Author: David Hoffman

Original source: Bankless

Author: David Hoffman

Original source: BanklessWhat is happening?ETH is becoming the bond of the digital age. Although we predicted a long time agosuch a trend, but until recently with

Consolidation of Ethereum Consensus Mechanisms

, this ETH demand was officially added to our cognitive framework.

Here are four signs that the era of ETH bonds is coming:1. Distrust of the US dollar has reached an all-time highDistrust of the dollar is at an all-time high. No matter how morally justified, there is no turning back for the US to remove the world's 11th largest economy from the global dollar system.

Russia's foreign assets are frozen

At the same time, it exposed the weakness of other countries when using the dollar system (the United States can freeze dollar assets for political and other reasons).

That would lead to an inflation rate unseen in decades.the interviewJim Bianco in the latest

the interview

Zhong believes that the U.S. Treasury bond market is bound to usher in a deep bear market.

"Nobody wants to be a holder of U.S. Treasuries," he said.

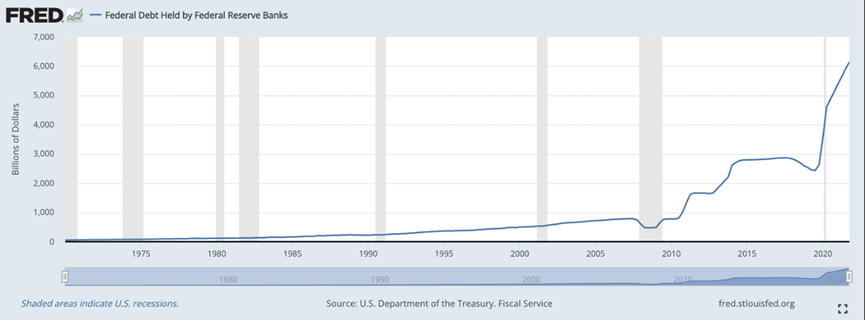

It is not surprising that the Fed's extremely high book debt and rising inflation rate make the long-term and short-term yields of US treasury bonds inverted. This indicator shows that investors have no desire to hold U.S. Treasuries for a long time.

People are looking for alternatives to US Treasuries.

Ethereum is filling the US Treasuries market fleeing due to lack of confidence, it is worth mentioning that this is a market with $14 trillion in space.

This also makes it very popular to compare the Ethereum staking market with the U.S. Treasury market.

While the Federal Reserve has an all-time high level of debt, Ethereum cannot hold debt. ETH is headed for deflation at a time when inflation threatens real returns for holders of U.S. Treasury bonds. Unlike the United States, which directly froze the world's 11th largest economy, Ethereum is neutral and credible.

Change is happening; the $14 trillion U.S. Treasury bond market is shrinking, and the $0.5 trillion ETH staking market is rising.

2. ETH Bonds Offer Higher Real Returns

However, the value of the US dollar is relatively stable, while the value of the ETH currency fluctuates violently! You can't compare the US bond market directly to ETH staking! This is ridiculous!

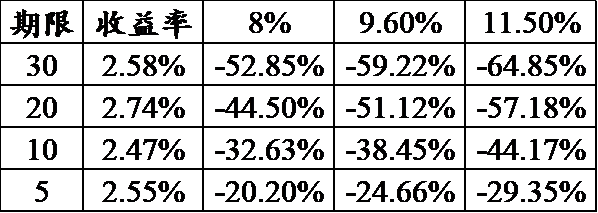

First, the past decade has been "ridiculous". In this decade, everyone is changing the paradigm understanding of the world they live in, and investors who do not accept new ideas will hardly succeed.Secondly, the value of the US dollar is relatively stable, while the value of the ETH currency fluctuates violently. But you can compare the two markets and calculate the threshold for retracement in ETH (both return the same).The image above is from Arthur Hayes

New work

. This graph shows how much ETH should depreciate given that both markets offer the same return.

For example: If the pledge rate of ETH is 8%, assuming that ETH falls by 32.6%, the rate of return that ETH can provide will not be lower than the 2.5% interest provided by the 10-year US Treasury bond.

Arthur Hayes believes that even if ETH fully realizes its value-added potential (the currency price rises to 10,000 US dollars or even higher), compared with the traditional U.S. Treasury bond market, rational investors will still be passionately looking for more value in the Ethereum pledge market. High return.

Yes, the price of ETH currency is unstable. But ETH's pledge rate of return is so high that currency price fluctuations are almost irrelevant.

It's even simpler to understand if you're fundamentally bullish on the future value of ETH.

1.“3. Traditional investors are gradually accepting ETH pledgeTraditional finance is waking up and accepting ETH as collateral.

The future of finance will run on Ethereum, and it's becoming clear

” – One River Asset Management.

2. “Ethereum transitions to a global asset.” Bloomberg.

My favorite quote is from Marcel Kasumovich (who is also from One River):"Ether is Transforming into a Low-Risk Cheap Bond".

Cryptocurrencies are generally not considered low-risk assets, and this is especially true for institutional investors.

But they're starting to realize it's biased.

Ethereum volatility is relatively high, however:

No foreign debts.

The total circulation is controlled by the program.

Globally accessible and permissionless; Ethereum does not exclude Russia from the dollar system like the US does.

Plus, volatility works both ways! Historically, in cryptocurrencies, the longer the holding period, the greater the positive return from volatility:4. The new risk-free rateWikipedia on "

risk free rate

"explanation of:

The long-term yield on U.S. Treasury coupon bonds is widely considered the risk-free rate. Government bonds are generally considered relatively risk-free for domestic holders because there is no risk of default.

But there is also the risk that the government will "print more money" to meet its obligations, which would result in repayments of lower monetary value. For investors, the loss of value needs to be measured by themselves, so strictly speaking, default risk does not include all risks.

In the past, the dollar has been slowly depreciating. Because of the slow depreciation, everyone ignored it for a long time.Ray DalioBut now the problem of dollar depreciation cannot be ignored.

As Bridgewater's

In other words, we are in a period of excessive sovereign debt, excessive currency issuance and a large gap between rich and poor.

When a large amount of money printing becomes a certain event, is the "risk-free interest rate" really so risk-free? Of course, we can still stick to the so-called risk-free rate. But this is only because the government controls the money printing machine, so it is basically impossible for the government to default on the sovereign currency.

But if the real risk-free rate is negative, it will inevitably lead to losses. Is the risk-free rate really "risk-free"?

The Fed's finances don't look too good. That has the potential to spur a change in the benchmarks by which risk is measured.

Will ETH Be the New Risk-Free Rate?

Ethereum can issue tokens at any time, but cannot hold any debt.

ETH’s “money printing” is governed by an algorithm designed to provide the greatest benefit to the Ethereum community, not the social elite.

The world is expected to undergo more drastic changes in the third decade after the millennium, and we will give new meaning to the "risk-free rate".

ETH is the new internet bond.