Original translation: Baize Research Institute

Original translation: Baize Research Institute

Like most things, the Internet is a feast for the eyes. In recent years, the development of the web has been divided into three phases: 'read' (Web1), 'read-write' (Web2) and 'read-write-own' (Web3). Web3 is premised on decentralization and powered by blockchain technology.

To me, describing the web in terms of technical potential, rather than user engagement, people miss the essence of it. In reality, the ebb and flow of the web is more iterative and should be seen as a continuum rather than fragmented into discrete phases.

The digital ownership that blockchain and its related technologies give users is a fascinating innovation, but it has barely touched every aspect of mainstream consumer consciousness. Decentralization is nothing new, it dates back to the early days of Web2, so decentralization is just a by-product of Web3 innovation.

I agree with Reid Hoffman's assertion that the current period of Web3 "wild idealism" will be followed by a stage of maturity where user utility/utility is prioritized and a guiding hand of regulation comes to the fore.

In this article, I understand Web3 as an acronym for a set of technologies built around the blockchain concept, rather than as a phase of the Internet.

I do believe this tech stack will become more prevalent in the consumer space over the next few years. However, it can only do so if it addresses a tangible consumer need, and breaks free from the current ego revelry. The technology itself doesn't matter, and consumers will get annoyed if startups emphasize their use of Web3 technologies in their marketing messages at the expense of providing utility to consumers.

I'm not a Web3 expert or believer. I also didn't read the Bitcoin whitepaper back in 2008/09. I'm very interested in Web3, and since joining dmg Ventures, I've spent some time learning more about the topic, but I know I've only scratched the surface.

My forte is consumerism. The same goes for dmg ventures as a whole, we are a consumer venture firm that differentiates itself by acting as a "conduit" between the startup ecosystem and mainstream consumers. Our parent company, DMGT, owns products such as MailOnline, Metro and i and reaches 35 million UK, 65 million US and 65 million rest of the world consumers every month.

first level title

What we understand about Web3

In short, we see Web3 as a practical technology capable of penetrating many areas of consumerism. The technology itself doesn't matter; what matters is that consumer usability can be improved. Web3 will support some of our existing focus areas: D2C, marketplaces, sustainable consumption, wellbeing, and finance and real estate. As far as specific applications are concerned, NFT can change the utility of consumers in the relatively short term, while DeFi has the potential to benefit everyday consumers in the long run.

Our interest in Web3 comes with a few caveats, although we hope these will be resolved over time:

Web3 severely lacks a regulatory framework

The token economy is immature, and asset prices fluctuate greatly, bringing high risks to consumers

Consumers dabble in Web3 without proper understanding, at great risk

The vast majority of mainstream consumers using Web3 technologies do so for speculative purposes

first level title

Web3 and the Hype

VC interest in Web3 has exploded since the start of 2021, with Web3-related startups raising a whopping $32 billion in funding in 2021, a 370% year-over-year increase. Web3 has quickly become a buzzword in VC, and the word is spread as widely as AI and ML were a few years ago.

Web3 specialist VC funds are popping up across the board, especially in the US with funds like Haun ($1.5B), Paradigm ($2.5B) and Web3 corporate VC funds like Coinbase Ventures. Big names are also getting a piece of the action, with a16z announcing a $4.5 billion fourth cryptocurrency fund in May 2022.

Web3 specialist funds are also popping up in Europe, albeit on a smaller scale than in the US. London-based Fabric Ventures, for example, announced its first £112m fund in June 2022. Established players such as Cherry Ventures and Felix are also eyeing Web3, with Felix listing Web3 as one of two key areas of focus for his new £478m fund.

However, some specialized funds will invest in exchange for tokens. There are many practical considerations before committing to doing so, and dmg Ventures does not intend to make token investments in the near future.

Ironically, VCs are investing heavily in a technology that defends the distribution of wealth and ownership in search of big returns. As Jack Dorsey pointed out last year, "You don't own Web3. VCs and their LPs own Web3. Web3 will never get away with providing them with incentives." That may be true, but I also do think you can reasonably Separate entity ownership from application ownership and give each party sufficient incentives. In Web3, there have been many compromises around centralization and decentralization, which is an insult to the "wild idealism" of some Web3 hardliners.

first level title

Framework for Web3

I won't provide an overview of the Web3 related discourse, there is too much to cover and others are better qualified to do so than I am.

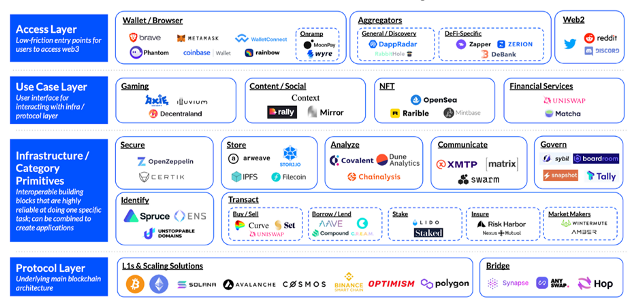

Instead, I thought it might be useful to have a brief overview of the Web3 technology stack. Due to the large number of innovations in Web3, it is very much an evolving stack.

Let's imagine Web3 as a pyramid with several different layers.

The "base layer" consists of companies building underlying blockchain architectures and solutions to increase the processing power of that architecture, as well as solutions that allow cross-blockchain interoperability.

Next, there's the "secondary infrastructure layer," which is made up of a myriad of different tools that are all focused on doing their own thing. For example, Snapshot, a decentralized voting system, and Dune Analytics, a data analytics solution for the Web3 ecosystem. Importantly, due to the open source nature of Web3, these tools can be combined to form applications like Lego bricks.

The third layer, dubbed the "use case layer" by Coinbase Ventures, is made up of companies that provide the user interface for interacting with the two infrastructure layers. This layer includes NFT marketplaces, such as Opensea, as well as gaming and metaverse platforms, such as Decentraland.

Finally there is the "corporate layer" that provides the gateway into Web3:

When trying to use Web3 for the first time, you need to hold some cryptocurrency. Achieving this involves using something called a "fiat onramp" (where you can exchange fiat currency for cryptocurrency), and then storing and managing your cryptocurrency in a crypto wallet. Fiat onramps like Moonpay and crypto wallets like Phantom are key parts of this layer. Some companies, such as Coinbase, offer both services.

Once you step into the Web3 gate, you will also encounter Web3 browsers (think Google Chrome), such as Brave; and dapp stores (think Apple's App Store), such as Dapprader.

There are also social platforms, support for community building, and introductions to Web3 projects. Ironically, up to now, most Web3 projects have primarily adopted Web2 social platforms, especially Discord, which is the most popular social platform for Web3 participants. In some cases, Discord is even incorporated into the tokenomics of Web3 projects (for example, only the owner of a specific NFT can join a Discord group). This shows that dividing the Web into distinct phases is a fallacy. However, Web3-centric social platforms are emerging, such as GM and Lens Protocol.

Within these layers, there are some integral consumer-related applications worth defining (yes, there are thousands more, I won't bore you here):

NFT - unique cryptographic tokens that reside on the blockchain and cannot be duplicated. NFTs can represent a range of things, from real estate to tweets to art, and these assets are tokenized and can be traded in Web3.

Metaverse - a virtual world accessible via the Internet where users can socialize and interact with built-in economies through NFTs, cryptocurrencies

DeFi - a new vision of financial services, based on peer-to-peer transactions and powered by blockchain technology

image description

first level title

Are mainstream consumers interested in Web3?

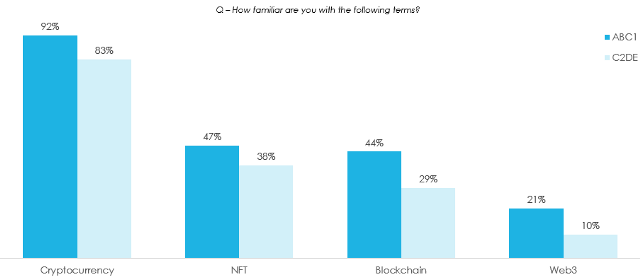

Our survey of 552 mainstream consumers representing a broad demographic range yielded some fascinating results.

image description

Interestingly, however, is the inverse relationship between awareness and interest. Of those who know the term "Web3," 44% are very interested in it, while only 23% know "cryptocurrency." To me, this reflects a general conservatism among consumers about money and wealth storage.

As I stated in a previous post on Why We Invest in Plum, <10% of Europeans would find the courage to sign up for a new bank, let alone swap their hard-earned cash for crypto. Although Web3 itself is based on "Crypto," the term is not as inflammatory as "Crypto" itself means.

This is the fundamental challenge facing Web3. Its defining feature is its financialization of the internet. In my opinion: 1) It will take a lot of work to convince mainstream consumers that the Web3 tech stack is a store of wealth; 2) Even so, many consumers will want to participate in Web3 in a casual capacity, and Web3 innovators will need to Find out how to attract consumers by minimizing their financial burden.

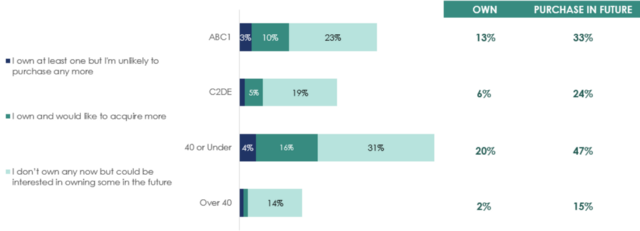

Another interesting but worrying fact from our survey is that friends and family are the most common source of information (48%) for people under the age of 40 to learn about Web3, with those over 40 mostly learning about it through news and opinion articles Web3 (53%).

To me, this shows that people under 40 are learning about Web3 mainly by word of mouth, rather than in-depth research. This is worrying because those under 40 today are more likely to invest in Web3 applications without properly realizing what they are investing in. For example, our survey found that people under the age of 40 are 10 times more likely to own an NFT today and 3 times more likely to buy an NFT in the future than people over the age of 40.

first level title

text

NFT

Almost anything you can think of (comic books, basketball videos, art, etc.) can be granted ownership by NFT. They are fairly easy to mint, and most minting happens on the Ethereum blockchain.

Compared to other Web3 applications, our NFT is a highly suitable product market for everyday consumers. For example, Sorare reportedly has more than 1 million users buying and trading players' digital cards. There are also industry-agnostic NFT marketplaces such as OpenSea, which, like Sorare, has over 1 million registered users.

While these numbers pale in comparison to Web2 giants like Amazon and eBay, it's a promising start. We primarily attribute this commitment to two reasons, which explain why we see potential in investing in startups utilizing NFTs.

First, NFTs have the potential to provide powerful utility to consumers, brands, and creators. For consumers, NFTs provide true ownership of assets. They can bring status, identity and a sense of belonging. Additionally, NFT creators can empower them with various utilities to further enhance customer value propositions (e.g. ownership of a specific NFT can give the owner access to specific things). While we haven't seen a startup deliver any particularly compelling utility to users, we recognize the possibility of doing so exists.

Second, NFTs powered by blockchain technology have the potential to disrupt consumer industries that have traditionally suffered from counterfeiting, such as fine art and luxury fashion.

The portability and liquidity of NFTs would make them an even more attractive asset class that democratizes by unlocking fractional ownership of different assets.

For brands and creators, NFTs present the opportunity to optimize capture of demand curves with granular price tiering to monetize fans based on varying degrees of enthusiasm. Ownership conferred by NFTs can also aid in customer acquisition, while brands and creators can shift their revenue by reducing intermediaries who charge margin.

Many brands have been experimenting with NFTs. Liverpool FC's attempt to sell NFTs early in 2022 reflects the current state of NFTs. They only sold £1.1m, 95% of which went unsold. While NFTs are moving towards the mainstream, consumer adoption of NFTs is still in its infancy.

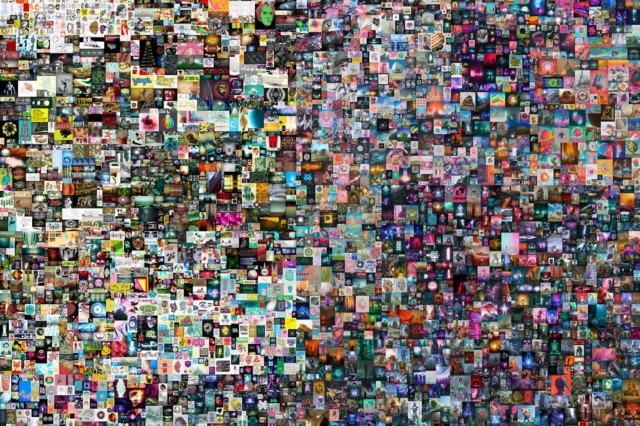

image description

Beeple's Everydays: The First 5000 Days sold for $69.3 million at Christie's in March 2021

Despite promises from NFT developers, we have yet to come across a startup offering tangible utility to users via NFTs. We are not interested in NFT technology itself, but in the practicality it can theoretically impart.

DeFi

DeFi is an interesting innovation that could be a game-changer for global finance, but it may take a few years before it's ready to penetrate the mass market.

In theory, DeFi enables anyone with internet access to send, receive, lend, borrow or trade cryptocurrencies without going through a bank or broker. It has the potential to empower the 1.7 billion credit-worthy and unbanked people around the world to a functional financial system, which is why we are keenly interested in it.

Unlike traditional financial services, DeFi offers instant liquidation and 24/7 uptime, which has the potential to significantly improve the efficiency of capital markets and eliminate the risk of hacking attacks posed by centralized cryptocurrency trading platforms. In addition, DeFi also eliminates financial intermediaries who charge margin.

Most of today's DeFi lending protocols require collateral. However, a new innovation called flash loans has emerged, which allows you to borrow money without collateral. It works by borrowing and repaying the loan in the same blockchain transaction. If repayment is not possible, the transaction is resumed as if nothing had happened.

There are a lot of kinks that need to be resolved before DeFi can hope to achieve mainstream consumer adoption. For example, user experience needs to be improved, regulation needs to be mature, and processing power must be improved.

Web3 education

I'm adding this to the list for now.

Given that Web3 is essentially the financialization of the Internet, Web3 education will be an area relevant to the democratization of financial services.

The importance of solutions to the Web3 knowledge gap cannot be overstated, as highlighted by our consumer survey results. However, I'm not sure anyone can build a business with Web3 education as a business.

Most mainstream consumers using Web3 are based on highly unreliable sources of information such as friends and family and gossip-like media. This situation must be addressed if consumers are to participate in Web3 in a responsible and sustainable manner.

epilogue

epilogue

Web3 will likely infiltrate many areas of consumerism in the coming years. However, to achieve this goal, it must focus on attracting mainstream consumers by satisfying their needs, rather than promoting "self-obsession".

Research by dmg Ventures reveals that consumers are getting information about Web3 from unreliable sources and are therefore likely to have an unhealthy relationship with Web3. We also found that consumers lack the knowledge to effectively become Web3 participants. While Web3 is premised on ownership, we think there are ways to make it more accessible.

We believe that Web3 technologies have the potential to improve traditional consumer domains. In terms of specific applications, we expect a startup that uses NFTs to provide tangible utility to consumers in the next 1-2 years, and DeFi is another interesting application, but it may take longer to provide value to everyday consumers .

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

Original link:

https://www.dmgventures.co.uk/deep-dive/dmgventures-web3-investment-thesis/

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.