According to Odaily’s incomplete statistics, a total of 31 domestic and overseas blockchain financing incidents were announced in the week from May 2nd to May 8th, a decrease from the previous week; There has been a substantial decline.

The largest single-funded deal in the past week was payment startup Kevin ($65 million). In addition, more noteworthy investment projects include NFT startup Zora ($50 million), chain game company Irreverent Labs ($40 million), and Web3 media company Decrypt ($10 million).

The following are the specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain)

*Payments startup Kevin completes $65 million Series A round led by Accel

Lithuanian fintech start-up Kevin announced on Tuesday that it completed a $65 million Series A round led by Accel, Eurazeo, OTB Ventures, Speedinvest, OpenOcean, Global Paytech Ventures, and 20VC founder Harry Stebbings, Supercell CEO and co-founder Ilkka Paananen, Venmo Angel investors including former CEO Amitabh Jhawar participated in the investment. The Block)

NFT startup Zora announced on Thursday that it has completed a $50 million seed round of financing at a valuation of $600 million, led by Haun Ventures, with participation from Coinbase Ventures and Kindred Ventures. It is reported that Haun Ventures is a Web3 venture capital institution founded by a16z general partner Katie Haun, and this is its first capital injection.

It is reported that Zora completed US$8 million in equity financing in March 2021, and then raised another US$2 million in October. (CoinDesk)

According to the US SEC’s filing on Friday, the chain game company Irreverent Labs recently completed a financing of US$40 million, and a total of 11 investors participated in the equity and option financing.

Irreverent Labs, helmed by esports veteran Rahul Sood, has previously attracted investment from a16z and Chainsmokers venture funds, and completed a $5 million financing in November last year. (CoinDesk)

Open-source data platform Prisma completes $40 million Series B financing led by Altimeter

According to official news, Prisma, an open source data platform, announced the completion of a $40 million Series B round of financing, led by Altimeter, with participation from Amplify Partners and Kleiner Perkins, and angel investors including founding members of companies such as Vercel, PlanetScale, GitHub, and SourceGraph.

Prisma is an open source data platform designed to bring developers, data owners and infrastructure teams together to share data across organizations and teams, and to solve problems between front-end and back-end teams as well as between data engineers, developers and Barriers among business analysts in the development process.

According to official news, Bitcoin.com announced the completion of a $33.6 million VERSE token private placement financing, Digital Strategies, KuCoin Ventures, Blockchain.com, ViaBTC Capital, Redwood City Ventures, 4SV, BoostX Ventures, Roger Ver, Jihan Wu, David Wachsman, etc. Participate in voting.

It is reported that VERSE is a reward and utility token for Bitcoin.com ecosystem contributors and participants, with a total supply of 12.6 billion. The VERSE Token Public Sale is scheduled to begin in June 2022 and will be launched as the first token project on the Bitcoin.com Verse Launchpad and will sell tokens representing 6% of the total supply.

Copper Raises $29M in Series A Funding Led by Fiat Ventures

Copper, a financial technology service and financial literacy platform for teenagers, announced that it has received US$29 million in Series A financing, led by Fiat Ventures, and participated by Panoramic Ventures, Insight Partners, Invesco Private Capital and other institutions.

Since its establishment in 2019, Copper has raised a total of US$42.3 million and has more than 800,000 registered users. It mainly provides personalized debit cards, digital wallet support, P2P transfers, and financial tips on dividends, budgeting, and compound interest. (Techcrunch)

Metaverse game Untamed Planet completes $24.3 million in financing led by Animoca Brands

Untamed Planet, a 3D immersive game based on metaverse and NFT concepts, has completed $24.3 million in financing, led by Animoca Brands.

As part of the partnership, Untamed Planet and Animoca Brands will develop and co-publish the metaverse game Untamed Metaverse, with Nway, a subsidiary of Animoca Brands, providing development support for the game. (Venturebeat)

Chain game platform LootRush completes USD 12 million seed round financing led by Paradigm

Blockchain game platform LootRush completed a $12 million seed round of financing, led by Paradigm, and participated by a16z and Y Combinator.

LootRush provides a quick-start platform for blockchain games, and also provides NFT rental services for games, aiming to lower the threshold for new game players and earn income for NFT owners. Currently, the LootRush platform only supports the Axie Infinity game, and plans to support more games such as CryptoKitties and NBA Top Shot. (CoinDesk)

Founded social and mobile game company DGN Games in 2014. (The Block)

3D Content Creation Platform Kinetix Closes $11M Funding Led by Adam Ghobarah

Kinetix, an artificial intelligence 3D content creation platform, completed an $11 million seed round of financing, led by Adam Ghobarah, founder of Top Harvest Capital and former executive of Google and Google Ventures, with participation from The Sandbox and ZEPETO (NAVER Z).

It is reported that Kinetix aims to provide a platform to help users in the Metaverse generate content, making creation fast and easy. (globenewswire)

Web3 Media Company Decrypt Raises $10M at $50M Post-Money Valuation

News Decrypt announced that it has completed a financing of 10 million US dollars with a post-investment valuation of 50 million US dollars, and has been spun off from ConsenSys Mesh to become an independent Web3 media company.

The new financing will be used to expand the team of journalists, strengthen the video and live broadcast activities, invest in the production arm of Decrypt Studios, and further develop PubDAO, a decentralized media project co-founded with other publishing partners.

Chain game studio Cometh completes USD 10 million seed round financing led by Ubisoft

Chain game studio Cometh completed a $10 million seed round of financing, led by venture firm White Star Capital, game giant Ubisoft (Ubisoft) and DeFi group Stake Capital, with participation from Serena Capital, Shima Capital and IDEO Colab Ventures. (The Block)

Chain game development studio InfiniGods completes $9 million in financing, led by Pantera Capital

InfiniGods, a chain game development studio, completed a $9 million seed round of financing, led by Pantera Capital, with participation from Framework Ventures, Jefferson Capital, Animoca Brands, and Double Peak.

It is reported that InfiniGods creates web and mobile games with mythological elements, and the gameplay includes puzzles, strategy and city building. InfiniGods intends to use the seed round funds to release three games in 2022, in addition to developing governance tokens, it also includes NFTs with in-game utility.

According to official news, Cassava Network, an African blockchain infrastructure ecosystem, has completed $8 million in financing, and more than 40 institutions including Dragonfly, CMT Digital, YGG, and Mirana participated in the financing.

It is reported that Cassava Network is committed to providing users with Web3 products and services including inclusive financial services, and will create a super traffic portal for users from Web2 to Web3. At present, a multi-chain wallet supporting Solana, ETH, and BNB Chain has been launched. Users can obtain reward points, conduct NFT transactions, and manage assets in the App.

Cassava will launch a series of AfriMyth NFTs that combine African traditional culture and cyberpunk style at the beginning of this month, which are free for users to collect. After synthesizing the collected NFT components, users can obtain multiple empowerments such as NFT airdrops and DeFi income.

Canadian digital asset trading platform VirgoCX completed a financing of 10 million Canadian dollars (about 7.8 million US dollars), led by Draper Dragon, and participated by Cobo Labs, OKX Blockdream Ventures, Molecular Group, Sora Ventures, and How Link Investment. The new financing will be used to promote VirgoCX's internationalization process, product development and other aspects.

It is reported that the cumulative transaction volume of VirgoCX in 2021 will reach 1 billion Canadian dollars (about 780 million U.S. dollars). It has released the global brand Virgo and will enter the Australian and British markets. In addition, Virgo also plans to launch an NFT liquidity aggregator in the second quarter of 2022. (Cointelegraph)

Americana Technologies, an NFT start-up company, announced the completion of a US$6.9 million seed round of financing, led by 776 Management, with participation from OpenSea and others, and angel investors including rapper Future.

Founded in 2021, Americana Technologies helps brands and creators transform physical goods such as streetwear, collectibles, cars, and artwork into NFTs. Its core product is an NFTA universal chip that can connect to physical objects and link them to NFTs. blockchain.

Founder Jake Frey said that he plans to use the funds to hire more engineers and designers to grow the 13-person team and develop a product that focuses on the physical performance of digital assets. Frey said the company currently only supports NFTs on the ethereum blockchain, but as it develops, the company is exploring integration with other chains such as Solana. (TechCrunch)

Decentralized asset management platform and social network Syndicate announced the completion of $6 million in financing, with more than 50 investors including a16z, South Park Commons, Carta Ledger, OpenSea, Circle Ventures, Polygon, United Talent Agency, CoinList, FalconX, Outliers VC DAO, etc. Fang participated in the vote.

It is reported that Syndicate allows anyone to create a "Web3 investment club" for on-chain and off-chain investment, including establishing a legal entity for their club.

The round brings the company’s total raised since its inception in January 2021 to $28 million. In August last year, Syndicate completed a US$20 million Series A financing, led by a16z, and over 150 investors including Atelier Ventures, Coinbase Ventures, and Snoop Dogg Ventures supported by BNP Paribas Group participated in the investment. (The Block)

Web3 social betting platform Stakes announced the completion of a US$5.3 million seed round of financing, with participation from Digital Currency Group (DCG), FBG Capital, CMS Holdings, LD Capital, Cadenza Ventures, Matrixport Ventures, and Sterling Select Group. At the same time, Sam Li, the former vice president of the NBA, served as an investor and strategic advisor.

According to reports, Stakes was established on IAC’s Newco incubator platform in January 2022. Its mission is to bring people together through sports and communities, allowing users to earn NFT rewards. (PR Newswire)

Bundlr Network announced the completion of a $5.2 million seed round of financing, led by Framework Ventures, Hypersphere Ventures, Arweave, and Permanent Ventures, with participation from OpenSea Ventures, Race Capital, and others. The new funds will be used to expand its team, especially in terms of business development, Rust developers, and marketing initiatives.

According to reports, Bundlr Network is an Arweave-based multi-chain expansion solution. The project team is currently building a set of tools designed to make it easier for users to upload and access files on the Arweave network. (PR Newswire)

Fintech firm Bnext secures $4.5 million additional investment from Borderless Capital

Borderless Capital invested an additional $4.5 million in Spanish fintech company Bnext, bringing its total investment to $10 million. The funds will be used to promote the DeFi ecosystem on Algorand.

It is reported that Spanish financial technology company Bnext aims to replace traditional banking business and raised a total of 11 million euros through token sales. (Globenewswire)

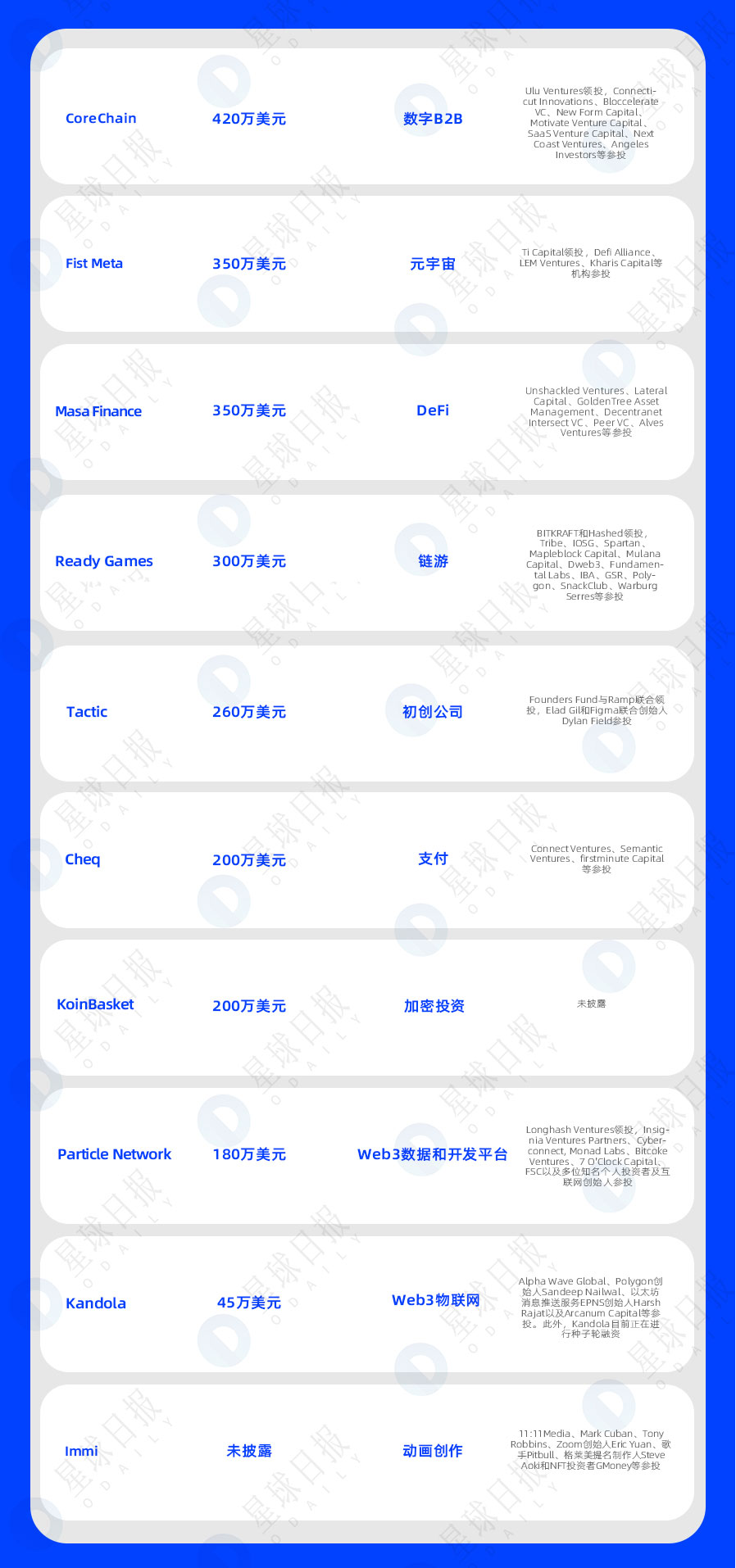

Digital B2B payment network CoreChain completes $4.2 million seed round led by Ulu Ventures

CoreChain, a blockchain-based digital B2B payment network, completed a $4.2 million seed round of financing led by Ulu Ventures, with participation from Connecticut Innovations, Bloccelerate VC, New Form Capital, Motivate Venture Capital, SaaS Venture Capital, Next Coast Ventures, and Angeles Investors cast. (Help Net Security)

News Fist Meta, the FIST ecological metaverse platform, completed a seed round of financing of US$3.5 million at a valuation of US$50 million. Ti Capital led the investment, and institutions such as Defi Alliance, LEM Ventures, and Kharis Capital participated in the investment.

Fist Meta will provide metaverse basic service facilities, and the new financing will be used to develop NFT trading platforms, large-scale interoperable metaverse games and virtual reality technology to promote the circulation and multi-chain value collection of metaverse assets represented by NFT , to provide basic services for the realization of Fist ecological diversification.

Masa Finance, a DeFi lending agreement, announced the completion of a $3.5 million Pre-Seed round of financing, with participation from Unshackled Ventures, Lateral Capital, GoldenTree Asset Management, Decentranet Intersect VC, Peer VC, and Alves Ventures.

Masa Finance is currently being built on Celo and Ethereum, and a beta version will be launched in the near future, with 36,000 registered users. Masa said in a statement that the next step would be a seed round. Subsequent funding will allow the company to hire more engineers, launch a product version of the protocol, conduct a public token sale, scale up node operators, and bring developers and lenders onto the platform. (TechCrunch)

Ready Games Completes $3 Million Financing Led by BITKRAFT and Hashed

News game startup Ready Games announced that it has raised $3 million through the AURA token sale, which will be used to develop the Web 3 mobile game department.

The financing was led by BITKRAFT and Hashed, with participation from Tribe, IOSG, Spartan, Mapleblock Capital, Mulana Capital, Dweb3, Fundamental Labs, IBA, GSR, Polygon, SnackClub, and Warburg Serres.

It is reported that the Web3 game division of Ready Games will focus on encouraging Web2 game programmers to explore and turn to Web3, while distributing games normally through traditional application stores (such as Apple App Store and Google Play Store). (CoinDesk

Tactic, a start-up company that helps companies manage and simplify cryptocurrency finances, today announced the completion of a $2.6 million seed round of funding, co-led by Founders Fund and Ramp, with participation from Elad Gil and Figma co-founder Dylan Field.

Tactic is addressing the accounting of a business’ cryptocurrency holdings and on-chain activity by aggregating data from disparate sources, giving businesses a “complete financial view of their balances and activity.” Tactic CEO Ann Jaskiw said Tactic has worked with accounting firms to help interpret accounting guidelines for DeFi-specific activities such as staking, NFT minting, and airdrops. (TechCrunch)

Encrypted payment start-up Cheq completed a $2 million Pre-Seed round of financing, with participation from Connect Ventures, Semantic Ventures, and firstminute Capital.

It is reported that Cheq hopes to enable cryptocurrency payments such as US dollar stablecoins in a user-friendly application. Users connect encrypted wallets to the platform and then use the application like a modern new type of bank. (Techcrunch)

Cryptocurrency Investment Startup KoinBasket Announces $2 Million Funding

KoinBasket, a cryptocurrency investment startup, announced the completion of an early-stage financing of $2 million. The Singapore-based company said the new financing will be used for product and geographic growth, technology investments, and team expansion. (Forkast)

Particle Network Completes $1.8 Million Pre-Seed Financing, Led by Longhash Ventures

Web3 data and development platform Particle Network announced the completion of US$1.8 million Pre-Seed financing, led by Longhash Ventures, Insignia Ventures Partners, Cyberconnect, Monad Labs, Bitcoke Ventures, 7 O'Clock Capital, FSC and many well-known individual investors and the Internet Founders participated. This round of financing will accelerate Particle Network's product launch and build a developer community.

Particle Network is a Web3 mobile application development and data platform for global developers. It aims to enable developers to develop scalable, multi-chain deployment, and high-reliability Web3 mobile applications without in-depth knowledge of blockchain technology. At the same time, it helps Developers organize and structure the data on the chain, and in this way help developers build user DIDs, so that product iterations and operations can be carried out in a targeted manner. Early Particle Network will focus on serving games and pan-game Web3 mobile application developers.

Web3 Internet of Things network Kandola completed a pre-seed round of financing of US$450,000, with participation from Alpha Wave Global, Polygon founder Sandeep Nailwal, Ethereum message push service EPNS founder Harsh Rajat, and Arcanum Capital. In addition, Kandola is currently conducting a seed round of financing.

Kandola Chief Marketing Officer Krithika said Web3 could be the tool to secure devices and ensure complete data privacy. However, Web3 currently has limitations in speed and cost, making it difficult to use for such real-world use cases. This gap is exactly what Kandola is solving: real-time messaging and storage without gas fees. (Cointelegraph)

Animation creation app Immi announced its official launch on the AppStore and completed a seed round of financing at a valuation of US$50 million. 11:11Media, Mark Cuban, Tony Robbins, Zoom founder Eric Yuan, singer Pitbull, Grammy-nominated producer Steve Aoki and NFT investor GMoney and others participated in the investment.

It is reported that Immi allows creators to use only their facial expressions to create animation content after selecting NFT characters, and plans to launch their own NFT characters. Currently, Immi provides nine character types, and each type provides two free characters, such as BoredApe#1398NFT and so on. (Reuters)

Indian social platform Hike completes a new round of financing led by Jump Crypto

The Indian social platform Hike announced the completion of a new round of financing, led by Jump Crypto, with participation from Tribe Capital and Republic Crypto. The financing amount was undisclosed. The financing was used to build the Rush Gaming Universe (RGU), a social gaming metaverse.

OKX Blockdream Ventures Strategically Invests in Klay Kingdoms

According to official news, OKX Blockdream Ventures announced a strategic investment in Metaverse GameFi platform Klay Kingdoms.

It is reported that Klay Kingdoms is a Metaverse GameFi/MetaFi project. While enjoying interesting strategic RPG games, users can use the DEX and NFT assets in the game to obtain additional income.