Author: David

Author: David

first level title

Main points:

Main points:

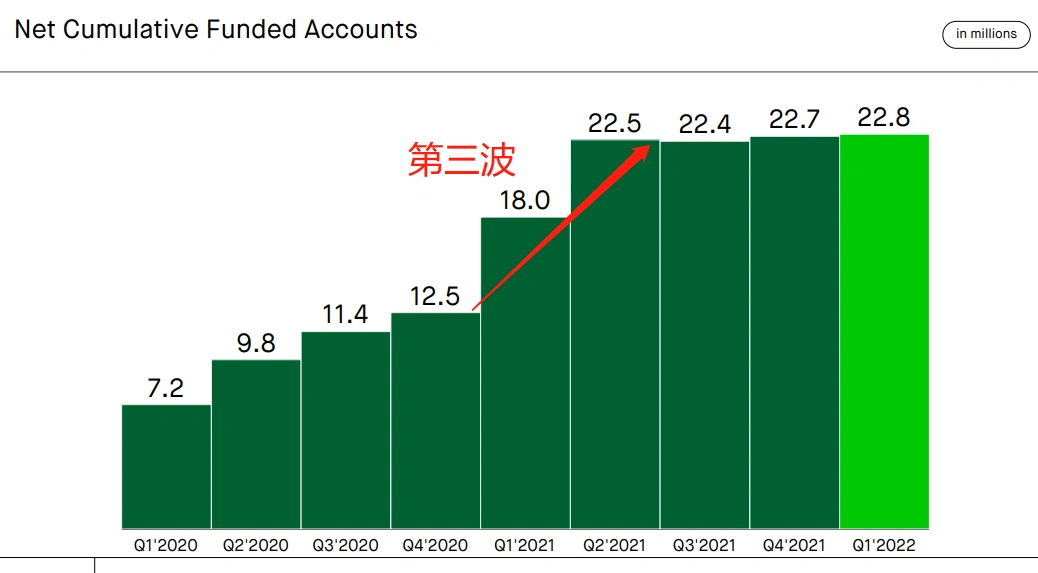

User surge: Since its launch in 2013, Robinhood has become one of the most popular and influential fintech apps in the world. Today, it has more than 22.8 million gold-holding accounts, up from just 300,000 in 2015.

What to watch: Robinhood has been the subject of much attention, including a retail trading frenzy, a record $70 million FINRA fine, ongoing congressional scrutiny, trading disruptions and mounting customer service issues.

Retail platform: Robinhood users are around 30 years old and like games. The average account median is 240 US dollars, with an average of 5,000 US dollars (the peers are more than 70,000 US dollars), and the customer acquisition cost is 12 dollars (the peers are more than 170 US dollars).

Opaque trading data: Most brokers publish their trading statistics to help investors compare payouts for order flow. Due to the use of PFOF (payment for order flow) to execute transactions, Robinhood cannot disclose this information to the public. Also because of PFOF, the U.S. regulators have imposed multiple fines on Robin Hood, and at the same time, new regulations are brewing to completely ban PFOF.

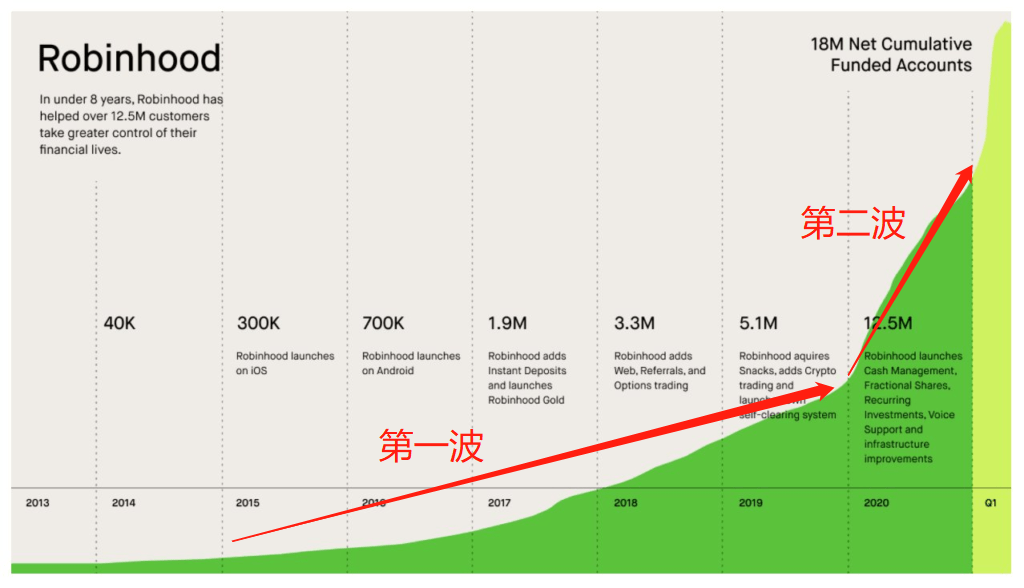

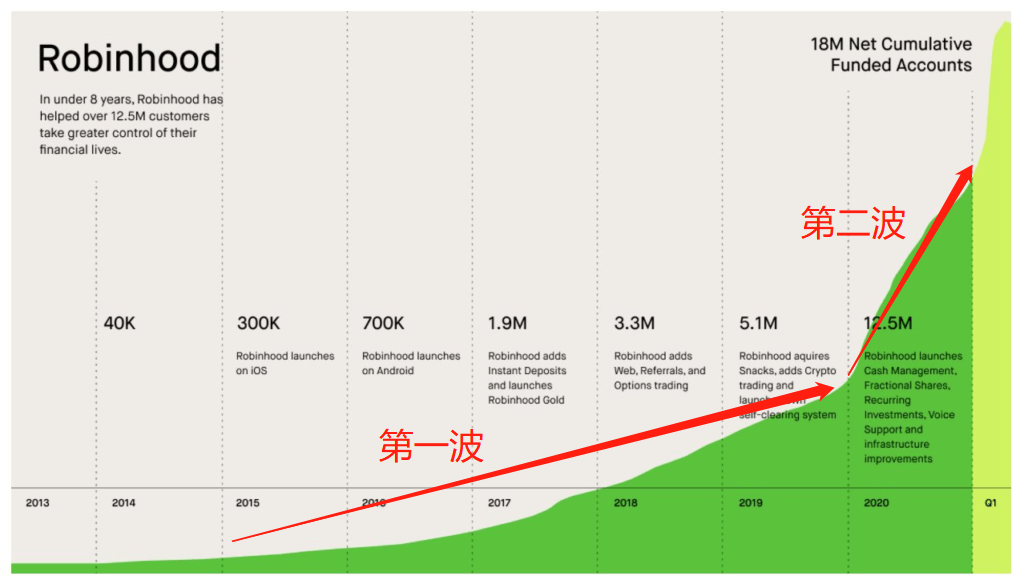

1. Three waves of user surge: how to capture long-tail users in a bottom-up manner

The first wave of user surge (300,000 to 5 million): significantly lower transaction threshold

Robinhood exited the commission-free service at the beginning (the general securities platform is 8-10 US dollars per lot), and there is no minimum account fund requirement, making it easier for low-income first-time investors to start trading. Users can also trade fractional shares – fractions* (can be as small as 1/1,000,000) of a single share of a company, rather than whole shares. This makes investing in stocks like Apple or ETFs much easier.

This accessibility greatly expands the platform's total addressable market, with trading users shifting from typically older, wealthier individuals (with at least some investment knowledge) to younger, less experienced, and poorer individuals. For example, Robin Hood's average customer is 31 years old, while Charles Schwab's average customer is around 50 years old. Most young people in their 20s had their first opportunity to get in a car and trade securities.

* Fractional shares can only be transferred between Robin Hood accounts, and cannot be transferred out. If forced to transfer out, fractional shares will be sold.

Attachment: How customers trade on Robinhood

Before users can start trading on Robinhood, they must apply for a brokerage account. This is because the US Securities and Exchange Commission (SEC) requires all brokers operating in the United States to collect and verify the personal information of an individual trading on their platform, including his net worth and social security number; customers also need to provide their bank Account, used for deposit and withdrawal.

Second Wave of User Explosion (5M to 12.5M): Simple, Gamified Experience

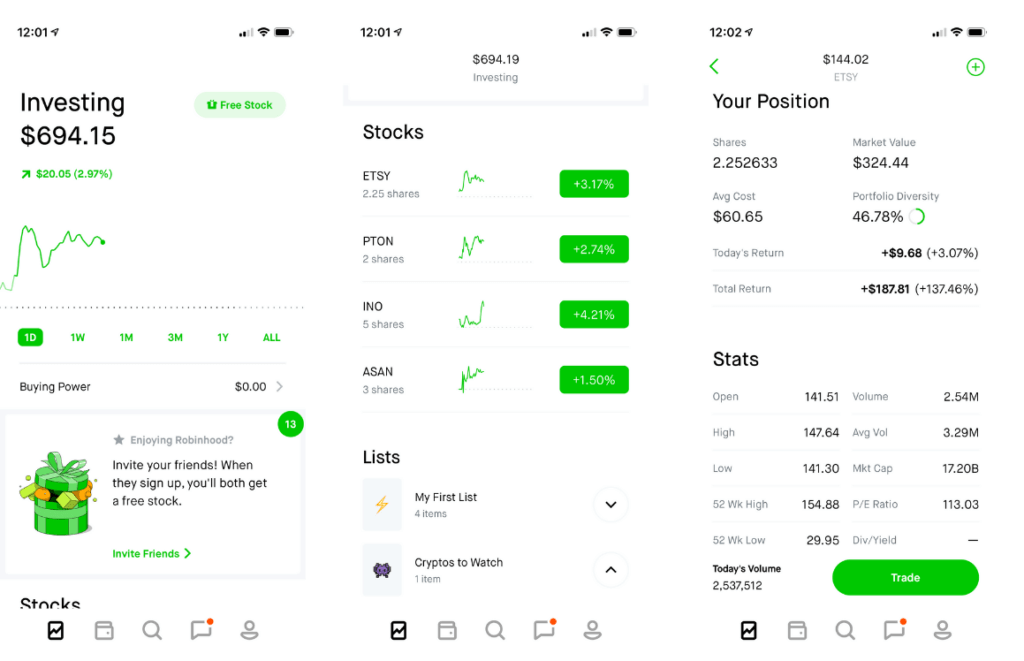

After the securities account is opened, the user enters the following page. The Robinhood trading page design is simpler than that of general brokerage accounts. Account holders' positions are summarized in green (up) or red (down), providing an overview of their entire portfolio. Buy and sell stocks or cryptocurrencies with just a double-click on a ticker symbol. Transactions show up as simple transactions in the user's account history, much the same way banking apps show deposits and withdrawals.

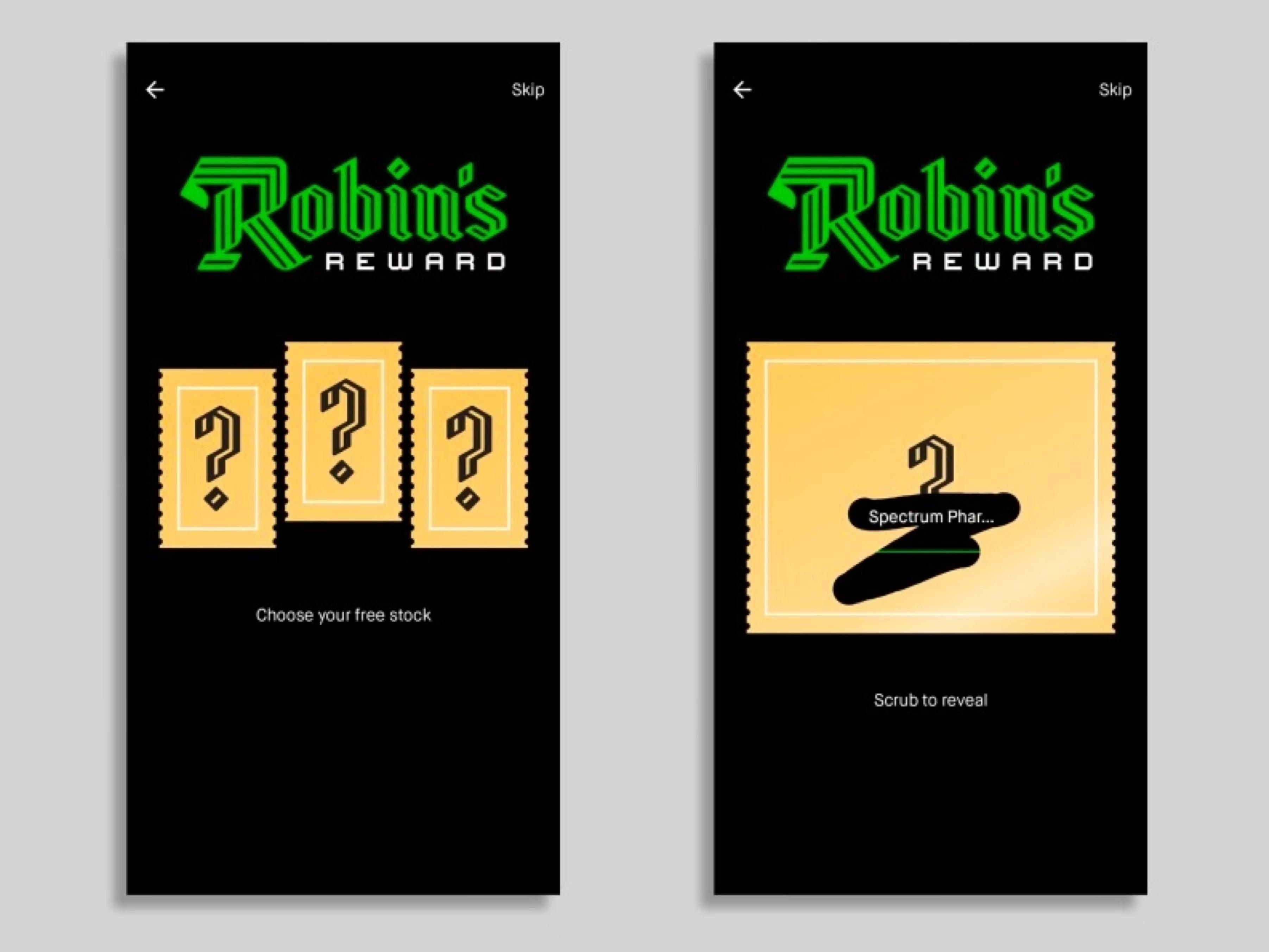

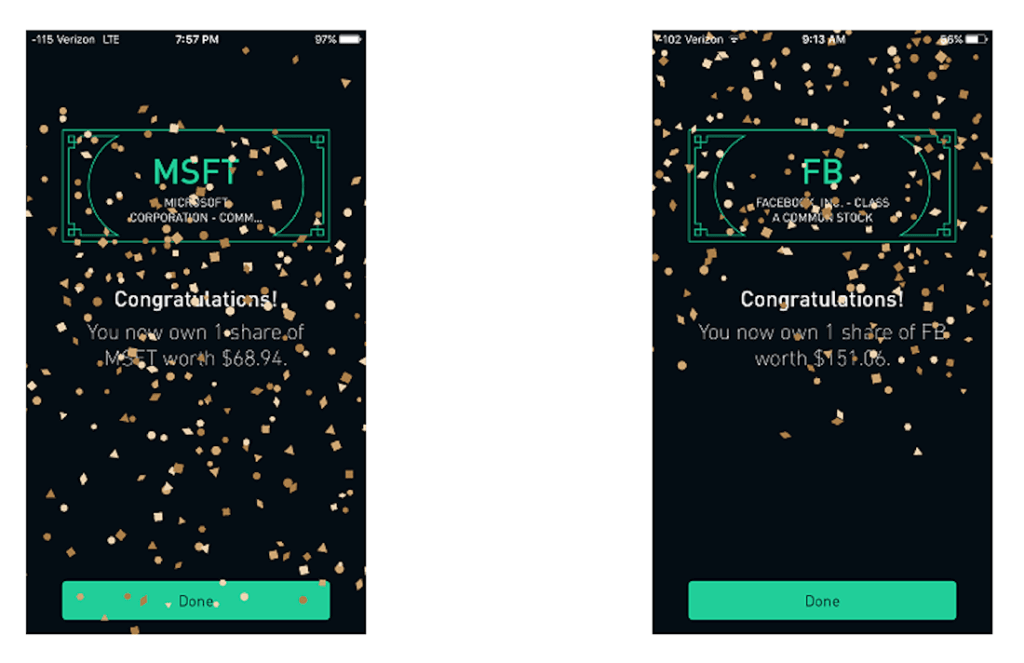

The gamification element begins once the customer starts interacting with the app. One of Robinhood's promises is that new accounts will receive free stock -- a single stock in a randomly determined company. While new users could theoretically acquire shares in companies like Apple or Tesla, this is unlikely in practice. New users have a 98% chance of getting shares worth between $2.50 and $10 for user growth.

Using the same psychological motivations that drive gaming behavior, Robinhood builds the UI to please those unfamiliar with active investing. Its interface is filled with emoji, push notifications, digital confetti, and support confirmation emails. Its "game loop" makes stock trading easy while providing sensory feedback.

By delighting users, Robinhood creates players rather than investors. This helps them ignore the fact that speculative investing is difficult and can cause them to lose a lot of money—even if they are professionals who spend hours and days scrutinizing companies and deals.

The addition of this kind of gaming experience, coupled with the home isolation brought about by the new crown epidemic, the US government’s disbursement of cash to citizens, and so on, are all believed to be the reasons why Robinhood soared by about 3 million new users in the first four months of 2020. In the first quarter of 2020, these so-called "coronavirus stock traders" traded 9 times as many stocks as E-Trade users and 40 times as many as Charles Schwab users. During the same period, the number of option contracts traded by Robin Hood was 88 times that of Charles Schwab users.

Discussion: Pros and Cons of Trading Gamification

It turns out that traders on Robinhood are underperforming institutional investors. Separate studies by Oklahoma State University and Emory University found that, on average, Robinhood traders buy stocks that don't do well over the next three to 20 days.

“We found that changes in ownership of Robinhood were unrelated to future returns, so labeled Robinhood users as ‘noise traders’ in the market. However, Robinhood may still have real value. The app provides an opportunity for the average retail investor to A chance to try trading - for as little as $1."

【Retail Trader Sophistication and Stock Market Quality: Evidence from Brokerage Outages】

“The Robin Hood app makes Wall Street feel like a no-lose game — not a place where you lose your life savings in a minute.”

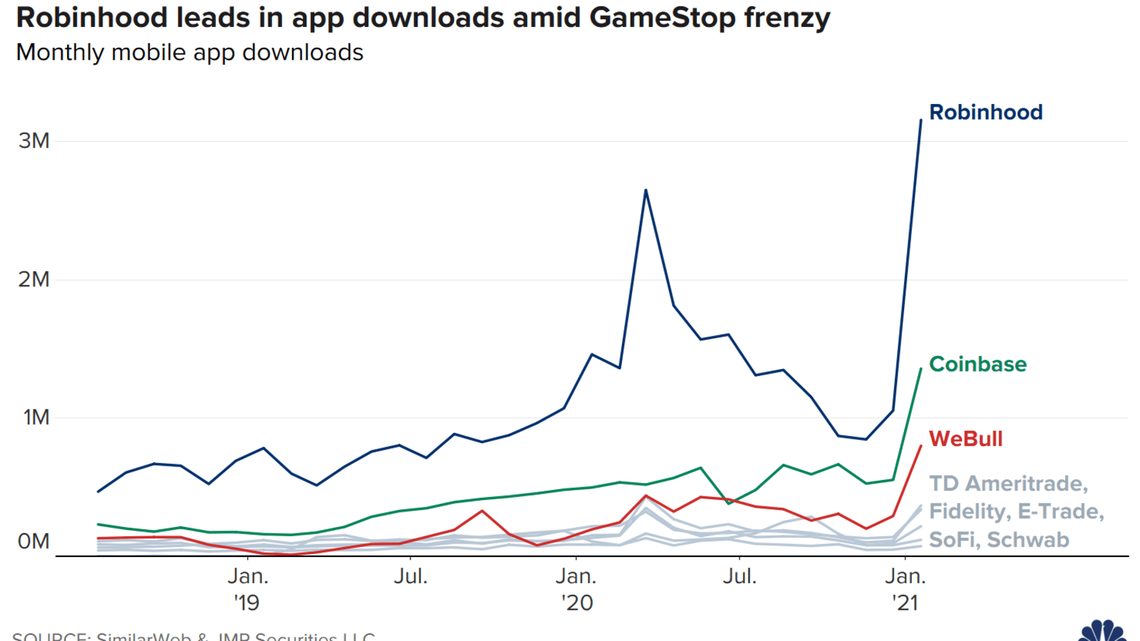

The third wave of user surge (12.5 million to 22.5 million): Explosive event marketing

WSB calls for Meme shares, Musk calls for Dogecoin

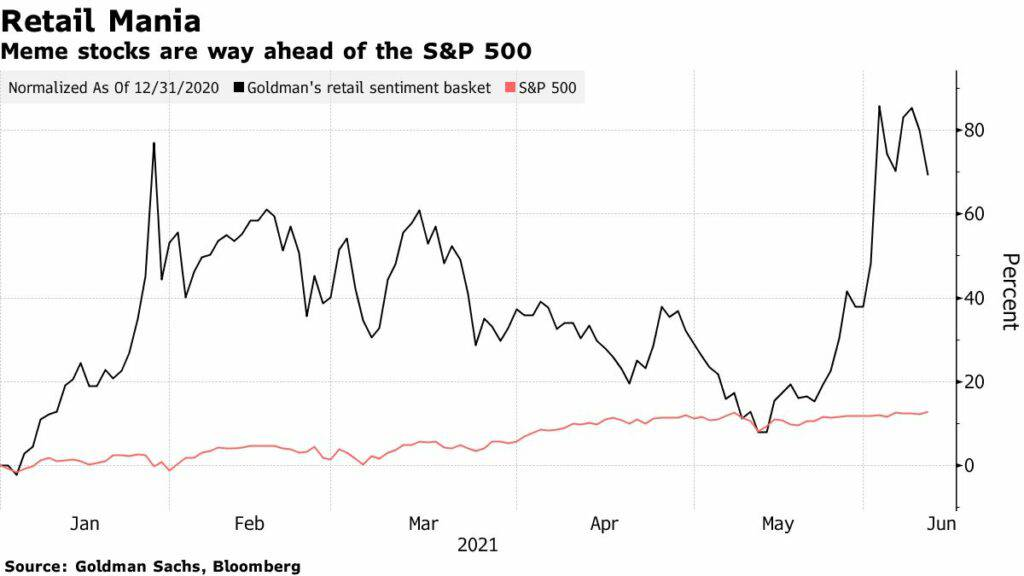

Meme stock trading exploded in early 2021, fueled by members of the WallStreetBets subreddit. Amateur day traders pumped up the shares of struggling companies like GameStop, AMC and Best Buy, partly to pump up hedge funds' short positions, partly for fun and partly to make money.

A large proportion of these traders turned to Robinhood to execute these trades (possibly due to the low cost of opening an account), causing the Robinhood app to receive so many orders in a short period of time that it was forced to stop trading - which later attracted regulatory attention. review.

In the month of January 21, Robinhood opened more new accounts than all other institutions combined.

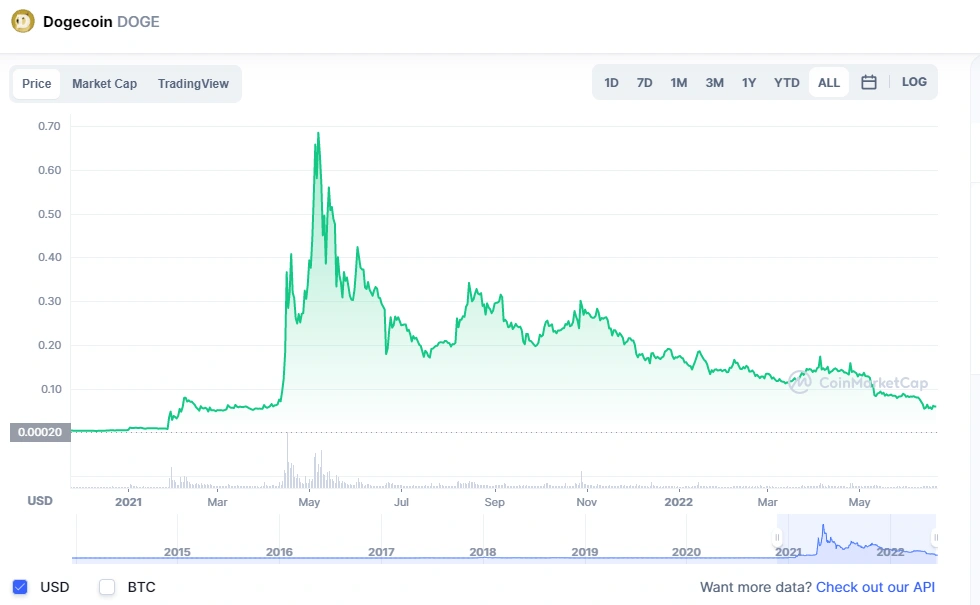

The company has also been a big beneficiary of the surge in the cryptocurrency market. The app allows investors to buy and sell seven digital currencies, including bitcoin, bitcoin cash, dogecoin, ethereum and litecoin. Among them, Dogecoin is the largest trading currency. It contributed more than 60% of the encryption revenue in the second quarter of last year and 25% of the annual revenue. It has to be said that the 20-fold surge in Dogecoin in the second quarter of last year is also due to Musk's call for orders and the influx of Robin Hood retail investors to catch up.

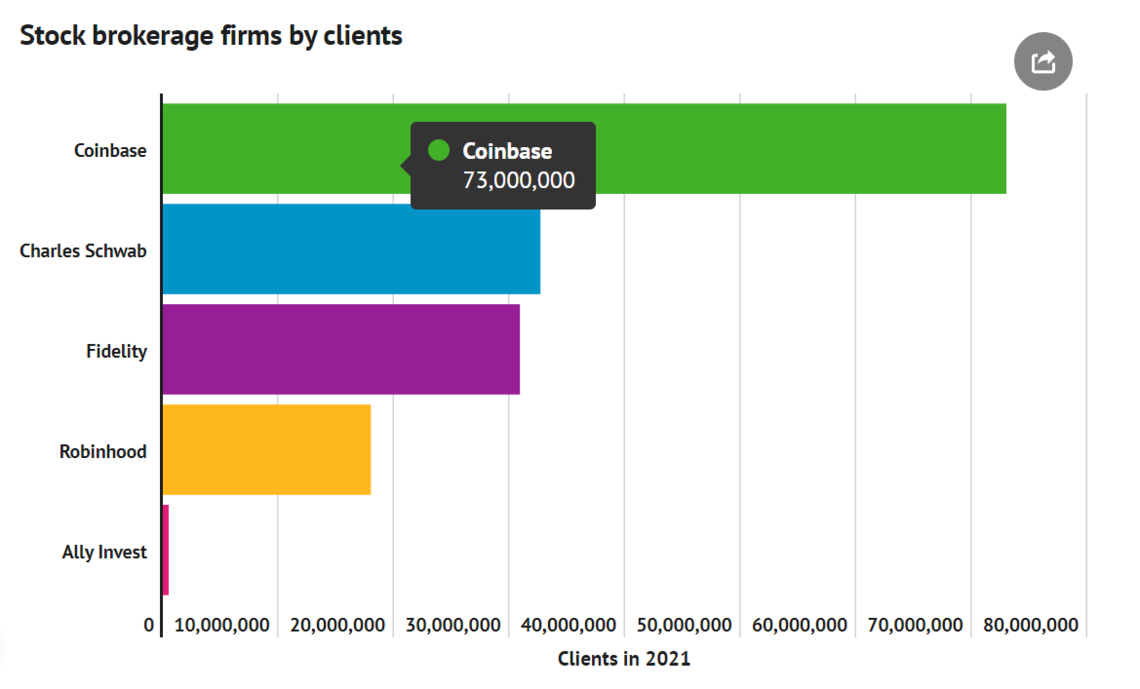

The result of Robin Hood's three waves of growth, first of all, is the sudden emergence of a new force in the brokerage market that has been ranked stable for decades.

Secondly, the rise of retail investors has become an important force that financial institutions and listed companies must pay attention to. In 2020, Charles Schwab estimates that the total assets of retail traders will be US$50 trillion, accounting for 20% of all US stock trading volumes, double that of 2010. The emergence of Robinhood has facilitated and accelerated the retailization of investors, and sensitive companies have begun to pay attention to the integration of IR and PR;

Finally, the lines between investment goods and consumer goods are beginning to become more blurred. Between 2015 and 2021, more than half of all funding accounts will come from newbies. The entry of younger generations not only affects the complexity of the market, but also the investment culture. The NFT mania of the past year can be traced back to this group of very young investors, as investment and equity become a means of self-expression.

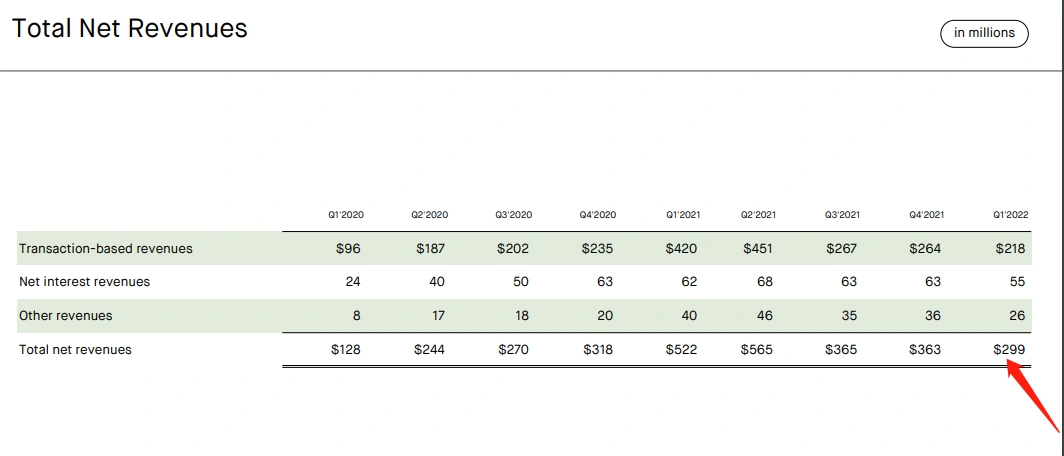

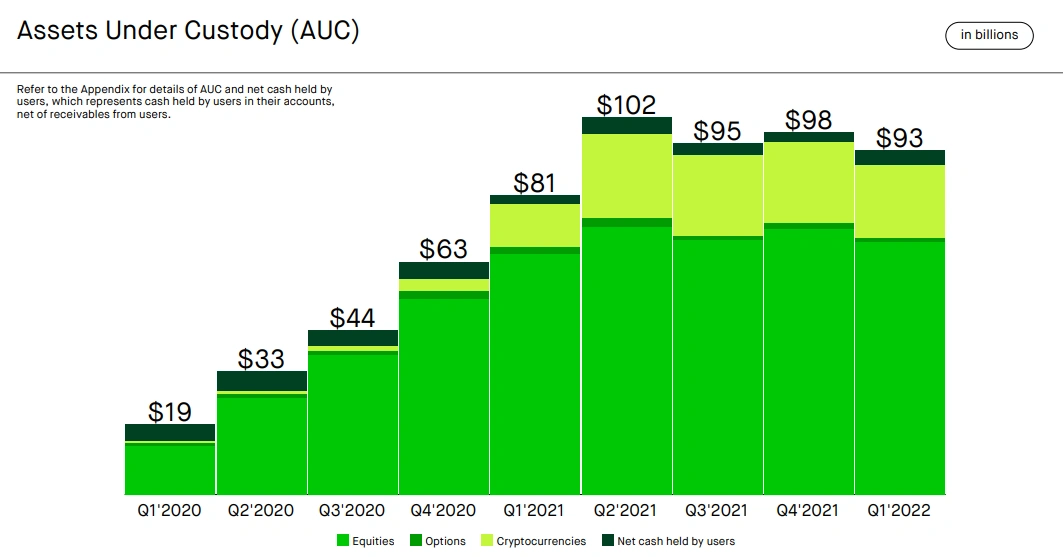

Status: The mad cow is gone, the situation is not good

Judging from the first quarter report of this year, monthly active users fell by 25% year-on-year, and platform revenue decreased by 47% year-on-year. Shares have fallen 80% from their IPO highs last year.

2. Robin Hood typical user portrait

With more than 13 million users with an average age of 31, Robinhood is positioning itself as ideal for younger investors looking to get in the game -- even if it means making small investments through fractional shares.

According to Robinhood CEO Vladimir Tenev, the median customer account size is $240, while the average account size is about $5,000. By comparison, before E-Trade was acquired by Morgan Stanley in 2020, the company's average brokerage account value was estimated to be around $69,000. The average account value at Morgan Stanley is even higher, at about $175,000.

In terms of customer acquisition costs, Robinhood's average cost to acquire a new funding account fell 60% from $53 in fiscal 2019 to $20 in fiscal 2020. Average customer acquisition cost halved from $32 to $15 in 2020 and Q1 2021.

In 2018, E-Trade spent $170M to purchase over 1M brokerage accounts (representing $18B in assets) from Capital One Financial, which were valued at approximately $170 each. Discussing the deal on a conference call, an E-Trade executive said it was "well below our typical customer acquisition costs for our broad clientele that meet our target profile," suggesting that E-Trade's customer acquisition The cost is usually higher than the $170 it pays for each brokerage account.

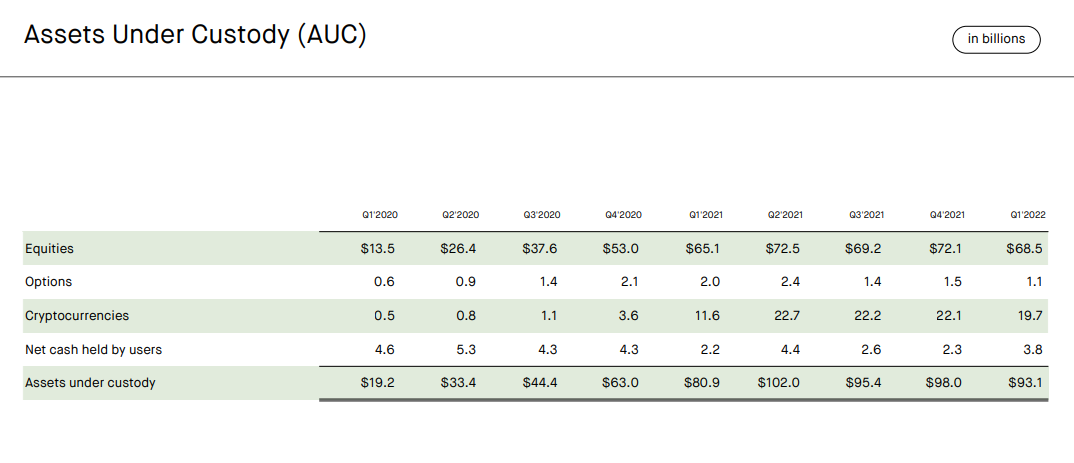

3. Robinhood transaction encryption service

Launched in 2018, Robinhood Crypto competes directly with cryptocurrency brokerages such as Coinbase, with Robinhood's advantage in offering commission-free trading. In 1Q21, 9.5 million customers traded cryptocurrencies such as Bitcoin, Ethereum and Dogecoin on the platform - a 458% increase from the previous quarter. At the end of the first quarter of 2022, the scale of encrypted assets deposited on the company's platform reached nearly 20 billion U.S. dollars, while the scale of encrypted assets deposited on the Coinbase platform during the same period was 256 billion U.S. dollars. Where Robinhood Crypto is relatively weak is its lack of transfer or withdrawal features: customers currently cannot transfer their crypto assets into or out of their accounts.

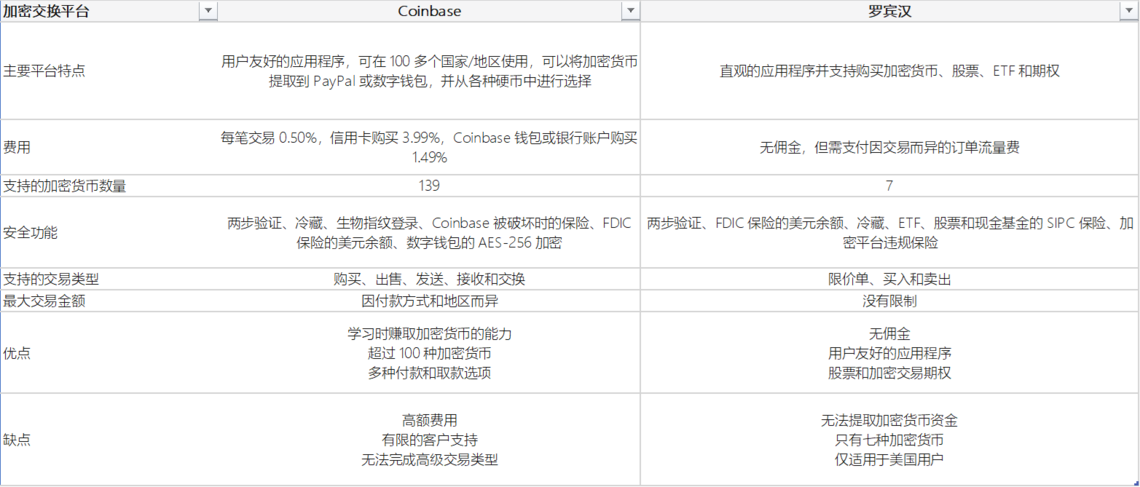

The main advantages and disadvantages of Robinhood and Coinbase trading cryptocurrency are as follows:

Both platforms operate similarly, allowing users to create accounts using a simple registration process and similar verification measures. Robinhood hands trades to market makers for execution and charges investors an order flow fee. After linking bank accounts, customers can buy cryptocurrencies, but they cannot be transferred to digital wallets until they are sold for cash.

In contrast, Coinbase is an online cryptocurrency exchange where customers have full control over their coins and can withdraw them to digital or cold wallets at any time.

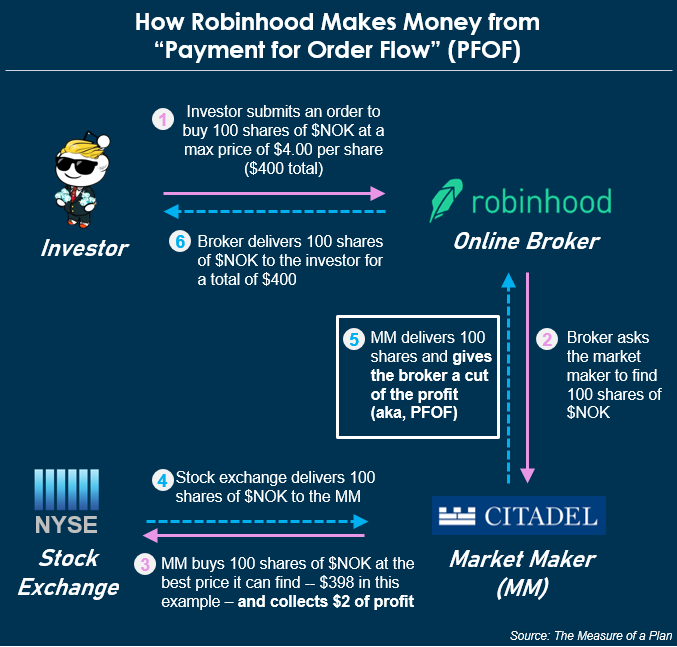

4. Order Flow (PFOF) Trading Mode

Robinhood uses PFOF (payment for order flow) to execute transactions. PFOF is a controversial practice in which brokers instruct third parties known as "market makers" to execute trades on their behalf. For Robinhood, the process looks like this:

First, investors place orders to buy or sell stocks or cryptocurrencies through the Robinhood app.

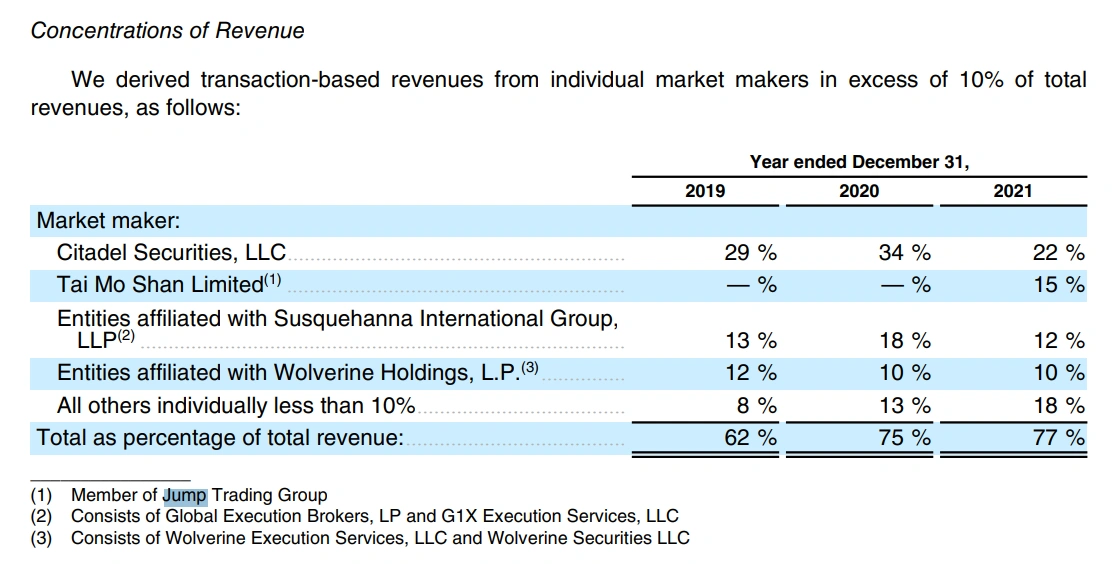

Next, Robinhood passes that order on to a market maker like Citadel Securities or Coinbase, which actually executes the trade. Market makers pay Robinhood a kickback fee — usually fractions of a cent — for those orders.

Finally, the trades are executed by market makers, who make a profit by buying shares for slightly less than they were sold for.

Market makers "generally have more information and processing power than retail traders and brokers," the SEC said. In theory, this makes them ideal intermediaries for large deals. But PFOF, pioneered by disgraced former investment banker Bernie Madoff, has been controversial for its lack of transparency.

Under SEC Rule 605, market makers are legally obliged to provide the best possible quality of execution for each trade. "Execution quality" refers to how close the strike price (the actual cost of a security, not its theoretical price) is to the bid or ask price of the security. But while market makers are legally compelled to seek the best possible trade execution for their clients, they are not compelled to offer the best possible price. This can lead to market makers executing trades at prices that are favorable to them, but may not be in the best interests of traders.

Robinhood is not the only broker utilizing PFOF. Other brokerages such as Charles Schwab and E-Trade also make money from PFOF, although much less than Robinhood -- PFOF accounts for only 3% of Schwab's revenue and 17% of E-Trade's revenue. Before its acquisition by Schwab in 2019, TD Ameritrade reported that its order flow payout was around 0.1 cents per share, while E-Trade reported similar figures.

Robinhood's heavy reliance on PFOF has created serious legal problems for it. In December 2019, the Financial Industry Regulatory Authority (FINRA) fined Robinhood $1.25 million for "best execution violations," and in December 2020 the SEC charged the firm with misleading its customers and fined it $65 million fine.

Appendix 1: Accounting Arrangements for Cryptoassets

From Robin Hood's 2021 Annual Report:

We act as an agent in the user's cryptocurrency transactions. We have established that we are an agent because we do not control the cryptocurrencies prior to delivery to our users, we are not primarily responsible for delivering cryptocurrencies to our users, and we do not face risks arising from the market price of cryptocurrencies prior to delivery to our customers. Volatility, we do not set the price charged to users. After purchasing cryptocurrencies on the platform, the user is its legal owner, and we and the cryptocurrencies hosted by the user have all rights and interests of ownership, including the right to appreciate and depreciate the cryptocurrencies. Therefore, the cryptocurrencies we hold on behalf of our users are not reflected in our balance sheet.

Appendix 2: Robin Hood Crypto Wallet and Robin Hood 3

Through Robin Hood 3, users can hold cryptocurrencies held by SELF CUSTODY, but users can use mnemonic words through Robin Hood; at the same time, they have the silky experience of CEX; and can experience cryptocurrency transactions, P2P transfers and DEFI through the tactile experience of the interface multiple functions.

Appendix 3: Investors