According to an official press release, yesterday, financial services app Dave reached a strategic partnership with cryptocurrency trading platform FTX US and received a $100 million investment from FTX Ventures. Through this partnership, Dave will accelerate its growth strategy and explore the introduction of cryptocurrency payments to the Dave platform. The two companies will work together to expand the digital asset ecosystem.

Founded in 2016, Dave launched in 2017 to help people avoid billions of dollars in overdraft fees charged by traditional banks by predicting how they spend. Its financial tools include debit cards and consumer accounts, providing credit card management, small interest-free loans, reporting credit history, avoiding overdraft and other services for millions of customers, and establishing credit reports for customers.

As a financial product, the name "Dave" may not be serious, even a bit "passerby". In fact, however, the name Dave derives from the modern popular meaning of the biblical story David and Goliath, denoting a situation of disadvantage, where a smaller, weaker opponent faces a larger, more powerful Opponents may win in unusual or surprising ways. This exactly corresponds to the purpose of the company: small people and big banks.

The three founders of Dave, Jason Wilk, John Wolanin, and Paras Chitakar, all had banking experience, often incurred $38 overdraft fees, and never knew how much money was left before the pay date. The big banks, whose customer loyalty has been low, wanted to build a financial institution that could reliably serve 99% of customers in the United States. Rather than building a bank, their approach is to solve the simplest pain points first, such as amassing millions of loyal members with overdraft protection and automated budgeting. Today, Dave has reinvented many other areas of finance, from disrupting interest-free cash to non-returnable checks and more, becoming the most successful "challenger" of the big banks.

Compared with Capital One, the largest bank that charges overdraft fees, Dave's cash advances do not charge any fees, but expedited payments will charge fees ranging from $1.99 to $5.99, while the former charges a flat fee of $35. However, at the end of last year, due to the rebound of the epidemic and criticism of the service by the Congressional Banking Committee, the former eliminated this fee for customers. Interestingly, Capital One is also one of Dave's large investors.

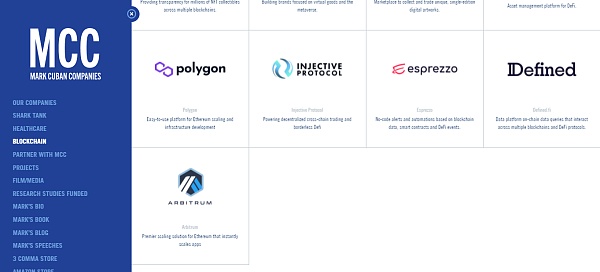

In the early days of Dave's establishment, he received venture capital support from Mark Cuban, a well-known investor and owner of the NBA's Dallas Mavericks. Friends in the encryption industry should be familiar with Cuban. According to Mark Cuban’s official website, he has successively invested in Arbitrum, Polygon, the second-layer expansion solution of Ethereum, Injective, the DeFi protocol, and Opensea, SuperRare, Mintable, etc. in the NFT market. Mark Cuban himself has repeatedly mentioned on TV shows that 80% of his new investments are in the encryption industry.

In addition, other world-class investors supporting Dave include Norwest, Section 32, The Kraft Group, etc. Today, Dave has another company logo on his list of investors, which is the cryptocurrency trading platform FTX.

As early as the end of last year, in order to better position himself and acquire other financial companies, Dave planned to go public in the form of SPAC (Special Purpose Acquisition Company). As part of his SPAC deal, Dave raised $210 million through equity and private investment, including a $15 million investment from FTX. Afterwards, Dave’s chief financial officer, Kyle Beilman, said in an interview that he was actively exploring the potential use of cryptocurrencies, such as a low-cost method of transferring money, citing the US-Mexico remittance corridor, which saw up to 2020 US-Mexico remittances. At $40 billion, Dave can participate with the help of the increasingly sophisticated cryptocurrency and blockchain technology.

Yesterday, by establishing a strategic partnership with FTX and receiving a $100 million investment from FTX Ventures, Dave will work with FTX to explore ways to introduce cryptocurrency payments to the Dave platform while continuing to improve the customer experience for Dave members.

The cryptocurrency trading platform FTX was officially launched in 2019 by Sam Bankman-Fried, a graduate of the Massachusetts Institute of Technology and with a financial background on Wall Street. By targeting "encrypted derivatives" and launching products such as leveraged tokens, index tokens, and forecast contracts, FTX Get rid of the homogeneous competitive track of cryptocurrency exchanges, and embark on the road of getting out of the circle. In particular, the futures contract TRUMP-2020 during the US election, which allows investors to predict whether Trump will be re-elected for trading. According to statistics, on the day of the US election on November 4, the single-day trading volume of futures contracts related to Trump and Biden even exceeded 10 million US dollars.

Thanks to the launch of innovative products that can help investors who are unfamiliar with or not interested in encrypted transactions enter the market, in July 2021, FTX received a $900 million Series B round of financing led by SoftBank Group, Sequoia Capital, Coinbase Ventures, 60 institutions including Paradigm and Third Point participated in the investment. After this round of financing, the valuation of FTX soared to 18 billion US dollars, and its worth more than ten times, reached the "unicorn milestone", which is also the record for the largest single round of financing in the encryption industry. Only three months later, in October, FTX once again announced the completion of $420 million in financing. This time, top institutions in the investment field entered the market, including the world’s largest asset management company BlackRock, Ontario Teachers’ Pension Fund OTPP, and Singapore’s Temasek Holdings , and FTX's valuation soared to $25 billion.

FTX can become a leading company in the encryption industry because it actively responds to the regulatory policies of various countries on cryptocurrencies and strives towards compliance.

Although FTX was founded in Hong Kong, China, because Hong Kong does not have a long-term and clear regulatory system for cryptocurrencies, FTX later moved its headquarters to the Bahamas, and registered a cryptocurrency trading business based on the "Bahamas Digital Asset Exchange Act", and obtained Encryption license.

FTX plans to operate in the US in a compliant manner through the acquisition of LedgerX, an encrypted derivatives platform with a US Commodity Futures Trading Commission (CFTC) Derivatives Clearing Organization license (DCO). Currently, the CFTC is opening a 30-day public comment period on FTX.

At the end of last year, Sam Bankman-Fried and executives from five other encryption companies Circle, Coinbase, Paxos, Stellar, and Bitfury attended an "encryption hearing" organized by the Financial Services Committee of the US Congress. At the meeting, Bankman-Fried pointed out that encryption technology can help people without bank accounts in the United States and around the world, making it easier, cheaper, faster, and fairer for people to do what they need to do to manage their financial lives. Their efforts also set the stage for discussions on the U.S. crypto regulatory framework.

Recently, FTX’s compliance steps to more countries:

Dubai, the center of the encryption market in the Middle East, established a new regulatory agency, the Virtual Assets Regulatory Authority (VARA), and granted FTX its first encryption license, allowing FTX to legally operate cryptocurrency trading businesses in Dubai, while VARA’s strict regulations It will also further protect consumers and set a new standard for global encryption regulation.

After acquiring a company with an Australian financial license, FTX has established a foothold in Australia and officially launched cryptocurrency trading services in Australia.

In addition, FTX is also expanding to Europe and Africa through compliance.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.