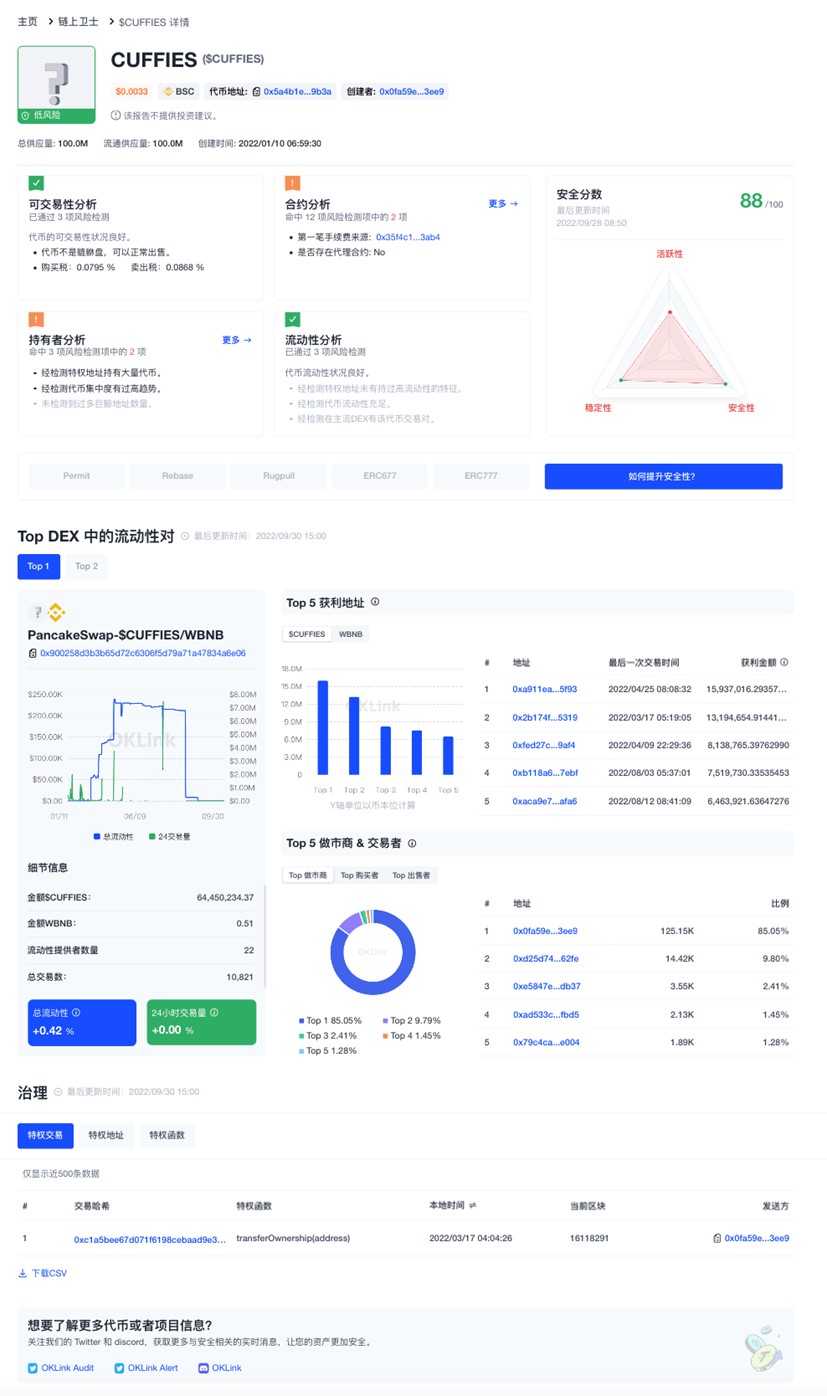

image description

View more risk token information

According to the person in charge of Okey Cloud chain guard products, the future "risk token detection" function plans to support 13 mainstream DEX detections of 9 (currently 2) EVM chains, providing more than 4.18 million token scans , So far, more than 160,000 risky tokens have been found, supporting the detection of 30+ risk items such as Pixiu disk and transaction tax. Through the "Risk Token Detection" tool, users can always pay attention to the liquidity of the market-making DEX. Once the liquidity drops rapidly, they can quickly withdraw assets at the first time to avoid security incidents on the chain.

It can be said that the emergence of on-chain guards made up for the previous "shortcomings" of the Okey Cloud Chain in the code security analysis level, and also allowed the OKey Cloud Chain to rely on the "double ax" of chain security: on-chain data analysis + code analysis, continuous It has consolidated its position as a leading blockchain security company in the industry. In recent years, Okey Cloud Chain has continuously increased the research and development of security technology on the chain, only to build a "firewall" for data on the chain in the Web3 era, and provide users with a safe and reliable blockchain through "blockchain + big data" technology information service.