Original source: readthegeneralist

old yuppie

Original compilation:old yuppie

first level title

Feasibility Insights:

If you only have a few minutes, here's what investors, operators, and founders should know about Aave.

The leading lender in the DeFi world. Aave is the de facto leader in the decentralized lending space. Even in the cryptocurrency downturn, its fully diluted market cap is above $1 billion. Aave has a total value locked (TVL) of $5.6 billion and is expected to generate annualized revenue of $16.8 million.

Powered by the community. One of the most noteworthy features of Aave is its strong community. Founder Stani Kulechov has prioritized this issue from the beginning, and it has devoted a lot of time to cultivating strata support. This foundation helps Aave stand out from its competitors.

A relentless innovator. Aave is not a sit-and-go project. Since its inception in 2017, it has continuously added new assets, ecosystems and product lines. The result is an integrated financial platform with unparalleled scope and flexibility.

Balance expansion with focus. The organization's biggest challenge in the coming years may be figuring out how to stay focused. This year, Aave has announced two important new initiatives in the social media and stablecoin space. While promising, they will be resource-intensive and bring new risky tracks.

Bill Gates once said: "Banking is necessary, banks are not". Aave founder Stani Kulechov might agree. His financial agreement is perhaps the clearest expression of this sentiment by cryptocurrencies. Since its inception in 2017, Aave has grown to support over $5.6 billion in total value locked (TVL), a metric similar to assets under management. During last year's bull run, TVL was close to $20 billion (even with some newer projects that weren't included in the parent company). Aave achieves these numbers by building a bankless-like banking system, a financial empire built on a protocol and driven by a passionate community.

Aave's ambitions are matched by its assets. Over the past year, Kulechov’s team has come up with several initiatives that hint at a broader future beyond lending, including over-collateralized stablecoins and decentralized social graphs. These projects, and others that will emerge over the next few years, will live under the umbrella of the “Aave Company,” alongside its best-known liquidity protocol. Only time will tell whether these ventures are distractions or allow Aave to become something greater: a tiny Alphabet, a home-based cryptocurrency conglomerate.

In today's article, we'll discuss:

The evolution of Aave. From the outside, Stani Kulechov looks like an unlikely entrepreneur. The former law student turned a small peer-to-peer lender into one of DeFi's blue-chip projects.

key lesson. Aave's success offers lessons about Web3 entrepreneurship, the institutionalization of DeFi, and the power of an active community.

first level title

Evolution: The rise of Aave

first level title

origin

In 2017, a Finnish law student decided to conduct an experiment. Stani Kulechov learned about Ethereum a few months ago while studying dispute resolution and contract law. When he discovered that it was possible to create self-enforcing and enforceable contracts, he was stunned by the implications. "It almost blew my mind," Kulechov later recalled.

Intrigued by the possibilities of ethereum, Kulechov decided to start a small side project focused on lending. The idea is that borrowers can put cryptocurrencies as collateral and then be paired with lenders. This peer-to-peer (P2P) process is built on Ethereum, utilizing its smart contracts. Kulechov calls it ETHLend.

This isn't Kulechov's first entrepreneurial endeavor. As a teenager, he displayed an admirably studious spirit, building financial technology applications in his spare time. Most notable is the revenue financing product for game makers. Instead of waiting 30 to 45 days to receive payment from the App Store, developers get paid instantly, allowing them to cover their costs and grow their business. Although a promising concept, Kulechov's project failed.

He expects ETHLend to follow a similar trajectory. "I never thought about being a startup founder, or anything like that. I was still in college," he said.

At first, it looked like Kulechov would get his wish. After sharing the idea on Reddit, Kulechov noted that "the idea itself was completely killed." Few see the need for such a service as he proposes, nor do they desire it. However, it wasn't long before the tide started to change. Despite ETHLend's efforts to attract users to its service, it's starting to attract a community of enthusiasts. This is largely due to Kulechov's willingness to engage with newcomers to cryptocurrency. "For some reason, I don't know why, but I feel like it's going to be a bigger project," he said. By the end of 2017, ETHLend conducted an initial coin offering (ICO) and received approximately $16.2 million in funding. In hindsight, it was one of the few projects to emerge during the ICO boom, showing its true staying power.

ETHLend's capital infusion is ahead of meaningful traction. Matching lenders and borrowers through P2P programs is a challenge given the immaturity of cryptocurrency finance. One cryptocurrency investor summed up the situation at the time. "The biggest challenge is that there are too few cryptocurrency users and DeFi users, and it is really difficult to solve this chicken-and-egg problem." ETHLend hasn’t frozen interest in the space just because the crypto winter has deepened.

The bear market proved to be a boon for ETHLend. The project was renamed to Aave and shifted from a P2P model to a collective one. Instead of directly matching lenders and borrowers, they simply add to or withdraw from a common pool. Aave developed this strategy in 2018 and 2019, launching "V1" of this pool strategy in early 2020.

It was at this time that Stani Kulechov considered a venture capital round. While ETHLend has raised funds through an ICO, the project will take time to bring in official partners. One investor recalled being impressed by the creativity of Kulechov and the organization he had created. "I have faith in Stani as an entrepreneur. It's clear they are innovating in really defined ways," they said.

While Aave is just starting to break into the Silicon Valley ecosystem, its closest competitors have locked up some of the most prestigious names. In 2018, former Postmates product manager Robert Leshner launched Compound. Like Aave, Leshner's creation facilitates on-chain lending and lending. It attracted $8.2 million in seed funding in 2018 and a $25 million Series A the year after. Andreessen Horowitz participated in both rounds, as did Polychain and Bain Capital Ventures. Because of these relationships, they have been dubbed the "800-pound gorillas" of the field, one source said.

In 2020, Aave grew its roster, bringing in Standard Crypto, Parafi, Framework, Blockchain Capital and the ill-fated Three Arrows Capital. That wasn’t the only good news Kulechov received that year: In December, Aave was added to Coinbase, bringing momentum to the project.

first level title

Core Products

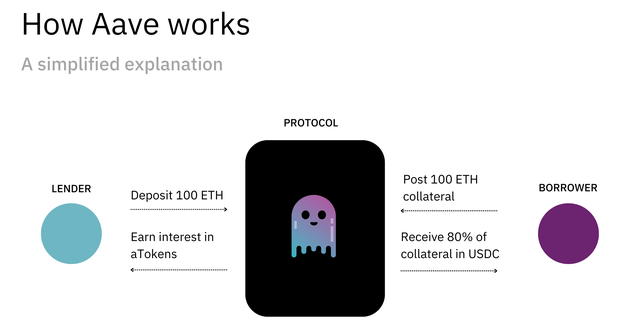

At its most basic level, Aave is a simple product. Beneath the tangle of features and quirks, Aave offers an easy way to lend and borrow. Its services both mimic and disrupt the traditional financial system.

Basically, it works like this. Imagine you were lucky enough to participate in an Ethereum ICO and have 100 ETH at your disposal. For now, you can decide to leave these assets alone and hope that the price of ETH appreciates over time. Ideally, though, you would be able to earn interest on those ETH.

This is what Aave does. Instead of letting your assets sit idle, you can deposit them into Kulechov’s platform and let them earn interest. Aave generates these yields by lending your ETH to borrowers. This interest is issued in the form of "aTokens", if you deposit ETH, you will get aETH; if you deposit DAI, you will get aDAI.

The situation on the borrower's side is equally straightforward. Imagine you want to borrow funds using your 100ETH as collateral. You don’t put it into Aave’s lending pool, you take it out as collateral. Once committed on the platform, you can then withdraw 80% of the collateral value (equivalent to 80ETH in this case). You can use this ETH to buy a car, put a down payment on a house, or make an investment while keeping your original 100ETH collateral intact and repaying the loan over time. Aave offers both fixed and variable rate loans around the flexibility of repayment schedules.

You might wonder why anyone would want to deposit more money just to borrow a smaller amount. Why take 100 ETH as collateral, just to get USDC equivalent to 80 ETH? One reason is to preserve the upside of growth assets. If you sell your ETH, you cannot benefit from any price appreciation. With a loan, you get short-term liquidity and still benefit from the upside.

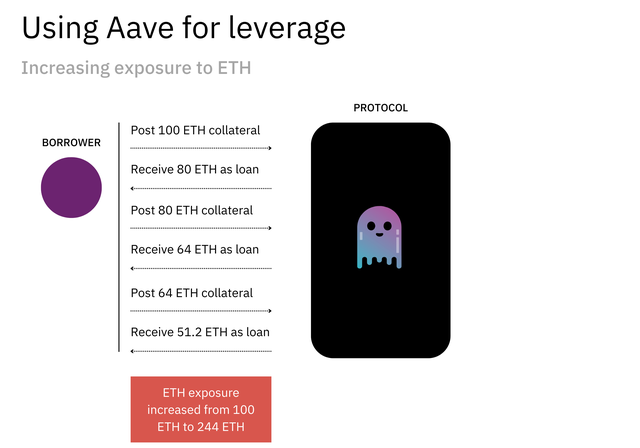

Another reason to use a service like Aave is to increase your own leverage. An investor can deposit 100ETH in collateral, receive 80ETH, deposit 80ETH in collateral, receive 64ETH, deposit 64ETH in collateral...and so on. The result would be an ultra-leveraged bet on the price of ETH. In the event of a pump, investors will see great returns, but a dip will cause severe pain.

first level title

Innovation

Aave has grown into a leader in DeFi lending, thanks in large part to its ability to innovate. Some sources stress that this is one of the project's defining features and a key reason why it was able to stand out from its competitors. Cryptocurrency investor Étienne Brunet pointed out: "Aave overtakes Compound with faster shipments". He highlighted the innovation of the project.

Looking back at Aave's work, it is clear that it has succeeded by taking existing solutions to new areas and developing new products. Today, Aave accepts 30 assets across seven ecosystems, including Fantom, Optimism, and Avalanche. In addition to typical tokens, Aave also offers pools pegged to "Real World Assets" (RWA). Co-developed with Centrifuge, a player bridging DeFi with the traditional economy, Aave’s RWA marketplace offers loan pools for real estate, freight forwarding, consumer lending, inventory financing, and more.

In addition to expanding the range of assets and ecosystems it serves, Aave has also created innovative lending products. "Flash loans" are perhaps the best example. Through this product, users can borrow millions of dollars in assets, as long as they are repaid within seconds in the same Ethereum transaction. It might sound like a disastrous proposition for customers and suppliers alike, delivering disaster in record time, but it has practical uses. Some rely on flash loans to take advantage of token price differences between exchanges.

Others take advantage of the ability to trade collateral and debt in a single transaction to avoid financial loss or improve loan terms. For example, imagine a user deposits ETH and withdraws Tether. If the price of ETH starts to plummet, their positions are at risk of liquidation. Using flash loans, they can swap their collateral for DAI, avoiding further declines. Likewise, if Tether's interest rate rises, users can convert their debt to DAI to avoid paying more. Aave is both a pioneer of this kind of product and has become the de facto destination for this kind of interaction.

Aave Arc is a newer initiative that provides institutional clients with “permissioned” liquidity pools. Unlike Aave's flagship service, Arc's capital pool complies with AML and KYC rules, making it a viable capital destination for large institutions. When Arc was announced earlier this year, Aave shared that it had backed thirty funds, including Bluefire Capital, CoinShares, GSR, Hidden Road, and Ribbit Capital.

first level title

traction

Aave doesn't just have a high market cap. Kulechov and company have built a project that attracts capital and users.

As mentioned earlier, Aave’s total locked value is thought to be $5.6 billion (down from earlier highs, but still enough to make it the fourth-largest project in DeFi) by that metric. Only Maker, Lido, and Curve have more assets in their smart contracts.

Despite a decline in TVL in recent months, Aave continues to expand active users. The protocol hit an all-time high of 36,000 in August and is growing 360% annually. These are small numbers by Web2 standards; many tech lenders have customers in the millions. For cryptocurrencies, however, this indicates a tangible user base. For comparison, Lido (which manages more assets) reached 11,400 users in the past year. Aave’s token holder count has also been steadily climbing, approaching 120,000 in August. A year ago, the figure was slightly above 90,000.

Aave makes money by charging lending fees, giving favorable terms to those who use the project’s own token. This business model generates huge revenue. In October 2021, Aave generated $59.4 million in revenue, of which the agreement took $6.2 million. Gross revenue includes interest paid by borrowers, while protocol revenue reflects the amount received by AAVE token holders. These numbers have dropped significantly as transaction volumes have declined in this crypto winter. In August, Aave's total revenue was $12.3 million and contract revenue was $1.4 million, down 62.5% and 57.5% year-over-year. Such numbers are not surprising in the context of the broader market.

Judging Aave's valuation in the context of these numbers is tricky. Are you concerned about the project's initial surge and notable peak? Or look at its recent data? A fully-diluted market cap of $1.23 billion looks attractive for a project with total revenue growth of more than 2,600% for the January-October 2021 period, with annualized revenue of $712.8 million. That sounds expensive for a project that is in steep decline and now tracks with a gross of $16.8 million.

first level title

Lesson learned: The importance of Aave

first level title

different ways to win

In 2020, few would bet on Aave becoming a major lender in DeFi. Compound is considered the frontrunner, with a more traditional tech leader at the helm and a cohort of high-profile investors. Aave, by contrast, was founded by a European team with less traditional backgrounds and few connections to Silicon Valley VCs.

This juxtaposition is repeated throughout the cryptocurrency ecosystem. Typically, for every Chosen Silicon Valley player, there's a down-and-out, community-driven outsider. Compound and Aave are just two examples of this binary structure. Uniswap and Sushiswap are also easily counted among these roles.

Aave shows us that both can work. Getting into Silicon Valley is not a prerequisite for success, even against competitors with such connections. While this reflects a super trend of technology taking over the world, it also reveals something about the dynamics of cryptocurrencies. By opening investment to retail investors and providing avenues to participate in growth and governance, projects outside of tech power centers can generate grassroots momentum.

That’s not to say more traditional approaches can’t work, Uniswap is the leading decentralized exchange for cryptocurrencies, and while Compound trails Aave in terms of market cap and TVL, it’s certainly a success. It currently has a fully diluted market cap of $625 million and a TVL of $2.25 billion. Total annualized revenue is thought to be $23 million. In April 2021, its high point, Compound brought in $46.8 million or $561.6 million in annualized revenue. While it has not kept pace with Aave, it is a project that can come up with big numbers and has its own advantages. For example, one source highlighted that Aave could learn from Compound’s user experience. Additionally, Compound has more token holders, beating Aave by 197,000 to 120,000, even though Aave has more active users.

first level title

power of community

We've talked about how Aave's power comes, at least in part, from its community. But how does it develop this power?

It seems to stem in part from Kulechov's personality and priorities. During our interaction, Kulechov described himself as "passionate about bringing together people who want to make products that have a positive impact on society." Aave's strong community seems to stem from this interest. In previous interviews, Kulechov noted that he is constantly engaging with the community. "I spend countless hours a day talking to people," he said. In the early days of Aave, he would walk users through the basics of cryptocurrencies, explain what a wallet is, and how to buy ETH.

These cumulative interactions helped him create a movement of unusual engagement and enthusiasm. AAVE's governance approach helps with this. Holders of AAVE tokens have the right to submit proposals and vote on them, making tangible contributions to the development of the project.

One of the most fun community events on Aave is the Raave – a series of dance parties that pop up around the world. Last month, the Raavers might have rallied in Bogotá; next month, they'll be in Berlin. Many described it as the most impressive and enjoyable rave they've ever been to. It might seem wasteful for a tech company to spend so much on entertainment. However, for a project that relies on community engagement, investing in moments of joy makes sense.

In addition to the direct advantage of having an engaged community, Aave also benefits indirectly, especially when it comes to recruiting. Brunet described Kulechov as a "true visionary who can hire people with a mission." He added that Aave has been "able to hire and retain top female talent" — a rarity in cryptocurrency. For a project with a less enthusiastic following and a smaller footprint, that kind of dedication and diversity will be harder to achieve.

first level title

The Attraction and Development of DeFi

While DeFi is often associated with unsustainable yield farming schemes and other financial shenanigans, Aave illustrates the benefits. Consumers who own crypto assets can earn interest and borrow money anywhere there is an internet connection.

Loans are an important part of the financial system. For consumers and businesses, access to credit enables many to take productive risks, or make important purchases they might not otherwise be able to make. For investors, Aave has created an attractive product that offers high yield and digestible risk. Compared with traditional financial services, Aave is faster, less difficult and more flexible.

The emergence and development of Aave Arc and RWA Markets suggest that the change of pace in DeFi may come from here. Giving institutional investors the safeguards they need, entrusting meaningful resources to the ecosystem, can unleash a wave of capital and make more conservative market participants increasingly comfortable with cryptocurrencies. Of course, this opportunity will not go uncontested. Compound has a great roster of whales and institutions, while newer offerings like Maple Finance have snowballed by focusing on this client base. As with traditional finance, this is a market with room for multiple big winners, but Aave will need to ensure it maintains its storage lending velocity to avoid falling behind.

The cycle of "real world assets" like freight financing offers another huge avenue for growth. Many of these loan opportunities are hard to come by, dominated by lethargic incumbents, and financially attractive. Aave's move here illustrates where the industry may be headed, and how cryptocurrencies are inserting themselves into the Web2 industry.

first level title

The Future: Formation of a Conglomerate

Stani Kulechov isn't content with just building the best lending platform in the world. His recent moves show his eagerness to tackle cryptocurrency’s most important problems, and tackle them one by one. Doing so is changing the fundamental face of Aave, moving it from a centralized set of lending products to something closer to a conglomerate. In fact, when I asked Kulechov how Aave is often poorly understood, he pointed to the scope of his work:

People often don't know the difference between the Aave company (a technology company that develops software products for Web3) and the Aave protocol, which is now decentralized and managed and maintained by the Aave DAO.

first level title

Lens agreement

In February, a new account called Lens Protocol tweeted a message: "Something is blooming...."

Aave "has said it's making a big move": a decentralized social graph. It might sound like a surprising move for a lending business, but those following Kulechov's interest weren't shocked. The Aave founder has expressed interest in social media for some time. Earlier this year, Kulechov was banned from Twitter for tweeting a joke claiming to be its new interim CEO. In fact, many in the cryptocurrency space thought it was interesting because it didn't seem too far-fetched.

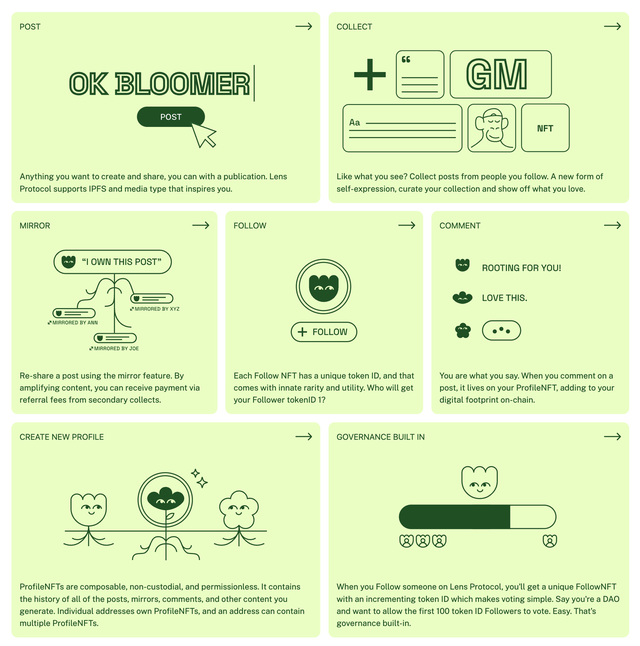

image description

Lens Protocol

The operation of Lens is carried out around NFT. When you sign up, you can create a profile NFT. In fact, each wallet address can have several and be able to hand over the management of the profile to a group. This is especially handy for DAOs.

Following someone will also generate an NFT. Since each NFT is unique, they carry information about when you followed someone, opening up the possibility for profiles to reward early supporters or regulate content visibility through this dimension.

Lens supports publishing rich media, including articles, photos, and videos. Users can purchase the content, add it to "favorites," and demonstrate their interest. For creators, this represents a new revenue stream. How popular this form of sponsorship and self-expression will be remains to be seen.

The forward version of Lens is "mirror". This amplifies the content and gives the amplified account exposure on its upper echelons. Those who retweet and share another account's posts earn a percentage of the fee when those posts are bought.

Finally, because Lens is decentralized, users can port their social graph from one app to another. Users truly own their own social network, rather than borrowing it from platforms that may one day ban them or decline in popularity.

Lens seems to be off to a good start so far. A Web3 contact said it was one of the most widely used protocols at hacking conferences, making it the de facto choice for any product requiring a social graph. New applications have emerged, including Lenster, Refract, Phaver, and Alps Finance. A recent article noted that 65,000 profiles and 300,000 posts were made with Lens.

Lens has also been developed from a governance perspective. Earlier this week, Kulechov announced the creation of CultivatorDAO, a collective focused on trust and user security. This DAO is designed to act transparently and conditionally. Users and developers can decide if they wish to "turn on" Cultivator's planning and management. The idea is that activating Cultivator can improve your social experience, removing bots and spam accounts. It can be forked by other communities and customized according to their needs.

While this is an interesting addition to Lens, CultivatorDAO reminds us just how big of a challenge Aave is taking on. Not only does Kulechov want to create a new technical framework for social media, he and his team are also building the human infrastructure. How will they manage to perform at full strength on both fronts?

first level title

GHO stablecoin

The connection of GHO to Aave's lending service is immediately visible. Introduced in July this year, GHO is a USD-pegged over-collateralized stablecoin that operates within the confines of the Aave protocol.

Once implemented, users will be able to mint GHO by depositing collateral. As with Aave's other loans, the amount of GHO minted will be a fraction of the value of the asset deposited. When users withdraw their collateral or are liquidated, their GHO holdings will be burned.

Foraging into the world of stablecoins is a dangerous proposition. Terra's demise has attracted considerable regulatory scrutiny, which Aave will hope to avoid. It also prompts healthy skepticism about the design decisions of these assets, which may take time to resolve. Like Lens, GHO could be a distraction from Aave's more immediate growth.

It seemed like a worthwhile bet. For all their volatility, stablecoins represent a massive asset class with considerable upside. As Aave intends to direct all interest earned on borrowing GHO towards its DAO treasury, it also provides a new revenue stream. We also have reason to think this is an elegant choice. After all, Aave has built a huge collateral base and distribution. In that regard, GHO feels like a natural extension of the power that Aave has won. Gaining a meaningful share here could propel Kulechov's fledgling conglomerate to great heights.

What will Aave look like in ten or twenty years? Stani Kulechov's ultimate goal may be to build a company no less than a cryptocurrency version of Alphabet, one of the sources said.

This comparison doesn't make much sense at first, but the more you think about it, the more it makes sense. From a product perspective, Aave and Alphabet have nothing in common. Not only do they operate in different markets, but they operate in different paradigms. However, a re-examination of Alphabet's S-1 filing reveals more fundamental similarities.

Larry Page and Sergey Brin wrote in their introduction letter: "Google is not a traditional company. We do not intend to become such a company. If we are very speculative in comparison with our current business Don't be surprised if there are small bets in even odd areas."

One can imagine Stani Kulechov making the same claim. An initiative like Lens Protocol may not quite align with its core business, but a willingness to experiment, take risks, and fail is the hallmark of a creative organization.

For now, Aave is still some distance away from Alphabet's heights. However, it displays a number of promising characteristics that suggest it could be a long-term compound. Aave is not a traditional lender. It doesn't intend to be one of those companies, either.