This week's summary:

- The correlation between Bitcoin and the U.S. stock market continued to decline last week, with the U.S. stock market rebounding while Bitcoin remained low. This shows what? How will the market react?

- The FOMC will start shrinking its balance sheet in June. Will it bring a catastrophe to the US stock market and cryptocurrency market?

- Terra 2.0 is about to launch after LUNA collapsed, can Terra be brought back to life?

1. Last week's industry trends:

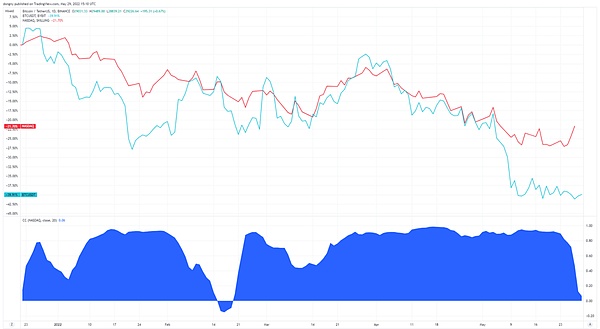

This week, the encryption market as a whole is still weak, and has experienced the eighth consecutive week of decline. Especially in the case of the recovery of the US stock market this week, there has been a rare decoupling between the encryption market and the US stock market, which has lasted for nearly three months. After the high correlation between Bitcoin and US stocks this week, the 20-day correlation fell below 0.5, showing the opposite trend. As of writing, Bitcoin closed at $29,214.4, down 2.1% from last week, while Ethereum performed relatively poorly. This week, it closed at $1,797, down 10% from last week.

In terms of news, this week’s encryption market is a bit dull. First, Terra 2.0 is officially launched this week. Late-stage speculative participants in LUNA will more or less gain part of the gains, but early-stage participants may only recover 10% of their losses (details See the Terra section). Secondly, the Move to Earn project STEPN announced the cancellation of users in China, and GMT dropped by more than 40% within two days. The STEPN team pointed out that China’s supervision on GPS is one of the important reasons for this cancellation, and also pointed out that mainland Chinese users accounted for the majority of the platform 5% of its user base, and suggested the move would not have a significant impact on its financial success.

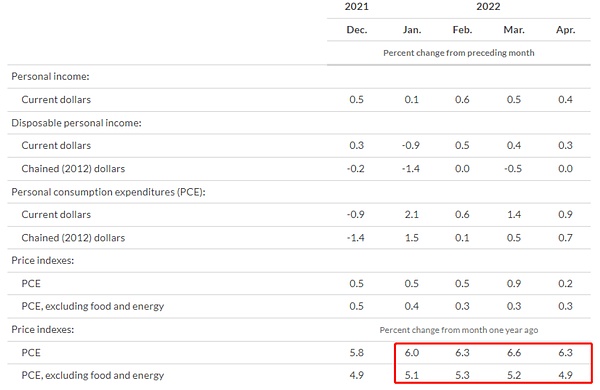

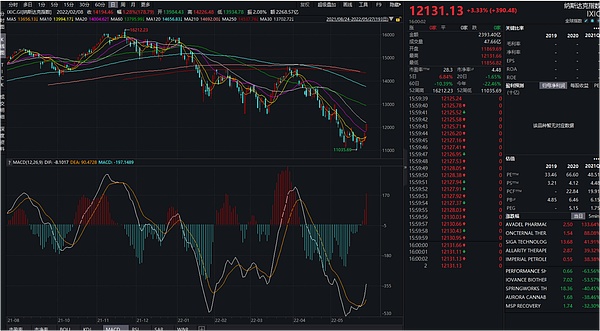

In contrast, U.S. stocks rebounded strongly last week after falling for seven consecutive weeks. The Nasdaq Composite rose nearly 6% in a week, standing on the 5-day line, 10-day line and 20-day line respectively. The market is turning to short-term strength. The main reason for the rebound in US stocks is the cooling of inflation. The PCE data released by the US Department of Commerce in April was 6.3, a drop from March. If food and energy are deducted, the core PCE is 4.9%. Since February It gradually fell back. A comparison of these two data found that food contributed a lot to the rise in PCE in April, indicating that residents are gradually expanding consumption. The Ministry of Commerce also reported that personal income increased by 0.4%, a slight decrease from March. When the growth rate of personal income stops growing, it means that the labor cost of enterprises will stabilize and profits will come out. For the encryption market, whether it can take advantage of the current short-term positive wind of the stock market is the key to the short-term rise in cryptocurrency prices. The obvious anti-fall effect of Bitcoin compared with other currencies this week also shows that the layout of institutions in it far exceeds that of other currencies.

2. Macro and analysis:

As we expected, Nasdaq rebounded strongly after the weekly line came out of nine consecutive negative days. However, due to the overall liquidity contraction, it has a strong water absorption effect on other risky assets, which eventually led to the decline of the digital currency market.

We judge that BTC will face a rebound in the future, and the rebound is weaker than that of the Nasdaq. If the Nasdaq continues to rebound, then BTC will recover 30,000 USDT and stand above 30,000 USDT.

BTC did not fall below the previous low point, and it will go sideways at around 30,000 USDT, and the possibility of a short-term sharp drop is small.

ETH did not fall below the previous box, and the trend followed BTC. Because of the relationship between Defi and ETH, we recommend paying close attention to ETH when it falls. It is not ruled out that if it falls sharply, it will happen in March 2020.

U.S. bond interest rate: The 2-year U.S. bond basically peaked and fell, reflecting the Fed’s expectation that the interest rate will reach more than 2.5% before the end of the year, and the possibility of a subsequent sharp jump is less.

U.S. bond interest rate: The 2-year U.S. bond basically peaked and fell, reflecting the Fed’s expectation that the interest rate will reach more than 2.5% before the end of the year, and the possibility of a subsequent sharp jump is less.

1. Technical indicators:

1) Arh999: 0.549, we still recommend that you can gradually buy at this position, and the probability of making a profit after holding it for 1-2 years is very high.

2) MVRV: 1.253, the cost performance is the same as Ahr999.

3) The number of BTC holding addresses: the number of addresses holding less than 10 coins is quickly entering the market, and the number of addresses holding more than 10 coins is basically sideways, but we can see that the number of addresses holding 10k coins has increased, and it has increased since April About 10 addresses count.

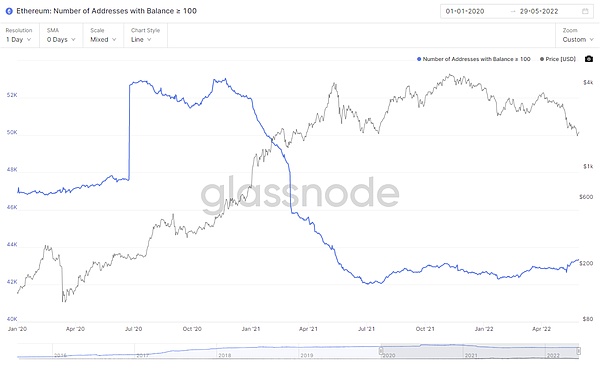

4) Changes in the number of ETH addresses: the number of addresses holding less than 100 coins has increased, but the number of addresses holding more than 100 coins has remained stable overall.

2. Summary:

3. Summary of investment and financing:

3. Summary of investment and financing:

1. Overall review of the market

• During the reporting period, 30 investment and financing events were disclosed, with a financing of approximately US$3.9 billion. In terms of specific tracks, the 14 projects of the Web 3.0 track accounted for nearly 50%, followed by the Defi and Cefi tracks with 7 projects and 5 projects respectively. Among them, there is one project that has raised more than 100 million yuan in financing, that is, StarkWare, an Israel-based Ethereum Layer 2 development company, completed a 100 million US dollar investment led by GreenoaksCapital and Coatue, followed by existing investors such as TigerGlobal, SequoiaCapital, Paradigm, etc. USD Series D financing.

2. Organization of the week

1) a16z: Will the fourth quarter become the next market highlight moment

• During the reporting period, a16z completed the $4.5 billion fundraising of Crypto Fund IV, of which about $1.5 billion will be used for seed round projects, and the remaining $3 billion will be invested in venture rounds and subsequent projects;

• Investment directions include: Web 3.0, Games, Defi, Layer 1/Layer 2 Infrastructures, Bridges, DAOs&Governance, NFTcommunities, privacy, creator monetization, new applications of ZK proofs, etc.;

•Enabling areas include: providing research and technical support for invested project teams, security management (key management, smart contract audit, etc.), talent introduction, legal supervision and market resource injection, etc.;

• As of now, the total amount deployed by a16z in the field of crypto/Web 3.0/Game exceeds USD 8 billion,It is not difficult to find that the previous crypto-themed funds issued by a16z all occurred 1-2 months after the market fell sharply, a16z injects confidence into the market and participants by announcing the news of successful fundraising when the market is in a downturn, and also reserves "food and grass" for the "winter" of the crypto market;

• For two consecutive years in 2020 and 2021, after a16z announced the completion of fundraising in the middle of the year, the market rose to varying degrees in the fourth quarter of that year.1.Layer2 expansion

4. Encrypted ecological tracking:

1.Layer2 expansion

1)StarkWare:

• StarkWare recently completed a $100 million Series D financing at a valuation of $8 billion, led by Greenoaks and Coatue. It completed a US$50 million Series C round of financing at a valuation of US$3 billion in November 2021. Its current investment lineup covers Sequoia Capital, Paradigm, Three Arrows Capital, Alameda Research, etc.

• StarkWare is the Layer 2 solution technology provider behind the well-known projects dYdX, ImmutableX, DiversiFi and other Layer 2 projects. StarkWare generates and verifies the proof of computational integrity through zk-Rollup and Validium mode, which greatly improves TPS and reduces Gas Fee. In practice, DiversiFi’s TPS can reach 18,000, Immutable’s NFT casting costs only 0.2 cents, and dYdX’s Finality can reach the second level. These improvements have brought users an excellent experience.

• StarkWare was born in May 2018. Its team is composed of world-class cryptographers and scientists. The core member is the former chief scientist of Zcash and the pioneer who brought ZK-SNARK into people's vision.

• StarkWare currently has three product lines, namely StarkEx, StarkNet and Cario, which are the early ZK-STARK solution, the more mature solution and the Turing-complete virtual machine Cairo. There are currently more than 50 projects developed and deployed on StarkNet, and they can be connected to Ethereum through a cross-chain bridge.

•At present, StarkWare’s products have no tokens released, and StarkNet officially stated that in the third or fourth quarter of 2022, StarkNet may be handed over to community governance, that is, operated through DAO, and decentralized governance is inseparable Therefore, there is reason to believe that StarkNet may have a plan to release tokens.

2)Celer

• The Celer cross-chain message (CelerIM) framework has been launched on the main network. Developers can use the Celer cross-chain message SDK to build cross-chain dApps. Specifically, CelerIM can be understood as an open, plug-and-play message cross-chain component , any new or existing Dapp can be integrated with CelerIM through a simple plug-in contract, thus transforming into a "native cross-chain Dapp" without adjusting the deployed code.

• Celer's cross-chain bridge cBridge has currently integrated 30+ blockchains such as Arbitrum, Optimism, BNBChain, Avalanche, and Fantom, and supports hundreds of tokens such as USDT, USDC, and ETH.

2. NFT

1) NFT dynamic summary:

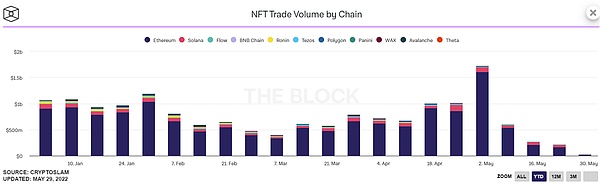

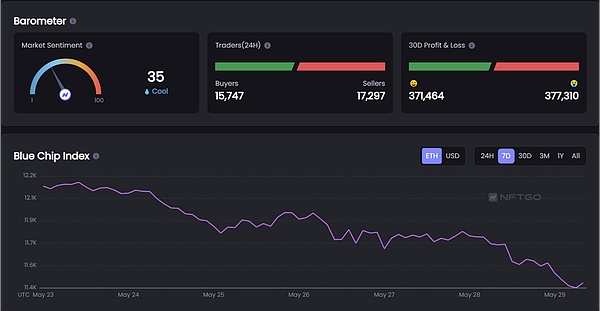

•In the past week, the overall NFT market transaction volume continued to decline, and the transactions in different markets and chains were still shrinking rapidly.

• At this stage, the emotional side of the NFT market is also cooling down as the encryption market continues to cool down. Even the top blue-chip projects are losing their attractiveness rapidly. At this stage, the market is more optimistic than ever before about projects with sustained community influence .

1) Overseas NFT project of the week: MoonDAO

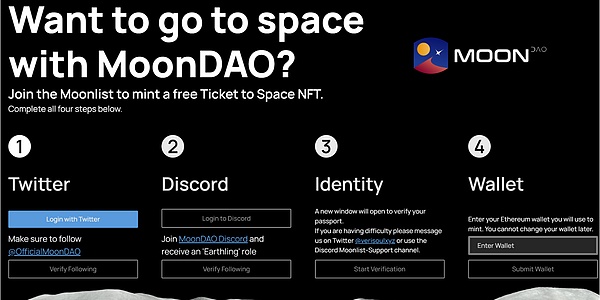

• MoonDAO was established in November 2021 with the mission of decentralizing access to space research and exploration. Launched on Juicebox, MoonDAO had an initial fundraising goal of $450,000 to send members into space and was a huge success, raising 2,623 ETH from the community (equivalent to $8.3 million in crowdfunding).

• Backed by MoonDAO's governance token $MOONEY, the community currently has over $40 million in funding and has successfully purchased 2 tickets to space from Blue Origin. This represents MoonDAO's first major milestone in space exploration, but it is only the first step in MoonDAO's multi-year roadmap in the future. It will also fund and coordinate its own space program in the future, no longer relying on other people's rockets, like NASA It also outsources certain rocket development to private companies, and later MoonDAO will use these new governance and coordination tools to form a more perfect alliance (Moon Colony), extending the rights and freedom of every person on Earth to the entire solar system.

• As of May 29, more than 50,000 people have participated in pre-ordering the first free NFT of space tickets launched by MoonDAO. The number of NFT issued is 9,060. In addition to receiving massive MoonDAO governance token airdrops, an NFT holder will be randomly selected to take off on the Blue Origin "New Shepard" rocket in July this year. In addition, MoonDAO has successfully held the first thousand-person metaverse AMA in Decentraland, and announced a series of MoonDAO space metaverse plans, and the governance token Mooney will also become its only hard currency.

• At 8:00 am PST on Sunday, June 3rd, MoonDAO will issue a space NFT collectible ticket, and the holder will have the opportunity to travel to space. The winners will have the chance to fly into space—provided each meets Blue Origin's flight requirements. Ticket holders will also be airdropped $MOONEY, the DAO’s governance token, so they can vote on issues within the DAO.

3) NFT-related financing:

1) Data review

3. GameFi chain games:

1) Data review

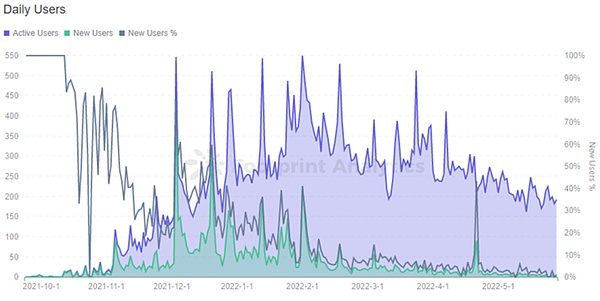

• In May 2022, the performance of Gamefi concept tokens such as SAND, GALA, FLOW, and AXS was sluggish, with a drop of about 50%, significantly underperforming BTC price fluctuations, among which SLP and TLM tokens fell by more than 60%;

• The downturn in the market has seriously affected the revenue of the game, which has directly led to the enthusiasm of game players to participate. Since 2022, the number of new game users has continued to decline, and the average daily number of new users in May is basically around 2%.

•GameFi platform GEMS announced that it has received a $50 million investment commitment from GEM Digital Limited (“GEM Group”), a digital asset investment company in the Bahamas. Up to now, GEMS has reached partnerships with more than 80 blockchain and e-sports companies, and will further enhance products and expand the ecosystem globally (mainly in Asia);

•GameFi platform GEMS announced that it has received a $50 million investment commitment from GEM Digital Limited (“GEM Group”), a digital asset investment company in the Bahamas. Up to now, GEMS has reached partnerships with more than 80 blockchain and e-sports companies, and will further enhance products and expand the ecosystem globally (mainly in Asia);

•Rich online business models, suitable for more participantsandNFT MarketplaceandDeFiUnion, which introduces a variety of payment models and loans, allowing players to purchase expensive NFTs through a variety of financial solutions; FanFiStudio, which recruits, trains, and authorizes aspiring GameFi gamers; and create opportunities for in-game communities; Arena, where players can gather online to play games, form teams and fight others in matches;

•"Disney" and "Universal Studios Model" to expand offline business and try to diversify income: GEMS combines the online system with offline business, that is, the online is the GEMS platform, and the offline refers to the hotel network all over Asia starting from Southeast Asia. The goal is to have 50 themed hotels within three years. Similar to Stepn's offline sports mode, even if the return on investment is no longer the only consideration for users, the improvement of physical condition has become an important motivating factor. GEMS allows players to obtain rewards in the game and exchange them for offline themed hotel points as the project's "non-currency Sexual income" mechanism, try to diversify the income;

•Reference conclusion: GEMS is the Gamefi project with the highest financing amount disclosed during the reporting period, and it provides players with more participation scenarios (games, lending, social networking, offline mapping, etc.), and the "bear market" stage can have such a large-scale fundraising amount. This shows that investors recognize the future development of the project. But does the investor's "funding commitment from GEM" also mean that the investor is currentlyWait and see with currency (funds), until the market or project development achieves a certain milestone1) Dynamic summary of the public chain:

4. Infrastructure infrastructure

1) Dynamic summary of the public chain:

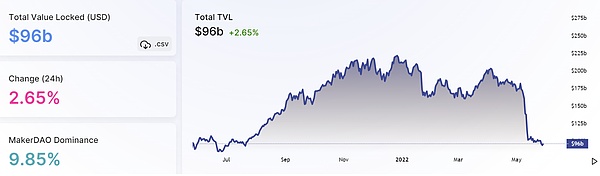

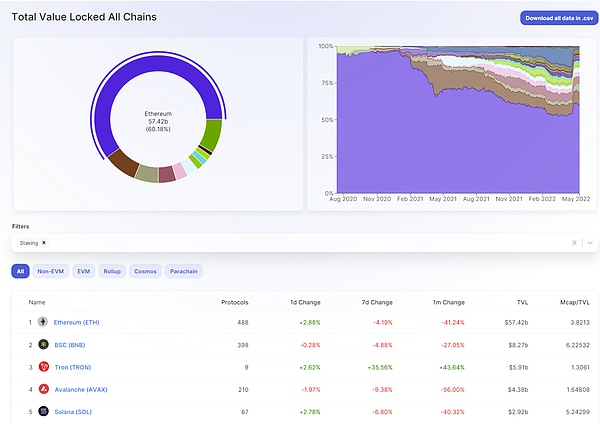

• The proportion of Ethereum increased slightly, from 59% last week to 60%. The top five rankings are unchanged.

• The proportion of Ethereum increased slightly, from 59% last week to 60%. The top five rankings are unchanged.

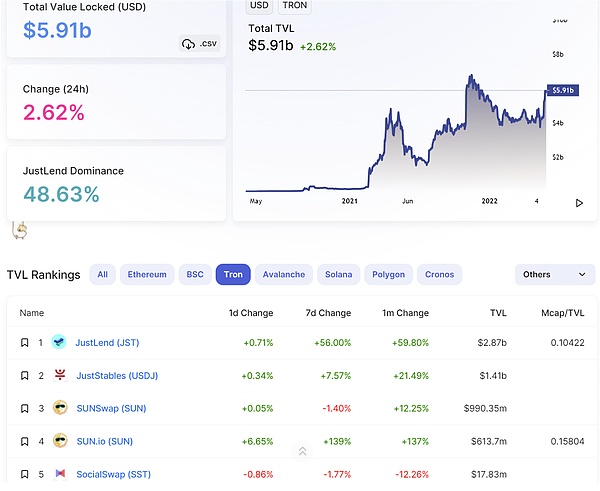

•Tron completes 3-week winning streak:

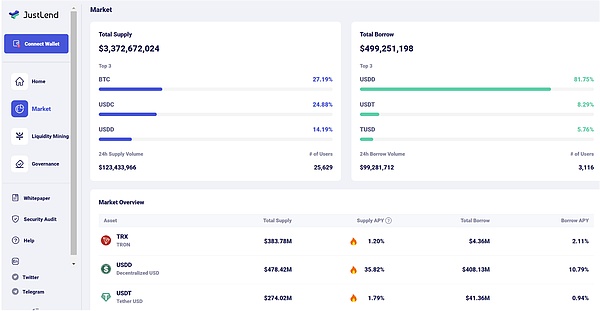

As can be seen from the details, JustLend has a TVL that is close to the average, and it has grown by more than 50% last week. From JustLend’s Market, we can see that the supply and burrow APY of USDD are 35.83% and 10.79% respectively, which is comparable to the high rate of return of UST in the LUNA ecosystem in the early days. Although this will be very beneficial to the value of the ecological native currency in the early stage And the rise of algorithmic stablecoins, but the excessive returns will definitely repay their costs in the later stage.

For an analysis of algorithmic stablecoins and Waves, another controversial ecology, please check our column.

2) Public chain ecology:

•Terra

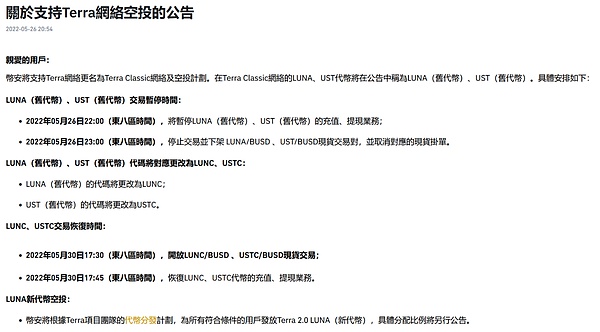

On May 28, the Terra 2.0 mainnet Pheonix-1 was officially launched and started to produce blocks. Its new token, LUNA, also completed airdrops and started trading on many exchanges, including KuCoin, OKX, and Matcha. It will go live later, scheduled for May 30.

The current price of LUNA is about US$6, and the highest price has exceeded US$18 after listing. The price fluctuates greatly, so it is not recommended to participate.

The old LUNA and UST (currently named LUNC and USTC) airdrop calculation rules are as follows:

Most of the LUNA will only unlock 30% during the airdrop, and the rest will be unlocked linearly within 1-2 years after 6 months. The released LUNA will continue to be airdropped to the user's wallet.

How attractive is Terra, which has lost the algorithmic stablecoin UST, and whether there are developers and users who are willing to believe in it after a huge failure is temporarily doubtful. The current competition in the public chain track is already very fierce. For developers, there is no reason to stay in Terra. There are many platform-based public chains and cross-chain ecosystems for them to choose from, and users migrate with their income. Lack of motivation to stay.

At present, most Terra Classic projects have announced that they will join Terra 2.0, but some projects have announced that they will rebuild on other chains, including:

Sports game project Fanfury announced that it will migrate to Juno Network;

Mars, a decentralized lending protocol based on Terra, announced that it will establish a new chain called Mars Hub in Cosmos;

Terra income aggregator Apollo release area update, multi-chain deployment, rebuild focus on the Cosmos ecosystem;

Loop Finance, the DEX and NFT market on Terra, has been migrated to Juno Network.

5.DAO Decentralized Autonomous Organization

5.DAO Decentralized Autonomous Organization

•Commonwealth

Commonwealth, the infrastructure platform of DAO, completed a financing of 20 million US dollars. Investors include SparkCapital, Polychain, Jump, Wintermute and BitDAO. It is reported that this round of financing will be used to promote its further development and decentralization, and the platform aims to become the ultimate community management platform for DAOs.

Commonwealth allows DAOs to easily deploy governance contracts, initiate crowdsales, and provide chat and on-chain notifications for DAO members to interact. In the future, it plans to launch an application store for DAO, so that each community can choose the functions they need.

The platform already has over 60,000 active users in over 700 decentralized communities across projects such as dYdX, AxieInfinity, NEAR, Solana, BitDAO, and Polygon. Common is expected to launch its own token, CMN.

In May 2021, Common completed a seed round of financing of US$3.2 million. Investors include Dragonfly Capital, ParaFiCapital, Hashed and other institutions. In addition, Do Kwon is also one of its angel investors.

As a new form of work and governance, DAO is a possible new form of company in the Web3 world, and the platform that provides infrastructure and services for it is an indispensable tool and has high investment value.

5. JZL team news:

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

We are always looking for creative ideas, business and cooperation opportunities, welcome to contact us and subscribe on JZL official website. We also look forward to your reading feedback. If there are obvious facts, understandings or data errors in the above content, please contact us for correction.