background

background

Unknowingly, nearly half a year has passed since Polkadot first opened the slot auction, and recently, with the auction going on, the 15th parachain has been connected to Polkadot.This means that the normalized slot auction has finally passed the initial exploration and is gradually on the right track。

Of course, it is precisely because of normalization that people need to know more about the first batch of slot auction teams, and the follow-up projects may have reached the point of fatigue, let alone awareness.

Therefore, we try to sort out the second batch of projects participating in the slot auction, so that everyone can understand the latest development of the current Polkadot ecology.

Compared with the development of other ecologies, Polkadot’s current progress will be relatively slow due to the threshold of parachain slot auctions, especially when the pressure of competition in the early stage is quite high.Because of this, the later projects may need more attention。

At the same time, we will briefly review the current changes in the Polkadot ecology due to the slot auction, and see how the slot auction can bring economic utility to the Polkadot ecology, especially the staking economy and the Polkadot slot auction. relationship, we will make a simple interpretation for readers.

The Second Batch of Slot Auctions

Polkadot’s first batch of slot auctions has been auctioned 5 times, and the winners are Acala, Moonbeam, Astar, Parallel, and Clover. We have already published the winners of the first batch of slots in "Polkadot's first round of slot auction ends, what role will the 5 parachains play?"Introduced in detail, so I won't go into details here.

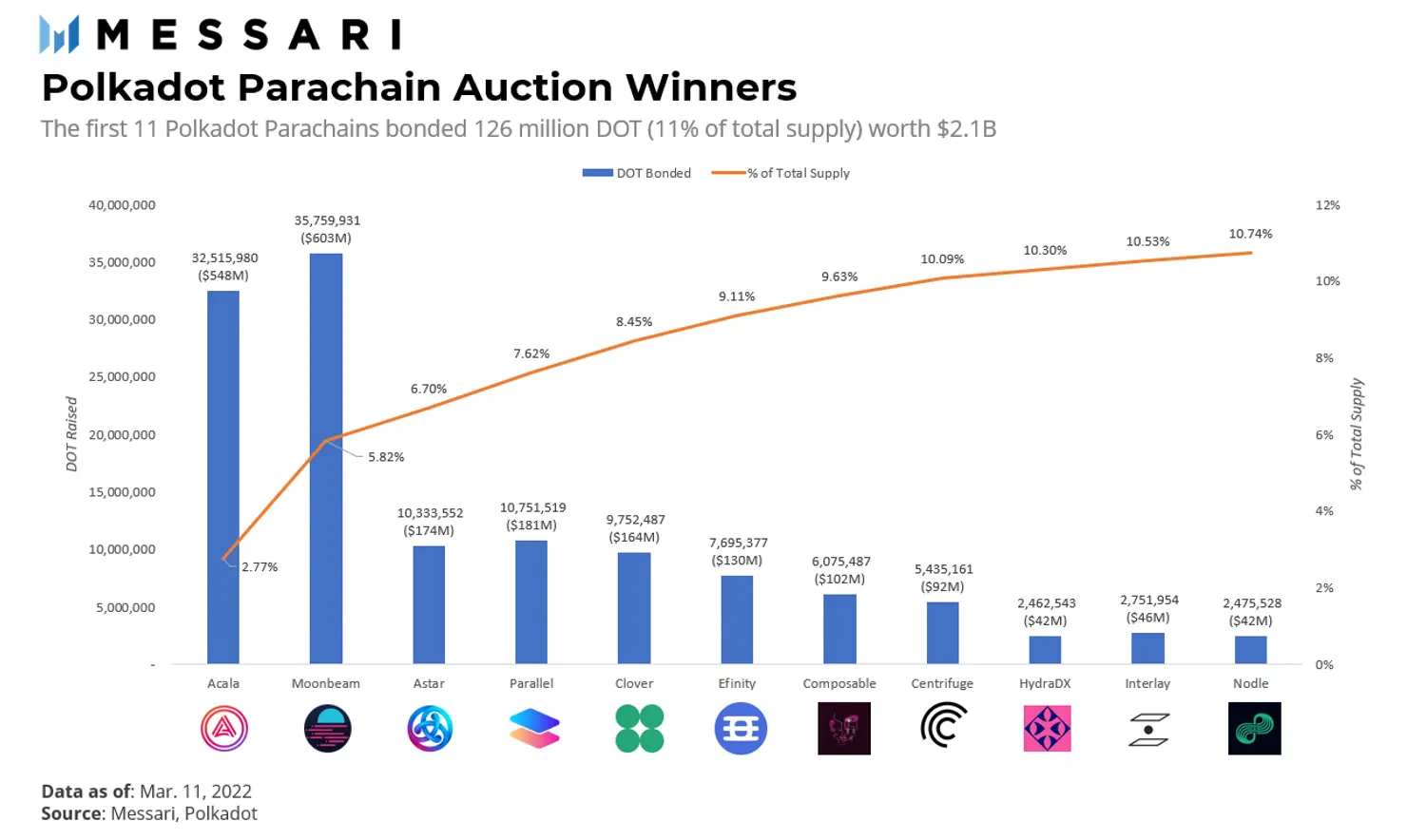

A total of 6 Auctions were conducted in Polkadot’s second slot auction batch, and the winners were Efinity, Centrifuge, Composable Finance, HydraDX, Interlay and Nodle,It has been connected to the Polkadot relay chain and launched the main network on March 12, 2022。

The first 11 parachains have locked 126 million DOTs (11% of the total supply) during the two-year lease period, but judging from the number of DOT auctions for 6-11 slots, it is obvious that there is a downward trend trend, and will become cheaper and cheaper.

but,

but,When the Polkadot ecology develops to the later stage and slots are scarce again, since the auction is a dynamic game, the cost of slots is likely to rise slowly again, but by that time, Polkadot still has parallel threads, and small teams can also access Polkadot at low cost through parallel threads.

Those who criticize Polkadot’s slot auction design has problems and feel that it is too expensive to join Polkadot’s ecology are self-defeating.

It should be noted that some rules of the Auction have changed since the 12th.

In the next 12 months, that is, 4 LPs, 7 Auctions in each LP

The top two winners in a batch can join the Polkadot network immediately, and the next five winners will join the Polkadot relay chain in the next LP

Auction open period: 27,000 blocks (less than 2 days)

A new auction starts every 172,800 blocks (12 days)

There are 73,800 blocks (about 5 days and 3 hours) between two auctions

Project review for the second batch of slots

Efinity

Efinity is a blockchain specially built for NFT in Polkadot released by Enjin, which aims to eliminate transaction friction and make NFT cross-chain to achieve platform aggregation.

Efinity is completely decentralized and open. Users do not need a blockchain wallet or pay transaction fees to bring any NFT in any blockchain to Efinity.

At the same time, Efinity will enhance the ease of use of NFT participating in the network. It is the world's first trustless NFT market and will motivate users who bring liquidity to NFT。

On March 31, 2021, Enjin completed US$18.9 million in financing through private placement to establish Efinity, the next-generation NFT blockchain based on Polkadot.

This round of financing was led by Crypto.com Capital, DFG Group, and Hashed, with participation from Hypersphere, BlockTower, Blockchain.com Ventures, Fenbushi, Iconium, HashKey, Arrington XRP Capital, and DeFi Alliance.

Currently, Efinity and Enjin are developing a cross-chain NFT marketplace called NFT.io, which provides a novel price discovery mechanism through Efinity.

Efinity also plans to establish a paratoken as a standard for token migration across different parallel chains in the Polkadot ecosystem, as well as a standard for entering and exiting Ethereum and other EVM systems。

In addition, Efinity will introduce novel user-friendly features and leverage Enjin's existing infrastructure to help projects build applications and games in Efinity. In the future, Efinity will also take the lead in the NFT field and achieve carbon-neutral NFT by 2030.

Efinity's launch of the Polkadot ecosystem will connect digital assets in the Enjin ecosystem to the Polkadot ecosystem, and provide support for the Polkadot ecosystem, Metaverse, blockchain games, decentralized infrastructure, NFT DApps, and more pioneering projects.

Provide a highly scalable solution for the NFT field, so that everyone can participate in the emerging NFT economy, and use its advantages to speed up the NFT subdivision track in the Polkadot ecosystem.

Centrifuge

Centrifuge is one of the first projects to launch a parachain on Polkadot, realizing the tokenization of real-world assets.

Its essence is a decentralized asset management protocol, a brand-new DeFi model that injects trillions of dollars of real asset value into DeFi. Users can place items such as invoices, houses, etc. on the blockchain to obtain loans.

Centrifuge has been favored by many top traditional and encrypted investment institutions.

In February 2021, Centrifuge completed a financing of US$4.3 million, led by Galaxy Digital and IOSG, and participated by Rockaway, Fintech Collective, Moonwhale, Fenbushi Capital, TRGC and HashCIB.

Not long ago, Centrifuge released a roadmap, planning to start and expand real-world asset pools on Centrifuge Chain, replacing Tinlake smart contracts on Ethereum.

at the same time

at the same timeBuild trust in real-world assets by building governance knowledge and tools for ecosystem members to accurately assess the risk of assets in the protocol and ensure that interest rates are set correctly, expand CFG usage scenarios, including fee mechanism, pledge mechanism, etc.

Centrifuge successfully connected to the Polkadot parachain, opened up real-world application scenarios for the Polkadot ecosystem, and provided the possibility of injecting into the encrypted field and obtaining liquidity for about 30 trillion locked and uncirculated funds around the world, and opened up the Polkadot ecosystem. Capacity for more liquid assets.

Composable Finance

Composable Finance is the hub of cross-chain interaction. It is a cross-chain, cross-layer and comprehensive DeFi infrastructure supported by Ethereum Layer2 and Polkadot.Its vision is to become the entry channel and network structure of the blockchain network, solving the pain points in the current DeFi interoperability, so as to realize the future of seamless interoperability。

Not long ago, Composable Finance announced the completion of more than $32 million in Series A financing, GSR, Tendermint Ventures, Fundamental Labs, Coinbase Ventures, LongHash Ventures, Figment VC, New Form Capital, Blockchain Capital, Yunt Capital, Jump Capital, Polytope Capital, NGC Ventures, SOSV and Spartan Group participated in the investment. The new funding will be used to expand the team and build products and further develop interoperability solutions.

Currently Composable Finance has launched Composable XCVM and Mosaic, an innovative and efficient cross-layer asset transfer solution. On Mosaic Bridge, Composable has successfully integrated other layer2 expansion solutions, including Arbitrium, Avalanch C-Chain, Polygon and the Ethereum mainnet.

In the future, Composable Finance will gradually solve the obstacles encountered in interoperability, enabling users to transfer their digital assets easily and freely.Become the preferred solution for Polkadot and Ethereum interoperability。

Composable Finance's access to the Polkadot ecosystem will establish a series of intuitive developer tools and decentralized communities for projects in the Polkadot ecosystem through smooth interaction, transmission, and communication.

Enables the transition from protocol to protocol interaction across ecosystems. It allows developers to build and deploy DApps more seamlessly.

HydraDX

HydraDX is a cross-chain liquidity protocol built on Substrate and deployed on Polkadot. Its goal is to establish the first multi-asset liquidity pool HydraDX Omnipool, providing users with a decentralized platform that supports frictionless interactions between all Crypto.

HydraDX started as a brainstorm at the Zee Prime Investment Conference, which means HydraDX was incubated and developed by Zee Prime.

The founder of HydraDX is also the founder of Zee Prime Capital, an investment fund under Zee Prime.And Zee Prime has invested in well-known projects including Polkadot, Solana, Hive, Acala, etc.。

In 2021, HydraDX completed a seed round financing of US$1.5 million, led by KR1 and Hypersphere, with participation from CMS Holdings, Tenzor Capital, DFG and other institutions.

The contributed DOT will be locked on Polkadot for 96 weeks and returned to KR1 after the respective HydraDX parachain lease is completed.

HydraDX is migrating from Snakenet to the Polkadot parachain, once the migration is complete, the HydraDX committee will launch a referendum to enable HDX token transfers。

In addition, HydraDX's research on Omnipool, a multiple liquidity pool, and the economic audit have been completed, and the remaining work of Omnipool will be implemented in order to achieve the first implementation of Omnipool as soon as possible.

The biggest innovation of HydraDX is to put all the tokens in one liquidity pool, allowing single or multiple assets to be added, and solving the problem of weak liquidity.The HydraDX protocol will mint HDX as a medium to determine relative value。

HDX will provide 50% of the initial value of the liquidity pool, and the other 50% will be composed of liquid assets provided by users. HydraDX will help developers of the Polkadot ecosystem to start projects and achieve loss-free token interaction.

Interlay

Interlay is a Polkadot ecological cross-chain project dedicated to connecting Crypto such as BTC with DeFi platforms such as Polkadot and Ethereum.

The Interlay network is hosted as a Polkadot parachain and will connect to Cosmos, Ethereum, and other major DeFi networks, helping them achieve interoperability and openness.

The latest round of financing for the project was on December 22, 2021. The investment management company DFG Capital conducted a round of financing for Interlay$6.5 million investment. The new funding will be used to scale Interlay's operations while attracting more developers to its open-source platform.

On April 8, Interlay released a new protocol white paper called XCLAIM Commit (XCC), which aims to improve the security of user funds and improve the efficiency of funds in the vault through the self-custody of BTC DeFi on all chains.

This XCC mechanism, as the base layer supporting interBTC assets, realizes greater asset sovereignty in the cross-chain. In addition, Interlay is about to complete the Polkadot-based BTC bridge development project, which will be released on the Kusama network.

Moreover, Interlay has integrated kBTC on its leading network Kintsugi. Currently, kBTC can be traded on the Karura and Moonriver networks.In the future, Interlay will also deploy its technology to other public chains to enhance the interoperability between chains。

interBTC is a period product of Interlay, which is an alternative token. Every interBTC is backed 1:1 by Bitcoin, fully collateralized, interoperable and censorship resistant.

BTC is still being adopted by more and more countries. Interlay introduces BTC into the Polkadot ecosystem, expanding the possibility of cross-chain for BTC. As Polkadot is the infrastructure of many ecosystems, the introduction of BTC has further promoted Polkadot's goal of becoming a truly interoperable ecosystem.

Nodle

Nodle is a decentralized IoT network built on the Polkadot ecosystem, providing secure, low-cost network connections and data mobility, and connecting billions of IoT devices around the world.

Nodle is not limited by proprietary hardware devices or complex blockchain architectures, and can run on any device with a low-power Bluetooth interface。

So far, Nodle has completed 5 rounds of financing, with a cumulative amount of more than 5 million US dollars (not including undisclosed). Previously, on December 11, 2019, Nodle completed the financing with the participation of BootstrapLabs, Blockchain.com Ventures, Blockchange Ventures, etc. , with a total amount of $3.5 million.

At present, Nodle has launched the Polkadot relay chain, which makes the NODL pass immediately liquid and usable in all other parallel chains.

Users of Nodle can benefit from the Nodle Cash App, interact with DeFi ecosystems such as decentralized exchanges or currency markets, and other DeFi ecosystems。

Nodle has built a massive wireless IoT network, with 5 million active smartphones serving as base stations every day.

Nodle has become the bridge capable of connecting billions of IoT devices, which lays the foundation for building unique, powerful data-driven applications in the future to generate new revenue streams.

At the same time, it also provides an important information infrastructure for the realization of Web3.0, and also provides the next-generation Internet of Things function for the Polkadot ecosystem.

Understanding Polkadot's unique slot economy from the Staking economy

How to understand Polkadot's slot economy?

Although Ethereum has not yet been upgraded to 2.0, the Staking mechanism around Ethereum 2.0 has already produced a sufficiently large Staking economy.

Lido, currently the second largest DeFi project by TVL, is a Staking service platform based on Ethereum 2.0., and provide a derivative stETH for users participating in Staking, which will release the liquidity of ETH in Staking, so that users can lower the threshold for participating in Staking, maximize the use of their own funds, and obtain additional benefits.

And on Curve, the DeFi project ranked No. 1 by TVL, the pool ranked No. 1 by TVL is stETH/ETH, which is as high as 4.9 billion US dollars. Therefore, the potential of the Staking economy can be seen.

On the other hand,Ethereum 2.0 is approaching, and the staking economy is getting a lot of attention. What kind of waves will the Polkadot ecology cause?》

On the other hand,Staking, a mechanism with lock-up settings, is actually similar to the unique slot auction on Polkadot, but it has changed from obtaining public chain Staking rewards to obtaining parallel chain Token rewards.。

Since there is a lock-up mechanism, slot auctions will also lock up a huge amount of assets, so how big will this market be?

We can do a rough calculation. Polkadot’s previous assumption for the distribution of Polkadot’s tokens was “circulation: slot lock: Staking lock = 17:33:50”. Calculated according to this ratio, the current market value of Polkadot’s total supply is about 200 Billion US dollars, it can be concluded that the value potential of slot lock-up is 6.6 billion US dollars, which is enough to support a huge slot economy.

Therefore, the slot economy will also be a major feature of Polkadot economy, there will naturally be projects focusing on this big cake, working hard around the assets locked in the slot auction, and the slot lock-up time will be very long (48 weeks on Kusama, 96 weeks on Polkadot), will It is particularly important to release liquidity from these long-term locked assets.

The main form of Polkadot’s slot economy may be similar to that of Staking economy. The project party releases the liquidity of users’ locked-up assets in slot auctions by generating corresponding derivatives. Users can sell derivatives or sell These derivatives are used for liquidity pools (such as stETH/ETH) similar to derivatives and genuine products on Curve, or these derivatives are used as collateral to lend other Crypto assets, and these applications will provide derivatives holders extra income.

When the slot economy is relatively mature, Polkadot’s future slot auction participants can not only get the Crowdloan rewards provided by the project party, but also get derivatives, and use the derivatives in other DeFi to obtain excess returns。

In addition, Crowdloan in the slot auction may have such a possibility of development, just for reference.

Users participating in the Polkadot parachain Crowdloan are actually very optimistic about the development of the parachain project. If the parachain supports smart contracts and needs to develop ecological applications, then the ecological application team on it can be considered for those Participate in airdrops by Crowdloan users as a way to cold start the project.

Because these Crowdloan users are more optimistic about this ecology than others, their loyalty will be higher, and their willingness to participate in the application will be stronger.Therefore, airdropping Crowdloan users is a way to consider for ecological applications。

secondary title

What are the applications of slot economy in the Polkadot ecosystem?

At present, many projects in the Polkadot ecosystem have launched corresponding products around Polkadot’s slot auction. Here we give some examples to illustrate.

Parallel Auction Loan

Users can participate in Polkadot slot auctions through Parallel's Crowdloan V2 platform. In order to encourage users, Parallel and project parties who want to participate in the auction will jointly provide additional tokens as incentives.

Therefore, users who participate in the slot auction through Parallel's Crowdloan V2 can not only get the basic project rewards, but also get the project's additional rewards and Parallel's PARA rewards.Two additional rewards have been added, and the DOT that users participate in the auction can also obtain the liquidity token cDOT。

At the end of the lease period, cDOT can be converted into DOT. cDOT can be traded in the AMM market, or can be pledged as a mortgage asset in the lending market to lend out DOT or stable currency assets and enjoy the interest of the loan.

Acala Liquid Crowdloan

When participants contribute to Acala Crowdloan, they will receive a derivative asset lcDOT, which represents their contribution to Crowdloan, and the received lcDOT will be distributed according to the DOT contribution ratio of 1:1.

Users can trade lcDOT on Acala Swap, or support lcDOT liquidity in the lcDOT pool to earn transaction fees and additional rewards. For example, the Acala Foundation will allocate 1 million ACA to the Acala Kickoff Rewards Program as a reward.

The incentive program will last for six months starting from February 10, 2022. Liquidity providers will have the opportunity to obtain ACA rewards through introductory reward pools such as lcDOT/DOT, lcDOT/aUSD and ACA/aUSD.

Of course, users can also use lcDOT as collateral to mint Acala’s stable asset aUSD. After completing the parachain lease (2 years), lcDOT enables users to exchange back the DOT locked at that time after the lock-up period.

Currently, this Liquid Crowdloan app only supports slot auctions for Acala and Karura, but as a module it can support other parachains.

Bifrost SALP

The full name of SALP is the Slot Auction Liquidity Protocol (Slot Auction Liquidity Protocol). It is an agreement launched by Bifrost Finance to release the liquidity of DOT/KSM locked in the parachain auction process. The release method is to issue derivatives of anchored locked assets assets.

Bifrost SALP will generate two derivatives, vsDOT/vsKSM and vsBond, representing asset attributes and equity attributes respectively.

Whether it is vsDOT/vsKSM or vsBond, you can trade at any time in the liquidity pool opened by Bifrost or other third-party liquidity pools, At the same time, Bifrost has joined forces with the project party to provide another way to generate interest, that is vsDOT/vsKSM & vsBond joint mining.

postscript

postscript

We are very happy to see that with the progress of the Polkadot slot auction, some teams and projects that were not so well-known have begun to come into our sight, and this also confirms one of the effectiveness of our earlier analysis of the Polkadot slot auction. That is to make those high-quality projects with a strong community atmosphere be seen and understood by more people. Looking at it now, this effect seems to have been confirmed.

On the other hand, as the auction of Polkadot slots continues, we can see that its participation cost is gradually decreasing,As the parachain slot auction continues, more projects will begin to test the waters in the Polkadot ecosystem due to cost reduction, and this is also in line with the development of things。

If the slot auction goes on smoothly, more DOTs will be locked up. With the DOT staking, the DOTs in circulation will become more scarce.

At the same time, when most of the DOT is locked by Staking and slot auction mechanisms, these assets can also be mined out of this huge asset by releasing liquidity, providing sufficient funds for the entire financial market of Polkadot, and the Polkadot ecology The vitality will naturally appear.

Welcome everyone to visit the Mirror address of Polkadot Ecological Research Institute:

*The information provided by the Polkadot Ecological Research Institute does not represent any investment hints. The published articles only represent personal opinions and are for reference only. Since there are no policies and regulations related to digital assets in China, users in mainland China are requested to pay close attention to the development of Crypto.

Welcome everyone to join our Telegram group of the Polkadot Ecological Research Institute:

https://t.me/polkadot_eri

Welcome everyone to visit the Mirror address of Polkadot Ecological Research Institute:

https://mirror.xyz/0x9A259b3a2316281Cc948cE2Cf1Ac610a79844f05