Original title:Ultimate Guide to NFT-Fi

Original source: Bankless

Original source: Bankless

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

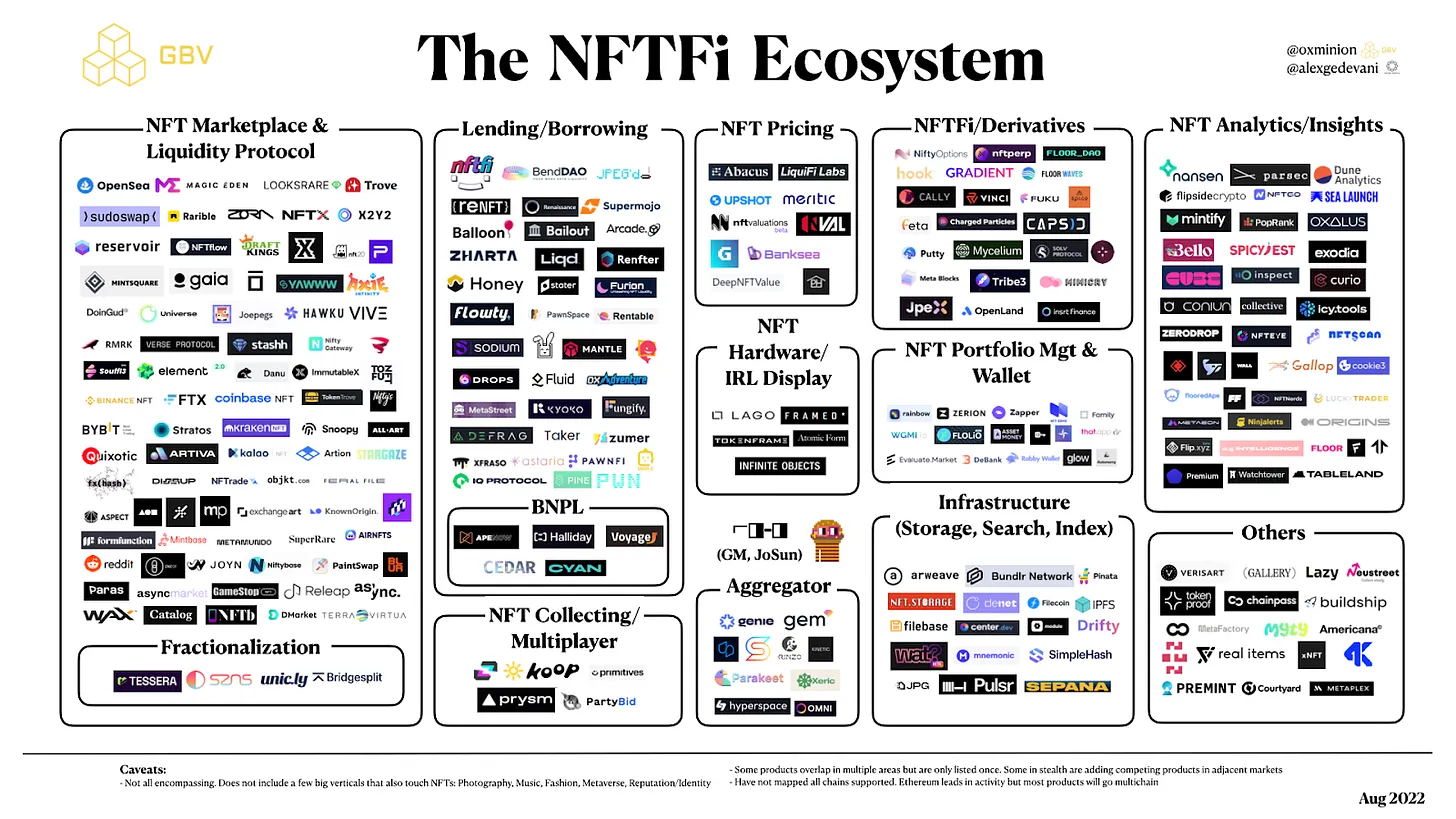

NFTFi is the intersection of decentralized finance (DeFi) and NFTs.

This new area unlocks a series of actions for collectors:

Make loans with your NFT as collateral.

Pay for NFTs in 3 monthly installments.

Rent an NFT for a period of time to gain social impact.

Use financial options to hedge the volatility of the holder's NFT assets.

Assess the value of your NFT while gaining liquidity for it.

As a community, divide an NFT and hold it together.

The NFTFi space is promising and thriving, and this article will introduce this ecosystem.

Image credit: Logan Craig

Image credit: Logan Craig

first level title

What is NFTFi?

Are NFTs an investment or a digital collectible — this is one of my favorite questions to ask for those active in the space.

However, we clearly see NFTs as investments in many ways. Crypto Twitter is flooded with questions and tutorials such as "What % of my cryptocurrency portfolio should be NFTs?", while Investopedia publishes articles such as "Pros and Cons of Investing in NFTs." We cheer when our NFTs go up in value, and when they don’t, most holders think it gives them the right to express displeasure with project founders.

secondary title

Enter NFTFi

But my question is becoming more and more irrelevant. A vibrant and innovative submarket has emerged around the financialization of NFTs called NFTFi (Non-fungible-token Finance) — regardless of how builders classify the nature of their projects.The emergence of such a market bud is not surprising. The NFT market in 2021Trading volume of $17.6 billion. this is the same yearGlobal traditional art market sales ($65 billion)

first level title

Image Source:0xminion

borrow money

borrow money

If you bought a Cryptopunk for 100 ETH, it's fine to brag about it on Twitter, but maybe you also want to unlock some dead money and use it for a loan. Lending protocols like NFTfi, Arcade, and Metastreet allow you to do just that. Borrowers can use NFT assets as collateral instead of using legal currency/ETH to borrow money like on Aave or Compound.

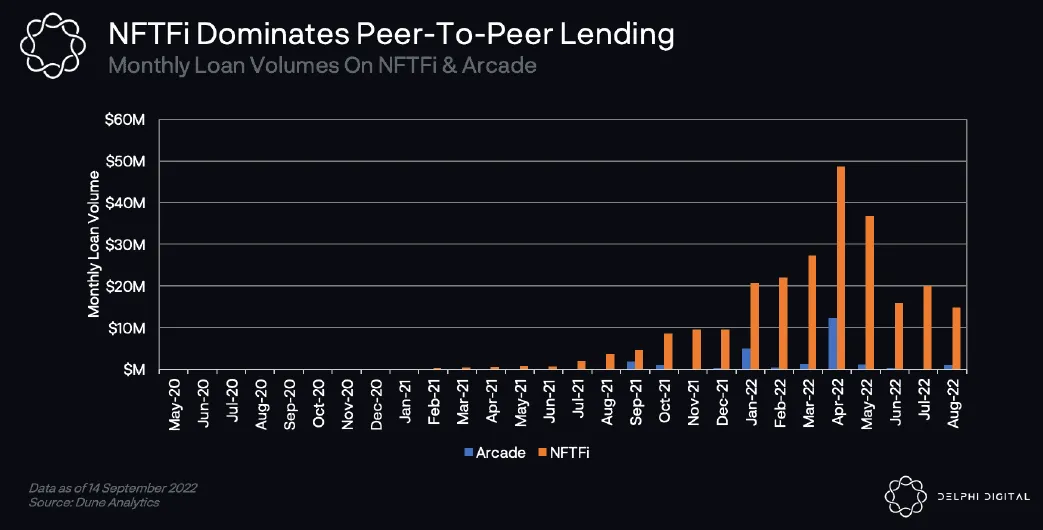

"NFTfi" is the leading project in this regard, far surpassing its competitors in terms of loan volume. It deploys a "peer-to-peer" model that functions exactly like order book trading.

From a protocol standpoint, this is indeed risky, for obvious reasons. The NFT market is speculative and Rug Pulls are common. If someone asks for a 10 ETH loan with a bunch of jpegs as collateral, you'll want to know if those jpegs are being run by a solid project involved in the game. For this reason, lending NFTFi protocols attempt to mitigate this risk by generally only accepting established "blue chip" NFTs such as Bored Apes, CryptoPunks, Doodles, Art Blocks, etc.

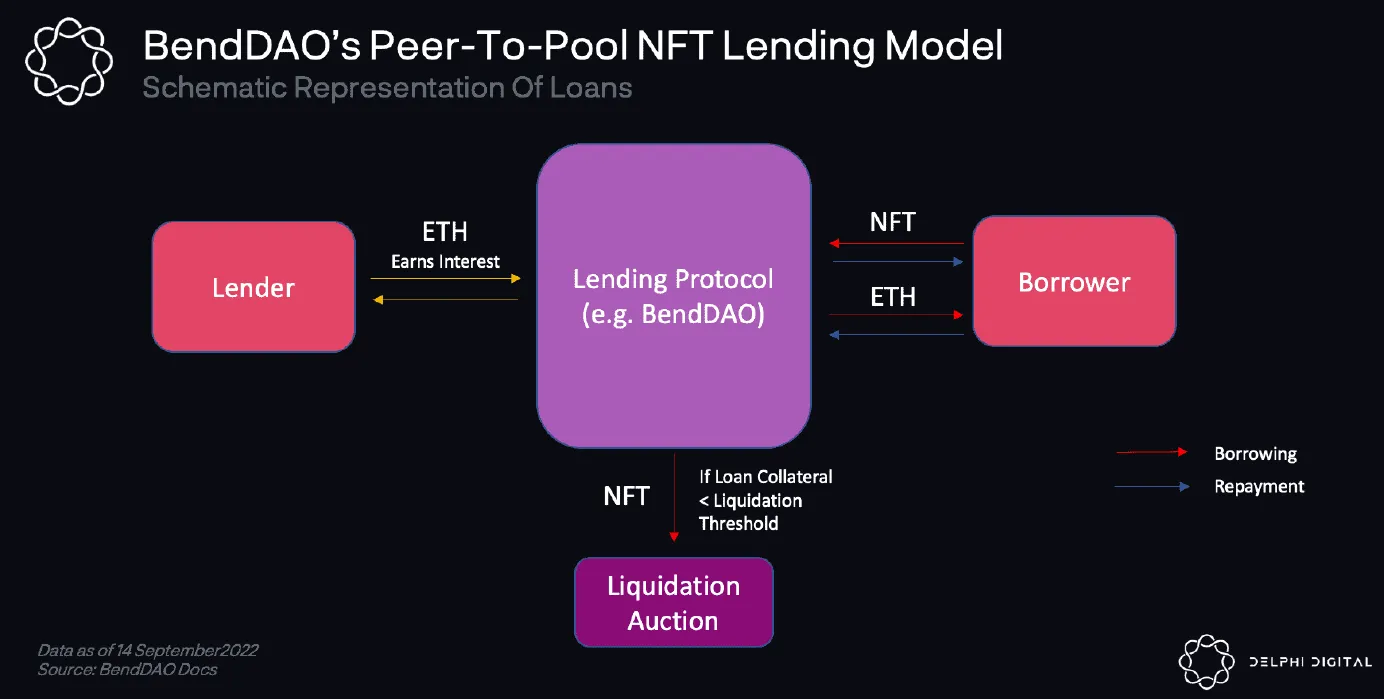

The downside of the peer-to-peer model is that it is capital inefficient, as transactions rely on matching borrowers and lenders with dual suitability needs. To counter this, projects such as BendDAO and JPED have introduced a more liquidity-efficient “peer-to-pool” model, connecting demand and supply in a customizable liquidity pool, eliminating the need for bidding and Awaiting bids as needed.

But the "peer-to-pool" model is not perfect either. They suffer from the same drawback as pooled liquidity protocols in DeFi, where lenders collectively panic and liquidity dries up.

What happens when the reserve price of an NFT is lower than the loan amount it is collateralized by? In theory, once the NFT collateral exceeds a set threshold (based on the loan), the protocol will liquidate the NFT collateral through an auction to protect lenders. In practice, they may not do this so smoothly.

Over the past year, most NFT projects have seen their prices drop by around 60-70%, and in August, BendDAO experienced a protocol-wide "bank run." The phenomenon that bank customers go to the bank to withdraw cash at the same time). When the protocol started to launch the liquidation auction, there was a lack of bidding as the liquidation threshold was too close to the reserve price. No one wants to buy NFTs that are so close to the liquidation threshold, which means that BendDAO underestimated the possibility of a market crash.

(See William Peaster's strategy on how to borrow and lend NFTs yesterday)

first level title

buy now pay later

In the fintech space, a recent trend among tech-savvy millennials and Gen Z has been buy now pay later (BNPL). Web3 builders are applying this trendy new wave of budget-friendly funding to the NFT market.

Cyan is the largest and best example of such a BNPL agreement. Here's a brief description of how it works from a buyer's perspective:

1. Bob wants a Pudgy Penguin. First, he initiates a BNPL program on Cyan to buy any Penguin currently listed on Opensea, LooksRare or X2Y2.

2. Cyan then offers Bob an installment plan with a pre-quoted interest rate that he needs to pay back in 3-month installment periods. Regardless of how the NFT price fluctuates, the installments will not change and are fixed for three months.Escrow based on Cyan-wrapped smart contracts。

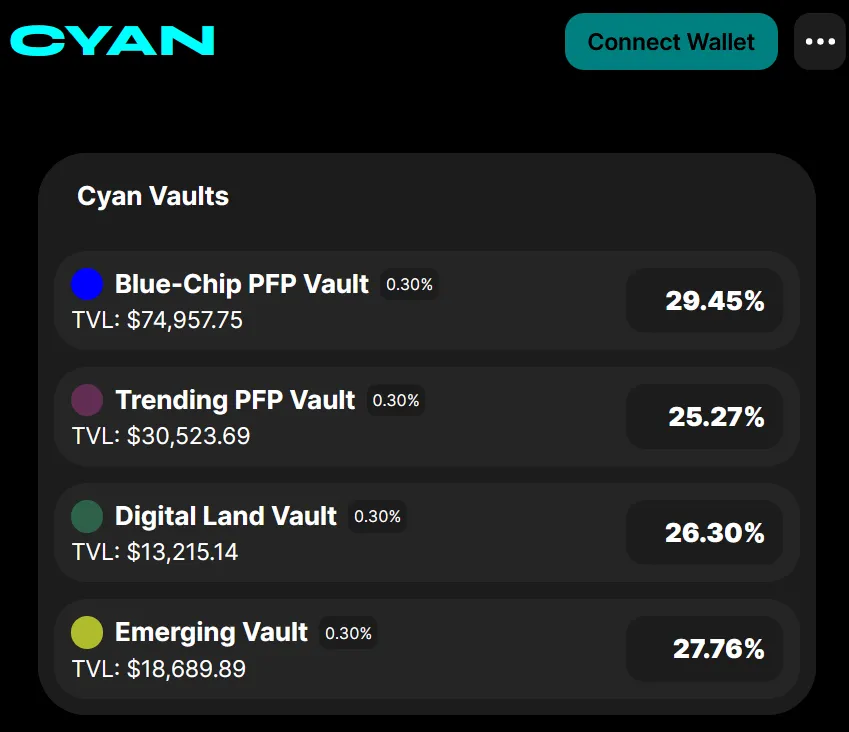

image description

Cyan's treasury as of September 2022

4. When Bob completes all his installments, the NFT will be transferred to his wallet and he can have full ownership. (Hint: If the price of the NFT appreciates during this period, Bob can pay for the BNPL plan in full upfront and sell the NFT.)

5. Additionally, overdue payments are considered a default and the NFT will be held in the corresponding Cyan Vault for liquidation.

So how does Cyan generate revenue?

Cyan currently leads the NFT BNPL submarket, with various competitors in the space building something similar, such as Teller protocol's "Ape Now, Pay Later," Cedar, Halliday, and Pine Loans.

first level title

RentalsreNFTNFT rental agreements are an emerging submarket of NFTFi that allow users to pay to access NFTs over a period of time. Participants include those offering secured and unsecured leasesVera。

or

Mortgage leases require funds to secure the transaction.

Unsecured leasing involves creating a "wrapped NFT" for the leaser, which is burned once the contract ends. Unlike mortgage leases, the renter never receives the original NFT.

NFT Leasing Services - Who will actually lease NFTs?

At this early stage, the product-market fit for NFT rentals seems most consistent with utility-based game NFTs today. Why? =

Blockchain games often require users to pay upfront fees by purchasing NFTs, a business model pioneered by Axie Infinity last year. As the cost of Axie NFTs skyrocketed, GameFi DAOs (like Yield Guild Games and Merit Circle) emerged to democratize entry for millions of players through a profit-sharing model where guilds would sponsor players’ upfront entry costs and reap the profits into.

first level title

Derivatives

Derivatives

NFT derivatives work exactly the same as they do in TradFi. The most famous NFT derivative project, NiftyOption, allows users to purchase NFT in the form of financial options, giving buyers the right to execute transactions at a specified price and date in the future, but without the obligation.

This allows NFT assets to be hedged in interesting ways, mitigating market volatility. Examples are as follows:

1. The price of the newest NFT project, Degentown, is going up, and you grab one for 10 ETH, hoping to sell it for a profit in the short term.

2. But this is a risky trade, you tell yourself that you are willing to take a 20% loss (2 ETH) on Degentown if the trade fails. To hedge against the worst, you create an NFT option, deposit your NFT into it as escrow, and set an incentive of 0.5 ETH.

3. Bob appears. Bob is a bigger Degen than you (referring to individuals or gamblers involved in high-risk transactions), and he believes that the price of Degentown may continue to rise. He was also motivated by your 0.5 ETH fee bait, and he took the bait.

4. Bob deposits 8 ETH (execution price) into the escrow smart contract and pays 0.5 ETH as a fee.

5. From now on, you can choose to exercise the option at any time within six months by withdrawing the escrow amount of 8 ETH.

6. Your incentives: If Degentown appreciates more than 10 ETH after 6 months, you should cancel the option contract, all you lose is the fee paid to Bob.

7. However, if your transaction doesn't work out, and Degentown plummets below 8 ETH, you can choose to execute the contract, because Bob has committed to buy it for 8 ETH, and your loss will be more than 2 ETH.

first level title

Evaluate

Evaluate

Valuing NFTs is difficult due to their illiquid and low-velocity nature. NFT projects try their best to "predict" them by adjusting a series of mechanisms such as borrowing rates, loan-to-value ratios (LTV), and liquidation thresholds. But they are, at best, experimental attempts to guard against market volatility.

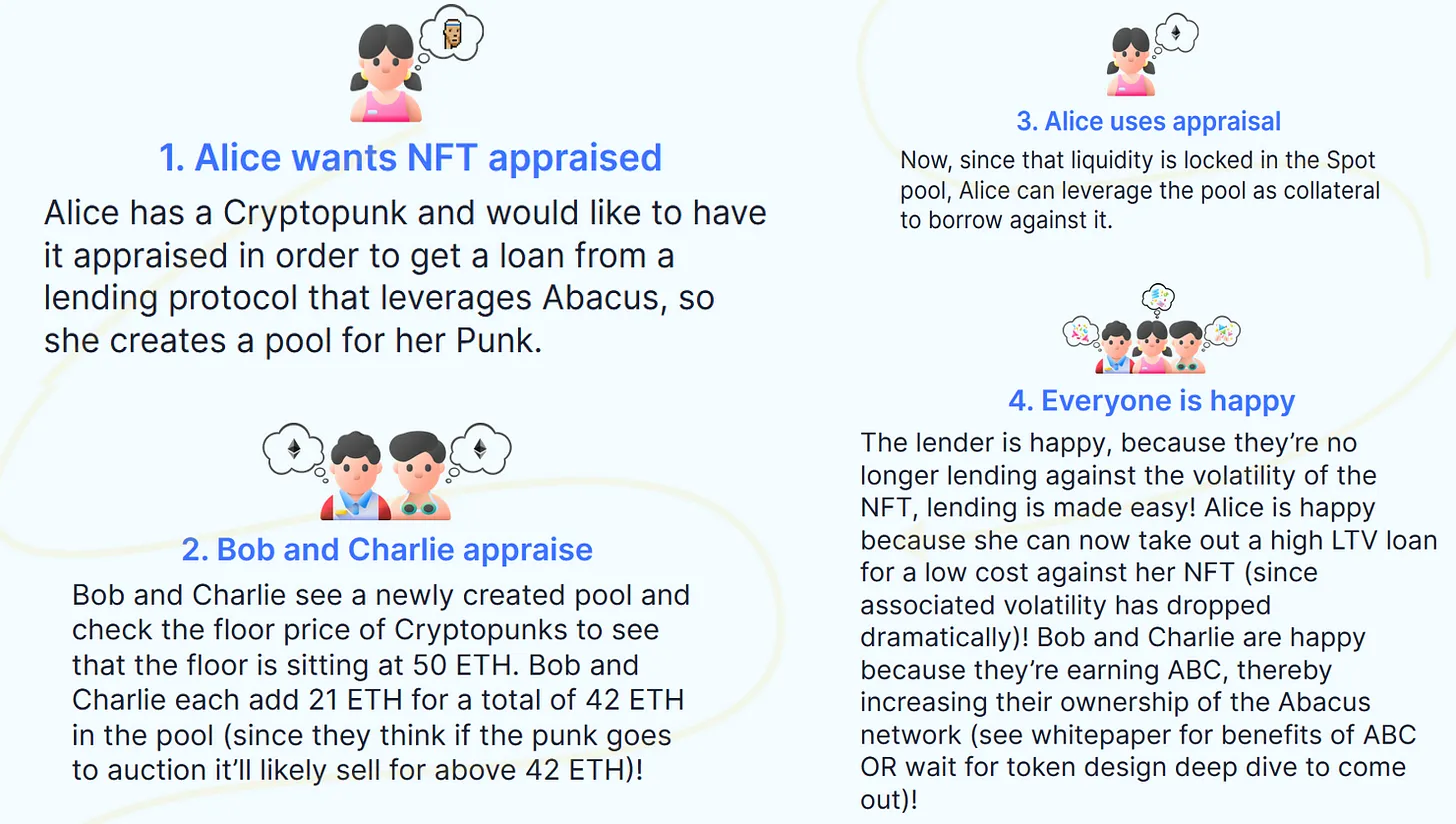

For example, Abacus innovatively uses proof-of-stake technology to create a liquidity-backed valuation system. Appraisers act as validators, guessing NFT values and investing their funds in different valuation tiers. In turn, NFT owners are backed by liquidity to use their NFTs as collateral.

image description

NFTBank offers a proprietary machine learning-based tool to simulate NFT price assessments. The appeal of NFTBank and Upshot is that they can be easily integrated via APIs, but unlike Abacus, which directly controls liquidity pools, their assessment may be seen as a lack of engagement.

first level title

Fragmentation

Fractional There is an irony to fragmentation, perhaps because it seeks to make what investors claim to be non-fungible assets fungible. But when you have assets worth thousands of dollars, being able to split them into more liquid so you can use them as collateral elsewhere makes a lot of sense, not to mention it's also In line with the decentralized spirit of Web3.

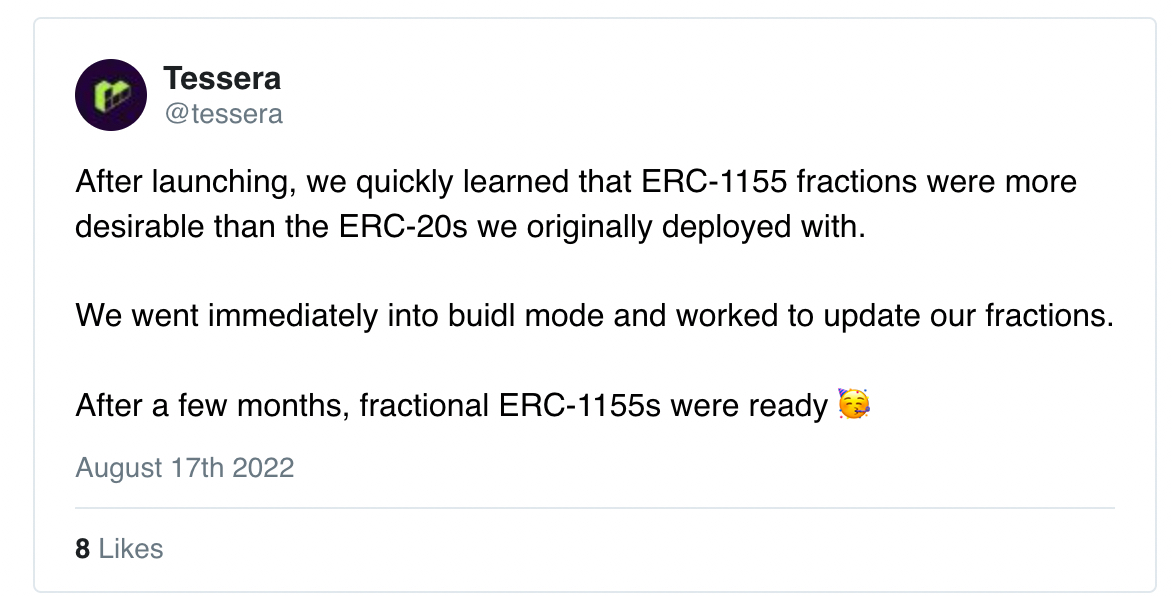

Mid-August, Tesserasaid on twittersaid on twitter

Un-fractionalizing NFTs is one of the toughest challenges facing builders in the space. In Fractional, non-fragmentation is decided by token holders voting on the reserve price,reserve pricereserve price(is the weighted average of all reserve price votes. When enough holders vote for the lowest price, a buyout is triggered and all holders can exchange their tokens for ETH)。

first level title

at last

at last

The commodification of art is often seen as a bad thing. Philosophers and intellectuals have long argued that capitalism distorts the nature of art forms in pursuit of greed. If true, NFTFi's hyper-financialization of NFTs must have sounded the death knell for Web3 culture.

Through immutable smart contracts, NFTFi opens up a world of financing possibilities for NFT ownership, enabling the public to no longer be limited to the role of passive bystanders of culture, but to acquire ownership and participate in its creation.