Original title:DeFi Thesis: Lend/Borrow Sector

Author: Michael Nadeau

Compilation of the original text: Dongxun

Author: Michael NadeauReportCompilation of the original text: Dongxunour lastlists a covered

Topics covered:

5 premium themes

These themes suggest that DeFi products and services will be widely adopted in the coming years. This week we will focus on the lending space of DeFi.

Topics covered:

What will happen to the bank?

ETH pledge rate and DeFi yield curve

Interest rate swaps and fixed rate loans

Undercollateralized Loans and Tokenized Real-World Assets

The impact of CBDC on the banking system

Hopefully, the analysis in this article can help you create a framework for thinking about DeFi protocols and the role they may play in financial services in the years to come. let's start.

01 What will happen to the bank?

If we believe that DeFi lending and money market applications will be widely adopted in 2030, what will happen to banks? In short, banks are not going away. The idea that we can enter an "unbanked" future seems very far-fetched. When you look around the crypto/DeFi ecosystem, you see tons of decentralized (more than anything else) apps - but in almost all cases there will still be a fiat on/off ramp to the bank .To be clear, the only way DeFi can scale is through traditional regulated entities — not just from a logistics/UX perspective, but from a capital markets perspective as well. We don't think DeFi apps will replace banks anytime soon. Will DeFi serve the marginalized unbanked? That's certainly true, but it's not going to be the main driver of the industry's growth.We also don’t think Bitcoin will replace the U.S. dollar or other global fiat currencies anytime soon. Nonetheless, we still believe that both (DeFi and BTC) will play an important role in the future of finance.

One of the core themes of our senior thesis on DeFi involves

The Power of Open Source Technology

. The open source operating system Linux, which started as a fringe movement in the 90s, is a good example. Microsoft took an extremely defensive and confrontational attitude towards Linux in the 90s, even calling it a "cancer". It turned out, however, that Microsoft became one of the largest Linux contributors in the world. But Linux didn't disrupt Microsoft, on the contrary, Linux allowed Microsoft to integrate more features, flexibility, security and hardware support into the products/services its customers wanted.

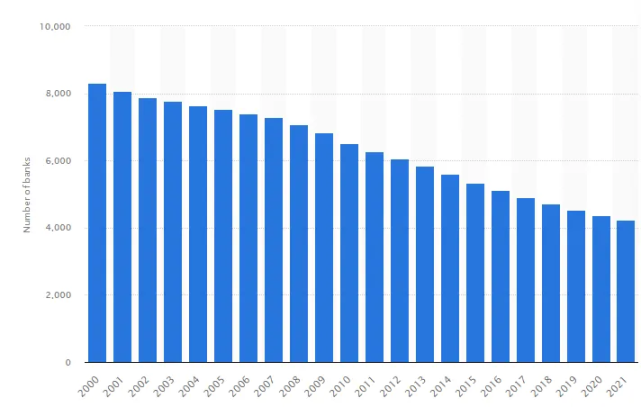

We can think of DeFi lending applications through a similar framework. They are open source protocols that allow others to freely use, build on, integrate with, etc. Therefore, we think banks will eventually integrate with DeFi lending apps.Why? Because their customers will demand new features, services, flexibility, controls, benefits, and more. In this case, users would be interacting with DeFi applications through the banking interface without even realizing they were using DeFi, just like Microsoft users would not know they were interacting with Linux.since 1921

Number of U.S. banks peaks at 30,456

image description

Source: FDIC, Statista

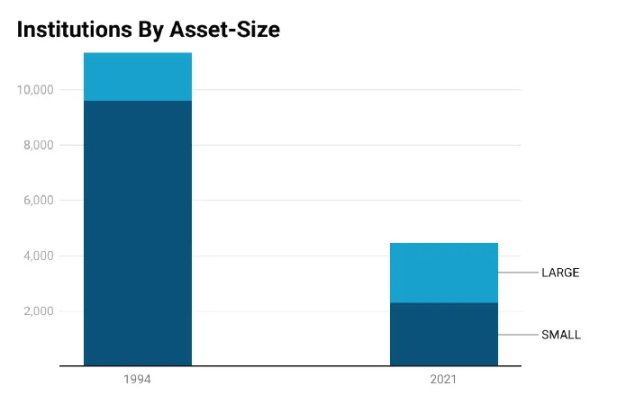

We've also seen consolidation within the industry as the number of banks has declined. Below is a comparison of the number of small and large banks from 1994 to the present. In 1994, small banks accounted for 84 percent of the market. Today, that figure is 52%.

image description

Source: NCRC

In the US, when we think of banking, we usually think of major players like JPMorgan Chase (JPM), Bank of America (BOA), Credit Suisse, or Wells Fargo. But many banks were smaller community banks that didn't have the resources to implement expensive new technology, causing them to fail and/or merge with larger banks. And this is where DeFi becomes incredibly powerful.For example, your local credit union didn't have the resources to implement and integrate expensive new technology to compete with the big banks, and now they don't. They can be simply “plugged” into open-source DeFi protocols via software development kits. In doing so, they tap into a network of open-source developers who work on them for essentially free. When analyzing El Salvador’s decision to join the Bitcoin network in 2021, we mentioned the idea of “inserting” open-source financial technology.。

DeFi protocols will enable these small banks to offer new cutting-edge services at low cost. This could help level the playing field between large and small banks and offset the aggressive consolidation we're seeing across the industry.

To see this in action, we first need to understand

Regulatory clarity, on-chain identity, and auditing standards for smart contracts

02 Ethereum's post-merger staking yield

With the merger of Ethereum to Proof-of-Stake (PoS) now complete, the yield on staking ETH is currently around 5.2% - a real yield (as opposed to the nominal yield represented by protocol inflation).

Ethereum is the only network in cryptocurrency that generates meaningful real yield. That being said, on-chain activity has been slowing down lately, as there were days when the burn in transaction fees did not offset the newly issued ETH. But remember, with a slight increase in on-chain activity, ETH is deflationary. When this happens, holders of ETH are no longer diluted by newly issued tokens.

The blockchain is now profitable, and as user transaction fees take over, there is no need to subsidize security providers/validators with new ETH issuance. Ethereum is growing up before our eyes.

Impact on DeFi Lending Apps

With the effective yield of staking ETH at 5%, many analysts predict that Ethereum may set a "risk-free" interest rate benchmark for DeFi. In this case, not only do stakers/validators get real money, they also get money through an asset that contains a "call option" on the future of web3. Of course, there are risks to consider, as the price of ETH may also drop in the future, or the network may not realize its potential.

If the ETH pledge rate is viewed as the “risk-free” rate for cryptocurrencies, we could start to see a DeFi yield curve forming. In a rational market, anyone using DeFi applications (which are more risky) for yield should demand a higher interest rate than the ETH collateral rate. Alternative L1 collateralization rates may also fall on this yield curve.

Most importantly, this new real yield available to ETH stakers should have an impact on capital flows in DeFi. If you can earn 5% with relatively low ETH staking risk, then apps like Aave and Compound should be able to outperform ETH staking rates in the near future. That's something we'll be watching closely.

Finally, if we go back to our argument that banks will “plug in” to DeFi lending apps, we should also expect banks to provide access to ETH collateralization rates.

Can pension funds diversify away from national debt? Are they looking to invest in something with a higher yield and significant upside? Will banks be incentivized to provide these services to improve profit margins? Would enterprise customers prefer a custodial solution with a trusted entity over holding their own private keys? We believe the answer to these questions will be yes.

03 Interest rate swap: Provide fixed-rate loans for DeFi

If we look up and down the technology stack, the bottom-up structure of yields is variable and determined by supply and demand. For example, at the bottom, we have the staking rate of ETH, which is determined by the number of stakers and the amount of on-chain activity happening in DeFi apps, gaming apps, NFTs, exchanges, trades, etc.If we move up the tech stack, we have DeFi applications whose yields again depend on the supply and demand of borrowers and lenders.To be clear, the same issues exist in traditional finance as well. At the base layer of TradFi, we have Treasury yields, which are set by central banks and change from time to time (as we saw recently). Floating rates create uncertainty and make life difficult for borrowers. For example, most people would not want to own a 30-year mortgage where interest rates could rise at any time. Enter the Interest Rate Swaps (also known as “interest rate swaps”) market, a trillion-dollar derivatives market that allows for fixed-rate loans.

Currently, in traditional finance, approximately 88% of corporate borrowing is done at a fixed rate. As the DeFi ecosystem develops and matures, we should expect to see new products enter the market to further support new business models. For example, today's DAO structures use their native tokens to raise funds and bootstrap. After establishing product-market fit, many of these new structures will likely seek revenue-backed traditional debt financing. Like any business, they will be looking for a fixed rate loan. For example,

Voltz protocol

is one such solution that aims to unlock fixed rate loans through its interest rate swap AMM. (Note: We have no relationship or investment with Voltz)

04 Low mortgages and real world assets

Borrowing in DeFi today requires overcollateralization of liquid deposits in the form of cryptoassets (ETH, BTC, etc.). For example, if you want to borrow $100, you need to deposit $150. This is currently the case with all blue chip lending apps such as Maker, Aave, and Compound.

The overcollateralization structure is necessary to allow smart contracts to automatically liquidate positions and ensure lenders get their money back during periods of market volatility. Therefore, DeFi has no counterparty risk. But not all risks have been eliminated, as there is considerable smart contract risk in DeFi today.

We see this overcollateralized loan structure as essentially a proof of concept for DeFi technology today. In the long run, this is not a capital efficient way to borrow money. Businesses are not over-collateralized to obtain loans. Instead, they prefer to borrow against productive assets while using those assets to deliver products and services. Therefore, undercollateralized or capital efficient loans are preferable. For example, if you're buying a house for $200,000, you don't want to pay $125,000 to get a $75,000 loan. You'd rather come up with less money and use your house (a productive asset) as collateral.

The solution to this challenge is to put real-world assets on-chain. The first instance of this is a USD-backed stablecoin, but there are many, many use cases. For example, tokenizing legal entities holding real estate assets would enable these assets to be used as collateral for efficient on-chain lending. Virtually anything of value can be tokenized.

That said, lenders and other market participants need a robust infrastructure to understand the nature of the tokenized underlying assets (legal status, financial statements, disclosures, etc.). As this infrastructure is built, we should see more and more assets being tokenized. This will open up more liquid trading of various assets, as well as more capital efficient lending and borrowing in DeFi.

Over the past year or so, two of the largest lending apps in DeFi, Aave and MakerDAO, have been expanding into the space. This could finally connect the regulated world of TradFi with the efficiencies enabled by public blockchain infrastructure.

05 Central bank digital currency

It is worth noting that the Federal Reserve is currently exploring a "hypothetical" CBDC (digital dollar) with more than 100 central banks around the world. If this plan is implemented, it could fundamentally restructure the existing monetary system and have a major impact on the banking industry. Today, the Fed does not have direct access to individuals and businesses in the economy. Instead, they interact with large commercial banks, which in turn deal directly with individuals and businesses. A CBDC would give the Federal Reserve direct access to individuals and businesses and broad tactical control over managing the economy and consumer behaviour.

It is unclear how a CBDC will affect the banking system, privacy, payments, the economy and consumer behaviour. It all depends on how it's implemented. A CBDC could potentially eliminate the need for large commercial banks. It could also remove physical cash from society and allow for negative interest rates.Many see CBDCs as the antithesis of DeFi and things built using Ethereum, Bitcoin, and other public blockchains. The latter are open, fully transparent platforms that users can opt in to. A CBDC could further centralize the monetary system. While we should not jump to hasty conclusions about how to design and implement a CBDC, we do know that, given the option, governments prefer to tighten controls rather than reduce them. While it may not be obvious to the public, controlling currency is one of the most powerful controls available to any government.

in conclusion

as we outlined

, we think Western culture will move towards a more decentralized system in the next few years (similar to embracing the internet, but with more regulation). Having said that, we still need to identify some possibility of becoming more centralized in the future. The implementation of a CBDC is something we will be watching closely.

in conclusion

In the shorter term, we expect to see a yield curve inside DeFi, with the ETH staking rate equivalent to the DeFi fed funds rate. We also expect to see new products adopted that enable fixed-rate loans in DeFi, and continue to build infrastructure to support tokenized real-world assets—assets that can be used as collateral in DeFi to achieve More efficient capital borrowing.