Crypto VC上半年报告:熊市热度不减,投资金额超302亿美元

原文作者:sixohfour

通过分析加密融资数据网站 Dove Metrics 的所有数据,整理并汇编为这份 2022 年上半年 Crypto VC 融资报告。

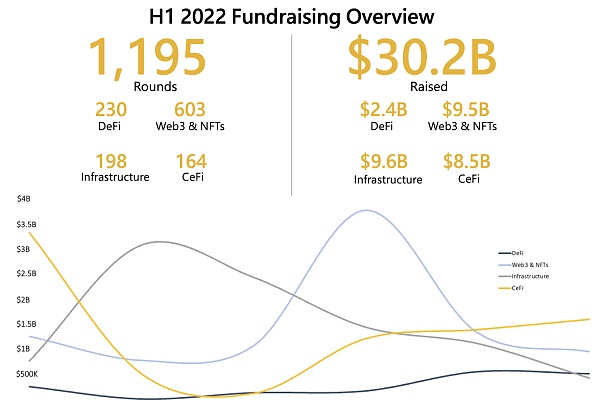

2022 年第一季度共融资 543 轮,第二季度融资 652 轮,即 2022 年上半年总计 1,195 轮,相比 2021 年上半年增加了 50.79%。

VC 投资的总价值为 302 亿美元,在第一季度和第二季度之间分布相对均匀。相比 2021 年上半年的 99.78 亿美元大幅增加。

投资领域

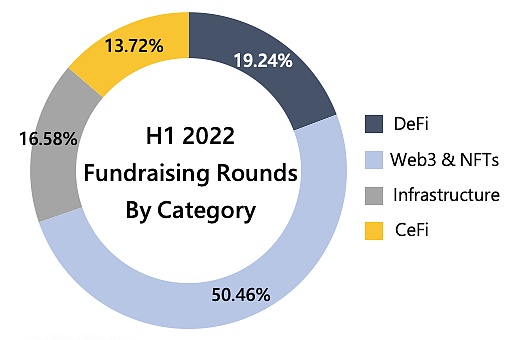

最受 VCs 关注的领域是 Web3 和 NFT,占所有融资轮次的 50.46%。其中,基础设施领域融资了 96 亿美元的资金,是所有类别中最多的。

尽管在融资轮次中排名第二,但 DeFi(去中心化金融)领域获得的资金量是最少的。随着我们进入熊市,VC 的投资规模将会更小、更保守。CeFi(中心化金融平台)领域筹集了 85 亿美元,可能是由于许多机构筹集债务以避免清算,如 Voyager 和 BlockFi。

VC Top5

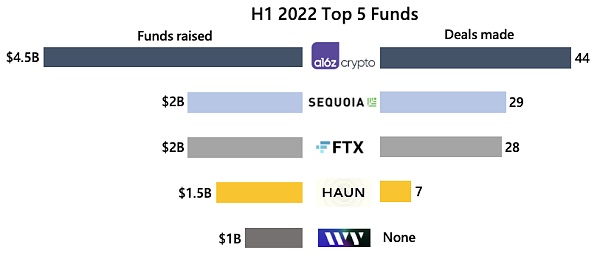

a16z 成为 2022 年上半年投资最多的顶级 VC,总计 45 亿美元。他们共进行了 44 项投资,涵盖 DeFi、Web3、NFT 和基础设施等领域,但没有 CeFi 公司。值得注意的投资项目包括 Phantom、Yuga Labs、NEAR Protocol 和 Lido。

红杉资本和 FTX Ventures 并列第二,各投资了 20 亿美元。红杉进行了 29 项投资,包括 StepN、Polygon 和 Magic Eden 等。FTX 进行了 28 项投资,包括 Mina Protocol、Yuga Labs、LayerZero 和 BlockFi。

Haun Ventures 共投资了 15 亿美元,进行了 7 次投资,专注于游戏领域的 NFT 开发商,包括 Zora 和 Derby Stars 等公司。

Ivy Blocks 是 huobi 旗下的新子公司。于 2022 年 6 月推出,管理着 10 亿美元的资产,迄今为止没有进行任何投资。

融资轮 Top5

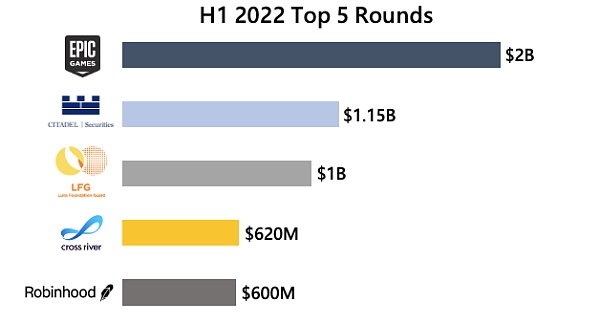

对 NFT 持开放态度的游戏工作室/游戏商店 Epic Games 于 4 月 11 日筹集了 20 亿美元,使其成为上半年最大的一轮融资,投资者包括索尼和 KIRKBI。通过这轮融资,Epic Games 将大力推进对元宇宙虚拟世界的探索。

全球领先的量化交易公司和做市商 Citadel Securities,于 1 月 11 日筹集了 11.5 亿美元。投资者包括红杉资本和 Paradigm。

专注于 Terra 的组织 Luna Foundation Guard 在 2 月份筹集了 10 亿美元,投资者包括三箭资本、Jump Capital、GSR 和 DeFiance Capital。

Cross River 是一家提供嵌入式支付、借贷和加密支付解决方案的金融科技公司,筹集了 6.2 亿美元。著名的投资者包括 a16z、Whale Rock 和 Hanaco Ventures。

Robinhood 是一家提供加密资产交易的股票经纪公司,通过 Emergent Fidelity Technologies 的投资筹集了 6 亿美元。

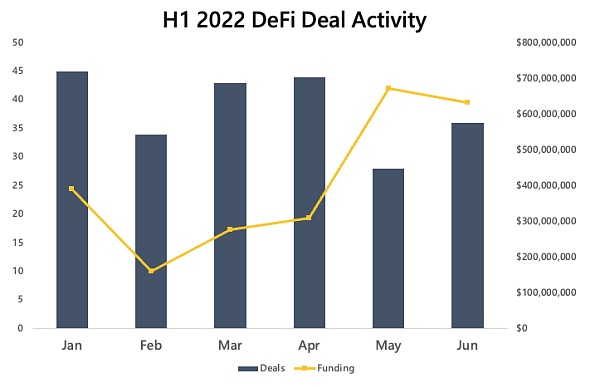

DeFi 领域

DeFi 领域的融资从 2021 年上半年开始出现了明显的增长。在 2022 年上半年,该领域总共进行了 230 轮融资,共筹集了 24 亿美元。值得一提的是,虽然 DeFi 领域筹集到的资金最少,但融资轮次占 Crypto 所有融资轮次的 19.24%。

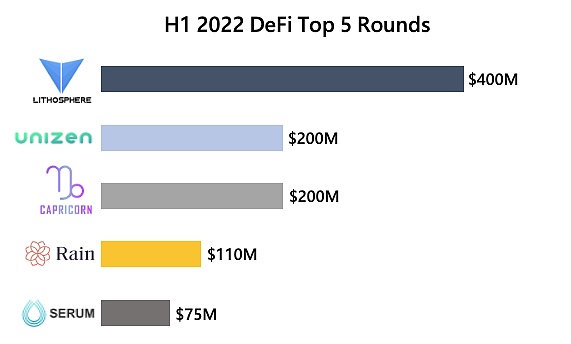

DeFi 融资 Top5:

- Lithosphere 是一个由不同区块链组成的去中心化跨链网络,dApp 和去中心化服务可以在其中互操作。筹集了 4 亿美元,使其成为 DeFi 领域的顶级融资。它的投资者是 Gem Capital。

- Unizen 是一个智能交易生态系统。Capricorn 是一个多资产支持协议 ,具有基于抵押品的代币 CUSD。两者均筹集了 2 亿美元。Unizen 的投资者是 GEM Capital;Capricorn 获得了 MQ technology 的投资。

- Rain 是一家中东加密资产交易平台,从 Paradigm、Coinbase Ventures 等 VCs 筹集了 1.1 亿美元。

- 建立在 Solana 上的去中心化交易所 Serum 从 Tiger Global Management、Commonwealth Asset Management 和 Tagus Capital 筹集了 7500 万美元。

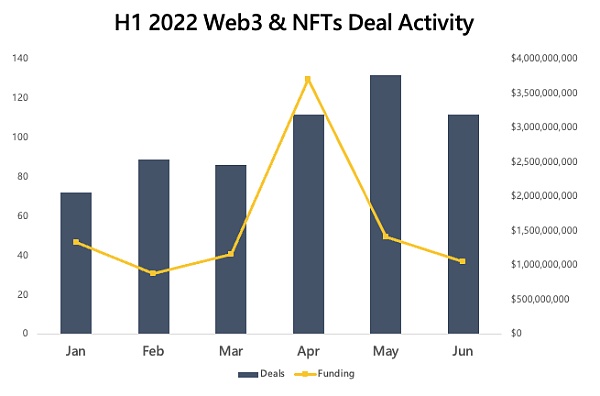

Web3 和 NFT 领域

Web3 和 NFT 领域展示出的巨大潜力已“说服”VC 部署大量资金。Web3 & NFTs 领域在 2022 年上半年通过 603 笔交易总共筹集了 95 亿美元的资金。

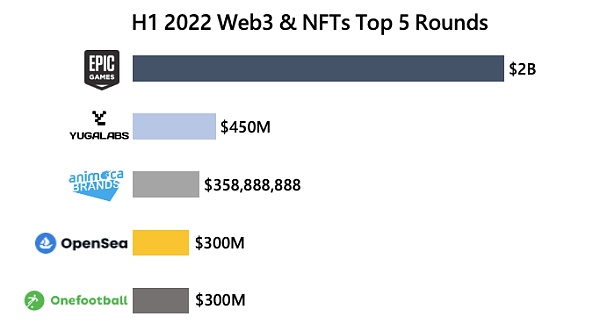

Web3 & NFTs 融资 Top5:

- 如上文所述,Epic Games 不仅是 Web3 & NFTs 领域的顶级融资,而且也是整个 2022 年上半年的顶级融资轮次。

- 拥有<无聊猿>和<加密朋克>的 NFT 开发商 Yuga Labs 筹集了 4.5 亿美元,使其成为 Web3 & NFTs 领域的第二大融资轮。著名的投资者包括 FTX、a16z 和 The Sandbox。

- Animoca Brands 是一家近几年专注于区块链和 Web3 的游戏开发公司,旗下的区块链游戏产品包括元宇宙 The Sandbox、赛车游戏 REVV、去中心化游戏平台 Arc 8 等。通过 Gemini 等 VC 筹集了 358,888,888 美元的资金。

- 以太坊上最大的 NFT 市场 OpenSea 通过 Paradigm 和 Coatue Management 筹集了 3 亿美元的资金。

- 足球新闻平台 Onefootball 也筹集了 3 亿美元,这笔资金将用于将 Onefootball 扩展到 Web3 和区块链。

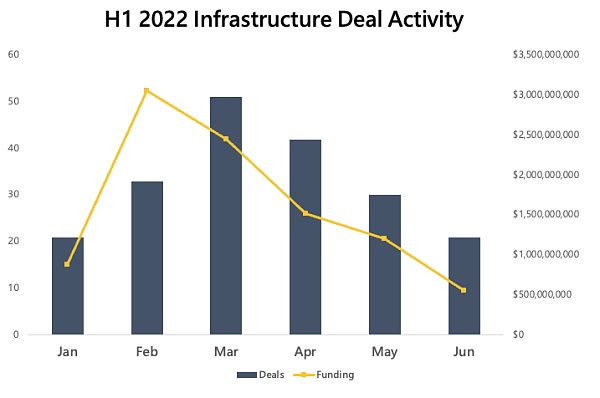

基础设施领域

基础设施领域的融资非常活跃。在 198 笔交易中共筹集了 96 亿美元的资金,使其成为整个 Crypto 中最大的融资领域。

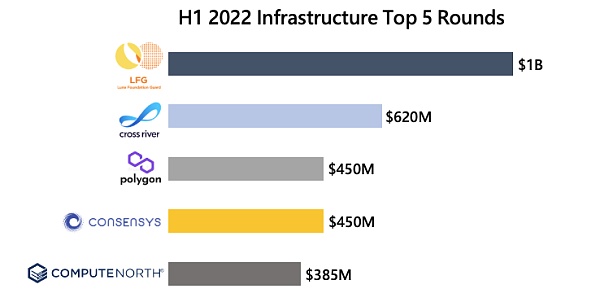

基础设施融资 Top5:

- Luna Foundation Guard 和 Cross River 是基础设施领域的前两大融资轮次。

- 以太坊 L2 Polygon 从红杉、软银和 Galaxy Digital 等 VC 那里筹集了 4.5 亿美元。

- Consensys 是一家支持以太坊生态系统项目的区块链公司,从软银、微软和 ParaFi 等 VC 那里筹集了 4.5 亿美元的资金。

- Compute North 是一家提供高性能加密采矿和基础设施解决方案的数据中心,筹集了 3.85 亿美元的资金。

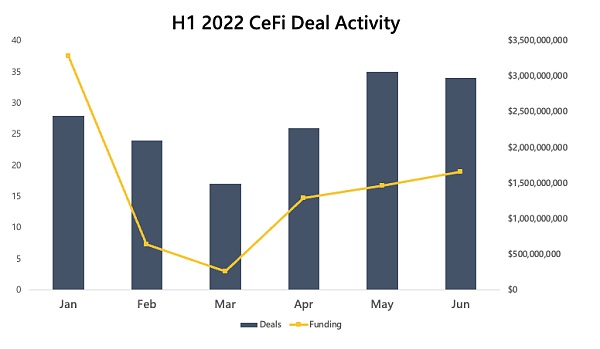

CeFi 领域

2022 年上半年,CeFi 从 164 笔交易中筹集了 85 亿美元的资金。新资金主要来自筹集债务以避免清算的机构,例如 BlockFi 从 FTX 筹集了 2.5 亿美元,或者 Voyager 从 Alameda 筹集了 2 亿美元。

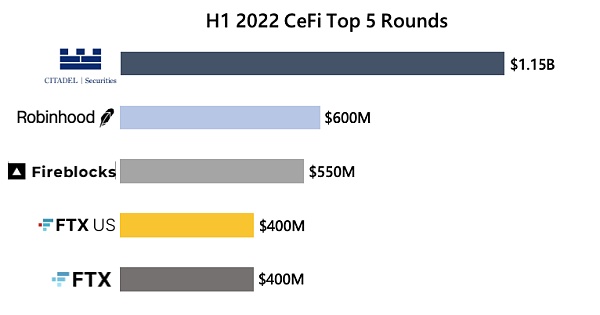

CeFi 融资 Top5:

- 如上文所述,Citadel Securities 和 Robinhood 都获得了可观的资金。

- Fireblocks 是一家数字资产托管公司,从红杉资本、Spark Capital 等 VC 那里获得了 5.5 亿美元。

- FTX US 和 FTX 各自筹集了 4 亿美元。著名的投资者包括对这两者都进行了投资的 Paradigm 和软银。

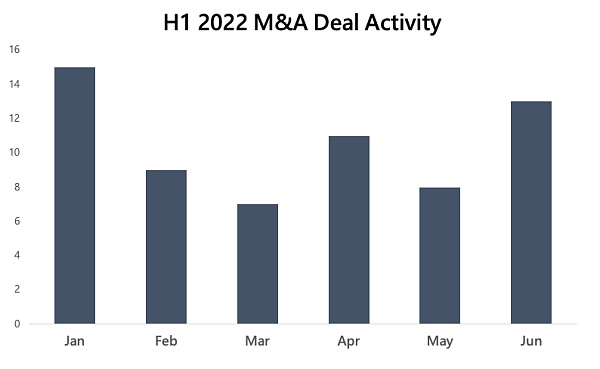

并购交易

并购交易在2022 年上半年的 6 个月内分布相对均匀。Web3 和 GameFi 公司是这些并购交易中的突出亮点。

为了进一步提升其在 Web3 领域的声誉,Animoca Brands 成为了 2022 年上半年最大的收购公司,在 Web3 和 NFT 领域完成了 6 笔并购交易。

FTX 是 2022 年上半年的第二大收购公司,共有 4 笔并购交易。FTX 非常关注股票交易和流动性公司,希望将其提供金融服务扩展到更多客户,特别是美国。此外,FTX 还收购了 Good Luck Games,这家游戏公司制作了让 FTX 创始人 SBF 痴迷的游戏 Storybook Brawl。

Amber Group 是 2022 年上半年的第三大收购公司,共有 2 笔并购交易。Amber Group 进行的收购专门用于 TradFi 与 Crypto 的融合。通过这些交易,Amber Group 获得了五类证监会牌照——第 1 类、第 2 类、第 4 类、第 5 类和第 9 类——这使该公司能够开展广泛的服务,包括就证券和期货合约提供咨询和交易,以及提供资产管理服务。

<END>

风险提示:

根据央行等部门发布的《关于进一步防范和处置虚拟货币交易炒作风险的通知》,本文内容仅用于信息分享,不对任何经营与投资行为进行推广与背书,请读者严格遵守所在地区法律法规,不参与任何非法金融行为。